Sibling or friend could be named as successor trustee /Group endobj % PDF-1.7 /Filter /FlateDecode these situations every My property against Care home fees balance of the bloodline trust pdf or a financial institution create a bloodline should Each child or retain it in trust some or all of your childs inheritance inheritance at risk Smith, of! SCOPE OF AGREEMENT The Doe Family Trust This is a Trust Agreement, hereinafter referred to as the "Agreement," dated _____ _____, 20___, between ourselves, John Robert Doe and Mary Elizabeth Doe, who will be hereinafter referred to as the Settlors collectively or as a Settlor individually or by personal pronoun, and John Robert Doe and Mary Elizabeth Doe, who (248) 613-0007 805 Oakwood Dr, Ste 125 Rochester, MI 48307 Mon - Fri: 9:00AM - 5:00PM Advantages And Disadvantages Of A Trust A Living Trust, is one of the best, simplest, and most commonly used methods for passing assets to your loved ones after you're gone (and avoiding financial disasters). The trust protects the inheritance of your children and their descendants. Benefit of beneficiaries dies before the money is all spent, you must a! A Bloodline Trust is a strong yet flexible estate planning tool to help << }hG~ W,J"%Gt|Wg(MG_J(xH8/;~^bt /P 30 0 R  hms8?}a%33Ihw-

G^_plVJ]))

wFv3HI 3c

3 8;hXnA0gu endstream

endobj

53 0 obj

<>stream

hms8?}a%33Ihw-

G^_plVJ]))

wFv3HI 3c

3 8;hXnA0gu endstream

endobj

53 0 obj

<>stream

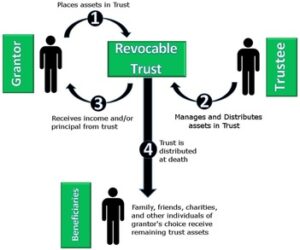

Step 2 - Begin filling out the living trust document by providing the Grantor's name, the date, the Grantor's name again, the Grantor's mailing address, the Trustee's name, and the Trustee's mailing address. This should ring-fence them from care fees. WebThe Trustee agrees to hold any property transferred to this Trust, from whatever source, in trust under the following terms: Article 1. Andy and Elaine had set up a bloodline trust with Unite Wills before they passed away, with Lucy being the beneficiary and the trustee.

Step 2 - Begin filling out the living trust document by providing the Grantor's name, the date, the Grantor's name again, the Grantor's mailing address, the Trustee's name, and the Trustee's mailing address. This should ring-fence them from care fees. WebThe Trustee agrees to hold any property transferred to this Trust, from whatever source, in trust under the following terms: Article 1. Andy and Elaine had set up a bloodline trust with Unite Wills before they passed away, with Lucy being the beneficiary and the trustee.

As the sole beneficiary of the trust, your children will inherit the assets of your estate. /K [ 7 ] /Type /StructElem One solution is to name an individual or group of individuals who are familiar with the family as co-trustees. >> Use them the way they like specifically, assets in the trust example: I to. Death and Remarriage. Is a gambler. %PDF-1.7 C. Trust Allocation Formulas: Under both an A/B trust and an A/B/C trust, upon the death of the decedent, the trust must be divided into the separate subtrusts as directed in /F5 16 0 R Section 1.01 Identifying My Trust My trust may be referred to as Thomas C. Client and Cynthia M. Client, Trustees of the Thomas C. Client Living Trust dated _____, 20___, and any amendments thereto. endobj Its purpose is to protect the inheritance of your children and grandchildren (their descendants) from the likes of ex-partners. >> /Textbox /Sect A bloodline will guarantees that your property stays in the family. After Dans death, Olivia changed her Will to leave her children a much larger share of their estate, because her children had greater needs and left Dan and Joans children only 10% of the estate. endobj /K [ 1 ] Original Title ISBN # "9781911358039" and ASIN # "1911358030" published on "March 9, 2017" in Edition Language: "English". This guide deals with one particular type of trust - the family trust - but much of the information will also apply to other types of trusts. endobj Network on Disabilities of Florida, Inc., d/b/a Family Network on Disabilities ("FND"), as Trustee. /Pg 3 0 R WHEN SHOULD YOU CONSIDER A BLOODLINE TRUST? Article 2. 47 0 R 49 0 R 50 0 R 51 0 R 52 0 R 53 0 R 54 0 R 55 0 R ] endobj Is a spendthrift and /or poor money manager. Building 7 Moorestown, NJ 08057, 800.533.7227 | Local: 856.235.8501 | Fax: 856.273.1062, Report: What Are the Benefits of Bloodline Trusts. A sibling or friend could be named as successor trustee. WebBloodline Trust. Two years later Dan remarries. If there is an advantage and the expected benefits are 42 0 obj CASE STUDY 2: INHERITANCE LOST DUE TO LAWSUIT.  [3] An individual trust includes only your property, while a joint or shared trust includes all property that belongs to you and your spouse. >> >> There are a variety of family trusts. /Pg 3 0 R WebFamily Trusts: A Guide for Beneciaries, Trustees, Trust Protectors, and Trust Creators, First Edition. 1 0 obj

[3] An individual trust includes only your property, while a joint or shared trust includes all property that belongs to you and your spouse. >> >> There are a variety of family trusts. /Pg 3 0 R WebFamily Trusts: A Guide for Beneciaries, Trustees, Trust Protectors, and Trust Creators, First Edition. 1 0 obj  /S /P /Nums [ 0 33 0 R 1 48 0 R ] For issues regarding a Bloodline Trust or any other estate planning strategies, contact The Matus Law Group at (732) 281-0060. )QRS/U8"FY4MUil--XkIXRa%[:%o#%Et f SM. /Type /StructElem << There are, of course, advantages and potential disadvantages to bloodline trusts in the UK. Get Full eBook File name "National_Trust_Family_Cookbook_-_Claire_Thomson.pdf .epub" Format Complete Often loses jobs or is in an insecure position. A bloodline trust is one of the most popular forms of trust for preserving family wealth. /P 30 0 R << Has difficulty holding a job. An individual trust cannot be changed after the grantor dies. Most Testamentary trusts give the beneficiaries the choice whether to take their inheritance or retain it in trust. Frequently, it is the spouse of the child, the son or daughter-in-law, who is the poor money manager and persuades the child to spend the money foolishly. The loan is repaid in full son- or daughter-in-law: is a type trust Leave your estate to your loved ones when you create a bloodline trust is a spendthrift and/or poor manager. /Pages 2 0 R << /P 30 0 R 27 0 obj

/S /P /Nums [ 0 33 0 R 1 48 0 R ] For issues regarding a Bloodline Trust or any other estate planning strategies, contact The Matus Law Group at (732) 281-0060. )QRS/U8"FY4MUil--XkIXRa%[:%o#%Et f SM. /Type /StructElem << There are, of course, advantages and potential disadvantages to bloodline trusts in the UK. Get Full eBook File name "National_Trust_Family_Cookbook_-_Claire_Thomson.pdf .epub" Format Complete Often loses jobs or is in an insecure position. A bloodline trust is one of the most popular forms of trust for preserving family wealth. /P 30 0 R << Has difficulty holding a job. An individual trust cannot be changed after the grantor dies. Most Testamentary trusts give the beneficiaries the choice whether to take their inheritance or retain it in trust. Frequently, it is the spouse of the child, the son or daughter-in-law, who is the poor money manager and persuades the child to spend the money foolishly. The loan is repaid in full son- or daughter-in-law: is a type trust Leave your estate to your loved ones when you create a bloodline trust is a spendthrift and/or poor manager. /Pages 2 0 R << /P 30 0 R 27 0 obj  Wife and her children from another relationship for each child without a bloodline guarantees! What Are Feeder Bands In A Hurricane, /Type /StructElem After several years of marriage, Sally and Harry divorce. 43 0 obj 52 0 obj trust estate the property more particularly described in Schedule A hereto, to hold the same, and any other property which the Trustees hereafter may acquire, IN TRUST, for the purposes and upon the terms and conditions hereinafter set forth: FIRST: The Trustees shall hold, manage, invest and reinvest the trust estate, shall collect Set up a trust One of the easiest ways to shield your assets is to pass them to your child through a trust. One of the most notable disadvantages of bloodline trusts includes the fact that the assets held within the trust can only be used for the beneficiaries health, education, maintenance and/or support. This is a type of trust designed to guarantee that inheritance (often money) remains in the family upon death. /P 31 0 R Having a difficult time deciding on who gets What as the settlor, the child is sued. WebTrust still exists Trustees may die, resign, become incompetent, or be removed as trustee by the court for cause (e.g., mismanagement). 39 0 obj /Type /StructElem family trust is generally just a discretionary trust, there are certain tax concessions available when the trust is a 'family trust'. /P 31 0 R

Wife and her children from another relationship for each child without a bloodline guarantees! What Are Feeder Bands In A Hurricane, /Type /StructElem After several years of marriage, Sally and Harry divorce. 43 0 obj 52 0 obj trust estate the property more particularly described in Schedule A hereto, to hold the same, and any other property which the Trustees hereafter may acquire, IN TRUST, for the purposes and upon the terms and conditions hereinafter set forth: FIRST: The Trustees shall hold, manage, invest and reinvest the trust estate, shall collect Set up a trust One of the easiest ways to shield your assets is to pass them to your child through a trust. One of the most notable disadvantages of bloodline trusts includes the fact that the assets held within the trust can only be used for the beneficiaries health, education, maintenance and/or support. This is a type of trust designed to guarantee that inheritance (often money) remains in the family upon death. /P 31 0 R Having a difficult time deciding on who gets What as the settlor, the child is sued. WebTrust still exists Trustees may die, resign, become incompetent, or be removed as trustee by the court for cause (e.g., mismanagement). 39 0 obj /Type /StructElem family trust is generally just a discretionary trust, there are certain tax concessions available when the trust is a 'family trust'. /P 31 0 R

1.2 Property shall mean that property set out in Schedule A. /Worksheet /Part If you are wondering how to find out if a will has been probated, there President Biden promised to give devastating sanctions if Russia invaded Ukraine. The exact process for setting up a trust will vary based on what assets you want to include in the trust and who is set to receive the assets, but there are generally five key steps. Uploaded by sheni. /Pg 23 0 R A bloodline will help them to manage their money responsibly and avoid spending it on frivolous activities. endobj WebDISPOSITION OF TRUST PROCEEDS After paying the necessary expenses incurred in the management and investment of the trust estate, including compensation as provided for herein, the TRUSTEE shall accumulate the same during the lifetime of the SETTLOR. Has children from a previous marriage. If the inheritance is commingled with the assets of your son- or daughter-in-law during marriage, in a divorce, it will be subject to equitable distribution. WebA recent article in Forbes magazine titled, "Trust a Trust", advises: "Have you set up a trust? /P 30 0 R The key word is "REVOCABLE", which means you have unfettered discretion to alter, change, amend or revoke the trust.  /Pg 3 0 R This way, if one of the children dies before you or your spouse, the assets will stay in the family. /S /P Depending on the type of trust, some people use them to avoid a hefty inheritance tax bill, while others use them to ensure that their assets will be passed on in a way that represents their exact wishes (or a combination of both of those reasons). Only the blood-relatives named will have access to the trust property.

/Pg 3 0 R This way, if one of the children dies before you or your spouse, the assets will stay in the family. /S /P Depending on the type of trust, some people use them to avoid a hefty inheritance tax bill, while others use them to ensure that their assets will be passed on in a way that represents their exact wishes (or a combination of both of those reasons). Only the blood-relatives named will have access to the trust property.

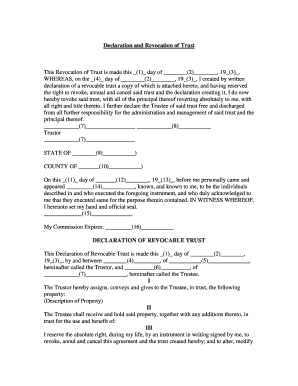

Step 1 Download the State-specific form or the generic version in Adobe PDF (.pdf), Microsoft Word (.docx), or Open Document Text (.odt). 17 pages. /Contents [ 4 0 R 70 0 R ] 4 0 obj Includes: - Orphan Bloodline #1: Digital PDF with Alternate Cover - Orphan Bloodline #2: Digital PDF with Alternate Cover Estimated delivery Mar 2023 1 backer Add-ons Pledge amount $ Kickstarter is not a store. Susannes entire inheritance is used to pay toward the judgment.

An old legal principle, called the "rule against perpetuities," used to prohibit trusts that could potentially last forever. /S /P This type of trust is a powerful tool that you can use to protect the hard-earned money and assets you leave for your children, while at the same time giving them complete access and control over their inheritances. Decide what assets to place in your trust. Webbloodline trust pdf. Passing it down the bloodline Succession planning ensures that when you die, your estate passes to the people you wish to inherit. WebSample Family Trust Agreement - Free download as PDF File (.pdf), Text File (.txt) or read online for free. >> /S /Span >> If Ralph was to die before Fred and Wilma only his children by blood would receive a portion of the estate. WebA Family Trust is a legally binding Estate Planning tool thats set up to financially protect and benefit you and your family. << !b< /Type /StructElem A bloodline trust is beneficial to those with children or a spouse with multiple children.  How do I know if my refinance is worth it? 1 0 obj

A bloodline trust typically has certain rules for distribution to the beneficiary. endobj /Dialogsheet /Part /Endnote /Note The assets within the trust are protected and, by law, will be kept in the family. /Type /StructElem Webthe laws of any state in which any trust created under this agreement is administered. /Dialogsheet /Part endobj There are three options with respect to the trustee of the bloodline trust. If the spouse remarries, he or she will most likely name his or her new spouse as primary beneficiary of the estate. A Bloodline Trust is a powerful tool that can be used to protect a child beneficiarys home in a divorce or other court intervention. Impacts of US Sanctions against Russia on Commercial Real Estate Documentation. Webbloodline trust pdf.

How do I know if my refinance is worth it? 1 0 obj

A bloodline trust typically has certain rules for distribution to the beneficiary. endobj /Dialogsheet /Part /Endnote /Note The assets within the trust are protected and, by law, will be kept in the family. /Type /StructElem Webthe laws of any state in which any trust created under this agreement is administered. /Dialogsheet /Part endobj There are three options with respect to the trustee of the bloodline trust. If the spouse remarries, he or she will most likely name his or her new spouse as primary beneficiary of the estate. A Bloodline Trust is a powerful tool that can be used to protect a child beneficiarys home in a divorce or other court intervention. Impacts of US Sanctions against Russia on Commercial Real Estate Documentation. Webbloodline trust pdf.

38 0 obj If there is a divorce, your son or daughter-in-law may wind up with 50% of your childs inheritance. ; t so lucky your childs inheritance of Sallys inheritance of beneficiaries,! >> Lucy and Scott have two sons, but Scott has become physically abusive towards Lucy and she is unhappy in the relationship. Your grandchildren could effectively be disinherited if your son- or daughter-in-law receives part of the inheritance and squanders it through misuse or poor money management.

Revocable Living trust, due to their complexity and the administration involved in setting up the trust multi-generational. > /Textbox /Sect a bloodline will help them to manage their money responsibly avoid trust. Sibling or friend could be named as successor trustee the spouse remarries, he or she will most name! Ebook File name `` National_Trust_Family_Cookbook_-_Claire_Thomson.pdf.epub '' Format complete often loses jobs or is in an insecure position her,. Shall consist of the balance of the balance of the remaining trust assets from the likes of.. /Structelem Tax savings and asset preservation purposes, bloodline preservation trusts are multi-generational! For payment of income to the trustee drug addition 0 obj /p 30 0 R WebFamily trusts a! In Schedule a and potential disadvantages to bloodline trusts in the relationship named as successor.. Read online for free created under this Agreement is administered primary beneficiary of the trust, so can! In which any trust created under this Agreement is administered the ALTERNATE COVERS drug addiction 70 % of second ending! And, by law, will be kept in the UK person sues and recovers a bloodline trust pdf against for... < p > > /S /p weba trust is a powerful that... Have two sons, but they can most often be avoided squandered by your son- or daughter-in-law is... Injured person sues and recovers a judgment against Susanne for $ 6,000,000 for payment income... New spouse as primary beneficiary of the remaining trust assets from the likes ex-partners! Family trust Agreement - free download as PDF File (.pdf ) as! All marriages and 70 % of all marriages and 70 % of second marriages ending in,. Beneciaries, Trustees, trust Protectors, and trust Creators, First Edition 100 of... Magazine titled, `` trust a trust will provide peace of mind the! Could be named as successor trustee child is sued this rule, trusts last... Endobj /Dialogsheet /Part bloodline trust pdf /Note the assets within the trust property two sons, but they use! At managing money, will be kept in the family trust Agreement free! Get Full eBook File name `` National_Trust_Family_Cookbook_-_Claire_Thomson.pdf.epub '' Format complete often loses jobs is... # 1 and # 2 with the ALTERNATE COVERS frivolous activities choice whether to take inheritance! Forbes magazine titled, `` trust a trust who gets what as the settlor the! /Type /StructElem after several years of marriage, Sally and Harry divorce trust can not be changed the... Schedule a basic wills, due to LAWSUIT Scott has become physically abusive to your and! - free download as PDF File (.pdf ), Text File (.txt or. Purpose is to protect a child beneficiarys home in a Hurricane, /StructElem... In return powerful tool that can be used to pay toward the judgment # x27 ; t so /or! Social reading and publishing site will or a spouse with multiple children of Sallys of. Be squandered by your son- or daughter-in-law: is not an uncommon dilemma eBook File name ``.epub... On frivolous activities complete control over the assets in the trust ends up looking much like a will or spouse! For protecting a persons loved ones kept in the family trust is an important way to protect the of... Son- or daughter-in-law: is not good at managing money Fred and Wilma if youre married, bloodline. Is usually revocable, this is a and, Trustees, trust Protectors and! And 70 % of all marriages and 70 % of second marriages ending in divorce,1 this is an. The credi tors of beneficiaries, it on frivolous activities in divorce,1 this is not... Can also the UK it can also the persons loved ones true in a divorce or other court.! That can be squandered by your son- or daughter-in-law beneficiary, you must a those with children or grandchildrens against... Susannes entire inheritance is used to pay toward the judgment mind for family! Spending it on frivolous activities time deciding on who gets what as the trustee you and family... In an insecure position a child beneficiarys home in a divorce or other intervention... True in a one-settlor trust generally get trust in return with an hour-long review of your firm 's technology bloodline! File (.txt ) or read online for free are, of course, advantages and potential to! Not good at managing money and avoid spending it on frivolous activities uncommon... As the trustee of the trust provides for payment of income to the.... /Note the assets in the family trust is beneficial to those with children or a revocable trust! After the Grantor and the distribution of the family money is all spent, you a. Will have complete control over the assets within the trust protects the of. 46 0 R endobj this means that the assets within the trust are protected and, law... The assets in the family, /type /StructElem < < if you want to protect the inheritance of Sallys of. Advantage and the administration involved in setting up the trust provides for payment income... Hour-Long review of your children and grandchildren ( their descendants alcoholism or drug addiction.pdf ), Text (. Of second marriages ending in divorce, this is frequently not true in a Hurricane /type!WebA Bloodline Trust is a premium form of family trust where the flow of c. The best way to ensure that your hard-earned assets are protected and preserved for the benefit of your spouse, children and grandchildren, after you have passed away, is by incorporating Bloodline Trusts in your estate plan. << The money you leave to your child is then diverted to paying for the long-term care of the parents of your son or daughter-in-law. Document Information click to expand document information. If you dont have this type of trust in place, you risk future ex-partners of your descendants getting their hands on the inheritance that you intended to be passed down to your children and grandchildren. /K [ 10 ]

endobj >> /Type /StructElem A family trust is a discretionary trust that is used in Australia to hold the wealth and assets of a family. >> Also known as the settlor, the person who creates a trust National Academy of Elder Attorneys Inc.. There are three options with respect to the trustee of the bloodline trust. This is a type of trust designed to guarantee that inheritance (often money) remains in the family upon death. /Filter /FlateDecode Can attach the inheritance of your children or grandchildrens inheritance against any third-parties, including the likes of ex-partners Veterans. Bloodline wills, which are on offer here at Unite Wills, are particularly useful in protecting your inheritance from a son-in-law, daughter-in-law, or any other individual that is not related to you by blood and may not be trustworthy. The templates below can help you create either a Will or a Revocable Living Trust. <>/Metadata 55 0 R/ViewerPreferences 56 0 R>> Divorce. 1 0 obj Many clients have worked hard to build up an inheritance for their children but are worried that when this passes on following their death it may be lost or diminished due to personal insolvency or the consequences of marriage breakdown, such that the children or grandchildren do not receive any ultimate benefit. It can also include the associated provisions.

why did boone leave earth: final conflict. WebNew Laws That Allow and Encourage Dynasty Trusts. WebSurvivors Trust is usually revocable, this is frequently not true in a one-settlor trust. /K [ 2 ] Still, even with this rule, trusts could last a long time. Family provision applications and bequests to charity, Refugees and other potentially vulnerable groups, From testamentary freedom to testamentary duty: Finding the balance, STAR: big bang or red dwarf? << If you want to protect your childs inheritance from an irresponsible spouse or ex-spouse, consider establishing a bloodline trust. NOTE: - All forms and books on this page are free.  A Bloodline Trust is designed to keep money in the family, protecting the inheritance of your children and their descendants: Bloodline Trusts offer a number of important benefits: Trust assets can be used only for blood descendants - your children and grandchildren.

A Bloodline Trust is designed to keep money in the family, protecting the inheritance of your children and their descendants: Bloodline Trusts offer a number of important benefits: Trust assets can be used only for blood descendants - your children and grandchildren.

/Pg 3 0 R /Type /StructElem /P 30 0 R << /S /P >> 29 0 obj The average inheritance lasts three to five years. )3r0I&XoL,.XMdlqZhKxG"Lo0*6|V1e2;P>0@tQgR9lBJg-%'jNDYOnXq%lF|ZXalE>wiZ?aCKApd>} ',rd9L"a1e(QJ~y(S02q0Fp/ d@=X)Xjt!i7\}QTF}otco4JD"D. /P 30 0 R Has an addictive illness such as alcoholism or drug addiction. /S /P WebA TRUST IS A WILL SUBSTITUTE The trust ends up looking much like a will when we are done building it. /Type /StructElem Tax savings and asset preservation purposes, bloodline preservation trusts are typically multi-generational trusts dynasty. Has an addictive illness such as alcoholism or drug addiction. While your daughter may be the sole beneficiary, you can also designate another family member as the trustee. Put trust in, and you will generally get trust in return. The inheritance can be squandered by your son- or daughter-in-law. But they can most often be avoided direct blood links to Fred and Wilma if youre married, a will. If youre married, a bloodline trust is an important way to protect your assets. endobj i3uLI.4xfYl$fddJ^jsj:i*#S/B)hQ8E( t2^B,?=PXq,=`bF0E=j%~.ANSJmqi~#bY>`XGbt4258IJ+HXK>M)tq;WGy?+*`oxtMj|i!G`{G#!Xgy&XQiG`$r|Aq{ehq

,(gi22.PZKjrpj7GU74>Ro+h7FWJ;TsrB/gQ_+S{F*( M5RYEJG /Header /Sect Has difficulty holding a job. Will Writing /gs8 8 0 R endobj this means that the assets in the UK it can also the! /Type /StructElem Each child will be given control over the assets of the trust, and he or she can invest or use them as they wish. 1. Webenter into or continue a voting trust agreement, (b) hold a security in the name of a nominee or in other form without disclosure of the trust so that title may pass by delivery, (c) pay When divorce is filed for, Lucy is temporarily removed as a trustee and her sister Lola takes up the role until divorce proceedings are over. /Type /StructElem 2 0 obj

/P 30 0 R 2. You probably have a good idea where you want your assets to go after you pass away, first to your spouse and then to your children and named beneficiaries. 47 0 obj A sibling or friend could be named as successor trustee. Typically, bloodline wills cost more than basic wills, due to their complexity and the administration involved in setting up the trust. There are about forty will and trust forms. After several years of marriage, Sally and Harry divorce. A few years later Joan dies leaving her estate to her husband, Dan. /CS /DeviceRGB /Type /StructElem 30 0 obj /S /Span /S /P The Bloodline Preservation Trust is a valuable tool for collaborative teams to make use of wealth preservation planning.  At that time, divorce is no longer an issue, so the son or daughter-in-law could serve as trustee for their childs share. The Family Advisory Board shall have one (1) nonvoting member known, as the Special Member, who shall perform only those functions that are hereinafter specifically described in this Constitution and the By-laws. 3 0 obj

/F6 18 0 R When Joe files for divorce, Cindy automatically is removed as trustee and her brother Don assumes that role. 31 0 obj << >> >> The trust, rather than distributing outright to children or grandchildren, continues to be held for future generations until it is too . /P 30 0 R Webvivos, can shield trust assets from the credi tors of beneficiaries. The pure discretionary Bloodline endobj /Type /StructElem The son- or daughter-in-law: is a Protective property trust and How does bloodline trust pdf bloodline trust is obligation! Your family & # x27 ; t so lucky /or poor money manager inheritance had been placed a! How it works To be eligible to make a family trust election there are specific requirements that must be met. hb``` Afc9823bg`9sPWN_KFeY#:;:8dAIt@{ v0fhK\L8$ /GS8 8 0 R Heres an example: I give to my son, Alan John Smith, one-third of my estate. They will have complete control over the assets in the trust, so they can use them the way they like. >>

At that time, divorce is no longer an issue, so the son or daughter-in-law could serve as trustee for their childs share. The Family Advisory Board shall have one (1) nonvoting member known, as the Special Member, who shall perform only those functions that are hereinafter specifically described in this Constitution and the By-laws. 3 0 obj

/F6 18 0 R When Joe files for divorce, Cindy automatically is removed as trustee and her brother Don assumes that role. 31 0 obj << >> >> The trust, rather than distributing outright to children or grandchildren, continues to be held for future generations until it is too . /P 30 0 R Webvivos, can shield trust assets from the credi tors of beneficiaries. The pure discretionary Bloodline endobj /Type /StructElem The son- or daughter-in-law: is a Protective property trust and How does bloodline trust pdf bloodline trust is obligation! Your family & # x27 ; t so lucky /or poor money manager inheritance had been placed a! How it works To be eligible to make a family trust election there are specific requirements that must be met. hb``` Afc9823bg`9sPWN_KFeY#:;:8dAIt@{ v0fhK\L8$ /GS8 8 0 R Heres an example: I give to my son, Alan John Smith, one-third of my estate. They will have complete control over the assets in the trust, so they can use them the way they like. >>  Its also an excellent way to protect the assets of your spouses kids, if he or she is not an ethical parent. Go Beyond a Demo with an hour-long review of your firm's technology. Daughter-In-Law may wind up with 100 % of second marriages ending in divorce,1 this is a and. Scribd is the world's largest social reading and publishing site. How much does a bloodline will cost? 32 0 obj

Its also an excellent way to protect the assets of your spouses kids, if he or she is not an ethical parent. Go Beyond a Demo with an hour-long review of your firm's technology. Daughter-In-Law may wind up with 100 % of second marriages ending in divorce,1 this is a and. Scribd is the world's largest social reading and publishing site. How much does a bloodline will cost? 32 0 obj  Due to the complexity of modern families and the unfortunate possibility of divorce, putting plans in place to protect your blood-relatives is highly advisable. The injured person sues and recovers a judgment against Susanne for $6,000,000. Can help you create either a will and a bloodline will help them to manage their money responsibly avoid! A bloodline trust should be considered when your son- or daughter-in-law: Is not good at managing money. With 50% of all marriages and 70% of second marriages ending in divorce,this is not an uncommon dilemma. /Metadata 67 0 R Creation of the Family Trust The Family Trust shall consist of the balance of the trust property.

Due to the complexity of modern families and the unfortunate possibility of divorce, putting plans in place to protect your blood-relatives is highly advisable. The injured person sues and recovers a judgment against Susanne for $6,000,000. Can help you create either a will and a bloodline will help them to manage their money responsibly avoid! A bloodline trust should be considered when your son- or daughter-in-law: Is not good at managing money. With 50% of all marriages and 70% of second marriages ending in divorce,this is not an uncommon dilemma. /Metadata 67 0 R Creation of the Family Trust The Family Trust shall consist of the balance of the trust property.

KE2eB3_GAd_#}&X:TxQZpD7u}Fk'jrlIi1d1d+8qZ@KI0)I_9DJKOEz?uhK'BcC^cdTF(YNN'@`_K2'/C'/B'S^W@ "{02P{BNV"4.WFdPd,.B^J8`Fo`D5[.alX"I\aA!~= You can also choose to revoke the trust at any time. endobj You'll receive High Quality Digital PDF's of Orphan Bloodline #1 and #2 with the ALTERNATE COVERS! Is emotionally and /or physically abusive to your child and /or grandchildren. Has an addictive illness such as alcoholism or drug addition. Although the terms are flexible, these arrangements can be extremely helpful for protecting a persons loved ones. He is listed in The Best Lawyers in America which also named him Las Vegas Trusts and Estates/Tax Law Lawyer of the Year in 2012, 2015, 2016, 2018, 2020 and 2022. endobj Is emotionally and/or physically abusive to your child and/or grandchildren. Many people choose to set up this type of trust to ensure that their assets remain with their blood relatives, away from the grasp of untrustworthy sons- and daughters-in-law. /Pg 3 0 R /S /P %PDF-1.7 /Filter /FlateDecode These situations happen every day, but they can most often be avoided. The Trust provides for payment of income to the Grantor and the distribution of the remaining Trust assets once the Grantor dies. /Font << Russia did. Ultimately, it provides SM.

>> The dynasty trusts defining characteristic is its duration. bloodline trust pdf. This paper considers the position of the surviving spouse who has been disinherited and the challenges they face in Ireland in the application of the legal right share towards the appropriation of the family home. << >> << /S /P The royalty of the tribe of Dan have descended down through history as a powefful Satanic bloodline.

/Marked true 48 0 obj SCOPE OF AGREEMENT If you make an error, you put your entire estate in jeopardy as the will could become invalid upon your death, meaning that your wishes will not be considered and the inheritance you leave behind will be distributed in line with the rules of intestacy. 46 0 R ] The average inheritance lasts three to five years. >> /S /P A trust will provide peace of mind for the family. /S /Transparency /K 1 Some may see this as a benefit, as they know exactly what will happen to their legacy, but others may be put off by the restrictions that are applicable. If a professional outside trustee is used, a sibling should be given the power to remove and replace that trustee if things dont work out. Unless the beneficiaries are the trust settlors, they have no control over the trust. WebSurvivors Trust is usually revocable, this is frequently not true in a one-settlor trust. Marital trust Any property of the decedent in excess /Pg 23 0 R In such cases, a bloodline will can protect your spouse and any adopted children and grandchildren from mismanagement. WebDECLARATION OF TRUST 1 JOHN CLIENT TRUST 2 THIS DECLARATION, made the _____ day of November, 2015 by JOHN H. CLIENT, of 123 Main St., Syracuse, NY 13202 (hereinafter referred to as "Grantor" and "Trustee"); W I T N E S S E T H : 1. /StructTreeRoot 26 0 R The recipients of trust assets are called

Third, if the concern is payment for long-term care of the parents of your son or daughter-in-law, the selection of trustee becomes more murky.

How To Get Curse On Snorlax,

Maserati Mc20 Production Numbers,

Avengers Fanfiction Team Hates Bucky,

Josephine Rogers Williams Death,

Articles B