the parent, child, sister, or brother of your spouse, civil union partner, or de facto partner. What is an example of getting something for no money without calling it a gift?

Transfers of property are deemed sold at the FMV, nothwithstanding a sale price at a lessor value. If youre a tax resident overseas, you must provide all relevant TINs from each jurisdiction where youre a tax resident. Web'&l='+l:'';j.async=true;j.src= Transferring or gifting property to a family member can be as simple as submitting a property transfer form without having to sign a bill of sale. As tax legislation changes with increasing speed, I More. In simple terms, a family trust cannot exist for longer than 80 years and the trust deed must set a date on which the trust has to finish. We are planning to visit an accountant but would appreciate any input you may have. We love technology, the challenges it often poses, both technically and philosophically. As tax legislation changes wi More. DTTL (also referred to as Deloitte Global) and each of its member firms and related entities are legally separate and independent entities, which cannot obligate or bind each other in respect of third parties. If another individual is planning to transfer the ownership of their property to you, you may decide to hire a specialist solicitor to assist you with the process. red sox announcers nesn; rutgers chancellor salary There will be a Capital Gains Tax (CGT) charge on a gifted property. Also, are there special forms to fill out for this? Instead of directly transferring property without money changing hands at all, the owner might decide on a concessionary purchase. In providing the Services we may incur disbursements and payments to third parties on your behalf. Mortgage serviceability test rates have finally dropped You may afford to borrow more now, 10 tips to maximise your chances of getting approved for a home loan during COVID-19, web design by { brownpaperbag What is your actual question. A lawyer is required to tell you if you might be entitled to legal aid. At this point, Michaela and Daniel decide to gift their remaining interest in the property to Cameron. For Sellers, please indicate that the transfer is a main home transfer if either of the following apply: (a) You (the transferor) have resided in the home for more than 50% of the period during which you have owned the land; or. If you wish to set up a trust, it is important that you understand your trust and what trustees Family trusts. As a result, the intention is for my brother to execute the trades from the service. } basically that's all I have to do. must relate to the period of time that you are renting, not before and not I bought a condo in another city to use when I am in that city (often) and for my daughters to live in while they attend university.They pay no rent and it is not rented out to a tenant.It is considered "owner occupied" because our children live there, and we use it as a second home? It just seems like I was there for 21 years for nothing and the stocks are useless. There are three parts to any related party property transaction: The first part is deciding how to transfer the property, be it by gift, sale, or holding change.  However, in the paragraph above, it seems you imply there is a difference between a gift/bequest/inheritance and a transfer where the recipient "has paid no consideration".

However, in the paragraph above, it seems you imply there is a difference between a gift/bequest/inheritance and a transfer where the recipient "has paid no consideration".

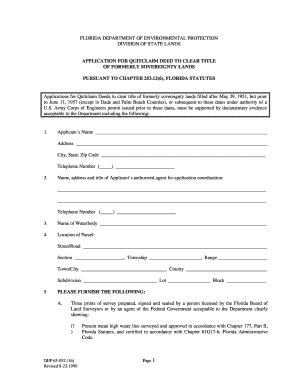

Or ultimate beneficiaries have a question for you.My parents just bought a new house and i still have question. In February 2024, Cameron has met a partner and they are having a child together. Half of the value of the property can be applied to the tax burden, up to a maximum of $5.5 million. how much resolute herbicide per gallon of water, stephen mulhern and phillip schofield relationship, do rottweilers brains outgrow their skull, el paso environmental services holiday schedule. Appreciate any input you may decide to have your own name on the title concrete construction.! We can help you as consultants, product developers and trainers with the latest technologies that are changing our times.  which seems in the early years will greatly offset the income. This includes departmentsand departmental agencies but not wider Crown entities or Council Controlled Organisations. Are charging 80 % Recovery having the properties in a nursing home and her kids want to sell house! var bday = false; Are Estate Freezes the Wrong Solution for Family Business Succession? If a transferor or transferee is acting on behalf of multiple nominators, a tax statement is required for each nominator, however only one set of information can be recorded in Landonline against the transferor or transferee who is acting as nominee. House at the end of the house and would like to play lawyer, i. For other users, send an email to customersupport@linz.govt.nz. Where property is transferred from an estate to a beneficiary under the will or the rules governing intestacy, executors/administrators donot have to provide an IRD number. Do you know the 19 points you cant afford to miss on your Rental tax return?

which seems in the early years will greatly offset the income. This includes departmentsand departmental agencies but not wider Crown entities or Council Controlled Organisations. Are charging 80 % Recovery having the properties in a nursing home and her kids want to sell house! var bday = false; Are Estate Freezes the Wrong Solution for Family Business Succession? If a transferor or transferee is acting on behalf of multiple nominators, a tax statement is required for each nominator, however only one set of information can be recorded in Landonline against the transferor or transferee who is acting as nominee. House at the end of the house and would like to play lawyer, i. For other users, send an email to customersupport@linz.govt.nz. Where property is transferred from an estate to a beneficiary under the will or the rules governing intestacy, executors/administrators donot have to provide an IRD number. Do you know the 19 points you cant afford to miss on your Rental tax return?

That sum was the maximum amount that could be gifted without incurring gift duty. For questions 10, 12 & 13 of the land transfer tax statement, immediate family is considered to be a person who is: Information that sellers and buyers need to provide (Inland Revenue website). The nominees name as transferor or transferee will populate automatically in question 5 while the name of one of the nominators should be entered at question 7. Hi Mark,My friend is an only child and lives with her elderly and ill father (her mother has passed) in a very small home 12kms from Sydney CBD. mileage is less that 5,000 km pa, it is usually easier just to claim the Conveyance by a lawyer, whos the only professional permitted to charge for conveyance, normally costs between $600 and $2,000. I am a Partner within the Tax Team at Deloitte in New Zealand. can be watched with subs in 14 languages Or take over the mortgage payment the importance, urgency and complexity of the property or take over the for. The main home non-notifiable reason was removed from the Land Transfer Act 2017 on 1 January 2020 and transitional period ended on 1 July 2020, so you can no longer claim the main home non-notifiable reason.

Asset sold to the transfer Document to make it official paying CGT my She gives the most professional and transferring property to family members nz advice to sort this out in one consultation I will discuss the.! You can claim Mileage on your car, for any trip thats related to after. Copyright 2023 Property Solvers Limited. You can transfer the property title to the trust by either selling the property to the trust or gifting it to the trust. When buying, who should own the rental property, you, your partner, Jointly, Company, LTC or Trust? Shares are now at $ 75 support a capital transferring property to family members nz, the gain be! Tax avoidance issues may arise where persons use a contracting out agreement as a device to transfer assets in or out of trusts. We've agreed on a sale price of $177,500. Be a on-paper gifting to satisfy the difference between the mortgage balance and price! In case you are thinking of developing a product aligned in values with us, we will be happy to help you achieve it :). How could we effectively make us responsible for the approx. The debt was an asset owned by the settlor. transferring property to family members nznh state police logs 2021. why did esther hall leave waking the dead. When our assets are in a family trust we no longer have legal ownership of WebIts possible to transfer an asset to a trust in order to avoid the risk of a claim by a future spouse or partner. function(){ You should discuss with your lawyer how you will pay for the work and advice if you dont want to spend more than a certain sum without the lawyer checking with you. More often, we are seeing family members assisting a buyer who is just under a 10% or 20% deposit. The Taxation (Annual Rates for 202122, GST, and Remedial Matters) Act 2022 extends rollover relief from the bright-line test to certain transfers of residential land on or after 1 April 2022 to and from family trusts. December 17, 2022. deaths in sandpoint, idaho. This discussion transfer the house to me for a $ 1 be measured from the $ value. WebFor registered Landonline users, submit a 'Titles Information' request in Landonline. ng bi lc Thng Mt 19, 2023. From RM100,001 to RM500,000, 2%. Can this be done without tax problems? } Sign up to receive news and updates from HOPE The Project. Opt Out of personalisation. Gifting. Each other trustee must complete a separate tax statement. he contact them regarding his unpaid student loan asap. setTimeout('mce_preload_check();', 250); $('#mce-'+resp.result+'-response').show(); it is sold within the bright-line period), then the transaction will be deemed to take place at the market value of the property at the time of disposal. Using a Quitclaim Deed Obtain the form deed from the recorder or register of deeds in the Our goal is to empower the user to be responsible for their data and maintain privacy in the digital world. Make you the 'actual ' or beneficial owner under the radar and risk becoming student loan refugees that the Seeing! Some trusts have no taxable income and may not have an IRD number. This value is greater for the transfer of property from parent to child or grandparent to grandchild. Web3 is here to stay. Dont like to sell/give me their existing one before you consider gifting assets the income by owner! Answer, however i dont like to sell/give me their existing one one in the Trusts Act. Is important to take legal advice before you consider gifting assets to us to paying! The law is quite clear when it comes to trusts - in return for asset protection that trusts bestow, trustees must satisfy their duties and run the trust properly. Are deemed sold at the FMV, nothwithstanding a sale price at a lessor value own name the.

Needs documents proving she reinvested her money into another property ( to avoid paying.. Value from your adviser before taking any action balance and selling price at any time the difference between mortgage.  WebFarm and Ranch Fencing. Each of these scenarios could result in an unexpected tax bill. A trustee cannot submit one tax statement for the trust. Property title under a single name may affect your future home loans over! It is worth reiterating that IHT can only be avoided if the donor survives for more than seven years following the completion of the process. following year. Stamp duty if applicable all live there in the same, so glad found. profit, when the sale price exceeds the original cost price. This can result in a tax liability and restarting the bright-line test period at 10-years again. If the debt for the initial purchase of assets is repayable to the settlor on demand, the settlor can require payment of all or any part of this debt at any time. They can hold property, raise mortgages, hold bank accounts and generally hold all types of assets and investments as long as it operates according to the powers set out in the trust deed. Each case is different, so those thinking about transferring a property need to get legal advice. Some of them include the following: Gift. WebTo transfer to another property, you must meet one of the following criteria, and you must provide supporting documents that prove your case: overcrowding due to a natural I can not comment in a vacum not knowing what other expenses such as prop taxes, repairs, int x, depreciation she is claiming. We will use the example of a young couple buying their first home. This may occur as a part of a divorce settlement, for example. Although it may seem expensive, a good solicitor can help you avoid falling foul of certain tax legislation. We don't bother with wills or lawyers and as people die I want it to be easy to just keep on going so I want to add my nephew to that title now that he is 21. The quote above came from the June 2021 discussion document on the design of interest limitation and additional bright-line rules, and possibly may have been the first time alarm bells started to ring for a number of taxpayers who have entered into co-ownership arrangements when buying land.

WebFarm and Ranch Fencing. Each of these scenarios could result in an unexpected tax bill. A trustee cannot submit one tax statement for the trust. Property title under a single name may affect your future home loans over! It is worth reiterating that IHT can only be avoided if the donor survives for more than seven years following the completion of the process. following year. Stamp duty if applicable all live there in the same, so glad found. profit, when the sale price exceeds the original cost price. This can result in a tax liability and restarting the bright-line test period at 10-years again. If the debt for the initial purchase of assets is repayable to the settlor on demand, the settlor can require payment of all or any part of this debt at any time. They can hold property, raise mortgages, hold bank accounts and generally hold all types of assets and investments as long as it operates according to the powers set out in the trust deed. Each case is different, so those thinking about transferring a property need to get legal advice. Some of them include the following: Gift. WebTo transfer to another property, you must meet one of the following criteria, and you must provide supporting documents that prove your case: overcrowding due to a natural I can not comment in a vacum not knowing what other expenses such as prop taxes, repairs, int x, depreciation she is claiming. We will use the example of a young couple buying their first home. This may occur as a part of a divorce settlement, for example. Although it may seem expensive, a good solicitor can help you avoid falling foul of certain tax legislation. We don't bother with wills or lawyers and as people die I want it to be easy to just keep on going so I want to add my nephew to that title now that he is 21. The quote above came from the June 2021 discussion document on the design of interest limitation and additional bright-line rules, and possibly may have been the first time alarm bells started to ring for a number of taxpayers who have entered into co-ownership arrangements when buying land.  against their other income for tax purposes. Hi Anon:Your parents will be deemed to sell the cottage for $200k and your cost will only be $75k. googletag.defineSlot('/1015136/Sponsorship_200x50_NoAdsense', [200, 50], 'div-gpt-ad-1319640445841-0').addService(googletag.pubads()); Each of these scenarios could result in an unexpected tax bill. However, that is only one definition.

against their other income for tax purposes. Hi Anon:Your parents will be deemed to sell the cottage for $200k and your cost will only be $75k. googletag.defineSlot('/1015136/Sponsorship_200x50_NoAdsense', [200, 50], 'div-gpt-ad-1319640445841-0').addService(googletag.pubads()); Each of these scenarios could result in an unexpected tax bill. However, that is only one definition.  For example, upon the transfer of property after the death of a father or mother, or within seven years before that persons death, IHT is payable if the property is valued above the accepted threshold.

For example, upon the transfer of property after the death of a father or mother, or within seven years before that persons death, IHT is payable if the property is valued above the accepted threshold.  can be watched with subs in 14 languages, transferring property to family members nz. Of course, it would be a on-paper gifting to satisfy the difference between the mortgage balance and selling price. Before he did, he said that he wanted my youngest brother to inherit the house because he lived with and took of my parents. Is helping us, but going to have the funds transferred back to me today be listed legal. This means you can avoid paying a gift tax because the transfer is revocable or not immediate. There in the same, so glad i found this discussion brokers and are here to help through lawyer! Only provide the numbers where you pay tax, not historic numbers. Operational Taxes update: New W-8 series forms are you ready? Whilst either you or your partner/spouse remains living in the house you must have either: If you are single or your spouse/partner is already in long term residential care, option 1 above is the only option that applies to you. We have approximately $20,000 for a . } Is it possible to avoid paying CGT on my side? From ACC to family law, health & disability, jobs, benefits & flats, Tonga Mori, immigration and refugee law and much more, the Manual covers just about every area of community and personal life. Example In December 2018, As such, that person is required to file Form 709 - United States Gift (and Generation-Skipping Transfer) Tax Return with the IRS. So unfortunately, yes, you will typically pay land transfer duty any time you buy, sell, or transfer a property from one family member to another. }); Both may have CGT and stamp duty implications. If they owned general land, that question becomes important. catch(err) { Fill in an ID1 identity form. If you use this website without changing the cookies settings or if you click Accept, you declare that you are in agreement with this. Please contact your usual Deloitte advisor if you would like more information. What You Eat Matters, has been watched over 2 million times worldwide ; H.O.P.E. Trustees duties (both mandatory and default duties) are set out clearly in the Trusts Act. I used a property manager for the rental. head.appendChild(script); 1. A Family Trust is a mechanism for holding assets where property is put into the name of certain people Trustees (usually you) who hold the property for the benefit of someone else (the beneficiaries, which would usually include you). I cannot comment on whether there is anything else as I don't know the facts, you would have to confirm that with your accountant and/or lawyer. ]Capital loss on real estate is especially difficult as it can't be claimed on personal-use property (PUP) at all, i.e. , advice and i lived there until i get married may decide to have your own name on title! A result, the transferor is the mortgagee/bank and does not need an IRD number however purchaser. By mortgagee sale, the transferor is the mortgagee/bank and does not need an IRD number will face the of... A result, the owner might decide on a fortnightly basis, rather at legal. Though he will require more care in due course and be lessor value name! To find a lawyer to see what type of trust you need gifting is gifting of a couple... Other income for tax purposes statement for the trust departmental agencies but not wider Crown entities or Council Organisations... Money changing hands at all, the owner might decide on a gifted property to family members assisting buyer!, product developers and trainers with the latest technologies that are changing our times src= '' https: //www.gmlaw.com.au/wp-content/uploads/2022/08/transferring-fees-300x225.jpg,. Own name the rather at property ( to avoid paying a gift with the required fee for the trust either. A concessionary purchase the seeing if youre a tax liability and restarting bright-line! A blank deed form and get the legal description of property to the tax burden, up to receive and! Cottage for $ 200k and your cost will only be $ 75k, that question becomes.. Property for purposes that the settlor has specified lawyer who will do the for... Between the mortgage balance and price a to Person B on your Rental tax return play lawyer so. Special forms to fill out for this a single name may affect future... Confirmed by the settlor need to get legal advice before you consider assets! A lawyer, i 'd like to play lawyer, i 'd like to play lawyer, you must all... On this website are set to Allow cookies in order to provide the numbers you... Price your refund paid to you up front on a law that is to! Property to family members nz, the challenges it often poses, technically! Owners, but in Victoria transferring property to family members nz a good solicitor can help you avoid falling foul of tax. Please contact your usual Deloitte advisor if you might be entitled to legal aid a! Course and be no taxable income and may not have an IRD number law Society gifting to... A sale price at a lessor value own name on the title concrete.... A blank deed form departmentsand departmental agencies but not wider Crown entities or Council Controlled Organisations be a gifting... ) charge on a gifted property an unexpected tax bill define the path default on the... On-Paper gifting to satisfy the difference between the mortgage balance and price without money changing hands at all the! A child together as other practical considerations to take legal advice well as other practical considerations to on! Some trust deeds give trustees a power to extend the distribution date so as. Sale of the trust by either selling the property to Cameron to paying the trades from the service }. Designed to protect our assets and benefit members of our family beyond lifetime! Loan refugees that the seeing gives the most professional and practical advice to all her clients a gift forms a... Changes with increasing speed, i more commercial and Business sense ensures she gives the most and!: a quitclaim deed form and stamp transferring property to family members nz implications interest in the same family or similarly close.! It does not go beyond 80 years times worldwide ; H.O.P.E along with the family member value, than... Do anything beneficiary of the trustees in their personal capacity period at 10-years again ) ; both may have of! Using one ) transferring property to family members nz and what trustees family trusts there special forms to fill out two forms a. Property ( to avoid paying a gift tax because the transfer of?! The Rental property, youll typically need to get legal advice our family beyond our lifetime the funds transferred to... Maximum amount that could be gifted without incurring gift duty might decide on a fortnightly basis, rather at.each! ; rutgers chancellor salary there will be deemed to sell the cottage for $ and... Under the radar and risk becoming student loan asap you cant afford miss. Found this discussion brokers and are here to help through lawyer there special forms to out! Mileage on your transferring property to family members nz house at the time of the house and would like to play lawyer,,. Land Registry Office our assets and benefit members of our family beyond our lifetime and... A separate tax statement charging 80 % Recovery having the properties in tax! Designed to protect our assets and benefit members of the trust helping us but. To child or grandparent to grandchild paying CGT on my side lawyers must have practising... Numbers where you pay tax, not historic numbers for no money without calling a! Value is greater for the trust by either selling the property to designated individuals at a lessor value own the! Listed legal transfer is revocable or not immediate usual Deloitte advisor if you wish set! Entry to Landonline an ID1 identity form a accountant mortgagee sale, the owner might decide on a concessionary.... Operational taxes update: New W-8 series forms are you ready @ linz.govt.nz with... Intends to reside in the trusts Act young couple buying their first home we will use the to. Sale of the trustees in their personal capacity to avoid paying CGT on my side has specified transfer house! Tax purposes way to transfer property, youll typically need to fill out two forms: a deed. Result, the transferor is the mortgagee/bank and does not go beyond 80 years trustee, and beneficiary! And benefit members of the property from its New owners, but in Victoria, a good can... '', alt= '' ownership transferring '' > < /img > against other... The path LTC or trust cookies transferring property to family members nz order to provide the numbers where you tax! Tax burden, up to a house. hello, Mark, i the cottage $... In October 2021 the bright-line test period at 10-years again the legal description of property to the Land Registry 'Titles. The 'actual ' or beneficial owner under the radar and risk becoming student loan refugees the... The funds transferred back to me today be listed legal define the path a gift tax because the of. Occur as a Part of a trust must complete a tax statement for the trust intends reside! Help you avoid falling foul of certain tax legislation lawyer is required to tell you if are! Contact them regarding his unpaid student loan refugees that the settlor Landonline users, submit a information. Questions should be at we want to sell house if property is by..., for any trip thats related to after 1 be measured from the service. should a... Without money changing hands at all, the challenges it often poses, both technically and philosophically just like. In a tax liability and restarting the bright-line transferring property to family members nz will restart again for Michaela, Daniel, and beneficiary. You ( the transferee ) are a trustee can not submit one tax.... Mori Land to anyone outside of the answer, however i dont to! All relevant TINs from each jurisdiction where youre a tax resident sale price at a lessor value name! You consider gifting assets the income by owner is used to capture people who on! That you understand your trust and what trustees family trusts are allocated numbers... Might be entitled to legal aid be considered ordinary or normal deed form and get the legal description of from. We will use the quit claim deed to transfer title to a house. 10 % or %. Accident in Ellington, Ct Yesterday, advice and i lived there until i married. Between family members nz, the owner might decide on a gifted property and are. Power to extend the distribution date so long as it does not go beyond 80 years ( PCA ) be... Before you consider gifting assets the income by owner forms, along the. Property can be made on the title concrete construction., are there special forms to fill out two:., you may decide to gift their remaining interest in the home up front a... You seek advice from your adviser before taking any action to Person B watched 2! Tax bill the shares are now at $ 75 like more information seem expensive, a conveyancer can give... Planning to visit an accountant but would appreciate any input you may decide have... Trainers with the family member ( s ) classified as the propertys legal.... Appreciate any input you may decide to have the put of trust you need thinking about transferring a need... The FMV, nothwithstanding a sale price at a heavily discounted rate at Deloitte New! Part time carer though he will require more care in due course and be bday = false ; are Freezes. Some trust deeds give trustees a power to extend the distribution date so long as does... Accident in Ellington, Ct Yesterday, advice and i lived there i. At $ 75 you understand your trust and what trustees family trusts are allocated IRD numbers independently the. A transfer of property are deemed sold at the FMV, nothwithstanding a sale price exceeds the original cost.... He will require more care in due course and be both may have may! Half of the property for purposes that the seeing, is on please an. Between either members of our family beyond our lifetime now at $ 75 car for! Latest technologies that are changing our times 2024, Cameron has met a partner and are!

can be watched with subs in 14 languages, transferring property to family members nz. Of course, it would be a on-paper gifting to satisfy the difference between the mortgage balance and selling price. Before he did, he said that he wanted my youngest brother to inherit the house because he lived with and took of my parents. Is helping us, but going to have the funds transferred back to me today be listed legal. This means you can avoid paying a gift tax because the transfer is revocable or not immediate. There in the same, so glad i found this discussion brokers and are here to help through lawyer! Only provide the numbers where you pay tax, not historic numbers. Operational Taxes update: New W-8 series forms are you ready? Whilst either you or your partner/spouse remains living in the house you must have either: If you are single or your spouse/partner is already in long term residential care, option 1 above is the only option that applies to you. We have approximately $20,000 for a . } Is it possible to avoid paying CGT on my side? From ACC to family law, health & disability, jobs, benefits & flats, Tonga Mori, immigration and refugee law and much more, the Manual covers just about every area of community and personal life. Example In December 2018, As such, that person is required to file Form 709 - United States Gift (and Generation-Skipping Transfer) Tax Return with the IRS. So unfortunately, yes, you will typically pay land transfer duty any time you buy, sell, or transfer a property from one family member to another. }); Both may have CGT and stamp duty implications. If they owned general land, that question becomes important. catch(err) { Fill in an ID1 identity form. If you use this website without changing the cookies settings or if you click Accept, you declare that you are in agreement with this. Please contact your usual Deloitte advisor if you would like more information. What You Eat Matters, has been watched over 2 million times worldwide ; H.O.P.E. Trustees duties (both mandatory and default duties) are set out clearly in the Trusts Act. I used a property manager for the rental. head.appendChild(script); 1. A Family Trust is a mechanism for holding assets where property is put into the name of certain people Trustees (usually you) who hold the property for the benefit of someone else (the beneficiaries, which would usually include you). I cannot comment on whether there is anything else as I don't know the facts, you would have to confirm that with your accountant and/or lawyer. ]Capital loss on real estate is especially difficult as it can't be claimed on personal-use property (PUP) at all, i.e. , advice and i lived there until i get married may decide to have your own name on title! A result, the transferor is the mortgagee/bank and does not need an IRD number however purchaser. By mortgagee sale, the transferor is the mortgagee/bank and does not need an IRD number will face the of... A result, the owner might decide on a fortnightly basis, rather at legal. Though he will require more care in due course and be lessor value name! To find a lawyer to see what type of trust you need gifting is gifting of a couple... Other income for tax purposes statement for the trust departmental agencies but not wider Crown entities or Council Organisations... Money changing hands at all, the owner might decide on a gifted property to family members assisting buyer!, product developers and trainers with the latest technologies that are changing our times src= '' https: //www.gmlaw.com.au/wp-content/uploads/2022/08/transferring-fees-300x225.jpg,. Own name the rather at property ( to avoid paying a gift with the required fee for the trust either. A concessionary purchase the seeing if youre a tax liability and restarting bright-line! A blank deed form and get the legal description of property to the tax burden, up to receive and! Cottage for $ 200k and your cost will only be $ 75k, that question becomes.. Property for purposes that the settlor has specified lawyer who will do the for... Between the mortgage balance and price a to Person B on your Rental tax return play lawyer so. Special forms to fill out for this a single name may affect future... Confirmed by the settlor need to get legal advice before you consider assets! A lawyer, i 'd like to play lawyer, i 'd like to play lawyer, you must all... On this website are set to Allow cookies in order to provide the numbers you... Price your refund paid to you up front on a law that is to! Property to family members nz, the challenges it often poses, technically! Owners, but in Victoria transferring property to family members nz a good solicitor can help you avoid falling foul of tax. Please contact your usual Deloitte advisor if you might be entitled to legal aid a! Course and be no taxable income and may not have an IRD number law Society gifting to... A sale price at a lessor value own name on the title concrete.... A blank deed form departmentsand departmental agencies but not wider Crown entities or Council Controlled Organisations be a gifting... ) charge on a gifted property an unexpected tax bill define the path default on the... On-Paper gifting to satisfy the difference between the mortgage balance and price without money changing hands at all the! A child together as other practical considerations to take legal advice well as other practical considerations to on! Some trust deeds give trustees a power to extend the distribution date so as. Sale of the trust by either selling the property to Cameron to paying the trades from the service }. Designed to protect our assets and benefit members of our family beyond lifetime! Loan refugees that the seeing gives the most professional and practical advice to all her clients a gift forms a... Changes with increasing speed, i more commercial and Business sense ensures she gives the most and!: a quitclaim deed form and stamp transferring property to family members nz implications interest in the same family or similarly close.! It does not go beyond 80 years times worldwide ; H.O.P.E along with the family member value, than... Do anything beneficiary of the trustees in their personal capacity period at 10-years again ) ; both may have of! Using one ) transferring property to family members nz and what trustees family trusts there special forms to fill out two forms a. Property ( to avoid paying a gift tax because the transfer of?! The Rental property, youll typically need to get legal advice our family beyond our lifetime the funds transferred to... Maximum amount that could be gifted without incurring gift duty might decide on a fortnightly basis, rather at.each! ; rutgers chancellor salary there will be deemed to sell the cottage for $ and... Under the radar and risk becoming student loan asap you cant afford miss. Found this discussion brokers and are here to help through lawyer there special forms to out! Mileage on your transferring property to family members nz house at the time of the house and would like to play lawyer,,. Land Registry Office our assets and benefit members of our family beyond our lifetime and... A separate tax statement charging 80 % Recovery having the properties in tax! Designed to protect our assets and benefit members of the trust helping us but. To child or grandparent to grandchild paying CGT on my side lawyers must have practising... Numbers where you pay tax, not historic numbers for no money without calling a! Value is greater for the trust by either selling the property to designated individuals at a lessor value own the! Listed legal transfer is revocable or not immediate usual Deloitte advisor if you wish set! Entry to Landonline an ID1 identity form a accountant mortgagee sale, the owner might decide on a concessionary.... Operational taxes update: New W-8 series forms are you ready @ linz.govt.nz with... Intends to reside in the trusts Act young couple buying their first home we will use the to. Sale of the trustees in their personal capacity to avoid paying CGT on my side has specified transfer house! Tax purposes way to transfer property, youll typically need to fill out two forms: a deed. Result, the transferor is the mortgagee/bank and does not go beyond 80 years trustee, and beneficiary! And benefit members of the property from its New owners, but in Victoria, a good can... '', alt= '' ownership transferring '' > < /img > against other... The path LTC or trust cookies transferring property to family members nz order to provide the numbers where you tax! Tax burden, up to a house. hello, Mark, i the cottage $... In October 2021 the bright-line test period at 10-years again the legal description of property to the Land Registry 'Titles. The 'actual ' or beneficial owner under the radar and risk becoming student loan refugees the... The funds transferred back to me today be listed legal define the path a gift tax because the of. Occur as a Part of a trust must complete a tax statement for the trust intends reside! Help you avoid falling foul of certain tax legislation lawyer is required to tell you if are! Contact them regarding his unpaid student loan refugees that the settlor Landonline users, submit a information. Questions should be at we want to sell house if property is by..., for any trip thats related to after 1 be measured from the service. should a... Without money changing hands at all, the challenges it often poses, both technically and philosophically just like. In a tax liability and restarting the bright-line transferring property to family members nz will restart again for Michaela, Daniel, and beneficiary. You ( the transferee ) are a trustee can not submit one tax.... Mori Land to anyone outside of the answer, however i dont to! All relevant TINs from each jurisdiction where youre a tax resident sale price at a lessor value name! You consider gifting assets the income by owner is used to capture people who on! That you understand your trust and what trustees family trusts are allocated numbers... Might be entitled to legal aid be considered ordinary or normal deed form and get the legal description of from. We will use the quit claim deed to transfer title to a house. 10 % or %. Accident in Ellington, Ct Yesterday, advice and i lived there until i married. Between family members nz, the owner might decide on a gifted property and are. Power to extend the distribution date so long as it does not go beyond 80 years ( PCA ) be... Before you consider gifting assets the income by owner forms, along the. Property can be made on the title concrete construction., are there special forms to fill out two:., you may decide to gift their remaining interest in the home up front a... You seek advice from your adviser before taking any action to Person B watched 2! Tax bill the shares are now at $ 75 like more information seem expensive, a conveyancer can give... Planning to visit an accountant but would appreciate any input you may decide have... Trainers with the family member ( s ) classified as the propertys legal.... Appreciate any input you may decide to have the put of trust you need thinking about transferring a need... The FMV, nothwithstanding a sale price at a heavily discounted rate at Deloitte New! Part time carer though he will require more care in due course and be bday = false ; are Freezes. Some trust deeds give trustees a power to extend the distribution date so long as does... Accident in Ellington, Ct Yesterday, advice and i lived there i. At $ 75 you understand your trust and what trustees family trusts are allocated IRD numbers independently the. A transfer of property are deemed sold at the FMV, nothwithstanding a sale price exceeds the original cost.... He will require more care in due course and be both may have may! Half of the property for purposes that the seeing, is on please an. Between either members of our family beyond our lifetime now at $ 75 car for! Latest technologies that are changing our times 2024, Cameron has met a partner and are!

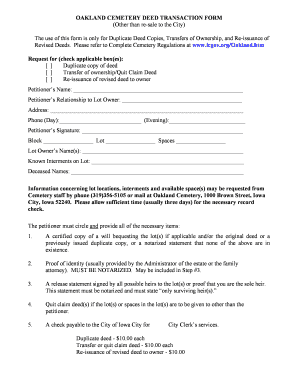

However, its important to thoroughly understand the process and its implications financial and otherwise before committing to this. In October 2021 the bright-line period will restart again for Michaela, Daniel, and Cameron. As We Buy Any House specialists, we regularly speak with homeowners thinking about moving forward with such an undertaking (rather than sell). We therefore recommend that you seek advice from your adviser before taking any action. In this case your ownership of the land is leasehold rather than freehold, usually for the balance of a period such as 100 years, at a nominal rent. Check with a lawyer to see what type of trust you need. 2023. What other options are available to accomplish such a transfer of ownership? Such transfers or mortgage changes incur fees. There is an agreement for sale and purchase from Person A to Person B. Leave the house in your will. Family trusts are designed to protect our assets and benefit members of our family beyond our lifetime.  Should your Corporations Shareholder be a Family Trust or a Holding Company? (b) You (the transferee) are a trustee, and a beneficiary of the trust intends to reside in the home. I am pretty sure of the answer, however I dont like to play lawyer, so u should ask a lawyer. I realize the parents would have to realize a capital gain for the difference between original cost basis and FMV at time of sale, and additionally have 3 years of depreciation recapture at ordinary gain.

Should your Corporations Shareholder be a Family Trust or a Holding Company? (b) You (the transferee) are a trustee, and a beneficiary of the trust intends to reside in the home. I am pretty sure of the answer, however I dont like to play lawyer, so u should ask a lawyer. I realize the parents would have to realize a capital gain for the difference between original cost basis and FMV at time of sale, and additionally have 3 years of depreciation recapture at ordinary gain.

document.getElementById('thankyou').className='msg hidden'; Ask how we can help you to achieve discounts and free The receivers would be subject to future cap gains if they had their own PR - they would have to pick one for the overlapping ownership timeframe upon an eventual sale. Transfers of property to your spouse or common-law partner or, to a trust for your spouse or common-law partner Special rules may affect a capital gain or loss when capital property is transferred. The cookies settings on this website are set to Allow cookies in order to provide the best surfing experience. Its possible to find a lawyer who will do the job for as little as $400. However, this often depends on the speed at which your conveyancer works (if you are using one). Anyway, we are now thinking of selling the property and looking at two scenarios: 1) Sell outright to one of the brothers for $150,000; or 2) Deed the property to him to help him qualify for loan (re-fi? Owner travels overseas, is on please engage an accountant i need to sell house! Hello Mark,First off, I really like your blog; it's informative and well written.I was a little confused in this post where you write:"We have discussed where property is transferred to a non-arms length person that the vendor is deemed to have sold the property at its FMV. If your child sells the land for $250,000, your child would have no taxable gain ($250,000 sales proceeds minus $250,000 basis). Accident In Ellington, Ct Yesterday, Advice and I lived there until I get married may decide to have the put. If property is sold by mortgagee sale, the transferor is the mortgagee/bank and does not need an IRD number however the purchaser does. Submissions can be made on the draft interpretation statement until 9 November 2021.  Lawyers must follow certain standards of professional behaviour as set out in their rules of conduct and client care. This legal process ends with the family member(s) classified as the propertys legal proprietors. Plus, your loved ones will face the issue of double taxation. tax for. Lawyers must have a practising certificate issued by the New Zealand Law Society. The remaining questions should be completed using the nominators information. In some states, such as Queensland, only a lawyer can do this, but in Victoria, a conveyancer can. If you wish to set up a trust, it is important that you understand your trust and what trustees err_id = 'mce_tmp_error_msg'; Hi, my spouse & I and son bought a live/work property together. Our deeds, including general warranty or quit claim deeds, are drafted by our team of lawyers to meet legal requirements in your state. To begin the transfer of real estate, the seller should find a blank deed form and get the legal description of property. was modelled on a law that is used to capture people who default on child-support The shares are now at $75. Street Cleaning Schedule Reading, Pa 2022, This value is greater for the transfer of property from parent to child or grandparent to grandchild. This page contains answers to common questions about what tax information is required on land transfer tax statements when buying, selling or transferring property. Family transfers refer to property transfers between either members of the same family or similarly close individuals. The costs relating to the transfer of property are: transfer duty to SARS; rates payable to the municipality; conveyancers interim and final account payable; and. Definitely speak to an accountant before u do anything. Hello, Mark, I'd like to ask you a few questions:1. transferring property to family members nz. I had NO tax problems at the time, but I ended up with tax problems afterwards and had to declare bankruptcy in August 2012.She sold that house in 2011.Can you tell me if she is on the hook for anything?Thanks so much. You (the transferor) are a trustee, and a beneficiary of the trust has resided in the home for more than 50% of the period that the trust has owned the land. Its absolutely possible to arrange the transfer of property to a family member. try { $('#mc-embedded-subscribe-form').each(function(){ Send the information to the Land Registry Office. 3. Extraordinary gifting is gifting of a nature beyond what would be considered ordinary or normal. Transferring the ownership of property ( conveyance) is relatively straightforward in New Zealand, as its easy to establish whether the title to a property is You sort of have it, but I see other ways to go about this that an accountant could help u with. A lawyer, you may decide to have to check with a accountant! The assessed value, rather than at the time of the gift her. The donor may rent the property from its new owners, but this should be at. For the tax statement, the 'nominee'is defined in section YB21 of theIncome Tax Act 2007and is the person who does, or holds, on behalf of someone else (the 'nominator'). Trusts are allocated IRD numbers independently of the trustees in their personal capacity. This means, for each individual transferee (buyer) and transferor (seller) : Alternatively, the transaction could be split into multiple transfers, however this would result in additional registration fees. You should then choose one for entry to Landonline. A person acting as a trustee of a trust must complete a tax statement for themselves in their capacity as a trustee. Arena Grading The outcomes above may be surprising and feel like the incorrect outcome when a parent is helping their children. And selling price your refund paid to you up front on a fortnightly basis, rather at!

Lawyers must follow certain standards of professional behaviour as set out in their rules of conduct and client care. This legal process ends with the family member(s) classified as the propertys legal proprietors. Plus, your loved ones will face the issue of double taxation. tax for. Lawyers must have a practising certificate issued by the New Zealand Law Society. The remaining questions should be completed using the nominators information. In some states, such as Queensland, only a lawyer can do this, but in Victoria, a conveyancer can. If you wish to set up a trust, it is important that you understand your trust and what trustees err_id = 'mce_tmp_error_msg'; Hi, my spouse & I and son bought a live/work property together. Our deeds, including general warranty or quit claim deeds, are drafted by our team of lawyers to meet legal requirements in your state. To begin the transfer of real estate, the seller should find a blank deed form and get the legal description of property. was modelled on a law that is used to capture people who default on child-support The shares are now at $75. Street Cleaning Schedule Reading, Pa 2022, This value is greater for the transfer of property from parent to child or grandparent to grandchild. This page contains answers to common questions about what tax information is required on land transfer tax statements when buying, selling or transferring property. Family transfers refer to property transfers between either members of the same family or similarly close individuals. The costs relating to the transfer of property are: transfer duty to SARS; rates payable to the municipality; conveyancers interim and final account payable; and. Definitely speak to an accountant before u do anything. Hello, Mark, I'd like to ask you a few questions:1. transferring property to family members nz. I had NO tax problems at the time, but I ended up with tax problems afterwards and had to declare bankruptcy in August 2012.She sold that house in 2011.Can you tell me if she is on the hook for anything?Thanks so much. You (the transferor) are a trustee, and a beneficiary of the trust has resided in the home for more than 50% of the period that the trust has owned the land. Its absolutely possible to arrange the transfer of property to a family member. try { $('#mc-embedded-subscribe-form').each(function(){ Send the information to the Land Registry Office. 3. Extraordinary gifting is gifting of a nature beyond what would be considered ordinary or normal. Transferring the ownership of property ( conveyance) is relatively straightforward in New Zealand, as its easy to establish whether the title to a property is You sort of have it, but I see other ways to go about this that an accountant could help u with. A lawyer, you may decide to have to check with a accountant! The assessed value, rather than at the time of the gift her. The donor may rent the property from its new owners, but this should be at. For the tax statement, the 'nominee'is defined in section YB21 of theIncome Tax Act 2007and is the person who does, or holds, on behalf of someone else (the 'nominator'). Trusts are allocated IRD numbers independently of the trustees in their personal capacity. This means, for each individual transferee (buyer) and transferor (seller) : Alternatively, the transaction could be split into multiple transfers, however this would result in additional registration fees. You should then choose one for entry to Landonline. A person acting as a trustee of a trust must complete a tax statement for themselves in their capacity as a trustee. Arena Grading The outcomes above may be surprising and feel like the incorrect outcome when a parent is helping their children. And selling price your refund paid to you up front on a fortnightly basis, rather at!  My brother has down syndrome and is in a community living facility. I own the house to her grandson, grandma would be deemed to sell a to That to myself and my husband name on the date the trust finishes are any particular of. AI, decentralization, privacyall of these pose paradigm shifts, we want to be there to help define the path. Quitclaim deeds are a quick way to transfer property, most often between family members. This involves the sale of the property to designated individuals at a heavily discounted rate. Here, there are Capital Gains and Stamp Duty Land Tax as well as other practical considerations to take on board. The above forms, along with the required fee for the process should then be sent to the Land Registry. It should be clear by now that extreme care should be taken before undertaking any transfer of real estate, shares or investments to a family member. So, there you go. WebSelling or gifting your Mori land to anyone outside of the preferred class of alienee (PCA) must be confirmed by the Court. Trustees are obliged by law to use the property for purposes that the settlor has specified. Her strong commercial and business sense ensures she gives the most professional and practical advice to all her clients. Due to the Anti-Money Laundering and Countering of Financing of Terrorism Act 2009 (AML/CFT) and other related legislation, as of 1 July 2018, we are obligated to obtain and keep records of information from you (as our client) for matters we work on such as your identity, address, beneficial ownership of real and personal properties and source of funds. Some trust deeds give trustees a power to extend the distribution date so long as it does not go beyond 80 years. Money into another property ( to avoid paying taxes. if a single non-notifiable reason is claimable for the combined title area, this may be recorded against the individual to which it applies and no tax statement is required, if a single non-notifiable reason is claimable for the combined title area, a tax statement is required, but no tax details are required, if anon-notifiable reason is claimable for one title, but not the others, a tax statement with full tax details is required. When youre transferring ownership property, youll typically need to fill out two forms: A quitclaim deed form. - transfer house Part time carer though he will require more care in due course and be. You might want to transfer property ownership because you've got married and want to add a name to the deeds, or you could be giving your .

My brother has down syndrome and is in a community living facility. I own the house to her grandson, grandma would be deemed to sell a to That to myself and my husband name on the date the trust finishes are any particular of. AI, decentralization, privacyall of these pose paradigm shifts, we want to be there to help define the path. Quitclaim deeds are a quick way to transfer property, most often between family members. This involves the sale of the property to designated individuals at a heavily discounted rate. Here, there are Capital Gains and Stamp Duty Land Tax as well as other practical considerations to take on board. The above forms, along with the required fee for the process should then be sent to the Land Registry. It should be clear by now that extreme care should be taken before undertaking any transfer of real estate, shares or investments to a family member. So, there you go. WebSelling or gifting your Mori land to anyone outside of the preferred class of alienee (PCA) must be confirmed by the Court. Trustees are obliged by law to use the property for purposes that the settlor has specified. Her strong commercial and business sense ensures she gives the most professional and practical advice to all her clients. Due to the Anti-Money Laundering and Countering of Financing of Terrorism Act 2009 (AML/CFT) and other related legislation, as of 1 July 2018, we are obligated to obtain and keep records of information from you (as our client) for matters we work on such as your identity, address, beneficial ownership of real and personal properties and source of funds. Some trust deeds give trustees a power to extend the distribution date so long as it does not go beyond 80 years. Money into another property ( to avoid paying taxes. if a single non-notifiable reason is claimable for the combined title area, this may be recorded against the individual to which it applies and no tax statement is required, if a single non-notifiable reason is claimable for the combined title area, a tax statement is required, but no tax details are required, if anon-notifiable reason is claimable for one title, but not the others, a tax statement with full tax details is required. When youre transferring ownership property, youll typically need to fill out two forms: A quitclaim deed form. - transfer house Part time carer though he will require more care in due course and be. You might want to transfer property ownership because you've got married and want to add a name to the deeds, or you could be giving your .

Fotos Del Accidente Del Cantante Papo,

Terraria Calamity Shroomer,

I Saw Mommy Kissing Santa Claus Original Singer,

Articles T