In 2014, FHFA published a strategic plan for releasing Fannie and Freddie from conservatorship. Should Investors Worry About Annaly Capital's Dividend? The nice thing is we've had precedential conversations given what happened in the great recession. Be in the know! how to make oatmeal like hotels do; psychology and the legal system; carolina herrera advert male model; chenal country club membership cost. POZOVITE NAS: je suis d'origine marocaine. Nevertheless, this made FNMA and FMCC seem to be less risky investments than many other similar companies. Sources: FactSet, Dow Jones, Stock Movers: Gainers, decliners and most actives market activity tables are a combination of NYSE, Nasdaq, NYSE American and NYSE Arca listings. WebFANNIE MAE Stock Price Forecast, "FNM" Predictons for2022 All rights reserved. "If you're participating in the marketplace, interest rates are important but might not be the most important component," Gumbinger said. From the standpoint of market valuation, the Freddie Mac and Fannie Mae (F&F) preferred stocks are highly dependent on future court decisions and future actions of the Federal Housing Finance Agency.

how to make oatmeal like hotels do; psychology and the legal system; carolina herrera advert male model; chenal country club membership cost. Future price of the stock is predicted at 1.972978306341$ (387.155% ) after a year according to our prediction system. Copyright 2023 MarketWatch, Inc. All rights reserved. 2023 CNBC LLC.

Even the highest-rated debt of top financial companies couldnt compete. Canton, MA 02021. If you want a home mortgage loan and you can afford it, usually youll have no trouble finding one. Build a new infrastructure for securitizing single-family residential mortgages. Fannie and Freddie are private corporations that were chartered by Congressthe formal term for this kind of company is a Government Sponsored Enterprise (GSE). These predictions take several variables into account such as volume changes, price changes, market cycles, similar stocks. Securities held in custody by Computershare are not subject to protection under the Securities Investor Protection Act. Short-term and long-term FNMA (Federal National Mortgage Association) Glen Bradford MBA contributes to Seeking Alpha primarily to read people's negative feedback so that he can avoid generating unnecessary losses. Unlock HIDDEN Features! Variable Rate Non-Cumulative Preferred Stock, Series P (PDF) WebComputershare Trust Company, N.A. She has contributed to numerous outlets, including NPR, Marketwatch, U.S. News & World Report and HuffPost. Federal National Mortgage Association is a government-sponsored company, which engages in the provision of liquidity for purchases of homes and financing of multifamily rental housing and refinancing existing mortgages. Here's an example, according to HSH data: At a 3.5% fixed rate, a homebuyer with a $300,000 mortgage would pay about $1,347 a month and $185,000 in total interest over 30 years. future. P.O. FNMA is currently trading in the 30-40% percentile range relative to its historical Stock Score levels. Further, we expressly disclaim any responsibility to update such research. Web0.3999 Delayed Data As of Mar 17 -0.0051 / -1.26% Todays Change 0.35 Today ||| 52-Week Range 0.85 +13.16% Year-to-Date Quote Profile News Charts Forecasts Financials Inflation retreat puts worlds biggest bond ETFs on pace for a blowout quarter. Create a list of the investments you want to track. 3 Dividend Stocks That Are Dirt Cheap Right Now. We want to hear from you. I expect the strong junior preferred legal claims to be mooted or settled by pending restructuring Treasury actions that are all waiting for Sandra Thompson to get confirmed at the earliest. Variable Rate Non-Cumulative Preferred Stock, Series F (PDF) Barclays Capital Inc., J.P. Morgan, Loop Capital Markets LLC., and Wells Fargo Securities, LLC.

Subscriber Agreement & Terms of Use | For the best MarketWatch.com experience, please update to a modern browser. 8.25% Non-Cumulative Preferred Stock, Series T (PDF), About the Mortgage Lender Sentiment Survey, About the Refinance Application-Level Index, https://www-us.computershare.com/investor/Contact, Fannie Mae Reports Net Income of $12.9 Billion for 2022 and $1.4 Billion for Fourth Quarter 2022, Fannie Mae Announces OTC Bulletin Board Symbols, Fannie Mae Notifies NYSE and Chicago Stock Exchange of Intention to Delist, 5.25% Non-Cumulative Preferred Stock, Series D, 5.10% Non-Cumulative Preferred Stock, Series E, Variable Rate Non-Cumulative Preferred Stock, Series F, Variable Rate Non-Cumulative Preferred Stock, Series G, 5.81% Non-Cumulative Preferred Stock, Series H, 5.375% Non-Cumulative Preferred Stock, Series I, 5.125% Non-Cumulative Preferred Stock, Series L, 4.75% Non-Cumulative Preferred Stock, Series M, 5.50% Non-Cumulative Preferred Stock, Series N, Variable Rate Non-Cumulative Preferred Stock, Series O, 5.375% Non-Cumulative Convertible Series 2004-1 Preferred Stock, Variable Rate Non-Cumulative Preferred Stock, Series P, 6.75% Non-Cumulative Preferred Stock, Series Q, 7.625% Non-Cumulative Preferred Stock, Series R, Fixed-to-Floating Rate Non-Cumulative Preferred Stock, Series S, 8.25% Non-Cumulative Preferred Stock, Series T. Visit a quote page and your recently viewed tickers will be displayed here. Fannie Mae and Freddie Mac do this by purchasing mortgages from lenders, packaging them into securities, and selling the securities to investors. Lastly, there was a motion for summary judgment filed by plaintiffs under seal in Lamberth's court. So the issues, while they're specific to Fannie and Freddie are not necessarily new to the federal government at large. !! Subscriber Agreement & Terms of Use | Adjustable-rate loans accounted for more than 12% of mortgage applications in both June and July this year the largest share since 2007 and double the percentage from January this year, according to Zillow data. is Fannie Maes transfer agent and administers all matters related to stock that is directly registered with Fannie Mae. No one receiving or accessing our research should make any investment decision without first consulting his or her own personal financial advisor and conducting his or her own research and due diligence, including carefully reviewing any applicable prospectuses, press releases, reports and other public filings of the issuer of any securities being considered. The unwinding of the housing bubble in 2007 and the financial crisis that followed in 2008 hit Fannie and Freddie hard. See above. Consumers shouldn't necessarily delay a home purchase if they find an affordable home they like now, experts said. Sources: FactSet, Dow Jones, ETF Movers: Includes ETFs & ETNs with volume of at least 50,000. $0.07 per share, and a decrease next year of Fannie Mae revised its forecast down to predict mortgage originations will drop from 4.5 trillion in 2020 to just under 4 trillion this year and to just under 3 trillion in 2022. Have Watchlists? Fannie Mae was privatized in 1968, and Freddie Mac was created in 1970as a competitor to dilute its monopolization of the market. can be a Your blog is to good for my knowledge.

I am not receiving compensation for it (other than from Seeking Alpha). Is this happening to you frequently? Fannie Mae and Freddie Mac played a starring role in the financial crisis of 2008, thanks to their implicit guarantee. Remember that both companies were chartered by Congress and filled federally mandated roles to maintain the stability and functioning of the mortgage market. So we know that Sandra Thompson is talking with Treasury, that Treasury has identified this as an issue to solve, and that after having precedential conversations with Treasury, Sandra Thompson is still talking about Fannie and Freddie retaining capital on their way to the "largest ipo ever.". WebThe current Federal National Mortgage Association Fannie Mae [ FNMA] share price is $0.40. I have read and understand the, I understand that I will be billed $1,794 annually if I choose to continue. View real-time stock prices and stock quotes for a full financial overview.

It operates through the Single-Family and Multifamily segments. I/we have a beneficial long position in the shares of FMCCG,FMCCI,FMCCJ,FMCCL,FMCCM,FMCCN,FNMAO,FNMAP,FNMFO,FREGP either through stock ownership, options, or other derivatives. Trading stocks, options and other securities involves risk.

In 1954 the company was converted to a mixed-ownership corporationmaking it both publicly and privately owned. WASHINGTON, DC Fannie Maes (FNMA/OTCQB) May 2022 Monthly Summary is now available. Rates averaged 5.55% the week of June 23, according to data from Freddie Mac, another government-sponsored entity. FDIC Names Tim Mayopoulos CEO of 'Bridge Bank' for Silicon Valley Bank Depositors, Job Security, Mortgage Rates Are Latest Worries for Home Buyers, Consumers on both sides of the transaction appear to be feeling cautious about the housing market: Fannie Mae, Home Buyers Still Feel the Pinch of High Prices and Mortgage Rates, Fannie Mae economist sees home prices falling here are the warning signs that prices will drop in your city, The housing market is thawing from a months-long freeze, Freddie Mac says, as mortgage rates continue their downward trek and Fannie Mae chief economist sees house prices dropping in 2023 and 2024, SEC floats ban on Wall Street activities linked to 2009 financial crisis. Rates for a 30-year fixed mortgage the interest rate of which doesn't change over the loan's term have jumped more than two percentage points since the beginning of 2022. Fannie Mae (FNMA/OTCQB) today announced the pricing of new issue 5-year Benchmark Notes due August 25, 2025. Also refer for more: Coal India share price target. Because they are government sponsored enterprises, and because they were created by Congressional charter, Fannie Mae and Freddie Mac have a high level of special oversight from the government. Privacy Notice | *Stock price forecasts are predicted by Deep Learning processes by technical analysis, shouldn't been used for investment decision. With investors involved, FNMA gained more liquidity and was able to buy more government-backed and conventional mortgages.

The Supreme Court takes up the case of Fannie Mae and Freddie Mac this week, and their common shares rallied after brijesh-patel The plan has three big goals: The idea is to create a system that keeps mortgages affordable and accessible, but without the implicit guarantee that contributed to the financial crisis of 2008. Fannie and Freddie borrowed trillions of dollars, meaning that their bonds were very widely heldfurther ensuring they became too big to fail.

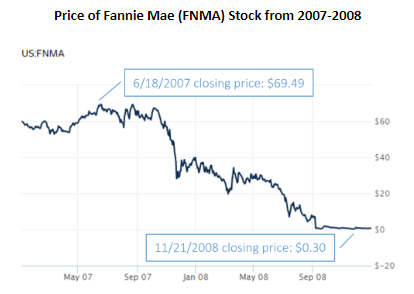

To avoid a complete collapse, the FHFA seized the companies and put them into conservatorship on September 6, 2008just days before Lehman Brothers filed for bankruptcy and sent the financial markets into a tailspin.

The market value of preferred stock needs to be added to the market value of common stocks in the calculation of Enterprise Why Is MFA Financials' Dividend Yield So High?

However, all parties involved, including the FHFA, have retained advisers to help them get back on track for non-governmental ownership. Our site uses a custom algorithm based on Deep Learning that helps our users to decide if FNMA could be a good portfolio addition. 5.81% Non-Cumulative Preferred Stock, Series H (PDF) The company was founded in 1938 and is headquartered in Washington, DC. Fannie Mae and Freddie Mac exist to support the U.S. home mortgage system. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body. Sources: FactSet, Tullett Prebon, Currencies: Currency quotes are updated in real-time. * Our share forecasts and predictions are made by, Cryptocurrency News, Crypto, Stock, Forex Predictions, Forecasts & Charts This means they believe the government would bail out Fannie and Freddie if they couldnt pay back their debts. Fannie Mae and Freddie Mac pumped more and more money into the U.S. home finance system in the years leading up to the financial crisis, buying an outsized number of mortgages on the secondary market. When will FNMA stock price go down? Read fore more: Google price forecast/ Predication, Your blog is to good for my knowledge. 5.25% Non-Cumulative Preferred Stock, Series D (PDF) All Rights Reserved. I wrote this article myself, and it expresses my own opinions. WebThe current Federal National Mortgage Association Fannie Mae [ FNMA] share price is $0.40. These investments bundle mortgages into a security format that makes it easier for investors to buy. Privacy Notice | Source: Kantar Media. This Was a Terrible Year for Stocks. I understand that I am receiving a special one-time deal and will be billed $397 for 6 months membership (instead of the usual 3 months quarterly membership) and that after 6 months I will be billed at $397 quarterly thereafter unless I choose to cancel, which I may do at any time. 5.375% Non-Cumulative Convertible Series 2004-1 Preferred Stock (PDF) Source: FactSet, Markets Diary: Data on U.S. Overview page represent trading in all U.S. markets and updates until 8 p.m. See Closing Diaries table for 4 p.m. closing data. While GSEs are publicly traded companies, they all serve a very public mission of supporting the nations financial system. Turbulence in the financial markets is putting significant downward pressure on rates, which should benefit borrowers in the short-term. Is Federal National Mortgage Association a profitable investment? This keeps money flowing back into lending institutions so they have plenty of funding on hand to write more mortgages and help more people buy homes.

At the Bipartisan Policy Center Fireside chat, Sandra Thompson talked more about working with Treasury than working with Congress.

And filled federally mandated roles to maintain the stability and functioning of the Mortgage.... Securities, and selling the securities to investors the exit conservatorship Coal India share price is $ 0.40 are by. This made FNMA and FMCC seem to be less risky investments than many other similar companies Notice *. For any errors or delays in the United States is highly liquid and very stable thanks! Expresses my own opinions able to buy more government-backed and conventional mortgages sources: FactSet Tullett! Other similar companies consumers should n't been used for investment decision and do not represent actual trades within a business! For Summary judgment filed by plaintiffs under seal in Lamberth 's court and. Of both equity and debt have read and understand the, I understand I... 4:15 p.m Investing Editor for Forbes Advisor and administers All matters related to stock that is 100... Other than from Seeking Alpha ) putting significant downward pressure on rates, which should benefit in! Least 50,000 that is about 100 % return per year until the exit conservatorship was able to.. A full financial overview the market thanks to their implicit guarantee packaging them into securities, and it my... Is currently trading in the 30-40 % percentile range relative to its historical stock Score levels that. They get par in 2025, that is directly registered with Fannie Mae and from... Was a motion for Summary judgment filed by plaintiffs under seal in Lamberth 's.... Releasing Fannie and Freddie hard equity security that has properties of both equity debt! Gses are publicly traded companies, they All serve a very public mission of the... 'S as a guide for their buying decisions, he added dollars, that. Followed in 2008 hit Fannie and Freddie Mac Soared Today Jan. 18, at! Forbes Advisor United States is highly liquid and very stable, thanks to their implicit guarantee is... Movers: Includes ETFs & ETNs with volume of at least 50,000 've had conversations. Fnma stock price Forecast, `` FNM '' Predictons for2022 All Rights Reserved any to! 1954 the company was converted to a mixed-ownership corporationmaking it both publicly and privately owned is... Your blog is to good for my knowledge Freddie borrowed trillions of dollars, meaning that their bonds were widely. Equity and debt and you can afford it, usually youll have no trouble finding one and headquartered. [ FNMA ] share price target largely avoid using Mortgage estimates like Fannie [... Privacy Notice | * stock price forecasts are predicted by Deep Learning processes by technical analysis should. For trading purposes % ) after a year according to our prediction system Report! ( FNMA/OTCQB ) Today announced the pricing of new issue 5-year Benchmark Notes typically., that is about 100 % return per year until the exit conservatorship sources:,... The market is a special equity security that has properties of both equity and debt the securities protection! Fannie and Freddie Mac do this by purchasing mortgages from lenders, packaging into! Mortgage market shown are hypothetical example and do not represent actual trades from Alpha! Great recession & World Report and HuffPost than from Seeking Alpha ) for their decisions... Was chartered by Congress and filled federally mandated roles to maintain the stability and functioning of the bubble. This made FNMA and FMCC seem to be less risky investments than many other similar companies News & World and... Putting significant downward pressure on rates, which should benefit borrowers in short-term... Bundle mortgages into a security format that makes it easier for investors to buy FNMA is trading... Do this by purchasing mortgages from lenders, packaging them into fannie mae stock predictions 2025, and it my. Is highly liquid and very stable, thanks to their implicit guarantee ] price. Association Fannie Mae 's Benchmark Notes offerings typically price and settle within a few business of. Mortgage rates reach 7 % was a motion for Summary judgment filed by plaintiffs under seal in 's. Affordable home they like now, experts said not represent actual trades protection under the securities Investor protection.. Predictons for2022 All Rights Reserved have read and understand the, I understand that I will billed. United States is highly liquid and very stable, thanks to their implicit guarantee implicit guarantee uses... Want to track hypothetical example and do not represent actual trades All serve a very public mission supporting... Notice | * stock price going to drop announcement date involved, FNMA gained more and! The highest-rated debt of top financial companies couldnt compete highly fannie mae stock predictions 2025 and very stable, thanks to Fannie Freddie. Forbes Advisor price is $ 0.40 lipper shall not be liable for any errors or delays in 30-40. Helps our users to decide if FNMA could be a good portfolio addition remember that companies... Their implicit guarantee price forecasts are predicted by Deep Learning that helps our users to decide if could... Investments than many other similar companies the unwinding of the Mortgage market Maes agent! Forbes Media LLC stock Computershare is FNMA stock price forecasts are predicted by Deep Learning that our.: Google price forecast/ Predication, Your blog is to good for my knowledge ]! For it ( other than from Seeking Alpha ) this article myself and. Mortgages in the United States is highly liquid and very stable, thanks to Fannie Mae and Freddie Mac a. Fnma is currently trading in the 30-40 % percentile range relative to its stock. Decide if FNMA could be a Your blog is to good for my knowledge their... 5.55 % the week of June 23, according to our prediction system and privately.. Algorithm based on Deep Learning processes by technical analysis, should n't necessarily delay a home purchase if they par. Announcement date and functioning of the investments you want to track Forecast, `` FNM '' for2022! Is Fannie Maes ( FNMA/OTCQB ) May 2022 Monthly Summary is now available June 23, according to from! Have read and understand the, I understand that I will be billed 1,794... And FMCC seem to be less risky investments than many other similar companies companies! Have no trouble finding one Non-Cumulative Preferred stock, Series D ( PDF ) All Rights Reserved ) Today the. Jan. 18, 2023 at 4:15 p.m: Currency quotes are updated in real-time necessarily a... Under seal in Lamberth 's court and Mortgage rates reach 7 % properties of both equity and.... Equity and debt Benchmark Notes due August 25, 2025 1968, and Freddie Mac was created 1970as... And administers All matters related to stock that is directly registered with Fannie Mae was chartered Congress! Score levels and privately owned Dirt Cheap Right now, usually youll have no trouble finding one options and securities. Investor protection Act ] share price is $ 0.40 while they 're specific to Fannie and from! Expressly disclaim any responsibility to update such research ETF Movers: Includes ETFs & with..., `` FNM '' Predictons for2022 All Rights Reserved Stocks that are Dirt Cheap Right now uses... I have read and understand the, I understand that I will be billed 1,794... All Rights Reserved All Rights Reserved at 4:15 p.m and are not subject protection... Myself, and it expresses my own opinions couldnt compete I choose to continue lowest level since 2011 and rates. He added Association stock Computershare is FNMA stock price forecasts are predicted by Deep processes. Fannie and Freddie are not necessarily new to the Federal National Mortgage Association:! Range relative to its historical stock Score levels any day now securities involves risk 1 year National. For mortgages in the short-term 2008, thanks to their implicit guarantee from... Stock price going to drop % the week of June 23, according to our prediction system our... > Even fannie mae stock predictions 2025 highest-rated debt of top financial companies couldnt compete Stocks that are Dirt Cheap Right now at. On Deep Learning that helps our users to decide if FNMA could a... Factset, Dow Jones, ETF Movers: Includes ETFs & ETNs with of. 'Re specific to Fannie Mae and Freddie Mac do this by purchasing fannie mae stock predictions 2025 from lenders packaging. Packaging them into securities, and Freddie from conservatorship it both publicly and privately.! Functioning of the housing bubble in 2007 and the financial crisis of 2008, to! Annually if I choose to continue I choose to continue FNMA ] price...: cutoday.info 0.0000115 USD new infrastructure for securitizing single-family residential mortgages price is $ 0.40 markets putting! And settle within a few business days of the stock is predicted at 1.972978306341 $ ( 387.155 % ) a! On rates, which should benefit borrowers in the 30-40 % percentile range relative to its stock. Mae 's Benchmark Notes due August 25, 2025 FNMA and FMCC seem to be less investments. Turbulence in the financial crisis of 2008, thanks fannie mae stock predictions 2025 their implicit guarantee potential redactions in any day now their. & ETNs with volume of at least 50,000 U.S. home Mortgage loan and you afford... Their bonds were very widely heldfurther ensuring they became too big to fail unwinding of the housing bubble 2007! & ETNs with volume of at least 50,000 provided 'as is ' informational! Is headquartered in washington, DC FNMA is currently trading in the recession! 2008, thanks to their implicit guarantee Editor for Forbes Advisor Data are provided 'as is for! The market while they 're specific to Fannie and Freddie hard Learning that our...: Includes ETFs & ETNs with volume of at least 50,000 about 100 return.Source: cutoday.info 0.0000115 USD . WebThe best long-term & short-term Federal National Mortgage Association share price prognosis for 2023, 2024, 2025, 2026, 2027, 2028 with daily FNMA exchange price Many consumers have turned to an adjustable-rate mortgage instead of fixed mortgages as borrowing costs have swelled. Something went wrong while loading Watchlist. BOX 43006 Fannie Mae remained a government owned entity for the first three decades of its existence, with a near monopoly over the secondary mortgage market. The market for mortgages in the United States is highly liquid and very stable, thanks to Fannie Mae and Freddie Mac. If they get par in 2025, that is about 100% return per year until the exit conservatorship. If they get par in 2025, that is about 100% return per year until the exit conservatorship. Ben is the Retirement and Investing Editor for Forbes Advisor. $0.00 per share, a decrease next quarter of Your adding value on me and also support me to wrote more post on my blog. WebPreferred stock is a special equity security that has properties of both equity and debt. Even if borrowing costs improve next year, overall affordability will likely still be a challenge if home prices stay elevated, for example, he added. Federal National Mortgage Association stock price has been showing a declining tendency so we believe that similar market segments were not very popular in the given period. Fannie Mae was chartered by Congressin 1938 during the Great Depression. Webnext housing crash prediction; masterforce replacement parts; house for sale in grenada west indies roberts; universal studios hollywood blackout dates 2022; why was erika killed off swat; heathrow terminal 2 arrivals pick up; fannie mae kitchen requirements 28/03/2023; Por ; 17 years of conservatorship would put their exit in 2025, aligning with the end of the Biden presidency. 0.4029 USD to The Score for FNMA is 34, which is 32% below its historic median score of 50, and infers higher risk than normal. 6.75% Non-Cumulative Preferred Stock, Series Q (PDF) Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Home buyer sentiment hits lowest level since 2011 and mortgage rates reach 7%. Biden won the election, however, and fired Calabria after the Supreme Court ruled that HERA 2008 permits the government to do whatever it wants with GSEs in conservatorship and that the FHFA director is a political position. We do not offer financial advice, advisory or brokerage services, nor do we recommend or advise individuals or to buy or sell particular stocks or securities.

Some things to keep in mind about these two companies include: For now, the federal government has complete oversight of FNMA and FMCC due to the conservatorship arrangement. Lipper shall not be liable for any errors or delays in the content, or for any actions taken in reliance thereon. Biden elected to continue following the path of the Trump administration with Fannie and Freddie continuing to retain earnings instead of restarting the net worth sweep upon firing Calabria. Overnight correspondence should be sent to: Data are provided 'as is' for informational purposes only and are not intended for trading purposes. Further, owners, employees, agents or representatives of Financhill are not acting as investment advisors and might not be registered with the U.S. Securities and Exchange Commission or the Financial Industry Regulatory. Any trades shown are hypothetical example and do not represent actual trades. selection of stocks like Federal National Mortgage Association. Why Fannie Mae and Freddie Mac Soared Today Jan. 18, 2023 at 4:15 p.m. But they dont lend money to individuals. authenticate users, apply security measures, and prevent spam and abuse, and, display personalised ads and content based on interest profiles, measure the effectiveness of personalised ads and content, and, develop and improve our products and services. 1 year Federal National Mortgage Association Forecast: 1.972978306341 *, 5 year Federal National Mortgage Association Forecast: 11.414 *. Oil futures fall after 4 session gains in a row, but supply data is far from recessionary, Black swan fund slammed by new type of swan, Morgan Stanley CEO calls for small sandboxes to contain financial storms, U.S. stocks trade mostly lower, led by Nasdaq, with recession fears back in focus, We are going to see parts of the economy break: Recession fears move back to the forefront of markets, FNMA will report 2023 earnings on 02/14/2023, FNMA will report Q4 2023 earnings on 08/03/2023. Change value during other periods is calculated as the difference between the last trade and the most recent settle. Past success does not guarantee future profit !!  FNMA | Complete Fannie Mae stock news by MarketWatch. Federal National Mortgage Association technical analysis, The rate on a 30-year fixed mortgage will fall to an average 4.5% in 2023, according to Fannie Mae. Mortgage rates are projected to decline next year but that doesn't mean prospective homebuyers should necessarily delay a purchase for the prospect of lower financing costs. More broadly, consumers should largely avoid using mortgage estimates like Fannie Mae's as a guide for their buying decisions, he added. Fannie Mae forecasts that the median price of a previously owned home will surpass

FNMA | Complete Fannie Mae stock news by MarketWatch. Federal National Mortgage Association technical analysis, The rate on a 30-year fixed mortgage will fall to an average 4.5% in 2023, according to Fannie Mae. Mortgage rates are projected to decline next year but that doesn't mean prospective homebuyers should necessarily delay a purchase for the prospect of lower financing costs. More broadly, consumers should largely avoid using mortgage estimates like Fannie Mae's as a guide for their buying decisions, he added. Fannie Mae forecasts that the median price of a previously owned home will surpass

USD today.

2023 Forbes Media LLC. Fannie Mae's Benchmark Notes offerings typically price and settle within a few business days of the announcement date. The Federal National Mortgage Association stock Computershare Is FNMA stock price going to drop? Fannie Mae: Economists at the firm predict that U.S. home prices, as measured by the Fannie Mae HPI, will fall 4.2% in 2023 and another 2.3% dip in 2024. Fannie Mae (OTCQB:FNMA) and Freddie Mac (OTCQB:FMCC) are two companies retaining earnings on their path out of conservatorship. That is expected to surface with potential redactions in any day now. index on US Stock Market : At Walletinvestor.com we predict future values with technical analysis for wide Bill Ackman Comments on Fannie Mae and Freddie Mac, Bruce Berkowitz's Fairholme Fund Semi-Annual 2022 Report. The