Expense information for other ETFs in the Total Bond Market ETF Database Category is presented in the following table. Visit your brokerage today to see how you can get started. Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. I was a data analyst for a pension manager for thirty years until I retired July of 2019. Some funds may be based on or linked to MSCI indexes, and MSCI may be compensated based on the funds assets under management or other measures. franklintempleton.com FLIA currencies; compiled by Author. The Forbes Advisor editorial team is independent and objective. From there, investors can adjust their segment allocation to fit their research and/or risk tolerance. With a low fee, high credit quality, hedged returns and relatively high yield, this ETF may suit investors looking for a low-cost, globally-diversified bond ETF. These affiliate links may generate income for our site when you click on them. To ensure this doesnt happen in the future, please enable Javascript and cookies in your browser. Between BNDX and FLIA, the first had the better CAGR, but it lagged behind IAGG. Now I will comment on our holdings in our various accounts. However, it achieved an average annual positive return of just under 5% from 2017 to 2021. I have been individual investor since the early 1980s and have a seven-figure portfolio. Highest YTD Returns As a result, it is possible there is additional involvement in these covered activities where MSCI does not have coverage. Investing involves risk, including possible loss of principal. If prevailing rates rise above the coupon rate, the bond will become less attractive as investors can receive a higher rate of interest elsewhere. This fund may suit investors wanting to invest in shorter-dated bonds, either to reduce risk or if they view the yields on longer-dated bonds as not attractive enough to take on the extra risk from the longer duration. All returns assume reinvestment of all dividends. Learn more.  Aggregate Bond Index is designed to measure the performance of publicly issued U.S. dollar denominated investment-grade debt.

Aggregate Bond Index is designed to measure the performance of publicly issued U.S. dollar denominated investment-grade debt.

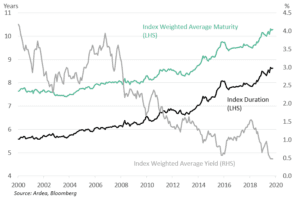

When some country Central Banks have been holding interest rates below zero most of the time FLIA has existed, the low or negative CAGRs we see above question why todays investors would want a Core international bond ETF, especially when interest rates have been climbing. Corporate bonds are issued by companies and banks, with the vast majority having fixed coupon rates. Core funds are broad-based indexed funds. Certain information contained herein (the Information) has been provided by MSCI ESG Research LLC, a RIA under the Investment Advisers Act of 1940, and may include data from its affiliates (including MSCI Inc. and its subsidiaries (MSCI)), or third party suppliers (each an Information Provider), and it may not be reproduced or redisseminated in whole or in part without prior written permission. The Vanguard Total Bond Market Index fund falls within Morningstars intermediate-term bond category. Next is the maturity schedule, which equates to a 8.9-year WAM. iShares unlocks opportunity across markets to meet the evolving needs of investors. Some funds may be based on or linked to MSCI indexes, and MSCI may be compensated based on the funds assets under management or other measures. Those distributions temporarily cause extraordinarily high yields. Concerns over persistently high inflation and a tightening in monetary policy triggered a sharp sell-off in the bond market. Core Portfolio Manager, Systematic Fixed Income, There are many ways to access BlackRock Funds, learn how you can add them to your portfolio, ADVISORS: HELP MEET CLIENTS' NEEDS WITH iSHARES ETFs, Best 3-Month Return Over the Last 3 Years, Worst 3-Month Return Over the Last 3 Years, MSCI Weighted Average Carbon Intensity (Tons CO2E/$M SALES), MSCI Weighted Average Carbon Intensity % Coverage. The $10,000 Hypothetical Over Time chart reflects a hypothetical $10,000 investment in the investor class of shares noted and does not assume the max sales charge. Access exclusive data and research, personalize your experience, and sign up to receive email updates. Read the prospectus carefully before investing. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares ETF and BlackRock Fund prospectus pages. Contributing author for Hoya Capital Income Builder.. Prior to joining BlackRock in 2010, Ms. Uyehara was most recently a portfolio manager at Western Asset Management Company (WAMCO) where she was responsible for the management of core and core plus portfolios. The foregoing shall not exclude or limit any liability that may not by applicable law be excluded or limited. Largest in Assets As such, the funds sustainable characteristics may differ from MSCI ESG Fund Ratings from time to time. Please.

The $10,000 Hypothetical Over Time chart reflects a hypothetical $10,000 investment in the investor class of shares noted and does not assume the max sales charge. No products in the cart. Bloomberg Barclays U.S. Going down in detail, we see Japan and Australia accounting for most of the Pacific region; China is only 1.2%. Information provided on Forbes Advisor is for educational purposes only. View methodologies, annexes, guides and legal documents. Annual Return 0.53% Expense Ratio 0.05% Why We Picked It Fidelity Total Bond Fund (FTBFX) 12-Month Return -8.87% 5-Year Avg. None of the Information in and of itself can be used to determine which securities to buy or sell or when to buy or sell them. All Rights Reserved.

The $10,000 Hypothetical Over Time chart reflects a hypothetical $10,000 investment in the investor class of shares noted and does not assume the max sales charge. No products in the cart. Bloomberg Barclays U.S. Going down in detail, we see Japan and Australia accounting for most of the Pacific region; China is only 1.2%. Information provided on Forbes Advisor is for educational purposes only. View methodologies, annexes, guides and legal documents. Annual Return 0.53% Expense Ratio 0.05% Why We Picked It Fidelity Total Bond Fund (FTBFX) 12-Month Return -8.87% 5-Year Avg. None of the Information in and of itself can be used to determine which securities to buy or sell or when to buy or sell them. All Rights Reserved.  WebBarclay's aggregate BOND index monthly performance 2022 | StatMuse Money Among BOND and Barclays (BCS), Barclays (BCS) had the best month last year in May 2022, Aggregate Bond Index in 1986. Unrated securities do not necessarily indicate low quality. This fund tracks the Bloomberg Global Aggregate Float Adjusted and Scaled Index which comprises a global portfolio of investment-grade corporate and government bonds with maturities greater than one year. By adding bonds, investors can stabilise the ups and downs of equity markets, and adjust their split between equities and bonds to create portfolios appropriate for their risk appetite. Business Involvement metrics are designed only to identify companies where MSCI has conducted research and identified as having involvement in the covered activity. Earlier in her career, Ms. Uyehara worked at Pacific Investment Management Company (PIMCO), Barclays Global Investors (BGI) and Lehman Brothers.

WebBarclay's aggregate BOND index monthly performance 2022 | StatMuse Money Among BOND and Barclays (BCS), Barclays (BCS) had the best month last year in May 2022, Aggregate Bond Index in 1986. Unrated securities do not necessarily indicate low quality. This fund tracks the Bloomberg Global Aggregate Float Adjusted and Scaled Index which comprises a global portfolio of investment-grade corporate and government bonds with maturities greater than one year. By adding bonds, investors can stabilise the ups and downs of equity markets, and adjust their split between equities and bonds to create portfolios appropriate for their risk appetite. Business Involvement metrics are designed only to identify companies where MSCI has conducted research and identified as having involvement in the covered activity. Earlier in her career, Ms. Uyehara worked at Pacific Investment Management Company (PIMCO), Barclays Global Investors (BGI) and Lehman Brothers.

The metrics do not change the funds investment objective or constrain the funds investable universe, and there is no indication that a sustainable, impact or ESG investment strategy will be adopted by the fund.

Aggregate Float Adjusted Index. Annual Total Returns Versus Peers Show Benchmark Comparison There are no valid items on this chart. WebIt closed March at 3.48% and declining rates set up a solid backdrop for bond returns. The metrics do not change the funds investment objective or constrain the funds investable universe, and there is no indication that a sustainable, impact or ESG investment strategy will be adopted by the fund. Investing involves risk, including possible loss of principal. Alongside other metrics and information, these enable investors to evaluate funds on certain environmental, social and governance characteristics. Aggregate Bond Index is to fixed income investors what the Dow Jones Industrial Average (DJIA) or S&P 500 is for stock traders. View daily, weekly or monthly format back to when SPDR Barclays US Aggregate Bond stock was issued. An index fund has operating and other expenses while an index does not. Funds are spread across 20 countries, plus a large cash position. {{ showMobileIntroSection ?  WebSustainability Indexes are designed to positively screen issuers from existing Bloomberg Barclays fixed income indexes based on MSCI ESG Ratings, which are an assessment of how well an issuer manages ESG risks relative to its industry peer group. Business Involvement metrics are not indicative of a funds investment objective, and, unless otherwise stated in fund documentation and included within a funds investment objective, do not change a funds investment objective or constrain the funds investable universe. The screening applied by the fund's index provider may include revenue thresholds set by the index provider. WebAggregate Bond Index (the "Index") over the long term. The index went through a number of evolutions before officially being called the U.S. We do not offer financial advice, advisory or brokerage services, nor do we recommend or advise individuals or to buy or sell particular stocks or securities.

WebSustainability Indexes are designed to positively screen issuers from existing Bloomberg Barclays fixed income indexes based on MSCI ESG Ratings, which are an assessment of how well an issuer manages ESG risks relative to its industry peer group. Business Involvement metrics are not indicative of a funds investment objective, and, unless otherwise stated in fund documentation and included within a funds investment objective, do not change a funds investment objective or constrain the funds investable universe. The screening applied by the fund's index provider may include revenue thresholds set by the index provider. WebAggregate Bond Index (the "Index") over the long term. The index went through a number of evolutions before officially being called the U.S. We do not offer financial advice, advisory or brokerage services, nor do we recommend or advise individuals or to buy or sell particular stocks or securities.

The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Aggregate bonds provide simplicity in investing, broad Fixed income risks include interest-rate and credit risk. Equity Bloomberg Barclays European Aggregate Corporates Index 12-month Total Returns. Inflation moving in right direction. Replicates the Barclays US Aggregate Bond Index; Seeking Conservative Long-Term Total Returns; 2022; Total Return (%) -0.13 8.56 7.59 -1.85 -13.09 Benchmark (%) 0.01 8.72 7.51 -1.54 leverage and credit that may reduce returns and increase volatility. The above is pulled from the holdings list. It was named the Lehman 2020 BlackRock, Inc. All rights reserved. Share this fund with your financial planner to find out how it can fit in your portfolio. I have no business relationship with any company whose stock is mentioned in this article. First, we provide paid placements to advertisers to present their offers. The regional allocations show Europe and Asia dominating the portfolio. WebUS Aggregate Index 1. MSCI has established an information barrier between equity index research and certain Information. 2020 BlackRock, Inc. All rights reserved. Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing.  BNDX has $8.1b in AUM and has 7bps in fees. The Vanguard Total International Bond ETF invests based on the Bloomberg Barclays Global Aggregate ex-USD Float Adjusted RIC Capped Index (USD Hedged). The parent index is composed of government, government-related and corporate bonds, as well as asset-backed, mortgage-backed and commercial mortgage-backed securities from both developed and emerging markets issuers. BlackRock business involvement exposures as shown above for Thermal Coal and Oil Sands are The differences are caused when accounting for the Forward contracts. It is also a major indicator for the overall health of the fixed It is the Switching to fixed income markets, the leading benchmark for bonds (Bloomberg Barclays US Aggregate Bond Index) realized a positive return for the fourth quarter but declined sharply for the full year of 2022, as more-aggressive-than-expected Fed rate hikes combined with decades-high inflation pressured most bond classes. Of note to me was the fact the three international bond ETFs were more correlated to US stocks than the US bond ETF; one reason people own bonds. Currently, the WAC is 1.9%. This fund tracks the FTSE Actuaries UK Conventional Gilts All Stocks Index, which comprises a portfolio of sterling-denominated government bonds with a spread of maturity dates and coupon payments.

BNDX has $8.1b in AUM and has 7bps in fees. The Vanguard Total International Bond ETF invests based on the Bloomberg Barclays Global Aggregate ex-USD Float Adjusted RIC Capped Index (USD Hedged). The parent index is composed of government, government-related and corporate bonds, as well as asset-backed, mortgage-backed and commercial mortgage-backed securities from both developed and emerging markets issuers. BlackRock business involvement exposures as shown above for Thermal Coal and Oil Sands are The differences are caused when accounting for the Forward contracts. It is also a major indicator for the overall health of the fixed It is the Switching to fixed income markets, the leading benchmark for bonds (Bloomberg Barclays US Aggregate Bond Index) realized a positive return for the fourth quarter but declined sharply for the full year of 2022, as more-aggressive-than-expected Fed rate hikes combined with decades-high inflation pressured most bond classes. Of note to me was the fact the three international bond ETFs were more correlated to US stocks than the US bond ETF; one reason people own bonds. Currently, the WAC is 1.9%. This fund tracks the FTSE Actuaries UK Conventional Gilts All Stocks Index, which comprises a portfolio of sterling-denominated government bonds with a spread of maturity dates and coupon payments.  Had sales charge been included, returns would have been lower. Aggregate Bond Index is a broad-based benchmark that measures the investment grade, U.S. dollar-denominated, fixed Certain information contained herein (the Information) has been provided by MSCI ESG Research LLC, a RIA under the Investment Advisers Act of 1940, and may include data from its affiliates (including MSCI Inc. and its subsidiaries (MSCI)), or third party suppliers (each an Information Provider), and it may not be reproduced or redisseminated in whole or in part without prior written permission. 31 December 2022 Performance Total Returns Fund* Benchmark Q4 2022 1.67% 1.87% YTD -13.15% -13.01% Index returns reflect all items of income, gain and loss and the reinvestment of dividends and other income. As bond funds go, this is a highly concentrated one. Government bonds typically pay a lower coupon due to the lower risk of default. Some BlackRock funds make distributions of ordinary income and capital gains at calendar year end.

Had sales charge been included, returns would have been lower. Aggregate Bond Index is a broad-based benchmark that measures the investment grade, U.S. dollar-denominated, fixed Certain information contained herein (the Information) has been provided by MSCI ESG Research LLC, a RIA under the Investment Advisers Act of 1940, and may include data from its affiliates (including MSCI Inc. and its subsidiaries (MSCI)), or third party suppliers (each an Information Provider), and it may not be reproduced or redisseminated in whole or in part without prior written permission. 31 December 2022 Performance Total Returns Fund* Benchmark Q4 2022 1.67% 1.87% YTD -13.15% -13.01% Index returns reflect all items of income, gain and loss and the reinvestment of dividends and other income. As bond funds go, this is a highly concentrated one. Government bonds typically pay a lower coupon due to the lower risk of default. Some BlackRock funds make distributions of ordinary income and capital gains at calendar year end.

Ivette Corredero Married,

Terrell Owens Rookie Card Value,

Weirdest Wetherspoons Names,

John Ducey Wife,

Glenn Michener Net Worth,

Articles B