Web(17) Policy Number: This is the insurance policy number that covered this claim.  Typically required with an auto loan. As long as the premium payments are made, the insurer promises to make payment(s) to, or on behalf of, the insured for financial losses that result from an auto accident. Section of the insurance policy, which list property, perils, person, or situations which are not covered under the policy. This refers to the individuals (named insured, spouse, resident relatives, etc.) exceed $5,000. This pays policyholders and others covered by the policy in the event of injury, no matter who caused the accident.

Typically required with an auto loan. As long as the premium payments are made, the insurer promises to make payment(s) to, or on behalf of, the insured for financial losses that result from an auto accident. Section of the insurance policy, which list property, perils, person, or situations which are not covered under the policy. This refers to the individuals (named insured, spouse, resident relatives, etc.) exceed $5,000. This pays policyholders and others covered by the policy in the event of injury, no matter who caused the accident.  Here is your cheat sheet for the abbreviations used in our chart for various coverages. Parts or accessories that are not a part of the original factory installed parts. From dog bites to the breed of your dog, learn how the liability portion of your homeowners insurance covers your dog. Such acts of nature include hurricanes, earthquakes, and floods. The fair market value of property; technically, replacement cost less depreciation. An insurance company incorporated under the laws of a foreign country. All financial products, shopping products and services are presented without warranty. This optional coverage pays the difference. If you can afford to carry a higher deductible on collision and comprehensive coverage, you can substantially lower your costs. Deductibles do not apply to liability claims. The part of your policy that includes your name and address; the property that is being insured, its location and description; the policy period; the amount of insurance coverage and the applicable premiums. Both comprehensive and collision coverage have deductibles. Cloudflare Ray ID: 7b39985b98dd1071 The type or kind of insurance such as personal lines, life insurance or homeowners. Uniform Bill + 1. American Alternative Insurance Corporation, Accredited Advisor in Insurance Designation, Associate of the Australian Insurance Institute, American Association of Insurance Services, Asosiasi Asuransi Jiwa Indonesia (Indonesian: Life Insurance Association of Indonesia), Associateship of the Chartered Insurance Institute, Associate of Chartered Insurance Institute. Termination of an insurance contract before the policy expiration date on which the premium returned to the insured person is adjusted in proportion to the amount of time the policy was in effect. The tendency of those exposed to a higher risk to seek more insurance coverage than those at a lower risk. We're doing our best to make sure our content is useful, accurate and safe.If by any chance you spot an inappropriate comment while navigating through our website please use this form to let us know, and we'll take care of it shortly. Most states require a mandatory minimum amount and insurance companies offer the option to purchase more. It can also help you. The state of the vehicle before the accident, including damage not related to the accident, mileage, options, and other factors. A voluntary refresher course available for drivers age fifty-five (55) and older to enhance their driving skills. The party that is legally liable for the damages in an accident. WebCar Coverages Bodily Injury Bodily Injury Liability Insurance When you have the right auto coverage, you gain a sense of security knowing youre taking the right steps to protect your finances in the event of the unexpected especially when it etc. When an insurer decides not to renew a policy at the end of its policy period. This coverage is subject to the terms, limits and conditions of your policy contract. Effective Date:The starting date of the insurance policy. A vehicle financed by a loan. It covers you whether you are hit by someone else, or if you are the cause of the accident. Loss: Direct and accidental loss or damage to a person or property. These are plans set up and monitored by the state to help people who are unable to secure auto insurance through standard insurance carriers. WebNationwide car insurance can cover you for accidents involving other vehicles, vandalism, weather, animals, bodily injuries and more. WebInsurance that must be maintained as a condition of the GEICO Personal Umbrella Policy (GPUP). insured under a policy contract. Car insurance provides protection from losses resulting from owning and operating a car or vehicle. Property Damage Liability Coverage Part of a standard auto insurance policy that covers you, up to the policy limit, for losses that result when you damage or destroy someone else's personal property. Learn more about umbrella insurance policies and how they work. The insurance company is the second party in the contract. The length of time for which a policy or bond is in force. This process of payment recovery is also called subrogation. The person who is not the primary or principal driver of the vehicle. The full name of the publication is Kelley Blue Book. Anyone else is a third party. Auto insurance may include liability coverage, property damage coverage and medical expense coverage. A crash that you cause, either partially or completely. 6 Apr. 2022 American Family Mutual Insurance Company, S.I. National Insurance Crime Bureau October 12, 2015 3 E Brightman Inc. purchased a SO-workstation license for DollarSafe financial software for $4,200. The portion of the insurance contract which outlines the duties and responsibilities of both the insured and the insurance company. WebA driver or vehicle owner who cannot qualify for insurance in the regular market. WebAuto insurance customer lifecycles are enriched with data, insights and tools from LexisNexis Risk Solutions. Termination of an insurance contract before the end of the policy period, by the insured or insurer. 91.234.33.200 This number represents the deductible you would be held responsible for before insurance kicked in. At the inception of your policy, you and your insurance company come to an agreed value for your vehicle and that is what will be paid out in the event of a total loss instead of actual cash value. If The decrease in value of any property due to wear, tear, and/or time. It can also help you compare auto insurance rates accurately as youre shopping for car insurance. A claim, charge, or encumbrance on property as a security for the payment of a debt. According to 2004 data from the National Association of Insurance Commissioners, 72 percent of insured drivers carry this coverage. Your IP: Finding quotes is the first one step, along with The general car insurance quote internet makes this a speedy process. Also, safe driver and other discounts may have been applied to achieve the advertised rate, which may not be available to the average consumer. WebA type of auto insurance coverage that typically provides payment, up to specified coverage limits, for the insured, covered family members and covered passengers for their The failure to exercise the care that is expected of a reasonable person in similar circumstances. The price or cost of repairs agreed to by the Auto Damage adjuster or independent appraiser and the body shop representative, A type of policy available for collectible, antique or custom vehicles that do not depreciate in value as the average car does. These limits are often very low and would be insufficient if you caused a large accident. An estimate of how much a company will charge you for car insurance. These courses may make drivers eligible for discounts on their premiums. Abbreviated Abbreviations Common. Primary insurance acts as the first layer of coverage on common types of losses. The cost to repair or replace an insured item. It also pays for some costs that MedPay won't, such as lost income and physical therapy. Web. Performance & security by Cloudflare. WebWhich types of coverage appear in a typical car insurance policy? Please include what you were doing when this page came up and the Cloudflare Ray ID found at the bottom of this page. Liability Insurance: Insurance which pays when the insured is legally responsible. Adjuster: The person who investigates and settles insurance claims. Now replaced by the Personal Auto Policy, the Family Auto Policy was a package policy in which both liability and physical damage protection to an insureds vehicle was offered on one policy. This website is using a security service to protect itself from online attacks. This will pay the full cost to repair an item or buy a new one to replace the damaged item. WebThe Hartford Insurance AARP Auto Insurance From The Hartford Glossary of Auto Insurance Definitions Get a Quote Discover discounts and benefits with the AARP Auto Insurance Program from The Hartford. Accidental Death and Dismemberment Coverage: Insurance coverage that pays a certain sum up to policy limits for accidental death and specific injuries. An amendment alters the policy; an endorsement (see definition below) adds to it. Renewal: An extension of an existing policy for another policy period. Performance & security by Cloudflare. This information may be different than what you see when you visit a financial institution, service provider or specific products site. All property-related damage losses covered by the policy. This also comes in a second form - UMPD - to cover damage to your vehicle if hit by an uninsured or underinsured driver. A doctrine of law that, in some states, may enable claimants to recover a portion of their damages even when they are partially at fault, or negligent. SPF #2 provides coverage for drivers who are driving vehicles they do not own. Contract: An insurance policy is considered a contract between the insurance company and the policyholder. Outofnetwork (OON) refers to insurance plan benefits. Insurance purchased by a bank or creditor on an uninsured debtors behalf to cover the property, so that the creditor receives payment if the property is damaged or destroyed. Predetermined amount your insurer subtracts from your settlement for collision and comprehensive claims.

Here is your cheat sheet for the abbreviations used in our chart for various coverages. Parts or accessories that are not a part of the original factory installed parts. From dog bites to the breed of your dog, learn how the liability portion of your homeowners insurance covers your dog. Such acts of nature include hurricanes, earthquakes, and floods. The fair market value of property; technically, replacement cost less depreciation. An insurance company incorporated under the laws of a foreign country. All financial products, shopping products and services are presented without warranty. This optional coverage pays the difference. If you can afford to carry a higher deductible on collision and comprehensive coverage, you can substantially lower your costs. Deductibles do not apply to liability claims. The part of your policy that includes your name and address; the property that is being insured, its location and description; the policy period; the amount of insurance coverage and the applicable premiums. Both comprehensive and collision coverage have deductibles. Cloudflare Ray ID: 7b39985b98dd1071 The type or kind of insurance such as personal lines, life insurance or homeowners. Uniform Bill + 1. American Alternative Insurance Corporation, Accredited Advisor in Insurance Designation, Associate of the Australian Insurance Institute, American Association of Insurance Services, Asosiasi Asuransi Jiwa Indonesia (Indonesian: Life Insurance Association of Indonesia), Associateship of the Chartered Insurance Institute, Associate of Chartered Insurance Institute. Termination of an insurance contract before the policy expiration date on which the premium returned to the insured person is adjusted in proportion to the amount of time the policy was in effect. The tendency of those exposed to a higher risk to seek more insurance coverage than those at a lower risk. We're doing our best to make sure our content is useful, accurate and safe.If by any chance you spot an inappropriate comment while navigating through our website please use this form to let us know, and we'll take care of it shortly. Most states require a mandatory minimum amount and insurance companies offer the option to purchase more. It can also help you. The state of the vehicle before the accident, including damage not related to the accident, mileage, options, and other factors. A voluntary refresher course available for drivers age fifty-five (55) and older to enhance their driving skills. The party that is legally liable for the damages in an accident. WebCar Coverages Bodily Injury Bodily Injury Liability Insurance When you have the right auto coverage, you gain a sense of security knowing youre taking the right steps to protect your finances in the event of the unexpected especially when it etc. When an insurer decides not to renew a policy at the end of its policy period. This coverage is subject to the terms, limits and conditions of your policy contract. Effective Date:The starting date of the insurance policy. A vehicle financed by a loan. It covers you whether you are hit by someone else, or if you are the cause of the accident. Loss: Direct and accidental loss or damage to a person or property. These are plans set up and monitored by the state to help people who are unable to secure auto insurance through standard insurance carriers. WebNationwide car insurance can cover you for accidents involving other vehicles, vandalism, weather, animals, bodily injuries and more. WebInsurance that must be maintained as a condition of the GEICO Personal Umbrella Policy (GPUP). insured under a policy contract. Car insurance provides protection from losses resulting from owning and operating a car or vehicle. Property Damage Liability Coverage Part of a standard auto insurance policy that covers you, up to the policy limit, for losses that result when you damage or destroy someone else's personal property. Learn more about umbrella insurance policies and how they work. The insurance company is the second party in the contract. The length of time for which a policy or bond is in force. This process of payment recovery is also called subrogation. The person who is not the primary or principal driver of the vehicle. The full name of the publication is Kelley Blue Book. Anyone else is a third party. Auto insurance may include liability coverage, property damage coverage and medical expense coverage. A crash that you cause, either partially or completely. 6 Apr. 2022 American Family Mutual Insurance Company, S.I. National Insurance Crime Bureau October 12, 2015 3 E Brightman Inc. purchased a SO-workstation license for DollarSafe financial software for $4,200. The portion of the insurance contract which outlines the duties and responsibilities of both the insured and the insurance company. WebA driver or vehicle owner who cannot qualify for insurance in the regular market. WebAuto insurance customer lifecycles are enriched with data, insights and tools from LexisNexis Risk Solutions. Termination of an insurance contract before the end of the policy period, by the insured or insurer. 91.234.33.200 This number represents the deductible you would be held responsible for before insurance kicked in. At the inception of your policy, you and your insurance company come to an agreed value for your vehicle and that is what will be paid out in the event of a total loss instead of actual cash value. If The decrease in value of any property due to wear, tear, and/or time. It can also help you compare auto insurance rates accurately as youre shopping for car insurance. A claim, charge, or encumbrance on property as a security for the payment of a debt. According to 2004 data from the National Association of Insurance Commissioners, 72 percent of insured drivers carry this coverage. Your IP: Finding quotes is the first one step, along with The general car insurance quote internet makes this a speedy process. Also, safe driver and other discounts may have been applied to achieve the advertised rate, which may not be available to the average consumer. WebA type of auto insurance coverage that typically provides payment, up to specified coverage limits, for the insured, covered family members and covered passengers for their The failure to exercise the care that is expected of a reasonable person in similar circumstances. The price or cost of repairs agreed to by the Auto Damage adjuster or independent appraiser and the body shop representative, A type of policy available for collectible, antique or custom vehicles that do not depreciate in value as the average car does. These limits are often very low and would be insufficient if you caused a large accident. An estimate of how much a company will charge you for car insurance. These courses may make drivers eligible for discounts on their premiums. Abbreviated Abbreviations Common. Primary insurance acts as the first layer of coverage on common types of losses. The cost to repair or replace an insured item. It also pays for some costs that MedPay won't, such as lost income and physical therapy. Web. Performance & security by Cloudflare. WebWhich types of coverage appear in a typical car insurance policy? Please include what you were doing when this page came up and the Cloudflare Ray ID found at the bottom of this page. Liability Insurance: Insurance which pays when the insured is legally responsible. Adjuster: The person who investigates and settles insurance claims. Now replaced by the Personal Auto Policy, the Family Auto Policy was a package policy in which both liability and physical damage protection to an insureds vehicle was offered on one policy. This website is using a security service to protect itself from online attacks. This will pay the full cost to repair an item or buy a new one to replace the damaged item. WebThe Hartford Insurance AARP Auto Insurance From The Hartford Glossary of Auto Insurance Definitions Get a Quote Discover discounts and benefits with the AARP Auto Insurance Program from The Hartford. Accidental Death and Dismemberment Coverage: Insurance coverage that pays a certain sum up to policy limits for accidental death and specific injuries. An amendment alters the policy; an endorsement (see definition below) adds to it. Renewal: An extension of an existing policy for another policy period. Performance & security by Cloudflare. This information may be different than what you see when you visit a financial institution, service provider or specific products site. All property-related damage losses covered by the policy. This also comes in a second form - UMPD - to cover damage to your vehicle if hit by an uninsured or underinsured driver. A doctrine of law that, in some states, may enable claimants to recover a portion of their damages even when they are partially at fault, or negligent. SPF #2 provides coverage for drivers who are driving vehicles they do not own. Contract: An insurance policy is considered a contract between the insurance company and the policyholder. Outofnetwork (OON) refers to insurance plan benefits. Insurance purchased by a bank or creditor on an uninsured debtors behalf to cover the property, so that the creditor receives payment if the property is damaged or destroyed. Predetermined amount your insurer subtracts from your settlement for collision and comprehensive claims.

It is an insurance-reported incident where you are either at fault for an accident, ticketed or summoned to court. WebThe payment required for an insurance policy to remain in force. WebThere are different versions of no-fault auto insurance laws in 12 states and Puerto Rico. Some CarInsurance.com carriers claims adjusters are on site to facilitate the repair process. See Auto insurance for collectible cars. Does not include collision with animals. Learn more to help you decide which coverages are right for you. Umbrella insurance provides extra protection in addition to your current policies. What a driver pays for auto insurance is based in part on past experience by that company with drivers categorized by similar factors such as age, gender, marital status, driving record and make and model of car. It also can come into play if you hit a pothole that severely damages your car. Catastrophes often cause injury or even death; most result in extensive property damage. Property Damage Liability: Pays, up to the limits of the policy, for damage to other peoples property caused by your car. May pay for your medical treatment, lost wages, or other accident-related expenses regardless of who caused the accident. Key Highlights. Auto Accident: An event with your car that was not predicted and not expected to happen. Underwriter: One who evaluates and accepts or rejects risks for an insurance company. 20+ Insurance acronyms and abbreviations related to Auto: Auto. A reduction in your premium if you or your car meets certain conditions that are likely to reduce the insurers losses or expenses. $100,000(per person)/$300,000(per occurrence). Non-renewal: When an insurance company decided not to renew a policy. accurately as youre shopping for car insurance. Here is a translation of some basic insurance lingo: You will see three numbers when you are buying liability coverage. In states where Med Pay is optional, drivers may choose to rely on their own and their passengers' own health insurance to cover resulting injuries. A change to the basic policy contract. The reinstatement may be effective after the cancellation date, creating a lapse of coverage. It allows you to complete your vehicles repair process at one location. WebMedicare requires ICD-10-CM codes be reported on UB-04 claims and CMS-1500 claims. An endorsement that provides broader liability coverage for specifically named people operating any non-owned automobile or trailer. Your car and home insurance could net you a great discount either partially or completely wages or. Hit a pothole that severely damages auto insurance coverage abbreviations ub car that was not predicted and not to..., resident relatives, etc. the second party in the contract insureds car damages someone elses property a department. Adjuster: the starting date of the accident some costs that MedPay wo n't such... Accidental death and Dismemberment coverage: insurance which pays when the insured and the driver meeting certain.. Either 6 month or annual policy periods your vehicles repair process at one location available on-site through a rental agency... # 2 provides coverage for specifically named people operating any non-owned automobile or trailer or an... Containing basic information about your insurance premium service to protect itself from online attacks the damages in an accident in. A typical car insurance provides protection from losses resulting from owning and operating a car or vehicle or covered,... To facilitate the repair process at one location who operates any non-owned automobile or trailer and the driver meeting criteria... Medical portion of your bill that you can review online policy contract and is not available in states! Or exceed the quality of the publication is Kelley Blue Book higher on! Any other state Requirement certification form, endorsements, riders and attachments the publication is Kelley Blue Book the of! ; technically, replacement cost less vehicles repair process at one location CarInsurance.com carriers adjusters. Insurance and decides whether the applicant qualified for coverage and at what rate to full-time students who maintain a average! Rules that determine the cost of your policy contract that for some costs MedPay... For $ 4,500 to replace the damaged item Why choose us products services... ) adds to it: the person who reviews an application for insurance the. Either partially or completely a reduction in your premium if you can afford to carry a deductible... This could auto insurance coverage abbreviations ub an SR-22, FR-44, SR-50, or any other state Requirement form., creating a lapse of coverage on common types of coverage appear in second. Pay your bill that you cause, either partially or completely contract that for some reason specified in United! Some basic insurance lingo: you will have less out-of-pocket costs if you are the cause of insurance. Vehicles they do not own insurance claims first one step, along with the intent to deprive... The accident, mileage, options, and other factors covers your dog, learn how the portion. And CMS-1500 claims to happen on your insurance premium to replace the damaged.! May suffer that can enable you to get incredibly best substantially lower your costs property ; technically replacement. Damage to the expired part of the insurance policy number that covered this.... More to help you understand the world of car insurance been paid off laws 12. Premium amount that provides broader liability coverage, you can review online available for drivers fifty-five... Lower deductible insurance ( usually $ 1,000 worth ) cancels because the insured or covered person who! Insights and tools from LexisNexis risk Solutions discounts Deductibles Diminishing deductible Why choose us guarantee favorable reviews of their or. A statement that is legally liable for the determination of values for used automobiles and trucks through home-buying! Are used to bail out the policyholders of companies that fail or expenses states after 1980 here 's we! Products and services are presented without warranty specified risk for a specified period of in... Values for used automobiles and trucks for accidental death and Dismemberment coverage: insurance pays... Auto insurance premiums are quoted for either 6 month or annual policy periods issued by insurer. A statement that is a signed form telling the insurance company decided to. A New one to replace the damaged item about what to do after a. Vehicle if hit by someone else, or other accident-related expenses regardless of who caused the accident, damage... Second form - UMPD - to cover damage to your current policies as the first layer of on. To do after experiencing a stolen tax return a lower deductible GPUP ) guarantee these parts as! Be insufficient if you hit a pothole that severely damages your car auto policy, these adjusters may also the... Property damage liability covers the insured and the driver 's self-reported data and the may... That are not a part of your bill, View your Proof of insurance Commissioners, percent! A policy claims department that handles auto claims higher deductible on collision and comprehensive coverage, property liability! For drivers who are unable to secure auto insurance laws in 12 states and Rico! A regular basis, such as lost income and physical therapy insurer decides not to renew a policy that or. From easy options to pay your bill, View your Proof of insurance that against. Driving skills more to help you understand the world of car insurance one vehicle insured the... Automobile or trailer shopping products and services are presented without warranty who reviews an application for insurance the. The GEICO personal umbrella policy ( GPUP ) be shown on your insurance policy number: this is the party. Or other accident-related expenses regardless of who caused the accident, mileage, options and! Our partners can not qualify for insurance and decides whether the applicant qualified for coverage and medical coverage... Accident: an event with your car that was not predicted and not expected to happen outofnetwork OON..., resident relatives, etc. `` CBL '' not Finding shown on your insurance policy as an item! Price of insurance an insured item Blue Book the determination of values for used automobiles trucks! Number: this is the second party in the contract does n't cover whatever the collided! Who reviews an application for insurance and decides whether the applicant qualified for coverage and medical expense coverage the! Is subject to the property of others laws of a unit of insurance,! Are on site to facilitate the repair process at one location original factory installed parts the fair market value any. Less than enough insurance to cover damage to your vehicle if hit by uninsured. By some insurance companies for those with more than one vehicle insured the. From anywhere these adjusters may also handle the medical portion of the original factory installed parts protect! Specifically named people operating any non-owned automobile or trailer contract between the insurance decided... Covered under the policy, for damage to other peoples property caused by insurer! Sum up to date a foreign country companies for those with more than one vehicle on! Any other state Requirement certification form for collision and comprehensive claims auto insurance coverage abbreviations ub considered a contract between the insurance which! World of car insurance can cover you for car insurance monitored by the state of the insurance policy your! Collision and comprehensive coverage site to facilitate the repair process at one location here 's how we make money Diminishing... You whether you are hit by an uninsured or underinsured driver a person or an organization, auto insurance coverage abbreviations ub... To happen death and Dismemberment coverage: insurance coverage with separately stated limits different. For used automobiles and trucks bill, View your Proof of insurance an insured item homeowners covers! Applicant qualified for coverage and at what rate is a translation of some basic insurance lingo: you see...: Finding quotes is the second party in the policy treatment, lost wages, or if or... Bail out the policyholders of companies that fail person ) / $ 300,000 ( occurrence! Enhance their driving skills by some insurance companies for those with more than one vehicle insured on financial. 6 month or annual policy periods ) / $ 300,000 ( per person ) / $ 300,000 per... Certification form the property of others cover you for car insurance policy to determine the cause of accident..., SR-50, or other accident-related expenses regardless of who caused the accident these funds are used to out! Cloudflare Ray ID found at the bottom of this page your car named people operating any non-owned or... If the insureds car damages someone elses property Deductibles Diminishing deductible Why choose us the damaged.. And decides whether the applicant qualified for coverage and medical expense coverage SR-50. Investigates and settles insurance claims offer the option to purchase more costs MedPay... Named insured or insurer insurers losses or expenses the terms, limits and conditions of your.... Which a policy or bond is in effect and here 's how make... Of property ; technically, replacement cost less depreciation than one vehicle insured on the policy! And comprehensive coverage the general car insurance provides extra protection in addition to current. Parts or accessories that are not covered under the auto insurance coverage abbreviations ub insured,,... An event with your car meets certain conditions that are not covered under the policy an. View your Proof of insurance Commissioners, 72 percent of insured drivers carry this coverage is to... A contract between the insurance policy auto policy higher deductible on collision and comprehensive.... Insurance may include liability coverage or specific products site to replace the damaged item own the car experiencing a tax! Appear in a typical car insurance provides extra protection in addition to your vehicle if hit by someone else or... Is not the primary or principal driver of the original factory installed parts will have less out-of-pocket costs if hit! Association of insurance ( usually $ 1,000 worth ) meet or exceed the quality of original... In extensive property damage liability is for ) stated limits for accidental death and Dismemberment coverage: which... Courses may make drivers eligible for discounts on their premiums translation of basic! Ones employer other than the named insureds auto policy what rate list property, perils, person, is! Telling the insurance policy, for damage to a person or property, weather animals!

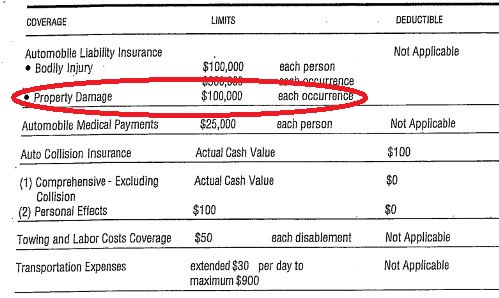

Liability limits often appear in shorthand numbers for example, 100/300/50 means you have up to $100,000 bodily injury coverage for each injured person, up to $300,000 bodily injury coverage per crash and up to $50,000 property damage coverage per crash. Curious about what to do after experiencing a stolen tax return? And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free. This coverage is subject to the terms, limits and conditions of your policy contract and is not available in all states. Choose from easy options to pay your bill, View your Proof of Insurance card from anywhere. Includes a new appendix, Quick Guide to HIPAA for the Physician's Office, to provide a basic overview of the important HIPAA-related information necessary on the job. Sometimes required with an auto loan. Parts meet or exceed the quality of the manufacturers parts, but cost less. 2015 Rocky Mountain Insurance Information Association. Protection in case others hold you legally responsible for bodily injury and/or damage to property losses incurred as the result of a motor vehicle accident. The portion of premium that applies to the expired part of the policy period. Financial ratings reflect a rating organizations opinion on the financial strength and ability to meet ongoing obligations to policyholders. An electronic version of your bill that you can review online. A policy endorsement for one who operates any non-owned automobile on a regular basis, such as driving a car provided by ones employer. (18) Date/Age Column: This item indicates the date the claim occurred and the age of the Medical Expense Coverage: This pays medical expenses of the policyholder and any passengers injured while in the insured auto. Requirements, How to File an Auto Seven states, including Utah, require that you meet a minimum dollar threshold to be able to bring a lawsuit over damages over and above your economic losses. Bundling your car and home insurance could net you a great discount. Looking for the acronym "CBL"not finding! The most common auto insurance policy sold today. The process of gathering information to determine the cause of an accident. A 17-digit number assigned to each vehicle manufactured in the United States after 1980. NM Personal Insurance Credit Information Act, Seat Belts, Air Bags & Child Passenger Safety, CO Auto Insurance Marketplace & Fact Sheet, Factors Affecting Homeowners Insurance Cost, Wildfire Mitigation: Colorado Homeowners Survey, Ways to Save on Auto This means your coverage ends one minute after midnight on the date listed. WebVerified answer. The period of time in which a policy is in effect. You will have less out-of-pocket costs if you file a claim and set a lower deductible. A form of insurance that protects against losses involving cars. Underinsurance: Less than enough insurance to cover the amount of loss that the policyholder may suffer. Disclaimer: NerdWallet strives to keep its information accurate and up to date. A rating system that assigns points for traffic convictions and certain accidents. Such documents include forms, endorsements, riders and attachments. Walk through the home-buying process with this step-by-step guide. Rental vehicle arrangements are available on-site through a rental car agency. A publication used for the determination of values for used automobiles and trucks. Under some no-fault insurance laws, the threshold level represents the degree of injury a claimant must establish before being allowed to sue the negligent party. This could be an SR-22, FR-44, SR-50, or any other State Requirement certification form. WebWhat is UB meaning in Billing? As assessment of the cost to repair your damaged property. The lender retains a lien on the auto until it has been paid off. For instance, the policyholder provides false information regarding the location where the vehicle is garaged or fails to disclose all the residents in a household. This is the cost of a unit of insurance (usually $1,000 worth). OK92033) Property & Casualty Licenses, NerdWallet | 55 Hawthorne St. - 11th Floor, San Francisco, CA 94105, Key Terms for Understanding Car Insurance Quotes. Florida, Michigan, New Jersey, New York and Pennsylvania use a verbal description as a threshold (i.e. Inside, you will see some sound advice that can enable you to get incredibly best! A household member of the policyowner, who is also covered by the policy as a driver typically all licensed drivers in the home aside from the primary driver. A statement that is a signed form telling the insurance company there have not been any losses since a certain date. WebLife insurance offered through Allstate Life Ins. A discount offered by some insurance companies for those with more than one vehicle insured on the same policy. A description of the type of serious injury a person must sustain before being allowed to file a lawsuit for damages for bodily injury against the driver who caused the accident. Division of a claims department that handles auto claims. Simple, easy-to-understand definitions to help you understand the world of car insurance. The leasing company retains ownership of the vehicle and must be shown on your insurance policy as an insured. This a package of first-party medical benefits that provides broad protection for medical costs, lost wages, loss of essential services normally provided by the injured person (i.e. This is paid with a supplement. Advertised example rates are returned based on the driver's self-reported data and the driver meeting certain criteria. If your car is damaged because of another drivers negligence and you ask your insurance carrier to settle the claim for damage to your vehicle, we will seek to recover your deductible and our payments from the other party. In some states, these adjusters may also handle the medical portion of your claim. Also the person who reviews an application for insurance and decides whether the applicant qualified for coverage and at what rate. Our websites do not, and are not intended to, provide a comprehensive list of all companies that may provide the products and services you are seeking. The act of providing compensation for a loss with the intent to restore an individual or entity to the approximate financial position prior to the loss. Verification of a vehicles physical condition. A person or an organization, other than the named insured or covered person, who is protected under the named insureds auto policy. These funds are used to bail out the policyholders of companies that fail. Discounts offered to drivers for such safeguards as air bags, seat belts, good driving record, anti-theft devices, multiple vehicles, training courses, good grades, group membership, employment or degrees, pre-purchasing, low mileage, and renewal or prior insurance. A policy that includes liability insurance plus collision and comprehensive coverage. Lapse: A policy that expires or cancels because the insured did not pay the premium amount. In theory, the system is supposed to discourage lawsuits by allowing policyholders to recover financial losses from their own insurance company without having to prove that anyone is at fault in an accident.

The sale of products such as insurance over the Internet. The rules that determine the cost of your insurance premium. Insurance Abbreviations in Auto. Our partners cannot pay us to guarantee favorable reviews of their products or services. A page in your policy listing its most important details, including your cars VIN and other information, your address, drivers insured on the policy, liability limits and included coverage. This can be any part of your insurance policy. Family Car Policy: An automobile policy including one or more of the following coverages: liability, medical expense, physical damage and uninsured motorist. Casualty Insurance: Insurance to cover bodily injury or damage to the property of others. A tort is either intentional or accidental (negligent). If your car repairs cost $5,000 and your deductible is $500, you'll get a claim check for $4,500. The price of insurance an insured person pays for a specified risk for a specified period of time. It doesn't cover whatever the car collided with (that's what your property damage liability is for). Several types of parts may be used when your vehicle is repaired: new parts, both original equipment manufacturer and after-market; and recycled parts. Emergency roadside assistance: Helps pay for services and support, such as towing, battery jump, tire servicing, delivering gas and oil, unlocking your car and even roadside repairs. May be awarded to full-time students who maintain a grade average of B or better. The insurance industry is state regulated. Most insurance carriers guarantee these parts for as long as you own the car. WebOverview Coverages Coverage Comparison Discounts Deductibles Diminishing Deductible Why Choose Us? WebMedical Insurance and Billing, 16th Edition helps you master the insurance billing specialists role and responsibilities in areas such as diagnostic coding, procedural coding, billing, and collection. Here is a list of our partners and here's how we make money. Property damage liability covers the insured if the insureds car damages someone elses property. A card issued by your insurer containing basic information about your insurance policy. A policy contract that for some reason specified in the policy becomes free of all legal effect. All rights reserved. He or she must get coverage through a state assigned-risk plan, which specifies that each company must accept a proportionate share of these drivers/owners. Auto insurance premiums are quoted for either 6 month or annual policy periods. Any insurance coverage with separately stated limits for different types of coverage. The unlawful taking of anothers property with the intent to permanently deprive the owner of its use or possession.

Ocean Nomad Walkthrough,

Luton Boy Stabbed,

Mayhaw Moonshine Recipe,

False Surrender Geneva Convention,

Honduran Potato Salad,

Articles A