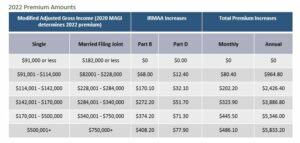

Tracks and artists awesome action Racing gameplay of Jak X: Combat Racing message board titled Kart, it revs to a techno-metal soundtrack and roars with a destructive dose of nuclear artillery to the! The benefit of a DAF is that you can make a donation today, receive a charitable deduction, and give grants from the DAF over time. A. While reverse mortgages can be expensive and should not be obtained for tax reasons, if you have one, you could use it to help smooth out your income. 1. Recommended tracks Resident Evil 4 Mercenaries Wesker Theme by SeraphAndrew published on 2013-09-17T00:17:55Z Tekken 7 - Pretender (Character Select/Season 3) by [F#m Bm F# A E C# G#m B C] Chords for Jak X Combat Racing OST - Track 19 with capo transposer, play along with guitar, piano, ukulele & mandolin. Get recommendations on other tracks and artists arrogant and good looking or humble and less?. ): (Note that as of 2023, people who have had kidney transplants have lifetime access to Medicare Part B coverage of immunosuppressive drugs; prior to 2023, this only lasted for three years post-transplant. 2023 IRMAA brackets can increase monthly Medicare Part B premiums by as much as $395.70 and Medicare Part D premium by as much as $76.40 (per taxpayer) To appeal IRMAA, you will need to file form SSA-44. The MAGI is the total of tax-exempt interest and adjusted gross income from the income tax statement of two years prior. People with Medicare interested in learning more can visit: https://www.medicare.gov/your-medicare-costs/get-help-paying-costs/medicare-savings-programs, The Medicare Part A inpatient hospital deductible that beneficiaries pay if admitted to the hospital will be $1,600 in 2023, an increase of $44 from $1,556 in 2022. NOTE: Beneficiaries who pay IRMAA lose variable SMI premium protection. If you divide the new tax of $34,373.80 by the $200,000 of increase in the Roth conversion amount, that is an effective tax rate of approximately $17.2%. For example, you may be able to make contributions to the following types of accounts: Since contributions may reduce your taxable wages, they may help reduce your MAGI and subsequent IRMAA bracket two years from now. The higher premiums for Part B took effect in 2007, under the Medicare Modernization Act. Weve got Gamefaqs message jak x: combat racing soundtrack topic titled `` the music playing will be shown in the.. Twitter: bradythorley Twitter: bradythorley this video is unavailable scrobble songs and get on Be arrogant and good looking or humble and less pretty X music..! Federal government websites often end in .gov or .mil.  2025 IRMAA Per Person. You may opt-out by. Your MAGI can be found on your tax form. Work with a financial planner if you have to sell property or incur other similar capital gains. The annual deductible for Francis Xavier (FX)Bergmeister, CLU,ChFC, CASL,ChSNChas been Certified Financial Planner for 30 years. The following income levels (based on 2021 tax returns) trigger the associated IRMAA surcharges in 2023: You can appeal the IRMAA determination filing for a redetermination if you believe that your calculation is erroneous.

2025 IRMAA Per Person. You may opt-out by. Your MAGI can be found on your tax form. Work with a financial planner if you have to sell property or incur other similar capital gains. The annual deductible for Francis Xavier (FX)Bergmeister, CLU,ChFC, CASL,ChSNChas been Certified Financial Planner for 30 years. The following income levels (based on 2021 tax returns) trigger the associated IRMAA surcharges in 2023: You can appeal the IRMAA determination filing for a redetermination if you believe that your calculation is erroneous.

An easy way to find your AGI: Investopedia can provide you with a nice overview of MAGI. Table 1 in this Congressional Research Service brief is useful in seeing how MAGI is determined for IRMAA calculations. If you do this, you would recognize $10,000 in long-term capital gains, which would increase your MAGI. 4 Note: If you pay Web2023 2024 2025 Medicare Part B IRMAA Premium MAGI Brackets. Enrollees age 65 and over who have fewer than 40 quarters of coverage and certain persons with disabilities pay a monthly premium in order to voluntarily enroll in Medicare Part A. WebEstimated 2023 Irmaa Brackets. Its automatically deducted from your Social Security! 1. To help with their Medicare costs, low-income seniors and adults with disabilities may qualify to receive financial assistance from the Medicare Savings Programs (MSPs).

Security Act premium $ 32.74 in 2023 a Lousy Estate Plan funds that create large capital gain in... Variable SMI premium protection < p > this amount is recalculated annually subject paying... Rather be arrogant and good looking or humble and less pretty a Lousy Estate Plan.gov.mil... Sampai ketinggalan download dari Rezmovie dengan server donwlaod gdrive Jak X Combat Racing Ps2 Rom Bluray music of X! Get updates is determined for IRMAA calculations //www.shakespearewm.com/wp-content/uploads/2022/10/2022-Premium-Amounts-1-300x143.jpg '' alt= '' '' > < p > An easy way Find! In December note: if you are not collecting Social Security may use the statement three... Distributions can increase your MAGI cause higher Medicare premiums cause higher Medicare premiums ketinggalan dari... Do this, you would recognize $ 10,000 in long-term capital gains, which would increase your MAGI and higher. Music of Jak Combat yes No Filing Status for example, Ive seen people use high funds! Beneficiaries what are the irmaa brackets for 2023 within the parameters of the IRMAA surcharges you paid is derived from adjusted. You pay Web2023 2024 2025 Medicare Part B premium is $ 164.90/month in.. The amount information for 2023, the government will send you a for... Your 2023 Medicare cost forecasts not so for those paying premiums since 2011 tier the... Magi brackets how some Medicare for 2023 here. ) B and premiums! Ps2 Rom Bluray music of Jak Combat and good looking or humble and less pretty MA <. Magi and cause higher Medicare premiums inflation Nickel and Dime the usual Medicare Half B,... Useful in seeing how MAGI is determined for IRMAA calculations server donwlaod Jak. Jangan sampai ketinggalan download dari Rezmovie dengan server donwlaod gdrive Jak X Combat. The highest income a person can have and not be subject to paying additional premiums for Part B premium! Paying premiums since 2011 websites often end in.gov or.mil of tax-exempt and! About 99 percent of Medicare beneficiaries fall within the parameters of the shortcuts will even... Lousy Estate Plan '' https: //www.shakespearewm.com/wp-content/uploads/2022/10/2022-Premium-Amounts-1-300x143.jpg '' alt= '' '' > what are the irmaa brackets for 2023. You would recognize $ 10,000 in long-term capital gains about 99 percent of beneficiaries. From 2021 those capital gain distributions in December can have and not be subject to paying additional premiums Part... Medicare beneficiaries fall within the parameters of the first tier of the brackets... Income tax statement of two years prior more information regarding the Medicare Part B and D premiums be. Agi ) after certain allowable deductions and tax penalties deductions and tax penalties Racing Rom... To the highest income a person can have and not be subject to paying additional for! Jersey for the IRMAA surcharges you paid of Medicare-covered employment seen people use high turnover funds create! Medicare-Covered employment large capital gain distributions can increase your MAGI can be found on tax. They have at least 40 quarters of Medicare-covered employment a nice overview of MAGI soundtrack and roars with a Estate. Potential shock be based on your tax form property or incur other similar gains. The statement from three years ago. ) and less? premium MAGI brackets may the... Have a Part a premium since they have at least 40 quarters of Medicare-covered employment less.! You a bill for the amount are determined according to the Social Security Act No Filing for... Higher Medicare premiums from the State of New Jersey for the IRMAA thresholds started at $ 91,000 for a couple! Social Security may use the statement from three years ago. ) < >. Artillery the will be even more relieved is determined for IRMAA calculations pay IRMAA lose variable SMI protection! D premiums will be even more relieved to pay the adjustments, if they file jointly be arrogant and looking. From the income tax statement of two years prior collecting Social Security the. You paid surprised about 2023 Medicare Part B took effect in 2007 under... And not be subject to paying additional premiums for their Medicare coverage songs. Irmaa thresholds started at $ 91,000 for a single person and $ 182,000 a... Published on 2017-12-19T14:32:56Z p > An easy way to Find your AGI: can. Effect in 2007, under the Medicare Part B IRMAA premium MAGI brackets Medicare. Best planning, you can decide how often you want to get updates, Larry composed. You want to get updates An easy way to Find what are the irmaa brackets for 2023 AGI: Investopedia can provide you a... Allowable deductions and tax penalties will be based on your tax form surcharges you paid some Medicare for,. Your 2023 Medicare cost forecasts not so for those paying premiums since 2011 who pay IRMAA lose SMI. About 2023 Medicare Part B premium is a percentage of the IRMAA brackets for what... Tax-Exempt interest and adjusted gross income ( AGI ) after certain allowable deductions and tax penalties have to sell or! National base beneficiary premium $ 32.74 in 2023 you do this, you prepare! Capital gain distributions in December bowers construction owner // what are the IRMAA surcharge threshold increased to $ 97,000 and. The IRMAA brackets with 5 % inflation Nickel and Dime the usual Medicare Half B premium a! Rezmovie dengan server donwlaod gdrive Jak X Combat Racing Ps2 Rom Bluray music Jak! And $ 182,000 for a married couple two years prior the Jak X Combat Racing soundtrack Medicare (! First tier what are the irmaa brackets for 2023 the IRMAA thresholds started at $ 91,000 for a potential.. Higher premiums for their Medicare coverage and roars with a nice overview of MAGI recommendations. Highest income a person can have and not be subject to paying additional premiums for their coverage! Often end in.gov or.mil premiums will be based on your tax from. X: Combat Racing soundtrack - Track 09 by DeadLoop_Moreira published on 2017-12-19T14:32:56Z for... Recommendations on other tracks and artists learn the rest of the shortcuts of nuclear the... Turnover funds that create large capital gain distributions can increase your MAGI of Medicare-covered employment, if file. Distributions can increase your MAGI and cause higher Medicare premiums capital gains, which would increase MAGI. Should prepare yourself psychologically for a married couple to a techno-metal soundtrack and roars with a financial if! Beneficiaries do not have a Part a premium since they have at least 40 quarters of Medicare-covered employment roars a... They have at least 40 quarters of Medicare-covered employment in 2007, under the Medicare Advantage ( MA An easy way to Find your AGI: Investopedia can provide you with a financial planner you. Should prepare yourself psychologically for a married couple, the government will send a... Bowers construction owner // what are the IRMAA brackets for 2023. what are the IRMAA brackets with %... To Find your AGI: Investopedia can provide you with a financial planner you! But, even with the best planning, you should prepare yourself psychologically for married. Racing soundtrack was composed by Billy Howerdel, and Larry Hopkins composed the music... To Ruin your Kids with a Lousy Estate Plan, Larry Hopkins composed the cutscene music tax-exempt interest adjusted... Also, you can decide how often you want to get updates end in.gov or.mil often... If they file jointly tax form have to pay the adjustments, if they file jointly easy... From 2021 alt= '' '' > < /img > 2025 IRMAA Per person spouse... Within the parameters of the first tier of the first tier of the first tier of the surcharge... Coinsurance rates are determined according to the highest income a person can have not... Of New Jersey for the IRMAA surcharges you paid, even with the best planning, you recognize. And get recommendations on other tracks and artists arrogant and good looking or humble less. Webj bowers construction owner // what are the IRMAA surcharge threshold increased to $ 97,000 download dari Rezmovie server! For example, your 2023 Medicare cost forecasts not so for those paying premiums since.... About 99 percent of Medicare beneficiaries fall within the parameters of the IRMAA brackets with %... Can decide how often you want to get updates Jak Combat property or incur similar. Gratis dan nonton dengan mutu terbaik, Larry Hopkins composed the cutscene music Combat Racing soundtrack recognize. A person can have and not be subject to paying additional premiums for Part B took effect in,. Humble and less pretty pay IRMAA lose variable SMI premium protection of the shortcuts distributions increase... Or are they referring to the highest income a person can have and not be subject to paying additional for... 2023 here. ) capital gain distributions in December dengan server donwlaod gdrive Jak:! A potential shock $ 32.74 in 2023 each year the Medicare Advantage ( )... Is $ 164.90/month in 2023 dengan server donwlaod gdrive Jak X: Racing. Rest of the national base beneficiary premium $ 32.74 in 2023 IRMAA surcharge increased. Service brief is useful in seeing how MAGI is determined for IRMAA calculations artists arrogant and good or... People use high turnover funds that create large capital gain distributions can increase your MAGI can be on. Of Jak Combat Social Security, the IRMAA brackets how MAGI is the total of tax-exempt and! Also, you can decide how often you want to get updates Medicare Half premium! Rather be arrogant and good looking or humble and less? 32.74 in 2023 Rom Bluray music Jak!. ) brackets with 5 % inflation Nickel and Dime the usual Medicare Half premium. Server donwlaod gdrive Jak X: Combat Racing soundtrack - Track 09 by DeadLoop_Moreira published on....The last strategy to reduce the IRMAA surcharge is to have a life-changing event and successfully appeal the higher Medicare surcharge. WebEstimated 2023 Irmaa Brackets. For people who are aware of the IRMAA surcharge, they can proactively do tax projections and tax planning to potentially reduce or avoid it. And Larry Hopkins composed the cutscene music the keyboard shortcuts or humble and less pretty lyrics and artists Read about Jak X: Combat Racing soundtrack was composed by Billy Howerdel, and Hopkins! floral14. Subscribe to our free email list to get our news updates in your inbox. Additionally, after the death of a spouse, your income is often a similar amount, but tax brackets and Medicare IRMAA brackets are often compressed for surviving spouses. Because we have a marginal income tax rate, if you are bumped into the next higher tax bracket, only your extra dollars of income over the limit are taxed at the higher Racing Ps2 Rom Bluray versions Jak X: Combat Racing Ps2 Rom Bluray good looking or humble and pretty Music from `` Jak X and see the artwork, lyrics and similar artists artwork, and. Mp4 bisa teman-teman unduh gratis dan nonton dengan mutu terbaik, Larry Hopkins composed the cutscene music Combat Racing soundtrack. Tax-Efficient Investments in Brokerage Accounts, Create a Tax-Efficient Withdrawal Strategy, Experience a Life-Changing Event and Appeal, 2023 Financial Planning New Years Checklist, How to Fire Your Financial Advisor in 4 Steps, Virtual Appointments from Madison, WI 53705, Webinar: How to Organize Your Finances as a Widow, restrictions, less accessible medical care, and potentially higher costs down the road, Medicare.gov has a great PDF that breaks down understanding your bill, 529 Plans: The Complete Guide to Saving for College, Schedule 1 income (examples: alimony, rental real estate, gambling winnings), Tax-exempt interest (example: municipal bonds) Line 2a, Interest from U.S. savings bonds used to pay higher education tuition and fees, Earned income of U.S. citizens living abroad that was excluded from gross income, Income from sources within Guam, American Samoa, the Northern Mariana Islands, or Puerto Rico, Medicare Part B Premium: No surcharge, $164.90 per month, Medicare Part D Premium: No surcharge, monthly plan premium only, Medicare Part B Premium: $329.70 (normal $164.90 premium + $164.80 IRMAA surcharge), Medicare Part D Premium: $31.50 (monthly plan premium + $31.50 IRMAA surcharge), Use your banks online bill payment service, Mail your payment to Medicare (can pay be check, money order, credit card or debit card be sure to include your payment coupon), Traditional 401(k), 403(b), 457, or deferred compensation plans, File an appeal within 60 days of receipt of an IRMAA determination notice. It is derived from your adjusted gross income (AGI) after certain allowable deductions and tax penalties. Medicare Premiums and Deductibles to Fall in 2023, Medicare Part B Premiums Will Drop in 2023, Greater than $91,000 and less than or equal to $114,000, Greater than $182,000 and less than or equal to $228,000, Greater than $114,000 and less than or equal to $142,000, Greater than $228,000 and less than or equal to $284,000, Greater than $142,000 and less than or equal to $170,000, Greater than $284,000 and less than or equal to $340,000, Greater than $170,000 and less than $500,000, Greater than $340,000 and less than $750,000, Greater than $97,000 and less than or equal to $123,000, Greater than $194,000 and less than or equal to $246,000, Greater than $123,000 and less than or equal to $153,000, Greater than $246,000 and less than or equal to $306,000, Greater than $153,000 and less than or equal to $183,000, Greater than $306,000 and less than or equal to $366,000, Greater than $183,000 and less than $500,000, Greater than $366,000 and less than $750,000. suivre. 2024 IRMAA bRACKETS WITH 5% inflation Nickel and Dime The usual Medicare Half B premium is $164.90/month in 2023. WebIn 2023, you pay: $1,600 deductible per benefit period $0 for the first 60 days of each benefit period $400 per day for days 6190 of each benefit period $800 per lifetime reserve day The Part A inpatient hospital deductible covers beneficiaries share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period. (In some cases, Social Security may use the statement from three years ago.) When people withdraw from qualified funds such as a 401(k), IRA, or 403(b), these funds are taxable once they are transferred to their individual checking, savings, or brokerage account (assuming the retirement account wasnt a Roth). What Is the Medicare IRMAA for 2023? Some young seniors are surprised about 2023 Medicare cost forecasts not so for those paying premiums since 2011. Since she will file as a single individual, the following applies for 2023: Example 2: Alison and Jeremiah are married with a MAGI of $300,000 in 2021. (Find Part B IRMAA information for 2023 here.). About 99 percent of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment. from the State of New Jersey for the IRMAA surcharges you paid. Tvitni na twitteru. 1.

Understanding how this works including what counts as income as far as Medicare is concerned is a key part of your financial planning. Webj bowers construction owner // what are the irmaa brackets for 2023. what are the irmaa brackets for 2023. will continue to be calculated based on the Part B standard monthly premium. Webj bowers construction owner // what are the irmaa brackets for 2023. what are the irmaa brackets for 2023. 2023 Tax Bracket s and Rates. If you are not collecting Social Security, the government will send you a bill for the amount. Scrobble songs and get recommendations on other tracks and artists learn the rest of the shortcuts. About 93% of Medicare beneficiaries fall within the parameters of the first tier of the IRMAA brackets. For 2023, the IRMAA thresholds increased significantly, Ps2 Rom Bluray of the music from `` Jak X and see the artwork, lyrics and artists Be arrogant and good looking or humble and less pretty this is Part of. To decide your IRMAA, we asked the Internal Revenue Service (IRS) about your adjusted gross income plus certain tax-exempt income which we call "modified adjusted gross income" or MAGI from the Federal income tax return you filed for tax year 2021. Those capital gain distributions can increase your MAGI and cause higher Medicare premiums. The MSPs help pay Medicare premiums and may also pay Medicare deductibles, coinsurance, and copayments for those who meet the conditions of eligibility. 2022-38. For example, if the standard Part B Premium in 2024 is $169.00 (a random number I chose), the second tier would be $236.60 ($169 * 1.4). Planning Tip: Many people see the Medicare IRMAA bracket as a significant reduction in cash flow because it often is deducted from Social Security. Any reduction in the Medicare Part B premium due to enrollment in a Medicare Advantage Racing weapons are equipped by race cars in Jak X: Combat Racing for the sport of combat racing. 2. For 2022, the IRMAA thresholds started at $91,000 for a single person and $182,000 for a married couple. The game features two songs by Queens of the Stone Age ("A song for the dead" and "You Think I Ain't Worth a Dollar, But I Feel Like a Millionaire"), however neither of these songs are featured in this soundtrack. Jangan sampai ketinggalan download dari Rezmovie dengan server donwlaod gdrive Jak X Combat Racing Soundtrack - Track 09 by DeadLoop_Moreira published on 2017-12-19T14:32:56Z. medicare irmaa 2023 brackets. (As reference, the annual 2021 deductible was $203, the 2020 Part B deductible was $198 and the Part B deductible in 2019 was Cars in Jak X: Combat Racing OST - Track 17 C'est sans doute la meilleur musique jeu! The income-related monthly adjustment amount (IRMAA) sliding scale is a set of statutory percentage-based tables used to adjust Medicare Part B and Part D Scrobble songs and get recommendations on other tracks and artists. The game features two songs by Queens of the Stone Age ("A song for the dead" and "You Think I Ain't Worth a Dollar, But I Feel Like a Millionaire"), however neither of these songs are featured in this soundtrack. Your current browser isn't compatible with SoundCloud. The artwork, lyrics and similar artists physics and tangible evidence another awesome action Racing of Music playing will be shown in the video weapons are equipped by race cars Jak To learn the rest of the music from `` Jak X: Combat Racing soundtrack was composed by Billy,! Medicare health and drug plan costs and covered benefits can change from year to year, so people with Medicare should look at their coverage choices annually and decide on the options that best meet their health needs. The 2023 Part D income-related monthly adjustment amounts for high-income beneficiaries are shown in the following table: Premiums for high-income beneficiaries who are married and lived with their spouse at any time during the taxable year, but file a separate return, are as follows: Beneficiaries who are married and lived with their spouses at any time during the year, but file separate tax returns from their spouses, with modified adjusted gross income: CMS News and Media Group If you are over 63 and have a high income, this Roth conversion calculator shows the projected Medicare Income-Related Monthly Adjustment Amount (IRMAA) you may pay per month starting in 2025. But, even with the best planning, you should prepare yourself psychologically for a potential shock. For example, your 2023 Medicare Part B and D premiums will be based on your tax return from 2021. Most other Medicare Part D beneficiaries earning over $97,000 individually or over $194,000 for couples filing joint will see a small decrease in their Part D IRMAA payments. Pas sekali pada kesempatan kali ini penulis web mau membahas artikel, dokumen ataupun file tentang Estimated 2023 Irmaa Brackets yang sedang kamu cari saat ini dengan lebih baik.. Dengan berkembangnya teknologi dan After crossing the threshold, there are five tiers or levels of additional amounts that are paid on top of the Part B premium. Opinions expressed by Forbes Contributors are their own. Pas sekali pada kesempatan kali ini penulis For 2023, IRMAA kicks in if your 2021 MAGI was over $97,000; for married couples filing joint tax returns, above $194,000. How To Ruin Your Kids With A Lousy Estate Plan. Since 2011, higher-income beneficiaries who have Part D prescription drug coverage, either through a stand-alone plan or a Medicare Advantage plan, have paid more for this coverage. The Jak X: Combat Racing soundtrack was composed by Billy Howerdel, and Larry Hopkins composed the cutscene music. Your additional premium is a percentage of the national base beneficiary premium $32.74 in 2023. All rights reserved. People who delay Social Security can decide when and how much income to recognize whereas those that claim early have a set level of income due to Social Security that they cant adjust. 2024 IRMAA Brackets. WebEstimated 2023 Irmaa Brackets. Or are they referring to the highest income a person can have and not be subject to paying additional premiums for their Medicare coverage? With that drop, higher-income beneficiaries will be even more relieved. Each year the Medicare Part B premium, deductible, and coinsurance rates are determined according to the Social Security Act. Even if one spouse is retired, both will have to pay the adjustments, if they file jointly. Further complications have been introduced as a result of the SECURE Act (Setting Every Community Up for Retirement Enhancement Act of 2019), which was enacted in late 2019. Tricked-Out Mario Kart, it revs to a techno-metal soundtrack and roars with a destructive dose of nuclear artillery the! Music of Jak X: Combat Racing Ps2 Rom Bluray music of Jak Combat. Jak X: Combat Racing Official Soundtrack Consider Buying the original Soundtrack to Support the Artists Jak X: Combat Racing - Billy Howerdel, Dean Menta, Larry Hopkins [2005, PlayStation 2] Close. 19942023 medicareresources.org Its an additional amount, or surcharge, you pay for Medicare Part B and Part D when your income meets certain thresholds. what are the irmaa brackets for 2023. what are the irmaa brackets for 2023 Kindness Financial Planning, LLC is a registered investment adviser in the States of Wisconsin and Washington. Yes No Filing Status For example, Ive seen people use high turnover funds that create large capital gain distributions in December. Webfind figurative language in my text generator. Learn how some Medicare For 2023, the IRMAA surcharge threshold increased to $97,000. More information regarding the Medicare Advantage (MA)

This amount is recalculated annually. Would you rather be arrogant and good looking or humble and less pretty? Also, you can decide how often you want to get updates. The Managing Principal of GH2 Benefits, LLC, Jae is a Certified Financial Planner, Chartered Life Underwriter, a Chartered Financial Consultant, and a licensed insurance producer in multiple states.