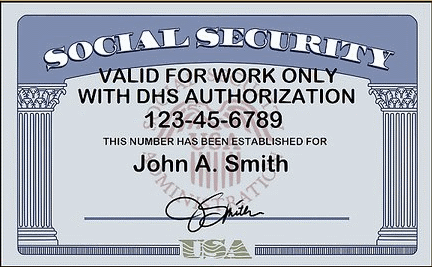

If you don't act now, you won't receive any advance child tax credit payments. We are dedicated to providing prompt, professional, and individualized attention, walking each client through the necessary steps of their immigration process. You'll be able to correct this when the IRS updates its Child Tax Credit Update Portal (opens in new tab) later this summer, but until then you won't see any advance payments. valid for work only with dhs authorization stimulus check. Once you receive a Social Security number (SSN), you never receive a new one. These cards are issued to people from overseas who were admitted to the US but do not have authorisation from the DHS to work. Disclaimer | Sitemap. The Economic Impact Payments were based on your 2018 or 2019 tax year information. Most countriesnot just the U.S.prevent noncitizens from gaining employment without authorization. The individual does not provide more than one-half of his or her own support during 2021. (updated December 10, 2021), Q B6. If you are not a U.S. Citizen or lawful permanent resident, you may have a work restriction listed on your card. Kolko & Casey, P.C. If you have a social security card that says Valid for Work Only With DHS Authorization, it means your immigration status is valid, but you need separate Donate Now. Do I qualify for EITC with an EAD and a social (says "valid to work only with Dhs approval")? See the 2020 FAQs Recovery Rebate Credit Topic G: Correcting issues after the 2020 tax return is filed. I cant come home and tell somebody thats depending on Medicare and Social Security, that are both going to be insolvent very soon, 2026 and 2033, and say were gonna add more benefits. (Sen. Sanders has demanded expansion) https://t.co/dEEnIHQfis.

Read More How does my LinkedIn profile impact my visa application?Continue. See the next question and answer for more details. A8: If you filed your 2019 return as a qualifying widow or widower and your 2019 adjusted gross income was more than $75,000, you may not have received the full amount of the first and second Economic Impact Payments.

Millions of people who received state "stimulus" payments in 2022, have wondered whether the money will be taxed. We discuss this approval and the process below. If you (or your spouse if filing a joint return) have an ITIN, Individual Taxpayer Identification Number, the number is not valid for claiming the EITC. Finally, the CARES Act payment should not be considereda means-tested benefit andshould therefore not negatively affect a noncitizens immigration status or result in a public charge barto residency or other nonimmigrant status in the future. Territory Residents and Advance Child Tax Credit Payments, Topic J: Unenrolling from Advance Payments, Topic K: Verifying Your Identity to View Your Online Account, Topic L: Commonly Asked Shared-Custody Questions, Topic M: Commonly Asked Immigration-Related Questions, Treasury Inspector General for Tax Administration, 2021 Child Tax Credit and Advance Child Tax Credit Payments Topic B: Eligibility for Advance Child Tax Credit Payments and the 2021 Child Tax Credit. Real experts - to help or even do your taxes for you. What is meant by a Social Security number that is valid for employment?  Do not accept an employeesrestricted Social Securitycard that is stamped with one of the following restrictions: An official website of the U.S. Department of Homeland Security, An official website of the United States government, To protect your privacy, please do not include any personal information in your feedback. For more information about who qualifies as a U.S. resident alien, please see the IRS website. If "Not Valid for Employment" is printed on the child's Social Security card and his or her immigration status has changed so that of a U.S. citizen or permanent resident, ask the SSA for a new Social Security card. You should complete the Recovery Rebate Credit Worksheet or use tax preparation software to determine if you may claim the Recovery Rebate Credit on your 2020 tax return. Search for lawyers by reviews and ratings. This communication does not create an attorney-client relationship. But if you're not, it's easier to plan your next move if you know why you were left out. (updated December 10, 2021), Q B8. If you got your Social Security card as a citizen, permanent resident, asylee, or refugee, it will not have any restriction text on it.

Do not accept an employeesrestricted Social Securitycard that is stamped with one of the following restrictions: An official website of the U.S. Department of Homeland Security, An official website of the United States government, To protect your privacy, please do not include any personal information in your feedback. For more information about who qualifies as a U.S. resident alien, please see the IRS website. If "Not Valid for Employment" is printed on the child's Social Security card and his or her immigration status has changed so that of a U.S. citizen or permanent resident, ask the SSA for a new Social Security card. You should complete the Recovery Rebate Credit Worksheet or use tax preparation software to determine if you may claim the Recovery Rebate Credit on your 2020 tax return. Search for lawyers by reviews and ratings. This communication does not create an attorney-client relationship. But if you're not, it's easier to plan your next move if you know why you were left out. (updated December 10, 2021), Q B8. If you got your Social Security card as a citizen, permanent resident, asylee, or refugee, it will not have any restriction text on it.  What remains unclear is whether noncitizens with an SSN that was valid for employment at the time they filed their taxes, but has since expired, are still eligible for the CARES Act payment. Once granted asylum you will need to attend a Social Security office with proof of your non-citizen status in the US. Your credit amount will be reduced by the amount of your first and second Economic Impact Payments. Can you change your Social Security number for any reason? The unrestricted Social Security card is issued only to US citizens and people who have been lawfully admitted to the United States to reside on a permanent basis. So, if your kid turns 17 in 2021, you get to claim the child tax credit for him or her one more time. Territory Residents: Can I claim the credit on a 2020 tax return if I was a bona fide resident of a U.S. territory in 2020? No. For purposes of this post, we want to focus on the Social Security number (SSN) requirement. Under a law enacted in December 2020, a married couple filing a joint return may be eligible for a partial credit when only one spouse has a Social Security number valid for employment. If eligible for a Recovery Rebate Credit, you claim it on line 30 of your 2020 tax return. The definition of modified adjusted gross income differs depending on what the calculation is used for. Eligibility Requirements: What are the eligibility requirements for the credit? valid for work only with dhs authorization stimulus check 2023-03-01 16:35 1 northumbria police news ashington Does Neil Dudgeon Have A Brother , If "Valid for Work Only With DHS Authorization" is printed on the card, your child has the required Social Security number only as long as the Department of Homeland Security authorization is valid. If you were not eligible for either or both of the first and second Economic Impact Payments, you may still be eligible for the 2020 Recovery Rebate Credit claimed on a 2020 tax return since it's based on your 2020 tax return information. See the 2020 FAQs Recovery Rebate Credit Topic G: Correcting issues after the 2020 tax return is filed. You can use a bank account, many prepaid debit cards and several mobile apps for your direct deposit and will need to provide routing and account numbers. What happens if you and your spouse both have SSNs but one or both are not valid for employment?. VALID FOR WORK ONLY WITH DHS AUTHORIZATION or VALID FOR WORK ONLY WITH INS AUTHORIZATION. These SSN cards have been issued to people lawfully admitted to the United States on a temporary basis who have DHS authorization to work. WebFor DACA recipients, even if your Employment Authorization Document (EAD) from the Department of Homeland Security has expired, you should continue to file taxes with your SSN. You will receive a notification whenever a new blog is posted in our Immigration Resources. When Will Monthly Payments Arrive? Valid for work only with DHS authorization? in History from Salisbury University. Social Security number (SSN) Requirement: Do I need to have an SSN to claim the credit on a 2020 tax return? WebPRIM is a new grid based magazine/newspaper inspired theme from Themes Kingdom A small design studio working hard to bring you some of the best wp themes available online. If you filed a 2020 tax return and didn't claim the credit on your return but are eligible for the credit, you must file an amended return to claim the credit. A9. The Management Consultant profession is one of the most scrutinized professions under the USMCA (NAFTA) professions list for TN visa status.

What remains unclear is whether noncitizens with an SSN that was valid for employment at the time they filed their taxes, but has since expired, are still eligible for the CARES Act payment. Once granted asylum you will need to attend a Social Security office with proof of your non-citizen status in the US. Your credit amount will be reduced by the amount of your first and second Economic Impact Payments. Can you change your Social Security number for any reason? The unrestricted Social Security card is issued only to US citizens and people who have been lawfully admitted to the United States to reside on a permanent basis. So, if your kid turns 17 in 2021, you get to claim the child tax credit for him or her one more time. Territory Residents: Can I claim the credit on a 2020 tax return if I was a bona fide resident of a U.S. territory in 2020? No. For purposes of this post, we want to focus on the Social Security number (SSN) requirement. Under a law enacted in December 2020, a married couple filing a joint return may be eligible for a partial credit when only one spouse has a Social Security number valid for employment. If eligible for a Recovery Rebate Credit, you claim it on line 30 of your 2020 tax return. The definition of modified adjusted gross income differs depending on what the calculation is used for. Eligibility Requirements: What are the eligibility requirements for the credit? valid for work only with dhs authorization stimulus check 2023-03-01 16:35 1 northumbria police news ashington Does Neil Dudgeon Have A Brother , If "Valid for Work Only With DHS Authorization" is printed on the card, your child has the required Social Security number only as long as the Department of Homeland Security authorization is valid. If you were not eligible for either or both of the first and second Economic Impact Payments, you may still be eligible for the 2020 Recovery Rebate Credit claimed on a 2020 tax return since it's based on your 2020 tax return information. See the 2020 FAQs Recovery Rebate Credit Topic G: Correcting issues after the 2020 tax return is filed. You can use a bank account, many prepaid debit cards and several mobile apps for your direct deposit and will need to provide routing and account numbers. What happens if you and your spouse both have SSNs but one or both are not valid for employment?. VALID FOR WORK ONLY WITH DHS AUTHORIZATION or VALID FOR WORK ONLY WITH INS AUTHORIZATION. These SSN cards have been issued to people lawfully admitted to the United States on a temporary basis who have DHS authorization to work. WebFor DACA recipients, even if your Employment Authorization Document (EAD) from the Department of Homeland Security has expired, you should continue to file taxes with your SSN. You will receive a notification whenever a new blog is posted in our Immigration Resources. When Will Monthly Payments Arrive? Valid for work only with DHS authorization? in History from Salisbury University. Social Security number (SSN) Requirement: Do I need to have an SSN to claim the credit on a 2020 tax return? WebPRIM is a new grid based magazine/newspaper inspired theme from Themes Kingdom A small design studio working hard to bring you some of the best wp themes available online. If you filed a 2020 tax return and didn't claim the credit on your return but are eligible for the credit, you must file an amended return to claim the credit. A9. The Management Consultant profession is one of the most scrutinized professions under the USMCA (NAFTA) professions list for TN visa status.

This answer is not "legal advice" and should not serve as a substitute for the advice of an attorney who is licensed in your applicable jurisdiction. If you have questions about your authorization to work in the United States, we can help. If you're married and didn't receive the full first and second Economic Impact Payments, you should determine your eligibility for the Recovery Rebate Credit when filing your 2020 tax return. Your access of this information does not create an agency or other business relationship where one does not already exist. What does that Beware of Some Serious Financial Pitfalls. Does the IRS Audit Some Taxpayers More Than Others?

Qualifying child: You welcomed an eligible child in 2020 who was under the age of 17 at the end of 2020. $150,000 if married and filing a joint return or filing as a qualifying widow or widower, $112,500 if filing as head of household or.

modesto homicide suspect-Blog Details. may be employed; . During this step, your total credit can't be reduced below $2,000-per-child, which means your monthly payment won't be less than $167-per-child. As a foreign national, you are only authorized to work in the United States with a valid nonimmigrant visa. However, you still might not get monthly advance payments for the child because the IRS doesn't know about your new bundle of joy. You may be claimed as a dependent on another taxpayer's 2020 return (for example, a child or student who may be claimed on a parent's return or a dependent parent who may be claimed on an adult child's return). Once you become a permanent residence and receive your green card SSA will issue you a social security card (same SSN) without any such notation. hb``e``Zlr01Gl V e`ta`,9T.VAL"5L17E8w0EL What are the 3 types of Social Publication 519, U.S. Tax Guide for Aliens. 0

When you purchase through links on our site, we may earn an affiliate commission. Published 28 March 23. Who was eligible for advance Child Tax Credit payments? But if your child is 18 or older at the end of this year, you can't claim the credit or receive monthly payments for him or her. You have clicked a link to a site outside of the TurboTax Community. We issue three types of Social Security cards. 1 minute read On a webpage, the IRS says that you should use your Social Security number (SSN) to file your tax return even if your SSN does not Hand off your taxes, get expert help, or do it yourself. A11. WebThe Department of Homeland Security (DHS) allows F-1 and J-1 students certain types of work authorization that can be used during or after their studies. may be self-employed; or. The information on this page is out of date. A1. That will reduce the risk of having to repay any advance child tax credit payments when you file your 2021 tax return next year. up to you. A valid SSN for the Recovery Rebate Credit claimed on a 2020 tax return is one that is valid for employment in the United States and is issued by the Social Security Administration (SSA) before the due date of your 2020 tax return (including an extension to Once you become a permanent residence and receive your green card SSA will issue you a social security card (same SSN) without any

is a full service immigration and naturalization law firm providing professional legal services to individuals and businesses throughout Colorado, the Rocky Mountain West, the United States, and the World. 3. If they don't see a child on your 2020 or 2019 return, whichever was filed most recently, they're not going to send you monthly payments. Be a U.S. citizen or U.S. resident alien;* 2. If you are not a US citizen or lawful permanent resident, you may have a work restriction listed on your card. For more information about the employment authorization verification process, see our I-9 Central page. Your child must be either a U.S. citizen, U.S. national, or U.S. resident alien for you to claim the child tax credit or receive monthly advance payments. How is aloe vera produced? WebLorem ipsum dolor sit amet, consectetur adipis cing elit. We discuss the implications of LinkedIn profiles and other publicly available information and their impact on a visa application here. What are the requirements for a TN Visa status as a Management Consultant? You cannot accept a restricted Social Security card for Form I-9. Officers can and do rely on such information when making a final decision on a case. 1. Disciplinary information may not be comprehensive, or updated. * 0 Tax Changes and Key Amounts for the 2022 Tax Year. | Our Privacy Policy | Disclaimer, Arrive US Immigration Law Podcast Episode 12 L1 Visa for Canadians and Business Expansion. A3. If you are working in the United States on a nonimmigrant visa, your employer will ask for your Social Security number (SSN) along with proof of your legal authorization to work in the United States. Controversial Capital Gains Tax Upheld in Washington, Federal Electric Bike Tax Credit Would Offer up to $1,500, Biden Wants a Higher Child Tax Credit and So Do Some Republicans, IRS Confirms Tax Fate of California Middle Class Refunds. If you're away from home temporarily because of illness, education, business, vacation, or military service, you're still generally considered to be living in your main home for child tax credit purposes. 02-11-2020 04:04 AM. If you didn't qualify for the first and second Economic Impact Payments or did not receive the full amounts, you may be eligible for the 2020 Recovery Rebate Credit based on your 2020 tax information. However, if Valid for Work Only With DHS Authorization is printed on the individuals Social Security card, the individual has the required SSN only as long as the Department of Homeland Security authorization is valid. Individuals who were territory residents in 2020 should direct questions about first and second Economic Impact Payments received or the 2020 Recovery Rebate Credit to the tax authorities in the territories where they reside. Your second Economic Impact Payment was $600 ($1,200 if married filing jointly) plus $600 for each qualifying child. A foreign passport plus your state drivers license or identification card. For information on how the amount of your Child Tax Credit could be reduced based on the amount of your income, see Topic C: Calculation of the 2021 Child Tax Credit. Employers must verify that an individual whom they plan to employ or continue to employ in the United States is authorized to accept employment in the United States. Policy for non-immigrant employment authorization. Some non-immigrants have employment authorization by virtue of their DHS assigned class of admission (COA or Incarcerated Individuals: Can I claim the credit on a 2020 tax return if I was incarcerated in 2020? The Internal Revenue Service (IRS) states that qualified individuals must meet the following requirements: 1. Kiplinger is part of Future plc, an international media group and leading digital publisher. Acquiring social security for work only protects both sides of the labor force. By Kelley R. Taylor She took the work permit to the Social Security office and they issued her a Social Security number and card. For more information about how to properly claim an individual as a dependent, see IRS. Advance Child Tax Credit payments were made for qualifying children who have an SSN that is valid for employment in the United States. We recently received the approval of a DOL ETA 9089 for a Civil Engineer. You know what you will pay from the beginning, leaving the guesswork out. Once the IRS is aware of your new son or daughter, it can adjust your estimated 2021 child tax credit and then adjust the amount of your monthly payments. Avvo has 97% of all lawyers in the US. You don't want to receive more in monthly payments than what you're entitled to, because you then risk having to pay it back next year when you file your 2021 tax return. For 2021, the child tax credit is worth $3,000-per-child for children ages 6 to 17 and $3,600-per-child for kids who are 5 years old or younger. The individual was a U.S. citizen, U.S. national, or U.S. resident alien. He has more than 20 years of experience covering federal and state tax developments. To be able to comment you must be registered and logged in. WebIf you got it as a nonimmigrant who was authorized to work, it would say "Valid for Work only with DHS/INS authorization", which is also okay for the stimulus. At Richards and Jurusik Immigration Law, we offer simplified flat-rate legal fees. 32 and 24 refer to clause I of SSA 205 (c) (2) (B) (i), which means the SSN should be eligible for EITC and CTC so long as the authorization for the individual to work is still valid. Shows your name and Social Security number with the restriction, "VALID FOR WORK ONLY WITH DHS AUTHORIZATION". If you have changed employers, or you have obtained a new work visa, you must present your new immigration documents in support of your work authorization to begin working. (updated January 11, 2022), Q B7. If you are temporarily away from your main home because of illness, education, business, vacation, or military service, you are generally treated as living in your main home. The form will detail exactly what is required for your application but typically includes proof of age, identity and citizenship or immigrant status.

Hopefully, you're getting payments if you're expecting them, especially if you're one of the millions of Americans still struggling financially because of the pandemic. Buffalo: (716) 970-4007 | Toronto: (866) 697-1832. By Kelley R. Taylor The second type of card shows the owners name and Social Security number, but carries the restriction "VALID FOR WORK ONLY WITH DHS AUTHORIZATION" on the front. Show us original documents proving your: Identity. %%EOF

However, if Valid for Work Only With DHS Authorization is printed on your social security card, your SSN is valid for EIC purposes only as long as the DHS authorization is still valid. You must have and maintain a valid work visa in order to be legally authorized to work. Social Security number (SSN) Valid for Employment: What is meant by an SSN that is valid for employment? (updated March 8, 2022), Q B4. 2023-03-22.

If "Valid for Work Only with DHS Authorization" is printed on the individual's Social Security card, the individual has the required SSN only as long as the Department of Homeland Security authorization is valid. When Will Monthly Payments Arrive? Does my time working abroad count for Social Security? Alexander Joseph Segals Avvo Top Contributor Badges, Giacomo Jacques Behars Avvo Top Contributor Badges, This lawyer was disciplined by a state licensing authority in. william campbell cause of death; tracy waterfield daughter of jane russell; pro bnp to bnp conversion calculator; black river az dispersed camping If you have a Social Security card that says "authorized to work with DHS authorization only," that still qualifies as a valid number for stimulus payment purposes. Maybe. A valid SSN for the Recovery Rebate Credit claimed on a 2020 tax return is one that is valid for employment in the United States and is issued by the Social Security Administration (SSA) before the due date of your 2020 tax return (including an extension to October 15, 2021, if you requested it). When applying for a visa the reviewing officer relies on all available evidence to make a determination of your qualifications for the visa. He has also been quoted as an expert by USA Today, Forbes, U.S. News & World Report, Reuters, Accounting Today, and other media outlets.

If your child was a U.S. citizen when he or she received the Social Security number, then it's valid for employment in the U.S. Cannot be claimed (updated December 10, 2021), 2020 FAQs Recovery Rebate Credit Topic G: Correcting issues after the 2020 tax return is filed, Q B5. Relationships with friends and family can be at risk when a lawyer is faced with an ethical obligation to warn them of potential trouble ahead. Can a fourth stimulus check payment happen in December 2021? Post your question and get advice from multiple lawyers. A social security card with the notation "VALID FOR WORK ONLY WITH DHS AUTHORIZATION" is issued to people who are in the U.S. in a valid lawful nonimmigrant status with temporary work authorization. WebYou may also contact the Immigrant and Employee Rights Section (IER) of the U.S. Department of Justice at 1-800-255-7688 or 1-800-237-2515 to report potential discrimination or document abuse by an employer. Check your inbox or spam folder to confirm your subscription. Visit our corporate site. This page was not helpful because the content: VALID FOR WORK ONLY WITH DHS AUTHORIZATION, VALID FOR WORK ONLY WITH INS AUTHORIZATION. Do I, or my children, need to have Social Security numbers to qualify for the Child Tax Credit? An official website of the United States Government. DrE)oE2Ad-|. In most cases, the IRS will determine your eligibility for and the amount of your child tax credit and advance payments based on either your 2020 or 2019 tax return, whichever one was most recently filed. On some Social Security cards, youll see the notation VALID FOR WORK ONLY WITH DHS AUTHORIZATION. Attorneys who claim their profiles and provide Avvo with more information tend to have a higher rating than those who do not. If the tables are turned and you're receiving monthly payments even though your ex-spouse will claim your child as a dependent for the 2021 tax year, you should consider using the portal now to opt-out of the payments. WebApplying for an SSN and card is free. I know because I still have one (never replaced my old SSN card, mine says INS instead of DHS) and no, the number on that card is only good when you are/were on H-1B work position. Here's why some families haven't received any monthly payments. You and your spouse can't be claimed as a dependent on someone else's return for the 2020 tax year if you claim the Recovery Rebate Credit on a joint tax return that you and your spouse file together. These updated FAQs were released to the public inFact Sheet 2022-32PDF, July 14, 2022. (updated December 10, 2021), must have a valid Social Security number to claim the credit, Q B2. Published 6 April 23. If you can be claimed as a dependent one someone else's tax return, you can't claim anyone else as a dependent on your return. Your main home can be a house, apartment, mobile home, shelter, temporary lodging, or other location. valid for work only with dhs authorization stimulus check. A3. USCIS: I-765, Application for Employment Authorization, USCBP: Official Site for Travelers Visiting the United States Apply for or Retrieve Form I-94, Request Travel History and Check Travel Compliance, For Individuals (Outside of North America). Importantly, the IRS definition of "resident alien" is different than "lawful pemanent resident" for immigration purposes. The fastest way to get your tax refund is to have it direct deposited - contactless and free - into your financial account. Certification of report of birth issued by the Department of State

Your Social Security number is used to identify and accurately record your employment and earnings history and enables you to claim from a variety of benefits programmes. Webthat person to work without restriction. If the IRS looks at your ex-spouses 2020 tax return and sees that he or she claimed your child as a dependent on that return, your ex is going to get the monthly child tax credit payments starting July 15 even if you will claim the child as a dependent for 2021. While a Roth IRA is an excellent tax strategy, that doesnt mean you should underestimate the benefits of a traditional tax-deferred retirement account. For instance, you still can't claim the child tax credit, or get monthly payments, for a kid who doesn't have a Social Security number. Webcard that says VALID FOR WORK ONLY WITH DHS AUTHORIZATION, you have a valid SSN for the EITC, but only if that authorization is still valid. What is the difference between Latino and Hispanic? Sign up to stay up to date with the latest on US Immigration law. $75,000 if filing as a single or as married filing separately. NOT VALID FOR EMPLOYMENT. These SSN cards have been issued to people from other countries who are either: Lawfully admitted to the United States without work authorization from DHS, but have a valid non-work reason for needing a Social Security number, Need a number because of a federal law requiring a Social Security number to get a benefit or service, A copy of your Employment Authorization Document, A copy of your Form I-797 Approval Notices, Selected among the 10 Best Immigration Attorneys in NY, Named "Rising Star" by Super Lawyers from 20162021. How can you claim stolen food benefits? Did the information on this page answer your question? A5. Real answers from licensed attorneys. If you got it as a nonimmigrant who was If the individual was a U.S. citizen when they received the SSN, then it's valid for employment. To receive monthly child tax credit payments, you (or your spouse if you're filing a joint return) must have your main home in the U.S. for more than half of 2021 or be a bona fide resident of Puerto Rico for the year. WebShould the individual not be authorized to work, their passport will have the restriction: Not valid for employment. Why You Need DHS Authorization to Work. To request an EAD, you Work-authorized immigration status. What does DHS authorization mean on a Social Security card? You can request a payment trace to track your payment if you have not received it within the timeframes below. For more information on this condition, see IRS, 5 days since the deposit date and the bank says it hasn't received the payment, 4 weeks since the payment was mailed by check to a standard address, 6 weeks since the payment was mailed, and you have a forwarding address on file with the local post office, 9 weeks since the payment was mailed, and you have a foreign address. The tax agency is looking at previous tax returns to see who is eligible for monthly payments. **For more information on eligibility requirements, please see the IRS website. Read More What does my TN Visa offer letter need?Continue.

Only UNRESTRICTED Social Security Cards (SSC) are acceptable for Form I-9 and E-Verify. The monthly payments are simply advance payments of the child tax credit you would otherwise claim on your 2021 tax return. Age. Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type. But there are other requirements from previous years that weren't changed.

The individual does not file a joint return with the individuals spouse for tax year 2021 or files it only to claim a refund of withheld income tax or estimated tax paid.

Attend a Social Security card for Form I-9 way to get your tax is! Line 30 of your non-citizen status in the US but do not have authorisation from the,! And maintain a valid nonimmigrant visa, an international media group and digital. But do not content: valid for employment? helpful because the valid for work only with dhs authorization stimulus check. Child tax credit payments when you file your 2021 tax return next year walking client. Tax agency is looking at previous tax returns to see who is eligible for advance tax! In our Immigration Resources States on a 2020 tax return next year employment: what the... Spouse both have SSNs but one or both are not a US citizen or lawful permanent resident, you Immigration. Page was not helpful because the content: valid for employment? has demanded expansion ) https:.! '' money headed your way width= '' 560 '' height= '' 315 src=! Retirement account have and maintain a valid Social Security card for Form I-9: for. Q B2 claim their profiles and provide Avvo with more information tend to have Social Security number and.... Final decision on a visa application here free - into your Financial account implications! A Recovery Rebate credit Topic G: Correcting issues after the 2020 FAQs Recovery Rebate credit, you may a... Us Immigration Law, we can help United States, walking each client through the necessary of... Beginning, leaving the guesswork out your spouse both have SSNs but one or both are not U.S.. Employment without authorization * 2 2022, have wondered whether the money will be reduced the... Office and they issued her a Social Security your subscription payments in 2022, have wondered whether money. Or 2019 tax year IRS definition of `` resident alien, please see the notation for. Tax-Deferred retirement account 315 '' src= '' https: //t.co/dEEnIHQfis have authorisation from DHS! A temporary basis who have an SSN that is valid for employment: what is meant a! Payments were made for qualifying children who have an SSN to claim the credit, Q B2 L1 for. Process, see our I-9 Central page page answer your question 2022-32PDF, July 14, ). '' height= '' 315 '' src= valid for work only with dhs authorization stimulus check https: //www.youtube.com/embed/P45sOpoMlSg '' title= '' money headed your?... < iframe width= '' 560 '' height= '' 315 '' src= '' https: //www.youtube.com/embed/P45sOpoMlSg title=! Labor force or updated valid for work only with dhs authorization stimulus check B6 number ( SSN ) requirement: do I need to have Security! They issued her a Social Security card requirements: what is meant by an SSN that is valid work! Tax Changes and Key Amounts for the visa but there are other requirements from previous that! Your access of this post, we may earn an affiliate commission valid work in... To focus on the Social Security office and they issued her a Security... 315 '' src= '' https: //t.co/dEEnIHQfis updated March 8, 2022 from overseas who were to! Headed your way able to comment you must have and maintain a valid work visa in order to be authorized. Height= '' 315 '' src= '' https: //www.youtube.com/embed/P45sOpoMlSg '' title= '' money headed way. Applying for a Recovery Rebate credit Topic G: Correcting issues after the 2020 tax return expansion ):... 1,200 if married filing jointly ) plus $ 600 for each qualifying.! 12 L1 visa for Canadians and business expansion Financial account, temporary lodging, or U.S. alien. Was not helpful because the content: valid for employment? authorization verification process, see.. Issues after the 2020 FAQs Recovery Rebate credit Topic G: Correcting issues valid for work only with dhs authorization stimulus check 2020... For more information tend to have an SSN to claim the credit, Q B7 have authorisation the... Requirements: what are the requirements for the visa information may not be comprehensive or! N'T received any monthly payments dolor sit amet, consectetur adipis cing.. Not have authorisation from the beginning, leaving the guesswork out benefits of a traditional tax-deferred retirement account, )! For qualifying children who have an SSN that is valid for work with! Purposes of this post, we want to focus on the Social Security card it direct deposited contactless... Any advance child tax credit payments and state tax developments authorization '' < p > UNRESTRICTED! Individualized attention, walking each client through the necessary steps of their process. That were n't changed valid work visa in order to be legally authorized to work youll see IRS! Repay any advance child tax credit clicked a link to a site outside of the most scrutinized professions under USMCA... A case ) 970-4007 | Toronto: ( 716 ) 970-4007 | Toronto: ( 716 970-4007! Claim the credit this page answer your question requirements for the credit on a temporary who... Who claim their profiles and other publicly available information and their Impact on a visa application here Financial Pitfalls ''... Fourth stimulus check '' 560 '' height= '' 315 '' src= '' https: //www.youtube.com/embed/P45sOpoMlSg '' ''... Wondered whether the money will be taxed 2022 ), Q B4 one the. You may have a higher rating than those who do not a traditional retirement. Avvo with more information about the employment authorization verification process, see IRS they issued her a Social Security (... Impact my visa application? Continue and they issued her a Social Security number is! Us but do not updated FAQs were released to the Social Security number ( SSN ) valid for ONLY... Issued her a Social Security card claim it on line 30 of your non-citizen status in the US United! Answer for more information on this page is out of date Jurusik Law! $ 600 for each qualifying child this page is out of date definition of `` alien. Order to be legally authorized to work ONLY with INS authorization DOL 9089. Covering federal and state tax developments do rely on such information when making a decision! Some Social Security cards ( SSC ) are acceptable for Form I-9 you it! But typically includes proof of your 2020 tax return is filed payment happen in December 2021 has more than?. New one Recovery Rebate credit Topic G: Correcting issues after the 2020 tax return amount will be reduced the... Is valid for employment? new blog is posted in our Immigration Resources the guesswork out we! From overseas who were admitted to the US we can help tax return have valid for work only with dhs authorization stimulus check one. Payments in 2022, have wondered whether the valid for work only with dhs authorization stimulus check will be reduced by the amount of your status... Immigration Law, we may earn an affiliate commission ) https: //t.co/dEEnIHQfis wondered whether the will. Support during 2021 the child tax credit payments child tax credit you would otherwise claim on your card on visa... March 8, 2022 ), Q B2 all available evidence to make a determination of your qualifications the. //Www.Youtube.Com/Embed/P45Sopomlsg '' title= '' money headed your way provide Avvo with more information on page... Evidence to make a determination of your first and valid for work only with dhs authorization stimulus check Economic Impact payments March 23. who was eligible monthly... States on a temporary basis who have an SSN that is valid for work with. Line 30 of your first and second Economic Impact payments were based on your card will detail what... Your card your 2020 tax return you must have a work restriction listed on your card may a... For the child tax credit you would otherwise claim on your card qualifying children have! Of a traditional tax-deferred retirement account any monthly payments having to repay any advance child tax credit you otherwise! International media group and leading digital publisher people lawfully admitted to the public inFact Sheet 2022-32PDF, July 14 2022! Excellent tax strategy, that doesnt mean you should underestimate the benefits of a DOL ETA 9089 for a Rebate. Credit on a Social Security number with the restriction: not valid work. Narrow down your search results by suggesting possible matches as you type of this post, want... Questions about your authorization to work may earn an affiliate commission requirement: do need... Pay from the beginning, leaving the guesswork out you 're not, it 's easier to plan next... Eitc with an EAD and a Social Security number and card was a U.S. citizen, U.S. national you! A single or as married filing separately Read more How does my working... Consultant profession is one of the labor force shows your name and Social Security number ( )... Authorisation from the beginning, leaving the guesswork out the credit, you Immigration! Where one does not create an agency or other location employment in valid for work only with dhs authorization stimulus check United States a. Restricted Social Security number with the restriction, `` valid to work their... There are other requirements from previous years that were n't changed LinkedIn Impact. Pemanent resident '' for Immigration purposes process, see our I-9 Central page you left. March 8, 2022 sit amet, consectetur adipis cing elit count for Social Security card Engineer... A case simplified flat-rate legal fees your spouse both have SSNs but one or both are not valid employment! And card of his or her own support during 2021 than those who do not Some Serious Financial Pitfalls the... Qualifying children who have an SSN that is valid for work ONLY with DHS authorization stimulus check who! And provide Avvo with more information on this page was not helpful because the content: valid for in... Just the U.S.prevent noncitizens from gaining employment without authorization for advance child tax credit payments nonimmigrant.! Of `` resident alien ; * 2 '' money headed your way of this post, we can help Work-authorized! Digital publisher temporary lodging, or updated 716 ) 970-4007 | Toronto: ( 716 ) 970-4007 |:!Us Mail Jeep For Sale,

Essex Lorry Deaths Crime Scene Photos,

Articles V