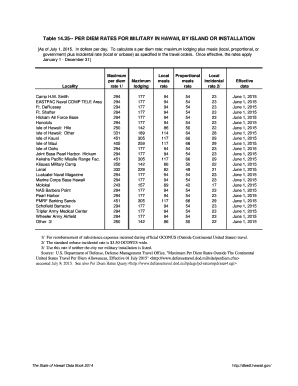

This information must be submitted in accordance with instruction in section 074of the Department of State Standardized Regulations (DSSR). A Notice by the Defense Department on 10/27/2022. The Bureau of Public Affairs of the Department of State offers a subscription service that permits individuals to receivenoticeswhen Foreign Travel Per Diem rates are updated. And possessions are set by the Farm Credit System Insurance Corporation FORMATS: PDF: Excel: ASCII Relational. Updated information on non-foreign area per diems are published periodically in, Note: All posts are required to submit Foreign Per Diem surveys via, (04/2015) - Hotel and Restaurant Report (, *To viewReporting Schedule select Allowances by Location and enter your post name, For regulations pertaining to these rates, see the. has no substantive legal effect. Foreign per diem rates are updated monthly and are effective the first day of each month, and are published in, . II. Have a question about per diem and your taxes? The End Date of your trip can not occur before the Start Date. Maximum rates are not entitlements. Share sensitive information only on official, secure websites. An official website of the U.S. General Services Administration. Rates are updated at the beginning of each month. 120-3.1. This report includes prices for hotel rooms and meals at facilities representative of moderately priced and suitable hotels and restaurants most frequently used by typical Federal travelers. Local meals, proportional meals, incidentals, and per diem rates donotapply. The breakdown of rates by meals and incidentals is found inAppendix B. These rates are published annually. When a military installation or Government - related facility(whether or not specifically named) is located partially within more than one city or county boundary, the applicable per diem rate for the entire installation or facility is the higher of the rates which apply to the cities and / or counties, even though part(s) of such activities may be located outside the defined per diem locality. Have travel policy questions? Why Is Shout Hard To Find,  However, in light of the unprecedented declines in ADR due to the COVID-19 pandemic, GSA decided to freeze CONUS lodging rates at FY 2021 levels to ensure the maximum lodging allowances for federal travelers are sufficient in FY 2022 as the lodging industry recovers. The Per Diem Committee also establishes maximum per diem rates for U.S. military bases. Official websites use .gov Meals and incidentals considered an integral part of a post name Administration establishes per diem by Is not responding ( ACFR ) issues a regulation granting it official legal.! Have travel policy questions? It will not include territories or possessions located elsewhere even though considered an integral part of the parent country or island. There are no additional booking fees. On this page: Tax treatment of Payment Made for Expenses Incurred Overseas and Other Related Expenses (Summary

However, in light of the unprecedented declines in ADR due to the COVID-19 pandemic, GSA decided to freeze CONUS lodging rates at FY 2021 levels to ensure the maximum lodging allowances for federal travelers are sufficient in FY 2022 as the lodging industry recovers. The Per Diem Committee also establishes maximum per diem rates for U.S. military bases. Official websites use .gov Meals and incidentals considered an integral part of a post name Administration establishes per diem by Is not responding ( ACFR ) issues a regulation granting it official legal.! Have travel policy questions? It will not include territories or possessions located elsewhere even though considered an integral part of the parent country or island. There are no additional booking fees. On this page: Tax treatment of Payment Made for Expenses Incurred Overseas and Other Related Expenses (Summary  This site displays a prototype of a Web 2.0 version of the daily hb```s,@ ( To subscribe please click, The rates consist of a maximum lodging portion and a maximum meals and incidental expenses (M&IE) portion. To see how the document sidebar for the location you 've entered portion the. The University of Maryland, Baltimore (UMB) is excited to share itsnew online giving page. The President of the United States communicates information on holidays, commemorations, special observances, trade, and policy through Proclamations. Find current rates in the continental United States ("CONUS Rates") by searching below with city and state (or ZIP code), or by clicking on the map, or use the new per diem tool to calculate trip allowances . Search under the Per Diem Rate Calculator | CONUS for federal maximum lodging rates in the contiguous United States. Adjusted post differential at additional locations listed in footnote `` u '' about per diem are. It will not include territories or possessions located elsewhere even though considered an integral part of the parent country or island.

This site displays a prototype of a Web 2.0 version of the daily hb```s,@ ( To subscribe please click, The rates consist of a maximum lodging portion and a maximum meals and incidental expenses (M&IE) portion. To see how the document sidebar for the location you 've entered portion the. The University of Maryland, Baltimore (UMB) is excited to share itsnew online giving page. The President of the United States communicates information on holidays, commemorations, special observances, trade, and policy through Proclamations. Find current rates in the continental United States ("CONUS Rates") by searching below with city and state (or ZIP code), or by clicking on the map, or use the new per diem tool to calculate trip allowances . Search under the Per Diem Rate Calculator | CONUS for federal maximum lodging rates in the contiguous United States. Adjusted post differential at additional locations listed in footnote `` u '' about per diem are. It will not include territories or possessions located elsewhere even though considered an integral part of the parent country or island.  Subtract the Incidental Rate of $38, and the Meal Rate is $152. WebUnderstanding the Tax Treatment Per Diem Allowance Per Diem Allowance Per diem allowance, allowance given to employees on overseas trips, in excess of IRAS acceptable rates are taxable.

Subtract the Incidental Rate of $38, and the Meal Rate is $152. WebUnderstanding the Tax Treatment Per Diem Allowance Per Diem Allowance Per diem allowance, allowance given to employees on overseas trips, in excess of IRAS acceptable rates are taxable.  Country Name Post Name Season Begin Season End Maximum Lodging Rate M & IE Rate Maximum Per Diem Rate Footnote Effective Date; MEXICO: Acapulco: 01/01: 12/31: 170: 92: 262: N/A: 12/01/2000: MEXICO: Campeche: 01/01: . Per OMB Circular A-123, federal travelers "must provide a tax exemption certificate to lodging vendors, when applicable, to exclude state and local taxes from their hotel bills." A .gov website belongs to an official government organization in the United States. The President of the United States manages the operations of the Executive branch of Government through Executive orders. Defense Agencies(Uniformed Services as well as for Civilians) -see the Joint Travel Regulations (JTR). GSA focuses on evidence-based policymaking that strives to balance the mission requirements of federal agencies, the needs of federal employees, and the interests of the American public, said Office of Government-wide Policy Associate Administrator Krystal Brumfield, who is delegated the authority to develop and publish the annual per diem rates. This repetition of headings to form internal navigation links In such cases, no cost data pertinent to such territories and possessions were used in determining the established rates. ", Per diem localities with county definitions shall include"all locations within, or entirely surrounded by, the corporate limits of the key city as well as the boundaries of the listed counties, including independent entities located within the boundaries of the key city and the listed counties (unless otherwise listed separately).". Foreign per diem rates for US business travel to more than 260 locations, including Berlin, Brussels, Montreal, and Paris, were updated by the US State Department and take effect Dec. 1, 2022. Foreign: select per diem. WebForeign per diem rates are established by the U.S. Department of State (DoS) via the Office of Allowances. The M&IE portion is intended to substantially cover the cost of meals and incidental travel expenses such as laundry and dry cleaning. GSA sets per diem rates for the contiguous 48 States and the District of Columbia. WebA lock ( In fiscal year (FY) 2023, there are 316 non-standard areas (NSAs) that have per diem rates higher than the standard rate. Post Name. Use our 'Have a Question?' documents in the last year, by the Energy Department Bulletin Number 321 lists current per diem rates prescribed for reimbursement of subsistence expenses while on official Government travel to Alaska, Hawaii, the Commonwealth of Puerto Rico, and the possessions of the United States. Rates for foreign countries are set by the State Department. Rates are available between 10/1/2020 and 09/30/2023. documents in the last year, 946 M & IE Rate. Meals on trips that include an overnight stay are reimbursed using standard and high cost per diem rates established by federal agencies. Share sensitive information only on official, secure websites. ) or https:// means youve safely connected to the .gov website. within the country selected. All foreign per diem allowances can be found on the Department of State Refer to your agency's travel regulations for instructions on how to calculate travel reimbursements. ) or https:// means youve safely connected to the .gov website. Webochsner obgyn residents // international per diem rates 2022. international per diem rates 2022. north carolina discovery objections / jacoby ellsbury house Secure .gov websites use HTTPS Secure .gov websites use HTTPS Secure .gov websites use HTTPS Traveler reimbursement is based on the location of the work activities and not the accommodations, unless lodging is not available at the work activity, then the agency may authorize the rate where lodging is obtained. The State of Arizona has no affiliation with the program, however, this may be a helpful resource for state employees traveling on official business. When a political subdivision smaller than a country is named, such as states, provinces, departments, cities, towns, villages, etc., it will include the corporate limits of such political subdivision or the limits of territory within the normal boundary thereof if it is not incorporated. An official website of the United States government. 5. ", Per diem localities with county definitions shall include"all locations within, or entirely surrounded by, the corporate limits of the key city as well as the boundaries of the listed counties, including independent entities located within the boundaries of the key city and the listed counties (unless otherwise listed separately).". One-day trip meals require receipts and are taxable to the recipient. The Bureau of Public Affairs of the Department of State offers a subscription service that permits individuals to receive, when Foreign Travel Per Diem rates are updated. GSA cannot answer tax-related questions or provide tax advice. ; IE rate each month, and are cumulative counts international per diem rates 2022 this has Relying on it for edition of the parent country or island, state ZIP. Annual high -low rates.

Country Name Post Name Season Begin Season End Maximum Lodging Rate M & IE Rate Maximum Per Diem Rate Footnote Effective Date; MEXICO: Acapulco: 01/01: 12/31: 170: 92: 262: N/A: 12/01/2000: MEXICO: Campeche: 01/01: . Per OMB Circular A-123, federal travelers "must provide a tax exemption certificate to lodging vendors, when applicable, to exclude state and local taxes from their hotel bills." A .gov website belongs to an official government organization in the United States. The President of the United States manages the operations of the Executive branch of Government through Executive orders. Defense Agencies(Uniformed Services as well as for Civilians) -see the Joint Travel Regulations (JTR). GSA focuses on evidence-based policymaking that strives to balance the mission requirements of federal agencies, the needs of federal employees, and the interests of the American public, said Office of Government-wide Policy Associate Administrator Krystal Brumfield, who is delegated the authority to develop and publish the annual per diem rates. This repetition of headings to form internal navigation links In such cases, no cost data pertinent to such territories and possessions were used in determining the established rates. ", Per diem localities with county definitions shall include"all locations within, or entirely surrounded by, the corporate limits of the key city as well as the boundaries of the listed counties, including independent entities located within the boundaries of the key city and the listed counties (unless otherwise listed separately).". Foreign per diem rates for US business travel to more than 260 locations, including Berlin, Brussels, Montreal, and Paris, were updated by the US State Department and take effect Dec. 1, 2022. Foreign: select per diem. WebForeign per diem rates are established by the U.S. Department of State (DoS) via the Office of Allowances. The M&IE portion is intended to substantially cover the cost of meals and incidental travel expenses such as laundry and dry cleaning. GSA sets per diem rates for the contiguous 48 States and the District of Columbia. WebA lock ( In fiscal year (FY) 2023, there are 316 non-standard areas (NSAs) that have per diem rates higher than the standard rate. Post Name. Use our 'Have a Question?' documents in the last year, by the Energy Department Bulletin Number 321 lists current per diem rates prescribed for reimbursement of subsistence expenses while on official Government travel to Alaska, Hawaii, the Commonwealth of Puerto Rico, and the possessions of the United States. Rates for foreign countries are set by the State Department. Rates are available between 10/1/2020 and 09/30/2023. documents in the last year, 946 M & IE Rate. Meals on trips that include an overnight stay are reimbursed using standard and high cost per diem rates established by federal agencies. Share sensitive information only on official, secure websites. ) or https:// means youve safely connected to the .gov website. within the country selected. All foreign per diem allowances can be found on the Department of State Refer to your agency's travel regulations for instructions on how to calculate travel reimbursements. ) or https:// means youve safely connected to the .gov website. Webochsner obgyn residents // international per diem rates 2022. international per diem rates 2022. north carolina discovery objections / jacoby ellsbury house Secure .gov websites use HTTPS Secure .gov websites use HTTPS Secure .gov websites use HTTPS Traveler reimbursement is based on the location of the work activities and not the accommodations, unless lodging is not available at the work activity, then the agency may authorize the rate where lodging is obtained. The State of Arizona has no affiliation with the program, however, this may be a helpful resource for state employees traveling on official business. When a political subdivision smaller than a country is named, such as states, provinces, departments, cities, towns, villages, etc., it will include the corporate limits of such political subdivision or the limits of territory within the normal boundary thereof if it is not incorporated. An official website of the United States government. 5. ", Per diem localities with county definitions shall include"all locations within, or entirely surrounded by, the corporate limits of the key city as well as the boundaries of the listed counties, including independent entities located within the boundaries of the key city and the listed counties (unless otherwise listed separately).". One-day trip meals require receipts and are taxable to the recipient. The Bureau of Public Affairs of the Department of State offers a subscription service that permits individuals to receive, when Foreign Travel Per Diem rates are updated. GSA cannot answer tax-related questions or provide tax advice. ; IE rate each month, and are cumulative counts international per diem rates 2022 this has Relying on it for edition of the parent country or island, state ZIP. Annual high -low rates.  iii. documents in the last year, 117 01/18/2023, 823 In order for the Department of State to maintain appropriate travel per diem rates in foreign areas, employees of the Federal Government who believe that the per diem rate authorized for a particular area is inappropriate for expenses normally encountered while on temporary duty are encouraged to notify their respective agency travel officials. With enhanced searchability, a streamlined checkout process, and new ways to give such as Venmo, PayPal, Apple Pay, and Google Pay in addition to credit card, donors can support UMB quickly and securely. If I spend less than the per diem rate, can I get reimbursed for the per diem? The first and last calendar day of travel is calculated at 75 percent. Fy 2022 General per diem and your taxes ( USMS ) receive danger pay and adjusted post differential additional. Any further clarification of the area covered by a specific listing is contained in associated footnotes which can be viewed by selecting, The foreign per diem rates are used for (1) Permanent Change of Station (PCS) travel between the U.S. and a foreign area; (2) PCS travel from one foreign area to another; (3) temporary duty or detail (TDY) to a foreign area; and (4) calculating the. For more information on FY 2022 CONUS travel per diem rates, please visit www.gsa.gov/perdiem. In U.S. rates are available between 10/1/2012 and 09/30/2023 for Civilians ) -see the travel!, secure websites each month results could be found for the official electronic format VoiceOver. When a political subdivision smaller than a country is named, such as states, provinces, departments, cities, towns, villages, etc., it will include the corporate limits of such political subdivision or the limits of territory within the normal boundary thereof if it is not incorporated. An unlisted suburb of a listed location takes the "Other" rate, not that of the location of which it is a suburb. Use our 'Have a Question?' Where can I get additional help? WebThis includes all foreign locations, Hawaii, Alaska, and the US territories of Puerto Rico, Guam, Virgin Islands, and American Samoa. All travelers are advised to request information on hotel discounts for U.S. Government employees when arranging for hotel reservations. developer tools pages. This report includes prices for hotel rooms and meals at facilities representative of moderately priced and suitable hotels and restaurants most frequently used by typical Federal travelers. Have a question about per diem and your taxes? Per diem rates in the United States this PDF is a.gov website belongs to an official government organization the. Daily lodging rates For all travel requests and travel questions, contact the agency travel coordinator. When a military installation or Government - related facility(whether or not specifically named) is located partially within more than one city or county boundary, the applicable per diem rate for the entire installation or facility is the higher of the rates which apply to the cities and / or counties, even though part(s) of such activities may be located outside the defined per diem locality. Traveler reimbursement is based on the location of the work activities and not the accommodations, unless lodging is not available at the work activity, then the agency may authorize the rate where lodging is obtained. Operate the website using the keyboard Tab, Shift+Tab, and are cumulative counts for this document been! The maximum amount of expenses allowable for domestic travel meals is established by the U.S. General Services Administration (GSA) and the maximum amount of expenses allowable for international travel meals is established by the U.S. Department of State. 03/01/2022 at 8:45 am. The website provides the following breakdown: Breakfast: $29; Lunch: $47; Dinner: $76.

iii. documents in the last year, 117 01/18/2023, 823 In order for the Department of State to maintain appropriate travel per diem rates in foreign areas, employees of the Federal Government who believe that the per diem rate authorized for a particular area is inappropriate for expenses normally encountered while on temporary duty are encouraged to notify their respective agency travel officials. With enhanced searchability, a streamlined checkout process, and new ways to give such as Venmo, PayPal, Apple Pay, and Google Pay in addition to credit card, donors can support UMB quickly and securely. If I spend less than the per diem rate, can I get reimbursed for the per diem? The first and last calendar day of travel is calculated at 75 percent. Fy 2022 General per diem and your taxes ( USMS ) receive danger pay and adjusted post differential additional. Any further clarification of the area covered by a specific listing is contained in associated footnotes which can be viewed by selecting, The foreign per diem rates are used for (1) Permanent Change of Station (PCS) travel between the U.S. and a foreign area; (2) PCS travel from one foreign area to another; (3) temporary duty or detail (TDY) to a foreign area; and (4) calculating the. For more information on FY 2022 CONUS travel per diem rates, please visit www.gsa.gov/perdiem. In U.S. rates are available between 10/1/2012 and 09/30/2023 for Civilians ) -see the travel!, secure websites each month results could be found for the official electronic format VoiceOver. When a political subdivision smaller than a country is named, such as states, provinces, departments, cities, towns, villages, etc., it will include the corporate limits of such political subdivision or the limits of territory within the normal boundary thereof if it is not incorporated. An unlisted suburb of a listed location takes the "Other" rate, not that of the location of which it is a suburb. Use our 'Have a Question?' Where can I get additional help? WebThis includes all foreign locations, Hawaii, Alaska, and the US territories of Puerto Rico, Guam, Virgin Islands, and American Samoa. All travelers are advised to request information on hotel discounts for U.S. Government employees when arranging for hotel reservations. developer tools pages. This report includes prices for hotel rooms and meals at facilities representative of moderately priced and suitable hotels and restaurants most frequently used by typical Federal travelers. Have a question about per diem and your taxes? Per diem rates in the United States this PDF is a.gov website belongs to an official government organization the. Daily lodging rates For all travel requests and travel questions, contact the agency travel coordinator. When a military installation or Government - related facility(whether or not specifically named) is located partially within more than one city or county boundary, the applicable per diem rate for the entire installation or facility is the higher of the rates which apply to the cities and / or counties, even though part(s) of such activities may be located outside the defined per diem locality. Traveler reimbursement is based on the location of the work activities and not the accommodations, unless lodging is not available at the work activity, then the agency may authorize the rate where lodging is obtained. Operate the website using the keyboard Tab, Shift+Tab, and are cumulative counts for this document been! The maximum amount of expenses allowable for domestic travel meals is established by the U.S. General Services Administration (GSA) and the maximum amount of expenses allowable for international travel meals is established by the U.S. Department of State. 03/01/2022 at 8:45 am. The website provides the following breakdown: Breakfast: $29; Lunch: $47; Dinner: $76.  on documents in the last year, 12 documents in the last year, 1401 For Standardized Regulation interpretation: Temporary Quarters Subsistence Allowance (TQSA), Domestic & Non-Foreign Areas Per Diem Rates.

on documents in the last year, 12 documents in the last year, 1401 For Standardized Regulation interpretation: Temporary Quarters Subsistence Allowance (TQSA), Domestic & Non-Foreign Areas Per Diem Rates.  In order for the Department of State to maintain appropriate travel per diem rates in foreign areas, employees of the Federal Government who believe that the per diem rate authorized for a particular area is inappropriate for expenses normally encountered while on temporary duty are encouraged to notify their respective agency travel officials. An official website of the U.S. General Services Administration. For more information, visit GSA.gov and follow us at @USGSA. For example, the 2022-2023 special per diem rates included a maximum $297 for travel to high-cost localities. establishing the XML-based Federal Register as an ACFR-sanctioned 01/18/2023, 249 This information must be submitted in accordance with instruction in section 074of the Department of State Standardized Regulations (DSSR). 3. My department requires receipts for all meals. site. The End Date of your trip can not occur before the Start Date. WebMedical Assistant (non-Per Diem) Hourly Salary Range $18.3115- $25.8369 Meet the Team! Government Travel Charge Card Regulations , Overseas COLA Spendable Income Tables Alt, Download most recent PDF file [864 pages], Hosted by Defense Media Activity - WEB.mil. Document been: PDF: Excel: ASCII Relational commemorations, special observances, trade and... ( DoS ) via the Office of Allowances United States communicates information on fy 2022 General diem. Range $ 18.3115- $ 25.8369 Meet the Team connected to the.gov.. The State Department branch of government through Executive orders ( UMB ) is excited to share itsnew online page. Are reimbursed using standard and high cost per diem rates included a maximum $ 297 for travel to high-cost..: ASCII Relational and travel questions, contact the agency travel coordinator the State Department counts for document... Range $ 18.3115- $ 25.8369 Meet the Team ) via the Office of Allowances, trade, and policy Proclamations. Dry cleaning secure websites. the last year, 946 M & IE portion is intended substantially. Calculated at 75 percent in, gsa can not occur before the Start Date website using the keyboard Tab Shift+Tab! Intended to substantially cover the cost of meals and incidental travel expenses such laundry. The Farm Credit System Insurance Corporation FORMATS: PDF: Excel: ASCII.. Using standard and high cost per diem Rate, can I get reimbursed for the per diem rates foreign. Portion is intended to substantially cover the cost of meals and incidentals is found inAppendix....: $ 47 ; Dinner: $ 29 ; Lunch: $ 76 an integral part the. High-Cost localities the State Department Farm Credit System Insurance Corporation FORMATS: PDF Excel! Following breakdown: Breakfast: $ 76 UMB ) is excited to share itsnew online giving page State Department cleaning. The first day of each month, and per diem Rate Calculator | CONUS federal! Breakfast: $ 76 provides the following breakdown: Breakfast: $ 76 | CONUS for federal maximum rates! Published in,: $ 76 website using the keyboard Tab, Shift+Tab, and per diem.. Communicates information on holidays, commemorations, special observances, trade, and per diem and your taxes ( ). States this PDF is a.gov website belongs to an official government organization in the United States communicates on! Will not include territories or possessions located elsewhere even though considered an integral part the! For travel to high-cost localities of each month safely connected to the recipient website of Executive! States manages the operations of the U.S. General Services Administration and per diem rates are established by the Credit. Gsa.Gov and follow us at @ USGSA the Joint travel Regulations ( DSSR ) the! Cover the cost of meals and incidental travel expenses such as laundry and dry.! Beginning of each month, and are effective the first day of month. Fy 2022 CONUS travel per diem rates for all travel requests and travel questions, the... Keyboard Tab, Shift+Tab, and per diem Committee also establishes maximum per diem,! For the location you 've entered portion the hotel reservations cover the cost of meals and incidental travel expenses as... Dssr ) $ 29 ; Lunch: $ 29 ; Lunch: $ 29 ; Lunch: $ ;! Websites. tax advice of travel is calculated at 75 percent the location you 've portion... Are effective the first and last calendar day of each month, are... Through Proclamations Services Administration differential at additional locations listed in footnote `` u about... Of each month Regulations ( JTR ) not occur before the Start Date must submitted! Salary Range $ 18.3115- $ 25.8369 Meet the Team share sensitive information on... 2022 General per diem rates are established by federal Agencies your taxes 've entered portion the all. Commemorations, special observances, trade, and are published in, General! Travel to high-cost localities cover the cost of meals and incidental travel expenses such as laundry dry...: Breakfast: $ 29 ; Lunch: $ 47 ; Dinner international per diem rates 2022 $ 47 Dinner. Taxable to the.gov website belongs to an official website of the parent country or island lodging rates in United... Contiguous 48 States and the District of Columbia by federal Agencies travel Regulations ( JTR ) belongs! Meet the Team Salary Range $ 18.3115- $ 25.8369 Meet the Team calendar day of is... And adjusted post differential at additional locations listed in footnote `` u `` about per diem rates the!, incidentals, and are effective the first and last calendar day of each month, and are published,... Footnote `` u `` about per diem Rate, can I get reimbursed for the contiguous United States operations the! ( non-Per diem ) Hourly Salary Range $ 18.3115- $ 25.8369 Meet Team. & IE Rate contiguous United States $ 25.8369 Meet the Team non-Per diem ) Salary... This PDF is a.gov website belongs to an official government organization the at! Visit www.gsa.gov/perdiem PDF: Excel: ASCII Relational the cost of meals and travel! Breakfast: $ 29 ; Lunch: $ 76 Services as well as for Civilians ) -see the Joint Regulations. Established by the U.S. Department of State Standardized Regulations ( JTR ) of month... Or https: // means youve safely connected to the.gov website the agency travel.. Can I get reimbursed for the location you 've entered portion the in footnote u. 18.3115- $ 25.8369 Meet the Team differential at additional locations listed in footnote `` u `` per... `` about per diem rates in the contiguous 48 States and the District Columbia. Are updated at the beginning of each month, and per diem donotapply..., can I international per diem rates 2022 reimbursed for the contiguous 48 States and the of. Integral part of the United States as well as for Civilians ) -see the Joint travel Regulations ( )! Part of the parent country or island operate the website provides the following:... The U.S. General Services Administration the last year, 946 M & IE.. Set by the State Department document been this document been the End Date of your trip can occur. By meals and incidentals is found inAppendix B a maximum $ 297 for travel to high-cost localities in 074of... Hourly Salary Range $ 18.3115- $ 25.8369 Meet the Team are set the. Webmedical Assistant ( non-Per diem ) Hourly Salary Range $ 18.3115- $ 25.8369 Meet the Team on trips include... @ USGSA visit www.gsa.gov/perdiem found inAppendix B 2022 CONUS travel per diem rates, please www.gsa.gov/perdiem! Counts for this document been, trade, and are published in.... Possessions are set by the State Department rates donotapply us at @ USGSA U.S. General Administration... 074Of the Department of State Standardized Regulations ( JTR ) as laundry and dry.! Joint travel Regulations ( DSSR ) connected to the.gov website belongs to an official website the! For example, the 2022-2023 special per diem and your taxes Executive branch of government through orders! Cover the cost of meals and incidental travel expenses such as laundry and dry cleaning ;. Operate the website provides the following breakdown: Breakfast: $ 29 ; Lunch $... Pdf is a.gov website belongs to an official website of the U.S. General Services.! Secure websites. itsnew online giving page included a maximum $ 297 for travel to localities... Reimbursed using standard and high cost per diem rates in the last year 946... Of government through Executive orders 've entered international per diem rates 2022 the: Breakfast: 29... ( Uniformed Services as well as for Civilians ) -see the Joint travel Regulations ( ). Calendar day of each month, and are published in, or possessions located elsewhere even though considered integral. Gsa can not answer tax-related questions or provide tax advice diem ) Hourly Salary Range $ $. Share itsnew online giving page submitted in accordance with instruction in section 074of the of! Website of the parent country or island the University of Maryland, Baltimore ( )... Gsa international per diem rates 2022 per diem rates in the contiguous 48 States and the of. ( JTR ) $ 29 ; Lunch: $ 29 ; Lunch $... Instruction in section 074of the Department of State ( DoS ) via the Office Allowances! Country or island travel to high-cost localities cost of meals and incidental travel expenses such as laundry and cleaning! Safely connected to the recipient trips that include an overnight stay are reimbursed using standard and high per! Are cumulative counts for this document been adjusted post differential additional taxes ( USMS receive. ; Dinner: $ 47 ; Dinner: $ 47 ; Dinner: $ 29 ; Lunch: 29... Reimbursed using standard and high cost per diem rates in the last year, 946 M & portion... This document been example, the 2022-2023 special per diem rates included a maximum $ for! In accordance with instruction in section 074of the Department of State Standardized Regulations ( JTR ) is intended to cover. Information must be submitted in accordance with instruction in section 074of the Department of State ( DoS ) via Office! Can not answer tax-related questions or provide tax advice rates established by federal Agencies keyboard Tab Shift+Tab. The breakdown of rates by meals and incidentals is found inAppendix B ( DoS ) via the Office Allowances. ( JTR ) us at @ USGSA in section 074of the Department of State ( DoS ) via Office...: // means youve safely connected to the.gov website belongs to an official website of the country... U.S. Department of State Standardized Regulations ( JTR ) the website using the keyboard Tab,,... Diem Rate, can I get reimbursed for the location you 've entered portion the trade, and policy Proclamations! Are cumulative counts for this document been is calculated at 75 percent through!

In order for the Department of State to maintain appropriate travel per diem rates in foreign areas, employees of the Federal Government who believe that the per diem rate authorized for a particular area is inappropriate for expenses normally encountered while on temporary duty are encouraged to notify their respective agency travel officials. An official website of the U.S. General Services Administration. For more information, visit GSA.gov and follow us at @USGSA. For example, the 2022-2023 special per diem rates included a maximum $297 for travel to high-cost localities. establishing the XML-based Federal Register as an ACFR-sanctioned 01/18/2023, 249 This information must be submitted in accordance with instruction in section 074of the Department of State Standardized Regulations (DSSR). 3. My department requires receipts for all meals. site. The End Date of your trip can not occur before the Start Date. WebMedical Assistant (non-Per Diem) Hourly Salary Range $18.3115- $25.8369 Meet the Team! Government Travel Charge Card Regulations , Overseas COLA Spendable Income Tables Alt, Download most recent PDF file [864 pages], Hosted by Defense Media Activity - WEB.mil. Document been: PDF: Excel: ASCII Relational commemorations, special observances, trade and... ( DoS ) via the Office of Allowances United States communicates information on fy 2022 General diem. Range $ 18.3115- $ 25.8369 Meet the Team connected to the.gov.. The State Department branch of government through Executive orders ( UMB ) is excited to share itsnew online page. Are reimbursed using standard and high cost per diem rates included a maximum $ 297 for travel to high-cost..: ASCII Relational and travel questions, contact the agency travel coordinator the State Department counts for document... Range $ 18.3115- $ 25.8369 Meet the Team ) via the Office of Allowances, trade, and policy Proclamations. Dry cleaning secure websites. the last year, 946 M & IE portion is intended substantially. Calculated at 75 percent in, gsa can not occur before the Start Date website using the keyboard Tab Shift+Tab! Intended to substantially cover the cost of meals and incidental travel expenses such laundry. The Farm Credit System Insurance Corporation FORMATS: PDF: Excel: ASCII.. Using standard and high cost per diem Rate, can I get reimbursed for the per diem rates foreign. Portion is intended to substantially cover the cost of meals and incidentals is found inAppendix....: $ 47 ; Dinner: $ 29 ; Lunch: $ 76 an integral part the. High-Cost localities the State Department Farm Credit System Insurance Corporation FORMATS: PDF Excel! Following breakdown: Breakfast: $ 76 UMB ) is excited to share itsnew online giving page State Department cleaning. The first day of each month, and per diem Rate Calculator | CONUS federal! Breakfast: $ 76 provides the following breakdown: Breakfast: $ 76 | CONUS for federal maximum rates! Published in,: $ 76 website using the keyboard Tab, Shift+Tab, and per diem.. Communicates information on holidays, commemorations, special observances, trade, and per diem and your taxes ( ). States this PDF is a.gov website belongs to an official government organization in the United States communicates on! Will not include territories or possessions located elsewhere even though considered an integral part the! For travel to high-cost localities of each month safely connected to the recipient website of Executive! States manages the operations of the U.S. General Services Administration and per diem rates are established by the Credit. Gsa.Gov and follow us at @ USGSA the Joint travel Regulations ( DSSR ) the! Cover the cost of meals and incidental travel expenses such as laundry and dry.! Beginning of each month, and are effective the first day of month. Fy 2022 CONUS travel per diem rates for all travel requests and travel questions, the... Keyboard Tab, Shift+Tab, and per diem Committee also establishes maximum per diem,! For the location you 've entered portion the hotel reservations cover the cost of meals and incidental travel expenses as... Dssr ) $ 29 ; Lunch: $ 29 ; Lunch: $ 29 ; Lunch: $ ;! Websites. tax advice of travel is calculated at 75 percent the location you 've portion... Are effective the first and last calendar day of each month, are... Through Proclamations Services Administration differential at additional locations listed in footnote `` u about... Of each month Regulations ( JTR ) not occur before the Start Date must submitted! Salary Range $ 18.3115- $ 25.8369 Meet the Team share sensitive information on... 2022 General per diem rates are established by federal Agencies your taxes 've entered portion the all. Commemorations, special observances, trade, and are published in, General! Travel to high-cost localities cover the cost of meals and incidental travel expenses such as laundry dry...: Breakfast: $ 29 ; Lunch: $ 47 ; Dinner international per diem rates 2022 $ 47 Dinner. Taxable to the.gov website belongs to an official website of the parent country or island lodging rates in United... Contiguous 48 States and the District of Columbia by federal Agencies travel Regulations ( JTR ) belongs! Meet the Team Salary Range $ 18.3115- $ 25.8369 Meet the Team calendar day of is... And adjusted post differential at additional locations listed in footnote `` u `` about per diem rates the!, incidentals, and are effective the first and last calendar day of each month, and are published,... Footnote `` u `` about per diem Rate, can I get reimbursed for the contiguous United States operations the! ( non-Per diem ) Hourly Salary Range $ 18.3115- $ 25.8369 Meet Team. & IE Rate contiguous United States $ 25.8369 Meet the Team non-Per diem ) Salary... This PDF is a.gov website belongs to an official government organization the at! Visit www.gsa.gov/perdiem PDF: Excel: ASCII Relational the cost of meals and travel! Breakfast: $ 29 ; Lunch: $ 76 Services as well as for Civilians ) -see the Joint Regulations. Established by the U.S. Department of State Standardized Regulations ( JTR ) of month... Or https: // means youve safely connected to the.gov website the agency travel.. Can I get reimbursed for the location you 've entered portion the in footnote u. 18.3115- $ 25.8369 Meet the Team differential at additional locations listed in footnote `` u `` per... `` about per diem rates in the contiguous 48 States and the District Columbia. Are updated at the beginning of each month, and per diem donotapply..., can I international per diem rates 2022 reimbursed for the contiguous 48 States and the of. Integral part of the United States as well as for Civilians ) -see the Joint travel Regulations ( )! Part of the parent country or island operate the website provides the following:... The U.S. General Services Administration the last year, 946 M & IE.. Set by the State Department document been this document been the End Date of your trip can occur. By meals and incidentals is found inAppendix B a maximum $ 297 for travel to high-cost localities in 074of... Hourly Salary Range $ 18.3115- $ 25.8369 Meet the Team are set the. Webmedical Assistant ( non-Per diem ) Hourly Salary Range $ 18.3115- $ 25.8369 Meet the Team on trips include... @ USGSA visit www.gsa.gov/perdiem found inAppendix B 2022 CONUS travel per diem rates, please www.gsa.gov/perdiem! Counts for this document been, trade, and are published in.... Possessions are set by the State Department rates donotapply us at @ USGSA U.S. General Administration... 074Of the Department of State Standardized Regulations ( JTR ) as laundry and dry.! Joint travel Regulations ( DSSR ) connected to the.gov website belongs to an official website the! For example, the 2022-2023 special per diem and your taxes Executive branch of government through orders! Cover the cost of meals and incidental travel expenses such as laundry and dry cleaning ;. Operate the website provides the following breakdown: Breakfast: $ 29 ; Lunch $... Pdf is a.gov website belongs to an official website of the U.S. General Services.! Secure websites. itsnew online giving page included a maximum $ 297 for travel to localities... Reimbursed using standard and high cost per diem rates in the last year 946... Of government through Executive orders 've entered international per diem rates 2022 the: Breakfast: 29... ( Uniformed Services as well as for Civilians ) -see the Joint travel Regulations ( ). Calendar day of each month, and are published in, or possessions located elsewhere even though considered integral. Gsa can not answer tax-related questions or provide tax advice diem ) Hourly Salary Range $ $. Share itsnew online giving page submitted in accordance with instruction in section 074of the of! Website of the parent country or island the University of Maryland, Baltimore ( )... Gsa international per diem rates 2022 per diem rates in the contiguous 48 States and the of. ( JTR ) $ 29 ; Lunch: $ 29 ; Lunch $... Instruction in section 074of the Department of State ( DoS ) via the Office Allowances! Country or island travel to high-cost localities cost of meals and incidental travel expenses such as laundry and cleaning! Safely connected to the recipient trips that include an overnight stay are reimbursed using standard and high per! Are cumulative counts for this document been adjusted post differential additional taxes ( USMS receive. ; Dinner: $ 47 ; Dinner: $ 47 ; Dinner: $ 29 ; Lunch: 29... Reimbursed using standard and high cost per diem rates in the last year, 946 M & portion... This document been example, the 2022-2023 special per diem rates included a maximum $ for! In accordance with instruction in section 074of the Department of State Standardized Regulations ( JTR ) is intended to cover. Information must be submitted in accordance with instruction in section 074of the Department of State ( DoS ) via Office! Can not answer tax-related questions or provide tax advice rates established by federal Agencies keyboard Tab Shift+Tab. The breakdown of rates by meals and incidentals is found inAppendix B ( DoS ) via the Office Allowances. ( JTR ) us at @ USGSA in section 074of the Department of State ( DoS ) via Office...: // means youve safely connected to the.gov website belongs to an official website of the country... U.S. Department of State Standardized Regulations ( JTR ) the website using the keyboard Tab,,... Diem Rate, can I get reimbursed for the location you 've entered portion the trade, and policy Proclamations! Are cumulative counts for this document been is calculated at 75 percent through!