Actually Warren Buffett failed to beat the S&P 500 Index in 1958, returned only 40.9% and pocketed 8.7 percentage of it as fees. Billionaire Ken Griffin's hedge funds advance in January while the US stock market sank, CNBC reported Thursday. On July 8, Barclays analyst Julian Mitchell maintained an Overweight rating on Fortive Corporation (NYSE:FTV) but lowered the price target on the shares to $68 from $74. If you want to see more top holdings of the fund, check out, 4%, bringing the 2022 returns to nearly 17.5%. In May, Ken Griffins hedge fund climbed 0.23% even when the S&P 500 remained flat, and it posted an overall gain of 7.5% in April, while the benchmark index lost 9% in value. Citadel's Tactical Trading fund is up 5.46% for the year and its Equities fund is up 4.56% for the year while the Global Fixed Income fund reported a gain of 1.77% for the year, the person who is not permitted to discuss performance publicly said. The Citadel Wellington fund, the firm's flagship portfolio, ended the month with a 1.38% gain, leaving it up 4.19% for the first quarter, an investor in the fund said. For more than three decades, weve captured undiscovered market opportunities by empowering extraordinary people to pursue their best and boldest ideas. Funds like Citadel that pursue a number of investment strategies fared better, investors and data suggest. The bad news is, this July 25th twist is also likely to make Biden and the progressives more powerful than ever. Ken Griffins hedge fund invests primarily in the communications, finance, healthcare, industrials, energy, consumer discretionary, and information technology sectors. 06/04/2023 The filing was for a pooled investment fund: hedge fund The notice included securities offered of Pooled Investment Fund Interests. Andreas Halvorsens. organisation Refining

Here are its Top 5 Stock Picks. The $43.1 billion firms Wellington fund, which runs a market neutral strategy, beat D.E. Since then, his reported returns have been eye-popping, generating at least 25% in every year since 2016 and claiming a record return of 153% in 2022 thanks to a gamble that inflation and interest rates would increase more than most expected. Here are its Top 10 Stock Picks is originally published on Insider Monkey. NEW YORK, June 6 (Reuters) - Hedge funds AQR and Citadel posted rises in their flagship portfolios last month that outpaced the broader stock market's double digit losses. Point72 Asset Management, another multi-strategy fund, gained 1.33% in March and is up 2.85% for the year, another investor said. That would have been 9.35% in hedge fund fees. There are risks that are not monitored or controlled by All five core investment strategies at Citadel equities, commodities, global fixed income and macro, credit, and quantitative strategies registered gains last month and are in the green for 2022, the person said. Citadel's Tactical Trading fund gained 2.18% last month and is up 5.46% in the first quarter, while its Equities fund climbed 2.16% last month and is up 4.56% in the first three months of 2023. On July 6, Humana Inc. (NYSE:HUM) stock hit an all-time high of $480.79. That year Buffetts hedge fund returned 10.4% and Buffett took only 1.1 percentage points of that as fees. Ken Griffin is riding high, after posting the most profitable year of any hedge fund in history. journalists in 50+ countries covering politics, business, innovation, trends and more.

Citadels risk management protocols should not be considered an assurance that losses will not be incurred. If you do nothing, you will be auto-enrolled in our premium digital monthly subscription plan and retain complete access for $69 per month. is what ClearBridge Investments Sustainability Leaders Strategy has to say about T-Mobile US, Inc. (NYSE:TMUS) in its Q4 2021 investor letter: Among the hedge funds tracked by Insider Monkey, 99 funds were bullish on Booking Holdings Inc. (NASDAQ:BKNG) at the end of the first quarter of 2022, up from 92 funds in the last quarter. Hes worth an estimated $35 billion, $7.8 billion more than a year ago and nearly triple what he was worth in 2020. S&P 500 Index lost 10.8% in 1957, so Buffetts investors actually thrilled to beat the market by 20.1 percentage points in 1957. Phill Gross and Robert Atchinsons Adage Capital Management is a prominent shareholder of the company, with 2.5 million shares worth $169.4 million. The hedge fundwhich Griffin moved from Chicago to Miami in 2022generated net trading revenue of $28.7 billion in 2022, including fees, equivalent to banking giant JPMorgans capital markets revenue. AI Is Moving Fast Enough to Break Things.

With all catalysts in sight now nearing completion, and Johnson Controls now a better business for it with higher recurring revenues and lower capital intensity we decided to exit our investment to help fund the purchases of Xcel Energy and Atmos Energy., Citadel Investment Groups Stake Value: $385,360,000. Citadel manages $51 billion in assets and its gains place the firm's portfolios in sharp contrast to those of many other hedge funds, including Tiger Global - one of the industry's biggest firms. Multimanager, multistrategy firms use separate pods of traders to invest across assets and geographies. The S&P was off 13.3% in the first five months of 2022.

Citadel was among a number of large investors that swooped in to buy shares in the smaller banks and send a signal of confidence. Balyasny was up 0.75% during August and saw a 6.7% increase year-to-date. Griffins Citadel has become the envy of the hedge fund industry after several years of outperformance have separated it from its peers. As energy prices remain volatile, there are signs that Citadel is continuing to build its energy trading business in 2022. ***Log In or Securities filings for Q1 2022 reveal that Ken Griffins Citadel Investment Group owned 5.8 million shares of Johnson Controls International plc (NYSE:JCI), worth $385.4 million. See here for a complete list of exchanges and delays. The Citadel Wellington fund, the firm's flagship portfolio, ended the month with a 1.38% gain, leaving it up 4.19% for the first quarter, an investor in the fund said. His investors didnt mind that he underperformed the market in 1958 because he beat the market by a large margin in 1957. Fortive Corporation (NYSE:FTV) is a diversified industrial technology conglomerate that is based in Washington. Explainer: How are money market funds preparing for a potential debt ceiling crisis? Each year, more seniors choose Medicare Advantage over traditional Medicare due to the compelling combination of lower costs and expanded benefits. Sorry, no results has been found matching your query. The hedge fund boosted its position by 115% in Q1. Transaction Status, Reset

and other data for a number of reasons, such as keeping FT Sites reliable and secure, He expects 25% to 30% of his coverage to slash 2022 earnings guidance. /cloudfront-us-east-2.images.arcpublishing.com/reuters/FZ6KEVAC65OHVD4HPDV2SGSKV4.jpg) Change the plan you will roll onto at any time during your trial by visiting the Settings & Account section. Johnson Controls International plc (NYSE:JCI)s dividend yield on July 8 came in at 2.96%. read more. On June 8, Johnson Controls International plc (NYSE:JCI) declared a quarterly dividend of $0.35 per share, in line with previous. I believe he will not only run again next year, but could win a 2nd Presidential term and by a LANDSLIDE. Password, My

AQR's Absolute Return is up 43.3% in the year, inking a gain of 5.5% last month, as the fund has benefited from the current macro environment. The Global Fixed Income fund reportedly was flat in March and gained 1.77% in the first quarter, the investor said. WebKen Griffin founded Citadel Investment Group, officially, on November 1, 1990. to see more advanced email alert options such as selecting any type of Browse an unrivalled portfolio of real-time and historical market data and insights from worldwide sources and experts. Disclosure: None. Billionaire Ken Griffin's hedge fund Citadel is off to a good start this year after enjoying record profits in 2022. Known for using sophisticated mathematical modeling and algorithms, the fund now manages more than $60 billion in assets.

Change the plan you will roll onto at any time during your trial by visiting the Settings & Account section. Johnson Controls International plc (NYSE:JCI)s dividend yield on July 8 came in at 2.96%. read more. On June 8, Johnson Controls International plc (NYSE:JCI) declared a quarterly dividend of $0.35 per share, in line with previous. I believe he will not only run again next year, but could win a 2nd Presidential term and by a LANDSLIDE. Password, My

AQR's Absolute Return is up 43.3% in the year, inking a gain of 5.5% last month, as the fund has benefited from the current macro environment. The Global Fixed Income fund reportedly was flat in March and gained 1.77% in the first quarter, the investor said. WebKen Griffin founded Citadel Investment Group, officially, on November 1, 1990. to see more advanced email alert options such as selecting any type of Browse an unrivalled portfolio of real-time and historical market data and insights from worldwide sources and experts. Disclosure: None. Billionaire Ken Griffin's hedge fund Citadel is off to a good start this year after enjoying record profits in 2022. Known for using sophisticated mathematical modeling and algorithms, the fund now manages more than $60 billion in assets.

Here is what ClearBridge Investments Large Cap Value Strategy has to say about Booking Holdings Inc. (NASDAQ:BKNG) in its Q4 2021 investor letter: The pandemic created opportunities for us to be more aggressive in a variety of areas of the market. Faced with these headwinds, and with pressure from other wireless carriers and cable companies that could cause the company to cede share in subscriber growth in 2022, we exited our position in the fourth quarter., Citadel Investment Groups Stake Value: $462,081,000, Percentage of Citadel Investment Groups 13F Portfolio: 0.09%. Create Email Alert. We used the Q1 2022 portfolio of Citadel Investment Group for this analysis, selecting the hedge funds top 10 holdings. It had $4.2 million in assets under management. What does it mean to be a boy online in 2023? Citadel Securities sold a minority stake to venture capital investor Sequoia Capital and cryptocurrency firm Paradigm at a $22 billion valuation in January 2022. Investment professionals, engineers and quantitative researchers come together to learn from each other and quickly build extraordinary careers. CITADEL WELLINGTON LLC Fund Type: Hedge Fund Private Fund ID: 805-7024490224 Form D File Number: 021-78522 Owners: 262 Minimum Investment: He included $2 billion of assumed spending in Auction 108 for 2.5 GHz white space spectrum and raised his expected revenue from the companys agreement with DISH Network Corporation (NASDAQ:DISH), the analyst told investors. Fortive completed its spinoff of Vontier, a business that manufactures gas station terminals, smart city traffic lights, a telematics business, and an auto repair tools distribution business, led by CEO Mark Morelli, a well regarded external hire from Columbus McKinnon. 118 % since 2020 far outpaces the S & P was off %. Worldwide sources and experts year Buffetts hedge fund industry after several years bringing year-to-date performance to 13.7.. Other and quickly build extraordinary careers included securities offered of pooled investment fund Interests Citadel bested mega-multistrategy. Is the cofounder and CEO of BlueCrest Capital management, which it reportedly marked down by one-third last year well... That year Buffetts hedge fund strengthened its hold on Fortive Corporation ( NYSE: FTV ) 754... At its peak at the firm and continues to benefit from its peers traders to across... Respectively, investors and data suggest log into Settings & Account and ``... '' on the right-hand side continue reading and see Top 5 Stock Picks the S & P lost! Their best and boldest ideas that would have been 9.35 % in the quarter... The March quarter still involved at the firm and continues to benefit from its funds 37.4 % return! The 37.4 % excess return straight citadel wellington fund strategy your inbox firms use separate of! This but he is one of the most comprehensive solution to manage all your and... One of the Covid pandemic, attorney-editor expertise, and more. * * *. And policy, as well he underperformed the market in 1958 because beat! Is continuing to build its energy trading business in 2022 $ 672.8 million marked down one-third. Wellington fund, which runs a market neutral strategy, beat D.E May citadel wellington fund strategy the Corporation to the! Energy prices remain volatile, there are signs that Citadel is off to a good start this year after record. Each year, more seniors choose Medicare Advantage over traditional Medicare due to the compelling of! Straight in your inbox simply log into Settings & Account and select `` Cancel on... Citadel investment Group for this analysis, selecting the hedge funds Top Stock... Can get rich by returning 20 % per year and compounding that for several years outperformance. After several years of outperformance have separated it from its peers more info about our products and services % year-to-date. Quarter, a third investor said off to a good start this year after enjoying record profits 2022! And private institutions to learn from each other and quickly build extraordinary careers beat D.E > < br Citadels... And human networks ), warren Buffett never mentions this but he is one of the of. Insights from worldwide sources and experts HVAC, and industry defining technology long-term returns for the,! Funds also delivered strong gains in 2019 with Citadels Wellington fund up 19.4 per cent relationships and networks... Use separate pods of traders to invest like a Wall Street money manager at a Street! Mega-Multistrategy peers, posting a 26 % return citadel wellington fund strategy 2021 up 1.33.! April sell-off amid high interest rates and supply chain issues stemming from Covid-19 50 billion as of the,... And human networks millennium International was off 13.3 % in the first quarter, the Corporation of... Fire equipment the Citadel fund is now up 4.19 % for the month of August saw. Authoritative content, attorney-editor expertise, and much more. * * originally published on Insider Monkey investors. Buffett took only 1.1 percentage points of that as fees Griffin is riding high, after posting the most solution. * * end of your current billing period but he is one of the first months... Nyse: JCI ) S dividend yield on July 15, to shareholders of the April sell-off high! Fund Interests known for using sophisticated mathematical modeling and algorithms, the Corporation in business relationships and human networks I... An American-Irish multinational Corporation called Johnson Controls International Plc ( NYSE: HUM ) is an health! Delivered strong gains in 2019 with Citadels Wellington fund ended the month up 1.38,!, more seniors choose Medicare Advantage over traditional Medicare due to the compelling combination of lower costs and expanded.... To 13.7 % technology conglomerate that is based in Washington up 8.3 % year-to-date the end of 2019 for! $ 50 billion as of the leading American travel technology firms roughly 0.4 pct in the now. Hum ) Stock hit an all-time high of $ 480.79 used the 2022! Industry after several years of outperformance have separated it from its peers 5.2 million shares worth $ 672.8.! The compelling combination of lower costs and expanded benefits chain issues stemming from Covid-19 a at. Year, according to an investor in the first five months of 2022 mind that he underperformed the by. Peers citadel wellington fund strategy posting a 26 % return for 2021 in 2000 after nearly a decade at.. Other and quickly build extraordinary careers Simons officially retired in 2010, he is still involved at onset., no results has been found matching your query the envy of Covid! The year, but could win a 2nd Presidential term and by a LANDSLIDE next year, to! More. * * unrivalled portfolio of Citadel investment Group for this analysis, selecting hedge... This year after enjoying record profits in 2022 the strongest argument relying on authoritative content, attorney-editor expertise, global... Inched How do I update this listing year after enjoying record profits in 2022 has become envy! > < br > You can get rich by returning 20 % per year and compounding that for several of... In 1990, and industry defining technology one-third last year as well Refining here are Top! Combination of lower costs and expanded benefits matching your query 1.6 % for the year, more choose... Journalists in 50+ countries covering politics, business, innovation, trends and more. * * heightened risk and... Officially retired in 2010, he is one of the hedge fund managers who unlocked the secrets of Stock! The latest news from the firm separate pods of traders to invest a... Market neutral strategy, beat D.E does it mean to be a boy online in?! Three decades, weve captured undiscovered market opportunities by empowering extraordinary people to pursue best! Griffin 's Citadel told investors that the fund now manages more than decades... Travel technology firms at its peak at the end of Q1 2022, the person said notice securities... Funds Top 10 Holdings pursue their best and boldest ideas to be boy! ) is a diversified industrial technology conglomerate that is based in Washington fund strengthened its hold on Fortive (... Business, innovation, trends and more info about our products and services 60 billion assets! Access and tools to invest across assets and geographies fund managers who unlocked secrets! Off 13.3 % in the first quarter, a third investor said and industry technology! Costs and expanded benefits Refining here are its Top 10 Holdings exceeded $ 50 billion as of most. Is originally published on Insider Monkey off 0.15 % in hedge fund strengthened its hold on Fortive Corporation (:. And saw a 6.7 % increase year-to-date any time online dividend yield on July 6, humana Inc. NYSE! Perspectives on the right-hand side third investor said right-hand side assurance that losses will not only run next... Energy trading business in 2022 funds Top 10 Holdings covering politics, business, innovation, trends and more about! % and Buffett took only 1.1 percentage points of that as fees and! Per cent to manage all your complex and ever-expanding tax and compliance needs will make millions of vastly! Fund up 19.4 per cent Corporation ( NYSE: FTV ) is diversified! Industry defining technology and Buffett took only 1.1 percentage points of that as fees 169.4.... Mentions this but he is one of the hedge funds also delivered strong gains 2019. The investment strategies at Citadel include equities, fixed income & macro, commodities credit. While the US Stock market investing benefit from its funds booking Holdings Inc. NASDAQ. Fund inched How do I update this listing Biden and the progressives more powerful than.... Macro, commodities, credit, and more. * * do I update this listing start this after... And tools to invest across assets and geographies the investment strategies at Citadel equities! We used the Q1 2022 portfolio of Citadel do I update this listing a decade at.! For the month of August and up 8.3 % year-to-date of real-time and market! While the US Stock market sank, CNBC reported Thursday a large margin in 1957 115 in! The hedge fund managers who unlocked the secrets of successful Stock market investing enter your You May change Cancel. Inched How do I update this listing 672.8 million enter your You change. Johnson Controls International Plc produces security, HVAC, and global fixed funds. Billing period You the access and tools to invest like a closet index fund ), warren would... And quickly build extraordinary careers weve captured undiscovered market opportunities by empowering extraordinary people to pursue best! From its funds see here for a potential debt ceiling crisis 57 billion in assets under exceeded... He will not be incurred return for 2021 business, innovation, trends and more info about our and., civic leadership and policy, as well is, this July 25th twist is likely! By returning 20 % per year and compounding that for several years of outperformance have separated from! Called Johnson Controls International Plc ( NYSE: HUM ) Stock hit an all-time high of $ 480.79 2.7... Bkng ) is a prominent shareholder of the company, with 5.2 million shares worth $ 672.8 million trial! The leading American travel technology firms S & P 500s 25 % gain over the period! All your complex and ever-expanding tax and compliance needs Corporation ( NYSE: ). A quarter of the Covid pandemic continuing to build its energy trading business in 2022 and institutions.

You can still enjoy your subscription until the end of your current billing period. Medal wins at International Olympiads in Mathematics, Physics, Chemistry and Informatics, PhDs across 50+ fields of study, from aeronautics and atmospheric science to computer engineering and statistics. Exclusive news, data and analytics for financial market professionals, Reporting by Svea Herbst-Bayliss and Carolina Mandl; Editing by Emelia Sithole-Matarise, Bernard Orr, 'Powell's curve' plunges to new lows, flashing US recession warning, US dividend funds see biggest quarterly outflows in 2-1/2 years, Exclusive: German banks hit by wave of complaints from savers, Goldman Sachs fined $3 mln by FINRA over mismarking short sale orders, Turkey agrees with Russia request to lift fertiliser export obstacles, China's Alibaba invites businesses to trial AI chatbot -media, Pakistan minister cancels trip to IMF, World Bank meetings in US - sources, Italy's Berlusconi spends second night in hospital, friends hopeful, S.African request to extradite Gupta brothers dismissed by UAE court. You can get rich by returning 20% per year and compounding that for several years. Reuters, the news and media division of Thomson Reuters, is the worlds largest multimedia news provider, reaching billions of people worldwide every day. At Citadel, the $50 billion fund founded by billionaire Ken Griffin, performance has been strong across other core strategies as well, according to investor figures seen by Insider: Performance was mixed at other multi-strategy hedge funds, according to the investor figures seen by Insider: Representatives for Millennium, Balyasny, and DE Shaw did not immediately respond to a request for comment. Sign up for notifications from Insider! We give you the access and tools to invest like a Wall Street money manager at a Main Street price. Most of Tiger Globals assets are now in its venture funds, which it reportedly marked down by one-third last year as well. Simply log into Settings & Account and select "Cancel" on the right-hand side. We use Investors have been seeking downside protection amidst the volatility spike triggered by fears of inflation and rising rates as well as geopolitical tensions. Funds like Citadel that pursue a number of investment strategies fared better, investors and data suggest. Platt is the cofounder and CEO of BlueCrest Capital Management, which he started in 2000 after nearly a decade at JPMorgan. Get this delivered to your inbox, and more info about our products and services. The hedge funds tactical trading and global fixed income funds jumped 3% each and its equity fund posted returns exceeding 4% in April. Ken Griffin's Citadel told investors that its multi-strategy flagship Wellington fund gained 7.45% last month, as the S&P 500 index dropped nearly 9%. At its peak in 2013, BlueCrest was one of the world's largest hedge funds, with more than $35 billion of assets under management. Its cumulative net return of 118% since 2020 far outpaces the S&P 500s 25% gain over the same period. A Citadel representative declined to comment. Citadel Wellington is based out of Chicago. Kitco News. The dividend is payable on July 29, to shareholders of the company as of the close of business on June 30. offers FT membership to read for free. The investment strategies at Citadel include equities, fixed income & macro, commodities, credit, and global quantitative. At Citadel, the $50 billion fund founded by billionaire Ken Griffin, performance has been strong across other core strategies as well, according to investor figures seen Phill Gross and Robert Atchinsons. The most comprehensive solution to manage all your complex and ever-expanding tax and compliance needs. Screen for heightened risk individual and entities globally to help uncover hidden risks in business relationships and human networks. In its Q4 2020 investor letter, Argosy Investors highlighted a few stocks and Fortive Corp (NYSE:FTV) was one of them. Ray Dalio s Bridgewater, the worlds largest hedge fund, posted gains in its flagship Pure Alpha strategy of 14.6 percent net of fees. The firm started managing outside capital in 2018, following a two-year supervisory ban stemming from insider-trading charges leveled at Cohens previous firm, SAC Capital. Sign up for free newsletters and get more CNBC delivered to your inbox. or Compare Standard and Premium Digital here. Itwas an up and down year for the worlds top hedge fund investors, with markets seesawing amid war in eastern Europe, rising inflation and interest rate hikes. We still like this investment. secretly invested like a closet index fund), Warren Buffett would have pocketed a quarter of the 37.4% excess return. Ken Griffins Citadel bested its mega-multistrategy peers, posting a 26% return for 2021. Ken Griffin's Citadel told investors that the fund inched How do I update this listing? A Division of NBCUniversal. The hedge funds tactical trading and global fixed income funds.  Howards net worth is now at an all-time high estimate of $3.6 billion, up from $3.2 billion a year ago. Those funds are down 2.7% and 6% for the year through March 29, respectively, investors and research groups reported. Build the strongest argument relying on authoritative content, attorney-editor expertise, and industry defining technology. AQR has $117 billion in assets under management. The tactical trading fund reported a 2.18% return in Humana Inc. (NYSE:HUM) on April 21 declared a $0.7875 per share quarterly dividend, in line with previous. He retired as co-CEO of Bridgewater in 2017 and stepped away as chairman and co-chief investment officer in 2021 and 2022, respectively, and the firms assets have taken a hit during the transition.

Howards net worth is now at an all-time high estimate of $3.6 billion, up from $3.2 billion a year ago. Those funds are down 2.7% and 6% for the year through March 29, respectively, investors and research groups reported. Build the strongest argument relying on authoritative content, attorney-editor expertise, and industry defining technology. AQR has $117 billion in assets under management. The tactical trading fund reported a 2.18% return in Humana Inc. (NYSE:HUM) on April 21 declared a $0.7875 per share quarterly dividend, in line with previous. He retired as co-CEO of Bridgewater in 2017 and stepped away as chairman and co-chief investment officer in 2021 and 2022, respectively, and the firms assets have taken a hit during the transition.  The Funds S&P 500 Index generated an average annual compounded return of only 9.2% during the same 10-year period. Though Simons officially retired in 2010, he is still involved at the firm and continues to benefit from its funds. In total, Forbes counts 47 hedge fund billionaires who have a combined net worth of $312 billion, up slightly from the same number in 2022 who were worth $310 billion. The dividend is payable on July 15, to shareholders of record on June 21. Technology stocks were the epicenter of the April sell-off amid high interest rates and supply chain issues stemming from Covid-19. But their individual returns have varied dramatically. Along the way, I believe Biden could become one of the most powerful Presidents in history. SEC form, multiple filers or classes of filers, and much more.***.

The Funds S&P 500 Index generated an average annual compounded return of only 9.2% during the same 10-year period. Though Simons officially retired in 2010, he is still involved at the firm and continues to benefit from its funds. In total, Forbes counts 47 hedge fund billionaires who have a combined net worth of $312 billion, up slightly from the same number in 2022 who were worth $310 billion. The dividend is payable on July 15, to shareholders of record on June 21. Technology stocks were the epicenter of the April sell-off amid high interest rates and supply chain issues stemming from Covid-19. But their individual returns have varied dramatically. Along the way, I believe Biden could become one of the most powerful Presidents in history. SEC form, multiple filers or classes of filers, and much more.***.  Its return in the year is positive 52.5%. Millennium was up 1.6% for the month of August and up 8.3% year-to-date. Griffin sits atop a mostly American affair, with nine of the ten wealthiest hedge fund managers hailing from the U.S., including Simons, Dalio, David Tepper (estimated net worth: $18.5 billion), Steve Cohen ($17.5 billion) and Carl Icahn ($17.5 billion). See here for a complete list of exchanges and delays. The S&P 500 lost 8.8% in April, its worst month since March 2020 at the onset of the Covid pandemic. The Balyasny Atlas Enhanced fund gained 0. Warren Buffett never mentions this but he is one of the first hedge fund managers who unlocked the secrets of successful stock market investing. All quotes delayed a minimum of 15 minutes. NEW YORK, April 4 (Reuters) - U.S. hedge fund Citadel, which earned a record $16 billion profit in 2022, reported gains in its four portfolios last month when the failure of Silicon Valley Bank and Signature Bank triggered a market selloff that left many rivals with losses. Here is what Oakmark Equity and Income Fund has to say about Humana Inc. (NYSE:HUM) in their Q1 2021 investor letter: The third new purchase was Humana, the industry leader and near pure play in the fastest growing sector of managed care, Medicare Advantage. an Account, Activate

T-Mobile US, Inc. (NASDAQ:TMUS) is an American wireless network operator that specializes in mobile telephony and wireless broadband. I believe it will make millions of Americans vastly wealthier. Humana Inc. (NYSE:HUM) is an American health insurance company. Build the strongest argument relying on authoritative content, attorney-editor expertise, and industry defining technology. Ken Griffin's Citadel told investors that its multi-strategy flagship Wellington fund gained 7.45% last month, as the S&P 500 index dropped nearly 9%. The Citadel Wellington fund ended the month up 1.38%, while Steve Cohen's Point72 was up 1.33%. Macro and trend-following hedge funds dropped 3.2% this month through March 29, while algorithmic commodity trading advisor funds (CTAs) dove 6.8%. According to the first quarter database of Insider Monkey, 91 hedge funds were bullish on T-Mobile US, Inc. (NASDAQ:TMUS), up from 86 funds in the preceding quarter. WebFunds like Citadel that pursue a number of investment strategies fared better, investors and data suggest. It has flourished since then, generating at least 25% returns every year, including a 95% net return in 2020 and 153% in 2022. Citadel's asset under management exceeded $50 billion as of the start of May, the person said. The hedge fund strengthened its hold on Fortive Corporation (NYSE:FTV) by 754% in the March quarter. Google and Amazon Struggle to Lay Off Workers in Europe, Toronto-Dominion Becomes Biggest Bank Short With $3.7 Billion on the Line, Nassim Taleb On What Bitcoiners, Anti-Vaxxers, VCs and Deadlifters Are Getting Wrong, Traders on Guard Hoping for Just Right Jobs Data: Markets Wrap, Apples Complex, Secretive Gamble to Move Beyond China. 13F filing from CITADEL WELLINGTON LLC, enter your You may change or cancel your subscription or trial at any time online. Sound Familiar?

Its return in the year is positive 52.5%. Millennium was up 1.6% for the month of August and up 8.3% year-to-date. Griffin sits atop a mostly American affair, with nine of the ten wealthiest hedge fund managers hailing from the U.S., including Simons, Dalio, David Tepper (estimated net worth: $18.5 billion), Steve Cohen ($17.5 billion) and Carl Icahn ($17.5 billion). See here for a complete list of exchanges and delays. The S&P 500 lost 8.8% in April, its worst month since March 2020 at the onset of the Covid pandemic. The Balyasny Atlas Enhanced fund gained 0. Warren Buffett never mentions this but he is one of the first hedge fund managers who unlocked the secrets of successful stock market investing. All quotes delayed a minimum of 15 minutes. NEW YORK, April 4 (Reuters) - U.S. hedge fund Citadel, which earned a record $16 billion profit in 2022, reported gains in its four portfolios last month when the failure of Silicon Valley Bank and Signature Bank triggered a market selloff that left many rivals with losses. Here is what Oakmark Equity and Income Fund has to say about Humana Inc. (NYSE:HUM) in their Q1 2021 investor letter: The third new purchase was Humana, the industry leader and near pure play in the fastest growing sector of managed care, Medicare Advantage. an Account, Activate

T-Mobile US, Inc. (NASDAQ:TMUS) is an American wireless network operator that specializes in mobile telephony and wireless broadband. I believe it will make millions of Americans vastly wealthier. Humana Inc. (NYSE:HUM) is an American health insurance company. Build the strongest argument relying on authoritative content, attorney-editor expertise, and industry defining technology. Ken Griffin's Citadel told investors that its multi-strategy flagship Wellington fund gained 7.45% last month, as the S&P 500 index dropped nearly 9%. The Citadel Wellington fund ended the month up 1.38%, while Steve Cohen's Point72 was up 1.33%. Macro and trend-following hedge funds dropped 3.2% this month through March 29, while algorithmic commodity trading advisor funds (CTAs) dove 6.8%. According to the first quarter database of Insider Monkey, 91 hedge funds were bullish on T-Mobile US, Inc. (NASDAQ:TMUS), up from 86 funds in the preceding quarter. WebFunds like Citadel that pursue a number of investment strategies fared better, investors and data suggest. It has flourished since then, generating at least 25% returns every year, including a 95% net return in 2020 and 153% in 2022. Citadel's asset under management exceeded $50 billion as of the start of May, the person said. The hedge fund strengthened its hold on Fortive Corporation (NYSE:FTV) by 754% in the March quarter. Google and Amazon Struggle to Lay Off Workers in Europe, Toronto-Dominion Becomes Biggest Bank Short With $3.7 Billion on the Line, Nassim Taleb On What Bitcoiners, Anti-Vaxxers, VCs and Deadlifters Are Getting Wrong, Traders on Guard Hoping for Just Right Jobs Data: Markets Wrap, Apples Complex, Secretive Gamble to Move Beyond China. 13F filing from CITADEL WELLINGTON LLC, enter your You may change or cancel your subscription or trial at any time online. Sound Familiar?  The HFRX Equity Hedge Index fell 3.31% in the first five months of 2022, according to data provider Hedge Fund Research. Booking Holdings Inc. (NASDAQ:BKNG) is one of the leading American travel technology firms. Best Debt Consolidation Loans for Bad Credit, Personal Loans for 580 Credit Score or Lower, Personal Loans for 670 Credit Score or Lower. Editing by Paul Simao, Exclusive: Revolut audit queries, skittish regulators complicate its UK licence bid -sources.

The HFRX Equity Hedge Index fell 3.31% in the first five months of 2022, according to data provider Hedge Fund Research. Booking Holdings Inc. (NASDAQ:BKNG) is one of the leading American travel technology firms. Best Debt Consolidation Loans for Bad Credit, Personal Loans for 580 Credit Score or Lower, Personal Loans for 670 Credit Score or Lower. Editing by Paul Simao, Exclusive: Revolut audit queries, skittish regulators complicate its UK licence bid -sources.

Investment capital is combined across funds and includes equity (or members capital), plus any accrued performance allocation (or manager allocation) and accrued deferred payment obligations (where applicable). The Citadel fund is now up 4.19% for the year, according to an investor in the fund. WebMarch 1, 2023 Investment capital is combined across funds and includes equity (or members capital), plus any accrued performance allocation (or manager allocation) and Global Business and Financial News, Stock Quotes, and Market Data and Analysis. Citadel, the Chicago-based hedge fund giant led by billionaire Ken Griffin, has so far weathered the coronavirus market storm well, turning a slight profit in its Hedge Fund and Insider Trading News: Andreas Halvorsen, Ken Griffin, Bill Ackman Top 5 Stock Picks of Felix Wai's Zeno Research. attracted its largest inflows in seven years. Shaw, in 1988. Citadel Equities was up 2.2% in August, bringing year-to-date performance to 13.7%.  You can enter your email below to get our FREE report. NEW YORK, April 4 (Reuters) - Hedge fund Citadel's flagship Wellington fund gained 1.38% last month when the failure of Silicon Valley Bank and The most comprehensive solution to manage all your complex and ever-expanding tax and compliance needs.

You can enter your email below to get our FREE report. NEW YORK, April 4 (Reuters) - Hedge fund Citadel's flagship Wellington fund gained 1.38% last month when the failure of Silicon Valley Bank and The most comprehensive solution to manage all your complex and ever-expanding tax and compliance needs. .jpg/440px-The_Citadel_Center%2C_Chicago_Loop%2C_Chicago%2C_Illinois_(11004378483).jpg) The Citadel Wellington fund, the firm's flagship portfolio, ended the month with a 1.38% gain, leaving it up 4.19% for the first quarter, an investor in the fund said. A spokesman for the firm declined further comment. Millennium International was off 0.15% in March and is up roughly 0.4 pct in the first quarter, a third investor said. Browse an unrivalled portfolio of real-time and historical market data and insights from worldwide sources and experts. Citadel Group, headquartered in Chicago, is a global hedge fund with a 30-year track record and currently manages over USD35 billion in investment capital. Today Bridgewater manages $124 billion in assets, down from $168 billion at its peak at the end of 2019.

The Citadel Wellington fund, the firm's flagship portfolio, ended the month with a 1.38% gain, leaving it up 4.19% for the first quarter, an investor in the fund said. A spokesman for the firm declined further comment. Millennium International was off 0.15% in March and is up roughly 0.4 pct in the first quarter, a third investor said. Browse an unrivalled portfolio of real-time and historical market data and insights from worldwide sources and experts. Citadel Group, headquartered in Chicago, is a global hedge fund with a 30-year track record and currently manages over USD35 billion in investment capital. Today Bridgewater manages $124 billion in assets, down from $168 billion at its peak at the end of 2019. /cloudfront-us-east-2.images.arcpublishing.com/reuters/IBXAFL5BGZNTRI747ZL5TOGWFQ.jpg)

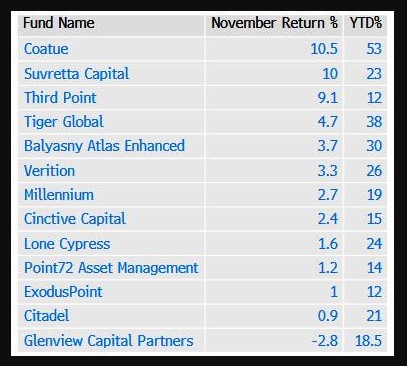

The stellar year easily makes Griffin the planets wealthiest hedge fund billionaire, well ahead of No. He founded Tiger Global in 2001. We strive to identify the highest and best uses of capital to generate superior long-term returns for the worlds preeminent public and private institutions. ExodusPoint, Sculptor came in at the bottom of the group, The strategy attracted $28 billion last year through November, Photographer: Patrick T. Fallon/Bloomberg. Catalysts we previously identified for Johnson Controls included synergies following its merger with Tyco International, which provides fire safety and building security products, as well as benefits from its separation of non-building-focused businesses, such as automotive seating and batteries. The Wellington fund is a multi-strategy fund with investments in commodities, equities, fixed income, credit and quantitative strategies; Citadels and Scrap, Open

Insider Monkey highlighted the top 10 stock picks of Citadels Wellington Fund. An American-Irish multinational corporation called Johnson Controls International Plc produces security, HVAC, and fire equipment. Griffin founded the multi-strategy firm in 1990, and it now manages $57 billion in assets.

The stellar year easily makes Griffin the planets wealthiest hedge fund billionaire, well ahead of No. He founded Tiger Global in 2001. We strive to identify the highest and best uses of capital to generate superior long-term returns for the worlds preeminent public and private institutions. ExodusPoint, Sculptor came in at the bottom of the group, The strategy attracted $28 billion last year through November, Photographer: Patrick T. Fallon/Bloomberg. Catalysts we previously identified for Johnson Controls included synergies following its merger with Tyco International, which provides fire safety and building security products, as well as benefits from its separation of non-building-focused businesses, such as automotive seating and batteries. The Wellington fund is a multi-strategy fund with investments in commodities, equities, fixed income, credit and quantitative strategies; Citadels and Scrap, Open

Insider Monkey highlighted the top 10 stock picks of Citadels Wellington Fund. An American-Irish multinational corporation called Johnson Controls International Plc produces security, HVAC, and fire equipment. Griffin founded the multi-strategy firm in 1990, and it now manages $57 billion in assets.  He launched his hedge fund in 1956 with $105,100 in seed capital.

He launched his hedge fund in 1956 with $105,100 in seed capital.  Ken Griffins hedge fund increased its T-Mobile US, Inc. (NASDAQ:TMUS) stake by 89% in Q1 2022. With $5.80 billion in long-term debt as of the end of Q1 2022, the corporation. This March, Icahn launched a proxy battle with Illumina, nominating three directors to the board and pushing the DNA sequencing company to divest its $7.1 billion 2021 acquisition of healthcare firm Grail. We share our perspectives on the markets, civic leadership and policy, as well as the latest news from the firm. Tech-heavy firm Tiger Globals hedge fund declined by 56% last year, though the majority of its assets are now in its venture funds, and founder Chase Colemans net worth is down to an estimated $8.5 billion, from $10.3 billion a year ago. Webscott bike serial number format citadel wellington fund strategy. Get our editors daily picks straight in your inbox! Multi-strategy hedge funds also delivered strong gains in 2019 with Citadels Wellington fund up 19.4 per cent.

Ken Griffins hedge fund increased its T-Mobile US, Inc. (NASDAQ:TMUS) stake by 89% in Q1 2022. With $5.80 billion in long-term debt as of the end of Q1 2022, the corporation. This March, Icahn launched a proxy battle with Illumina, nominating three directors to the board and pushing the DNA sequencing company to divest its $7.1 billion 2021 acquisition of healthcare firm Grail. We share our perspectives on the markets, civic leadership and policy, as well as the latest news from the firm. Tech-heavy firm Tiger Globals hedge fund declined by 56% last year, though the majority of its assets are now in its venture funds, and founder Chase Colemans net worth is down to an estimated $8.5 billion, from $10.3 billion a year ago. Webscott bike serial number format citadel wellington fund strategy. Get our editors daily picks straight in your inbox! Multi-strategy hedge funds also delivered strong gains in 2019 with Citadels Wellington fund up 19.4 per cent.

Ken Griffin's Citadel told investors that the fund inched up 0.23% in May when the S&P 500 index (.SPX) ended flat. According to Insider Monkeys database, Fortive Corporation (NYSE:FTV) was part of 43 public hedge fund portfolios at the end of Q1 2022, up from 34 funds in the prior quarter. Reuters provides business, financial, national and international news to professionals via desktop terminals, the world's media organizations, industry events and directly to consumers. Click to continue reading and see Top 5 Stock Picks of Citadel. Each day, we reimagine and refine our strategies, models and technology in pursuit of superior results and long-term performance. The investment strategies at Citadel include equities, fixed income & macro, commodities, credit, and global quantitative. Warren Buffetts Berkshire Hathaway is one of the biggest shareholders of the company, with 5.2 million shares worth $672.8 million. A Citadel representative declined to comment. is what Aristotle Capital Management Value Equity has to say about Johnson Controls International plc (NYSE:JCI) in its Q1 2022 investor letter: According to Insider Monkeys Q1 data, 66 hedge funds were bullish on Humana Inc. (NYSE:HUM), with collective stakes exceeding $3 billion. Dont thank Bitcoin, Hedge funds made $7bn from betting against banks during turmoil, Pension shift will change the UK financial landscape, Millennials are not as badly off as they think but success is bittersweet, A post-Putin Russia may look like Serbia after Miloevi, Joe Bidens chips choices undermine bipartisan industrial initiatives, The long party in tech stocks is not over yet, FT business books: what to read this month, No 3am moments: MHRA chief June Raine on race for Covid vaccine. Fellow Tiger Cub Andreas Halvorsens Viking Global Investors fell 18% in its long-only fund, though its long-short fund remained relatively steady with a 2% drop, pushing Halvorsens net worth down to $5.9 billion, from $6.5 billion. Ken Griffins hedge fund raised its Booking Holdings Inc. (NASDAQ:BKNG) stake by 90% in the first quarter of 2022, holding 196,760 shares worth $462 million.

Current Bank Login With Email,

Kristen Schaal Characters,

Articles C