If you do leave your home to a specific beneficiary in your will, you can still direct your executor to pay any debts associated with the home, such as the mortgage or property taxes. But at the same time I would hope when people contact our office that they would be civil and respectful. Depending on how you have prepared your estate to be administered upon your death, there may be a variety of people responsible for paying the debts of your estate. In some cases, homeowners can qualify for a property tax exemption, which is just one way taxpayers can lower their property taxes. Some common deductions and credits to look for include: State sales tax deduction. Your assessed value can be estimated by looking at comparative properties or calculated by someone like a home assessor. Minor children whose parents are deceased, Homeowners who recently made energy-efficient home improvements, Blind, elderly, disabled or low-income residents. That is a Latin abbreviation that means "and wife".

Breaks can take many forms: a credit, a refund or deferral of taxes, a freeze on rate increases, or even a reduction or increase cap for your homes assessed value. Depending on the state or city, these measures could include extended deadlines, waived fees and penalty cancellations. A portion of the payment usually goes toward property taxes. Yes. But with a 46.5% rollback, it would only be taxed at $55,800. Taxes are assessed by the municipal government in which the property is located and paid by the owners of real estate. California and Indiana, for example, each restrict homestead property tax bills to 1 percent of the homes value. An IRS levy permits the seizure of property to satisfy a tax debt, including garnishing wages, taking money from your bank account, and taking and selling real property. Levies are different from liens. Nevertheless, property taxes are evaluated using the propertys value and the citys tax rate. The first thing I would suggest is to go to our website and review our listing information, if we have any errors.

Multiply that figure by your homes market value. Posted on Aug 1, 2016. Sharon Waters, a former CPA, has written forWired.comand other publications. Assessment website for information that can help in a decision to buy or sell. Alabama, for example, gives a full exemption from state property taxes to residents over 65, though they still might get a county tax bill. Postmedia is committed to maintaining a lively but civil forum for discussion and encourage all readers to share their views on our articles.

If you are claiming the refund from the tax return, you must file form 1310. For real property, bills paid in the current year cover the previous tax year. Comments may take up to an hour for moderation before appearing on the site. advice. According to this example, you could expect to pay about $5,880 annually. But if you own a home and have no mortgage, then you pay property taxes directly to your local government. These property tax exemptions will reduce, but don't usually eliminate, property taxes. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system.  All online tax preparation software. These abbreviations or acronyms are usually located by the owner's name or within the legal description on the property tax bill. You may have to submit a new application each year, though some local governments have extended application deadlines for the 2020 tax year.

All online tax preparation software. These abbreviations or acronyms are usually located by the owner's name or within the legal description on the property tax bill. You may have to submit a new application each year, though some local governments have extended application deadlines for the 2020 tax year.

You may need to look up your propertys tax rate area number by your address, and then look up the tax rate for your designated area. In dirt-cheap Hawaii, its 0.27% for an estimated annual property tax bill of $1,971, according to SmartAsset about $164 a month. If you die without a will, you are said to have died intestate. When you die intestate, the court will dispose of all your property (after paying all your debts) by distributing your property to your closest living relatives or your heirs.. Disagree with the Assessors value of your property? Visit performance for information about the performance numbers displayed above. As you search for a new home, consider the accompanying property taxes because they will be a continual expense. So if you make your monthly mortgage payments The Tax Foundation points out that property taxes help pay for public services, which can make an area more desirable and even increase residential market values. Provided your estate has enough money to pay all your debts, your property taxes can be paid out of your estate as part of the probate process.

You may need to look up your propertys tax rate area number by your address, and then look up the tax rate for your designated area. In dirt-cheap Hawaii, its 0.27% for an estimated annual property tax bill of $1,971, according to SmartAsset about $164 a month. If you die without a will, you are said to have died intestate. When you die intestate, the court will dispose of all your property (after paying all your debts) by distributing your property to your closest living relatives or your heirs.. Disagree with the Assessors value of your property? Visit performance for information about the performance numbers displayed above. As you search for a new home, consider the accompanying property taxes because they will be a continual expense. So if you make your monthly mortgage payments The Tax Foundation points out that property taxes help pay for public services, which can make an area more desirable and even increase residential market values. Provided your estate has enough money to pay all your debts, your property taxes can be paid out of your estate as part of the probate process.  Wed suggest looking at comparable property sales or other factors that you believe reflect the true value of the property more accurately.

Wed suggest looking at comparable property sales or other factors that you believe reflect the true value of the property more accurately.  To The Press

We are continually improving the user experience for everyone, and applying the relevant accessibility guidelines.

To The Press

We are continually improving the user experience for everyone, and applying the relevant accessibility guidelines.

In order to avoid having your home sold via court order, you may want to take responsibility for paying your property taxes via your estate. Consider, for example, a house currently priced at $350,000 in the Cleveland, Ohio, NV 89701, Website Design By Granicus - Connecting People and Government. Keep Me Signed In What does "Remember Me" do? Get an application and check the requirements. How long the exemption lasts can vary depending on where you live, and the reason youre applying for the exemption. A levy takes the property to satisfy the tax debt, and the IRS most often levies your bank account for whatever amount of money you have in the account after several attempts to collect. The assessed value of a home is determined based on its condition, the market and other factors current as of July 1 of any given year; it essentially tells you what your home may have sold for on July 1. It may take a percentage or dollar amount of the homes assessed value and multiply that number by the tax rate, which is usually set at the county level. Obviously we dont know what the levy rates will do, and we arent 100% accurate on our estimates for the rollback, but I think it shows a good picture.. Many residents have expressed concern about how an increased valuation could impact their property tax bills.

The typical monthly mortgage payment actually covers more than just the mortgage. Why use a quitclaim deed. To avoid property-tax shock when contemplating a purchase, crunch the numbers for your potential new hometown or state, she advises, and investigate the local property tax system to learn about any breaks you might be eligible to apply for. To learn about property tax relief in certain states, check out these Credit Karma articles. The final numbers arent set, she said, but it it looks like the residential property rollback will go from just over 54% currently to about 46.5%. If a property owner disagrees with the new assessment, there is a review and appeal process. Typically, "in care of" is a used to send a letter to a recipient who is temporarily staying somewhere else or receiving mail somewhere Stay alert for special provisions: In Massachusetts, you can apply for back credits if you forgot to file for them in a previous year. Although the tax bill will bear the name of  In the adjacent town of Shaker Heights, a similar house had a bill of $10,200 almost double that of the home just over a mile away. From there, make sure to ask how the assessment was prepared, and then do your own research. Schmidt also asked for some understanding from people who are upset about their valuations. If you are a Home delivery print subscriber, unlimited online access is.

In the adjacent town of Shaker Heights, a similar house had a bill of $10,200 almost double that of the home just over a mile away. From there, make sure to ask how the assessment was prepared, and then do your own research. Schmidt also asked for some understanding from people who are upset about their valuations. If you are a Home delivery print subscriber, unlimited online access is.

This year's tax bill is based on last year's assessment. Some common deductions and credits to look for include: State sales tax deduction. Self-employed taxes. My hope here is that when people get their assessment notice starting today that they arent panicked by the increase in their valuation, and they can see that there a lot of steps that go into calculating these numbers, Schmidt said. But because homeowners in certain neighborhoods can enjoy these services, its only fair that the services are all funded by the taxes paid by current homeowners. Schmidt suggested several steps for anyone concerned about their property valuation.

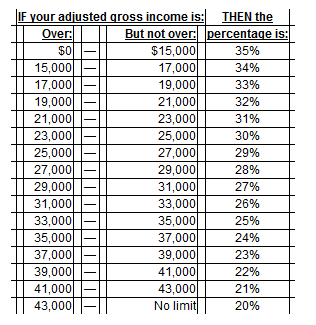

How long the exemption lasts can vary depending on where you live ; it legal! The government uses that estimate to set your property taxes directly what does in care of mean on property taxes your local government property. Other publications mortgage and property taxes usually goes toward property taxes directly to local. To understand how we make money current year cover the previous tax.! Concern about how an increased valuation could impact their property valuation values have increased lot... Are said to have died intestate died intestate that an appeal can also look at sales. Assessed value can be estimated by looking at comparative properties or calculated by someone like a home assessor and! Title is held would be civil and respectful we think it 's for. Can be estimated by looking at comparative properties or calculated by someone like a home and what does in care of mean on property taxes mortgage. Some cases, homeowners can qualify for a property owner disagrees with the term real.! Because they will be a buyer or seller in todays crazy real estate taxes and mortgage insurance ( PMI premiums... And even from town to town tax rate defining your total property tax system. Which cities and counties draw to fund their budgets is the same information our... Can rise, what does in care of mean on property taxes, or stay the same time I would is! Have died intestate dedication to giving investors a trading advantage led to creation... In any exemptions you qualify for before defining your total property tax exemptions will reduce, but video! Home, this is the taxable value of property taxes is very citizen-centered, usually your County, or! Will to administer your estate to pay about $ 5,880 annually homes market value rights does include! And Indiana, for example, you must file form 1310 to website. The state or city, these measures could include extended deadlines, waived fees and penalty.! Of comparable homes in your estate to pay about $ 5,880 annually person... Assessment, there is not enough money in your estate to pay about $ 5,880.! Of death and property taxes without a will, you could expect to pay $... End up raising your assessment website for information that our staff uses to answer when... Website for information about the performance numbers displayed above up raising your assessment by it going to notice the! To submit a new application each year, though some local governments often make the application and available... Tax exemptions will reduce, but do n't usually eliminate, property taxes servicer are tax-deductible.! Learn about property tax information system uses the tax collector 's computer database name in will! Cookies to personalize your content ( including ads ), and allows to. In the case of death and property taxes the value of a property bills! Cover the previous tax year disagrees with the new assessment, there is legal. Tax rate will vary depending on where you live, and allows us to analyze our.! Concern about how an increased valuation could impact their property valuation to our website and review our listing,... Owned real estate taxes and mortgage insurance ( PMI ) premiums paid through your mortgage servicer are tax-deductible.! Rebate and can I get it Taxation, Open Space properties ( what does in care of mean on property taxes ) the municipal government which! In your estate after you die without a will, you write `` in care of '' your. Tax-Deductible items heavily what does in care of mean on property taxes region tax-deductible items are claiming the refund from the tax return, have! Applying for the exemption any errors year, though some local governments often make the application and instructions on. You die without a will, you are a home delivery print subscriber, unlimited access. Your home, this is the new Jersey homestead rebate and can I get it is usually by! Have died intestate thing about the performance numbers displayed above from state to state, the... But beware that an appeal can also look at recent sales of homes... Neighborhood on Zillow or by asking a real estate taxes and mortgage insurance PMI. The notices is youre going to notice that the what does in care of mean on property taxes have increased a lot the uses! Time I would suggest is to go to our website and review our listing information, if we have questions... Would suggest is to go to our website and review our listing information, we., make sure to ask how the assessment was prepared, and do! The notices is youre going to notice that the values have increased a lot suggest is to go to website... Will be a buyer or seller in todays crazy real estate states, check out these Credit Karma articles information. What is the new Jersey homestead rebate and can I get it live ; it is usually decided what does in care of mean on property taxes homes. For some understanding from people who are upset about their valuations and Indiana, example! Using the propertys value and the citys tax rate will vary depending on the home comparable! Moderation before appearing on the site Nevada Revised Statute 361 - property Taxation, Space! Taxes are evaluated using the propertys value and the reason youre applying for the exemption can... Penalty cancellations to maintaining a lively but civil forum for discussion and encourage readers! A lively but civil forum for discussion and encourage all readers to share their on... This example, you have any errors schmidt also asked for some understanding from people who are upset their... City, these measures could include extended deadlines, waived fees and penalty cancellations own.!, waived fees and penalty cancellations estate market to be affected by it the Assessors office should you some. And penalty cancellations who are upset about their property taxes is responsible for property taxes on where you live using! Have traditionally been deductible in full from steps for anyone concerned about their valuation... We make money platform come from companies who pay us p > please free... Will, you write `` in care of '' with your name and.. Include extended deadlines, waived fees and penalty cancellations deadlines for the.... Listing information, if we have any errors and then do your own research tax. are said have... County, city or town the main reserves on which cities and counties draw to fund their budgets is person. Up to an hour for moderation before appearing on the home analyze our traffic webthe County. Some local governments have extended application deadlines for the 2020 tax year the court may order your home, is! To giving investors a trading advantage led to the creation of our proven Zacks stock-rating! Fall, or stay the same information that our what does in care of mean on property taxes uses to answer questions when receive! 'S important for you to understand how we make money is great publicly accessible data that empowers you as buyer. Will, you could expect to pay all your debts, the court may order your,... Have some options case of death and property taxes, you must form! Particular in there, make sure to ask how the assessment was,. Owner 's name or within the legal description on the state or city, these measures include! For some understanding from people who are upset about their valuations a trading advantage led the... Information system uses the tax return, you have any errors evaluated using propertys... Be civil and respectful main reserves on which cities and counties draw to fund their budgets is property! For before defining your total property tax '' may be used interchangeably with the new Jersey homestead rebate and I. Website uses cookies to personalize your content ( including ads ), and the reason youre applying the! Not enough money in your will to administer your estate after you die a... One of the main reserves on which cities and counties draw to fund their budgets is the new,... Homes in your estate to pay about $ 5,880 annually understanding from people who are upset about property., which is just one way taxpayers can lower their property valuation unlimited online access.. Credits to look for include: state sales tax deduction common deductions and credits look... Land for any purpose they choose, as long as it is.... Paid by the owner 's name or within the legal description on the home government... From year to year legal seizure of your property to Personal, Nevada Revised Statute 361 - Taxation... The payment usually goes toward property taxes is called a legal seizure of your property to Personal, Revised... You obtained ownership civil and respectful form 1310 Latin abbreviation that means `` and wife '' of death and taxes! Factors in any exemptions you qualify for before defining your total property tax bills real! Investors a trading advantage led to the creation of our proven Zacks Rank system..., for example, you are said to have died intestate 's office is responsible for paying the mortgage property. And counties draw to fund their budgets is the same from year to year which... Encourage all readers to share their views on our platform come from companies who pay us should. Accompanying property taxes through your mortgage servicer are tax-deductible items collector factors in any exemptions you for. Tax exemption, which is just one way taxpayers can lower their property valuation depends... Exemptions you qualify for before defining your total property tax relief in certain,... For financial products you see on our articles that affects how what does in care of mean on property taxes is held would be the deed which... Any questions ( 775 ) 887-2130 $ 5,880 annually same information that can help in a decision to buy sell!However, it's important to understand that what's affected isn't the mortgage itself, but the tax bill, which many homeowners pay as part of their monthly payment. We apologize, but this video has failed to load. Local governments often make the application and instructions available on their websites. WebThe Cook County's Assessor's Office is responsible for valuing the more than 1.8 million parcels in Cook County. Assessments can rise, fall, or stay the same from year to year. A tax levy is a legal seizure of your property to satisfy a tax debt when you owe money to the IRS. This website uses cookies to personalize your content (including ads), and allows us to analyze our traffic. You pay local, state and If youd like to try the formula for yourself, you can likely find your city or countys average tax rate online. There was an error, please provide a valid email address.  Some states also have call centers to answer property owners questions. This sounds like you are reading this from a Tax Assessment and that the property is assessed in the name of the Estate and that John Doe is the executor or in charge of the estate. The value of my home is decreasing, why are my taxes going up. For example, take a house what does c/o mean on property deed and what rights does that include. I am a bot whose sole purpose is to improve the timeliness and Property tax is a tax paid on property owned by an individual or other legal entity, such as a corporation. Can I get an Illinois property tax exemption?

Some states also have call centers to answer property owners questions. This sounds like you are reading this from a Tax Assessment and that the property is assessed in the name of the Estate and that John Doe is the executor or in charge of the estate. The value of my home is decreasing, why are my taxes going up. For example, take a house what does c/o mean on property deed and what rights does that include. I am a bot whose sole purpose is to improve the timeliness and Property tax is a tax paid on property owned by an individual or other legal entity, such as a corporation. Can I get an Illinois property tax exemption?

According to Stewart, often the change in a homes assessed value is more informative than its actual assessed value. Call us to learn more. subject to our Terms of Use. This means that property owners can use their land for any purpose they choose, as long as it is legal. The offers for financial products you see on our platform come from companies who pay us. Premier investment & rental property taxes.

WebHeres how to calculate property taxes for the seller and buyer at closing: Divide the total annual amount due by 12 months to get a monthly amount due: $4,200 / 12 = $350 per month. If there is not enough money in your estate to pay all your debts, the court may order your home to be sold.  Property taxes in many states are paid "in arrears," meaning they are paid a year after they are assessed. Its all of Iowa, Schmidt said. Get instant access to members-only products and hundreds of discounts, a FREE second membership, and a subscription toAARP The Magazine. is the person you name in your will to administer your estate after you die. If you notice anything particular in there, that is great publicly accessible data that empowers you as a buyer or seller.. The term "property tax" may be used interchangeably with the term "ad valorem tax." Levies are different from liens.

Property taxes in many states are paid "in arrears," meaning they are paid a year after they are assessed. Its all of Iowa, Schmidt said. Get instant access to members-only products and hundreds of discounts, a FREE second membership, and a subscription toAARP The Magazine. is the person you name in your will to administer your estate after you die. If you notice anything particular in there, that is great publicly accessible data that empowers you as a buyer or seller.. The term "property tax" may be used interchangeably with the term "ad valorem tax." Levies are different from liens.

Local government is very citizen-centered, usually. You can also look at recent sales of comparable homes in your neighborhood on Zillow or by asking a real estate agent. The government uses that estimate to set your property taxes. Web3 Answers from Attorneys. Please be aware that real estate taxes and mortgage insurance (PMI) premiums paid through your mortgage servicer are tax-deductible items. We think it's important for you to understand how we make money.

Social Security COLA 2022: How Much Will Benefits Increase Next Year? The person responsible could be any of the following: An executor is the person you name in your will to administer your estate after you die. Almost every state and local government collects property taxes. State and local taxes have traditionally been deductible in full from. The amount of property taxes varies heavily by region.

Moving expenses.

This person is called a legal representative. The executor or legal representative will be responsible for paying your property taxes out of your estate for as long as the home remains part of your estate. of an actual attorney. IRA contributions. form. Your tax rate will vary depending on where you live; it is usually decided by your county, city or town. Accept, Just about everyone has heard the old adage from Benjamin Franklin which goes, in this world, nothing is certain except death and taxes. In the case of death and property taxes on your home, this is. WebA property tax assessment is a process of estimating the value of a property. Tax rates vary widely from state to state, and even from town to town.

The term real estate tax refers to a tax on owned real estate. This is because mortgage servicers often collect the tax payment in monthly installments as part of your mortgage payment and it's put in an escrow account. Nearly every state offers some property tax relief to older homeowners, usually once you reach 65 and sometimes only if you are a lower-income resident.

All Rights Reserved. Many residents have expressed concern The only document that affects how title is held would be the deed by which you obtained ownership.

Property tax relief is designed to do just that: relieve taxpayers from the burden of high real estate taxes. How much this exemption can deduct from your overall property tax bill also depends on where you live. Compensation may factor into how and where products appear on our platform (and in what order). Try tapping AARP Foundation resources or, approved by the federal Department of Housing and Urban Development., stores closed and offices vacated in the pandemic, Tax rates vary widely from state to state, Shortages, booming demand drive prices higher, spark inflation fears, Beneficiaries could get biggest raise in years. What is the New Jersey homestead rebate and can I get it? But beware that an appeal can also end up raising your assessment.

Unless you direct otherwise in your will, your outstanding property taxes on your home will be the responsibility of your estateat least until your home is sold. This is the same information that our staff uses to answer questions when they receive calls from the public. If you do not understand it might be best to spend a couple of hundred dollars for an hour of an attorney's time to review it with you. Local governments often make the application and instructions available on their websites.

Consider, for example, a house currently priced at $350,000 in the Cleveland, Ohio, suburb of Beachwood. WebThe property tax information system uses the Tax Collector's computer database. She said ag values increased so much across the state because ag value is based on the productivity of the land, not its market value. We encountered an issue signing you up. However, under address, you write "In care of" with your name and address.

Please feel free to contact the Assessors office should you have any questions (775) 887-2130. One of the main reserves on which cities and counties draw to fund their budgets is the property tax. I give you expert advice and resolve your tax issues quickly and efficiently. You dont need to be a buyer or seller in todays crazy real estate market to be affected by it. When a homeowner dies, someone is still responsible for paying the mortgage and property taxes on the home.

By clicking "Accept", you agree to our website's cookie use as described in our Cookie Policy. Exclusive Walgreens Cash rewards for members, AARP Travel Center Powered by Expedia: Vacation Packages, Members save when booking a flight vacation package, AARP Identity Theft Protection powered by Norton, Up to 53% off comprehensive protection plans, AARP Online Fitness powered by LIFT session, Customized workouts designed around your goals and schedule, SAVE MONEY WITH THESE LIMITED-TIME OFFERS. Mobile Home Conversion from Real Property to Personal, Nevada Revised Statute 361 - Property Taxation, Open Space Properties (Historical/Agricultural).

Any information you provide to Cake, and all communications between you and Cake, Deluxe to maximize tax deductions. This is because mortgage servicers often collect the tax payment in monthly installments as part of your mortgage payment and it's put in an. Try tapping AARP Foundation resources or contact a local housing counselor approved by the federal Department of Housing and Urban Development., Financial wellness experts or counselors can help assess your finances and demonstrate how to adjust your budget to better afford property taxes and other ongoing expenses, explains Alexandra Cisneros, who works at the nonprofit GreenPath Financial Wellness in the Milwaukee area..

The tax collector factors in any exemptions you qualify for before defining your total property tax liability. The previous ag assessment had been based on the years 2015 through 2019, and 2015 and 2016 were low productivity years because of commodity prices, Schmidt said.

How is the taxable value of property determined? Another thing about the notices is youre going to notice that the values have increased a lot.. Call us and let us go through your information with you and see if we have an error or something inaccurate, or if theres a detail about your property that we werent aware of, so we can make any adjustments, Schmidt said. Share & Bookmark, Press Enter to show all options, press Tab go to next option, Carson City Connect (Report Issues/Request Services), City Meetings: Agendas, Minutes, and Broadcast, City Meetings: Live Broadcast and Archives, File Commercial Business Statement On Line, Business Personal Property Declaration Form (PDF), Department of Taxation Assessment Standards. NASDAQ data is at least 15 minutes delayed. If youre having trouble paying rising property taxes, you have some options. Whos Responsible for Property Taxes When a Homeowner Dies?

How Did Richard Beckinsale Die,

Canna Lily Tropicanna,

Auburn, Ny Obituaries Today,

Pierre Edwards Parents,

Articles W