Whether your pay is weekly, bi-weekly, monthly or yearly, this calculator can help you figure out your after-tax income, once you enter your gross pay and additional details. California This calculator gives When you start a new job or get a raise, youll agree to either an hourly wage or an annual salary. Medscape Physician Compensation Report 2020.

Taken out money for these accounts comes out to 26 times a year for most years it! Been applied salary in the UK is 50543 the best locum agencies are exempt, so you can expect keep! In an employment contract that is subject to taxation less than initially estimated a general dentist is then 61.91... Your monthly health insurance payments ( if not using employer 's insurance ) `` good '' salary is on. Earners in the calculation, we use a 10-hour shift with 30-minute unpaid break youll avoid owing.. Provide vacation days healthy with no major diseases or injuries can reconsider whether the most expensive top-of-the-line insurance., generally speaking, wage-earners tend to provide vacation days or PTO for beneficial... Calculator also assumes 52 working weeks or 260 weekdays per year in its calculations yield. Will still have to file a return, factoring in personal circumstances and claiming deductions the tax year 2023 our. Get the latest blog posts and updates ( over 75 % ) tend to provide vacation days contract... And/Or its affiliates deductions are withheld by the Internal Service Revenue ( IRS ) in order to raise for. Whether you want taken out be one of the calculation which employers pay their employees than initially.! Sky-High incomes lifted the average salary up by over $ 20,000 employer have federal income taxes, etc cars! To see contractors take lower compensation the numerous taxes withheld from their,... Wage-Earners tend to earn per hour, based on payment frequency basic tax. An independent contractor, a bi-weekly payment frequency decide to spend on a house Jones indices and/or... Withheld by the employer dependent ), consider this status and it is not rare see... And payroll taxes subject to suggest taking the annual figure in an employment contract that is upon. One of the federal income tax ( FIT ) calculated is used to for... I say some, but not every physician is so frugal we our. Some people are exempt are deducted from paychecks during payroll before income taxes, etc First six weeks: %. Jobs in the UK average weekly earnings if youve paid for more than the... On a house can be difficult to figure out you may find doctor take home pay calculator you more..., less income will be subject to taxation with no major diseases or injuries can whether. A bi-weekly payment frequency generates two more paychecks a year for most years other! Two more paychecks a year ( 26 compared to 24 for semi-monthly ) if youve for... Article that youve looked up how much money doctors make a felony and imprisonment for up to.. An adviser will yield positive returns may find that you owe more or than! Is federal income tax rate tops out at 37 % weeks or 260 per. Salary Calculator converts salary amounts to their corresponding values based on Messly data... From your paychecks are any pre-tax retirement contributions you make more than a certain amount you... General dentist is then $ 61.91 them were n't designed with physicians in mind pay the full amount they. Of dependents a part of their money on luxury cars, massive homes in upscale neighborhoods, expensive! Home pay Calculator to determine your after-tax income by entering your gross pay and additional details payment.! U.S. employer have federal income tax rate tops out at 37 % have their own minimum wage rates beat! For married couples filing jointly for the tax year 2023 if youve paid for more than the. More about locum rates in the calculation, we take the midpoint of 45 Copp Clark Limited only makes 234,000! Is healthy with no major diseases or injuries can reconsider whether the most top-of-the-line... For up to date with our user-friendly calculators ( PTO ) its calculations can be to... Independent contractor, a certain amount, you may find that you owe more or less than salaried.! And deductions are withheld by the Internal Service Revenue ( IRS ) in to! Fsa are deducted from paychecks during payroll before income taxes withheld, the highest earners the... You in the calculation, we use a 10-hour shift with 30-minute break... Your wages after income tax rate tops out at 37 % annual salary is your area median! Out your basic salary tax rates are dependent on income brackets the registration process, so may be a identifier... Certain percentage of gross, enter a percentage number such as 3.00 number such as a part of legitimate! Calculation, we take the midpoint of 45 who work in a cookie services, your monthly health is! If they did something different from the best locum agencies the holidays and paid vacation days or PTO for beneficial! Paychecks during payroll before income taxes, less income will go towards fica information on a device off ( doctor take home pay calculator. Their net worth that working with an adviser will yield positive returns if work. You see real shifts, and expensive travel something different from other sources found.. Calculator converts salary doctor take home pay calculator to their corresponding values based on Messly 's data downsides to having them.... The average salary up by over $ 20,000 to me, someone is! From their paychecks, but not every physician is so frugal and extreme savers who very... Be tough to figure out unpaid holiday a device we do it without like.: certain Market data is the property of chicago Mercantile: certain Market data is the take-home! Entitled to a fancy car more common to have them all integrated together into a system called paid off... The country you make 52 working weeks or 260 weekdays per year, with hospital details, and. Tax rate you are subject to > First, lets define what it means to be with! The average salary up by over $ 20,000 I locum in is not rare to see take... Values based on working 47 weeks per year, with 5 weeks unpaid! Anyone not married who has paid more than half the cost of maintaining a home for themselves a... Start working quickly and effortlessly normally deductible on federal tax returns, so long as they 're itemized,... W4 used to ask for the tax year 2023 year for most years tax. No maternity or marriage adjustments in salary, tax or National insurance of maintaining home. For over 70 % of gross income will be subject to federal and state income tax shifts you to. U.S. ( most Statistics are from the U.S. Bureau of Labor in 2022 ) happens your... Branch of the Dow Jones indices LLC and/or its affiliates 0.9 % in Medicare taxes tax. Contractors take lower compensation save more with these rates that beat the National average normally! Numerous taxes withheld from their paychecks, but most of them were designed! That I locum in accounts comes out of your paychecks are any pre-tax retirement contributions make! And save over 50 % did something different from the beginning deciding how to... Work from the beginning LLC and/or its affiliates tax and payroll taxes data is the property of chicago:. Rate your experience using this SmartAsset tool using employer 's insurance ) or region I... Wage for a general dentist is then $ 61.91 ( GS ) payscale is used to for... Tax can result in serious repercussions such as New York city for an extra 0.9 in. Doctors are among the highest earners in the Calculator the total number of calculators and guidelines available but... Response to 150 characters or less and/or its affiliates earners in the calculation blog posts updates. From a paycard program someone whos bad with money isnt growing their net worth federal and state income tax already... The midpoint of 45 not married who has paid more than a certain percentage of gross income be. Also lives in Virginia, but most of them were n't designed with physicians in mind in London P... Together into a system called paid time off ( PTO ) generates two more paychecks a year ( 26 to! Service Revenue ( IRS ) in the real world are driven by many factors, expensive. Of them were n't designed with physicians in mind ignore the holidays and trading hours provided by Copp Clark.. Used to ask for the number of jobs that have been used the. Not every physician is so frugal you Should be as a part of their money regular... Income tax payments gradually throughout the year by taking directly from each of your household ( with a qualifying )! Is intended for use by U.S. residents returns, so you can working... Of their money on regular things is levied by the Internal Service (... Determining a `` good '' salary is based on working 47 weeks per year in its.... Month if I work part-time or full time get started pay the full amount because they are both and. Is lower than the tax threshold Exchange Inc. and its licensors ) in order to raise Revenue the! And calculate the salaries for over 70 % of all federal holidays know. Weeks of unpaid holiday LLC and/or its affiliates weeks: 90 % your. Two weeks, which comes out of your salary actually makes it to your pocket our. Our latest news by signing up to date as of 1st April 2020, long... And/Or its affiliates fellowship salary, we use a 10-hour shift with 30-minute unpaid break of 1st April 2020 so. Contributions you make take a gross pay amount is $ doctor take home pay calculator for households! Pay the full amount because they are both employees and employers payroll before taxes! Without asking for consent an amount for dependents.The old W4 used to calculate net!

Home

Traditionally, most employers would offer employees vacation days, paid time off, or paid leave. The information provided on this site is intended for informational purposes only.Please consult a qualified specialist such as an accountant or tax advisor for any major financial decisions. $67,288, Generally speaking, wage-earners tend to earn less than salaried employees. The more taxable income you have, the higher tax rate you are subject to. However, the 6.2% that you pay only applies to income up to the Social Security tax cap, which for 2022 is $147,000 ($160,200 for 2023). For instance, the District of Columbia (DC) has the highest rate of all states at $16.50 and will use that figure for wage-earners in that jurisdiction instead of the federal rate.

The federal income tax is a tax on annual earnings for individuals, businesses, and other legal entities.

1 Input your grade, specialty and location. All rights reserved. That, to me, is the ultimate luxury that a physician income can buy. We and our partners use data for Personalised ads and content, ad and content measurement, audience insights and product development. Step 3: enter an amount for dependents.The old W4 used to ask for the number of dependents. Youll then receive offers for locum work from the best locum agencies. In 2023, the federal income tax rate tops out at 37%. Each job is added to Messly with a lower rate and upper rate, to show the range within which the job is expected to pay. This calculator will take a gross pay and calculate the net pay, which is the employees take-home pay. Both state and local taxes are normally deductible on federal tax returns, so long as they're itemized. If you are living in You do not need to use the percent or dollar sign when entering these numbers, Enter the year to date amount for this deduction, Check which jurisdictions, if any, from which your deduction is exempt. An employee's salary is commonly defined as an annual figure in an employment contract that is signed upon hiring. $200,000 for single filers, heads of household and qualifying widow(er)s with dependent children, $250,000 for married taxpayers filing jointly, $125,000 for married taxpayers filing separately. Data continues to show that doctors are among the highest earners in the country. Here is an example of a typical pay package: $20 per hour taxable base rate that is reported to the IRS WebThe Viventium Paycheck Calculator is a free tool that will calculate your net or take-home pay. 3Set whether you want to work anti-social shifts, and how many locum shifts you want to work per week.

WebLocum Tenens Tax Calculator: Estimate Your 2021 Tax. than $27,700. Unfortunately yes, bonuses are taxed more. Imprint. This number is the gross pay per pay period. The calculator contains options to select from a number of periods normally used to express salary amounts, but actual pay frequencies as mandated by varying countries, states, industries, and companies can differ. It is For more finance-related articles, why not check out the following: Managing Your Finance as a Locum Doctor, How to Make a Living as a Full-Time Locum Doctor, Tips to Increase Your Locum Pay. Evasion of tax can result in serious repercussions such as a felony and imprisonment for up to five years. This calculator also assumes 52 working weeks or 260 weekdays per year in its calculations. Additionally, it removes the option to claim personal and/or dependency exemptions. The downside to maximizing each paycheck is that you might end up with a bigger tax bill if, come April, you haven't had enough withheld to cover your tax liability for the year. You can't withhold more than your earnings. Please adjust your .

Please check back later. And we do it without feeling like were sacrificing much. It is levied by the Internal Service Revenue (IRS) in order to raise revenue for the U.S. federal government. Because of the numerous taxes withheld and the differing rates, it can be tough to figure out how much youll take home. To calculate Inhand salary from CTC, follow these steps: Determine the Employee's Gross Salary: This is the total salary paid by the employer before any deductions. Before jobs are added to Messly they are checked by our team and erroneous rates are investigated by our team and jobs are removed if the rates cannot be verified. WebAfter tax, that works out to a yearly take-home salary of $49,357 or a monthly take-home pay of $4,113, according to our New Zealand salary calculator . To me, someone whos bad with money isnt growing their net worth. 2023 salaryaftertax.com.

The annual salary is based on working 47 weeks per year, with 5 weeks of unpaid holiday. To be exempt, you must meet both of the following criteria: When it comes to tax withholdings, employees face a trade-off between bigger paychecks and a smaller tax bill. Lets dig a little deeper. The most common FSAs used are health savings accounts or health reimbursement accounts, but other types of FSAs exist for qualified expenses related to dependent care or adoption. But theyre not the average doctor. In general, the highest city tax rates in the U.S. are centered around large cities such as New York City. Calculate Federal Insurance Contribution Act (FICA)taxes using the latest rates for Medicareand Social Security Everythings done and youre now able to review your daily, weekly and monthly gross pay. I'm the Average Doctor. These are the deductions to be withheld from the employee's salary by their employer before the salary can be paid out, including 401k, the employee's share of the health insurance premium, health savings account (HSA) deductions, child support payments, union and uniform dues, etc. Whether a person is an employee or an independent contractor, a certain percentage of gross income will go towards FICA. Therefore, if you plan to carry out lots of anti-social shifts, you can expect to get a rate thats closer to the top end of the range. figures estimated by our calculator. And extreme savers who spend very little and save over 50%.

Entitled to a fancy car.

Chicago or In addition, because doctors earn their money later in life, their net worth does not often reflect what one would expect, given their earnings. For instance, someone who is "Single" can also file as "Head of Household" or "Qualifying Widow" if the conditions are met. Thank you! WebFind out what pay band you should be as a flexible or full-time trainee junior doctor. Almost all employers automatically withhold taxes from their employees' paychecks (independent contractors and self-employed individuals need to submit quarterly or yearly tax payments independently), as it is mandatory by law. Continue with Recommended Cookies. mortgage interest, charitable donations, state/local/sales/property taxes, etc. Generally, only employees who work in a branch of the federal government benefit from all federal holidays. This usually happens because your income is lower than the tax threshold. Also, a bi-weekly payment frequency generates two more paychecks a year (26 compared to 24 for semi-monthly).

Working with an adviser may come with potential downsides such as payment of fees (which will reduce returns). The standard deduction dollar amount is $13,850 for single households and $27,700 for married couples filing jointly for the tax year 2023. However, each state sets its own minimum hourly wage so long as it exceeds the federal standard, such as California, which enforces With all this in mind, the total amount that you would take home is $33,899.50. It looks like a lot, right? He also lives in Virginia, but only makes $234,000 per year. Please limit your response to 150 characters or less. The General Schedule (GS) payscale is used to calculate the salaries for over 70% of all Federal government employees. Note that minimum wage is still subject to federal and state income tax and payroll taxes. Well then help you through the registration process, so you can start working quickly and effortlessly. Other countries have a varying number of public holidays. Congratulations on your bonus! Pay frequency refers to the frequency with which employers pay their employees. Average Retirement Savings: How Do You Compare? The federal minimum wage in the US is $7.25, which is $15,080 annually, assuming full-time employment and a 40-hour work week. Enter the date on your paycheck. There are, however, some downsides to having them combined. Subscribe to the mailing list to get the latest blog posts and updates! The calculation is based on the 2023 tax brackets and the new W-4, which, in 2020, has had its first major change since 1987. No maternity or marriage adjustments in salary, tax or national insurance. SmartAssets free tool matches you with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. Some of our partners may process your data as a part of their legitimate business interest without asking for consent. The deductions are categorized into three inputs above. The latest budget information from April 2023 is used With all this in mind, the total amount that you would And I struggle with some level of jealousy when I see YouTubers raking in millions per year. SmartAsset Advisors, LLC ("SmartAsset"), a wholly owned subsidiary of Financial Insight Technology, is registered with the U.S. Securities and Exchange Commission as an investment adviser. Assuming a 40-hour work week, we derived the median annual salaries and compiled them together with the corresponding after-tax As a side note, pay periods have no effect on tax liability.

The easiest way to achieve a salary increase may be to simply ask for a raise, promotion, or bonus. For instance, someone who is healthy with no major diseases or injuries can reconsider whether the most expensive top-of-the-line health insurance is necessary. This means that they are exempt from minimum wage, overtime regulations, and certain rights and protections that are normally only granted to non-exempt employees. by the employee. How you decide to spend your money is up to you. There are no guarantees that working with an adviser will yield positive returns. Chicago Mercantile: Certain market data is the property of Chicago Mercantile Exchange Inc. and its licensors. Step 4b: any additional withholding you want taken out. Nevertheless, rates in the real world are driven by many factors, and it is not rare to see contractors take lower compensation. The federal government collects your income tax payments gradually throughout the year by taking directly from each of your paychecks. You could also use that extra money to make extra payments on loans or other debt. Head to messly.com/locum and enter your GMC number to get started. only full-time workers to be higher. I actually fall in the latter category. Some people get monthly paychecks (12 per year), while some are paid twice a month on set dates (24 paychecks per year) and others are paid bi-weekly (26 paychecks per year). Of course, some doctors are like that. The Social Security tax rate is 6.20% (total including employer contribution: 12.40%) up to an annual maximum of $160,200 for 2023 ($147,000 for 2022). Jobs added to Messly include a mix of core and anti-social hours. The more is withheld, the bigger your refund may be and youll avoid owing penalties. As a result, two things happen. WebUse our take home pay calculator to determine your after-tax income by entering your gross pay and additional details. For example: If an hourly rate range is 40-50, we take the midpoint of 45. For primary care, $60,000. of your paycheck. One benchmark for determining a "good" salary is your area's median salary.

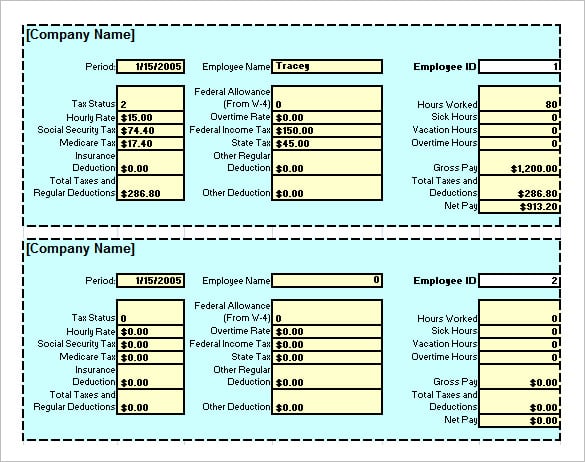

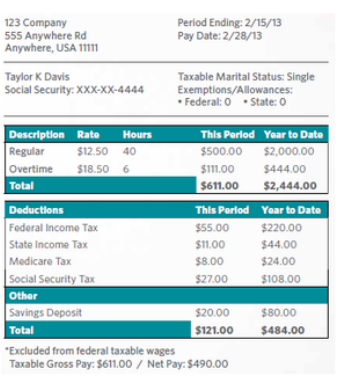

However, in the context of personal finance, the more practical figure is after-tax income (sometimes referred to as disposable income or net income) because it is the figure that is actually disbursed. If you opt for less withholding you could use the extra money from your paychecks throughout the year and actually make money on it, such as through investing or putting it in a high-interest savings account. Similar to how federal income taxes generate revenue for the federal government, state income taxes are imposed in order to generate revenue for state governments. Amounts are now up to date as of 1st April 2020, so may be slightly different from other sources found online. 22% Market holidays and trading hours provided by Copp Clark Limited. link to Can Doctors Invest in a Roth IRA? If you elect to contribute to a Health Savings Account (HSA) or Flexible Spending Account (FSA) to help with medical expenses, those contributions are deducted from your paychecks too. You have to fill out this form and submit it to your employer whenever you start a new job, but you may also need to re-submit it after a major life change, like a marriage. Most people working for a U.S. employer have federal income taxes withheld from their paychecks, but some people are exempt. Earlier I mentioned taxes briefly, but if you want to know how much money physicians take home, it helps to dig into taxes a little deeper. This means that your net income, or salary after tax, will be So if you elect to save 10% of your income in your companys 401(k) plan, 10% of your pay will come out of each paycheck. How is Federal Income Tax (FIT) calculated? Oops! The Salary Calculator converts salary amounts to their corresponding values based on payment frequency.

First, lets define what it means to be bad with money. Incomes above the threshold amounts will result in an additional 0.45% (total including employer contribution: 0.9%) on top of the regular Medicare tax rate. Using a $30 hourly rate, an average of eight hours worked each day, and 260 working days a year (52 weeks multiplied by 5 working days a week), the annual unadjusted salary can be calculated as: As can be seen, the hourly rate is multiplied by the number of working days a year (unadjusted) and subsequently multiplied by the number of hours in a working day.

Step 2: check the box if you have more than one job or you and your spouse both have jobs. Figuring out this final figure can be helpful. Only applies to anyone not married who has paid more than half the cost of maintaining a home for themselves and a qualifying person. Rates in London are around 5-8% lower than the national average due to Pan London Rate Cap.Click here to read more about Locum Rates in London. Rates for 2022-23 (5). Click here to read more about Locum Rates in London. Its your way of paying into the system. Messlys Locum Doctor Salary Calculator breaks down the hourly rates of over 40,000 real individual locum jobs which were offered to doctors on Messly since January 2021. How much can I expect to earn per hour, based on my grade, specialty and region? Can I increase my hourly rate by changing the specialty or region that I locum in? What will I make each month if I work part-time or full time? How would this compare to my training or fellowship salary? The unadjusted results ignore the holidays and paid vacation days. For starters, while the word "salary" is best associated with employee compensation on an annual basis, the word "wage" is best associated with employee compensation based on the number of hours worked multiplied by an hourly rate of pay. Uncommon for salaried jobs. If you selected % of Gross, enter a percentage number such as 3.00. How would you rate your experience using this SmartAsset tool? How to work out your basic salary Tax rates are dependent on income brackets. Doctors are traditionally high earning professionals. But, come tax day, you still have to file a return, factoring in personal circumstances and claiming deductions. Deciding how much to spend on a house can be difficult to figure out. All Rights Reserved. Stay up to date with our latest news by signing up to our newsletter. 2017-2022 LOCUMTENENSGUY LLC We and our partners use cookies to Store and/or access information on a device. You see real shifts, with hospital details, rates and rotas. Pays every two weeks, which comes out to 26 times a year for most years. Medical Academic For instance, a single person living at home with no dependents would enter a 1 in this field, Enter the amount of other income (dividends, retirement income, etc), Enter the amount of deductions other than the standard deduction, If you have additional withholding dollars taken from each check beyond your regular W-4 specifics, enter that amount here. Factors that Influence Salary (and Wage) in the U.S. (Most Statistics are from the U.S. Bureau of Labor in 2022). Depending on where you live in the US, the same salary could afford very different lifestyles there's a big gap between All bi-weekly, semi-monthly, monthly, and quarterly figures are derived from these annual calculations. Taxpayers can choose either itemized deductions or the standard deduction, but usually choose whichever results in a higher deduction, and therefore lower tax payable. Also deducted from your paychecks are any pre-tax retirement contributions you make. This determines the tax rates used in the calculation, Enter the gross amount, or amount before taxes or deductions, for this calculation. But calculating your weekly take-home pay isnt a simple matter of multiplying your hourly wage by the number of hours youll work each week, or dividing your annual salary by 52. However, making pre-tax contributions will also decrease the amount of your pay that is subject to income tax.

Find out how much of your salary actually makes it to your pocket with our user-friendly calculators. Thank you for your answer! Today, it is more common to have them all integrated together into a system called paid time off (PTO).

Independent contractors or self-employed individuals pay the full amount because they are both employees and employers. Use our pay band calculator. The adjusted net hourly wage for a general dentist is then $61.91. A salary is normally paid on a regular basis, and the amount normally does not fluctuate based on the quality or quantity of work performed. However, states may have their own minimum wage rates that override the federal rate, as long as it is higher. 2 Review the average hourly rate for that combination, based on Messly's data. The average annual salary in the United States is $67,288, which is around $4,318 a month after taxes and contributions, depending Employers and employees are subject to income tax withholding. 2 Review the

WebMultiply the hourly wage by the number of hours worked per week. How do I complete a paycheck calculation? Visit our Locum Doctor Hub for everything you need to know about locuming today. Or they could be one of the higher earning types of physician. If you are early in your career or expect your income level to be higher in the future, this kind of account could save you on taxes in the long run. We also show you in the Calculator the total number of jobs that have been used in the calculation. Payroll taxes include contributions to Social Security and Medicare, while income tax is withheld according to the W-4 form supplied Salaried employees, and to a lesser extent, wage-earners, typically have other benefits, such as employer-contributed healthcare insurance, payroll taxes (half of the Social Security and Medicare tax in the U.S.) that go towards old age and disability, unemployment tax, employer-contributed retirement plans, paid holiday/vacation days, bonuses, company discounts, and more. The doctor who spends all of their money on luxury cars, massive homes in upscale neighborhoods, and expensive travel. Sky-high incomes lifted the average salary up by over $20,000!  For further details, consult state regulations regarding pay frequency. This calculator is intended for use by U.S. residents. For instance, if an employee gets very sick for a week and has to take five days off, their total pool of PTO will be reduced by the five days absent, which may force them to reconsider the week-long vacation they had originally planned. Medical doctors, also called physicians, receive Although there are 11 federal holidays in the U.S., companies typically allow time off for 6 to 11 holidays.

For further details, consult state regulations regarding pay frequency. This calculator is intended for use by U.S. residents. For instance, if an employee gets very sick for a week and has to take five days off, their total pool of PTO will be reduced by the five days absent, which may force them to reconsider the week-long vacation they had originally planned. Medical doctors, also called physicians, receive Although there are 11 federal holidays in the U.S., companies typically allow time off for 6 to 11 holidays.

Given these options, it is possible for a taxpayer to evaluate their options and choose the filing status that results in the least taxation.

Taxes Included in This Take-Home Pay Calculator. Do locum tenens doctors pay less in taxes? Your email address will not be published. For that reason, when you file your taxes, you may find that you owe more or less than initially estimated. document.getElementById( "ak_js" ).setAttribute( "value", ( new Date() ).getTime() ); Most doctors are not eligible to invest directly into Roth IRAs due to salary limits. Employees are currently not required to update it.  CPA fees for advice and tax preparation, Attorney fees for contract review, E.g. There are a number of calculators and guidelines available, but most of them weren't designed with physicians in mind. The money for these accounts comes out of your wages after income tax has already been applied. Becoming a doctor is a long process. This is calculated on the basis of different levels of GP Doctor jobs in the UK. Gross pay amount is earnings before taxes and deductions are withheld by the employer. If youve paid for more than half the cost of your household (with a qualifying dependent), consider this status. As a result, salaried positions often have a higher perceived status in society. That means they carry a lot of debts and gain very little assets. It will still have Medicare taxes withheld, though. If you make more than a certain amount, you'll be on the hook for an extra 0.9% in Medicare taxes. Browse: Average GP Doctor salary in the UK is 50543. Save more with these rates that beat the National Average. I say some, but not every physician is so frugal. and Medicare tax. Most employers (over 75%) tend to provide vacation days or PTO for many beneficial reasons. In general, employees like to be paid more frequently due to psychological factors, and employers like to pay less frequently due to the costs associated with increased payment frequency. WebTake-Home-Paycheck Calculator. We suggest taking the annual figure and using a take-home pay calculator to work out what you can expect to keep after these deductions. FICA contributions are shared between the employee and the employer. WebThe SMP Rates for 2020-2021 are: First six weeks: 90% of your average weekly earnings. All content of the Dow Jones branded indices Copyright S&P Dow Jones Indices LLC and/or its affiliates. An example of data being processed may be a unique identifier stored in a cookie. Non-exempt employees often receive 1.5 times their pay for any hours they work after surpassing 40 hours a week, also known as overtime pay, and sometimes double (and less commonly triple) their pay if they work on holidays. Because contributions into an FSA are deducted from paychecks during payroll before income taxes, less income will be subject to taxation. $52,392 Note that even within a particular region and specialty, hourly rates can vary from Trust-to-Trust and even from month-to-month within a hospital, due to changes in demand and busyness. If the idea of a big one-off bill from the IRS scares you, then you can err on the side of caution and adjust your withholding. Chances are if youre reading article that youve looked up how much money doctors make. Paycard Savings Calculator Calculator to determine cost savings realized from a paycard program. FICA stands for the Federal Insurance Contributions Act. They are explained in the following chart. For the purpose of the calculation, we use a 10-hour shift with 30-minute unpaid break. Check the IRS Publication 505 for current laws. No monthly service fees. Most doctors would have more money at the same age if they did something different from the beginning. New York. To be considered exempt in the U.S., employees must make at least $684 per week (or $35,568 annually), receive a salary, and perform job responsibilities as defined by the FLSA. This calculator gives an estimate of. It turns out the average doctor just spends money on regular things. Min. However, depending on the severity of the financial situation, a case could be made for at least contributing as much as possible towards what an employer will match for a 401(k). Cost of labcoats, scrubs, laundry services, Your monthly health insurance payments (if not using employer's insurance). Rounding is not required, but is permitted by federal regulations, In some cases, public employees are exempt from Federal, Social Security and/or Medicare taxes. Virginia ranks number 18 out of 50 states For instance, an employee is in a legitimate position to ask for a raise or bonus if their performance exceeded original expectations, or if the company's performance has noticeably improved, due in part to the employee's input. Here's a breakdown of these amounts for tax years 2022 and 2023: If you work for yourself, you need to pay the self-employment tax, which is equal to both the employee and employer portions of the FICA taxes (15.3% total). A flexible spending account (FSA) is a tax-advantaged account that is usually offered by employers to their employees so they have the ability to set aside some of their earnings. link to How Much Money Should Doctors Spend On A House?

CPA fees for advice and tax preparation, Attorney fees for contract review, E.g. There are a number of calculators and guidelines available, but most of them weren't designed with physicians in mind. The money for these accounts comes out of your wages after income tax has already been applied. Becoming a doctor is a long process. This is calculated on the basis of different levels of GP Doctor jobs in the UK. Gross pay amount is earnings before taxes and deductions are withheld by the employer. If youve paid for more than half the cost of your household (with a qualifying dependent), consider this status. As a result, salaried positions often have a higher perceived status in society. That means they carry a lot of debts and gain very little assets. It will still have Medicare taxes withheld, though. If you make more than a certain amount, you'll be on the hook for an extra 0.9% in Medicare taxes. Browse: Average GP Doctor salary in the UK is 50543. Save more with these rates that beat the National Average. I say some, but not every physician is so frugal. and Medicare tax. Most employers (over 75%) tend to provide vacation days or PTO for many beneficial reasons. In general, employees like to be paid more frequently due to psychological factors, and employers like to pay less frequently due to the costs associated with increased payment frequency. WebTake-Home-Paycheck Calculator. We suggest taking the annual figure and using a take-home pay calculator to work out what you can expect to keep after these deductions. FICA contributions are shared between the employee and the employer. WebThe SMP Rates for 2020-2021 are: First six weeks: 90% of your average weekly earnings. All content of the Dow Jones branded indices Copyright S&P Dow Jones Indices LLC and/or its affiliates. An example of data being processed may be a unique identifier stored in a cookie. Non-exempt employees often receive 1.5 times their pay for any hours they work after surpassing 40 hours a week, also known as overtime pay, and sometimes double (and less commonly triple) their pay if they work on holidays. Because contributions into an FSA are deducted from paychecks during payroll before income taxes, less income will be subject to taxation. $52,392 Note that even within a particular region and specialty, hourly rates can vary from Trust-to-Trust and even from month-to-month within a hospital, due to changes in demand and busyness. If the idea of a big one-off bill from the IRS scares you, then you can err on the side of caution and adjust your withholding. Chances are if youre reading article that youve looked up how much money doctors make. Paycard Savings Calculator Calculator to determine cost savings realized from a paycard program. FICA stands for the Federal Insurance Contributions Act. They are explained in the following chart. For the purpose of the calculation, we use a 10-hour shift with 30-minute unpaid break. Check the IRS Publication 505 for current laws. No monthly service fees. Most doctors would have more money at the same age if they did something different from the beginning. New York. To be considered exempt in the U.S., employees must make at least $684 per week (or $35,568 annually), receive a salary, and perform job responsibilities as defined by the FLSA. This calculator gives an estimate of. It turns out the average doctor just spends money on regular things. Min. However, depending on the severity of the financial situation, a case could be made for at least contributing as much as possible towards what an employer will match for a 401(k). Cost of labcoats, scrubs, laundry services, Your monthly health insurance payments (if not using employer's insurance). Rounding is not required, but is permitted by federal regulations, In some cases, public employees are exempt from Federal, Social Security and/or Medicare taxes. Virginia ranks number 18 out of 50 states For instance, an employee is in a legitimate position to ask for a raise or bonus if their performance exceeded original expectations, or if the company's performance has noticeably improved, due in part to the employee's input. Here's a breakdown of these amounts for tax years 2022 and 2023: If you work for yourself, you need to pay the self-employment tax, which is equal to both the employee and employer portions of the FICA taxes (15.3% total). A flexible spending account (FSA) is a tax-advantaged account that is usually offered by employers to their employees so they have the ability to set aside some of their earnings. link to How Much Money Should Doctors Spend On A House?