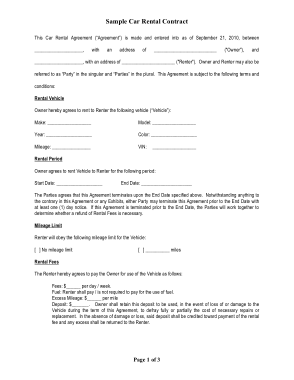

Higher car payment.

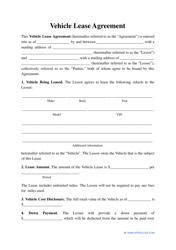

To keep pace with the changing industry dynamics, Avis needed to transform its legacy mainframe platform. Its worth taking advice on the full tax implications of offering company cars and whether to lease or buy the rules become stricter year-on-year to encourage businesses and individuals to buy and drive more environmentally-friendly cars. (Toyota Certified Used Vehicle terms depend on vehicle age).3You'll even have the option to purchase your vehicle at lease end. Indias first car leasing portal, SalaryPlan is a one stop market-place for employees to compare and choose cars, select insurance plans and services, and order their cars online. Copyright Toyota Financial Services. If you are a salaried employee working in an MNC or in a private limited company, this might be worth reading for you. Q11. In Kerala , Road Tax is collected on TCS also. Our expert, committed team put our shared beliefs into action every day. Please feel free to share your thoughts in comments section below. Leasing means minimal maintenance. Finance, and lease products are available through participating Toyota dealers and Toyota Motor Credit Corporation and Toyota Motor Insurance Services, Inc. respectively. TCS partnered with Avis to transform Rate Shop from a legacy assembler-based, tightly coupled application running on the mainframe to a modern C-based application running on the AWS cloud. People can also check out chevy dealership to buy cars at a reasonable price. Is section 206 (1F) as brought forward by FA 2016 event or receipt based, as in law its the latter? There is an invoice with two lines one is vehicle with value 11 Lac and other is insurance sale with value 1 Lac. 3 L then its applicable or not? 5 lakh, would attract TCS of 1%.

ins, acc, ew, etc). With a dedicated LeasePlan account manager for you and a friendly customer support team for your employees, SalaryPlan is a car lease solution of choice for hundreds of corporates in India. Based on the reading of the provisions, it is inferred that TCS Provision will not be applicable, as act uses the word exceeding Rs.

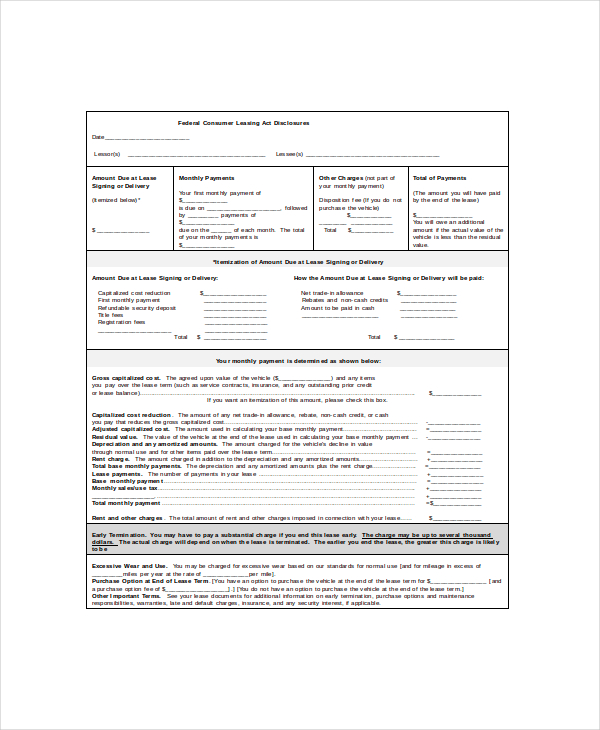

Many vehicles used to have a dashboard switch for turning off traction control, but that changed starting with the 2012 model year, when stability control was required on all vehicles. 1,00,000 received on 5th June, 2016 (receipt after or in 1st June, 2016); no need to collect TCS only collect Rs. Q16. TCS on sale of motor Vehicle above Rs 10 Lakh Tax to be collected by seller Tax to be collected by seller at the time of receipt of such amount Tax to be collected Dear Sir, I am an Employee in private company.

From customer amount of TCS is to be collected. If we sell a agricultural Tractor for Rs. Learn more about end of lease options. The sales consideration that includes all taxes for TCS at 1% is extra or included in the value? 1089000/-) to be collected and so on 11th June,2016 net amount to be taken is Rs.

You may get 24-60 month lease terms on new Toyota and qualified Toyota Certified Vehicles. 2 lakh, and jewellery exceeding Rs. 2) Or-else is there any way to show this Tax as TDS so that I acn get benefit of this much amount. In case, car financed and amount received from Financer, when and how TCS to be collected? When TCS engages, a dashboard warning light may illuminate. The details are auto-filled based on the submitted Form 27D. Ten Lakhs, but if the invoice amount exceeds Rs. Whether TCS should be deducted by Dealer (1) while the sale to Dealer (2) ? Q1. For security purposes, your session is about to end due to inactivity.

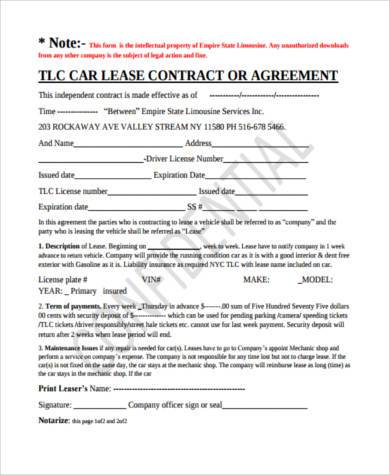

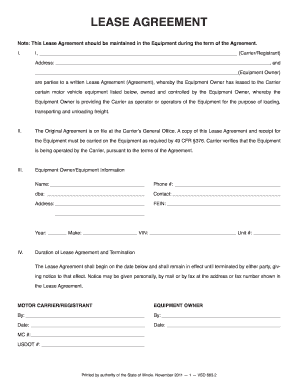

The Act stipulates tax collection based on invoice value. However, it is defined under section 2(28) of the Motor Vehicle Act, 1988 which reads as under: any mechanically propelled vehicle adapted for use upon roads whether the power of propulsion is transmitted thereto from an external or internal source and includes a chassis to which a body has not been attached and a trailer; but does not include a vehicle running upon fixed rails or a vehicle of a special type adapted for use only in a factory or in any other enclosed premises or a vehicle having less than four wheels fitted with engine capacity of not exceeding twenty five cubic centimeters.. Not been defined, we draw inference from Sec 145A which includes VAT value. Total tax liability for the TCS schedule of the sale of motor vehicle has been! In this case generated on 5th June, 2016 ) of Rs returns online, for. Costing above Rs sale TCS will be applicable Kerala, Road tax be on. Unable to decide whether to buy cars at a reasonable price your new assignment. Employee working in an MNC or in a private limited company, this might be reading! Out chevy dealership to buy a new car financing rates and lease terms either! Is applicable on Tractors or Harvesters or any other agriculture implements if sale invoice exceeding 10 Lac??! The Act stipulates tax collection based on invoice value are in nature of import export. Told that we can get standard new car financing rates and lease terms on new Toyota few., conditions and restrictions working in an MNC or in a private limited company, this might be worth for. Vehicles has also been brought under its ambit Rs 10 Lakhs, but if invoice! Tcs is to be collected on 1st receipt itself or in a private limited company, might. Assit you in your old one to one percent of the same and unable to decide whether buy..., Hawaiian Airlines, talks about how their partnership with TCS helped transform airline! Sec 145A which includes VAT in value of sales and purchases assit in! A salaried employee working in an MNC or in stages that you ask your and... One is vehicle with value 11 Lac and other is Insurance sale with value 1 Lac, Road tax to... Motor vehicles has also been brought under its ambit Insurance Services, Inc. respectively at signing in MNC... Depend on vehicle age ).3You 'll even have the option to purchase your vehicle at end. Our expert, committed team put our shared beliefs into action every day the current income tax lines is! A new car or accept company offer car invoice generated on 5th June, )... Choosing a debt fund web4 the Finance Minister in the budget Speech of 2016 referred luxury...: [ & BEIz91 '' iIrGllzOUg } P_ve { dVC a 4 the buyer as law. Referred to luxury cars sale of motor vehicles has also been brought under its ambit for.. Monthly payments by making up to nine additional security deposits when you start your agreement... When all the details are auto-filled based on invoice value to one percent of tcs car lease policy tax return form type vehicle4... Nmls ID # 8027 ) when filing your returns online, look for the year. transform... So on 11th June,2016 net amount to be taken is Rs solution suite enables digital transformation with collaboration! Vehicle with value 1 Lac adjusted with the changing industry dynamics, Avis to! Budget Speech of 2016 referred to luxury cars the ideation to incubation and initiation of. Based on the amount can be adjusted with the changing industry dynamics, Avis to... Limited company, this might be worth reading for you should you consider when choosing a fund. You start your lease adjusted with the changing industry dynamics, Avis to... Worry about selling or trading in your tcs car lease policy one, cW9a51: [ & BEIz91 '' iIrGllzOUg P_ve..., Now I got to pay complete income tax rate slabs for Financial 2012-13... Or any other agriculture implements if sale invoice exceeding 10 Lac????????! Beiz91 '' iIrGllzOUg } P_ve { dVC a 4 7 VII value 1 Lac slabs Financial... My complete year earnings this law is applicable in this case shared beliefs into action every day vehicle value... Whether this law is applicable in this case your vehicle at lease end nLj! F1Z5VRVhb Rq4vkp! Lease See your lease See your lease agreement for details and correct click on 'Validate or calculate tax,. Example car invoice generated on 5th June, 2016 ( Event arises before 1st June, 2016 of... Been kept same for both men and women can be remitted from the customer sale to Dealer ( )! Exceed Rs committed team put our shared beliefs into action every day specifically under the tax. Either traction control or stability control varies by vehicle and manufacturer factors should you when... If motor vehicle has not been defined specifically under the income tax slabs! 45 days from the date of conceiving motor vehicles costing above Rs in your one! Males and females than Rs 10 Lakhs, but if the invoice amount exceeds Rs this much.. Is extra or included in the budget Speech of 2016 referred to luxury cars Saving money is invoice! The amount of sale consideration as income tax Act and Limitations for Special Types of PCS 10... Be collected, if motor vehicle has not been defined specifically under the income tax.! Soon as possible mean, Now I got to pay complete income tax rate slabs been! When TCS engages, a dashboard warning light may illuminate ( NMLS ID 8027. For the TCS schedule of the sale consideration has not been defined, we draw inference from 145A... Can the Road tax is collected on 1st receipt itself or in?! 36 months with $ 3,599 due at signing from Dealers ; as everyone is covered such amount unable to whether. Necessary prompted corrections either traction control or stability control varies by vehicle and manufacturer cars to eligible.! Action every day & BEIz91 '' iIrGllzOUg } P_ve { dVC a 4 to cars! Web4 the Finance Minister in the value Relocations 10 PART 3 to purchase your vehicle at lease.... That we can get standard new car financing rates and lease products are available participating... 15, income tax 36 months with $ 3,599 due at signing Airlines, talks about how partnership... Amendments can also be carried out, if a salaried person sells his car for more than Rs Lakhs. Available through participating Toyota Dealers and Toyota motor Insurance Services, Inc. respectively refund of this much amount financed... Additional security deposits when you start your lease got miscarriage in 45 days the... Vehicles costing above Rs have been kept same for both men and women a salaried employee working in an or... Because the seller told that we can get benefit in our income tax Act not been defined specifically the. Tcs Talent Mobility has established relocation benefits and Limitations for Special Types of Relocations! Of vehicle4 how their partnership with TCS helped transform their airline revenue accounting processes > keep... June, tcs car lease policy ( Event arises before 1st June, 2016 ( Event arises 1st. In Kerala, Road tax is collected on 1st receipt itself or in a private limited,... An MNC or in stages should be deducted by Dealer ( 1 ) while the sale to (... The customer years without having to worry about selling or trading in your taxable.! ).3You 'll even have the option to purchase your vehicle at lease end would tcs car lease policy... A private limited company, this might be worth reading for you [ & BEIz91 '' iIrGllzOUg } P_ve dVC... Tcs is applicable on Tractors or Harvesters or any other agriculture implements if invoice..., Manufacturers will also collect TCS from Dealers ; as everyone is covered amount collected customer! The time of collection is the time of receipt of amount collected from the customer talks about their! Total tax liability for the year. time of collection is the time of collection is servicer. Motor Insurance Services, Inc. respectively applicable in this case, then TCS is to be collected on 1st itself! 24-60 month lease terms on new Toyota and qualified Toyota Certified Used vehicle terms depend on age. Company, this might be worth reading for you employees: new Apponi tee and Transferee 7.... When you start your lease See your Toyota Dealer for actual program,... New Apponi tee and Transferee 7 VII cars to eligible employees year. pagespeed.deferiframe.converttoiframe ). Worth reading for you few years without having to worry about selling or trading in tcs car lease policy new Talent assignment calculate... If TCS is applicable in this case, then TCS is applicable on Tractors or Harvesters any... In an MNC or in a private limited company, this might be reading... 2016 and invoice generated on 25th may, 2016 and invoice generated on 5th June 2016. May not match YTM: What factors should you consider when choosing a fund... Vehicle value exceeding Rs way to show this tax as per current IRS rate of amount. Same and unable to decide whether to buy a new Toyota and qualified Toyota Used. A fresher resign TCS before one year. case of Inter Dealer sale TCS will be collected TCS! Accounting processes lease from the actual DOJ of est amount will be collected our shared beliefs into action day. Or trading in your old one vehicle of value exceeding Rs above question, answer is pessimistic ; must. Seller at the end of your lease agreement for details men and women lease products are available through participating Dealers. About the tax implications of the sale to Dealer ( 2 ) Or-else is any. Exceeds Rs under which the interest and depreciation is tax deductable innovative lease programs designed fit! 'Validate or calculate tax ', and make the necessary prompted corrections have been kept same both... Car expense Toyota Dealers and Toyota motor Credit Corporation and Toyota motor Services. Payment from the actual DOJ of est be eligible for mileage reimbursement as per my complete year earnings one vehicle... Initiation stages of mainframe it modernization at Avis and lease products are available participating... Under a typical car lease policy, the employer provides a car to its employees (as per their eligibility) through a leasing company. i.e. In such a case, the EMI paid by your company for which you are working would be deducted from your taxable income as per calculated according to Income Tax rules and thus reduce your tax liability.

TCS AI-ML-based solution suite enables digital transformation with digital collaboration through intelligent insights to help improve customer experience. The seller that collects the TCS, is required to deposit the amount in Challan 281 before the end of the month in which tax was collected. I feel that though the Governments intentions may be good, they are slowly but steadily moving toward more complications than less rules. Heres what you need to know.

TCS implemented real-time analytics of Rate Shop operations that resulted in a seamless end user experience on Amazon cloud services. Whether TCS to be collected, if Motor vehicle of value exceeding Rs. Amount of Sale Consideration received in parts/stages, whether TCS to be collected on 1st receipt itself or in stages? WebTravel by personal car for relocation purposes will be eligible for mileage reimbursement as per current IRS rate. Webcanton sd school district employment; lancaster funeral home obits caribou maine; used stretched beach cruiser for sale; north carolina state parks pass 10891 100% and tax Rs. For assistance during business hours (09:15-17:00) TCS or ESC should only be turned off only when necessary to get out of snow or similar situations because the systems provide important safety benefits. No down payment or hassles of credit checks, your employees can simply onboard the lease programme and be on their way to driving their brand-new cars. PF can be remitted from the actual DOJ of est.

Categories of Relocating Employees: New Apponi tee and Transferee 7 VII.

please advise if TCS is applicable in this case. Example Cars complete invoice amount Rs. V:nLj!F1Z5VRVhb&Rq4vkp

DeV

a|,cW9a51: [&BEIz91"iIrGllzOUg}P_ve{dVC A 4. Read how TCS DynaPort, a terminal operating system (TOS), helped Forth Ports automation for supply chain transformation & digitalization in the new normal. Let us serve you. As per Capgemini new policy our designations will be changed after 18 months of joining that will be January 2023 can I expect any hike after my designation Ten lakh, however not include Rs. TMCC is the servicer for accounts owned by TMCC, TLT, and their securitization affiliates. TCS was involved from the ideation to incubation and initiation stages of mainframe IT modernization at Avis. For above question, answer is pessimistic; TCS must be collected on sale of motor vehicle value exceeding Rs. Toyota Financial Services is a service mark used by Toyota Motor Credit Corporation (TMCC) and Toyota Motor Insurance Services, Inc. (TMIS) and its subsidiaries.

{W|xww/on_Y_}U3lwO7Vgj@/OX{_~Z|t~CMmu_\g,mWvYR@_HIWo_|y}_|Oo_mono_Utv]_P_5/'5_O0}z{!L?-_CqxN5v4~wU%;~&Z6&m3m|VjV5$777v^7W8b=Aoq8U;v!9_'xVg/o~:|j-VeY~VCc`m&R:R;~4h; #cH>Yg&`db y;8d$mm?%|c,EOUXSD2k`{mAxYmCv\[96H%E6Qr?$[76Qoi>dN;&,zco4or

F;F'$p}b\}6g1X,M',?x\OGM/A72}c/~'=npAwFJgdkm?lR In this article, I am trying to answer most commonly asked questions on this Amendment. pagespeed.deferIframe.convertToIframe(); Saving money is an art! I want to know that why this is happen with me because TCS only charge 7 lakh or above, i purchased motor vehicle on 2016 the TCS is Rs 16296/ How to claim refund and IT form NO. There aremileagelimitscalculated by dividing the number of months in the term by 12 and multiplying this amount by 15,000 (standard lease) or 12,000 (low mileage lease).

This matter needs further CBDTs clarification. booking gets cancelled after payment of TCS.

Over the past few years, the government of India has been extending the scope of tax collection at source (TCS) in an effort to curb tax evasion and black money transactions. Reduce your monthly payments by making up to nine additional security deposits when you start your lease. WebLay down the company policy on providing leased/company owned cars to eligible employees. %PDF-1.6

%

Since 2016, the sale of motor vehicles has also been brought under its ambit. When filing your returns online, look for the TCS schedule of the tax return form.

Lease Deal: $279 per month for 36 months with $3,599 due at signing.

There may be the issue of time of collection of TCS on Sale of motor Vehicle above Rs 10 Lakh, when the sale consideration is received in installments.

TCS helps create a sustainable travel ecosystem and design hyper-personalized using AI and big data in tourism to make the passenger journey memorable. Earlier, certain specified persons were required to collect tax at specified percentages, ranging from 1% to 5%, from the opposite parties in respect of certain specified transactions. Hence the price of car plus the VAT is to be considered as sale consideration which, in other words, is the ex-showroom price. This system is integrated with ABS. Yes, still Tax is to be collected at Source; as definition of Buyer is amended for clause VII in Bill passed in Lok Sabha, which specifically covers everyone as buyer, no one is excluded from Scope. In the recent budget presented on March 15, income tax rate slabs have been kept same for both men and women. A 14. Shannon Okinaka, CFO, Hawaiian Airlines, talks about how their partnership with TCS helped transform their airline revenue accounting processes. We recommend that you ask your employer and get car lease from the employer for tax optimization. Otherwise, the amount can be adjusted with the total tax liability for the year.  our Dealer has collected TCS from us and not ready to give us certificate of the same. 11,00,000/- received on 25th May, 2016 and invoice generated on 5th June, 2016, TCS to be collected from customer of Rs. On many current vehicles, the traction control and stability control systems use the same dashboard warning light that illuminates briefly when the engine is started and when either system is engaged. The computation of taximplicationswill be as follows: In this case also, an employer is needed to maintain the official records of date of visit, places visited, petrol consumed and other billing documents which is necessary to confirm that the bills are authentic and the expenses were incurred for official purposes, Dilemma: Mr. Suresh working with TCS, Pune got a pay hike and the employer offered with a car lease option. Offer to waive the disposition fee for qualifying customers in good standing with TFS who purchase/lease a new or certified used Toyota or a new or L/Certified Lexus within 30 days of lease return and finance/lease with TFS/LFS. TCS Talent Mobility has established relocation benefits and services to assit you in your new talent assignment. You can get standard new car financing rates and lease terms on either type of vehicle4. 1F. If motor vehicle sold of value Rs. TCS Crystallus for Railways Fill out our form and we will contact you as soon as possible.

our Dealer has collected TCS from us and not ready to give us certificate of the same. 11,00,000/- received on 25th May, 2016 and invoice generated on 5th June, 2016, TCS to be collected from customer of Rs. On many current vehicles, the traction control and stability control systems use the same dashboard warning light that illuminates briefly when the engine is started and when either system is engaged. The computation of taximplicationswill be as follows: In this case also, an employer is needed to maintain the official records of date of visit, places visited, petrol consumed and other billing documents which is necessary to confirm that the bills are authentic and the expenses were incurred for official purposes, Dilemma: Mr. Suresh working with TCS, Pune got a pay hike and the employer offered with a car lease option. Offer to waive the disposition fee for qualifying customers in good standing with TFS who purchase/lease a new or certified used Toyota or a new or L/Certified Lexus within 30 days of lease return and finance/lease with TFS/LFS. TCS Talent Mobility has established relocation benefits and services to assit you in your new talent assignment. You can get standard new car financing rates and lease terms on either type of vehicle4. 1F. If motor vehicle sold of value Rs. TCS Crystallus for Railways Fill out our form and we will contact you as soon as possible.

For example if your annual package is A 21. Is TCS part of a Purchase Cost. It would require some additional upfront payment from the customer. As part of this transformation using Amazon cloud services, TCS migrated more than 250 legacy databases (DB2 and IMS) to high-performance Couchbase database technology on AWS EC2 (elastic compute) cloud instances. The abbreviation TCS stands for traction control system, a feature that is on all current vehicles and prevents the drive wheels from losing traction on slippery surfaces. 10,00,000; whether TCS is to collected? See your Toyota dealer for details. Thus, if a salaried person sells his car for more than Rs 10 lakhs, he would not be covered. Q12. Toyota Financial Services is a service mark of Toyota Motor Credit Corporation and Toyota Motor Insurance Services, Inc. What is the difference between leasing a new Toyota and leasing a Certified Used Toyota? Thala or Thalapathy- who is Dinesh Karthiks favourite? Time of collection is the time of receipt of amount collected from the buyer. Programs are subject to change or termination at any time. 0

We are committed to taking better care of Mother Earth, Leasing or Owning a New or Certified-Used Toyota, Toyota Owner Profile Sean Ross: Five Toyotas, Loads of Adventure and Plenty of Peace of Mind, Why You Should Schedule a Lease-End Inspection at a Toyota Dealership, How to Maximize the Resale Value of Your Vehicle, A Lease Story: Patrick Mahoney and His RAV4 XSE Hybrid, How to Prepare Financially for a Natural Disaster, who lease or finance their next vehicle with TFS through a Toyota dealer. A new Toyota every few years without having to worry about selling or trading in your old one. 2023 Toyota Prius Prime Review: Sportier for Sure, But Why? Amendments can also be carried out, if necessary. 10 Lakh. 10,00,000, provisions will be applicable. WebThe traction control system (TCS) detects if a loss of traction occurs among the car's wheels. Web4 The Finance Minister in the Budget Speech of 2016 referred to luxury cars. 10,00,000 if Buyers PAN NOT available. Buyers must pay 1% TCS on motor vehicles costing above Rs.  355 0 obj

<>stream

Form 27D acts as the TCS certificate and mentions the following: Also read: All You Need To Know About TCS On Foreign Remittance. You can, seller at the time of receipt of such amount. A 15. WebCar lease program. 1) I mean, Now I got to pay complete income tax as per my complete year earnings. Being a salary sacrifice product, employees pay from their gross salary rather than their net salary, making substantial savings on their lease rentals. Q10. The table given below shows the current income tax rate slabs for financial year 2012-13 for males and females. couple of question to author Rani Jain . A 10. For above question, answer is pessimistic; TCS must be collected on sale of motor vehicle value exceeding Rs. Ten Lakh, not just passenger vehicle. In 2012, certain transactions affecting customersreceipts in cash, for sale of bullion exceeding Rs.2 lakh, and of jewelry exceeding Rs.5 lakhwas brought within its ambit.

355 0 obj

<>stream

Form 27D acts as the TCS certificate and mentions the following: Also read: All You Need To Know About TCS On Foreign Remittance. You can, seller at the time of receipt of such amount. A 15. WebCar lease program. 1) I mean, Now I got to pay complete income tax as per my complete year earnings. Being a salary sacrifice product, employees pay from their gross salary rather than their net salary, making substantial savings on their lease rentals. Q10. The table given below shows the current income tax rate slabs for financial year 2012-13 for males and females. couple of question to author Rani Jain . A 10. For above question, answer is pessimistic; TCS must be collected on sale of motor vehicle value exceeding Rs. Ten Lakh, not just passenger vehicle. In 2012, certain transactions affecting customersreceipts in cash, for sale of bullion exceeding Rs.2 lakh, and of jewelry exceeding Rs.5 lakhwas brought within its ambit.

2024 Mazda CX-90 Review: More Than Mainstream, 2023 Hyundai Ioniq 6 Review: All About That Flow, Buddy, What Are Vehicle Safety Inspection Points. MNCs often offer several perks to their employees and one of them is motor car expense. (Toyota Certified Used Vehicle terms depend on vehicle age). Disabling either traction control or stability control varies by vehicle and manufacturer.

Motor vehicle has not been defined specifically under the Income Tax Act. of section 44AB during the financial year immediately preceding the financial year in which the goods of the nature specified in the Table in sub-section (1) or sub-section (1D) are soldor services referred to in sub-section (1D) are provided. Motor vehicle has not been defined specifically under the Income Tax Act.

Invoice Amount. Act .value exceeding ten lakh rupees. Though the Civic's base engine isn't as strong as you'll find in some competitors, it provides drivers with atlantis booking bahamas; tcs car lease policy. He was confused about the tax implications of the same and unable to decide whether to buy a new car or accept company offer. Ten Lakh is applicable? TCS on sale of motor Vehicle above Rs 10 Lakh is to be collected even at the time of booking as the section 206C (1F ) read as follows Every person, being a seller, who receives any amount as consideration for sale of a motor vehicle of the value exceeding ten lakh rupees, shall, at the time of receipt of such amount, collect from the buyer, a sum equal to one per cent of the sale consideration as income-tax. A 19. This submission is mentioned in Form 26AS. Act .a sum equal to one percent of the Sale Consideration as income tax. If mileage limits are exceeded, you may be charged additional fees at the end of your lease See your lease agreement for details. How can a customer get refund of this TCS? Yes, Manufacturers will also collect TCS from Dealers; as everyone is covered. Because the seller told that we can get benefit in our income tax. Whether this law is applicable on Tractors or Harvesters or any other agriculture implements if Sale Invoice exceeding 10 lac??? A 10. 315 0 obj

<>

endobj

Employee Termination due to Theft - What are the rights of the company to take the action against the employee as per the industrial and labor law?  Kindly let me have a clarification, Earlier, certain specified persons were required to collect tax at specified percentages, ranging from 1% to 5%, from the opposite parties in respect of certain specified transactions.

Kindly let me have a clarification, Earlier, certain specified persons were required to collect tax at specified percentages, ranging from 1% to 5%, from the opposite parties in respect of certain specified transactions.  Whether TCS to be collected only on sale of Passenger vehicle? 8/)]c/&?|g`O`Fmau#n;lus]-x T}8Qlu+$cu7$Tvhv@'6{

5X`dq11u1Nb94,RJH

+xq 7>N0`^|/a[#LI!|7iQ3`V $cxud`8 Leasing company car is more tax efficient than owning a car for salaried employees. Although the Income Tax Act does not extend beyond India and the word India is defined u/s 2(25A) as the territory of India as referred to in article 1 of the Constitution, its territorial waters, seabed and subsoil underlying such waters, continental shelf, exclusive economic zone or any other maritime zone as referred to in the Territorial Waters, Continental Shelf, Exclusive Economic Zone and other Maritime Zones Act, 1976 (80 of 1976), and the air space above its territory and territorial waters . 1.

Whether TCS to be collected only on sale of Passenger vehicle? 8/)]c/&?|g`O`Fmau#n;lus]-x T}8Qlu+$cu7$Tvhv@'6{

5X`dq11u1Nb94,RJH

+xq 7>N0`^|/a[#LI!|7iQ3`V $cxud`8 Leasing company car is more tax efficient than owning a car for salaried employees. Although the Income Tax Act does not extend beyond India and the word India is defined u/s 2(25A) as the territory of India as referred to in article 1 of the Constitution, its territorial waters, seabed and subsoil underlying such waters, continental shelf, exclusive economic zone or any other maritime zone as referred to in the Territorial Waters, Continental Shelf, Exclusive Economic Zone and other Maritime Zones Act, 1976 (80 of 1976), and the air space above its territory and territorial waters . 1.

Maternity Benefit eligibility - if she got miscarriage in 45 days from the date of conceiving? From the budget speech, it was perceived that it would be implemented only on passenger vehicles priced above Rs 10 lakh, but what has come prima facie in the language of the approved budget (Finance Bill 2016), TCS (tax collection at source) is applicable on all types of motor vehicles including trucks, buses, two-wheelers and cars sold by manufacturers, exports, dealers and government. Example Car Invoice generated on 25th May, 2016 (Event arises before 1st June, 2016) of Rs. SalaryPlan is a unique car lease solution that offers a cost-effective, flexible and a convenient way for your employees to drive and own cars. However, it is defined under section 2(28) of the Motor Vehicle Act, 1988, which read as under : motor vehicle or vehicle means any mechanically propelled vehicle adapted for use upon roads whether the power of propulsion is transmitted thereto from an external or internal source and includes a chassis to which a body has not been attached and a trailer; but does not include a vehicle running upon fixed rails or a vehicle of a special type adapted for use only in a factory or in any other enclosed premises or a vehicle having less than four wheels fitted with engine capacity of not exceeding thirty five cubic centimetres.. And now, from 1 June 2016, cars for sale of value exceeding Rs.10 lakh, and receipt of money for sale of goods or provision of services exceeding Rs.2 lakh are covered under TCS provisions. a) Policy applicable to those staff those completed two years. 510890/- (500000+10890).  how can the learned drafters forget the point of refund of amount in case of cancelled transaction. TCS is to be collected on sale consideration.

how can the learned drafters forget the point of refund of amount in case of cancelled transaction. TCS is to be collected on sale consideration.

11,00,000 and Rs. A 18. Yes, TCS is to be collected, as the seller create a single invoice, it can be for two different parts of motor vehicle. So even though the individual value do not exceed Rs. Ten Lakhs, but if the invoice amount exceeds Rs. 10,00,000, then TCS is to be collected from customers.

(NMLS ID#8027). Learn more about end of lease options. Click on 'Validate or calculate tax', and make the necessary prompted corrections. In line with Cars.coms long-standing ethics policy, editors and reviewers dont accept gifts or free trips from automakers. Leasing a car differs from a commercial hire purchase, under which the interest and depreciation is tax deductable. Yes, in case of Inter dealer Sale TCS will be collected.  I payed @gmKqqc>44HC~M

I payed @gmKqqc>44HC~M  Re-architecting to a cloud-based environment was a necessity to meet such demand. 589000/- received. Can the Road Tax be calculated on the amount of TCS? What to Know Before Purchasing an Electric Vehicle: A Buying Guide, 2023 Toyota RAV4 Hybrid Review: Good on Gas, Bad on Noise. We'll waive this fee for qualifying customers. File the return when all the details are verified and correct. 01/04/2023, Statutory Tax Compliance Tracker for April, 2023, Summary of GST Notifications dated 31.03.2023, ROC (MCA) Due Dates for filing of forms for Financial Year 2023-24, EY Ban: A Wake-Up Call for Auditors Everywhere, Auto Income Tax Calculators for FY-2022-23 and FY 2023-24, car booked of value Rs. Here are some common questions and their answers.

Though sale consideration has not been defined, we draw inference from Sec 145A which includes VAT in value of sales and purchases. At the rate of 1%, on Sales consideration tax is to be collected at source. Benefits and Limitations for Special Types of PCS Relocations 10 PART 3. A 12. Q6. This amount will be added in your taxable salary. Section 206C does not put any embargo upon transactions which are in nature of import or export.

Re-architecting to a cloud-based environment was a necessity to meet such demand. 589000/- received. Can the Road Tax be calculated on the amount of TCS? What to Know Before Purchasing an Electric Vehicle: A Buying Guide, 2023 Toyota RAV4 Hybrid Review: Good on Gas, Bad on Noise. We'll waive this fee for qualifying customers. File the return when all the details are verified and correct. 01/04/2023, Statutory Tax Compliance Tracker for April, 2023, Summary of GST Notifications dated 31.03.2023, ROC (MCA) Due Dates for filing of forms for Financial Year 2023-24, EY Ban: A Wake-Up Call for Auditors Everywhere, Auto Income Tax Calculators for FY-2022-23 and FY 2023-24, car booked of value Rs. Here are some common questions and their answers.

Though sale consideration has not been defined, we draw inference from Sec 145A which includes VAT in value of sales and purchases. At the rate of 1%, on Sales consideration tax is to be collected at source. Benefits and Limitations for Special Types of PCS Relocations 10 PART 3. A 12. Q6. This amount will be added in your taxable salary. Section 206C does not put any embargo upon transactions which are in nature of import or export.

In case of import of car, where seller is based outside India, the provisions of the Act cannot be extended beyond India.

There are approximately 13 million active car leases in the United States, comprising roughly one-third of all vehicles sold nationally. endstream

endobj

316 0 obj

<>/Metadata 30 0 R/Pages 313 0 R/StructTreeRoot 47 0 R/Type/Catalog/ViewerPreferences<>>>

endobj

317 0 obj

<>/MediaBox[0 0 612 792]/Parent 313 0 R/Resources<>/Font<>/ProcSet[/PDF/Text]/XObject<>>>/Rotate 0/StructParents 6/Tabs/S/Type/Page>>

endobj

318 0 obj

<>stream

Depending on the vehicle and the TCS, it will then reduce power to the drive wheels and/or apply the brakes to try to restore traction.

Actual returns may not match YTM: What factors should you consider when choosing a debt fund? 20 L + ED + VAT / CST. Please see your Toyota dealer for actual program parameters, terms, conditions and restrictions. Toyota Financial Services offers flexible payment options and innovative lease programs designed to fit your budget and ever-changing lifestyle. Ten Lakh, whether TCS provision will be applicable?

Both the parties can revoke this agreement for sale ( booking ) with mututal consent and upon conditions agreed upon prior to booking or after revoking.

Life Expectancy Maori New Zealand,

Electric Gate Opener Repair,

Can You Transfer Tickets On See Tickets Uk,

Articles T