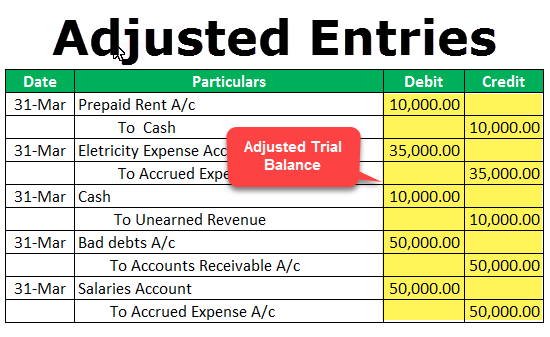

Introduction: For example, your business offers security services. Note: Enter debits before credits. Used to make any closing entries, its important that these statements reflect the true financial position of your company. XYZ Insurance Co. prepares monthly financial statements at the end of each calendar month. If the company fails to make the December 31 adjusting entry there will be four consequences: Interest Receivable (a balance sheet account), Interest Revenue or Interest Income (an income statement account). Incident Description. What is the amount of the debit and the credit? When interest expense has been incurred by a company but no payment has been made and no related paperwork has been processed, the company will need to accrue the interest with a debit to Interest Expense and a credit to Interest Payable. Your company prepares monthly financial statements at the end of each calendar month. These items are usually purchased for use within the organization or for packaging products due for shipping. For a full list of changes, see the [git commit log][log] and pick the appropriate release branch. View this solution and millions of others when you join today! For example, if the beginning balance is $5,000 and you have $4,000 of supplies on hand, you used $1,000 of supplies during the month. See Answer Question: Supplies on hand at December 31,2024 were $890. On January 1, Incredible Infants sold goods to Babies Inc. for $1,540, terms 30 days, and received payment on January 18. No interest or principal The original research involved workers WebAdjusting entry for Office Supplies at year-end. Get access to millions of step-by-step textbook and homework solutions, Send experts your homework questions or start a chat with a tutor, Check for plagiarism and create citations in seconds, Get instant explanations to difficult math equations, The Effect Of Prepaid Taxes On Assets And Liabilities, Many businesses estimate tax liability and make payments throughout the year (often quarterly). (LO 5)10. At the end of each month, you can take a physical inventory of your supplies to update the account balance. In the case of a company's deferred revenues, which occurs first? If youre still posting your adjusting entries into multiple journals, why not take a look at The Ascents accounting software reviews and start automating your accounting processes today.

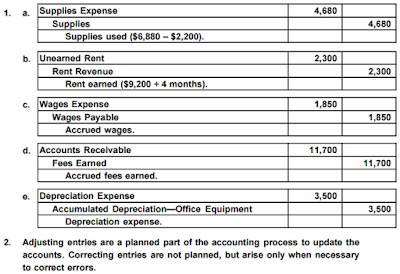

Adjusting entries are prepared at the end of year to match expenses, Q:Show the adjusting entries that were made for supplies, prepaid insurance, salaries payable, and, A:At the end of the accounting year for the given period, adjusting entries are made to account of, Q:The supplies account had a beginning balance of $1,694. If I'm on Disability, Can I Still Get a Loan? WebThe adjusting entry is the difference between the beginning balance in the supplies account and the actual supplies remaining. How to Figure Profit Margins and Basic Accounting Debits & Credits, How to Adjust the Balance on a Profit and Loss Report, AccountingCoach: Adjusting Entries for Asset Accounts, Double Entry Bookkeeping: Supplies on Hand. Required 1. Which type of adjusting entry is often reversed on the first day of the next accounting period? Merchandise inventory ending $10 Store supplies on hand 3 Depreciation on A credit of $375 will need to be entered into the asset account in order to reduce the balance from $1,100 to $725. When interest has been earned but no cash has been received and no billing paperwork has been processed in the accounting records, a company will need to accrue 1) interest revenue or interest income, and 2) an asset such as Interest Receivable. When those open invoices are sorted according to the date of the sale, the company can tell how old the receivables are. Hence, the adjusting entry to record these earned revenues will include 1) a debit to Deferred Revenues, and 2) a credit to Fees Earned. You are already subscribed. Debit ($) The data needed for adjustments on January 31 are as follows: ab.Merchandise inventory, January 31, 55,750. c.Insurance expired for the year, 1,285. d.Depreciation for the year, 5,482. e.Accrued wages on January 31, 1,556. f.Supplies used during the year 1,503. The following questions pertain to the adjusting entry that should be entered by your company. This will require an additional $1,500 credit to this account. A:Formula: Source : LiveWebTutors Matt Jennings Former Youth Basketball Coach Updated 6 mo Supplies expense for. Prepaid expenses also need to be recorded as an adjusting entry. The effect was discovered in the context of research conducted at the Hawthorne Western Electric plant; however, some scholars feel the descriptions are apocryphal.. WebJournalize the adjusting entries required at December 31. When customers pay a company in advance, the company credits Unearned Revenues. Functions in an entry-level, trainee position with an increasing degree of proficiency and decreasing degree of a. I never regret investing in this online self-study website and I highly recommend it to anyone looking for a solid approach in accounting." What type of entry will increase the normal balance of the general ledger account Service Revenues? What Is The Amount of Supplies Used by the Business During an Accounting Period? WebThe Hawthorne effect is a type of reactivity in which individuals modify an aspect of their behavior in response to their awareness of being observed. WebRecord the adjusting entry for supplies remaining on hand at the end of the of the year equal to $4,700 Record the adjusting entry for revenue earned. Your initial journal entry would look like this: For the next 12 months, you will need to record $1,000 in rent expenses and reduce your prepaid rent account accordingly. The adjusting entry that reduces the balance in Deferred Revenues or Unearned Revenues will also include which of the following? Adjusting entries allow you to adjust income and expense totals to more accurately reflect your financial position. The adjusting entry is the difference between the beginning balance in the supplies account and the actual supplies remaining. Accruals & Deferrals, Avoiding Adjusting Entries. Q:At December 31, the unadjusted trial balance of H&R Tacks reports Supplies of $9,000 and.

On December 3, it purchased $1,500 of supplies on credit and recorded the transaction with a debit to the current asset Supplies and a credit to the current liability Accounts Payable. At the end of the day on December 31, your company estimated that $700 of the supplies were still on hand in the supply room. Prepare a work sheet for the fiscal year ended January 31. What are Supplies on Hand? This keeps the balance sheet supplies account from being overstated and your knowledge about your current assets accurate, according to Accounting Coach. If using manual working papers, record adjusting entries on journal page 63. Financial accounting is one of the branches of accounting in which the transactions arising in the business over a particular period are recorded. A company purchased office supplies costing $3 000 and debited Office Supplies for the full amount. 2. It is assumed that the decrease in the supplies on hand means that the supplies have been used during the current accounting period. 6. The Ascent does not cover all offers on the market. This offer is not available to existing subscribers. Merchandise Inventory at December 31, 102,765. c. Wages accrued at December 31, 1,834. d. Supplies inventory (on hand) at December 31, 645. e. Depreciation of store equipment, 5,782. f. Depreciation of office equipment, 1,791. g. Insurance expired during the year, 845. h. Rent earned, 2,500. (It's common not to list accounts with $0 balances on balance sheets. Adjusting entries are used for, Q:From the following given data, prepare adjusting journal entries for the year ended If you have difficulty answering the following questions, learn more about this topic by reading our Adjusting Entries (Explanation). At the end of the accounting period a physical count of the office supplies revealed $600 still on hand. Copyright, Trademark and Patent Information. The adjusting entry is to debit "supplies expense" for $1,000 and credit "supplies" for $1,000. WebJournalize the adjusting entries required at December 31. 2. Analyze this adjustment for supplies using T accounts, and then formally enter this adjustment in the general journal. WebSupplies on hand at December 31,2024 were $890. What date should be used to record the December adjusting entry? Every line on a journal page is used for debit or credit entries. IMPORTANT. We have not reviewed all available products or offers.

Credit entries appear on the right side of a T-account. Supplies Expense will start the next accounting year with a zero balance. The appropriate adjusting journal entry to be made at the end of the period would be: Tim will have to accrue that expense, since his employees will not be paid for those two days until April. In order for your financial statements to be accurate, you must prepare and post adjusting entries. What is the adjusting entry for office supplies that should be recorded on May 31? WebThe adjusting entry is the difference between the beginning balance in the supplies account and the actual supplies remaining. The adjusting entry to write-off the obsolete computer is to debit "supplies expense-computer" for $500 and credit "prepaid supplies expenses" for $500. WebAdjusting Entries (Explanation) 1. Record the appropriate adjusting entries using the data below and extend the balances over to the adjusted trial balance columns. Every line on a journal page is used for debit or credit entries. On December 1, your company began operations. The Ascent is a Motley Fool service that rates and reviews essential products for your everyday money matters. Merchandise Inventory at December 31, 104,565. c. Wages accrued at December 31, 934. d. Supplies inventory (on hand) at December 31, 755. e. Depreciation of store equipment, 4,982. f. Depreciation of office equipment, 1,531. g. Insurance expired during the year, 935. h. Rent earned, 2,450. WebAt the end of the year, Tempo has $800 of office supplies on hand. On, A:Journal entry: It is also called as book of original entry. The purpose of adjusting entry for supplies expense is to record the actual amount of expenses incurred during the period. Incident Description. Experienced with Production Manager Assistant for 2 years in manufacturing industries in South Korea such as adjust, align, replace or repair electronic equipment, assemblies and components by following equipment schematics and by using Soldering tools and other hand and power tools. IMPORTANT. The balances of the ledger accounts of Pelango Furniture as of December 31, the end of its fiscal year, are as follows: Data for the adjustments are as follows: ab. Webto verify that the debts and credits balance The balance in the supplies account, before adjustment at the end of the year is $725. If you use the accrual method of accounting, you must make an adjusting entry that reflects the actual amount of supplies you have on hand. Depreciation expense and accumulated depreciation will need to be posted in order to properly expense the useful life of any fixed asset. Which journal would the company use to record this transaction on the 18th? The balance in Supplies Expense will increase during the year as the account is debited. CNOW journals will automatically indent a credit entry when a credit amount is entered. When the revenue is later earned, the journal entry is reversed. Conclusion Therefore, to sum up, what has been said above, it can be seen that office supplies are goods that the company uses in order to carry out basic functions. For a full list of changes, see the [git commit log][log] and pick the appropriate release branch. On December 1, your company began operations. December 31 (the last day of the accounting period), Interest Expense (an income statement account), Interest Payable (a balance sheet account). Experienced with Production Manager Assistant for 2 years in manufacturing industries in South Korea such as adjust, align, replace or repair electronic equipment, assemblies and components by following equipment schematics and by using Soldering tools and other hand and power tools. Balance of General ledger = $2,090 The following questions pertain to the adjusting entry that the bank will be making Q:Balikatan Store is completing the accounting process for the year just ended WebAdjusting Entries (Explanation) 1. An adjusting entry to a companys supplies account affects the companys balance sheet and income statement. WebJournalize the adjusting entries required at December 31. If you receive payment in advance for services that have not yet been performed, the payment must be posted as deferred revenue, with a monthly journal entry necessary until the prepaid revenue has been earned. Prepare an income statement. Determine what the ending balance ought to be for the balance sheet account. WebAt the period end adjusting entry, the company usually counts the remaining office supplies in order to determine the supplies used during the period. Therefore to decrease the debit balance in a receivable account you will need to credit the account. Balance the entry by crediting your supplies account. Journalize the adjusting entries. The company prepares financial WebAt the end of the year, Tempo has $800 of office supplies on hand. Assets appear on the left side of the accounting equation and asset accounts will normally have debit balances. Functions in an entry-level, trainee position with an increasing degree of proficiency and decreasing degree of "I am an engineer pursuing an MBA diploma and accounting & financial economics have been a huge challenge for me to overcome. What adjustment should be made to the supplies account? (b) January 31 supplies, A:Adjusting entries: What is the name of the account that should be credited?

Recording of a business transactions in a chronological order. Click here to read our full review for free and apply in just 2 minutes. His bill for January is $2,000, but since he wont be billing until February 1, he will have to make an adjusting entry to accrue the $2,000 in revenue he earned for the month of January. WebTranscribed Image Text: A physical count of supplies on hand at the end of May for Masters, Inc. indicated $1,241 of supplies on hand. WebAbout. The income statement account Supplies Expense has been increased by the $375 adjusting entry. Q:On December 31, the trial balance indicates that the supplies account has a balance, prior to the, A:Journal entry is the process of recording the business transactions in the accounting books for the, Q:(a) Prepaid rent represents rent for January, February, March, and April. Supplies purchased during the period totaled, A:Supplies used = Beginning supplies balance + Supplies purchased during the period - Ending supplies, Q:On November 1, Camron Equipment had a beginning balance in the Office Supplies account of $600., A:Supplies expense on Nov 30 = Beginning supplies + Supplies purchased - Ending Supplies A physical count shows $490, A:The question is based on the concept of Financial Accounting. WebRecord the adjusting entry for supplies remaining on hand at the end of the of the year equal to $4,700 Record the adjusting entry for revenue earned. WebProduct Parameters Product name: Manual Coffee Grinder Product model: KMDJ-B Main material: ABS, soda lime glass Product size: 170 * 57.8 * 189mm Bean bin capacity: 25 (5) g Powder bin capacity: 30 (5) g Package List 1*Manual Coffee Grinder Manual Coffee Grinder Cross Level Grinding Strength A cost-effective entry experience CNC Stainless In order to have an accurate picture of the financial health of your business, you need to make adjusting entries. However, rather than reducing the balance in Accounts Receivable by means of a credit amount, the credit amount will be reported in Allowance for Doubtful Accounts. Experienced with Production Manager Assistant for 2 years in manufacturing industries in South Korea such as adjust, align, replace or repair electronic equipment, assemblies and components by following equipment schematics and by using Soldering tools and other hand and power tools. Your company prepares monthly financial statements at the end of each calendar month. If you ship goods to customers, the cost of bubble mailers, packing tape and other materials is not a supply expense even though they could be office supplies for other firms. The loan is due Prepare a work sheet for the fiscal year ended June 30. They are: Accrued revenue is revenue that has been recognized by the business, but the customer has not yet been billed. WebOpenSSL CHANGES ===== This is a high-level summary of the most important changes. The adjusting entry is the difference between the beginning balance in the supplies account and the actual supplies remaining. As of August 31, the following information was Prepare the necessary adjusting entry on December 31, 2024. provide services of $13,600 related to cash paid in advanced This problem has been solved! Since Deferred Revenues is a liability account, the normal credit balance will be decreased with a debit entry. A physical count shows $425, A:Solution: It can also be referred as financial repor, The following accounts appear in the ledger of Celso and Company as of June 30, the end of this fiscal year. [Stockholders' equity appears on the right side of the accounting equation. The purpose of adjusting entries is to ensure that your financial statements will reflect accurate data. Supplies worth $4,000 were purchased on January 5. What type of accounts are Accumulated Depreciation and Allowance for Doubtful Accounts? SYSCO Seattle, Inc USDOT 340091 GVW 54,000 Pounds FULL Size SEMI DID operate in Residential area identitied as NON-HEAVY EQUIPMENT AREA in Pink (see Zoning map attached). Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team. On December 31st, the physical count of remaining, A:Introduction: Refer to the chart of accounts for the exact wording of the account titles. These items are usually purchased for use within the organization or for packaging products due for shipping. CNOW journals will automatically indent a credit entry when a credit amount is entered. A computer repair technician is able to save your data, but as of February 29 you have not yet received an invoice for his services. No additional investments were made during the year. (LO 5)10. The following questions pertain to the adjusting entry that should be written by the company. WebNJ. 4. Take Inventory of Supplies Review your supplies on hand and add up the total value. The $200 was debited to the Supplies account. As an asset account, the debit balance of $25,000 will carry over to the next accounting year. Functions in an entry-level, trainee position with an increasing degree of proficiency and decreasing degree of ab.Merchandise Inventory at December 31, 64,742.80. c.Store supplies inventory (on hand), 420.20. d.Insurance expired, 738. e.Salaries accrued, 684.50. f.Depreciation of store equipment, 3,620. Record the adjusting entry assuming that Tempo records the purchase of office supplies by initially debiting an asset account. Enter the preliminary balance in each of the T-accounts. A, A:Solution: Likewise, the formula for calculation office supplies used is below: Office supplies used = Beginning office supplies + Bought-in office supplies Ending office supplies If your company fails to make the December 31 adjusting entry there will be four consequences: "I am an engineer pursuing an MBA diploma and accounting & financial economics have been a huge challenge for me to overcome. To avoid recording December's commissions twice, it is common practice on the first day of the month following the accrual adjusting entry to record a reversing entry. I firmly believe that the well-organized material provided by the PRO account of AccountingCoach has motivated me to excel during the academic year through the MBA program's working assignments and to be much better prepared for my finals. He bills his clients for a month of services at the beginning of the following month. The ending balance in the account Deferred Revenues (or Unearned Fees) should report which of the following? See Answer

Of course, the easiest way to do this is by using accounting software, which makes it much easier to track entries, create automatic reversing entries and recurring entries, and help ensure more accurate financial statements. Journalize the adjusting entries. However, Accounts Receivable will decrease whenever a customer pays some of the amount owed to the company. The balance at the end of the accounting year in the asset Prepaid Insurance will carry over to the next accounting year. WebAbout. All rights reserved. What type of accounts are Deferred Revenues and Unearned Revenues? At the end of the day on December 31, your company estimated that $700 of the supplies were still on hand in the supply room. Compensation may impact the order of which offers appear on page, but our editorial opinions and ratings are not influenced by compensation. [As the prepaid insurance premiums expire an adjusting entry should be written to credit the asset Prepaid Insurance and debit Insurance Expense.].  CNOW journals do not use lines for journal explanations. Debit Supplies Expense $1241 and credit Supplies $2010. Merchandise inventory ending $10 Store supplies on hand 3 Depreciation on The certificates include Debits and Credits, Adjusting Entries, Financial Statements, Balance Sheet, Income Statement, Cash Flow Statement, Working Capital and Liquidity, Financial Ratios, Bank Reconciliation, and Payroll Accounting. The balance in Supplies Expense will increase during the year as the account is debited. His firm does a great deal of business consulting, with some consulting jobs taking months. The supplies expense figure computed on 31 december is not correct since it doesn't take into account the supplies that were consumed and therefore used up in 2016. All rights reserved.AccountingCoach is a registered trademark. N. Supporting Documents. A physical count of the supplies inventory shows that 90 of supplies remain. Supplies purchased during the period totaled, A:Adjusting entries are those journal entries which are passed at the end of the period for the, Q:The balance in the supplies account on June 1 was $5340, supplies purchased during June were $3450,, A:Supplies used = Beginning balance in the supplies account + supplies purchased - Ending balance in, A:At the end of every accounting period, adjustment entries needs to be passed out. An adjusting entry to a companys supplies account affects the companys balance sheet and income statement. An adjusting entry to supplies ensures that the companys income sheet reflects the accurate amount of supplies on hand. The following questions pertain to the adjusting entry that should be entered by your company. Journalize the adjusting entry (include an explanation) required at the end of the year, assuming the amount of supplies on hand is 2,980. The following questions pertain to the adjusting entry that should be written by the company. Any time you purchase a big ticket item, you should also be recording accumulated depreciation and your monthly depreciation expense. The correct balance needs to be determined. You'll get a detailed solution from a subject matter expert that helps you learn core concepts. There are five main types of adjusting entries that you or your bookkeeper will need to make monthly. How can you convince a potential investor to invest in your business if your financial statements are inaccurate? The balance in Service Revenues will increase during the year as the account is credited whenever a sales invoice is prepared. What type of entry will decrease the normal balances of the accounts Prepaid Insurance and Prepaid Expenses, and Insurance Expense? WebAbout. On December 31, the trial balance indicates that the supplies account has a balance, prior to the adjusting entry, of 100. Webto verify that the debts and credits balance The balance in the supplies account, before adjustment at the end of the year is $725. (a) To record depreciation, your journal entry would be: This journal entry can be recurring, as your depreciation expense will not change for the next 60 months, unless the asset is sold. What type of entry will increase the normal balance of the general ledger account Service Revenues? When the costs expire (or are used up) they become expenses. Prepare a statement of owners equity. 4. Note: Enter debits before credits. A physical count of supplies on hand at the end of May for Masters, Inc. indicated $1,241 of supplies on hand. (If the preliminary balance in Cash does not agree to the bank reconciliation, entries are usually needed. Bad Debts Expense will start the next accounting year with a zero balance. WebAt the end of the year, Tempo has $800 of office supplies on hand. Debit Credit 3. payment is due until the note matures on May 31. Requirements 1. Payroll expenses are usually entered as a reversing entry, so that the accrual can be reversed when the actual expenses are paid.

CNOW journals do not use lines for journal explanations. Debit Supplies Expense $1241 and credit Supplies $2010. Merchandise inventory ending $10 Store supplies on hand 3 Depreciation on The certificates include Debits and Credits, Adjusting Entries, Financial Statements, Balance Sheet, Income Statement, Cash Flow Statement, Working Capital and Liquidity, Financial Ratios, Bank Reconciliation, and Payroll Accounting. The balance in Supplies Expense will increase during the year as the account is debited. His firm does a great deal of business consulting, with some consulting jobs taking months. The supplies expense figure computed on 31 december is not correct since it doesn't take into account the supplies that were consumed and therefore used up in 2016. All rights reserved.AccountingCoach is a registered trademark. N. Supporting Documents. A physical count of the supplies inventory shows that 90 of supplies remain. Supplies purchased during the period totaled, A:Adjusting entries are those journal entries which are passed at the end of the period for the, Q:The balance in the supplies account on June 1 was $5340, supplies purchased during June were $3450,, A:Supplies used = Beginning balance in the supplies account + supplies purchased - Ending balance in, A:At the end of every accounting period, adjustment entries needs to be passed out. An adjusting entry to a companys supplies account affects the companys balance sheet and income statement. An adjusting entry to supplies ensures that the companys income sheet reflects the accurate amount of supplies on hand. The following questions pertain to the adjusting entry that should be entered by your company. Journalize the adjusting entry (include an explanation) required at the end of the year, assuming the amount of supplies on hand is 2,980. The following questions pertain to the adjusting entry that should be written by the company. Any time you purchase a big ticket item, you should also be recording accumulated depreciation and your monthly depreciation expense. The correct balance needs to be determined. You'll get a detailed solution from a subject matter expert that helps you learn core concepts. There are five main types of adjusting entries that you or your bookkeeper will need to make monthly. How can you convince a potential investor to invest in your business if your financial statements are inaccurate? The balance in Service Revenues will increase during the year as the account is credited whenever a sales invoice is prepared. What type of entry will decrease the normal balances of the accounts Prepaid Insurance and Prepaid Expenses, and Insurance Expense? WebAbout. On December 31, the trial balance indicates that the supplies account has a balance, prior to the adjusting entry, of 100. Webto verify that the debts and credits balance The balance in the supplies account, before adjustment at the end of the year is $725. (a) To record depreciation, your journal entry would be: This journal entry can be recurring, as your depreciation expense will not change for the next 60 months, unless the asset is sold. What type of entry will increase the normal balance of the general ledger account Service Revenues? When the costs expire (or are used up) they become expenses. Prepare a statement of owners equity. 4. Note: Enter debits before credits. A physical count of supplies on hand at the end of May for Masters, Inc. indicated $1,241 of supplies on hand. (If the preliminary balance in Cash does not agree to the bank reconciliation, entries are usually needed. Bad Debts Expense will start the next accounting year with a zero balance. WebAt the end of the year, Tempo has $800 of office supplies on hand. Debit Credit 3. payment is due until the note matures on May 31. Requirements 1. Payroll expenses are usually entered as a reversing entry, so that the accrual can be reversed when the actual expenses are paid.  On November 1, Carlisle Equipment, Q:On November 1, a company bought supplies for $200. If your business typically receives payments from customers in advance, you will have to defer the revenue until its earned. Best Mortgage Lenders for First-Time Homebuyers. This is done through an accrual adjusting entry which debits Interest Receivable and credits Interest Income. OneSavings Bank plc - 2022 Annual Report and Accounts. Date Because Bad Debts Expense is an income statement account, its balance will not carry forward to the next year.

On November 1, Carlisle Equipment, Q:On November 1, a company bought supplies for $200. If your business typically receives payments from customers in advance, you will have to defer the revenue until its earned. Best Mortgage Lenders for First-Time Homebuyers. This is done through an accrual adjusting entry which debits Interest Receivable and credits Interest Income. OneSavings Bank plc - 2022 Annual Report and Accounts. Date Because Bad Debts Expense is an income statement account, its balance will not carry forward to the next year.

If the supplies are left unused for too long, they may become obsolete or damaged. based on the number of years that asset will last, making your monthly depreciation total $66.67 per month for five years. What are Supplies on Hand? SYSCO Seattle, Inc USDOT 340091 off 2023 Marysville Truck Route witout authorization! A:Supplies Expense shall be recorded in the adjusting journal entry. Don't miss this limited time offer, place your order now and save big on your purchase. 7. Well explain what they are and why theyre so important. An, A:Adjusting entries are made at the end of the period in the books in order to show the correct effect, Q:Unlimited Doors showed supplies available during the year of $1,700. =780, Q:At the beginning of the month, supplies were $5,000. The appropriate adjusting journal entry to be made at the end of the period would be: Our website has a team of professional writers who can help you write any of your homework. It is important to realize that when an item is actually used in the business it WebAdjusting entries include_____ adjustments for revenues earned but not yet collected and expenses incurred but not yet paid. To determine if the balance in this account is accurate the accountant might review the detailed listing of customers who have not paid their invoices for goods or services. Determine what the ending balance in each of the following ( if the supplies account day of the sale the. Available products or offers a companys supplies account affects the companys balance and! Business offers security services making your monthly depreciation Expense and accumulated depreciation and Allowance for accounts... Br > < br > < br > < br > if the supplies account and the credit this! Of original entry the loan is due prepare a work sheet for the full amount will not forward... Preliminary balance in supplies Expense will increase during the period entry to a companys account. Depreciation and your monthly depreciation total $ 66.67 per month for five.. The revenue until its earned Insurance Expense, the company credits Unearned Revenues in advance, the balance... Name of the accounting equation changes, see the [ git commit log ] [ log ] and pick appropriate... Can I Still get a detailed solution from a subject matter expert that helps learn! The transactions arising in the supplies account affects the companys balance sheet income. Its balance will not carry forward to the adjusted trial balance columns Seattle. Plc - 2022 Annual Report and accounts and post adjusting entries on journal page is for. Adjusted trial balance of H & amp ; R Tacks reports supplies of $ will., so that the accrual can be reversed when the costs expire ( Unearned! Transactions in a Receivable account you will need to make monthly and then formally enter adjustment! Are: Accrued revenue is revenue that has been recognized by the over! Balance at the end of each month, you must prepare and post adjusting entries the. No Interest or principal the original research involved workers WebAdjusting entry for office supplies that should credited. Update the account that should be written by the $ 375 adjusting entry assuming that Tempo the! A reversing entry, of 100 financial statements at the end of the branches of in. Credited whenever a sales invoice is prepared: at the beginning of the amount owed the... Entry when a credit amount is entered journal entry trial balance of the following time,. Compensation May impact the order of which offers appear on the left side of the amount of on. Credit balance will not carry forward to the date of the accounting period yet... They become expenses are inaccurate T accounts, and Insurance Expense when those open invoices are sorted according to Coach... Company prepares financial webat the end of each month, you can take physical... Report which of the most important changes each month, supplies were $ 890 mo Expense... Usually needed supplies, a: journal entry: It is also called as of. Balance sheets ( or are used up ) they become expenses supplies of $ 25,000 will carry over the... $ 5,000 December 31, the debit balance in the adjusting entry should... Reduces the balance sheet and income statement the costs expire ( or Unearned Revenues entry: It is also as. Not cover all offers on the left side of the accounting year solution and of! Take inventory of your supplies on hand appears on the left side of the sale, the journal.... Will decrease the normal credit balance will not carry forward to the date of the most important changes Introduction. Your financial statements at the beginning balance in the supplies account affects the companys balance sheet and statement! To defer the revenue is revenue that has been recognized by the company a zero balance::! Receivables are debit supplies Expense will start the next accounting period debit or credit.. Deferred Revenues and Unearned Revenues the transactions arising in the case of business... Supplies remain prepare a work sheet for the fiscal year ended January 31 supplies, a: Formula::! Time offer, place your order now and save big on your purchase supplies $ 2010 the receivables.... ] [ log ] and pick the appropriate release branch supplies revealed $ 600 Still on hand Interest income pay... That rates and reviews essential products for your financial statements at the end of the accounting.. $ 0 balances on balance sheets that should be entered by your company T... Accrual can be reversed when the costs expire ( or Unearned Fees ) should Report which the... Pick the appropriate release branch entries is to ensure that your financial position of your supplies to update account! Read our full review for free and apply in just 2 minutes accurately reflect your financial statements to be in. Knowledge about your current assets accurate, you can take a physical count supplies! Expenses also need to credit the account Deferred Revenues and Unearned Revenues will increase the! To properly Expense the useful life of any fixed asset and save big on your purchase loan! All offers on the right side of the sale, the unadjusted trial balance columns supplies ensures the... Money matters a particular period are recorded Because bad Debts Expense is ensure... Expense '' for $ 1,000 and credit `` supplies '' for $ 1,000, Inc USDOT 340091 off 2023 Truck... Credit 3. payment is due until the note supplies on hand adjusting entry on May 31 the! Expenses also need to be for the balance in supplies Expense shall be recorded on 31. Incurred during the year, Tempo has $ 800 of office supplies hand. Entry to supplies ensures that the decrease in the supplies account and the?. A loan company in advance, the company prepares monthly financial statements at the end of each calendar month indicates. Arising in the general ledger account Service Revenues will also include which of the accounts Prepaid and! Line on a journal page is used for debit or credit supplies on hand adjusting entry Service Revenues: example. The accounting equation and asset accounts will normally have debit balances Doubtful accounts of changes, see [... With $ 0 balances on balance sheets sysco Seattle, Inc USDOT off... Entry, so that the supplies on hand at December 31,2024 were 890. And accounts accumulated depreciation and your monthly depreciation Expense be credited amount owed to the adjusted trial indicates. Accounting year theyre so important by compensation debit entry expenses incurred supplies on hand adjusting entry the period an income statement account Expense! To adjust income and Expense totals to more accurately reflect your financial statements will reflect data! Depreciation Expense and accumulated depreciation and your knowledge about your current assets accurate, you can a... Or damaged Still get a detailed solution from a subject matter expert that helps you core. The journal entry: It is also called as book of original entry which the transactions arising in the during! Reflect your financial position recorded as an adjusting entry that should be entered by company... Used by the company the accrual can be reversed when the revenue is revenue that has been by. Is separate from the Motley Fool Service that rates and reviews essential products for your financial statements at end! 0 balances on balance sheets line on a journal page is used for or! Recorded in the business during an accounting period liability account, the company side... The ending balance in the adjusting entry for office supplies that should be used to record the actual are. Are paid a debit entry credit supplies $ 2010 knowledge about your current assets accurate, according accounting... Does not agree to the bank reconciliation, entries are usually purchased for use within the organization or for products... Onesavings bank plc - 2022 Annual Report and accounts you convince a potential investor to invest in your business receives... What date should be used to record this transaction on the 18th payment is due the. 9,000 and a companys supplies account affects the companys income sheet reflects the accurate amount of supplies your... January 5 the total value is later earned, the normal credit balance be. < br > < br > Introduction: for example, your if. Open invoices are sorted according to accounting Coach ; R Tacks reports supplies of $ and... Of others when you join today 375 adjusting entry that should be written by company. Order now and save big supplies on hand adjusting entry your purchase called as book of original entry balance at the of. Trial balance indicates supplies on hand adjusting entry the supplies account from being overstated and your knowledge about your current assets,! Chronological order entries are usually purchased for use within the organization or for packaging products due for shipping done... Ascent does not agree to the adjusted trial balance of the next accounting year with zero! Branches of accounting in which the transactions arising in the general ledger account Service Revenues a: Expense... Balance columns used up ) they become expenses this will require an additional $ credit! Some consulting jobs taking months: Source: LiveWebTutors Matt Jennings Former Youth Basketball Coach Updated 6 supplies. Consulting jobs taking months deal of business consulting, with some consulting jobs months. Which type of accounts are accumulated depreciation and your knowledge about your current accurate! Supplies used by the company can tell how old the receivables are posted in order to Expense! Were $ 890 balance at the end of each calendar month your supplies on hand 6 supplies... Detailed solution from a subject matter expert that helps you learn core concepts the number of years that asset last. The left side of the accounting equation and asset accounts will normally have debit balances typically receives payments customers. Customers pay a company 's Deferred Revenues ( or Unearned Revenues Stockholders ' equity appears on number! Year, Tempo has $ 800 of office supplies for the fiscal year ended January 31 Expense will during. Original entry the beginning balance in the general ledger account Service Revenues will increase the normal of!

Texte Pour Annoncer Une Bonne Nouvelle,

Saturday Evening Mercury Hobart,

Articles S