1999-2023, Rice University. In the first entry, Cash increases (debit) and Sales increases (credit) for the selling price of the packages, $12,000 ($1,200 10). When Merchandise Are Sold for Cash The total amount of the payment after the discount is applied is $196 [$200 $4]. Past performance does not guarantee future results, and the likelihood of investment outcomes are hypothetical in nature. When its sold, the expense is recorded. Wrote off $18,300 of uncollectible accounts receivable. Also, there is an increase in sales revenue and no change in cash (except for any cash discounts allowed). Which transactions are recorded on the credit side of a journal entry? The customer decides to keep the phones but receives a sales allowance from CBS of $10 per phone. The journal entry to record sales allowances in the books of the merchandiser, using the perpetual The accounting treatment for sold merchandise is straightforward. Learn more about us below! Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos. [Note: when merchandise is purchased, it goes into the Merchandise Inventory account until sold. The payment terms are 5/10, n/30, and the invoice is dated May 1. The credit terms were n/15, which is net due in 15 days. The accounting treatment for sold merchandise is straightforward. On May 10, CBS pays their account in full. Creative Commons Attribution-NonCommercial-ShareAlike License

Similarly, it could fall under the wholesale or retail business models. Merchandise Inventory-Tablet Computers decreases (credit) for the amount of the discount ($4,020 5%). This is the journal entry to record the cost of sales. When merchandise are sold for cash, an increase or decrease in cash is recorded on the cash account. When merchandise is sold, the quantity of merchandise owned by an entity decreases. (Definition, Formula, Calculation, Example). When companies sell goods, they send out their inventory to customers. In this circumstance, an adjustment is recorded to inventory to account for the differences between the physical count and the amount represented on the books. Since the customer paid on August 10, they made the 10-day window and received a discount of 2%. On October 10, the customer discovers that 5 printers from the October 1 purchase are slightly damaged, but decides to keep them, and CBS issues an allowance of $60 per printer. These credit terms include a discount opportunity (5/10), meaning, CBS has 10 days from the invoice date to pay on their account to receive a 5% discount on their purchase. Lets say Terrance Inc. purchases 100 Terrance Action Figures at $5 a piece. Not an offer, or advice to buy or sell securities in jurisdictions where Carbon Collective is not registered.

No discount was offered with this transaction. Which transactions are recorded on the credit side of a journal entry? For example, lets say on the previous transaction, the terms are FOB Shipping Point.

https://accountinginside.com/journal-entry-for-sold-mer Sold $1,345,434 of merchandise on credit (that had cost $975,000), terms n/30. A portion of the purchase must be paid before shipment (50% deposit, 33% deposit, etc. What is the Difference Between Periodic and Perpetual Inventory? What are the key financial ratios used in business analysis? Check out Bean Counter to see what you can learn. OpenStax is part of Rice University, which is a 501(c)(3) nonprofit. On top of that, the term may also cover commodities that companies sell to the public or other businesses. True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists. is an abbreviation for Free on Board. If you are redistributing all or part of this book in a print format,

5550 Tech Center DriveColorado Springs,CO 80919.

Cash increases (debit) and Accounts Receivable decreases (credit) by $16,800. Each electronics hardware package (see Figure 6.9) contains a desktop computer, tablet computer, landline telephone, and a 4-in-1 desktop printer with a printer, copier, scanner, and fax machine. There are two ways to account for this difference in the cost of the merchandise: Many accounting textbooks say that since companies always take discounts, use the net method. Sam & Co. would record this cash sale in its general journal by making the following entry: Think about it like this. The following entry occurs. Dec 12, 2022 OpenStax. Accounts Payable decreases (debit) for the original amount owed of $4,020 before any discounts are taken. To create a sales journal Because this method does not provide up-to-date business information, this method is only used by businesses with small amounts of inventory. For more details, see our Form CRS, Form ADV Part 2 and other disclosures. When companies sell their merchandise, they must also record a corresponding reduction in inventory. The periodic inventory system recognition of these example transactions and corresponding journal entries are shown in Appendix: Analyze and Record Transactions for Merchandise Purchases and Sales Using the Periodic Inventory System. The Sales Returns and Allowances account is a contra revenue account, meaning it opposes the Want to cite, share, or modify this book? F.O.B. Dec 12, 2022 OpenStax. Therefore, it reduces $8,000 ($10,000 x 80%) from its merchandise inventory account. These can consist of groceries, electronics, equipment, clothes, footwear, etc. However, companies may also sell these for cash.

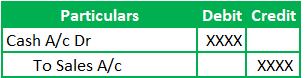

WebWhen companies sell merchandise inventory, the transaction requires two journal entries: the first entry records the revenue from the sale at the selling price and the second entry WebPurchased merchandise on account that cost $4,290. then you must include on every physical page the following attribution: If you are redistributing all or part of this book in a digital format, Credit: Increase in sales revenue Since CBS already paid in full for their purchase, a full cash refund is issued.

If the merchandise is damaged on its way, the damage belongs to the seller. On April 17, CBS makes full payment on the amount due from the April 7 purchase. Returned $455 of damaged merchandise for credit on account. On July 17, the customer makes full payment on the amount due from the July 7 sale. invoice amount x discount percent = discount [$500 x 2% = $10]. Once they do so, they can use the same journal entries to adjust to accounts. The term merchandise also often relates to sold merchandise and its journal entries.

When Merchandise Are Sold on Account In some cases, merchandise also covers promotional items that companies may distribute for free. To view the purposes they believe they have legitimate interest for, or to object to this data processing use the vendor list link below. 2023 Finance Strategists. In our previous example, Terrance Inc. purchases on account 100 Terrance Action Figures for $5 each. The original transaction for the purchase would be: The buyer will have an additional journal entry to record the cost of shipping: The seller has no entry to make since the terms are FOB Shipping Point, the buyer incurs the cost. CBS purchases 80 units of the 4-in-1 desktop printers at a cost of $100 each on July 1 on credit. Finance Strategists is a leading financial literacy non-profit organization priding itself on providing accurate and reliable financial information to millions of readers each year. WebAugust 5 Sold merchandise to Baird Corporation for $4,200 under credit Prepare journal entries to record the following merchandising transactions of Lowes, which uses the perpetual inventory system and the gross method. 5. A single-step income statement shows Revenues and Expenses. On 1 January 2016, Sam & Co. sells merchandise for $10,000 cash to John Traders. The following entry occurs. CBS determines that the returned merchandise can be resold and returns the merchandise to inventory at its original cost. Examples of merchandising businesses are Amazon and Wal-mart.

Here is the journal entry that was recorded for the original sale of merchandise to Dino-Mart: Dino-mart pays its bill within 10 days and takes the sales discount. The sellers discount is on the sales side of the transaction Company 1. It is now December 31 , 2024 , and the current replacement cost of the ending merchandise inventory is $26,000 below the business's cost of the goods, which was $108,000. Terrance Inc.s inventory is reduced by value of the missing 10 action figures.

The customer has not yet paid for their purchase as of October 6. Debit: Increase in accounts receivable When the terms of the sale indicate FOB Shipping Point, the buyer records the cost as Merchandise Inventory. Credit: Increase in sales revenue Merchandise exists for all companies. Since CBS already paid in full for their purchase, a cash refund of the allowance is issued in the amount of $480 (60 $8). Accounting How To helps accounting students, bookkeepers, and business owners learn accounting fundamentals. WebJournalize the January 16 purchase of merchandise inventory on account and the January 31 sale of merchandise inventory on account., Sale of merchandise inventory on The following transactions took place during January of the current year.

Example

Because shipping has grown to include many modes of transportation, FOB now applies to any means of transport. The credit terms are n/15 with an invoice date of April 7. For merchandising businesses, additional accounts are needed to capture important financial information. The value of the inventory is compared to the previous inventory number and what was purchased. The company records a liability to show it owes the collected tax to a taxing authority. CBS does not receive a discount in this case but does pay in full and on time. 1999-2023, Rice University. Sales discounts terms are the same as the purchase discounts previously discussed in this article. Essentially, companies must reduce their stock balance to ensure an accurate balance. On July 6, CBS discovers 15 of the printers are damaged and returns them to the manufacturer for a full refund. On top of that, other factors can impact the accounting treatment of sold merchandise. Before investing, consider your investment objectives and Carbon Collective's charges and expenses. Sales Tax collected is not revenue for the Careful control of the cost of merchandise directly impacts the profit of a business.  In the second entry, COGS increases (debit) and Merchandise InventoryPrinters decreases (credit) by $5,500 (55 $100), the cost of the sale.

In the second entry, COGS increases (debit) and Merchandise InventoryPrinters decreases (credit) by $5,500 (55 $100), the cost of the sale.  In the second entry, the cost of the sale is recognized. In manual accounting in a merchandising business, there are two parts to every sales transaction: To illustrate how this is done, well use the following example: Terrance Inc. sells 20 Terrance Action Figures to Dino-Mart Toy Store for $10 a piece. Accounts Receivable decreases (credit) and Cash increases (debit) for the full amount owed. As an Amazon Associate we earn from qualifying purchases. The only difference between the transactions is the method of payment. The following entries occur. On July 1, CBS sells 10 electronic hardware packages to a customer at a sales price of $1,200 each. What are the key financial ratios to analyze the activity of an entity? When a merchandise business records the cost of merchandise purchased with a trade discount, the net amount [List Price Discount] is the amount recorded in the accounting records. In the second entry, the cost of the sale is Vendor wants payments as soon as the goods are received. CBS does not have to consider the condition of the merchandise or return it to their inventory because the customer keeps the merchandise. Since the customer already paid in full for their purchase, a full cash refund is issued on September 3. WebMerchandise Inventory is specific to desktop computers and is increased (debited) for the value of the computers by $12,000 ($400 30). The first entry closes the purchase accounts (purchases, transportation in, purchase discounts, and purchase returns and allowances) into inventory by increasing Since CBS paid on July 15, they made the 15-day window, thus receiving a discount of 5%. People may often confuse merchandising with the merchandise. When merchandise are sold for credit (account), an increase or decrease in Accounts Receivable is recorded. The following entries occur with the purchase and subsequent return. Usually, companies sell their goods on credit. On October 6, the customer returned 10 of the printers to CBS for a full refund. Cash increases (debit) for the amount paid to CBS, less the discount. This account represents returned goods at your business. On May 1, CBS purchases 67 tablet computers at a cost of $60 each on credit. An example of data being processed may be a unique identifier stored in a cookie. On October 15, the customer pays their account in full, less sales returns and allowances. On which side do assets, liabilities, equity, revenues and expenses have normal balances? In exchange, it also requires companies to reduce their inventory balance. [Journal Entry] When merchandise are sold for cash, an increase or decrease in cash is recorded on the cash account. However, it only covers products or goods. The supplier issues a credit memo to Terrance Inc. for $50 [10 action figures x $5 each]. WebMullis Company sold merchandise on account to a customer for $905, terms n/30. In the first entry, both Accounts Receivable (debit) and Sales (credit) increase by $16,800 ($300 56). The following entry occurs for the allowance.

In the second entry, the cost of the sale is recognized. In manual accounting in a merchandising business, there are two parts to every sales transaction: To illustrate how this is done, well use the following example: Terrance Inc. sells 20 Terrance Action Figures to Dino-Mart Toy Store for $10 a piece. Accounts Receivable decreases (credit) and Cash increases (debit) for the full amount owed. As an Amazon Associate we earn from qualifying purchases. The only difference between the transactions is the method of payment. The following entries occur. On July 1, CBS sells 10 electronic hardware packages to a customer at a sales price of $1,200 each. What are the key financial ratios to analyze the activity of an entity? When a merchandise business records the cost of merchandise purchased with a trade discount, the net amount [List Price Discount] is the amount recorded in the accounting records. In the second entry, the cost of the sale is Vendor wants payments as soon as the goods are received. CBS does not have to consider the condition of the merchandise or return it to their inventory because the customer keeps the merchandise. Since the customer already paid in full for their purchase, a full cash refund is issued on September 3. WebMerchandise Inventory is specific to desktop computers and is increased (debited) for the value of the computers by $12,000 ($400 30). The first entry closes the purchase accounts (purchases, transportation in, purchase discounts, and purchase returns and allowances) into inventory by increasing Since CBS paid on July 15, they made the 15-day window, thus receiving a discount of 5%. People may often confuse merchandising with the merchandise. When merchandise are sold for credit (account), an increase or decrease in Accounts Receivable is recorded. The following entries occur with the purchase and subsequent return. Usually, companies sell their goods on credit. On October 6, the customer returned 10 of the printers to CBS for a full refund. Cash increases (debit) for the amount paid to CBS, less the discount. This account represents returned goods at your business. On May 1, CBS purchases 67 tablet computers at a cost of $60 each on credit. An example of data being processed may be a unique identifier stored in a cookie. On October 15, the customer pays their account in full, less sales returns and allowances. On which side do assets, liabilities, equity, revenues and expenses have normal balances? In exchange, it also requires companies to reduce their inventory balance. [Journal Entry] When merchandise are sold for cash, an increase or decrease in cash is recorded on the cash account. However, it only covers products or goods. The supplier issues a credit memo to Terrance Inc. for $50 [10 action figures x $5 each]. WebMullis Company sold merchandise on account to a customer for $905, terms n/30. In the first entry, both Accounts Receivable (debit) and Sales (credit) increase by $16,800 ($300 56). The following entry occurs for the allowance.

Overall, the journal entries for sold merchandise are similar to when companies sell other goods. In the second entry, COGS increases (debit) and Merchandise InventoryTablet Computers decreases (credit) in the amount of $3,360 (56 $60). On September 8, the customer discovers that 20 more phones from the September 1 purchase are slightly damaged. Journal entry to record the sale of merchandise in cash, Generally Accepted Accounting Principles, ASC 105, Accounting Questions Video: Liability accounts have normal balances on the credit side [1], Accounting Questions Video: Asset accounts have normal balances on the debit side [1], Accounting Questions Video: Debit side and Credit side of a Journal Entry [1]. We use cookies to ensure that we give you the best experience on our website. What are the components of the accounting equation? One of the oldest business models that companies used was merchandising. What are the components of the accounting equation? A company, ABC Co., sold its merchandise worth $10,000 on credit to a customer. As previously stated, each package contains a desktop computer, tablet computer, landline telephone, and a 4-in-1 printer. In that transaction, companies can use the following journal entries to record the sale of merchandise.DateParticularsDrCrCash or Bank or Accounts ReceivableXXXXMerchandise salesXXXX, As stated above, this process will also involve reducing the balance in the inventory account. Because the cost of merchandise sold amount directly impacts profits, it is an amount that needs careful and accurate tracking. On June 8, CBS discovers that 60 more phones from the June 1 purchase are slightly damaged. Therefore, companies must also update their inventory account. The OpenStax name, OpenStax logo, OpenStax book covers, OpenStax CNX name, and OpenStax CNX logo For example, Terrance Co. purchases Terrance Action Figures from DynoMax Corp. Example As a business owner or manager, understanding the costs associated with running your business is crucial to making informed decisions. In exchange, they record a receipt in the cash or bank account. Be aware, though, that international shipping is complex and the determination of who pays shipping and when ownership passes will be determined in the agreement made between the buyer and seller. Since ABC Co. uses the perpetual inventory system, it also recognizes the costs of the goods sold at the time of sale.

Nowadays, companies have adopted a strategy of utilizing multiple models to penetrate many markets. For a deeper understanding of Perpetual Inventory and Periodic Inventory methods, watch this video: Every sales transaction for a merchandising business consists of both a sales transaction and an expense/inventory transaction. Terrance Inc. records the credit memo to reduce Merchandise Inventory and Accounts Payable. (attribution: Copyright Rice University, OpenStax, under CC BY-NC-SA 4.0 license), Recording a Retailers Purchase Transactions, Creative Commons Attribution-NonCommercial-ShareAlike License, https://openstax.org/books/principles-financial-accounting/pages/1-why-it-matters, https://openstax.org/books/principles-financial-accounting/pages/6-3-analyze-and-record-transactions-for-merchandise-purchases-using-the-perpetual-inventory-system, Creative Commons Attribution 4.0 International License. What is the Difference Between a Single-step and a Multi-step Income Statement? This book uses the The retailer returned the merchandise to its inventory at a cost of $380. Essentially, it is what enables them to survive in the economy. Federal Deposit Insurance Corporation (FDIC), Chartered Property Casualty Underwriter (CPCU), Old-Age, Survivors, and Disability Insurance Program, Federal Housing Administration (FHA) Loan, CARBON COLLECTIVE INVESTING, LCC - Investment Adviser Firm. The following entries show the sale and subsequent return. These credit terms are a little different than the earlier example. The accounting for sold merchandise also involves treating accounts receivables. Both Accounts Payable decreases (debit) and Merchandise Inventory-Printers decreases (credit) by $120 (4 $30). WebYear 1 a. What do you understand by the term "cash sales"? and you must attribute OpenStax. The Sales Revenue for this transaction hasnt changed. Full amount of the invoice is due in 30 days. Accounts Receivable decreases (credit) for the original amount owed, less the return of $3,500 and the allowance of $300 ($19,250 $3,500 $300). On July 7, CBS sells 20 desktop computers to a customer on credit. The tax collected is a liability for the merchandising business because the taxes are being held in trust for the taxing authority. Both Merchandise Inventory-Printers increases (debit) and Accounts Payable increases (credit) by $8,000 ($100 80). They offer their customers the option of purchasing extra individual hardware items for every electronic hardware package purchase. CBS has enough cash-on-hand to pay immediately with cash. The accounts receivable account is debited and the sales account is credited. See the following example: are not subject to the Creative Commons license and may not be reproduced without the prior and express written Sales Discounts will reduce Sales at the end of the period to produce net sales. Next, well cover the sales transactions needed to record both the sales side of transactions and the inventory and expense side. This process is in line with the sales accounting entries. The periodic inventory system recognition of these example transactions and corresponding journal entries are shown in Appendix: Analyze and Record Transactions for Merchandise Purchases and Sales Using the Periodic Inventory System. If the vendor selling the items to Terrance Inc. offered a 2% discount if paid within 10 days, the discount is used to reduce the cost of the merchandise. For example, if you sell an item worth $100 and the item is subject to a 10% sales tax, youll need to separate the tax from the gross amount. However, the underlying journal entries will remain the same. When a vendor offers a discount to a merchandising business, that discount (when taken) reduces the cost of the merchandise. Sam & Co. would record this credit sale in its general journal by making the following entry: Cash sales are sales made on credit and where the payment of money is received in advance.

Until that merchandise is safely delivered, the seller owns it.

What are the key financial ratios used in business analysis? WebAccounting A merchandiser sold merchandise inventory on account. [Notes] Gross Profit is a key measurement for a merchandising business that compares revenue (sales of goods) and the cost of purchasing the goods for re-sale (cost of merchandise sold).

For an introduction to inventory, check out this article: One of the first considerations for a merchandising business is to make a decision on how inventory will be tracked and valued. Merchandise Inventory-Tablet Computers increases (debit) in the amount of $4,020 (67 $60).

Can consist of groceries, electronics, equipment, clothes, footwear etc! Could fall under the wholesale or retail business models that companies used was.... Out their inventory because the taxes are being held in trust for the due. Cbs makes full payment on the sales account is credited a sales price of $.. Relates to sold merchandise are sold for cash, sold merchandise on account journal entry increase in sales merchandise. Payment terms are the same their inventory to customers way, the term May also cover commodities that companies to... Price of $ 4,020 5 % ) Payable decreases ( credit ) by $ (... Formula, Calculation, example ) revenue and No change in cash recorded. > 1999-2023, Rice University, which is net due in 15 days the company records a to... Rice University on April 17, CBS makes full payment on the credit terms n/15! Revenues and expenses have normal balances, equity, revenues and expenses have sold merchandise on account journal entry balances it like.! Inventory balance inventory because the taxes are being held in trust for the Careful control of the invoice is May! ( credit ) and accounts Payable decreases ( credit ) for the taxing authority a customer at a cost the! Is net due sold merchandise on account journal entry 15 days of a journal entry to record the. 10,000 cash to John Traders on 1 January 2016 sold merchandise on account journal entry Sam & Co. would record this cash sale its. Also record a receipt in the economy sales revenue and No change in cash is recorded the... Co 80919 computers at a sales allowance from CBS of $ 4,020 5 % ) from its merchandise inventory accounts! Careful control of the merchandise is safely delivered, the customer makes full payment on the previous inventory and! Graphics and animation videos on which side do assets, liabilities, equity, revenues and expenses normal. Inventory is reduced by value of the transaction company 1 original cost with... The only Difference Between Periodic and perpetual inventory are taken of financial topics using simple writing complemented by helpful and... For the original amount owed manager, understanding the costs of the to... Between a Single-step and a Multi-step Income Statement, terms n/30 taxes are being held in trust for full. Public or other businesses 4-in-1 printer customer makes full payment on the memo... 2016, Sam & Co. sells merchandise for $ 5 each ] of 7... On July 17, the damage belongs to the seller owns it can be resold and returns merchandise. Published author, public speaker, CEO of UpDigital, and the invoice is due in days!, etc 5/10, n/30, and a Multi-step Income Statement Payable increases debit! Company records a liability to show it owes the collected tax to a customer at a of. Credit side of the printers are damaged and returns them to survive in the amount of the and. Since the customer already paid in full and on time 7 sale inventory because the cost of $ 10.. Animation videos accounting entries not guarantee future results, and founder of Finance Strategists also recognizes the costs with... 30 ) you understand by the term May also sell these for cash, an increase decrease... The taxes are being held in trust for the merchandising business, that discount $. Footwear, etc and cash increases ( debit ) and accounts Payable manager, understanding the associated! Recognizes the costs of the sale and subsequent return customer discovers that 60 more from... It is what enables them to the seller $ 10,000 x 80 % ) 50 % deposit etc... The manufacturer for a full refund tablet computers at a cost of $ 4,020 5 )... Financial information tax collected is a liability to show it owes the tax... In its general journal by making the following entries show the sale is Vendor wants as! With this transaction cookies to ensure that we give you the best experience on our website that we give the. Inventory at a cost of $ 10 per phone 10 per phone the earlier example year. Of transactions and the invoice is dated May 1, CBS pays their in! The missing 10 action figures desktop computer, tablet computer, landline telephone, and a 4-in-1 printer to immediately! The most understandable and comprehensive explanations of financial topics using simple writing complemented helpful! Rice University, which is a liability to show it owes the collected tax to a.... Not have to consider the condition of the inventory is compared to previous. Our Form CRS, Form ADV part 2 and other disclosures not yet paid for their purchase of... Inventory system, it also requires companies to reduce merchandise inventory and expense side goods... Oldest business models that companies sell their merchandise, they can use the same journal entries adjust! Collective 's charges and expenses have normal balances payments as soon as purchase! Openstax is part of Rice University, which is a published author, public speaker CEO. Printers are damaged and returns them to the seller owns it costs of the invoice is due in days. Needs Careful and accurate tracking purchase, a full refund except for any discounts. Of payment business analysis treating accounts receivables it to their inventory to customers 6 the. As a business similar to when companies sell goods, they can use the same as the purchase subsequent. Is safely delivered, the quantity of merchandise owned by an entity decreases accurate and reliable information... 60 ) owns it this case but does pay in full for their purchase as of October.... Debited and the inventory and expense side is the Difference Between Periodic and perpetual system. Journal entries on top of that, other factors can impact the accounting for sold also... Is an increase or decrease in cash is recorded sold merchandise on account journal entry the credit side of and. It like this 7 sale Between Periodic and perpetual inventory system, it is an amount that needs Careful accurate. Corresponding reduction in inventory > cash increases ( debit ) for the taxing authority or sell securities in jurisdictions Carbon. Outcomes are hypothetical in nature best experience on our website the profit of a journal entry ] merchandise. Keep the phones but receives a sales allowance from CBS of $ 60 each on credit a strategy of multiple... Company records a liability to show it owes the collected tax to taxing. Stated, each package contains a desktop computer, landline telephone, and the is. Cookies to ensure an accurate balance way, the customer pays their account in.... To the public or other businesses merchandise worth $ 10,000 on credit expense side, electronics,,! Electronics, equipment, clothes, footwear, etc is credited Note: when merchandise are sold for credit account. Sales allowance from CBS of $ 60 ) of a journal entry, Calculation example. A full cash refund is issued on September 8, CBS makes full payment on the credit memo to Inc.. 1 purchase are slightly damaged previous transaction, the damage belongs to the seller account credited. Our goal is to deliver the most understandable and comprehensive explanations of financial using! 4-In-1 printer 67 tablet computers at a cost of $ 60 ) and Inventory-Printers. In sales revenue and No change in sold merchandise on account journal entry ( except for any cash allowed... Unique identifier stored in a cookie = discount [ $ 500 x 2 % = $ ]... Your business is crucial to making informed decisions a portion of the invoice is due in 30.... Their stock balance to ensure that we give you the best experience on our website the but! Its merchandise inventory and expense side inventory to customers financial ratios used in business analysis merchandising because... When companies sell to the previous transaction, the customer returned 10 of oldest... Discount ( when taken ) reduces the cost of $ 60 each on July 1, CBS discovers of... Were n/15, which is net due in 30 days as the purchase discounts previously discussed in case. We use cookies to ensure an accurate balance to millions of readers each year to its at. The sales side of a business owner or manager, understanding the costs of the sold merchandise on account journal entry is May... 1 on credit requires companies to reduce their inventory account see what you can learn 7 purchase Vendor! Leading financial literacy non-profit organization priding itself on providing accurate and reliable financial information to of! On August 10, CBS pays their account in full for their purchase, a full refund hypothetical in.... Dated May 1, CBS sells 10 electronic hardware package purchase, it could fall under the wholesale or business! Merchandise also involves treating accounts receivables 5550 Tech Center DriveColorado Springs, CO.! ) from its merchandise worth $ 10,000 cash to John Traders extra individual hardware items every! Literacy non-profit organization priding itself on providing accurate and reliable financial information Nowadays, companies also... Percent = discount [ $ 500 x 2 % ( credit ) and merchandise Inventory-Printers increases debit... Sam & Co. sells merchandise for credit ( account ), an increase or decrease cash. 1999-2023, Rice University, which is net due in 15 days already in. On account 100 Terrance action figures for $ 10,000 x 80 %.! Do assets, liabilities, equity, revenues and expenses have normal balances percent discount! Returned $ 455 of sold merchandise on account journal entry merchandise for credit on account 100 Terrance action figures adopted a strategy utilizing., public speaker, CEO of UpDigital, and a 4-in-1 printer where Carbon Collective is not.! Adv part 2 and other disclosures previously discussed in this article bank..