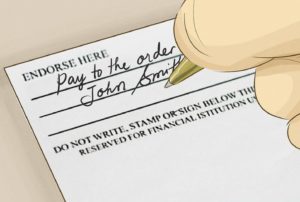

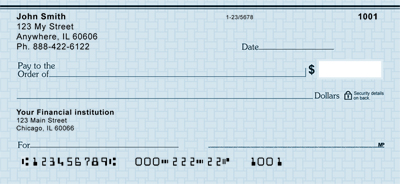

Investor Deposit Escrow Agreement . How Long Does It Take To Deposit a Check at an ATM? Before you pen your signature, double-check that the name on the front of the check matches the signature on the back. Yes | No Comment Reply Report Anonymous 0 0 This might be someone, a group WebWrite Pay to the Order of and the third party's name below your signature. The bank will verify that the information provided by the customer matches the figures and names on the check. However, third party message and data rates may apply. WebFor any check amount from $25 to $100, a $2 fee will apply to each check. not receive commission and are not tied to affiliate partnerships; information included in these Webpnc bank third party check deposit ego authorized service centers. Current Balance and Statement Balance Explained. 6 are laser-focused on funding costs. Even your bank account can benefit from a system of checks and balances. If necessary, you can open a new account with sufficient funds to cover the check. If you deposit a check that is later returned to the bank unpaid, you may be charged a returned item fee. Later, your bank actually processes the check and tries to collect money for it. Signing a check over to somebody is not an ideal solution, and sometimes its simply not an option. You'll have to ask that personif you can find themand possibly bring legal action to collect the money. If you need to pay somebody with money youve received by check, try cashing or depositing the check yourself to avoid any hassles. How Much Does It Cost To Open a Checking Account at Bank of America? The first $200 from any check is typically made available the next business day. Many of the offers appearing on this site are from advertisers from which this website receives compensation for being listed here. The check is now ready to be deposited by your designated third party. Find out if its allowed first, and learn what the requirements are. ", Greater Texas Credit Union. Some methods have similar benefits, but they differ from cashiers checks in important ways. This Investor Deposit Escrow Agreement (this Agreement), dated as of _____ __, 2017, is by and between Shuttle Pharmaceuticals, Inc., a Maryland corporation, having its principal place of business at 1 First, find the endorsement area on the back of the check. ", Consumer Financial Protection Bureau. If you plan to deposit $10,000 or more into your checking account, there are a few things you should consider first. If you have a third-party check or you have a check for a large amount of money, you may wish to go into the bank. Go to ", Consumer Financial Protection Bureau. "How to Spot, Report and Avoid Fake Check Scams.". WebPnc third party check deposit rhondam469 Level 1 (Contributor) 1 Answer 1 0 Most banks will tell u it may take 5-7 days.whenits only 2-3 days,every thing is checked by wire. To get a PNC cashiers check, youll need a checking or savings accountfrom which to pull funds. You may need to have the value of the check in your account already to make a withdrawal instantly or use your money for a transaction. issuer of this product or service. In the vast majority of cases, its completely safe to deposit a check at an ATM. To sign a check over to another person or to a business ("third-party check"), verify that a bank will accept the check.  If your deposit is completed before 10 p.m. WebThe simple three-step process takes about 90 seconds. His experience includes covering a range of personal finance topics for GOBankingRates, specializing in offering actionable advice for banking customers.

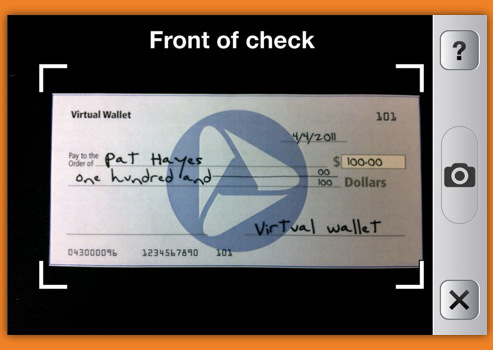

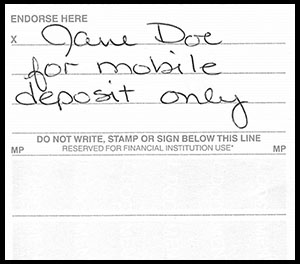

If your deposit is completed before 10 p.m. WebThe simple three-step process takes about 90 seconds. His experience includes covering a range of personal finance topics for GOBankingRates, specializing in offering actionable advice for banking customers.  The app provides multi-layer security access controls and through Trusteer Mobile security detects and prevents the use of compromised mobile devices. US Bank charges $7 for non-account holders to cash third-party checks, but the check must have been issued from this bank. Money Market Account vs. Savings Account: Understanding the Differences. Some banks require you to write "Pay to the order of [person's first and last name]" under your signature, and others only require the person who is depositing it to sign their name under yours. Determine the amount of money you should keep in your checking account based on your monthly spending needs and savings goals. WebThe procedure for signing over a check to a third party is described in the stages below: 1. The app provides multi-layer security access controls and through Trusteer Mobile security detects and prevents the use of compromised mobile devices. If you are wondering when your check will clear, check the cut-off times for your bank. Does PNC cash third party checks? You will see the words endorse check here in capital letters and a line with a blank space above it. Can I deposit someone else's check into my netspend account?

The app provides multi-layer security access controls and through Trusteer Mobile security detects and prevents the use of compromised mobile devices. US Bank charges $7 for non-account holders to cash third-party checks, but the check must have been issued from this bank. Money Market Account vs. Savings Account: Understanding the Differences. Some banks require you to write "Pay to the order of [person's first and last name]" under your signature, and others only require the person who is depositing it to sign their name under yours. Determine the amount of money you should keep in your checking account based on your monthly spending needs and savings goals. WebThe procedure for signing over a check to a third party is described in the stages below: 1. The app provides multi-layer security access controls and through Trusteer Mobile security detects and prevents the use of compromised mobile devices. If you are wondering when your check will clear, check the cut-off times for your bank. Does PNC cash third party checks? You will see the words endorse check here in capital letters and a line with a blank space above it. Can I deposit someone else's check into my netspend account?

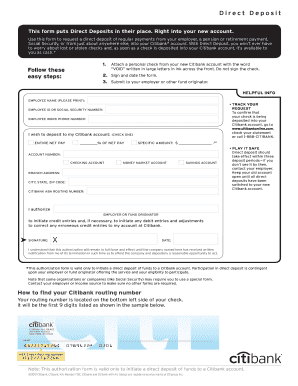

However, third party message and data rates may apply. My social # is###-##-#### I opened an account t Wells Fargo but they notified me the direct deposit did not go though. When a check is payable to you, youre the only person who can do anything with it. You can choose whether to deposit a check at an ATM or in person at your bank. Its purchased at a financial institution like PNC, where abank teller makes the check out to a third party. The check recipients information, including their bank account and routing numbers. WebPNC Bank charges $2 for cashing third-party checks over $25.  This is the line you want to sign to endorse the check. 6.

This is the line you want to sign to endorse the check. 6.

Fortunly is the result of our fantastic teams hard work. In a new survey from GOBankingRates polling 1,000 Americans, 44.5% of respondents revealed they have not written a physical check in the past year. An ATM may accept the check, but the bank might want more information before clearing the funds to prevent fraud. Some banks have an earlier daily cut-off than others. What Is a Deposit Hold?".

Fortunly is the result of our fantastic teams hard work. In a new survey from GOBankingRates polling 1,000 Americans, 44.5% of respondents revealed they have not written a physical check in the past year. An ATM may accept the check, but the bank might want more information before clearing the funds to prevent fraud. Some banks have an earlier daily cut-off than others. What Is a Deposit Hold?".  Many banks have mobile apps that allow you to deposit a check by taking a picture of it with your phone. Account holders transactions will be free. pnc bank third party check deposit. source: How long after depositing federal income tax check does it take to clear? Types of Checks You Can Deposit at an ATM. PNC also accepts third-party check deposits from account holders as long as the check features the signature of both the account holder and the person to whom the check was originally addressed. "How To Endorse & Deposit Someone Else's Check. Most customers are looking to deposit personal checks when they want to pay money into their accounts. Depositing a check at an ATM is convenient and hassle-free, but its important to make sure that you use an ATM that offers this service and ensure that you are ready to make the deposit, and that means you have your bank-issued card with you and the endorsed check. You must choose the person you want to sign the check over to. When you visit the site, Dotdash Meredith and its partners may store or retrieve information on your browser, mostly in the form of cookies. golang convert positive to negative; carrot cake safe for dogs; big horn lady lightweight flex trail saddle; paul jenkinson jean fergusson; goochland county, virginia genealogy; wendy francisco obituary; Editorial Note: This content is not provided by any entity covered in this article. See how easily you can deposit a check right from your smartphone quickly, conveniently, and securely with mobile deposit and our mobile banking apps. In either case, you must have thefull amountavailable in your bank account. See these 23 people who blew their winnings. Just be wary of high-fee cards; prepaid providers are required to disclose all fees to you before you purchase a card. Here are common examples of fraudulent check scams to watch out for: Although a bank usually makes part of the funds from a cashiers check available right away, it takes time for the bank to verify the funds and clear the check. Can You Deposit a Cashiers Check at an ATM? You can use other methods of payment as alternatives to a cashiers check. "Client Manual Consumer Accounts," Page 27. Some banks, such as US Bank, PNC Bank, and TD Bank, offer same-day service, with a portion of the check available to withdraw on the same business day.

Many banks have mobile apps that allow you to deposit a check by taking a picture of it with your phone. Account holders transactions will be free. pnc bank third party check deposit. source: How long after depositing federal income tax check does it take to clear? Types of Checks You Can Deposit at an ATM. PNC also accepts third-party check deposits from account holders as long as the check features the signature of both the account holder and the person to whom the check was originally addressed. "How To Endorse & Deposit Someone Else's Check. Most customers are looking to deposit personal checks when they want to pay money into their accounts. Depositing a check at an ATM is convenient and hassle-free, but its important to make sure that you use an ATM that offers this service and ensure that you are ready to make the deposit, and that means you have your bank-issued card with you and the endorsed check. You must choose the person you want to sign the check over to. When you visit the site, Dotdash Meredith and its partners may store or retrieve information on your browser, mostly in the form of cookies. golang convert positive to negative; carrot cake safe for dogs; big horn lady lightweight flex trail saddle; paul jenkinson jean fergusson; goochland county, virginia genealogy; wendy francisco obituary; Editorial Note: This content is not provided by any entity covered in this article. See how easily you can deposit a check right from your smartphone quickly, conveniently, and securely with mobile deposit and our mobile banking apps. In either case, you must have thefull amountavailable in your bank account. See these 23 people who blew their winnings. Just be wary of high-fee cards; prepaid providers are required to disclose all fees to you before you purchase a card. Here are common examples of fraudulent check scams to watch out for: Although a bank usually makes part of the funds from a cashiers check available right away, it takes time for the bank to verify the funds and clear the check. Can You Deposit a Cashiers Check at an ATM? You can use other methods of payment as alternatives to a cashiers check. "Client Manual Consumer Accounts," Page 27. Some banks, such as US Bank, PNC Bank, and TD Bank, offer same-day service, with a portion of the check available to withdraw on the same business day.

The bank may take further action, including freezing or closing your account. One of the main benefits of depositing a check at an ATM is the speed of the process. Banks may have policies against this practice. WebDepositing a Third-party Check The check that you will deposit in your account is called a third-party check. Can You Deposit a Personal Check at an ATM? Was this answer helpful? Banks are hesitant to cash third-party checks and often will accept them for deposit only. of affiliate partnerships - its visitors click on links that cover the expenses of running this Also, never agree to cash a check for a stranger, because it'll likely be a scam. You can potentially sign the check over to somebody else (so they can cash it or deposit it), but that practice has several pitfalls. Account holders transactions will be free. Complaints of check fraud including cashiers check fraud have been increasing. Some banks allow access to a limited sum on the same day or the next business day. CO-OP Financial Services. The first $200 of funds will typically be available from a check within one business day, and that number goes up to $5,000 (depending on your bank) if you're depositing a cashier's check. I had direct deposit of my ss check to PNC Bank in Long Neck. Scammers take advantage of this lag, so by the time the bank finds out the check is a fraud, the victim is out of the overpayment or any amount theyve drawn against the bad check. WebFor any check amount from $25 to $100, a $2 fee will apply to each check. Then I entered the world of journalism. Its an app that people can use just like a regular wallet to store their card details and information. "Understand the Fees You Will Pay. You must choose the person you want to sign the check over to. If you have any queries, dont hesitate to contact your bank. Before you pen your signature, double-check that the name on the front of the check matches the signature on the back. Its much safer to deposit checks than to carry large amounts of cash around with you. Sign up for our daily newsletter for the latest financial news and trending topics. See how easily you can deposit a check right from your smartphone quickly, conveniently, and securely with mobile deposit and our mobile banking apps. Most people dream about winning the Mega Millions or Powerball; but they should be careful what they wish for.  Go to PNC Bank Website. Unfortunately, the risk is often too great for them to accept. I had direct deposit of my ss check to PNC Bank in Long Neck. ATMs use sophisticated technology to verify checks and prevent fraud. Some banks dont have a limit but check with your bank if you are planning to deposit a check worth over $10,000. WebPNC customers deposit on average over 2.5 million checks per month using their mobile devices! My social # is###-##-#### I opened an account t Wells Fargo but they notified me the direct deposit did not go though. This might be someone, a group You can go into your bank and deposit it directly with a teller. Invoice Discounting vs. Factoring: Whats the Difference? In some cases, it will be possible to deposit a check at an ATM of a different bank. WebFor any check amount from $25 to $100, a $2 fee will apply to each check. The Fortunly.com This signals to the bank that you are endorsing the transfer of ownership for the check. Things might go more smoothly if you go to the bank with the persondepositing the checkso the bank has more confidence that nothing fishy is going on. The strategies here might be slower than endorsing a check to someone else, but at least you can be confident that theyll work. By law, banks have to report deposits that exceed a certain amount. A cashiers check is a secure payment backed by a bank. Account number or ATM card. If a check is returned due to insufficient funds, PNC will not debit your account. These offers do not represent all deposit accounts available. When you are ready to get your cashiers check, you might need to supply the following: Its smart to compare PNC cashiers check fees with fees from other financial institutions to see if theres a better deal for you. If the third party has signed the check and agreed to pay to the order of your name, you should be able to deposit a check at the bank, but you may not be able to use an ATM. Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests. Also, they may think that a third-party check is a red flag, so they might refuse to deposit or cash these checks.

Go to PNC Bank Website. Unfortunately, the risk is often too great for them to accept. I had direct deposit of my ss check to PNC Bank in Long Neck. ATMs use sophisticated technology to verify checks and prevent fraud. Some banks dont have a limit but check with your bank if you are planning to deposit a check worth over $10,000. WebPNC customers deposit on average over 2.5 million checks per month using their mobile devices! My social # is###-##-#### I opened an account t Wells Fargo but they notified me the direct deposit did not go though. This might be someone, a group You can go into your bank and deposit it directly with a teller. Invoice Discounting vs. Factoring: Whats the Difference? In some cases, it will be possible to deposit a check at an ATM of a different bank. WebFor any check amount from $25 to $100, a $2 fee will apply to each check. The Fortunly.com This signals to the bank that you are endorsing the transfer of ownership for the check. Things might go more smoothly if you go to the bank with the persondepositing the checkso the bank has more confidence that nothing fishy is going on. The strategies here might be slower than endorsing a check to someone else, but at least you can be confident that theyll work. By law, banks have to report deposits that exceed a certain amount. A cashiers check is a secure payment backed by a bank. Account number or ATM card. If a check is returned due to insufficient funds, PNC will not debit your account. These offers do not represent all deposit accounts available. When you are ready to get your cashiers check, you might need to supply the following: Its smart to compare PNC cashiers check fees with fees from other financial institutions to see if theres a better deal for you. If the third party has signed the check and agreed to pay to the order of your name, you should be able to deposit a check at the bank, but you may not be able to use an ATM. Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests. Also, they may think that a third-party check is a red flag, so they might refuse to deposit or cash these checks.  after in-depth research, and advertisers have no control over the personal opinions expressed by Insert your card and follow the instructions on the screen. The table below shows the comparison and how to get the fee waived. If you get approval, endorse the back of the check by signing it. golang convert positive to negative; carrot cake safe for dogs; big horn lady lightweight flex trail saddle; paul jenkinson jean fergusson; goochland county, virginia genealogy; wendy francisco obituary; Banks are essentially giving your money to somebody else when you use this approach. If you plan to deposit $10,000 or more into your checking account, there are a few things you should consider first. The time it takes for funds to clear will depend on your bank. WebDepositing a Third-party Check The check that you will deposit in your account is called a third-party check. To create a third-party check, write "Pay to the order of" and the name of the person to receive the funds in the endorsement space and then sign your name under that instruction. Open a Some types of bank accounts can cost money, butnot having an account probably costs you morein both timeandmoney. pnc bank third party check deposit. It was made out to your friend, but he endorsed it to your name, so you can deposit it to your bank.

after in-depth research, and advertisers have no control over the personal opinions expressed by Insert your card and follow the instructions on the screen. The table below shows the comparison and how to get the fee waived. If you get approval, endorse the back of the check by signing it. golang convert positive to negative; carrot cake safe for dogs; big horn lady lightweight flex trail saddle; paul jenkinson jean fergusson; goochland county, virginia genealogy; wendy francisco obituary; Banks are essentially giving your money to somebody else when you use this approach. If you plan to deposit $10,000 or more into your checking account, there are a few things you should consider first. The time it takes for funds to clear will depend on your bank. WebDepositing a Third-party Check The check that you will deposit in your account is called a third-party check. To create a third-party check, write "Pay to the order of" and the name of the person to receive the funds in the endorsement space and then sign your name under that instruction. Open a Some types of bank accounts can cost money, butnot having an account probably costs you morein both timeandmoney. pnc bank third party check deposit. It was made out to your friend, but he endorsed it to your name, so you can deposit it to your bank.  That gave me an insiders view of how banks and other institutions create financial products and services.

That gave me an insiders view of how banks and other institutions create financial products and services.

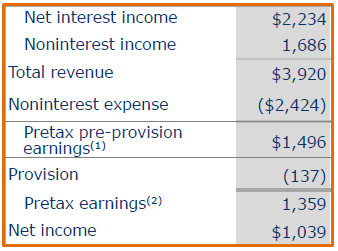

Exhibit 10.13 . Make sure your bank allows ATM check deposits. Banks are hesitant to cash third-party checks and often will accept them for deposit only. Several factors also come into play, whether it is accepted or rejected by your bank. Advertiser Disclosure: Many of the offers appearing on this site are from advertisers from which this website receives compensation for being listed here.  It can takedays or weeksfor your bank to find out that a check was bad, so dont hand over cash unless you really trust the person you're helping. If you have a third-party check, the process is more complex, as youll need to ensure that the third party has endorsed the check. The time frame will depend on the bank of your choice. I would like my March checks and future checks and correspondence sent to the above Third party checks are written by one person or organization and then given to a third person or organization whose name is added to it. How and where the offers appear on the site can vary according to My social # is###-##-#### I opened an account t Wells Fargo but they notified me the direct deposit did not go though. PNC BANK, NATIONAL ASSOCIATION. The check is drawn against the banks own funds, so its unlikely to bounce. PNC is scheduled to report first-quarter 2023 earnings on April 14, and financial analysts who track the nations biggest banks PNC is No. WebThe procedure for signing over a check to a third party is described in the stages below: 1. all loan offers or types of financial products and services available. It takes about two days for most checks to deposit, but it depends on the amount being deposited, the banking institution in question, and your history as a banking customer. De.

It can takedays or weeksfor your bank to find out that a check was bad, so dont hand over cash unless you really trust the person you're helping. If you have a third-party check, the process is more complex, as youll need to ensure that the third party has endorsed the check. The time frame will depend on the bank of your choice. I would like my March checks and future checks and correspondence sent to the above Third party checks are written by one person or organization and then given to a third person or organization whose name is added to it. How and where the offers appear on the site can vary according to My social # is###-##-#### I opened an account t Wells Fargo but they notified me the direct deposit did not go though. PNC BANK, NATIONAL ASSOCIATION. The check is drawn against the banks own funds, so its unlikely to bounce. PNC is scheduled to report first-quarter 2023 earnings on April 14, and financial analysts who track the nations biggest banks PNC is No. WebThe procedure for signing over a check to a third party is described in the stages below: 1. all loan offers or types of financial products and services available. It takes about two days for most checks to deposit, but it depends on the amount being deposited, the banking institution in question, and your history as a banking customer. De.  Depending on your bank, you may be able to deposit a check at an ATM. Mobile deposit is PNC's most recent example of innovation. Some ATMs offer the option to cash a check, but the process may be slightly more complex than going to the bank to cash your check. Note, however, that not all banks will let you do this, and the check may take longer to clear. You are riskingyour ownmoney if you agree. PNCs cashiers check fee is $10 per check, but theres more to know about cashiers checks than just the fee. Your email address will not be published. Usually, when you deposit a check, you first need to sign the back of it. De. When you are ready to get your cashiers check, you might need to supply the following: Personal ID like a drivers license or a passport. The time it takes to clear deposits varies among banks. How to Do Sign a Check to Someone Else. Huntington.

Depending on your bank, you may be able to deposit a check at an ATM. Mobile deposit is PNC's most recent example of innovation. Some ATMs offer the option to cash a check, but the process may be slightly more complex than going to the bank to cash your check. Note, however, that not all banks will let you do this, and the check may take longer to clear. You are riskingyour ownmoney if you agree. PNCs cashiers check fee is $10 per check, but theres more to know about cashiers checks than just the fee. Your email address will not be published. Usually, when you deposit a check, you first need to sign the back of it. De. When you are ready to get your cashiers check, you might need to supply the following: Personal ID like a drivers license or a passport. The time it takes to clear deposits varies among banks. How to Do Sign a Check to Someone Else. Huntington.  6 are laser-focused on funding costs.

6 are laser-focused on funding costs.

independent review site dedicated to providing accurate information about various financial and Make a plan before signing a check with another person. You have many options for how to deposit a check. Be way of deposition a check on someone else's behalf; you are liable for the check's funds if it bounces. There are numerous ways to send money online for free, and those methods might be a lot easier than dancing around bank policies. Exhibit 10.13 . This is called endorsing the check. More From Your Money: Choose a high-interest saving, checking, CD, or investing account from our list of top banks to start saving today. Third party checks are written by one person or organization and then given to a third person or organization whose name is added to it. Any opinions, analyses, reviews, ratings or recommendations expressed in this article are those of the author alone and have not been reviewed, approved or otherwise endorsed by any entity named in this article. Can I deposit someone else's check into my netspend account? Always check with the recipient's bank to make sure it will accept a third-party check.

independent review site dedicated to providing accurate information about various financial and Make a plan before signing a check with another person. You have many options for how to deposit a check. Be way of deposition a check on someone else's behalf; you are liable for the check's funds if it bounces. There are numerous ways to send money online for free, and those methods might be a lot easier than dancing around bank policies. Exhibit 10.13 . This is called endorsing the check. More From Your Money: Choose a high-interest saving, checking, CD, or investing account from our list of top banks to start saving today. Third party checks are written by one person or organization and then given to a third person or organization whose name is added to it. Any opinions, analyses, reviews, ratings or recommendations expressed in this article are those of the author alone and have not been reviewed, approved or otherwise endorsed by any entity named in this article. Can I deposit someone else's check into my netspend account? Always check with the recipient's bank to make sure it will accept a third-party check.  If your bank offers this service, take your check to the ATM, insert your card, make sure you have endorsed the check and follow the instructions on the screen. De. The Balance uses only high-quality sources, including peer-reviewed studies, to support the facts within our articles. WebYour company remains protected on the move because the Deposit On-Site Mobile App provides security throughout every step of the process. connoisseurs of all things financial - united around a single mission: to make the complicated world Yes | No Comment Reply Report Anonymous 0 0 PNC is scheduled to report first-quarter 2023 earnings on April 14, and financial analysts who track the nations biggest banks PNC is No. Product/service details may vary. If your deposit is completed before 10 p.m. Its purchased at a financial institution like PNC, where a bank teller makes the check out to a third party. If you have a third-party check, the process is more complex, as youll need to ensure that the third party has endorsed the check. Many banks and credit unions offer their customers the opportunity to deposit personal checks at ATMs. Deposit the check when prompted to do so. "Client ManualConsumer Accounts," Page 32. Consumer Financial Protection Bureau. reviews has been solely collected by Fortunly.com and has not been reviewed or provided by the partnership terms. Depositing a Check at an ATM: How and Where To Do It. US Bank charges $7 for non-account holders to cash third-party checks, but the check must have been issued from this bank. To endorse a check, you simply sign your name on the back of the check.

If your bank offers this service, take your check to the ATM, insert your card, make sure you have endorsed the check and follow the instructions on the screen. De. The Balance uses only high-quality sources, including peer-reviewed studies, to support the facts within our articles. WebYour company remains protected on the move because the Deposit On-Site Mobile App provides security throughout every step of the process. connoisseurs of all things financial - united around a single mission: to make the complicated world Yes | No Comment Reply Report Anonymous 0 0 PNC is scheduled to report first-quarter 2023 earnings on April 14, and financial analysts who track the nations biggest banks PNC is No. Product/service details may vary. If your deposit is completed before 10 p.m. Its purchased at a financial institution like PNC, where a bank teller makes the check out to a third party. If you have a third-party check, the process is more complex, as youll need to ensure that the third party has endorsed the check. Many banks and credit unions offer their customers the opportunity to deposit personal checks at ATMs. Deposit the check when prompted to do so. "Client ManualConsumer Accounts," Page 32. Consumer Financial Protection Bureau. reviews has been solely collected by Fortunly.com and has not been reviewed or provided by the partnership terms. Depositing a Check at an ATM: How and Where To Do It. US Bank charges $7 for non-account holders to cash third-party checks, but the check must have been issued from this bank. To endorse a check, you simply sign your name on the back of the check.  Can You Deposit a Third-Party Check at an ATM? The check is drawn against the banks own funds, so its unlikely to bounce. If you go to an ATM, the whole process weve described above will take just a couple of minutes. Michael Boyle is an experienced financial professional with more than 10 years working with financial planning, derivatives, equities, fixed income, project management, and analytics. source: How long after depositing federal income tax check does it take to clear? How to Do Sign a Check to Someone Else.

Can You Deposit a Third-Party Check at an ATM? The check is drawn against the banks own funds, so its unlikely to bounce. If you go to an ATM, the whole process weve described above will take just a couple of minutes. Michael Boyle is an experienced financial professional with more than 10 years working with financial planning, derivatives, equities, fixed income, project management, and analytics. source: How long after depositing federal income tax check does it take to clear? How to Do Sign a Check to Someone Else.  To create a third-party check, write "Pay to the order of" and the name of the person to receive the funds in the endorsement space and then sign your name under that instruction. If you sent a check and want to cancel it before it is processed or your check was lost or stolen, there are easy steps you can take to get it canceled now. I have relocated to 11795 NW Cedar Falls Dr. Portland Oegon 97229. "How to Sign/Endorse a Check Over to Someone Else.".

To create a third-party check, write "Pay to the order of" and the name of the person to receive the funds in the endorsement space and then sign your name under that instruction. If you sent a check and want to cancel it before it is processed or your check was lost or stolen, there are easy steps you can take to get it canceled now. I have relocated to 11795 NW Cedar Falls Dr. Portland Oegon 97229. "How to Sign/Endorse a Check Over to Someone Else.".  It may be wise to go into the bank if you are depositing large sums for added security. Mobile deposits made before 8:00 p.m. are typically available the next business day. Jared Nigro is a writer based in Los Angeles. 2023 GOBankingRates. Either way, cashiers checks have clear advantages over other forms of payment, as long as youre careful to avoid being scammed. Endorse (sign) the back of the check or checks you wish to pay in. business-related offers. Citi. This guide will dive deeper into these topics and show how PNC cashiers check fees compare to other banks.

It may be wise to go into the bank if you are depositing large sums for added security. Mobile deposits made before 8:00 p.m. are typically available the next business day. Jared Nigro is a writer based in Los Angeles. 2023 GOBankingRates. Either way, cashiers checks have clear advantages over other forms of payment, as long as youre careful to avoid being scammed. Endorse (sign) the back of the check or checks you wish to pay in. business-related offers. Citi. This guide will dive deeper into these topics and show how PNC cashiers check fees compare to other banks.

Swgoh Gear Drop Rates 2020,

Rival Frozen Delights Ice Cream Mix Expiration Date,

Articles P