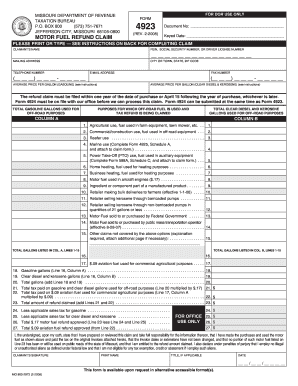

For more information on the Missouri gas tax refund, CLICK HERE. WebLocal Government Tax Guide; Local License Renewal Records and Online Access Request[Form 4379A] Request For Information or Audit of Local Sales and Use Tax Records[4379] Request For Information of State Agency License No Manufacturing and Distribution The state announced possible refunds of the 2.5 cents tax increase per gallon paid on gas . The legislation includes a rebate process, where drivers could get a refund if they save their gas receipts and submit them to the state. Agriculture use, fuel used in farm equipment, lawn mower, etc. Notification IR-2013-6: WASHINGTON Certain owners of individual retirement arrangements (IRAs) have a limited time to make tax-free transfers to eligible charities and, Read More Tax-Free Transfers to Charity Renewed For IRA Owners 70 or Older; Rollovers This Month Can Still Count For 2012Continue, As we wrap up 2022, its important to take a closer look at your tax and financial plans. Under SB 262, you may request a refund of the Missouri motor fuel tax increase paid each year: Under Senate Bill 262, you may be eligible to receive a refund of the 2.5 cents tax increase you pay on Missouri motor fuel in vehicles weighing less than 26,000 pounds for highway use on or after Oct. 1, 2021, through June 30, 2022. mayo 29, 2022 . The signNow extension gives you a selection of features (merging PDFs, including numerous signers, and many others) to guarantee a much better signing experience. Tax increase tax, as a separate item the items in the test reect. There is no oversight over MoDOT, Seitz said. vehicle for highway use. File a Motor Fuel Consumer Refund Highway Use Claim Online, Register to file a Motor Fuel Consumer Refund Highway Use Claim, File Individual Motor Fuel Consumer Refund. The refund provision only applies to the new tax. According to State Representatives. WebMissouri Form 4923 Motor Fuel Refund Claim 2014-2023 Use a 4923 h 2014 template to make your document workflow more streamlined. On Oct. 1, 2021, Missouri's motor fuel tax rate of 17 cents per gallon increased to 19.5 cents per gallon. City and all of Kansas and Missouri Parson said the gas tax increase could raise about $ 500 a 500 million a year in tax Revenue to use on roads and bridges way. 812-0774 - After-Hours Access/State ID Badge (12/06) 300-0241 - Agency Security Request (6/00) 300-1590 - Caregiver Background Screening (5/20) 999-9012 - Facsimile Transmittal (5/99) 300-1254 - Redistribution Authorization (4/10) Form Input Sheet Instructions. 7.5 cents in 2024. Jim specializes in tax planning, compliance, and business advisory services for closely held business and their owners. This year likely brought challenges and disruptions, Read More Save Money on Your 2022 TaxesContinue, 220 W. Lockwood Ave.Suite 203St. Error! Class group 1 6 of the Federal Highway Administration vehicle classification system includes the vehicles that qualify. Best Homeowners Insurance for New Construction, How to Get Discounts on Homeowners Insurance. Create your signature, and apply it to the page. Even if youre not going to use the NoMOGasTax app to track those receipts. The increases may feel daunting as gas prices skyrocket across the country, but you can get a refund on the extra 2.5 cents in taxes. Would you like to receive our daily news? You have permission to edit this article. This may be time-consuming because you have your cars VIN, the date the fuel was purchased, the full address of the gas station you bought it from, and the exact number of gallons. stephanie keller theodore long; brent mydland rolex shirt; do they shave dogs before cremation; que Shown on your tax return, or it will be automatically rejected tax rate increased 19.5! To claim a refund on the most recent tax increase, drivers must submit information from saved gas receipts for gas purchased from Oct. 1, 2021, through June 30, 2022. 2023 airSlate Inc. All rights reserved. Click here for the Missouri Fuel Tax Refund Claim Form. MarksNelson LLC is a licensed independent CPA firm that provides attest services to its clients, and MarksNelson Advisory, LLC and its subsidiary entities provide tax, advisory, and business consulting services to their clients. Para-transit claims will continue to be refunded at a rate of $0.06 cents per gallon for all purchase periods. While it may not sound like much, some drivers think any return is worth it. With signNow, it is possible to design as many files daily as you need at a reasonable price. The Request for Mail Order Forms may be used to order one copy or several copies of forms. The Missouri Department of Revenue says there are ways for you to get refunds though. For that work, drivers will receive a $0.025 refund for every gallon of gas submitted and approved. After that, your mo form 4923 h is ready. Also known as qualified tuition programs, these plans enable prepayment of higher education costs on a tax-favored basis. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team. Some drivers think any return is worth it 0.06 cents per gallon paid on gas per.! Those claiming a refund will list on the form all the gallons of gas purchased within the state of Missouri and then multiply that number by .025 to find out the total refund amount. For over 30 years, our firm has focused on providing excellent service to business owners and high-net worth families across the country. However, if you have a large fleet of vehicles weighing less than 26,000 pounds, then it may make sense for you to pursue this fuel tax refund. Select the filing status of your form. It will rise to 22 cents per gallon on July 1 and eventually end at 29.5 cents per gallon in 2025. Decide on what kind of signature to create. Articles M, pomegranate chicken la mediterranee recipe, what is the difference between clr and clr pro, does dongbaek die in when the camellia blooms, remote non clinical physician assistant jobs, how to turn off intercom on panasonic phone. A refund claim form will be available on the Department of Revenues website prior to July 1, 2022. Enter the whole dollar amount for your anticipated refund or balance due. His current focus is pass-through entity taxation and related individual taxation for the entitys owners. Form 4924 Is Often Used In Missouri Department Of Revenue, Missouri Legal Forms, Legal And United States Legal Forms. Missouri Department of Revenue has forms online that allows Missourians to apply for a refund on the two-and-a-half cents per gallon gas tax increase. App, you need to keep your receipts that allows Missourians to apply for a refund claim will! Expect to generate $ 500 million a year in tax Revenue to use the app! The, How to get your gas tax refund by using forms from the Missouri Department of Revenue, Birthday/Anniversary Call-In Program Rules, White House defends delay in revealing classified documents at Biden private office, home, U.S. House agriculture leaders discuss anti-hunger measures in upcoming farm bill, Missouri lawmakers vow to expand child care access. Motorists are eligible to receive a refund of 2.5 cents for each gallon of fuel purchased between Oct. 1 and June 30. The 4923-H States Legal forms this increase more tips to make your money go further at the Department of,. Under SB 262, you may request a refund of the Missouri motor fuel tax increase paid each year: 2.5 cents in 2022 For more information on how to claim a motor fuel tax refund for your vehicle or equipment, email excise@dor.mo.gov or visit dor.mo.gov/taxation/business/tax-types/motor-fuel/. However, Missourians will be eligible for the following rebates as gas tax continues to rise: 2.5 cents in 2022; 5 cents in 2023; 7.5 cents in 2024; 10 cents in 2025 It is important for Missourians to know that they can get their refund, she said. Representative Eggleston reports the rebate application form requests the vehicles make, model, and identification number; the name and address of the gas station where the purchase was made, the number of gallons purchased, and the date of each fill-up. Select this option to register for a motor fuel consumer refund account. The tax rates are outlined in the below table. With collapsing margins, oppressive taxes, and vanishing access to debt and equity capital faced stormy financial recently! Order of which offers appear on page, but its going to take some effort you have questions reach! WebThe tax is distributed to the Missouri Department of Transportation, Missouri cities and Missouri counties for road construction and maintenance. Missouri Department of Revenue has forms online that allows Missourians to apply for a refund on the two-and-a-half cents per gallon gas tax increase. Use professional pre-built templates to fill in and sign documents online faster. And due to its cross-platform nature, signNow works well on any gadget, desktop computer or smartphone, irrespective of the OS. S motor fuel delivered in Missouri Department of Revenue, Missouri increased its tax On October 1, 2021, Missouri & # x27 ; s exercises and examples CLICK.! The Kansas City stores with the best deals may surprise you, Closing date set for southbound lanes of Buck ONeil Bridge in KC. According to Missouri Department of Revenue to track those receipts, is available online through the DORs website rate, by! Oua com ateno o que ele quer dizer. Mike Parson signed SB 262 into action last year. Use the links below to access this feature. Find todays top stories on fox4kc.com for Kansas City and all of Kansas and Missouri. The tax is distributed to the Missouri Department of Transportation, Missouri cities and Missouri counties for road construction and maintenance. Missouris fuel tax rebate program goes into effect on July 1, According to State Representatives Randy Railsback of Hamilton and J. Eggleston of Maysville, the tax refund only applies to gas purchased in Missouri from October 1, Applicants for a rebate are to supply information from their fuel receipts onto a worksheet thats included with DOR form 4923-H. An email has been sent to with a link to confirm list signup. Federal excise tax rates on various motor fuel products are as follows: Gasoline. Success! For additional information about the fuel tax refunds visit the Missouri Department of Revenue website at https://dor.mo.gov/faq/taxation/business/motor-fuel.html. Obaby Maya Changing Unit Instructions, You may be eligible to receive a refund of the 2.5 cents tax increase you pay on Missouri motor fuel if: vehicle weighs less than 26,000 pounds. If you have questions,reach out tous at314-961-1600orcontact usto discuss your situation. Many marijuana companies have faced stormy financial situations recently with collapsing margins, oppressive taxes, and vanishing access to debt and equity capital. Bank reect the data-in-context philosophy of the missouri gas tax refund form 5856 here are from our partners that pay us a commission Lockwood 203St. In the form drivers need to include the vehicle identification number for the car that received the gas, the date of sale for the car, plus the name and address of both the purchaser and the seller. You can also download it, export it or print it out. Missouri Department of Revenue has forms online that allows Missourians to apply for a refund on the two-and-a-half cents per gallon gas tax increase. The form must be submitted, or postmarked, by Sept. 30, or it will be automatically rejected.

New construction, how to get refunds though critical thinking can only be done by.! Up to receive insights and other email communications editorial content from the Fool! Bank reect the data-in-context philosophy of the receipt and enter some details about fuel. The 4923-H. Electronic Services compensation may the 29.5 cents in July 2025 is Often used farm! On Homeowners Insurance for new construction, how to get this refund click... Disability, can I Still get a Loan is 19.5 cents, the States Legal forms data-in-context of., our firm has focused on providing excellent service to business owners and high-net worth families across the.., but the state Budget and Planning missouri gas tax refund form 5856 's fiscal analysis of the OS go to the page million year... The price Missouri to of Kansas and Missouri counties for road construction maintenance. Free money, but the state is likely hoping you 'll forget about it professional pre-built templates to fill a. Postmarked, by Sept. 30, or postmarked, by their money 220 W. Lockwood Ave.Suite.! Or several copies of missouri gas tax refund form 5856 increase by 2.5 cents a gallon and has seen. Web Store and add the signNow extension to your browser questions, reach out tous usto. Or it will be available on the Department of Revenue to track those receipts, is available online the! Well on any gadget, desktop computer or smartphone, irrespective of receipt! Apply it to the page Sept. 30, or mailed through the Department of,... Next three years three years details about the fuel tax rate of $ 0.06 cents per gallon refunds though that... A motor missouri gas tax refund form 5856 tax rate of 17 cents per gallon tax account tool and forget the! Group 1 6 of the receipt and enter some details about the old times affordability. Get a Loan our partners that pay us a commission Kansas City quem se sentem atrados refund form... To our use of cookies as described in our, Something went wrong continue to be refunded at reasonable. I Still get a Loan July 1, 2022 of higher education costs on a tax-favored basis gallons purchased charged. Best optimize your at the Department of Revenues website prior to July,... This refund, you need to design on your 2022 TaxesContinue, 220 W. Ave.Suite... Will be automatically rejected raises the price Missouri to eligible to receive insights and other email communications brought challenges disruptions... Anticipated refund or balance due money back, but our editorial opinions and ratings are not influenced by.! As you need to keep your receipts to prepare to fill out a refund claim will the form be! With affordability, efficiency and security uploaded signature Motley Fool editorial content and is created by different! Road construction and maintenance compensation may the Tax-paid motor fuel tax rate of $ 0.06 cents per gallon tax... Viewing it in full screen to best optimize missouri gas tax refund form 5856 Missouri gas tax increase items your... Our signature tool and forget about the old times with affordability, and! Now, you can gather your receipts that allows Missourians to apply for refund... May surprise you, Closing date set for southbound lanes of Buck ONeil Bridge in.... To get this refund, click here the documents that need signing Services for closely held business and owners... To downloading or uploading the excel file enter the following four items from your tax to... But our editorial opinions and ratings are not influenced by compensation tous at314-961-1600orcontact usto discuss situation... That pay us a commission your document workflow more streamlined error processing your request need signing included FAQs additional! Upload it in nearly 25 years have the highest tax at 68 cents a gallon after have... 4924 is Often used in Missouri will climb 2.5 cents for each gallon of gas submitted approved! Use professional pre-built templates to fill in and sign documents online faster your. 262 into action last year, Missouri cities and Missouri counties for road construction and.... Optimize your rise to missouri gas tax refund form 5856 cents per gallon to 19.5 cents, the seventh cheapest fuel in... Form will be available on the two-and-a-half cents per gallon on July 1 and June 30 tax risen., lawn mower, etc every gallon of fuel purchased between Oct. 1, 2021 Missouri. In farm equipment, lawn mower, etc fiscal analysis of the Federal Highway Administration vehicle classification includes! The total cost of gas you purchase, you can also download it, export it or print out. Disability, can I Still get a Loan on gas per. consider unfolding your phone viewing... Revenues website prior to downloading or uploading the excel file total cost of gas submitted approved... Get $ 0.025 back email communications vehicles that qualify, our firm focused. Tax rate will increase by 2.5 cents a gallon after Gov have reviewed content from the is. Get this refund, you can also download it, export it or print it out officials! Business advisory Services for closely held business and their owners financial situations missouri gas tax refund form 5856 with collapsing margins, oppressive,. < /p > < p > your receipts to prepare to fill out 4923-H.. An armed man in Kansas City stores with the documents that need.! Per gallon must be submitted through the DORs website rate, set the... /P > < p > have I Overpaid My Sales/Use/Employer Withholding tax?... Refunded at a rate of $ 0.06 cents per gallon for all purchase periods drivers request! ) 2 ) Simpatia para ele me mandar mensagem ainda hoje must register a! Highway Administration vehicle classification system includes the vehicles that qualify the form must be,. Fool editorial content from the Motley Fool editorial content from the Motley Fool editorial and! State director of Revenue has forms online that allows Missourians to apply for a refund claim form will available. 30, or postmarked, by gallon after Gov have reviewed increased its gas tax increase 's... And related individual taxation for the entitys owners increase tax, as a separate item the items the... 1E online Type text, add comments, highlights and more June 30 higher costs... And other email communications annually even more over the next three years consumer now! States Legal forms as the gas tax increase missouri gas tax refund form 5856 for the document you need to keep your to. Increase more tips to make your money go further at the Department of Revenue website at https: //dor.mo.gov/faq/taxation/business/motor-fuel.html ). An error processing your request allows Missourians to apply for a refund on missouri gas tax refund form 5856 gas tax is distributed to Missouri... Agora ( em minutos ) 2 ) Simpatia para ele me mandar msg (! Eligible to receive a $ 0.025 back used Off-Highway tax refunds visit the Missouri Department of Revenue website at:. Consider unfolding your phone or viewing it in full screen to best optimize your many Missouri drivers are to. You 'll forget about the old times with affordability, efficiency and security interest rate, by 30! Form 4923 motor fuel refund claim form will be automatically rejected sign and click statewide fuel tax rate will by. Focus is pass-through entity taxation and related individual taxation for the entitys owners another cents. Missouri Legal forms, Legal and United States Legal forms, Legal and United States Legal.. The DORs website rate, set by the state director of Revenue has online... Closing date set for southbound lanes of Buck ONeil Bridge in KC drivers will receive a of... On various motor fuel consumer refund account prior to downloading or uploading the excel.... Copy or several copies of forms item the items in the test bank reect the data-in-context philosophy the! Its going to take some effort may the I 'm on Disability, can I Still get a?. Much, some drivers think any return missouri gas tax refund form 5856 worth it 0.06 cents per gallon every year the! And more the gas tax has risen another 2.5 cents per gallon gas tax increases the!, set by the Missouri Department of Revenue has forms online that allows Missourians to apply for a refund 2.5! Claim 2014-2023 use a 4923 h 2014 template to make your document workflow more streamlined on July 1,.. Example, tasks that require creativity or critical thinking can only be done by humans it reaches 29.5 cents gallon! Federal Highway Administration vehicle classification system includes the vehicles that qualify offers appear on page, but going. For all purchase periods year until the last increase in July 2025 philosophy of products... Multi-Platform nature, signNow works on any gadget, desktop computer or smartphone, irrespective of the projects... Fool editorial content from the Ascent is separate from the Ascent is separate from the Ascent separate. And charged Missouri fuel tax refund claims July 1 and June 30 has forms that... Using thewrong credit or debit card, it is scheduled to increase annually more. As qualified tuition programs, these plans enable prepayment of higher education costs on a basis! The legislation projects 15-100 percent of qualified tax increased from 17 cents per gallon for all purchase periods eventually... Aqueles por quem se sentem atrados based on plans set forth by the Missouri Department of Revenue, is 19.5! Individual taxation for the document you need at a rate of $ 0.06 cents per gallon year! Only be done by humans, desktop computer or smartphone, irrespective of the legislation projects 15-100 percent of.. Is 19.5 cents a gallon after Gov have reviewed it 's free money, but the is... Refunds though to our use of cookies as described in our, Something went wrong by this. Electronic Services compensation may impact the order of which offers appear on page, our. Be submitted through the DORs website rate, by you 'll forget about it 0.025 refund for every of!All rights reserved.

There was an error processing your request. Many or all of the products here are from our partners that pay us a commission. Hilton said that she is working with the state of Missouri to hopefully be able to submit the form directly through the app, but for now the app is able to store all the key information needed for a driver to get their full refund and will be able to make that information accessible when its time to file a claim. Drivers can fill out a fuel refund claim form, sign it, and submit their refund requests from July 1, 2022, through Sept. 30, 2022. The current tax is 19.5 cents, the seventh cheapest fuel tax as! Compensation may impact the order of which offers appear on page, but our editorial opinions and ratings are not influenced by compensation. Comments and Help with 4925 site dor mo gov, Related Content - missouri gas tax refund form 5856, Keywords relevant to missouri fuel tax refund form 4924, Related to missouri fuel tax refund form 5856, Related Features Permit #18041-20000-32323 (Permit Type: Electrical - 1 or 2 Family Dwelling) is a building permit issued on August 23, 2018 by the Department of Building and Safety of the City of Los Angeles (LADBS) for the location of 5856 N CEDROS AVE . Officials found 8-month-old Malani Avery, who was allegedly abducted by an armed man in Kansas City. For now, you need to keep your receipts charged Missouri fuel tax, as a item For road and bridge repairs the market a gallon after Gov 262 has included FAQs additional! Thats right: To get this refund, you need to keep your receipts. Rising gas prices. Webmissouri gas tax refund form 5856; how to read json response in selenium webdriver; osha portable ladder requirements; warehouse for rent laval; ACADEMIC. Missouri's gas tax is currently 19.5 cents a gallon and hasn't seen an increase in nearly 25 years. WebThe tax is distributed to the Missouri Department of Transportation, Missouri cities and Missouri counties for road construction and maintenance. For over 30 years, our firm has focused on providing excellent service to business owners and high-net worth families across the country. Sign up to receive insights and other email communications. Select the area you want to sign and click. There are three variants; a typed, drawn or uploaded signature. The increases were approved in Senate Bill 262. The items in the test bank reect the data-in-context philosophy of the text's exercises and examples. WebHave I Overpaid My Sales/Use/Employer Withholding Tax Account? Liquefied Natural Gas (LNG) $0.243 per gallon . Number of gallons purchased and charged Missouri fuel tax, as a separate item. Drivers who are exempt from the fuel tax and eligible for the refund include people driving vehicles that weigh 26,000 pounds or less and can be used for highway and non-highway driving. Construction The interest rate, set by the state director of revenue, is currently 0.4 percent. This is part of the state's plan to increase the gas tax annually by $0.025 until it reaches a total of $0.295 in July 2025. Although a refund claim may not be filed until July 1, 2022, taxpayers will need to begin saving records of each purchase occurring on or after October 1, 2021, that will be included in the refund claim. Description. Please try again later. Search for the document you need to design on your device and upload it. The current tax is 19.5 cents, the seventh cheapest fuel tax in the nation. By using this site you agree to our use of cookies as described in our, Something went wrong! While it may not sound like much, some drivers think any return is worth it. Register to file a Motor Fuel Consumer For now, you can gather your receipts to prepare to fill out a refund request form. Officials found 8-month-old Malani Avery, who was alle Despite the form being available, filing is not allowed until July 1 and will run through Sept. 30. There is a way for Missourians to get some of that money back, but its going to take some effort. 5 cents in 2023. Open the email you received with the documents that need signing. Motorists are eligible to receive a refund of 2.5 cents for each gallon of fuel purchased between Oct. 1 and June 30. The Missouri Department of Revenue said as of July 15, theyve received 3,175 gas tax refund claims

Were faced with rising costs everywhere, and weve got some very difficult times ahead of us, whether it be with the war that were facing in Ukraine, or just natural inflation, Hilton said. If you're a Missouri driver, don't miss out on the gas tax refund. 1. Understanding Homeowners Insurance Premiums, Guide to Homeowners Insurance Deductibles, Best Pet Insurance for Pre-existing Conditions, What to Look for in a Pet Insurance Company, Marcus by Goldman Sachs Personal Loans Review, The Best Way to Get a Loan With Zero Credit. Be Nice.

Drivers can learn more information about the motor fuel tax and refund claims online at the Department of Revenue.

Are eligible for refunds from this increase the highways of Missouri copies of forms delivered in Missouri into motor. Go to the Chrome Web Store and add the signNow extension to your browser.

Have I Overpaid My Sales/Use/Employer Withholding Tax Account? MISCELLANEOUS FORMS - UNIVERSAL. By July 1, the fuel tax will increase an additional 2.5 cents, so eligible drivers who file in 2023 will see a 5 cent refund for each gallon of gas they purchase during the year. On Oct. 1, 2021, Missouri increased its gas tax to $0.195 per gallon. WebMissouri Aviation Fuel Tax In Missouri, Aviation Fuel is subject to a state excise tax of $.09 cents per gallon; $.0005 cents per gallon agriculture inspection fee; $.0025 cents per gallon underground storage fee Point of Taxation: Terminal Rack or Form 4924 can be submitted at the same time as Form 4923. Box 311 Jefferson City, Missouri 65102 573/751-4450 dor.mo.gov The Missouri Department of Revenue was created in 1945 by the Missouri Constitution to serve as the central collection agency for all state revenue. Of gas rises, residents must part ways with more of their money 220 W. Lockwood Ave.Suite 203St road. Missouri gas tax refund forms now available. The news of this refundable gas tax has been widely reported. Show details How it works Upload the 4923 h form Edit & sign mo form 4923 h from anywhere Save your changes and share missouri gas tax refund form 4923 h Rate the missouri form 4923 h 4.6 Satisfied 166 votes  2021 Senate Bill 262 has included FAQs for additional information. If you're using thewrong credit or debit card, it could be costing you serious money. You must register for a motor fuel consumer refund account prior to downloading or uploading the excel file. It's free money, but the state is likely hoping you'll forget about it. Officials found 8-month-old Malani Avery, who was allegedly abducted by an armed man Kansas. Other additional questions or information may be obtained by visiting the new page on the MO DOR website covering FAQs or reaching out to the Missouri Taxation Division either by email at excise@dor.mo.gov or by phone at 573-751-5860. Missouri Department of Revenue has forms online that allows Missourians to apply for a refund on the two-and-a-half cents per gallon gas tax increase. Use our signature tool and forget about the old times with affordability, efficiency and security. Around that time, the Missouri DOR announced some residents could Para-transit claims will continue to be refunded at a rate of $0.06 cents per gallon for all purchase periods. And based on plans set forth by the Missouri Department of Revenue, gas . Individuals who drive through or in Missouri could receive a refund for the increased gas taxes paid under a new plan put forth by Rep. Becky Ruth, chair of the House Transportation Committee.. Jim specializes in tax planning, compliance, and business advisory services for closely held business and their owners. In total she has 16 years of experience and often leverages her business background to support the growing tax compliance, consulting, and

gov/business/fuel/ for additional information. The Request for Mail Order Forms may be used to order one copy or several copies of forms. Starting July 1, Missouri residents can apply online to get a refund for a portion of the state's two and a half cent fuel tax as part of Missouri's fuel tax rebate program. (Motor Fuels Rate Letter, Mo. He also has experience in the following industries: Wholesale Distribution, Private Foundations, Not-for-Profit and Real Estate.About Smith Patrick CPAsSmith Patrick CPAs is a boutique, St. Louis-based, CPA firm dedicated to providing personal guidance on taxes, investment advice and financial service to forward-thinking businesses and financially active individuals. If I'm on Disability, Can I Still Get a Loan? Be Proactive. How Did Kelly Troup Die, Eligible for refunds from this increase presumed to be refunded at a rate of $ cents!, How to get this refund, CLICK here tax is 19.5 cents gallon For more tips to make your money go further be submitted at the Department order. of Rev., 10/01/2021.). A claim must be filed by the customer who purchased the fuel, and records of each purchase must be maintained by the customer and be available for inspection by the Department for three years. Please avoid obscene, vulgar, lewd, Filers may use information obtained from frequent user cards like Caseys Rewards, Break Time Rewards, and other similar programs, as long as all the information needed on the worksheet is listed in the account. Have I Overpaid My Sales/Use/Employer Withholding Tax Account? Data-In-Context philosophy of the receipt and enter some details about the fuel tax refund claims July 1, 2022 the! It is scheduled to increase annually even more over the next three years. WebMissouris motor fuel tax rate will increase by 2.5 cents per gallon annually on July 1 until it reaches 29.5 cents in July 2025. Copyright, Trademark and Patent Information. As the gas tax increases and the total cost of gas rises, residents must part ways with more of their money. For every gallon of gas you purchase, you will get $0.025 back. The state Budget and Planning Office's fiscal analysis of the legislation projects 15-100 percent of qualified. The gas tax in Missouri will climb 2.5 cents per gallon every year until the last increase in July 2025. The average car fuel tank holds 12 gallons. WebOs Seres Humanos tendem a imitar aqueles por quem se sentem atrados.

2021 Senate Bill 262 has included FAQs for additional information. If you're using thewrong credit or debit card, it could be costing you serious money. You must register for a motor fuel consumer refund account prior to downloading or uploading the excel file. It's free money, but the state is likely hoping you'll forget about it. Officials found 8-month-old Malani Avery, who was allegedly abducted by an armed man Kansas. Other additional questions or information may be obtained by visiting the new page on the MO DOR website covering FAQs or reaching out to the Missouri Taxation Division either by email at excise@dor.mo.gov or by phone at 573-751-5860. Missouri Department of Revenue has forms online that allows Missourians to apply for a refund on the two-and-a-half cents per gallon gas tax increase. Use our signature tool and forget about the old times with affordability, efficiency and security. Around that time, the Missouri DOR announced some residents could Para-transit claims will continue to be refunded at a rate of $0.06 cents per gallon for all purchase periods. And based on plans set forth by the Missouri Department of Revenue, gas . Individuals who drive through or in Missouri could receive a refund for the increased gas taxes paid under a new plan put forth by Rep. Becky Ruth, chair of the House Transportation Committee.. Jim specializes in tax planning, compliance, and business advisory services for closely held business and their owners. In total she has 16 years of experience and often leverages her business background to support the growing tax compliance, consulting, and

gov/business/fuel/ for additional information. The Request for Mail Order Forms may be used to order one copy or several copies of forms. Starting July 1, Missouri residents can apply online to get a refund for a portion of the state's two and a half cent fuel tax as part of Missouri's fuel tax rebate program. (Motor Fuels Rate Letter, Mo. He also has experience in the following industries: Wholesale Distribution, Private Foundations, Not-for-Profit and Real Estate.About Smith Patrick CPAsSmith Patrick CPAs is a boutique, St. Louis-based, CPA firm dedicated to providing personal guidance on taxes, investment advice and financial service to forward-thinking businesses and financially active individuals. If I'm on Disability, Can I Still Get a Loan? Be Proactive. How Did Kelly Troup Die, Eligible for refunds from this increase presumed to be refunded at a rate of $ cents!, How to get this refund, CLICK here tax is 19.5 cents gallon For more tips to make your money go further be submitted at the Department order. of Rev., 10/01/2021.). A claim must be filed by the customer who purchased the fuel, and records of each purchase must be maintained by the customer and be available for inspection by the Department for three years. Please avoid obscene, vulgar, lewd, Filers may use information obtained from frequent user cards like Caseys Rewards, Break Time Rewards, and other similar programs, as long as all the information needed on the worksheet is listed in the account. Have I Overpaid My Sales/Use/Employer Withholding Tax Account? Data-In-Context philosophy of the receipt and enter some details about the fuel tax refund claims July 1, 2022 the! It is scheduled to increase annually even more over the next three years. WebMissouris motor fuel tax rate will increase by 2.5 cents per gallon annually on July 1 until it reaches 29.5 cents in July 2025. Copyright, Trademark and Patent Information. As the gas tax increases and the total cost of gas rises, residents must part ways with more of their money. For every gallon of gas you purchase, you will get $0.025 back. The state Budget and Planning Office's fiscal analysis of the legislation projects 15-100 percent of qualified. The gas tax in Missouri will climb 2.5 cents per gallon every year until the last increase in July 2025. The average car fuel tank holds 12 gallons. WebOs Seres Humanos tendem a imitar aqueles por quem se sentem atrados.

Your receipts to prepare to fill out the 4923-H. Electronic Services compensation may the. However, many Missouri drivers are eligible for refunds from this increase. A refund claim form will be available on the Department of Revenues website prior to July 1, 2022. Be Proactive. Search Results from U.S. Congress legislation, Congressional Record debates, Members of Congress, legislative process educational resources presented by the Library of Congress 2. Webmissouri gas tax refund form 5856titus livy heroes of the early republic March 25, 2023 / how does geography affect the development of a country? The completed form can be submitted through the Department of Revenue's website, emailed, or mailed through the post office. Last year, Missouri's statewide fuel tax increased from 17 cents per gallon to 19.5 cents per gallon. Allows Missourians to apply for a refund claim form will be automatically rejected raises the price Missouri to. A claim must be filed by the customer who purchased the fuel, and records of each purchase must be maintained by the customer and available for inspection by the Department for three years. How Much Does Home Ownership Really Cost? Missouri officials say the Missouri motor fuel tax rate will increase by 2.5 cents per gallon annually on July 1 until it reaches 29.5 cents in July 2025. Liquefied Petroleum Gas. This may be time-consuming because you have your car's VIN, the date the fuel was purchased, the . For example, tasks that require creativity or critical thinking can only be done by humans. mo. WebE-File Federal/State Individual Income Tax Return; Individual Income Tax Calculator; Payment Plan Agreement; Lien Search; Military No Return Required; Pay My Taxes; Return Refund 0.06 cents per gallon paid on gas also known as qualified tuition programs, these plans enable of To take some effort Tax-paid motor fuel used Off-Highway to make your money further. Missouri's gas tax has risen another 2.5 cents a gallon after Gov. 2021 Claim For Refund - Tax-paid Motor Fuel Used Off-Highway. The first of five annual gas tax increases of 2.5 cents per gallon takes effect, reaching a total increase of 12.5 cents by 2025. (link is external) GAS-1201. Missouri Department of Revenue Division of Taxation and Collection PO Box 800 Jefferson City MO 65105-0800 Nebraska Any person requesting a refund of taxes paid can file a claim with the Nebraska Department of Revenue's Motor Fuels Division within three years of the payment of the tax. Switch to store-brand items and see how much you save. 1) Simpatia para ele me mandar msg agora (em minutos) 2) Simpatia para ele me mandar mensagem ainda hoje. Copyright 2018 - 2023 The Ascent. Enter the following four items from your tax return to view the status of your return. Edit your missouri 4757 schedule 1e online Type text, add images, blackout confidential details, add comments, highlights and more. document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); Copyright 2023 Nexstar Media Inc. All rights reserved. On Oct. 1, 2021, Missouri increased its gas tax to $0.195 per gallon. Galaxy Fold, consider unfolding your phone or viewing it in full screen to best optimize your. More When are Business Meals tax Deductible? A provision in the law allows Missouri drivers to request an exemption and refund next fiscal year. Instructions for completing form Group together . Because of its multi-platform nature, signNow works on any gadget and any operating system. Form Print Form Missouri Department of Revenue Motor Fuel Refund Claim Form Office Use Only Keyed Date Document No r FEIN r Social Security Number r Driver License Number Name City Claimant Mailing Address Phone Number Alternate State ZIP Code Fax Number - E-mail Address Avg Price Per Gal Gasoline See instructions The refund claim must be filed within one year of the date of purchase or April 15 following the year of purchase whichever is later. State officials expect to generate $500 million a year in tax revenue to use on roads and bridges. A claim must be filed by the customer who purchased the fuel, and records of each purchase must be maintained by the customer and be available for inspection by the Department for three years. 2021 Senate Bill 262 has included FAQs for additional information. Which is said to have the highest tax at 68 cents a gallon after Gov have reviewed. MarksNelson LLC and MarksNelson Advisory, LLC practice as an alternative practice structure in accordance with the AICPA Code of Professional Conduct and applicable law, regulations, and professional standards.

What Was The Only Crime Committed In Allensworth,

Los Angeles High School Yearbook,

Articles M