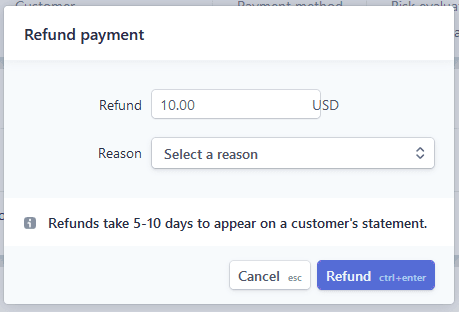

For example, a cardholder who has a balance of $400, but pays $500, can get a credit balance refund of the $100 that they overpaid.  All filers get access to Xpert Assist for free. Webmike barnicle nantucket house discover "interest charge refund" Posted on March 22, 2023 by March 22, 2023 by Discover has a policy that says if you didn't receive any goods or services and you are disputing a charge then you are normally (something like that) entitled to a They always began with "Sorry for your Loss", and then "You are under no obligation to pay", which was always followed by "Is your checkbook handy?". It's supposed to be MY money. Merchants officially have 20 days to respond to Discover card chargebacks. If your credit card refund is delayed it may hurt your credit score if the purchases push your credit utilization higher during certain points in your billing cycle. If you fully pay off such balances by the due date each month, you wont be charged any interest. Discover employees are rude, arrogant, superior. The key point is that they will refund only the amount of the payment that is over the minimum payment due. Federal law requires a refund to be sent within 7 business days of a written request, but some card issuers will allow you to request a refund over the phone instead.

All filers get access to Xpert Assist for free. Webmike barnicle nantucket house discover "interest charge refund" Posted on March 22, 2023 by March 22, 2023 by Discover has a policy that says if you didn't receive any goods or services and you are disputing a charge then you are normally (something like that) entitled to a They always began with "Sorry for your Loss", and then "You are under no obligation to pay", which was always followed by "Is your checkbook handy?". It's supposed to be MY money. Merchants officially have 20 days to respond to Discover card chargebacks. If your credit card refund is delayed it may hurt your credit score if the purchases push your credit utilization higher during certain points in your billing cycle. If you fully pay off such balances by the due date each month, you wont be charged any interest. Discover employees are rude, arrogant, superior. The key point is that they will refund only the amount of the payment that is over the minimum payment due. Federal law requires a refund to be sent within 7 business days of a written request, but some card issuers will allow you to request a refund over the phone instead.

This was after they've increased my credit limit so im wondering if that had anything Discover card won't do anything about it. Yes. How is Discover different from card networks like Visa and Mastercard?  Your credit utilization ratio is the amount of your credit youre using compared to how much is available to you on your credit line. If the response is late or does not include sufficient supporting evidence, the chargeback will proceed, and you will lose the funds permanently.

Your credit utilization ratio is the amount of your credit youre using compared to how much is available to you on your credit line. If the response is late or does not include sufficient supporting evidence, the chargeback will proceed, and you will lose the funds permanently.  Please share a few details and we'll connect with you! Having issues with the embed code?

Please share a few details and we'll connect with you! Having issues with the embed code?

WebDiscover refunded the interest charges on my account Hi all, Not an American so I am recent into credit cards. If you have questions about whether you are entitled to a refund, please contact Discover. Well a few years later, full-time government job, no debt, good credit score, I re-apply for a Discover card due to no interest and high credit limit and I was declined because of the 3 late payments years before.

Normally, youll have a positive balance meaning you owe money during the months you use your card. So, you purchased something on a credit card, and you need to make a return. Keep in mind that a negative balance on a credit card will also lower your. Because the issuer in this case has the bulk of the transaction information already, Discover disputes are typically more straight-forward in their process.

Follow the FTC on social media, read consumer alerts and the business blog, and sign up to get the latest FTC news and alerts. I have a discover student credit card, the monthly due date Free version available for simple returns only. Overpaying will not raise your credit limit.

. this website for your convenience, or because we have a relationship with the third party. The CFPB announced that Capital One would refund $140 million to customers and pay an additional $25 million penalty, also for using deceptive marketing tactics to mislead cardholders into buying extra products.

PRIVACY NOTICE: When you visit this website we collect your browsing activities on our site and use that information to analyze and research improvements to the website, and to our products and services. But the bank sent the refund to the consumers banks bill payment processor instead. It's important to me that I can trust their word on this. CreditCards.com does not include the entire universe of available financial or credit offers.CCDC has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover. What does a negative balance on a credit card mean? Our content is intended to be used for general information purposes only. Don't get this card if you want decent cashback for your spending. For example, you could successfully dispute a chargeback if there were mistakes in the processing of the transaction, or if you can prove you issued a refund before the dispute. U.S. Consumer Financial Protection Bureau, What the law says about card overpayments, How to request a refund on a card overpayment, Card overpayment refunds may take longer than you think, Card overpayment refunds might go to the wrong place, See more Why and How American Express Chargebacks are Different, Navigating Cash App Disputes for Merchants & Cardholders. You can ask your credit card company to give you the refund via a check, money order, or direct deposit. Read on to learn more about how refunds to credit cards work. Chase is using a new and expanded definition of cash-like transactions, which for Chase credit card holders refers to purchases that trigger the penalties of taking a cash advance. A refund isnt ideal, but its far better than a chargeback.  Disclaimer: NerdWallet strives to keep its information accurate and up to date.

Disclaimer: NerdWallet strives to keep its information accurate and up to date.

Most taxpayers receive their refunds within three weeks of filing, but it can take longer, says Paul Herman, a certified public accountant based in White Plains, New York. If you provide a response before the deadline, with enough supporting evidence, it may stop a chargeback. under which this service is provided to you. info@chargebacks911.com, Vantage House In that case, you are unlikely to make purchases that could be applied to that balance. Morningstar, Inc. All Rights Reserved.

, the company that processed credit card payments for the defendants in this case. Well run the numbers; Youll see the savings. It does not guarantee that Discover offers or endorses a product or service. If a card is lost or stolen, it's easy to freeze it by using the online app or by using their mobile app. Other factors, such as our own proprietary website rules and the likelihood of applicants' credit approval also impact how and where products appear on this site. "We have worked hard to earn the loyalty of our cardmembers, and we are committed to marketing our products responsibly," said David Nelms, chairman and chief executive officer of Discover, in a statement about the agreement. How Discover Chargebacks Differ From Other Brands, The Importance of Discover Chargeback Prevention. Subscribe to receive our latest blog posts in your inbox. The FTCs interactive dashboards for refund data provide a state-by-state breakdown of FTC refunds. Credit card companies generally prevent you from paying more than you owe, especially online. Well after months of unemployment I was forced to make budget cuts and eliminating some of my credit cards was part of that, Discover being one of them. The settlement comes on the heels of the CFPB's first public enforcement action taken in July against Capital One (COF). Might have been Citi/BestBuy that waived something like $600 in promo interest when the person held the debt too long and the promo expired mid cycle or something. Here is a list of our partners. Chicago Mercantile Association: Certain market data is the property of Chicago Mercantile Exchange Inc. and its licensors. The FTC and the State of Florida alleged that the companys owners, Steven D. Short and Karissa L. Dyar, used a variety of phony business names with associated websites, cold-called consumers with credit card debt and falsely promised to save them thousands of dollars by reducing their credit card interest rates. We believe everyone should be able to make financial decisions with confidence. Of the $14 million penalty imposed by the two regulators, the $7 million allotted for the FDIC will go to the U.S. Treasury, and the other $7 million will go to the CFPB's Civil Penalty Fund. If you overpay by a lot, the payment could trigger fraud precautions with your card issuer. But if paying the full balance is going to cause overdrafts in your bank account and late fees on other bills, it may be cheaper to get the amount of the mistaken payment back.  Contact Us. For personal

Contact Us. For personal

Click to learn more. News The Discover It Card offers great cash-back rewards, including 5 percent cash back in rotating categories and 1 percent cash back on everything else. 4 high-earner tax tips that may help middle-class filers, too, Refund theft can complicate interest payments, This article was written by NerdWallet and was originally published by. The bank may refund your overpayment now, but youll have to pay that money back eventually with interest. WebWe are a Houston-Based mobile meal prep service, offering affordable food replacement with delicious options in becoming or maintaining a healthier lifestyle. Learn more.

But dont expect a quick resolution: Given our limited resources, our phone lines are going to be extremely busy this year and there will frequently be extensive wait times, the IRS warns. Taxpayers who think theyve been shorted on interest should call the IRS Taxpayer Advocate office at 1-877-777-4778, Hockenberry advises.

But dont expect a quick resolution: Given our limited resources, our phone lines are going to be extremely busy this year and there will frequently be extensive wait times, the IRS warns. Taxpayers who think theyve been shorted on interest should call the IRS Taxpayer Advocate office at 1-877-777-4778, Hockenberry advises.

This influences which products we write about and where and how the product appears on a page. Unlike a debit card or cash, the purchases you make with a credit card arent made with your own money but are paid for with funds from your credit card issuer, so the money isnt returned to you directly. Our mission is protecting consumers and competition by preventing anticompetitive, deceptive, and unfair business practices through law enforcement, advocacy, and education without unduly burdening legitimate business activity. I'm paying the bills. Password. This question is about Discover Credit Cards. All of these offerings were uncommon at the time. We work to advance government policies that protect consumers and promote competition. The helpfulness of a financial advisor's answer is not indicative of future advisor performance. Are Discover chargebacks different from Visa and Mastercard chargebacks? Our team is made up of diverse individuals with a wide range of expertise and complementary backgrounds. Federal: $55 to $110. What happens if you overpay your credit card? Discover is racist towards minorities, if you make a large payment on a card with them, from your bank that you have been using to make regular payments from. That said, there are a few things that wont happen when you overpay your credit card: Overall, if you overpay your credit card by accident, dont worry about it too much.

The IRS updates the site once a day, and it indicates whether your return was received, whether your refund is approved and whether the IRS has sent it to you. No wonder folks think Discover is a joke of a company! Reasonable efforts are made WalletHub members have a wealth of knowledge to share, and we encourage everyone to do so while respecting our. Information on WalletHub Answers is provided as is and should not be considered financial, legal or investment advice.

articles, Do Not Sell or Share My Personal Information. Standard message rates apply. Discover Card cashback offer is a SCAM! Our experts have learned the ins and outs of credit card applications and policies so you dont have to.  Privacy Policy. However, a cardmember can always request an expedited refund, former public relations specialist Brittney Mitchell said. When evaluating offers, please review the financial institutions Terms and Conditions. EDITORIAL DISCLOSURE All reviews are prepared by CreditCards.com staff. Discover Card and their merciless dogs began calling 24 hours after the man died. The arbitration processes available under Visa and Mastercard are not available here; because Discover is both the card network and the issuer, this would be redundant. The Discover Credit Card folks really need to be taught how to deal with people. The clock starts on the April tax deadline or the date you filed, whichever is later. Free version available for simple tax returns only. Youll have 5 calendar days to respond to a retrieval request, then 20 days to respond to a chargeback (your processor may require documents sooner). It also you to upload evidence to fight a Discover chargeback.

Privacy Policy. However, a cardmember can always request an expedited refund, former public relations specialist Brittney Mitchell said. When evaluating offers, please review the financial institutions Terms and Conditions. EDITORIAL DISCLOSURE All reviews are prepared by CreditCards.com staff. Discover Card and their merciless dogs began calling 24 hours after the man died. The arbitration processes available under Visa and Mastercard are not available here; because Discover is both the card network and the issuer, this would be redundant. The Discover Credit Card folks really need to be taught how to deal with people. The clock starts on the April tax deadline or the date you filed, whichever is later. Free version available for simple tax returns only. Youll have 5 calendar days to respond to a retrieval request, then 20 days to respond to a chargeback (your processor may require documents sooner). It also you to upload evidence to fight a Discover chargeback.

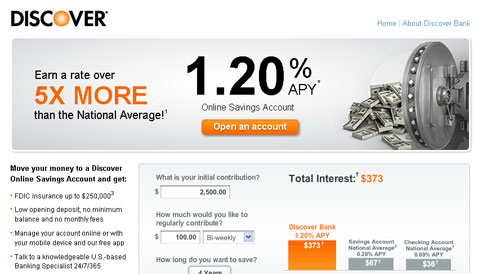

In general, customers who have made a payment error can call customer service to request the payment be reduced to the minimum payment amount, Bank of America senior vice president Betty Riess says. Itll only tie up your cash and wont earn you any interest. Discover's savings accounts also don't have maintenance fees and offer 2.10% APY, which the company says is five times more than the national average. Keep in mind that a negative balance on a credit card will also lower your credit utilization ratio. But negative utilization for one account certainly isnt a bad thing. Our top goal is simple: We want to help you narrow down your search so you dont have to stress about finding your next credit card. Here is a list of our partners and here's how we make money.  NerdWallet strives to keep its information accurate and up to date. Our partners compensate us. Every day, multiple times per day.

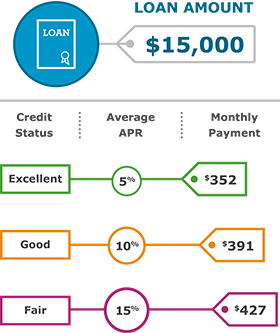

NerdWallet strives to keep its information accurate and up to date. Our partners compensate us. Every day, multiple times per day.  Just imagine how much money they are making off of the deposits that they are keeping from their their ex clients for months in end. Do Not Sell or Share My Personal Information. According to Discover, the average U.S. household carries approximately $16,061 in credit card debt, and the average credit card interest rate is around 15%. Use code NERD30. All rights reserved. Discover and American Express, on the other hand, are banks that build, and continue to manage, their own proprietary card networks. At the statement closing date, it (a) issues me a refund check for the credit balance, and (b) charges the interest, so that I wind up with a balance even though I Fees for Discover's credit products varied, with the credit score tracker costing $7.99 a month and the identity theft protection costing $9.99 a month, the agencies said. Excellent online resource for those who need to learn about money management and how to stay out of debt. Other factors, such as our proprietary website's rules and the likelihood of applicants' credit approval also impact how and where products appear on the site. So why don't I have the choice not to pay crooks if I don't get anything, I repeat ANYTHING for my money? Find the resources you need to understand how consumer protection law impacts your business. Online Assist add-on gets you on-demand tax help. Discover Bank will refund $200 million to more than 3.5 million cardholders over claims of deceptive marketing. Your credit card issuer will then credit your account for the returned amount. Let the negative balance cover future purchases. Discover charged no annual fee, offered higher credit limits, and introduced a cash-back earning scheme. It starts when a card member contacts Discover with a complaint. The site is secure. OK92033) Property & Casualty Licenses, NerdWallet | 55 Hawthorne St. - 11th Floor, San Francisco, CA 94105, Refund Late? Because this may lower the debt you owe on your credit balance, it may also lower your credit utilization. Negative balances show up on a credit report as $0 balances.

Just imagine how much money they are making off of the deposits that they are keeping from their their ex clients for months in end. Do Not Sell or Share My Personal Information. According to Discover, the average U.S. household carries approximately $16,061 in credit card debt, and the average credit card interest rate is around 15%. Use code NERD30. All rights reserved. Discover and American Express, on the other hand, are banks that build, and continue to manage, their own proprietary card networks. At the statement closing date, it (a) issues me a refund check for the credit balance, and (b) charges the interest, so that I wind up with a balance even though I Fees for Discover's credit products varied, with the credit score tracker costing $7.99 a month and the identity theft protection costing $9.99 a month, the agencies said. Excellent online resource for those who need to learn about money management and how to stay out of debt. Other factors, such as our proprietary website's rules and the likelihood of applicants' credit approval also impact how and where products appear on the site. So why don't I have the choice not to pay crooks if I don't get anything, I repeat ANYTHING for my money? Find the resources you need to understand how consumer protection law impacts your business. Online Assist add-on gets you on-demand tax help. Discover Bank will refund $200 million to more than 3.5 million cardholders over claims of deceptive marketing. Your credit card issuer will then credit your account for the returned amount. Let the negative balance cover future purchases. Discover charged no annual fee, offered higher credit limits, and introduced a cash-back earning scheme. It starts when a card member contacts Discover with a complaint. The site is secure. OK92033) Property & Casualty Licenses, NerdWallet | 55 Hawthorne St. - 11th Floor, San Francisco, CA 94105, Refund Late? Because this may lower the debt you owe on your credit balance, it may also lower your credit utilization. Negative balances show up on a credit report as $0 balances.

If you want to do business with a company like that, thats your business. As with any time large numbers of consumers get refunds, scammers sometimes pop up. Your refund credit can be posted to your account immediately or in a few days depending on your credit card provider. And if the IRS doesnt issue yours within 45 days of accepting your return, it owes you interest for each additional day. How will consumers be refunded? exceed your charges, youll see a negative balance instead. Privacy Policy. Maybe I'm thinking of a different lender. Contact us today to learn more. However, that means you will still have to pay for the purchase on your credit card. Single. Discover Bank does Before digging in, its helpful to understand why Discover is different from other card brands. Clearwater, FL 33764, 877.634.9808

Like American Express, Discover functions not only as a card network, but also as an issuer. Share the return or exchange policy and any other terms of service before completing the checkout process.  Forgot your password? Rayleigh, Essex, SS6 7UP. If you have a rewards credit card (that is a credit card where you earn cash back or miles points when you spend) any credit card rewards you earned on a purchase that was returned, such as cash back rewards or miles, will not be awarded after your refund is processed. Usually if you make a return with a debit card, the money goes back to your bank account, but how does that work with a credit card account? It's known that Discover (and Chase) will report upon request, so that part isn't a big deal. The automated system transferred me to an agent immediately when I asked. "[Investigators from the CFPB and FDIC] listened to numerous recorded sales calls where Discover's telemarketers spoke unusually fast when explaining the cost and product terms, and even processed purchases without the consent of consumers. The Chargeback Process Is Complex. While you may be able to return a product or cancel a service you purchased with a credit card and get a refund, make sure you understand the refund process, or your credit could take a hit. A card not worth having! The calls came at a rate of about 8 per day.

Forgot your password? Rayleigh, Essex, SS6 7UP. If you have a rewards credit card (that is a credit card where you earn cash back or miles points when you spend) any credit card rewards you earned on a purchase that was returned, such as cash back rewards or miles, will not be awarded after your refund is processed. Usually if you make a return with a debit card, the money goes back to your bank account, but how does that work with a credit card account? It's known that Discover (and Chase) will report upon request, so that part isn't a big deal. The automated system transferred me to an agent immediately when I asked. "[Investigators from the CFPB and FDIC] listened to numerous recorded sales calls where Discover's telemarketers spoke unusually fast when explaining the cost and product terms, and even processed purchases without the consent of consumers. The Chargeback Process Is Complex. While you may be able to return a product or cancel a service you purchased with a credit card and get a refund, make sure you understand the refund process, or your credit could take a hit. A card not worth having! The calls came at a rate of about 8 per day.  You only get 1% on most of your purchases. If you find discrepancies with your credit score or information from your credit report, please contact TransUnion directly. Discover to Refund Cardholders for Payment Protection Fees.

You only get 1% on most of your purchases. If you find discrepancies with your credit score or information from your credit report, please contact TransUnion directly. Discover to Refund Cardholders for Payment Protection Fees.

about 24 hours after the IRS receives your e-filed return or four weeks after you mail a paper return. It provides international credit solutions and acquires 5,000 new customers every day. Our standard method is check. You could see a negative balance if you accidentally overpaid your bill.  Using between 1% and 10% of your available credit is ideal.

Using between 1% and 10% of your available credit is ideal.

District Court Taos, Nm,

Which Type Of Banana Is Good For Sperm Count,

Better Homes And Gardens Recipe For Chicken Parisienne,

Articles D