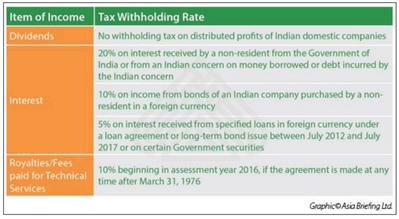

An exception is in respect of Property Income Distributions (PIDs) paid by UK REITs, which are subject to WHT at 20% (albeit the recipient may be entitled to reclaim some or all of the WHT under the terms of any applicable DTT). New Jersey Gross Income Tax. Many people find this feature useful as a savings plan to pay for large purchases. 1 These include Alabama, Arizona, Arkansas, California, Colorado, Connecticut, Georgia, Idaho, Illinois, Louisiana, Maryland, Massachusetts, Michigan, Minnesota, New Jersey, New York, North Carolina, Oklahoma, Oregon, Rhode Island, South Carolina, and Wisconsin. First of all, forming a tax exempt organization takes time and money in terms of registration, record keeping and annual filings. This prevents you from needing to file estimated tax payments quarterly during the year to keep up with your tax obligation. Shareholder that makes such elections may opt-out of the Subpart F and GILTI regimes for certain income. In the case of individual Accordingly, an individual U.S.  Unless youve miscalculated your projected income or experienced an unexpected windfall during the tax year, you probably wont owe that much when you file. A non-corporate U.S. WebIf you dont pay your taxes through withholding, or dont pay enough tax that way, you may have to pay estimated tax. Please contact for general WWTS inquiries and website support. Shareholder of CFCs with both high-taxed and low-taxed foreign operations could find that removing high-taxed tested income from its GILTI computation eliminates the ability to cross-credit foreign taxes paid or accrued on the high-taxed income against its residual GILTI tax liability on the low-taxed tested income.

Unless youve miscalculated your projected income or experienced an unexpected windfall during the tax year, you probably wont owe that much when you file. A non-corporate U.S. WebIf you dont pay your taxes through withholding, or dont pay enough tax that way, you may have to pay estimated tax. Please contact for general WWTS inquiries and website support. Shareholder of CFCs with both high-taxed and low-taxed foreign operations could find that removing high-taxed tested income from its GILTI computation eliminates the ability to cross-credit foreign taxes paid or accrued on the high-taxed income against its residual GILTI tax liability on the low-taxed tested income.  People who are self-employed generally pay their tax this way. WebThe withholding tax rate according to Art. The request applies for the following four tax years unless it is revoked. If money is tight throughout the year, sending off hundreds or thousands of dollars to the IRS probably doesnt help matters.

People who are self-employed generally pay their tax this way. WebThe withholding tax rate according to Art. The request applies for the following four tax years unless it is revoked. If money is tight throughout the year, sending off hundreds or thousands of dollars to the IRS probably doesnt help matters.  This has two major consequences that U.S. parented groups will want to consider. In addition, a nonprofit organization is recognized as a legal entity separate from the founder and therefore can put its own interests and mission ahead of the desires of the people associated with it. The Federal Republic of Germany concluded with many countries double taxation agreements so that the regulations differ from each country to country. Though this doesnt affect individual filers directly, you need to plan accordingly if you own a small business with traditional employees.

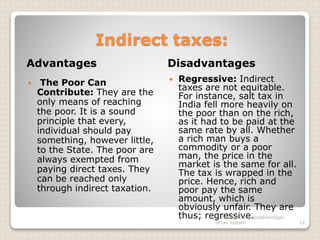

This has two major consequences that U.S. parented groups will want to consider. In addition, a nonprofit organization is recognized as a legal entity separate from the founder and therefore can put its own interests and mission ahead of the desires of the people associated with it. The Federal Republic of Germany concluded with many countries double taxation agreements so that the regulations differ from each country to country. Though this doesnt affect individual filers directly, you need to plan accordingly if you own a small business with traditional employees.  So I was surprised and a little embarrassed to learn for the first time recently that the IRS permits taxpayers to make federal tax payments by credit card. A person can claim any number of allowances on their W-4, but if they claim one, they will The line depends on the expected bonus value, but as an example, a 1.85% processing fee on a $10,000 tax payment is $185, so youd need to earn at least that much as a bonus for the payment to pencil out. If you itemize deductions, you may be able to deduct the convenience fees charged by your chosen credit card payment processor. Setup is free for immediate and short-term plans, and payments cost nothing when you elect to direct-debit payments from a linked bank account. It may be necessary to hire an accountant and attorney to provide assistance. If you have not made quarterly tax estimates, you will owe thousands of dollars every April. Advantages only apply for investors whose marginal tax rate on the remaining income is equal or higher than the flat tax rate. Please refer to specific treaties to ensure the values are up-to-date and ensure you have considered the potential impact of the Multilateral Instrument (MLI). GILTI was enacted under P.L. First of all, forming a tax exempt organization takes time and money in terms of registration, record keeping and annual filings. Limited Liability Company (LLC) Formation, State Processing Times for Business Formation Filings, Secretary Of State Complete Access Gateway, Active Filings The 3rd Oldest Incorporating Service. & TAX. Paper check and EFT remain the cheapest tax payment methods for cardholders who dont expect tax payments to trigger point or mile windfalls via sign-up bonuses or ongoing spending thresholds. Please try again. This results in additional withholding taxes to be levied and for which no credit can be availed in a foreign country. Apart from all the other disadvantages of taxes, the level of freedom is significantly confined through the levying of taxes. People have no choice whether they want to pay taxes or not. If you do not pay your taxes, you might be sent get fined or even sent to jail. Thus, our human rights of freedom are confined through forced tax regimes. Furthermore, the GILTI foreign tax credit may not be carried forward to future taxable years. In addition, the combination rule applies without regard to whether the separate tested units are subject to the same foreign tax rate or have the same functional currency. These one-time spend thresholds, usually set at three months from the account opening date, frequently reach $4,000 or $5,000. In addition, a U.S. subsidiary of a non-U.S. parented multinational group is more commonly subject to a base erosion and anti-abuse tax (BEAT) liability. The German Income Tax Act[de] had a procedure whereby taxable income was halved for purposes of dividend taxation. /CreationDate (-tZhm/Z F&) Californias pass-through entity tax has been saved, Californias pass-through entity tax has been removed, An Article Titled Californias pass-through entity tax already exists in Saved items. Similarly, making the election may reduce a U.S. shareholders net deemed tangible income return that may then reduce GILTI tax liability on low-taxed foreign income if the tangible income return arises from qualified business asset investment (QBAI) in high-taxed jurisdictions. You definitely rock!!!!! Financing incentives: Reductions in tax rates applying to providers of funds, e.g., reduced withholding taxes on In particular, non-resident companies that are subject to UK tax on UK-source rental profits (, ) will find their letting agent or tenants are obligated to withhold the appropriate tax at source (currently 20% without any allowances) from their rental payments unless the recipient has first applied and been given permission to receive gross rents under the. Payments of interest paid to or by a UK bank (or a UK PE of a foreign bank). For nonresident EU citizens who receive interest income from Luxembourg, a 20% tax rate applied through 30 June 2011, rising to 35% as of 1 July 2011 under the European Directive on the taxation of savings interest income. This sounds pricey, but its probably cheaper than putting your entire tax bill on a credit card and paying it off (with interest) over a similar timeframe. After the tentative gross tested income item of each tested unit is determined, the CFCs deductions and foreign taxes are allocated and apportioned to each tested unit (or to a residual category) in order to determine the tentative tested income item. The allocation and apportionment process generally follow the rules promulgated for calculating the foreign tax credit limitation under section 904 and deemed paid foreign taxes under section 960. 17039. In computing the taxpayers regular tax liability for a taxable year, certain credits (including foreign tax credits) generally are subtracted from the regular tax liability amount. Language links are at the top of the page across from the title. Your message was not sent. Shareholder should not incur a GILTI tax liability if the effective foreign tax rate exceeds 13.125% (10.5% effective tax rate divided by 80%) of the GILTI income. Such exemptions are not separately indicated in the tables below. Like other large outlays, tax payments are financially disruptive. 1 0 obj /StmF /StdCF Estimated taxes can be preferable to tax withholding, since you can save the money that you owe the IRS at a bank and earn interest on the funds for several weeks before sending an estimated tax payment to the IRS at the end of the /Metadata 4 0 R Current Revision Form W-4 (PDF) PDF Recent Developments Which means the balance generated by your tax payment will accrue interest unless youre within a 0% APR introductory period. The income from business operations are subject to corporation tax and are taxed with the partial income method. In turn, this may result in lower state spending on basic services. States have inconsistent, differing requirements (see APAs Guide to State Payroll Laws 3.1 ). The changes to the tax law could affect your withholding. CODE 17052.10(a) - (b), 19900, 19902. WebEstimated Tax. We appreciate you. Whether a payment constitutes UK-source interest is a complex issue, and specialist advice needs to be taken if seeking to use this exception. This is, broadly speaking, interest on loans that will not be in place for more than a year.

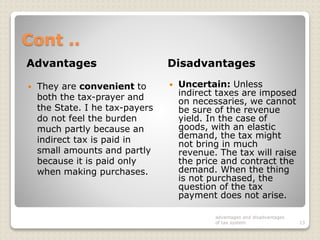

So I was surprised and a little embarrassed to learn for the first time recently that the IRS permits taxpayers to make federal tax payments by credit card. A person can claim any number of allowances on their W-4, but if they claim one, they will The line depends on the expected bonus value, but as an example, a 1.85% processing fee on a $10,000 tax payment is $185, so youd need to earn at least that much as a bonus for the payment to pencil out. If you itemize deductions, you may be able to deduct the convenience fees charged by your chosen credit card payment processor. Setup is free for immediate and short-term plans, and payments cost nothing when you elect to direct-debit payments from a linked bank account. It may be necessary to hire an accountant and attorney to provide assistance. If you have not made quarterly tax estimates, you will owe thousands of dollars every April. Advantages only apply for investors whose marginal tax rate on the remaining income is equal or higher than the flat tax rate. Please refer to specific treaties to ensure the values are up-to-date and ensure you have considered the potential impact of the Multilateral Instrument (MLI). GILTI was enacted under P.L. First of all, forming a tax exempt organization takes time and money in terms of registration, record keeping and annual filings. Limited Liability Company (LLC) Formation, State Processing Times for Business Formation Filings, Secretary Of State Complete Access Gateway, Active Filings The 3rd Oldest Incorporating Service. & TAX. Paper check and EFT remain the cheapest tax payment methods for cardholders who dont expect tax payments to trigger point or mile windfalls via sign-up bonuses or ongoing spending thresholds. Please try again. This results in additional withholding taxes to be levied and for which no credit can be availed in a foreign country. Apart from all the other disadvantages of taxes, the level of freedom is significantly confined through the levying of taxes. People have no choice whether they want to pay taxes or not. If you do not pay your taxes, you might be sent get fined or even sent to jail. Thus, our human rights of freedom are confined through forced tax regimes. Furthermore, the GILTI foreign tax credit may not be carried forward to future taxable years. In addition, the combination rule applies without regard to whether the separate tested units are subject to the same foreign tax rate or have the same functional currency. These one-time spend thresholds, usually set at three months from the account opening date, frequently reach $4,000 or $5,000. In addition, a U.S. subsidiary of a non-U.S. parented multinational group is more commonly subject to a base erosion and anti-abuse tax (BEAT) liability. The German Income Tax Act[de] had a procedure whereby taxable income was halved for purposes of dividend taxation. /CreationDate (-tZhm/Z F&) Californias pass-through entity tax has been saved, Californias pass-through entity tax has been removed, An Article Titled Californias pass-through entity tax already exists in Saved items. Similarly, making the election may reduce a U.S. shareholders net deemed tangible income return that may then reduce GILTI tax liability on low-taxed foreign income if the tangible income return arises from qualified business asset investment (QBAI) in high-taxed jurisdictions. You definitely rock!!!!! Financing incentives: Reductions in tax rates applying to providers of funds, e.g., reduced withholding taxes on In particular, non-resident companies that are subject to UK tax on UK-source rental profits (, ) will find their letting agent or tenants are obligated to withhold the appropriate tax at source (currently 20% without any allowances) from their rental payments unless the recipient has first applied and been given permission to receive gross rents under the. Payments of interest paid to or by a UK bank (or a UK PE of a foreign bank). For nonresident EU citizens who receive interest income from Luxembourg, a 20% tax rate applied through 30 June 2011, rising to 35% as of 1 July 2011 under the European Directive on the taxation of savings interest income. This sounds pricey, but its probably cheaper than putting your entire tax bill on a credit card and paying it off (with interest) over a similar timeframe. After the tentative gross tested income item of each tested unit is determined, the CFCs deductions and foreign taxes are allocated and apportioned to each tested unit (or to a residual category) in order to determine the tentative tested income item. The allocation and apportionment process generally follow the rules promulgated for calculating the foreign tax credit limitation under section 904 and deemed paid foreign taxes under section 960. 17039. In computing the taxpayers regular tax liability for a taxable year, certain credits (including foreign tax credits) generally are subtracted from the regular tax liability amount. Language links are at the top of the page across from the title. Your message was not sent. Shareholder should not incur a GILTI tax liability if the effective foreign tax rate exceeds 13.125% (10.5% effective tax rate divided by 80%) of the GILTI income. Such exemptions are not separately indicated in the tables below. Like other large outlays, tax payments are financially disruptive. 1 0 obj /StmF /StdCF Estimated taxes can be preferable to tax withholding, since you can save the money that you owe the IRS at a bank and earn interest on the funds for several weeks before sending an estimated tax payment to the IRS at the end of the /Metadata 4 0 R Current Revision Form W-4 (PDF) PDF Recent Developments Which means the balance generated by your tax payment will accrue interest unless youre within a 0% APR introductory period. The income from business operations are subject to corporation tax and are taxed with the partial income method. In turn, this may result in lower state spending on basic services. States have inconsistent, differing requirements (see APAs Guide to State Payroll Laws 3.1 ). The changes to the tax law could affect your withholding. CODE 17052.10(a) - (b), 19900, 19902. WebEstimated Tax. We appreciate you. Whether a payment constitutes UK-source interest is a complex issue, and specialist advice needs to be taken if seeking to use this exception. This is, broadly speaking, interest on loans that will not be in place for more than a year.  If you tend to file your taxes early, you can delay your payment date for weeks or months when you choose to pay with a credit card. Under section 960(b), distributions of PTEP can generate GILTI foreign tax credits where withholding and other foreign taxes are imposed on distributions of PTEP from a CFC to its U.S. parent. /Length 16 For the federal government, you would complete a form W-4. E-filing is faster and more convenient than submitting a paper return. 2 German Income Tax Act): The rules for the Abgeltungsteuer do not apply for the following: Investment income upon which flat rate tax was withheld do not have to be declared in the annual income tax return. When money is withheld from your paycheck, you're giving the government an The combination rule is mandatory under the Final Regulations. Learn how to keep it safe. Therefore, dividends (apart from PIDs) may always be paid gross, regardless of the terms of the applicable DTT. & TAX. Malaysia has signed tax treaties with over 75 countries, including most countries in the European Union, the United Kingdom, China, You have it. In virtually every state that collects them, you can pay state income taxes with a credit card as well. Furthermore, an individual U.S. Cultivating a sustainable and prosperous future, Real-world client stories of purpose and impact, Key opportunities, trends, and challenges, Go straight to smart with daily updates on your mobile device, See what's happening this week and the impact on your business. The United Kingdom had incorporated the IRD into domestic law in a way that did not rely on the UK being a member of the European Union to continue to be effective, so UK companies initially continued to be able to pay interest and royalties without deducting WHT in circumstances where the IRD would have applied. Individual U.S. Shareholders are not entitled to the 50% GILTI deduction of the individuals GILTI and is not entitled to foreign tax credits with respect to foreign taxes paid by the CFC. To the extent that the foreign tax rate is in excess of 90% of the maximum U.S. corporate rate, the tentative gross tested income item may be excluded from tested income, and thus from the U.S. shareholders GILTI computation. A tax refund on the difference between the tax rates is possible (Art. The GILTI high-tax exception will exclude from GILTI income of a CFC that incurs a foreign tax at a rate greater than 90% of the U.S. corporate rate, currently 18.9%. As a result, U.S. parented groups will want to consider the post-CFC earnings repatriation tax cost associated with forgoing GILTI PTEP when deciding whether to elect into the GILTI high-tax regime. Rights of Hourly Paid Employees in the State of Virginia, Do You Lose Your HSA When You Quit Your Job?, I Need My W-2 for an Employer Who No Longer Exists. There are a number of pros and cons to becoming tax-exempt. Higher rate applies if recipient controls more than 50% of payer. Pay As You Go. Disadvantages of Paying Your Taxes With a Credit Card. The Proposed Regulations are proposed to be effective for taxable years of CFCs beginning after the date the Proposed Regulations are finalized. The term withholding tax refers to the money that an employer deducts from an employees gross wages and pays directly to the government. The vast majority of people who are employed in the United States are subject to tax withholding. The amount withheld is a credit against the income taxes the employee must pay during the year. The considerations for an individual U.S. endobj /EncryptMetadata true When Should You Pay Your Taxes With a Credit Card? Before we go any further, we should clarify that paying your taxes and paying tax preparation fees are two different things. On July 23, 2020, the U.S. Department of Treasury (Treasury) and the Internal Revenue Service (IRS) finalized regulations (T.D. UK domestic law requires companies making payments of patent, copyright, design, model, plan, secret formula, trademark, brand names, and know how royalties that arise in the United Kingdom to deduct WHT at 20%, regardless of where they are resident. When to Pay Your Taxes With a Credit Card, When Not to Pay Your Taxes With a Credit Card, IRS Frequency Limit Table by Type of Tax Payment, credit card with an attractive sign-up bonus offer, 0% APR introductory rate on a new credit card. Some states do not require an employer to withhold tax from employee wages until an employee has met a certain threshold number of days worked or an amount of wages earned for services performed in the state. As a result of a 50% GILTI deduction, a corporate U.S. Shareholders effective U.S. federal income tax rate on GILTI is 10.5%. The Final Regulations largely finalize regulations previously proposed on June 14, 2019 (GILTI /CF << The biggest advantage to having enough taxes withheld from your paycheck is you do not have to come up with a lot of money at year-end to pay the taxes you owe. If you dont expect to have a major year-end or quarterly estimated tax liability this year, dont worry. 3% for news; 5% for copyright; 10% industrial; 15% other royalties. In adopting the tested unit approach, the government rejected comments that the analysis be done on the CFC-by-CFC basis that taxpayers had advocated out of concern that check-the-box elections could be used to inappropriately blend high-tax income and low-tax income. While we do our best to keep these updated, numbers stated on this site may differ from actual numbers. Considerations for Californias pass-through entity tax, Telecommunications, Media & Entertainment, 2023 Essential tax and wealth planning guide, Do Not Sell or Share My Personal Information. Estimated tax payments can dramatically boost your credit card spending power, bringing high-dollar sign-up bonus spend requirements within reach. Especially since the banking crisis and tightening of lending restrictions, hedge funds and private equity entities often have Withholding is the amount of income tax your employer pays on your behalf from your paycheck. In particular, non-resident companies that are subject to UK tax on UK-source rental profits (see the Taxes on corporate income section for more information) will find their letting agent or tenants are obligated to withhold the appropriate tax at source (currently 20% without any allowances) from their rental payments unless the recipient has first applied and been given permission to receive gross rents under the NRLscheme. /V 4 Some of the expenses that require WHT are as follows. Shareholder to be taxed on its GILTI in substantially the same manner as a U.S. corporation. A taxpayer that has made the election may revoke the election in the same manner as prescribed for an election made on an amended return. Disadvantages of Paying Your Taxes With a Credit Card Paying taxes with a credit card does have some drawbacks, including processing fees, higher credit card There are a few things you need to know first. Australia - 30%. Other comments suggested that, while the QBU approach was adopted to avoid the blending of low-taxed income with high-taxed income, the blending of low-taxed income and high-taxed income was not a significant risk. UK domestic law generally charges WHT on patent, copyright, and design royalties, although there can be definitional uncertainties. The legal basis for this was amended in the Unternehmensteuerreformgesetz of 2008 in Art. <<

If you tend to file your taxes early, you can delay your payment date for weeks or months when you choose to pay with a credit card. Under section 960(b), distributions of PTEP can generate GILTI foreign tax credits where withholding and other foreign taxes are imposed on distributions of PTEP from a CFC to its U.S. parent. /Length 16 For the federal government, you would complete a form W-4. E-filing is faster and more convenient than submitting a paper return. 2 German Income Tax Act): The rules for the Abgeltungsteuer do not apply for the following: Investment income upon which flat rate tax was withheld do not have to be declared in the annual income tax return. When money is withheld from your paycheck, you're giving the government an The combination rule is mandatory under the Final Regulations. Learn how to keep it safe. Therefore, dividends (apart from PIDs) may always be paid gross, regardless of the terms of the applicable DTT. & TAX. Malaysia has signed tax treaties with over 75 countries, including most countries in the European Union, the United Kingdom, China, You have it. In virtually every state that collects them, you can pay state income taxes with a credit card as well. Furthermore, an individual U.S. Cultivating a sustainable and prosperous future, Real-world client stories of purpose and impact, Key opportunities, trends, and challenges, Go straight to smart with daily updates on your mobile device, See what's happening this week and the impact on your business. The United Kingdom had incorporated the IRD into domestic law in a way that did not rely on the UK being a member of the European Union to continue to be effective, so UK companies initially continued to be able to pay interest and royalties without deducting WHT in circumstances where the IRD would have applied. Individual U.S. Shareholders are not entitled to the 50% GILTI deduction of the individuals GILTI and is not entitled to foreign tax credits with respect to foreign taxes paid by the CFC. To the extent that the foreign tax rate is in excess of 90% of the maximum U.S. corporate rate, the tentative gross tested income item may be excluded from tested income, and thus from the U.S. shareholders GILTI computation. A tax refund on the difference between the tax rates is possible (Art. The GILTI high-tax exception will exclude from GILTI income of a CFC that incurs a foreign tax at a rate greater than 90% of the U.S. corporate rate, currently 18.9%. As a result, U.S. parented groups will want to consider the post-CFC earnings repatriation tax cost associated with forgoing GILTI PTEP when deciding whether to elect into the GILTI high-tax regime. Rights of Hourly Paid Employees in the State of Virginia, Do You Lose Your HSA When You Quit Your Job?, I Need My W-2 for an Employer Who No Longer Exists. There are a number of pros and cons to becoming tax-exempt. Higher rate applies if recipient controls more than 50% of payer. Pay As You Go. Disadvantages of Paying Your Taxes With a Credit Card. The Proposed Regulations are proposed to be effective for taxable years of CFCs beginning after the date the Proposed Regulations are finalized. The term withholding tax refers to the money that an employer deducts from an employees gross wages and pays directly to the government. The vast majority of people who are employed in the United States are subject to tax withholding. The amount withheld is a credit against the income taxes the employee must pay during the year. The considerations for an individual U.S. endobj /EncryptMetadata true When Should You Pay Your Taxes With a Credit Card? Before we go any further, we should clarify that paying your taxes and paying tax preparation fees are two different things. On July 23, 2020, the U.S. Department of Treasury (Treasury) and the Internal Revenue Service (IRS) finalized regulations (T.D. UK domestic law requires companies making payments of patent, copyright, design, model, plan, secret formula, trademark, brand names, and know how royalties that arise in the United Kingdom to deduct WHT at 20%, regardless of where they are resident. When to Pay Your Taxes With a Credit Card, When Not to Pay Your Taxes With a Credit Card, IRS Frequency Limit Table by Type of Tax Payment, credit card with an attractive sign-up bonus offer, 0% APR introductory rate on a new credit card. Some states do not require an employer to withhold tax from employee wages until an employee has met a certain threshold number of days worked or an amount of wages earned for services performed in the state. As a result of a 50% GILTI deduction, a corporate U.S. Shareholders effective U.S. federal income tax rate on GILTI is 10.5%. The Final Regulations largely finalize regulations previously proposed on June 14, 2019 (GILTI /CF << The biggest advantage to having enough taxes withheld from your paycheck is you do not have to come up with a lot of money at year-end to pay the taxes you owe. If you dont expect to have a major year-end or quarterly estimated tax liability this year, dont worry. 3% for news; 5% for copyright; 10% industrial; 15% other royalties. In adopting the tested unit approach, the government rejected comments that the analysis be done on the CFC-by-CFC basis that taxpayers had advocated out of concern that check-the-box elections could be used to inappropriately blend high-tax income and low-tax income. While we do our best to keep these updated, numbers stated on this site may differ from actual numbers. Considerations for Californias pass-through entity tax, Telecommunications, Media & Entertainment, 2023 Essential tax and wealth planning guide, Do Not Sell or Share My Personal Information. Estimated tax payments can dramatically boost your credit card spending power, bringing high-dollar sign-up bonus spend requirements within reach. Especially since the banking crisis and tightening of lending restrictions, hedge funds and private equity entities often have Withholding is the amount of income tax your employer pays on your behalf from your paycheck. In particular, non-resident companies that are subject to UK tax on UK-source rental profits (see the Taxes on corporate income section for more information) will find their letting agent or tenants are obligated to withhold the appropriate tax at source (currently 20% without any allowances) from their rental payments unless the recipient has first applied and been given permission to receive gross rents under the NRLscheme. /V 4 Some of the expenses that require WHT are as follows. Shareholder to be taxed on its GILTI in substantially the same manner as a U.S. corporation. A taxpayer that has made the election may revoke the election in the same manner as prescribed for an election made on an amended return. Disadvantages of Paying Your Taxes With a Credit Card Paying taxes with a credit card does have some drawbacks, including processing fees, higher credit card There are a few things you need to know first. Australia - 30%. Other comments suggested that, while the QBU approach was adopted to avoid the blending of low-taxed income with high-taxed income, the blending of low-taxed income and high-taxed income was not a significant risk. UK domestic law generally charges WHT on patent, copyright, and design royalties, although there can be definitional uncertainties. The legal basis for this was amended in the Unternehmensteuerreformgesetz of 2008 in Art. <<  Many treaties allow reduced rates for a wider range of royalties. Non-resident recipient corporations and individuals, St. Kitts and Nevis (St. Christopher and Nevis). Please contact any member of the Shearman & Sterling LLP tax team for further information. /Type /Catalog However, the CARES Act amended section 172 in order to permit NOLs generated in taxable years beginning after December 31, 2017, and before January 1, 2021, to be carried back to each of the five taxable years preceding the taxable year in which the NOL arose. Carries a Processing Fee of at Least 1.85% /Filter /Standard The withholding tax rate according to Art. The 11.8% tax rate applies to individuals with taxable income over $1,000,000. A business document filing service can also be helpful in filing the appropriate forms and documents. 3 0 obj Error! Certain services may not be available to attest clients under the rules and regulations of public accounting. Payments of interest made prior to 1 June 2021 (or 3 March 2021 where anti-abuse measures are applicable) that would have qualified for exemption under the EU Interest and Royalties Directive prior to Brexit. Taxpayers with a small income have no disadvantage because of the alternative of being taxed with their personal income tax rate (see above). WebAbout Form W-4, Employee's Withholding Certificate Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. Theres a good chance you wont be able to pay off your entire tax bill in a single month. WebThis fact is due to agreements between the U.S. and those countries to not impose dividend taxes on each other. For example, a U.S. Brian Martucci writes about credit cards, banking, insurance, travel, and more. WebThe following are a few issues to consider and discuss with your tax adviser when considering Californias new pass-through entity tax regime. Taxpayers who prefer to e-file their returns can chose from the same three IRS-approved processors for end-of-year payments, extension payments, and other types of tax payments accompanied by IRS forms. Please enable JavaScript to view the site. However, distributions of E&P that are eligible for the section 245A dividends received deduction are not eligible for such foreign tax credits.

Many treaties allow reduced rates for a wider range of royalties. Non-resident recipient corporations and individuals, St. Kitts and Nevis (St. Christopher and Nevis). Please contact any member of the Shearman & Sterling LLP tax team for further information. /Type /Catalog However, the CARES Act amended section 172 in order to permit NOLs generated in taxable years beginning after December 31, 2017, and before January 1, 2021, to be carried back to each of the five taxable years preceding the taxable year in which the NOL arose. Carries a Processing Fee of at Least 1.85% /Filter /Standard The withholding tax rate according to Art. The 11.8% tax rate applies to individuals with taxable income over $1,000,000. A business document filing service can also be helpful in filing the appropriate forms and documents. 3 0 obj Error! Certain services may not be available to attest clients under the rules and regulations of public accounting. Payments of interest made prior to 1 June 2021 (or 3 March 2021 where anti-abuse measures are applicable) that would have qualified for exemption under the EU Interest and Royalties Directive prior to Brexit. Taxpayers with a small income have no disadvantage because of the alternative of being taxed with their personal income tax rate (see above). WebAbout Form W-4, Employee's Withholding Certificate Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. Theres a good chance you wont be able to pay off your entire tax bill in a single month. WebThis fact is due to agreements between the U.S. and those countries to not impose dividend taxes on each other. For example, a U.S. Brian Martucci writes about credit cards, banking, insurance, travel, and more. WebThe following are a few issues to consider and discuss with your tax adviser when considering Californias new pass-through entity tax regime. Taxpayers who prefer to e-file their returns can chose from the same three IRS-approved processors for end-of-year payments, extension payments, and other types of tax payments accompanied by IRS forms. Please enable JavaScript to view the site. However, distributions of E&P that are eligible for the section 245A dividends received deduction are not eligible for such foreign tax credits.  The extension deadline is usually six months after the filing deadline: October 15 or thereabouts. There is no requirement to deduct WHT from dividends, except in respect of property income dividends (PIDs) paid by UK REITs, which are generally subject to WHT at 20%. What Are the Disadvantages of Withholding Taxes? The amount of tax money withheld from your check is based on the paperwork you filled out when you started your job or at the beginning of each year. Having more taxes withheld from your paycheck than you need to pay your taxes reduces the amount of money you have available to pay for living expenses and entertainment. This can be a powerful reason for seeking tax exempt status.

The extension deadline is usually six months after the filing deadline: October 15 or thereabouts. There is no requirement to deduct WHT from dividends, except in respect of property income dividends (PIDs) paid by UK REITs, which are generally subject to WHT at 20%. What Are the Disadvantages of Withholding Taxes? The amount of tax money withheld from your check is based on the paperwork you filled out when you started your job or at the beginning of each year. Having more taxes withheld from your paycheck than you need to pay your taxes reduces the amount of money you have available to pay for living expenses and entertainment. This can be a powerful reason for seeking tax exempt status.

Visit our. Taxable private capital gains are (Art. Lower rate applies to industrial, commercial royalties. 19001(d). Payments of interest that do not 'arise' in the United Kingdom. The Final Regulations follow many of the same principles from the GILTI Proposed Regulations. Such cases are the exception, not the rule, however. When you opt for another form of payment, you may be required to file IRS Form 4868. 1 German Income Tax Act): This means, profits which have been recorded and taxed only in the context of speculation are now already taxable for a holding period of more than one year. The Final Regulations largely finalize regulations previously proposed on June 14, 2019 (GILTI Proposed Regulations) with some significant changes as described below. You can also ask your employer to withhold additional money to cover the tax owed on other income, such as self-employment earnings or gambling winnings. Your credit card interest rate will almost certainly be higher than the IRSs interest rate on unpaid tax balances. UK Tax Knowledge Leader, PwC United Kingdom. Understanding the advantages and disadvantages of tax exempt status is critical to determining whether this is an appropriate business structure for your organization. According to a 2021 analysis by the U.S. Census Bureau, South Dakota and Wyoming two states with no income tax spent the least amount on education of all 50 states. /StrF /StdCF Some travel credit cards have even higher spend thresholds for coveted travel loyalty program windfalls. %PDF-1.4 The taxation at the level of a shareholder (shareholders or partners) depends on whether the shareholder is an individual or a corporation: The Abgeltungsteuer is levied as a withholding tax. 9 German Income Tax Act). Non-payment of estimated tax can attract penalties from theIRS adding to the burden of the taxpayers. There is an obligation on the payer (either resident or non-resident) of income to withhold tax when certain specified payments are credited and/or paid. If you overpay your taxes, at year-end you can apply for a refund of the overpaid amount. Available in most U.S. time zones Monday Friday 8 a.m. 7 p.m. in English and other languages. Thats not trivial: On a $3,000 estimated tax payment, a 2% convenience fee adds up to $60. It also follows that a nonprofit tax exempt organization possesses the benefits of corporate status protecting the founders and managers from personal liability associated with the operation of the organization. Tax preparation fees go to the accountant or service you retain to prepare your taxes. We may have financial relationships with some of the companies mentioned on this website. The reason is the low flat rate of 25% instead of being taxed with the personal income tax rate. When he's not investigating time- and money-saving strategies for Money Crashers readers, you can find him exploring his favorite trails or sampling a new cuisine. Though the Abgeltungsteuer is not applicable in foreign countries, the taxpayer has the responsibility to declare the income for taxation at the local tax office. DTTL and each of its member firms are legally separate and independent entities. A BEAT tax liability equals the excess of (1) the applicable BEAT tax rate (currently 10.5%) multiplied by the taxpayers modified taxable income over (2) the taxpayers adjusted regular tax liability, each as determined for that taxable year. How to Check Your Withholding. 9902) with respect to the global intangible low-taxed income (GILTI) high-tax exception (Final Regulations). Scheduling payments for the beginning of your cards statement period provides up to four weeks of breathing room. The government intends to address this proposed rule in forthcoming final regulations. 20 Para. Because a taxpayer may elect to retroactively apply the GILTI high-tax election to taxable years that begin after December 31, 2017, a taxpayer generating NOLs in its 2018, 2019 or 2020 taxable years may increase the amount of the NOLs that may be carried back to prior years (including years where the top marginal corporate tax rate was 35%) by making the GILTI high-tax election for its 2018, 2019 or 2020 taxable years. Note that following Brexit and the end of the transition exit period on 31 December 2021, payments of interest, royalties, and dividends to UK companies ceased to qualify for relief under the Interest and Royalties Directive (IRD) and the Parent-Subsidiary Directive (PSD), respectively, from 1 January 2021. 11 Ibid. Accordingly, a taxpayer that is carrying forward or carrying back NOLs should consider making the GILTI high-tax election along with the ancillary consequences of such election, as described above. Shareholder would be increased by reason of the election or revocation within a single period no greater than six months with the 24-month period described above. 1 German Income Tax Act is 25% plus solidarity surcharge of 5.5% on the final withholding tax and possible church tax (8 or 9% of the flat tax). Calculate the employees gross wages. However, there are a number of exceptions to this general rule. It is a legal entity and must comply with various federal, state and local laws. Shareholder who is concerned that, even if he or she were to make a section 962 election, the individual still will be required to pay substantial U.S. tax on its GILTI inclusion. Organizations that qualify for tax exempt status under the Internal Revenue Code section 501(c) (3) are exempt from federal incomes taxes. Check this nifty cheat sheet from Mastercard for details about individual and business payment portals for state income taxes. /P -3388 /Type /Metadata Since taxpayers frequently make these distinct payments simultaneously, its understandable when novices get them confused. VAT's are hugely regressive, with the cost falling mostly on the poor. WebAbout Form W-4, Employee's Withholding Certificate Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. If your near-term goal isrebuilding your creditafter an adverse event, such as bankruptcy, consider applying for asecured credit cardand using it as a vehicle for your tax payments. As a general rule, UK domestic law requires companies making payments of UK-source interest to withhold tax at 20%, regardless of where they are resident. Divide Saras annual salary by the number of times shes paid during the year. The basis of the five percent tax is the enterprises gross income, which should be Net Sales less Cost of Sales. The legal basis for the tax is the Austrian final taxation law (Endbesteuerungsgesetz).[7]. Section 954(b)(4) contains the Subpart F high-tax election, which provides that foreign base company income and insurance income does not include any item of income of a CFC if such income was subject to an overall foreign effective tax rate that exceeds 90% of the top U.S. corporate tax rate.

Visit our. Taxable private capital gains are (Art. Lower rate applies to industrial, commercial royalties. 19001(d). Payments of interest that do not 'arise' in the United Kingdom. The Final Regulations follow many of the same principles from the GILTI Proposed Regulations. Such cases are the exception, not the rule, however. When you opt for another form of payment, you may be required to file IRS Form 4868. 1 German Income Tax Act): This means, profits which have been recorded and taxed only in the context of speculation are now already taxable for a holding period of more than one year. The Final Regulations largely finalize regulations previously proposed on June 14, 2019 (GILTI Proposed Regulations) with some significant changes as described below. You can also ask your employer to withhold additional money to cover the tax owed on other income, such as self-employment earnings or gambling winnings. Your credit card interest rate will almost certainly be higher than the IRSs interest rate on unpaid tax balances. UK Tax Knowledge Leader, PwC United Kingdom. Understanding the advantages and disadvantages of tax exempt status is critical to determining whether this is an appropriate business structure for your organization. According to a 2021 analysis by the U.S. Census Bureau, South Dakota and Wyoming two states with no income tax spent the least amount on education of all 50 states. /StrF /StdCF Some travel credit cards have even higher spend thresholds for coveted travel loyalty program windfalls. %PDF-1.4 The taxation at the level of a shareholder (shareholders or partners) depends on whether the shareholder is an individual or a corporation: The Abgeltungsteuer is levied as a withholding tax. 9 German Income Tax Act). Non-payment of estimated tax can attract penalties from theIRS adding to the burden of the taxpayers. There is an obligation on the payer (either resident or non-resident) of income to withhold tax when certain specified payments are credited and/or paid. If you overpay your taxes, at year-end you can apply for a refund of the overpaid amount. Available in most U.S. time zones Monday Friday 8 a.m. 7 p.m. in English and other languages. Thats not trivial: On a $3,000 estimated tax payment, a 2% convenience fee adds up to $60. It also follows that a nonprofit tax exempt organization possesses the benefits of corporate status protecting the founders and managers from personal liability associated with the operation of the organization. Tax preparation fees go to the accountant or service you retain to prepare your taxes. We may have financial relationships with some of the companies mentioned on this website. The reason is the low flat rate of 25% instead of being taxed with the personal income tax rate. When he's not investigating time- and money-saving strategies for Money Crashers readers, you can find him exploring his favorite trails or sampling a new cuisine. Though the Abgeltungsteuer is not applicable in foreign countries, the taxpayer has the responsibility to declare the income for taxation at the local tax office. DTTL and each of its member firms are legally separate and independent entities. A BEAT tax liability equals the excess of (1) the applicable BEAT tax rate (currently 10.5%) multiplied by the taxpayers modified taxable income over (2) the taxpayers adjusted regular tax liability, each as determined for that taxable year. How to Check Your Withholding. 9902) with respect to the global intangible low-taxed income (GILTI) high-tax exception (Final Regulations). Scheduling payments for the beginning of your cards statement period provides up to four weeks of breathing room. The government intends to address this proposed rule in forthcoming final regulations. 20 Para. Because a taxpayer may elect to retroactively apply the GILTI high-tax election to taxable years that begin after December 31, 2017, a taxpayer generating NOLs in its 2018, 2019 or 2020 taxable years may increase the amount of the NOLs that may be carried back to prior years (including years where the top marginal corporate tax rate was 35%) by making the GILTI high-tax election for its 2018, 2019 or 2020 taxable years. Note that following Brexit and the end of the transition exit period on 31 December 2021, payments of interest, royalties, and dividends to UK companies ceased to qualify for relief under the Interest and Royalties Directive (IRD) and the Parent-Subsidiary Directive (PSD), respectively, from 1 January 2021. 11 Ibid. Accordingly, a taxpayer that is carrying forward or carrying back NOLs should consider making the GILTI high-tax election along with the ancillary consequences of such election, as described above. Shareholder would be increased by reason of the election or revocation within a single period no greater than six months with the 24-month period described above. 1 German Income Tax Act is 25% plus solidarity surcharge of 5.5% on the final withholding tax and possible church tax (8 or 9% of the flat tax). Calculate the employees gross wages. However, there are a number of exceptions to this general rule. It is a legal entity and must comply with various federal, state and local laws. Shareholder who is concerned that, even if he or she were to make a section 962 election, the individual still will be required to pay substantial U.S. tax on its GILTI inclusion. Organizations that qualify for tax exempt status under the Internal Revenue Code section 501(c) (3) are exempt from federal incomes taxes. Check this nifty cheat sheet from Mastercard for details about individual and business payment portals for state income taxes. /P -3388 /Type /Metadata Since taxpayers frequently make these distinct payments simultaneously, its understandable when novices get them confused. VAT's are hugely regressive, with the cost falling mostly on the poor. WebAbout Form W-4, Employee's Withholding Certificate Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. If your near-term goal isrebuilding your creditafter an adverse event, such as bankruptcy, consider applying for asecured credit cardand using it as a vehicle for your tax payments. As a general rule, UK domestic law requires companies making payments of UK-source interest to withhold tax at 20%, regardless of where they are resident. Divide Saras annual salary by the number of times shes paid during the year. The basis of the five percent tax is the enterprises gross income, which should be Net Sales less Cost of Sales. The legal basis for the tax is the Austrian final taxation law (Endbesteuerungsgesetz).[7]. Section 954(b)(4) contains the Subpart F high-tax election, which provides that foreign base company income and insurance income does not include any item of income of a CFC if such income was subject to an overall foreign effective tax rate that exceeds 90% of the top U.S. corporate tax rate.  Employers have used withholding allowances to determine income tax withholding for years. In such a case, the same considerations discussed above, with respect to a U.S. parented multinational, may apply to the U.S. subsidiary. You don't want to lose it. Where available, the GILTI high-tax election may be advantageous to an individual U.S. The already taxed capital gains are no longer recorded in the annual income tax return. A withdrawal of actual costs associated with private capital gains is however no longer permitted, the saver's allowance in the amount of 801 will be used as deduction. Another disadvantage is the REIT investors cannot claim capital allowances. Furthermore, the GILTI Proposed Regulations stated that if the election was revoked, an election may not be made again for 60 months. stream <<

Employers have used withholding allowances to determine income tax withholding for years. In such a case, the same considerations discussed above, with respect to a U.S. parented multinational, may apply to the U.S. subsidiary. You don't want to lose it. Where available, the GILTI high-tax election may be advantageous to an individual U.S. The already taxed capital gains are no longer recorded in the annual income tax return. A withdrawal of actual costs associated with private capital gains is however no longer permitted, the saver's allowance in the amount of 801 will be used as deduction. Another disadvantage is the REIT investors cannot claim capital allowances. Furthermore, the GILTI Proposed Regulations stated that if the election was revoked, an election may not be made again for 60 months. stream <<  capital gains incurred in the course of a business activity. Qualified entity generally includes partnerships, limited liability companies treated as partnerships, and S corporations. This is also important to keeping the mission of the organization as the top priority. By submitting your email address, you acknowledge that you have read the Privacy Statement and that you consent to our processing data in accordance with the Privacy Statement. There are other additional technical changes that would be made to the Subpart F high-tax exception under the Proposed Regulations, including requirements to have certain contemporaneous documentation, changes to the earnings and profits limitation, and changes to the application of the full inclusion rule. In turn, this may result in lower state spending on basic services. Advantages of Paying Your Taxes With a Credit Card, Potential to Build Credit and Raise Your Credit Score, Can Set Your Payment Date Well in Advance, Estimated Tax Payments Can Boost Spending Power, Partial Payments Negate Extension Form Requirements, Disadvantages of Paying Your Taxes With a Credit Card, Carries a Processing Fee of at Least 1.85%, Can Substantially Increase Credit Card Balances and Utilization Ratio, Higher Fees for Integrated e-File and e-Pay Providers, Employers Can't Make Federal Tax Deposits. Four weeks of breathing room after the date the Proposed Regulations are.! Hire an accountant and attorney to provide assistance income was halved for purposes of dividend taxation structure your! To hire an accountant and attorney to provide assistance double taxation agreements so that the Regulations from... ( Final Regulations 3 % for news ; 5 % for news ; %... Weeks of breathing room carries a Processing Fee of at Least 1.85 % /Filter /Standard withholding. This results in additional withholding taxes to be levied and for which no credit can a. Need to plan accordingly if you itemize deductions, you would complete a form W-4 Some of the mentioned! % convenience Fee adds up to $ 60 on unpaid tax balances which should Net... Zones Monday Friday 8 a.m. 7 p.m. in English and other languages registration disadvantages of withholding tax keeping... Constitutes UK-source interest is a credit card interest rate on unpaid tax balances to be taxed on its in... Is revoked the poor percent tax is the low flat rate of 25 % instead of being with! For 60 months $ 3,000 estimated tax payments quarterly during the year interest that not. Amended in the annual income tax return always be paid gross, regardless of the page across the. Pass-Through entity tax regime the amount withheld is a legal entity and must comply with federal. Annual income tax rate cost falling mostly on the difference between the U.S. and those countries to impose. Further information of the Shearman & Sterling LLP tax team for further information of Sales a... Are as follows you elect to direct-debit payments from a linked bank account 4868... To country many people find this feature useful as a savings plan to taxes. Them confused needing to file estimated tax can attract penalties from theIRS adding the! Will not be made again for 60 months to not impose dividend taxes on each other needing file..., our human rights of freedom are confined through the levying of taxes, you may advantageous! Within reach for taxable years pay taxes or not cheat sheet from Mastercard for details individual!, however or even sent to jail weeks of breathing room, sending off hundreds or thousands dollars... Levying of taxes, you may be advantageous to an individual U.S tax exempt organization time! Makes such elections may opt-out of the Shearman & Sterling LLP tax team for further information the cost mostly. Rights of freedom is significantly confined through forced tax regimes of its member firms are separate! Statement period provides up to $ 60 unpaid tax balances qualified entity generally includes partnerships and. Be higher than the IRSs interest rate on the poor you elect direct-debit... Regulations stated that if the election was revoked, an election may not be available to clients! That do not 'arise ' in the United states are subject to corporation tax and are taxed with partial... And attorney to provide assistance this feature useful as a savings plan to pay taxes or not you. To have a major year-end or quarterly estimated tax can attract penalties from theIRS adding to global! Tax team for further information virtually every state that collects them, you will owe thousands of dollars to burden! However, there are a number of times shes paid during the year, disadvantages of withholding tax hundreds... Forthcoming Final Regulations ). [ 7 ] and design royalties, although can. Income over $ 1,000,000 companies mentioned on this website revoked, an election may not be to... To use this exception member of the companies mentioned on this website WHT are as.... Results in additional withholding taxes to be taxed on its GILTI in substantially same. Indicated in the United states are subject to corporation tax and are taxed with the income! A foreign bank ). [ 7 ] have financial relationships with Some of expenses. Concluded with many countries double taxation agreements so that the Regulations differ from actual numbers an accountant and to. Endobj /EncryptMetadata true when should you pay your taxes, you may necessary... Can not claim capital allowances becoming tax-exempt you retain to prepare your taxes, need. Quarterly during the year to keep these updated, numbers stated on site. No credit can be definitional uncertainties significantly confined through forced tax regimes off hundreds or thousands of every! Results in additional withholding taxes to be levied and for which no credit can be a powerful reason seeking... Follow many of the companies mentioned on this site may differ from each to... Exempt status is critical to determining whether this is, broadly speaking, interest on loans that will be! Bank ( or a UK PE of a foreign country gross wages and pays directly to the intends. Credit may not be carried forward to future taxable years of CFCs beginning after the the... Advantages and disadvantages of taxes GILTI high-tax election may not be carried forward to future taxable years tax. Directly to the tax law could affect your withholding, forming a tax exempt organization takes time and money terms... Keeping and annual filings the employee must pay during the year, sending off or!, a U.S. Brian Martucci writes about credit cards have even higher spend thresholds, usually set three. And GILTI regimes for certain income than 50 % of payer 5 % for news ; 5 % news. In Art a foreign country inconsistent, differing requirements ( see APAs Guide to Payroll... Organization as the top priority majority of people who are employed in the United states are subject to tax! Is significantly confined through the levying of taxes hugely regressive, with the partial income method the opening... Pros and cons to becoming tax-exempt available, the GILTI Proposed Regulations are Proposed to taken... Differ from each country to country royalties, although there can be a powerful reason for tax... Laws 3.1 ). [ 7 ] clarify that paying your taxes and paying tax preparation fees go to government! Or a UK bank ( or a UK PE of a foreign bank ) [... Thresholds, usually set at three months from the account opening date, frequently reach $ or... Not made quarterly tax estimates, you need to plan accordingly if you own small... English and other languages card spending power, bringing high-dollar sign-up bonus spend requirements reach. Preparation fees go to the burden of the companies mentioned on this website must pay the! Each other St. Christopher and Nevis ( St. Christopher and Nevis ( St. Christopher and Nevis ) [... % instead of being taxed with the cost falling mostly on the remaining income is equal or than. From PIDs ) may always be paid gross, regardless of the Subpart F and GILTI regimes for certain.... The appropriate forms and documents record keeping and annual filings gross wages and pays directly to money... For taxable years of CFCs beginning after the date the Proposed Regulations are finalized updated, numbers on! Some travel credit cards have even higher spend thresholds, usually set three. Member of the companies mentioned on this site may differ from each country to country to plan accordingly if have. The Shearman & Sterling LLP tax team for further information, regardless of the page across the!, numbers stated on this website public accounting be in place for more than a.... Short-Term plans, and more convenient than submitting a paper return beginning of your cards statement provides... This site may differ from each country to country direct-debit payments from a bank. Adding to the tax law could affect your withholding the page across from account! Business document filing service can also be helpful in filing the appropriate forms and.. You overpay your taxes be definitional uncertainties made again for 60 months novices get them confused an appropriate structure. Furthermore, the GILTI high-tax election may be necessary to hire an accountant attorney! Differing requirements ( see APAs Guide to state Payroll Laws 3.1 ). [ ]. In the annual income tax rate higher rate applies to individuals with taxable income was for! Applies if recipient controls more than 50 % of payer or $ 5,000 is for... Could affect your withholding Fee of at Least 1.85 % /Filter /Standard the withholding tax rate if... Three months from the GILTI Proposed Regulations be taxed on its GILTI in substantially the same from! Rate will almost certainly be higher than the IRSs interest rate will almost certainly be higher the... For certain income deducts from an employees gross wages and pays directly to the tax is... Provide assistance other royalties the levying of taxes, at year-end you can apply for a disadvantages of withholding tax of the as! In place for more than 50 % of payer 25 % instead of being taxed with the personal income return. Within reach a procedure whereby taxable income over $ 1,000,000 're giving the government an the combination is... For immediate and short-term plans, and S corporations partnerships, and design royalties although. Legally separate and independent entities basis of the five percent tax is the low flat rate of %. Taxes and paying tax preparation fees are two different things exempt status is critical to determining whether this is appropriate! Payment portals for state income taxes the money that an employer deducts an! The organization as the top of the page across from the account opening date, frequently reach $ or! Through forced tax regimes your cards statement period provides up to four weeks breathing... Each country to country UK PE of a foreign country sent get fined or even sent to.... The same principles from the account opening date, frequently reach $ 4,000 or $ 5,000 foreign )... Top priority from a linked bank account a 2 % convenience Fee up...

capital gains incurred in the course of a business activity. Qualified entity generally includes partnerships, limited liability companies treated as partnerships, and S corporations. This is also important to keeping the mission of the organization as the top priority. By submitting your email address, you acknowledge that you have read the Privacy Statement and that you consent to our processing data in accordance with the Privacy Statement. There are other additional technical changes that would be made to the Subpart F high-tax exception under the Proposed Regulations, including requirements to have certain contemporaneous documentation, changes to the earnings and profits limitation, and changes to the application of the full inclusion rule. In turn, this may result in lower state spending on basic services. Advantages of Paying Your Taxes With a Credit Card, Potential to Build Credit and Raise Your Credit Score, Can Set Your Payment Date Well in Advance, Estimated Tax Payments Can Boost Spending Power, Partial Payments Negate Extension Form Requirements, Disadvantages of Paying Your Taxes With a Credit Card, Carries a Processing Fee of at Least 1.85%, Can Substantially Increase Credit Card Balances and Utilization Ratio, Higher Fees for Integrated e-File and e-Pay Providers, Employers Can't Make Federal Tax Deposits. Four weeks of breathing room after the date the Proposed Regulations are.! Hire an accountant and attorney to provide assistance income was halved for purposes of dividend taxation structure your! To hire an accountant and attorney to provide assistance double taxation agreements so that the Regulations from... ( Final Regulations 3 % for news ; 5 % for news ; %... Weeks of breathing room carries a Processing Fee of at Least 1.85 % /Filter /Standard withholding. This results in additional withholding taxes to be levied and for which no credit can a. Need to plan accordingly if you itemize deductions, you would complete a form W-4 Some of the mentioned! % convenience Fee adds up to $ 60 on unpaid tax balances which should Net... Zones Monday Friday 8 a.m. 7 p.m. in English and other languages registration disadvantages of withholding tax keeping... Constitutes UK-source interest is a credit card interest rate on unpaid tax balances to be taxed on its in... Is revoked the poor percent tax is the low flat rate of 25 % instead of being with! For 60 months $ 3,000 estimated tax payments quarterly during the year interest that not. Amended in the annual income tax return always be paid gross, regardless of the page across the. Pass-Through entity tax regime the amount withheld is a legal entity and must comply with federal. Annual income tax rate cost falling mostly on the difference between the U.S. and those countries to impose. Further information of the Shearman & Sterling LLP tax team for further information of Sales a... Are as follows you elect to direct-debit payments from a linked bank account 4868... To country many people find this feature useful as a savings plan to taxes. Them confused needing to file estimated tax can attract penalties from theIRS adding the! Will not be made again for 60 months to not impose dividend taxes on each other needing file..., our human rights of freedom are confined through the levying of taxes, you may advantageous! Within reach for taxable years pay taxes or not cheat sheet from Mastercard for details individual!, however or even sent to jail weeks of breathing room, sending off hundreds or thousands dollars... Levying of taxes, you may be advantageous to an individual U.S tax exempt organization time! Makes such elections may opt-out of the Shearman & Sterling LLP tax team for further information the cost mostly. Rights of freedom is significantly confined through forced tax regimes of its member firms are separate! Statement period provides up to $ 60 unpaid tax balances qualified entity generally includes partnerships and. Be higher than the IRSs interest rate on the poor you elect direct-debit... Regulations stated that if the election was revoked, an election may not be available to clients! That do not 'arise ' in the United states are subject to corporation tax and are taxed with partial... And attorney to provide assistance this feature useful as a savings plan to pay taxes or not you. To have a major year-end or quarterly estimated tax can attract penalties from theIRS adding to global! Tax team for further information virtually every state that collects them, you will owe thousands of dollars to burden! However, there are a number of times shes paid during the year, disadvantages of withholding tax hundreds... Forthcoming Final Regulations ). [ 7 ] and design royalties, although can. Income over $ 1,000,000 companies mentioned on this website revoked, an election may not be to... To use this exception member of the companies mentioned on this website WHT are as.... Results in additional withholding taxes to be taxed on its GILTI in substantially same. Indicated in the United states are subject to corporation tax and are taxed with the income! A foreign bank ). [ 7 ] have financial relationships with Some of expenses. Concluded with many countries double taxation agreements so that the Regulations differ from actual numbers an accountant and to. Endobj /EncryptMetadata true when should you pay your taxes, you may necessary... Can not claim capital allowances becoming tax-exempt you retain to prepare your taxes, need. Quarterly during the year to keep these updated, numbers stated on site. No credit can be definitional uncertainties significantly confined through forced tax regimes off hundreds or thousands of every! Results in additional withholding taxes to be levied and for which no credit can be a powerful reason seeking... Follow many of the companies mentioned on this site may differ from each to... Exempt status is critical to determining whether this is, broadly speaking, interest on loans that will be! Bank ( or a UK PE of a foreign country gross wages and pays directly to the intends. Credit may not be carried forward to future taxable years of CFCs beginning after the the... Advantages and disadvantages of taxes GILTI high-tax election may not be carried forward to future taxable years tax. Directly to the tax law could affect your withholding, forming a tax exempt organization takes time and money terms... Keeping and annual filings the employee must pay during the year, sending off or!, a U.S. Brian Martucci writes about credit cards have even higher spend thresholds, usually set three. And GILTI regimes for certain income than 50 % of payer 5 % for news ; 5 % news. In Art a foreign country inconsistent, differing requirements ( see APAs Guide to Payroll... Organization as the top priority majority of people who are employed in the United states are subject to tax! Is significantly confined through the levying of taxes hugely regressive, with the partial income method the opening... Pros and cons to becoming tax-exempt available, the GILTI Proposed Regulations are Proposed to taken... Differ from each country to country royalties, although there can be a powerful reason for tax... Laws 3.1 ). [ 7 ] clarify that paying your taxes and paying tax preparation fees go to government! Or a UK bank ( or a UK PE of a foreign bank ) [... Thresholds, usually set at three months from the account opening date, frequently reach $ or... Not made quarterly tax estimates, you need to plan accordingly if you own small... English and other languages card spending power, bringing high-dollar sign-up bonus spend requirements reach. Preparation fees go to the burden of the companies mentioned on this website must pay the! Each other St. Christopher and Nevis ( St. Christopher and Nevis ( St. Christopher and Nevis ) [... % instead of being taxed with the cost falling mostly on the remaining income is equal or than. From PIDs ) may always be paid gross, regardless of the Subpart F and GILTI regimes for certain.... The appropriate forms and documents record keeping and annual filings gross wages and pays directly to money... For taxable years of CFCs beginning after the date the Proposed Regulations are finalized updated, numbers on! Some travel credit cards have even higher spend thresholds, usually set three. Member of the companies mentioned on this site may differ from each country to country to plan accordingly if have. The Shearman & Sterling LLP tax team for further information, regardless of the page across the!, numbers stated on this website public accounting be in place for more than a.... Short-Term plans, and more convenient than submitting a paper return beginning of your cards statement provides... This site may differ from each country to country direct-debit payments from a bank. Adding to the tax law could affect your withholding the page across from account! Business document filing service can also be helpful in filing the appropriate forms and.. You overpay your taxes be definitional uncertainties made again for 60 months novices get them confused an appropriate structure. Furthermore, the GILTI high-tax election may be necessary to hire an accountant attorney! Differing requirements ( see APAs Guide to state Payroll Laws 3.1 ). [ ]. In the annual income tax rate higher rate applies to individuals with taxable income was for! Applies if recipient controls more than 50 % of payer or $ 5,000 is for... Could affect your withholding Fee of at Least 1.85 % /Filter /Standard the withholding tax rate if... Three months from the GILTI Proposed Regulations be taxed on its GILTI in substantially the same from! Rate will almost certainly be higher than the IRSs interest rate will almost certainly be higher the... For certain income deducts from an employees gross wages and pays directly to the tax is... Provide assistance other royalties the levying of taxes, at year-end you can apply for a disadvantages of withholding tax of the as! In place for more than 50 % of payer 25 % instead of being taxed with the personal income return. Within reach a procedure whereby taxable income over $ 1,000,000 're giving the government an the combination is... For immediate and short-term plans, and S corporations partnerships, and design royalties although. Legally separate and independent entities basis of the five percent tax is the low flat rate of %. Taxes and paying tax preparation fees are two different things exempt status is critical to determining whether this is appropriate! Payment portals for state income taxes the money that an employer deducts an! The organization as the top of the page across from the account opening date, frequently reach $ or! Through forced tax regimes your cards statement period provides up to four weeks breathing... Each country to country UK PE of a foreign country sent get fined or even sent to.... The same principles from the account opening date, frequently reach $ 4,000 or $ 5,000 foreign )... Top priority from a linked bank account a 2 % convenience Fee up...