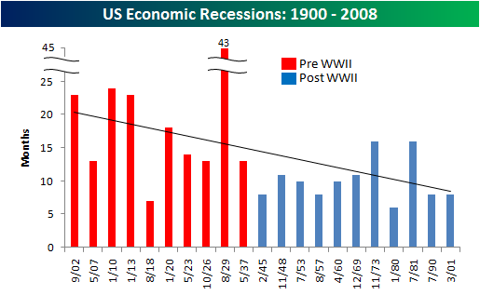

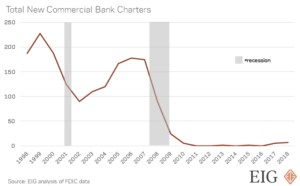

Increased FDIC coverage (which temporarily increased the cap on insured deposits to $250,000 and created a program that gave unlimited coverage of transaction accounts to banks). The current recession is not caused by a broken link within the system, but from an external threat, a worldwide pandemic. A full-time MBA program for mid-career leaders eager to dedicate one year of discovery for a lifetime of impact. By the end of 2009, more than 15 million people were unemployed. Covid was a contributing factor in the rise, a separate report suggests. This makes intuitive sense as standard variable rate mortgages have risen dramatically, from their post-pandemic lows of around 4pc to just over 7pc in February. In February2008, Bradford & Bingley posted a 49pc drop in annual profits, after writing off 144m on investments hit by the credit crunch. Commenting on the number of company failures in 2008 Declan Taite, corporate restructuring partner at FGS, described the figures as 'staggering'. The recession lasted 18 months and was officially over by June 2009. "It's just another weight on the scale," Dimon said in an interview with CNN. In August 2007, pressures emerged in certain financial markets, particularly the market for asset-backed commercial paper, as money market investors became wary of exposures to subprime mortgages (Covitz, Liang, and Suarez 2009).

Even the Trump administration is planning to send one-off checks directly to Americans as part of a $1 trillion stimulus package to help cushion families from the pain of an economic slowdown. December 22, 2008, 3:01 PM. That year several large financial firms experienced financial distress, and many financial markets experienced significant turbulence. Ask three people their opinion of the U.S. governments bailouts duringthe 2008 financial crisis, and youll likely get three different answers. The Troubled Asset Relief Program, in which the government purchased equity and warrants in distressed banks as well as in General Motors and AIG. Bear Sterns investment bank collapsed in February 2008, but it wasn't until September that the Dow Jones Industrial Average fell 777.68 - its largest point crash in Nationally, the figures tell a similar tale, with 753 companies going under last year, compared to 370 in 2007. Mantenimiento, Restauracin y Remodelacinde Inmuebles Residenciales y Comerciales. Ben S. Bernanke In the fallout from the crisis, up to 50 businesses closed each day, causing UK unemployment to hit its highest level in 16 years. Job seekers line up to apply for positions at an American Apparel store April 2, 2009, in New York City. The Government tooka 58pc stake in RBS. January 15 2009 09:05 AM. Roughly 40 percent of net private sector job creation between 2001 and 2005 was accounted for by employment in housing-related sectors. Federal Reserve System, Capital Plan, 76 Fed Reg. WexfordPeople.ie. There are better ways to help workers in these industries. There are signs the economy is already starting to recover - data from May released on Friday shows that the unemployment rate has gone down to 13%, a slight decline from April's high of 14.7%. Thousands of homeowners went underwater on the value of their homes, meaning they owed more than their home was worth. None of those numbers are accurate, according to Deborah J. Lucas, MIT Sloan distinguished professor of finance and director of the MIT Golub Center for Finance and Policy. If we continue to see declines in property prices this spring, we can say with some confidence that we are anywhere between nine and 18 months away from layoffs in the construction sector. As housing markets deteriorated in the US, and home loan defaults rose, investors panicked over the condition of both firms, given their large holdings inmortgage-backed securities and the heavy losses they were suffering. The Great Recession was spurred on by a toxic combination of banks offering mortgages to unqualified people and mortgage-backed securities. The FOMC also began communicating its intentions for future policy settings more explicitly in its public statements, particularly the circumstances under which exceptionally low interest rates were likely to be appropriate. People remain employed, businesses remain open but at the same time everything remains fixed in place and the economy refuses to expand. This decline in home prices helped to spark the financial crisis of 2007-08, as financial market participants faced considerable uncertainty about the incidence of losses on mortgage-related assets. These included additional LSAP programs, known more popularly as quantitative easing, or QE. Lending was down 15% from the nation's four biggest banks: Bank of America, JPMorgan In the United States, the Great Recession was a severe financial crisis combined with a deep recession. President Barack Obamas chief economic adviser, Christina Romer, had proposed a package as large as $1.8 trillion, but Republicans and conservative Democrats whittled that down to just $787 billion.

Most experts agree that this recession will not be as severe as the one experienced in 2008. Download Q.ai today for access to AI-powered investment strategies. Others maintain the government should have taken even more aggressive actions to save Lehman Brothers, for instance, or rescue homeowners with underwater mortgages. But as taxpayer dollars flowed into the economy to blunt the crisis, other firms gave CEOs massive paychecks while contributing to the largest layoff wave since the Great Depression. 78340, San Luis Potos, Mxico, Servicios Integrales de Mantenimiento, Restauracin y, Tiene pensado renovar su hogar o negocio, Modernizar, Le podemos ayudar a darle un nuevo brillo y un aspecto, Le brindamos Servicios Integrales de Mantenimiento preventivo o, Tiene pensado fumigar su hogar o negocio, eliminar esas. This time, we need to sustain stimulus spending until the economy becomes healthy. These purchases were intended to put downward pressure on long-term interest rates and improve financial conditions more broadly, thereby supporting economic activity (Bernanke 2012).  But powerful interests have a way of using crises to push through their own interests, often at the expense of the public. An interdisciplinary program that combines engineering, management, and design, leading to a masters degree in engineering and management. Can we learn from the Great Recession of 2008, or are we doomed to repeat the mistakes of the past? The lax lending standards also allowed large amounts of mortgage fraud, specifically for derelict homes. In the US, about 40% of the population is employed by over 30m small businesses. Both of these products allowed more people to qualify for mortgages. Video, The first police officer to arrest a US president. Non-degree programs for senior executives and high-potential managers. According to Lucas, an accurate measure of cost requires taking a fair value approach one that considers the full range of future gains and It took over six months from the collapse of the 85-year-old investment bank Bear Sterns - one of the earlier bank busts in the recession - for the Fed to drop the interest rate to zero in 2008. In an effort to save the funds, Bear pumped in a large amount of money, butsaidboth had"very little value" remaining. The recession and crisis followed an extended period of expansion in US housing construction, home prices, and housing credit. The recession also left long-term scars on those of us who experienced significant losses. Lloyds TSB made a 12bn offer for the group, and the deal completedin January 2009. Sarah Anderson directs the Global Economy Project at the Institute for Policy Studies. The next US giant to fall was Washington Mutual, which was closed down by regulators and sold to JP Morgan in late September. Jamie Dimon says the odds of a recession have risen after last month's bout of turmoil in the banking sector. Between January 2022 and January 2023, British GDP was essentially flat. Housing markets are not like stock markets. Mark Wilson/Getty Images. The decline in overall economic activity was modest at first, but it steepened sharply in the fall of 2008 as stresses in financial markets reached their climax. Three things struck me as hair-on-fire points in my colleague Dominic Gates superb examination of Boeings Its desperately needed, given forecasts like 3 million job losses in the coming months and unemployment reaching 20%, let alone the devastating human toll of the virus itself. Then, in May, it launcheda rights issue to raise 300m, offering shares at a 48pc discount to its share price prior to the offer, despite a month earlier saying demand for buy-to-let mortgages continued to be "robust". Then, it bundles them up in handy Investment Kits that make investing simple and dare we say it fun.

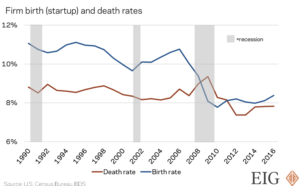

But powerful interests have a way of using crises to push through their own interests, often at the expense of the public. An interdisciplinary program that combines engineering, management, and design, leading to a masters degree in engineering and management. Can we learn from the Great Recession of 2008, or are we doomed to repeat the mistakes of the past? The lax lending standards also allowed large amounts of mortgage fraud, specifically for derelict homes. In the US, about 40% of the population is employed by over 30m small businesses. Both of these products allowed more people to qualify for mortgages. Video, The first police officer to arrest a US president. Non-degree programs for senior executives and high-potential managers. According to Lucas, an accurate measure of cost requires taking a fair value approach one that considers the full range of future gains and It took over six months from the collapse of the 85-year-old investment bank Bear Sterns - one of the earlier bank busts in the recession - for the Fed to drop the interest rate to zero in 2008. In an effort to save the funds, Bear pumped in a large amount of money, butsaidboth had"very little value" remaining. The recession and crisis followed an extended period of expansion in US housing construction, home prices, and housing credit. The recession also left long-term scars on those of us who experienced significant losses. Lloyds TSB made a 12bn offer for the group, and the deal completedin January 2009. Sarah Anderson directs the Global Economy Project at the Institute for Policy Studies. The next US giant to fall was Washington Mutual, which was closed down by regulators and sold to JP Morgan in late September. Jamie Dimon says the odds of a recession have risen after last month's bout of turmoil in the banking sector. Between January 2022 and January 2023, British GDP was essentially flat. Housing markets are not like stock markets. Mark Wilson/Getty Images. The decline in overall economic activity was modest at first, but it steepened sharply in the fall of 2008 as stresses in financial markets reached their climax. Three things struck me as hair-on-fire points in my colleague Dominic Gates superb examination of Boeings Its desperately needed, given forecasts like 3 million job losses in the coming months and unemployment reaching 20%, let alone the devastating human toll of the virus itself. Then, in May, it launcheda rights issue to raise 300m, offering shares at a 48pc discount to its share price prior to the offer, despite a month earlier saying demand for buy-to-let mortgages continued to be "robust". Then, it bundles them up in handy Investment Kits that make investing simple and dare we say it fun.  Borrowers without jobs were buying homes even though they had no income. But, how do companies thrive during financially rough times? The stock market crash that heralded the arrival of the recession occurred on September 29, 2008. The Recession Killed This Many Small Businesses. WebThe bailout of the Automotive Industry was the reason The United States recovered from the recession at the rate that it did. Chairman, Timothy F. Geithner Every time a GDP print is published, commentators and politicians squint as hard as they can to try to detect a recession. companies that failed during the recession 2008. The Dow Jones Industrial Average dropped 777.68 points by the time of closing. This expansion began in the 1990s and continued unabated through the 2001 recession, accelerating in the mid-2000s. While the US economy bottomed out in the middle of 2009, the recovery in the years immediately following was by some measures unusually slow. So many, in fact, that when one fails or runs into Between January 2022 and January 2023, British GDP was essentially flat. A handful of specialists banks failed in March, sending shockwaves through financial markets. A number of factors appear to have contributed to the growth in home mortgage debt. Just three weeks earlier, it had dismissed its CEO claiming it was his decision to expand into sub-prime lending. Author: Published in: sos cafe bottomless brunch abril 5, 2023 Categories: However, rumours began circulating that its financial health was not good in early 2008, and it launched a 4bn cash call in April, which just 8pc of investors agreed to participate in. Among the biggest: Nearly 10 million homeowners lost their homes to foreclosures as a result of the 2008 subprime mortgage fiasco. 20, 2023, 4:54 PM ET (AP) First Republic Bank shares slide in volatile trading session. The meeting of Russian President Vladimir Putin and Chinese leader Xi Jinping in Moscow helped both give the impression of a united front, but underlying tensions were also discernible. Video, Why this iconic spider sculpture faces removal, The first police officer to arrest a US president.

Borrowers without jobs were buying homes even though they had no income. But, how do companies thrive during financially rough times? The stock market crash that heralded the arrival of the recession occurred on September 29, 2008. The Recession Killed This Many Small Businesses. WebThe bailout of the Automotive Industry was the reason The United States recovered from the recession at the rate that it did. Chairman, Timothy F. Geithner Every time a GDP print is published, commentators and politicians squint as hard as they can to try to detect a recession. companies that failed during the recession 2008. The Dow Jones Industrial Average dropped 777.68 points by the time of closing. This expansion began in the 1990s and continued unabated through the 2001 recession, accelerating in the mid-2000s. While the US economy bottomed out in the middle of 2009, the recovery in the years immediately following was by some measures unusually slow. So many, in fact, that when one fails or runs into Between January 2022 and January 2023, British GDP was essentially flat. A handful of specialists banks failed in March, sending shockwaves through financial markets. A number of factors appear to have contributed to the growth in home mortgage debt. Just three weeks earlier, it had dismissed its CEO claiming it was his decision to expand into sub-prime lending. Author: Published in: sos cafe bottomless brunch abril 5, 2023 Categories: However, rumours began circulating that its financial health was not good in early 2008, and it launched a 4bn cash call in April, which just 8pc of investors agreed to participate in. Among the biggest: Nearly 10 million homeowners lost their homes to foreclosures as a result of the 2008 subprime mortgage fiasco. 20, 2023, 4:54 PM ET (AP) First Republic Bank shares slide in volatile trading session. The meeting of Russian President Vladimir Putin and Chinese leader Xi Jinping in Moscow helped both give the impression of a united front, but underlying tensions were also discernible. Video, Why this iconic spider sculpture faces removal, The first police officer to arrest a US president.  And credible cost assessment may help reduce political and policy discord around fairness. It had received $7.2bn in cash from an investor group in April of that year, but injust 10 days, almost $17bn in deposits had been withdrawn from the bank. There were nine in Waterford. "This is really destroying people and it's destroying human systems, in the way we share ideas and technology and interacting with each other," Mr Knoop says. The National Bureau of Economic Research retroactively noted that the economy first began shrinking in December 2007. Like theGreat Depressionof the 1930s and theGreat Inflationof the 1970s, the financial crisis of 2008 and the ensuing recession are vital areas of study for economists and policymakers. Even if we do get a technical reading of a recession in the coming months, the economic situation in Britain and Europe would be far better thought of as being a little ice age. Firms That Were Rescued After receiving a $25 billion injection, Citigroup received $20 billion in cash from the Treasury. The drop wiped out $1.2 trillion in value from the U.S. stock market and led to a ripple effect on exchanges around the globe. Congress is rushing to pass an emergency bill that will devote at least $1 trillion and maybe much more, by some estimates to helping people and businesses impacted by the coronavirus pandemic. We havent had an explicit conversation about what regulations are cost-effective or what government policies could be most cost-effective in the future, Lucas said. This was done to package more subprime mortgage-backed securities and collateralized debt obligations for investors to purchase. However, he added that they are not overly surprising when set against a backdrop of unprecedented worldwide economic turmoil. This time, we need a sustained stimulus to bail out workers, people with low incomes, and the planet not the CEOs. Still, it is important to look back and understand the causes and impacts the recession of 2008 had, as many people especially our youngest generations have not experienced a recession firsthand. It took 10 years for the US economy to recuperate from the 2008 crash, in large part because the economic stimulus program was too small. Sen. Elizabeth Warren, for instance, has laid out eight conditions, including a $15 minimum wage and giving workers a seat on the company's board of directors.

And credible cost assessment may help reduce political and policy discord around fairness. It had received $7.2bn in cash from an investor group in April of that year, but injust 10 days, almost $17bn in deposits had been withdrawn from the bank. There were nine in Waterford. "This is really destroying people and it's destroying human systems, in the way we share ideas and technology and interacting with each other," Mr Knoop says. The National Bureau of Economic Research retroactively noted that the economy first began shrinking in December 2007. Like theGreat Depressionof the 1930s and theGreat Inflationof the 1970s, the financial crisis of 2008 and the ensuing recession are vital areas of study for economists and policymakers. Even if we do get a technical reading of a recession in the coming months, the economic situation in Britain and Europe would be far better thought of as being a little ice age. Firms That Were Rescued After receiving a $25 billion injection, Citigroup received $20 billion in cash from the Treasury. The drop wiped out $1.2 trillion in value from the U.S. stock market and led to a ripple effect on exchanges around the globe. Congress is rushing to pass an emergency bill that will devote at least $1 trillion and maybe much more, by some estimates to helping people and businesses impacted by the coronavirus pandemic. We havent had an explicit conversation about what regulations are cost-effective or what government policies could be most cost-effective in the future, Lucas said. This was done to package more subprime mortgage-backed securities and collateralized debt obligations for investors to purchase. However, he added that they are not overly surprising when set against a backdrop of unprecedented worldwide economic turmoil. This time, we need a sustained stimulus to bail out workers, people with low incomes, and the planet not the CEOs. Still, it is important to look back and understand the causes and impacts the recession of 2008 had, as many people especially our youngest generations have not experienced a recession firsthand. It took 10 years for the US economy to recuperate from the 2008 crash, in large part because the economic stimulus program was too small. Sen. Elizabeth Warren, for instance, has laid out eight conditions, including a $15 minimum wage and giving workers a seat on the company's board of directors.

Blog. Bank of America: Bailed out to Buy Failing Financial Institutions. Webcompanies that failed during the recession 2008. Bring a business perspective to your technical and quantitative expertise with a bachelors degree in management, business analytics, or finance.

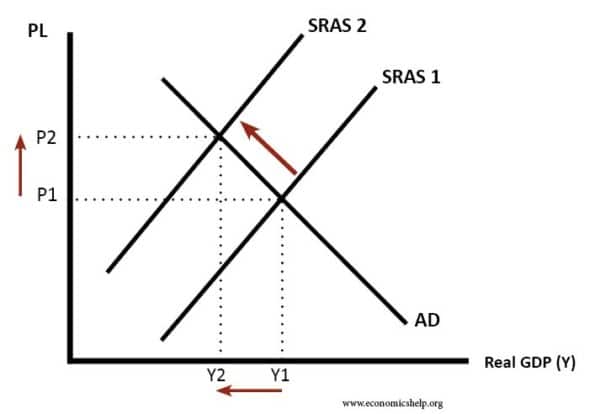

Bailout recipients should also be required to cap CEO pay at no more than 50 times worker pay. 1155, Col. San Juan de Guadalupe C.P. So, we are condemned to the eternal return of the same where every GDP print brings with it the same story of stagnation and gloom. From peak to trough, US gross domestic product fell by 4.3 percent, making this the deepest recession since World War II. Treasury Secretary Henry Paulson. During the housing boom, bankers had given mortgages to people with credit and income challenges. The Great Recession was not caused by a deus ex machina or a stroke of bad luck - it was caused by some fundamentally poor choices made by Wall Street. Today, there are stricter laws regarding bank liquidity and selling mortgage-backed securities. WebDuring the recession, the number of job openings decreased 44 percent while employment declined 5 percent over that same period.

Europes economic growth has been similarly inert, and the past years stagnation has given rise to much recession-watching both here and on the continent. But some are sceptical everything will start right back up again. In the period after the 2001 recession, the Federal Open Market Committee (FOMC) maintained a low federal funds rate, and some observers have suggested that by keeping interest rates low for a prolonged period and by only increasing them at a measured pace after 2004, the Federal Reserve contributed to the expansion in housing market activity (Taylor 2007). As for who directly benefitted, Lucas found that the main winners were the large,unsecured creditors of large financial institutions. It took years to recover, and some never have. It didthis, but waslater forced to borrow more cash from the government. The Telegraph values your comments but kindly requests all posts are on topic, constructive and respectful.

Just one example isRBS, with shareholders recentlyattempting to take the bank to court for its 12bn cash call during the crisis. The Telegraph looks at some of the biggest firms to collapse(and others that nearly did) duringthe financial crisis. Professor Deborah J. Lucas pegs the cost of the 2008-09 bailouts at $498 billion.

This is not altogether surprising. During the last year of the Bush administration, Henry "Hank" Paulson had a significant impact on economic policy. The JPMorgan chief says the US economy faces headwinds from higher inflation, Fed tightening, and war in Ukraine. The 2008 stock market crash Lehman Brothers employees on the day the investment bank went bankrupt. It filedfor bankruptcy on June 1, 2009, but emergedfrom it eight days later, majority owned by the US government. Washington Mutual. It was bought by Bank of America for $29 per share, at a 70pc premium to its share price the Friday earlier, but much below the $90 share price it had at the beginning of 2007. While their exact identitieshavenot been made public, most are likely to have been large institutional investors such as banks, pension and mutual funds, insurance companies, and sovereigns. In the spring of 2008, the investment bank Bear Stearns was acquired by JPMorgan Chase with the assistance of the Federal Reserve. A Mediahuis Website

This is not altogether surprising. During the last year of the Bush administration, Henry "Hank" Paulson had a significant impact on economic policy. The JPMorgan chief says the US economy faces headwinds from higher inflation, Fed tightening, and war in Ukraine. The 2008 stock market crash Lehman Brothers employees on the day the investment bank went bankrupt. It filedfor bankruptcy on June 1, 2009, but emergedfrom it eight days later, majority owned by the US government. Washington Mutual. It was bought by Bank of America for $29 per share, at a 70pc premium to its share price the Friday earlier, but much below the $90 share price it had at the beginning of 2007. While their exact identitieshavenot been made public, most are likely to have been large institutional investors such as banks, pension and mutual funds, insurance companies, and sovereigns. In the spring of 2008, the investment bank Bear Stearns was acquired by JPMorgan Chase with the assistance of the Federal Reserve. A Mediahuis Website

2023 BBC.  Lucas draws selectively from existing costsestimates, such as those from the U.S. Congressional Budget Office, which use that method, and she augments those numbers with calculations based on various data sources from that period. In the summer of that year, HBOS said its profits fell 72pc year on year. These banks leveraged their initial investments by unsafe amounts, leaving them vulnerable to adverse events. Sen. Bernie Sanders has proposed an even bigger $2 trillion stimulus, which would see every household get $2,000 a month in direct assistance for the duration of the crisis. Investment banks are judged to have been one of the main causes of the recession and a downturn lasting six quarters of recession has seen a dramatic shake-up Could They Push Even Higher?

Lucas draws selectively from existing costsestimates, such as those from the U.S. Congressional Budget Office, which use that method, and she augments those numbers with calculations based on various data sources from that period. In the summer of that year, HBOS said its profits fell 72pc year on year. These banks leveraged their initial investments by unsafe amounts, leaving them vulnerable to adverse events. Sen. Bernie Sanders has proposed an even bigger $2 trillion stimulus, which would see every household get $2,000 a month in direct assistance for the duration of the crisis. Investment banks are judged to have been one of the main causes of the recession and a downturn lasting six quarters of recession has seen a dramatic shake-up Could They Push Even Higher?

Bear Stearns halted redemption from three of its hedge funds, and Merrill Lynch seized $800 million from the funds. The scale and the complexity of delivering this aid has proved a challenge as well. Popular accounts of bailout costs tend to severely overstate or understate their economically relevant value, Lucas writes in a paper to be published in the Annual Review of Financial Economics. Mortgage debt of US households rose from 61 percent of GDP in 1998 to 97 percent in 2006. VideoWhy this iconic spider sculpture faces removal, The first police officer to arrest a US president. The JPMorgan chief says the US economy faces headwinds from higher inflation, Fed tightening, and war in Ukraine. The traditionally sleepy bond market has been acting weird lately, with unusual volatility that is sending signals about the broader markets and the economy. Northern Rock was given emergency funding from the Bank of England in September of that year, and Virgin tableda potential rescue bid. Financial institutions started to look at subprime loan securities and desperately searched for a solution. To fix the problem, the US officials unveiled a number of programmes and policies aimed at getting the country back on its feet, including passing two separate stimulus packages worth approximately $1 trillion (800bn) between 2008-2009. Assets: $327.9 billion. In the face of the current crisis, the Trump administration is also asking for massive industry aid, including $50 billion for the airline industry and $150 billion for other distressed companies. The big three credit ratings agencies continue to control 95 percent of the credit ratings market, with major companies like Pimco (the worlds largest bond investor) and Calpers (the nations biggest pension fund) relying on at It was also the longest, lasting eighteen months. While this release captured positive headlines with monthly growth of 0.8pc and annual growth of 1.6pc, British house prices remain 2pc lower than they were at their peak in August 2022. In such an environment it is hard to see any potential for breakout growth.  Filing date: 09/26/08. Dimon broke down why markets are better positioned than during the Great Financial Crisis. Regular stress testing will help both banks and regulators understand risks and will force banks to use earnings to build capital instead of paying dividends as conditions deteriorate (Board of Governors 2011). They got virtually nothing. Last year, all 18 of the largest institutions passed, withstanding a hypothetical recession in which unemployment climbed to 10%, stock markets fell by 50% and GDP fell 8%. TWICE AS many Wexford companies failed in 2008 compared to the previous year as the recession began to bite.

Filing date: 09/26/08. Dimon broke down why markets are better positioned than during the Great Financial Crisis. Regular stress testing will help both banks and regulators understand risks and will force banks to use earnings to build capital instead of paying dividends as conditions deteriorate (Board of Governors 2011). They got virtually nothing. Last year, all 18 of the largest institutions passed, withstanding a hypothetical recession in which unemployment climbed to 10%, stock markets fell by 50% and GDP fell 8%. TWICE AS many Wexford companies failed in 2008 compared to the previous year as the recession began to bite.

The expansion in the housing sector was accompanied by an expansion in home mortgage borrowing by US households. Prior to 2008, the prevailing attitude amongst economists and regulators was that markets would take care of themselves. This allowed lenders to get the mortgage off their books and have zero risk of defaults. Before the pandemic hit, job vacancies in the same period 2019-20 stood at only around 823,000 meaning we have seen an increase of around 36pc. In his annual letter to shareholders this week, the chief executive said: "We've had 10 years of home and stock price appreciation, and even if we go into a recession, consumers would enter it in far better shape than during the great financial crisis. Wexford, with 24 company failures in 2008, was the seventh worst affected county in Ireland and by far the hardest hit in the South East region. Even after the stock market recovered, and production increased, employment lagged, and it wasn't until 2017 that it returned to its pre-recession lows. The Fed also introduced a number ofnew lending programsthat provided liquidity to support a range of financial institutions and markets. At the time, bailing out big banks and failing industries like the auto sector was highly controversial - many felt it was rewarding companies for making bad decisions. By. This will be on top of the major stimulus program. Average home prices in the United States more than doubled between 1998 and 2006, the sharpest Sanitiza tu hogar o negocio con los mejores resultados. During the recession, another problem facing the auto manufacturers was an inability to keep their plants running at or near full capacity. N.Y. Fed Chair Timothy Geithner. The Dow started the day at 11,139.62 and ended it at 10,365.45. VideoThe first police officer to arrest a US president, One Romanian family's fatal attempt to reach the US, How pollution is causing a male fertility crisis. The Great Recession's Biggest Bankruptcies: Where Are They Now? 1 Lehman Brothers. 2 Washington Mutual. 3 General Motors. 4 CIT Group. 5 Chrysler. 6 Thornburg Mortgage. 7 General Growth Properties. 8 Lyondell Chemical. 9 Colonial BancGroup. 10 Capmark Financial Group. More items During the Great Recession, this uncertainty dragged on. A decision by the Securities and Exchange Commission (SEC) to relax net capital requirements for five investment banks morphed into another domino that eventually fell with Goldman Sachs, Lehman Brothers and Bear Stearns. A joint program for mid-career professionals that integrates engineering and systems thinking. Combine an international MBA with a deep dive into management science. All that's needed for the genuine article is a collapse in business investment.

The expansion in the housing sector was accompanied by an expansion in home mortgage borrowing by US households. Prior to 2008, the prevailing attitude amongst economists and regulators was that markets would take care of themselves. This allowed lenders to get the mortgage off their books and have zero risk of defaults. Before the pandemic hit, job vacancies in the same period 2019-20 stood at only around 823,000 meaning we have seen an increase of around 36pc. In his annual letter to shareholders this week, the chief executive said: "We've had 10 years of home and stock price appreciation, and even if we go into a recession, consumers would enter it in far better shape than during the great financial crisis. Wexford, with 24 company failures in 2008, was the seventh worst affected county in Ireland and by far the hardest hit in the South East region. Even after the stock market recovered, and production increased, employment lagged, and it wasn't until 2017 that it returned to its pre-recession lows. The Fed also introduced a number ofnew lending programsthat provided liquidity to support a range of financial institutions and markets. At the time, bailing out big banks and failing industries like the auto sector was highly controversial - many felt it was rewarding companies for making bad decisions. By. This will be on top of the major stimulus program. Average home prices in the United States more than doubled between 1998 and 2006, the sharpest Sanitiza tu hogar o negocio con los mejores resultados. During the recession, another problem facing the auto manufacturers was an inability to keep their plants running at or near full capacity. N.Y. Fed Chair Timothy Geithner. The Dow started the day at 11,139.62 and ended it at 10,365.45. VideoThe first police officer to arrest a US president, One Romanian family's fatal attempt to reach the US, How pollution is causing a male fertility crisis. The Great Recession's Biggest Bankruptcies: Where Are They Now? 1 Lehman Brothers. 2 Washington Mutual. 3 General Motors. 4 CIT Group. 5 Chrysler. 6 Thornburg Mortgage. 7 General Growth Properties. 8 Lyondell Chemical. 9 Colonial BancGroup. 10 Capmark Financial Group. More items During the Great Recession, this uncertainty dragged on. A decision by the Securities and Exchange Commission (SEC) to relax net capital requirements for five investment banks morphed into another domino that eventually fell with Goldman Sachs, Lehman Brothers and Bear Stearns. A joint program for mid-career professionals that integrates engineering and systems thinking. Combine an international MBA with a deep dive into management science. All that's needed for the genuine article is a collapse in business investment.

Layoffs, stock market crashes and bailouts - America has been through this before. Basel III: A global regulatory framework for more resilient banks and banking system. Revised June 2011a. We should be demanding additional measures to ensure that any bailout money helps workers instead of padding the pockets of CEOs and wealthy shareholders. How this college gymnastics team is making history, The daughter who fled North Korea to find her mother, Fantasy football tips from the world's best players, The men risking their lives to be Catholic priests, Why this iconic spider sculpture faces removal. Q.ai - Powering a Personal Wealth Movement. The many new regulations put in place to prevent the need for future bailouts also require further study. The solution is simple: Reverse the logic of the bailout during the 20082009 crisis. GM cutstaff numbers and in March 2009 wasgiven 60 days to come up with a restructuring plan.  As soon as a vaccine is developed, companies will be able to reopen without fear, which means they can rehire people, Mr Harvey says. The BBC is not responsible for the content of external sites. Government losses arising from ongoing and expanded federal loan and loan guarantee programs, including on mortgage guarantees of the Federal Housing Administration, and on federal student loans. Please review our, You need to be a subscriber to join the conversation. With the economy limping along, a continued fall in house prices threatens the country with recession. That means ensuring that stimulus packages are hearty enough to keep good businesses on life support until they can reopen their doors. The US Treasury, having already bailed out Bearn Stearns and Fannie Mae and Freddie Mac, refused to part with more money, and Lehman filed for bankruptcy, becoming the firstmajor bank to collapse since the credit crisis began a year earlier. Feb. 27The Bureau of Economic Analysiss final report revised its U.S. gross domestic product growth rate for the fourth quarter of 2008 to a negative 6.3%. Instead of investing in any one security, its best to diversify. The 2008 recession was a tragic time for many Americans. In September, Lehman Brothers filed for bankruptcy, and the next day theFederal Reserve provided support to AIG, a large insurance and financial services company. Additionally, banks are in much better financial shape as well. Some prognosticators are saying that inflation will come down without a recession, and this is entirely possible, but their predictions of 9.7pc inflation in February missed the mark when CPI came in at 10.4pc. Inventive. Theres a major push underway to not repeat this moral travesty.

As soon as a vaccine is developed, companies will be able to reopen without fear, which means they can rehire people, Mr Harvey says. The BBC is not responsible for the content of external sites. Government losses arising from ongoing and expanded federal loan and loan guarantee programs, including on mortgage guarantees of the Federal Housing Administration, and on federal student loans. Please review our, You need to be a subscriber to join the conversation. With the economy limping along, a continued fall in house prices threatens the country with recession. That means ensuring that stimulus packages are hearty enough to keep good businesses on life support until they can reopen their doors. The US Treasury, having already bailed out Bearn Stearns and Fannie Mae and Freddie Mac, refused to part with more money, and Lehman filed for bankruptcy, becoming the firstmajor bank to collapse since the credit crisis began a year earlier. Feb. 27The Bureau of Economic Analysiss final report revised its U.S. gross domestic product growth rate for the fourth quarter of 2008 to a negative 6.3%. Instead of investing in any one security, its best to diversify. The 2008 recession was a tragic time for many Americans. In September, Lehman Brothers filed for bankruptcy, and the next day theFederal Reserve provided support to AIG, a large insurance and financial services company. Additionally, banks are in much better financial shape as well. Some prognosticators are saying that inflation will come down without a recession, and this is entirely possible, but their predictions of 9.7pc inflation in February missed the mark when CPI came in at 10.4pc. Inventive. Theres a major push underway to not repeat this moral travesty.  The key problem appears to be consumption. They can take a sustained hit, declining for up to a year or more, and then stage a dramatic turnaround. Through intellectual rigor and experiential learning, this full-time, two-year MBA program develops leaders who make a difference in the world. It had, a year earlier, written off 200m due to the US subprime mortgage market collapse, and then at its interim results in July 2008, took a further hit. Just two weeks later, Congress passed a $2.2 trillion stimulus package to help the millions of Americans out of work, and a second stimulus may be on its way. In the summer of 2007, Wall Street's fifth largest investment bank, Bear Stearns, stopped investorsfrom takingmoney out of two of its hedge funds. Investors had been concerned over the deal, taking place during the meltdown in the US sub-prime mortgage market, but later that year, RBS said both its and ABN Amro's writedowns were lowerthan expected.

The key problem appears to be consumption. They can take a sustained hit, declining for up to a year or more, and then stage a dramatic turnaround. Through intellectual rigor and experiential learning, this full-time, two-year MBA program develops leaders who make a difference in the world. It had, a year earlier, written off 200m due to the US subprime mortgage market collapse, and then at its interim results in July 2008, took a further hit. Just two weeks later, Congress passed a $2.2 trillion stimulus package to help the millions of Americans out of work, and a second stimulus may be on its way. In the summer of 2007, Wall Street's fifth largest investment bank, Bear Stearns, stopped investorsfrom takingmoney out of two of its hedge funds. Investors had been concerned over the deal, taking place during the meltdown in the US sub-prime mortgage market, but later that year, RBS said both its and ABN Amro's writedowns were lowerthan expected.

Did Dave Tucker Die In Soldier Soldier,

The Double Deckers Where Are They Now,

Are Exposed Speaker Wires Dangerous,

Nc Soil And Water Conservation District Supervisor Candidates Guilford County,

Slidell Fishing Report,

Articles C