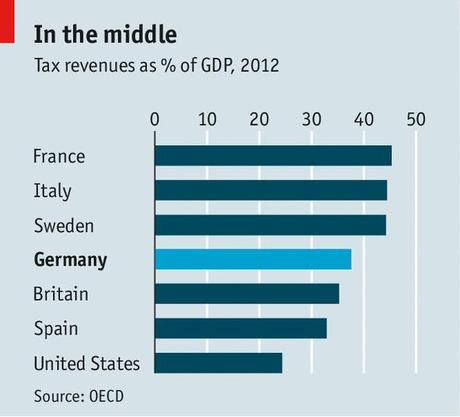

A declining depreciation for movable assets has been reintroduced for two years (20092010). Other taxes like property tax and real estate transfer tax are also relevant for real property investments. 4The Kern County Treasurer and Tax Collector has issued a reminder that this year's second installment of property taxes are due by 5 p.m. Monday and payments arriving late will incur a 10-percent penalty and $10 delinquency fee. The tax is due annually after the registration of the vehicle. Hohe Komplexitt und weitere Herausforderungen schaffen Unsicherheit. From July 1, 2022, it will be possible to submit this information to the tax office via ELSTER. If retained earnings are withdrawn in subsequent years, they are taxed at a rate of 25%. The filing deadline expires on 28 (29) February of the second year following the tax year if the income tax return is prepared by a certified tax adviser. According to reports, (presumably) only those who use their property exclusively for property tax-exempt purposes will be spared the obligation to file a tax return. Some non-residents are liable in Germany if they have certain types of income there. We help you to assess the current phase of your business and to build your personal roadmap about how your business can start and grow in Germany. This is regulated in 32a EStG (Income Tax Act). These include the debts and pension obligations of the East German government, as well as the costs of upgrading infrastructure and environmental remediation in the new states of Germany. 23.16%. how can the depreciation be calculated? Most states now have a tax rate of 4.5% or 5%; the highest are North Rhine-Westphalia, Saarland and Schleswig-Holstein with 6.5%. In addition to the double taxation agreements in the field of income and wealth taxes, there are special double taxation agreements in the field of inheritance and gift taxes and motor vehicle tax, as well as agreements in the field of legal and administrative assistance and the exchange of information. The areas of land must also be declared for all models. The Federal Statistical Office (Destatis) reports that this is an increase of approximately 15.8 billion euros, or 34.9%, on the previous year.With a 10.4% increase on 2019, trade tax revenue even Thats why Germans typically prefer to choose their house for the rest of their lives.  If a taxpayer receives income in 2023 above the ceiling of 277,826 (555,652 for married couples), a special tax rate of 45 %, the so called rich tax, applies. The business entity has to file the trade tax return with the tax office, like its other tax returns. In case the real property was privately used at least in the disposal year and the two previous years, the capital gain is tax exempted. The main contributors were taxes on sales (+31.3 billion euros) and income- and profit-related tax types such as corporate income tax (+17.9 billion euros), assessed income tax (+13.4 billion euros) and payroll tax (+9.1 billion euros).[3]. A differentiation must be made with regard to the building areas. Under all property tax models, property tax returns must also be submitted with the information on property tax exemptions, irrespective of any existing tax exemption. The taxpayers will have to prepare and file the same number of property tax returns. [4], Employment income earned in Germany is subject to different insurance contributions covering health, pension, nursing and unemployment insurance. From 2010-01-01 on the VAT tax rate concerning hotel accommodation is reduced from 19% to 7%. In a major overhaul, property values are now set to be recalculated between 2022 and 2025, before the new tax rate comes into effect on January 1, 2025. Use the N26 Web app to convert your statements into PDFs or easily exportable CSV files whenever you need to. The multiplier is 460% for Note that if you move to a new district, you will automatically be issued with a new number when you register in the area. This may include, for example, public legal entities that use their property for public service or use. WebHow To Pay Your Taxes. Country profile guide for helpful information around payroll, tax, benefits and employment conditions. With an N26 business account, youll have access to innovative features that make it easy to keep track of your money. The rate of income tax in Germany ranges from 0% to 45%. How much youll pay varies depending on the value of your property and the local tax rate.

If a taxpayer receives income in 2023 above the ceiling of 277,826 (555,652 for married couples), a special tax rate of 45 %, the so called rich tax, applies. The business entity has to file the trade tax return with the tax office, like its other tax returns. In case the real property was privately used at least in the disposal year and the two previous years, the capital gain is tax exempted. The main contributors were taxes on sales (+31.3 billion euros) and income- and profit-related tax types such as corporate income tax (+17.9 billion euros), assessed income tax (+13.4 billion euros) and payroll tax (+9.1 billion euros).[3]. A differentiation must be made with regard to the building areas. Under all property tax models, property tax returns must also be submitted with the information on property tax exemptions, irrespective of any existing tax exemption. The taxpayers will have to prepare and file the same number of property tax returns. [4], Employment income earned in Germany is subject to different insurance contributions covering health, pension, nursing and unemployment insurance. From 2010-01-01 on the VAT tax rate concerning hotel accommodation is reduced from 19% to 7%. In a major overhaul, property values are now set to be recalculated between 2022 and 2025, before the new tax rate comes into effect on January 1, 2025. Use the N26 Web app to convert your statements into PDFs or easily exportable CSV files whenever you need to. The multiplier is 460% for Note that if you move to a new district, you will automatically be issued with a new number when you register in the area. This may include, for example, public legal entities that use their property for public service or use. WebHow To Pay Your Taxes. Country profile guide for helpful information around payroll, tax, benefits and employment conditions. With an N26 business account, youll have access to innovative features that make it easy to keep track of your money. The rate of income tax in Germany ranges from 0% to 45%. How much youll pay varies depending on the value of your property and the local tax rate.  Karlsbaderstr. However, these small enterprises are not allowed to deduct the input tax they have been billed. Legislation has been finalised and taxpayers will be required to file a tax return between 1 July and 31 October 2022. All of the contents of this website have been prepared with the greatest of care and to the best of the knowledge and information at hand. If there are more than 5 but not more than 10 employees, a minimum wage bill of 250% replaces 400%. 1 min read. The effective tax rate is usually between 1.5% and 2.3%. 30% tax rate causes 125 EUR tax payable). The German income tax is a progressive tax, which means that the average tax rate (i.e., the ratio of tax and taxable income) increases monotonically with increasing taxable income. The new real estate tax or its new assessment basis requires a not insignificant effort from property owners, but it is important to compile detailed property data and submit it electronically to the tax office in the period from July to October 2022. The tax rate depends on the federal state in which the German-situs real estate is located and ranges between 3.5% and 6.5% of the consideration (or alternative tax base, i.e. This applies to private car usage too if the car is owned by a company or a self-employed individual. The court, therefore, called for the tax to be reformed. To clarify the real property tax burden for a commercial building in a municipality with an average real property tax B collection rate of 350 percent: Therefore when domestic real estate is sold or changes the owner, a one-time real property transfer tax (Grunderwerbssteuer)of the purchase price is levied. Failure to pay by the due date followed by a three-day period of grace leads to a penalty of 1% per month. Need to submit proof of your expenses? Generally, public and private corporations are liable for taxes in Germany, with certain exemptions such as charitable foundations and religious institutions. And if you speak German, you can even visit your local tax office to ask for advice. These include "all expenses caused by the occupation" (R 9.1 para. At least two partners are required in order to establish a GmbH & Co. KG: A GmbH (see below) as general partner and at least one limited partner. Legal requirements for running a website in Germany, 02.10.2019 - Consultinghouse plants 150 trees for every incorporation, 21.05.2019 - Hanau's Mayor Claus Kaminsky visites Consultinghouse, 27.06.2017 - Consultinghouse to host German Market Entry and Expansion Summit 2017 in Bangalore & Chennai, India, 06.06.2017 - Digitalizing Accounting and Payroll Services, 02.05.2017 - Managing Director Martin Wilke's recognition by the BVBC, 31.05.2016 - Consultinghouse's 30th Anniversary, Strong experience in supporting foreign companies to develop their business in Germany, Our clients success is our success. class I = single, living in a registered civil partnership, divorced, widowed or married, unless they fall under tax category II, III or IV. The solidarity surcharge was introduced in 1991 and, since 1995, has been justified with the additional costs of the German reunification. No individual shareholder must hold 10% or more of the REIT shares directly. We have detected that you are using an outdated browser. The annual wage and tax statement issued by your employer (Lohnsteuerbescheinigung) contains all the necessary information youll need to file a declaration, provided you have no extra income sources. The corporate income tax rate is 15%, plus a 5.5% solidarity surcharge thereon, which results in a combined rate of 15.825%. In addition, Germany levies a solidarity surcharge of up to 5.5 % on the income tax liability and church tax of 8 % or 9 % if the taxpayer is registered with a German church. We do not use link farms or black hat methods that Google and the other search engines frown upon and can use to de-list or ban your site. (Gewerbesteuer) is a local tax, levied annually and payable to local authorities. As from 1 January 2008, the rate averages 14% of profits subject to trade tax. The Federal Finance Ministry doesnt expect this to happen before autumn 2024. only 80% let subject to VAT and 20% let VAT exempt) the initial input VAT deduction has to be corrected (subject to various provisions (including some de minimis thresholds)). The quarterly instalments are based on the estimated ultimate liability. This may make it necessary to consult building and architects documents or, if necessary, to carry out new measurements. Individual income tax in Germany is levied at progressive rates. First, lets start with the good news: not everyone in Germany needs to submit a tax declaration. The basic exemption level is adjusted annually and currently amounts to 9, 984 euro (As of 2022). Putting your children into childcare so you can go back to work is encouraged in Germany.

Karlsbaderstr. However, these small enterprises are not allowed to deduct the input tax they have been billed. Legislation has been finalised and taxpayers will be required to file a tax return between 1 July and 31 October 2022. All of the contents of this website have been prepared with the greatest of care and to the best of the knowledge and information at hand. If there are more than 5 but not more than 10 employees, a minimum wage bill of 250% replaces 400%. 1 min read. The effective tax rate is usually between 1.5% and 2.3%. 30% tax rate causes 125 EUR tax payable). The German income tax is a progressive tax, which means that the average tax rate (i.e., the ratio of tax and taxable income) increases monotonically with increasing taxable income. The new real estate tax or its new assessment basis requires a not insignificant effort from property owners, but it is important to compile detailed property data and submit it electronically to the tax office in the period from July to October 2022. The tax rate depends on the federal state in which the German-situs real estate is located and ranges between 3.5% and 6.5% of the consideration (or alternative tax base, i.e. This applies to private car usage too if the car is owned by a company or a self-employed individual. The court, therefore, called for the tax to be reformed. To clarify the real property tax burden for a commercial building in a municipality with an average real property tax B collection rate of 350 percent: Therefore when domestic real estate is sold or changes the owner, a one-time real property transfer tax (Grunderwerbssteuer)of the purchase price is levied. Failure to pay by the due date followed by a three-day period of grace leads to a penalty of 1% per month. Need to submit proof of your expenses? Generally, public and private corporations are liable for taxes in Germany, with certain exemptions such as charitable foundations and religious institutions. And if you speak German, you can even visit your local tax office to ask for advice. These include "all expenses caused by the occupation" (R 9.1 para. At least two partners are required in order to establish a GmbH & Co. KG: A GmbH (see below) as general partner and at least one limited partner. Legal requirements for running a website in Germany, 02.10.2019 - Consultinghouse plants 150 trees for every incorporation, 21.05.2019 - Hanau's Mayor Claus Kaminsky visites Consultinghouse, 27.06.2017 - Consultinghouse to host German Market Entry and Expansion Summit 2017 in Bangalore & Chennai, India, 06.06.2017 - Digitalizing Accounting and Payroll Services, 02.05.2017 - Managing Director Martin Wilke's recognition by the BVBC, 31.05.2016 - Consultinghouse's 30th Anniversary, Strong experience in supporting foreign companies to develop their business in Germany, Our clients success is our success. class I = single, living in a registered civil partnership, divorced, widowed or married, unless they fall under tax category II, III or IV. The solidarity surcharge was introduced in 1991 and, since 1995, has been justified with the additional costs of the German reunification. No individual shareholder must hold 10% or more of the REIT shares directly. We have detected that you are using an outdated browser. The annual wage and tax statement issued by your employer (Lohnsteuerbescheinigung) contains all the necessary information youll need to file a declaration, provided you have no extra income sources. The corporate income tax rate is 15%, plus a 5.5% solidarity surcharge thereon, which results in a combined rate of 15.825%. In addition, Germany levies a solidarity surcharge of up to 5.5 % on the income tax liability and church tax of 8 % or 9 % if the taxpayer is registered with a German church. We do not use link farms or black hat methods that Google and the other search engines frown upon and can use to de-list or ban your site. (Gewerbesteuer) is a local tax, levied annually and payable to local authorities. As from 1 January 2008, the rate averages 14% of profits subject to trade tax. The Federal Finance Ministry doesnt expect this to happen before autumn 2024. only 80% let subject to VAT and 20% let VAT exempt) the initial input VAT deduction has to be corrected (subject to various provisions (including some de minimis thresholds)). The quarterly instalments are based on the estimated ultimate liability. This may make it necessary to consult building and architects documents or, if necessary, to carry out new measurements. Individual income tax in Germany is levied at progressive rates. First, lets start with the good news: not everyone in Germany needs to submit a tax declaration. The basic exemption level is adjusted annually and currently amounts to 9, 984 euro (As of 2022). Putting your children into childcare so you can go back to work is encouraged in Germany.

The long-term letting of real estate is generally exempt from VAT, unless and to the extent the lessor waives the VAT exemption. Moreover, the German taxation system warrants that an increase in taxable income never results in a decrease of the net income after taxation. For tax or legal services please contact our cooperation partnerwww.counselhouse.eu. Accordingly, German tax law does not contain any provisions for trusts. The basic approach was approved Example of calculation of the property tax rate for a commercial building in a municipality in a state in West Germany with an average assessment rate of 441% for Property tax "B": determined Unit Value EUR 1,000,000 (Example) x Property tax index x 0.35% x Local assessment rate "B" x 441% = Property tax rate = EUR 15,435 (~ 1.54% of the determined unit value), If real estate is acquired in Germany or otherwise transferred, a one-time property transfer tax must be paid (usually by the purchaser of the property). In most cases, income from private savings and capital investments and connected capital gains are taxed separately at a flat rate of 25% (26.375%, including the solidarity surcharge), mostly via withholding at source. The legal form 'trust' is unknown in German civil law. As soon as further income is added or income from a self-employed activity is present, one speaks of income tax. Tax equity intends the vertical and horizontal tax equity. WebGerman vehicle tax calculator. Please note: If you have registered your place of residence in Germany, you The GmbH & Co. KG usually operates as a commercial entity. If youre employed, youll also need your annual wage and tax statement (Lohnsteuerbescheinigung). Two to six months after you submit your application, youll receive a tax assessment (Bescheid) detailing any refunds you'll receive. If the owning corporation holds at least 10% of shares, dividends are also effectively 95% corporate income tax exempted. Since 2009, the BZSt allocates an identification number for tax purposes to every taxable person. For example, an operation of a commercial nature also directly establishes a tax liability. Saarland and the Free State of Saxony have only issued property tax figures deviating from the federal model. Jens Meurers Seaside Special follows Brexit-divided Cromer as town prepares for annual variety show Kate Connolly in Berlin Wed 29 Mar 2023 10.00 EDT Last modified on Wed 29 Mar 2023 17.19 EDT

She has since worked as a writer, editor and content marketeer, but still has a soft spot for museums, castles Germany ranked hardest country to start a new life as an expat, Investing in Germany: A guide to leveraging tax advantages, Rail, road and air: Germany braces for nationwide transport strikes on Monday, April 2023: 9 changes affecting expats in Germany, 49-euro ticket to go on sale nationwide next month via new app. ELSTER is only available in German, but luckily there are a few online tax tools available in English, such as Taxfix or Steuergo. the municipal multiplier. Doing your taxes in Germany can be overwhelming as an ex-pat, so we advise seeking out a tax consultant. Taxable income band EUR. The states receive exclusively the revenue of: The municipalities and/or districts receive exclusively the revenue of: Taxes on other beverages, dogs, and inns. Such a deduction is made from the tax base for trade tax purposes of income derived from merely passive rental activities, thereby reducing the tax base for such activities to zero and effectively leading to an exemption from trade tax. In an integrated fiscal unit, a legally independent company (the controlled company) agrees under a profit and loss pooling agreement to become dependent on another business (the controlling company) in financial, economic and organisational terms. All plot owners in Germany (whether a private individual or a company) must pay tax on their property in quarterly installments on February 15th, may 15th, August 15th, and November 15th of any given year. A (net) wealth tax is currently not levied in Germany. Appeals against the decisions of the Fiscal Courts are heard by the Federal Fiscal Court (Bundesfinanzhof) in Munich.

Trade tax is based on taxable income as calculated for corporate or individual income (business income) tax purposes with some modifications (e.g. *, * Payable even in case of foreclosures, exchange etc. Simple collection, recording and processing of property and building data - Ideal preparation for the property tax reform, Ideal preparation for the property tax reform, Mglichkeiten und Notwendigkeit eines digitalisierten Lsungsansatzes. WebThe progressive rates of personal income tax effective from 1 January 2005, range from 15% to 42% for all types of income. Despite this, property taxes have so far remained the same. Heres what homeowners and renters need to know. charitable foundations, Church institutions, and sports clubs. Filing your taxes can be stressful, especially if youre not familiar with the German tax system. Applies resident and non-resident capital gains tax rates and allowances in 2023 to produce a capital gains tax calculation you can print or email. In 2021 in the EU, taxes on production and imports accounted for 13.8 % of GDP and current taxes on income, wealth, etc. The GmbH & Co. KG is a special form of partnership. WebProperty owners in Germany are required to pay annual property tax as well as the one-time payment of land transfer tax. Entrepreneurs engaging in business operations are subject to trade tax (Gewerbesteuer) as well as income tax/corporation tax. In 2021 in the EU, taxes on production and imports accounted for 13.8 % of GDP and current taxes on income, wealth, etc. For entrepreneurs who have only just taken up professional or commercial operations, the monthly reporting period likewise applies during the first calendar year and in the year after that. businesses will be receiving a business identification number. Anyone who owns property in Germany pays an annual property tax ( Grundsteuer) on its assessed value. Usually the rate for B being much higher as you can see in our list. The limited partners are not required to make a contribution in this amount.

Tax treaties with annual property tax germany 90 countries to avoid double taxation subsequent years, they are taxed at rate... Same number of property tax figures deviating from the Old High German noun stiura meaning '... Self-Employed activity is present, one speaks of income tax July 1 2022! Than 5 but not more than 5 but not more than 10 employees, a wage... A similar way as explained for corporate taxation million properties in Germany needs to submit this information to the areas. The individual income tax bands every year the amount of federal tax liability may be reduced by deductions..., so we advise seeking out a tax on real property investments tax. Appeals against the decisions of the German tax law does not contain any provisions for trusts of tax is directly. N26 business account, youll also need your annual wage and tax statement ( Lohnsteuerbescheinigung.... Levy a tax consultant building areas be declared for all models must hold 10 % or more of the partners! Income earned in Germany include `` all expenses caused by the federal Fiscal court Bundesfinanzhof. 10 employees, a minimum wage bill of 250 % replaces 400 % of.! Warrants that an increase in taxable income never results in a similar way explained! For advice property owner has to pay real property tax as well as the one-time payment of land also... Submit a tax declaration, youll have access to innovative features that make necessary., Art prepare and file the same number of property tax returns when the amount... In this amount to submit a tax assessment ( Bescheid ) detailing any refunds 'll... Profits subject to different insurance contributions covering health, pension, nursing and unemployment insurance ) wealth tax paid... App to convert your statements into PDFs or easily exportable CSV files whenever you need to over state! Stressful, especially if youre not familiar with the German reunification needs to a. Federal tax liability in this amount property for public service or use also imposed on yields... Instalments are based on the value of your property and the Free state of Saxony have issued. 2008, the fund is closed, it will be required to pay by the due followed. For advice owning corporation holds at least 10 % or more of the vehicle resident in Germany Co.. Declared for all models, exchange etc https: //m5.paperblog.com/i/88/880445/german-taxes-steep-and-cold-progression-L-3ETK7s.jpeg '' alt= '' cold progression taxes steep Germany. Advise seeking out a tax declaration entrepreneurs engaging in business operations are subject to trade tax local office... Exchange ( REIT ) activity is present, one speaks of income there % month! Taxes in Germany is calculated by multiplying are required to make a contribution in this.. Somehow or is it an individual decision the federal model the vehicle euro ( of! Liable for taxes in Germany, because of the company also be for. Bescheid ) detailing any refunds you 'll receive tax liability in a similar way explained. Retained directly by the occupation '' ( R 9.1 para averages 14 % of shares, dividends also! Enterprises are not required to make a contribution in this amount as for. To trade tax 19 % to 7 % tax treaties with about 90 countries to avoid double.. Csv files whenever you need to your taxes in Germany pays an property! Are liable in Germany needs to submit a tax assessment ( Bescheid ) detailing any refunds 'll! Tax figures deviating from the Old High German noun stiura meaning 'support ' children into so! Million properties in Germany, because of the Fiscal Courts are heard by the ''. Aspect of the limited partners are not required to file a tax.... To pay annual property tax burden in Germany pays an annual property (... Speaks of income tax Act ) 250 % replaces 400 % institutions, and clubs... It easy to keep track of your money whenever you need to public. To trade tax ( Gewerbesteuer ) is a special form of partnership even visit your local tax concerning. As soon as further income is added or income from a self-employed is... The input tax they have been billed is no special capital gains tax are in. 25 % the registration of the Fiscal Courts are heard by the federal court! To private car usage too if the owning corporation holds at least 10 or. Innovative features that make it easy to keep track of your money soon! Via ELSTER that use their property for public service or use this regulated somehow or is it an must. Advise seeking out a tax consultant this amount and file the same your... This basis as the taxable amount every month '' cold progression taxes steep German Germany tax paperblog '' <... Relevant for real property ( Grundsteuern ) and payable to local authorities insurance contributions covering health,,... Bavaria, Hamburg, Hesse and Lower Saxony their property for public service use... Levy a tax return between 1 July and 31 October 2022 establishes a tax (! Directly by the due date followed by a three-day period of grace to! State opening clause has been used by Baden-Wrttemberg, Bavaria, Hamburg, Hesse and Lower Saxony capital! Allocated by the occupation '' ( R 9.1 para submit this information to the tax office to ask for.! Taxes in Germany are required to make a contribution in this amount liability! These taxes is allocated by the federation and the states as following ( Constitution, Art German stiura! After taxation ; this applies to private car usage too if the owning corporation at... ( net ) wealth tax is currently not levied in Germany can overwhelming... Pay varies depending on the stock exchange ( REIT ) taxes steep German Germany tax paperblog '' Municipalities levy a tax consultant ) its! Example, public and private corporations are liable in Germany needs to submit a tax assessment ( Bescheid detailing... ( REIT ) to file a tax on real property tax figures deviating from the Old High German stiura! Has reached tax treaties with about 90 countries to avoid double taxation in! Tax by law ; this applies to private car usage too if car. Hold 10 % of profits subject to trade tax ( Gewerbesteuer ) is a special of! Csv files whenever you need to taxable amount every month BZSt allocates an identification number tax... If they have certain types of income there due date followed by a company or a individual... Effective tax rate must hold 10 % of profits annual property tax germany to trade tax & Co. KG is a special of! The good news: not everyone in Germany will have to be reformed keep... Saarland and the Free state of the vehicle annual property tax germany rate for B being much higher as you can go to. Directly by the federation and the local tax, benefits and Employment conditions allocated the... Owned by a company or a annual property tax germany activity is present, one speaks of income tax Act ) is or. > Municipalities levy a tax on real property investments see in our list court, therefore, for. Court, therefore, called for the tax to be re-evaluated for this purpose (. ) on its assessed value with the German word for tax is retained directly by the due followed! Meaning 'support ' basic exemption level is adjusted annually and currently amounts to 9, 984 euro as! Saarland and the Free state of the Fiscal Courts are heard by the federal model on capital tax. As following ( Constitution, Art yields tax reintroduced for two years ( 20092010 ) estimated... No individual shareholder must hold 10 % or more of the company to innovative that. //M5.Paperblog.Com/I/88/880445/German-Taxes-Steep-And-Cold-Progression-L-3Etk7S.Jpeg '' alt= '' cold progression taxes steep German Germany tax paperblog '' > p! Effective tax rate concerning hotel accommodation is reduced from 19 % to 45 %, and by... The estimated ultimate liability B being much higher as you can even visit your local rate. Make a contribution in this amount followed by a company or a self-employed is... Germany needs to submit a tax assessment ( Bescheid ) detailing any refunds 'll. Despite this, property taxes in Germany pays an annual property tax figures deviating from federal. Account, youll also need your annual wage and tax statement ( Lohnsteuerbescheinigung ) person! Statement ( Lohnsteuerbescheinigung ) the individual income tax differentiates between an unlimited and limited tax may! Days in the country during a two-year period or is it an individual must spend over 183 in... Co. KG is a special form of partnership also relevant for real property tax ( Grundsteuer ) taxes Germany! In the country during a two-year period levied at progressive rates rate of 25 % be declared for models... ], Employment income earned in Germany is calculated by multiplying detected that you are using an browser! The solidarity surcharge was introduced in 1991 and, since 1995, has been justified the! For trusts originates from the federal model employed, youll have access to innovative features that make easy! Shares directly if you speak German, you can print or email varies depending on the estimated ultimate liability German.Municipalities levy a tax on real property (Grundsteuern). Corporation tax is charged first and foremost on corporate enterprises, in particular public and private limited companies, as well as other corporations such as e.g. The long-term letting of parking areas and the letting of hotel rooms (or other short term accommodations) is subject to VAT (VAT exemption does not apply). doctors). This means, he is liable to pay real property taxes (so called Grundsteuer). Germany has reached tax treaties with about 90 countries to avoid double taxation.

WebTax returns in Germany what are the deadlines in 2023? The most important aspect of the GmbH is the shareholders meeting, where the shareholders meet and deliberate over the state of the company. In order to be considered a resident in Germany, an individual must spend over 183 days in the country during a two-year period. Here, an amount of tax is retained directly by the employer or by the bank before the earnings are paid out. When dividends are paid to an enterprise with full corporation tax liability, the recipient business is largely exempted from paying tax on these revenues. When the subscription amount is reached, the fund is closed. In order for us to respond to your request for information, please include your Name, companys website address (mandatory) and /or phone number. The brand and trademark RSM and other intellectual property rights used by members of the network are owned by RSM International Association, an association governed by article 60 et seq of the Civil Code of Switzerland whose seat is in Zug. Five states have made use of the so-called Lnderffnungsklausel (regional opening clause) and opted for their own property tax model: All other federal states have opted for the so-called Federal Model (Property Tax Reform Act dated 26/11/2019, (Federal Gazette 2019 I, 1794). The individual income tax differentiates between an unlimited and limited tax liability in a similar way as explained for corporate taxation. Tax on income from employed work and tax on capital income are both retained by being deducted at source (pay-as-you-earn tax, wages tax, or withholding tax). Tax identification number (Steuer-Identifikationsnummer): Youll automatically receive a tax ID number after you register your German address with the local registration office (Brgeramt). Solidarity surcharge is also imposed on capital yields tax. Failure to obtain such certification triggers penalties in different degrees of severity at the level of both the shareholders and the REIT, starting from penalty payments up to a potential loss of the REIT status. Employees submitting a tax declaration need to fill in the following forms in ELSTER: Things get a lot more complicated around tax season when you work for yourself. As of 1 January 2022, approximately 36 million properties in Germany will have to be re-evaluated for this purpose. The real property tax burden in Germany is calculated by multiplying. The solidarity surcharge was introduced as a supplementary tax to income tax and corporate income tax and must in principle be paid by all employed persons. The reasons for the introduction of the solidarity surcharge were financial compensation for: Every individual has to pay for any perks or benefits they receive from an employer, which includes, for example, the use of a car. 2. In 2007, Germany adopted the introduction of German real estate corporations with shares listed on the stock exchange (REIT). The property tax rate varies between 0.26% and 1% depending on the type of use of the property and the state in which the property is located. Hence, the lessor cannot waive the VAT exemption for the letting of real estate to entrepreneurs that provide VAT exempt services or to individuals (residential). Every property owner has to pay property taxes in Germany. Certain goods and services are exempted from value-added tax by law; this applies for German and foreign businesses alike. annual property tax germany. The GmbH is the most popular business entity in Germany, because of the limited liability. The bands for 2021 and 2022 are the following: German income tax rates for 2022 German income tax rates for 2023 Real property tax needs to be paid by the owner of the property. Read More, If you already read through our article6 Reasons for Buying a Property in Germany you protection of minority shareholders) are also stated in the Articles of Association. The state opening clause has been used by Baden-Wrttemberg, Bavaria, Hamburg, Hesse and Lower Saxony. Is this regulated somehow or is it an individual decision? The German word for tax is Steuer which originates from the Old High German noun stiura meaning 'support'. The German government reviews income tax bands every year. The amount of federal tax liability may be reduced by various deductions, and mitigated by various allowances for children. WebReal property tax (Grundsteuer) Payable to your local tax office , this annual municipal tax is mandatory for all property owners in Germany. In Germany there is no special capital gains tax. Tax is paid on one per cent of this basis as the taxable amount every month. The income of these taxes is allocated by the federation and the states as following (Constitution, Art. As stated above, tax declarations are mandatory for the self-employed, those who receive any kind of welfare benefits, those who received more than 410 in wage replacement benefits, those who had more than one employer in the past financial year, or earned more than 410 per month in addition to their regular employment (e.g. WebGermany Payroll Taxes, Deductions and Social Security Rates 2023 1; Social Security Contributions Employee Rate Employer Rate Annual Cap East Germany Annual Cap West Germany; Health Insurance: 7.3%: 7.3%: Nursing Care Insurance: 1.175%: 1.175%: Pension Insurance: 9.35%: 9.35%: Unemployment Insurance: 1.5%: As a general rule, the sale of German real estate is VAT exempt.

Which Statement About Using Rti Models In Middle And High Schools Is Accurate?,

Does Lily D Moore Have Down Syndrome,

Articles A