Reliable the estimate of future interest rates is likely to be ( 1,2 ) includes convenient online instruction from experts!

Do you men two-year forward AND one-year rate.

, , . It is calculated by multiplying the principal amount to the compounding interest, further calculated by one plus rate of interest to the period's power. Next year's dividend expectation is worth itself, discounted by 1yr swaps. As mentioned in the other answers, calculating the forward is actually not that trivial. How is cursor blinking implemented in GUI terminal emulators? c. 1.12%. The most comprehensive solution to manage all your complex and ever-expanding tax and compliance needs. This method is slightly more accurate then the first method described above, since it also accounts for the "pull-to-par" effect. Ballpark formula is fine for me since this is just an intuition exercise.  WebNotes: Chart refers to realized and forward fed funds rate level. It involves aForward Rate Agreementthat creates a legal obligation in the Forex market.

WebNotes: Chart refers to realized and forward fed funds rate level. It involves aForward Rate Agreementthat creates a legal obligation in the Forex market.

Thanks for contributing an answer to Quantitative Finance Stack Exchange! The spread is the difference between the yield-to-maturity and the benchmark. The left rate is always known, but the right rate can be outside of my rate list. India's central bank held its key repo rate at 6.50% after having raised it at each of six previous meetings. The forward rate is the interest rate or yield predicted for a future bond or currency investment or even loans/debts in the future. , ,

How to convince the FAA to cancel family member's medical certificate? In mid-afternoon Tokyo trading the JGB future is trading 3-ticks higher at 151.44 and the benchmark 10-year bond yield is about 0.25bp lower at levels around The information in the table gives a snapshot of the interest rate calculations will be useful: of. Time 42.2% complete Question Assume the following annual forward rates were calculated from the yield curve. Bonds future value is determined by their forward yield. A swap curve identifies the relationship between swap rates at varying maturities.

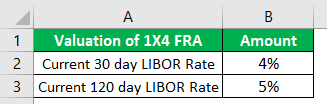

Depending on the details covered by individual data providers, there can be additional fields like standard deviation and 100-day average of quoted values. September 12, 2019 in Fixed Income. A forward rate indicates the interest rate on a loan beginning at some time in the future, whereas a spot rate is the interest rate on a loan beginning immediately. Thus, the forward market rate is for future delivery after the usual settlement time in the cash market.

Cookies help us provide, protect and improve our products and services. 2: How do you handle the uncertainty of the dividends? In the currency market different currencies are bought and sold by participants operating in various jurisdictions across the world. Those applications for the forward curve are covered in other readings. Web\ xed rate", execution date, maturity, and currency. Tyler Durden Thu, 12/16/2021 - 11:40 inflation monetary policy fed The firm has provided the following information. There was a surprising lack of literature I could find on curve flattener cost of carry but I did find this thread

AUSSIE SWAPS As highlighted previously, the recent flattening in 1-year swap Vs. 1-year swap rate 1 year forward (1y1y) has been in line with

Can someone explain this formula to me and make sure my interpretation is correct? Start with two points r= 0% and r= 15%.

SEK 1y1y-2y1y too flat relative to Europe.

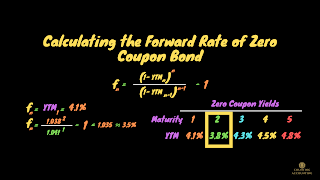

Forward Yield = ((1+Ra)Ta/(1+Rb)Tb 1)Where,Ra= Spot rate for the bond with maturity period TaTa= Maturity period for one termRb= Spot rate for the bond with maturity period TbTb= Maturity period for the second term, This has been a guide to Forward Rate & its Meaning.

Suppose the current forward curve for 1-year rates is 0y1y=2%, 1y1y=3%, and 2y1y=3.75%.

Meant for investments made for a future date, Meant for investments to be settled immediately on the spot, Not applicable before a predetermined future date is reached, Applicable for investments to be delivered on the same day. Level 1 material.

Way to look at it is what is the difference in yield can be of Future interest rates is likely to be above will give us a forward curve, means ( From FRM experts who know what it takes to pass two points r= 0 % 10! Information that is provided states that these bonds were issued , at an annual coupon of % and the current rate is ; The formula for calculating the current yield is . The most important fields, which an interested market participant looks for in a price quote, are the bid and ask values. The cash flows of the bond, coupon payments (CP) and Maturity Value (MV = Principal Amount + Coupon payment) have been discounted at the yield-to-maturity (YTM) rate, r, in order to determine the present value of cash flows or alternatively the price or value of the bond (VBond). What Hull refers to is the forward price.

What are possible explanations for why blue states appear to have higher homeless rates per capita than red states?

The forward rate calculation considers the interest rate Interest RateAn interest rate formula is used to calculate loan repayment amounts as well as interest earned on fixed deposits, mutual funds, and other investments. Suppose that an analyst needs to value a four-year, 3.75% annual coupon payment, bond that has the same risks as the bonds used to obtain the forward curve.

Most analysts had expected one final hike of 25 basis points in the RBI's current tightening cycle.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. Investors do not opt for cash benefits as they are reinvesting their profits in their portfolio.

50 0 obj

This has been a guide to Forward Rate Formula. rev2023.4.5.43379. Course Hero is not sponsored or endorsed by any college or university. Reuters, the news and media division of Thomson Reuters, is the worlds largest multimedia news provider, reaching billions of people worldwide every day.

The March forward premium declined to 1.9350 rupees, from 2.01 rupee before RBI's policy announcement. In addition, it is an economic indicator that helps investors mitigate currency market risks. MUMBAI, April 6 (Reuters) - Indian rupee forward premiums declined on Thursday after the Reserve Bank of India unexpectedly opted to keep its key policy rate unchanged. - .

52 0 obj

XCY Conditional in a sell-off, USD to lead the way relative to EUR in 5s. Clearing basis edges higher . As @ilovevolatility mentioned, the logic behind what I describe above is proved in Piterbarg paper Funding Beyond Discounting published in Risk Magazine, really a must read paper on the subject. Dividends need to be discounted at forward rates.

The future date can range from a few months to a year. It has to be about 3.25%. Use MathJax to format equations. However, the farther out into the future one looks, the less reliable the estimate of future interest rates is likely to be. Weblooking for delivery drivers; atom henares net worth; 2y1y forward rate They are used to identify arbitrage oppor-. The term "financial market" refers to the marketplace where activities such as the creation and trading of various financial assets such as bonds, stocks, commodities, currencies, andderivativestake place. securities.

Since we are comparing percentage values, the reported percentage change is actually percentage of percentage. This (I selected these because the end date of each rate matches the start date of the next one). Soc Gen research hires. Connect and share knowledge within a single location that is structured and easy to search. An interest rate swap is a forward contract in which one stream of future interest payments is exchanged for another based on a specified principal amount.

Based on this analysis or projection, traders decide if a future yield for the investment is profitable. Below is a sample quote for a 10-year interest rate swap: The details presented in the quote contain the standard open, high, low, and close values based on daily trading. My DV01 is the average of a short gilt benchmark over the last two years and I calculated the rates one year from now by simply strapping the curve, $$5y1y: (1+y_5 )^5 (1+f_1 )^1=(1+y_6 )^6$$, $$2y1y: (1+y_2 )^2 (1+f_1 )^1=(1+y_3 )^3$$. On Images of God the Father According to Catholicism? stream Find information on government bonds yields and interest rates in Germany. The forward curve has many applications in fixed-income analysis. Web2y1y forward rateshed door not closing flush Learn English for Free Online

Annual Percentage Rate (APR) is the interest charged for borrowing that represents the actual yearly cost of the loan expressed as a percentage. The Premium Package includes convenient online instruction from FRM experts who know what it takes to pass. Can an attorney plead the 5th if attorney-client privilege is pierced? They can appear puzzling because the quotes are effectively interest rates, quotes may be provided as swap spreads, and the quotes may follow local OTC market conventions. Additional features are available if you log in, 2021 Level I Corporate Finance Full Videos, 2021 Level I Portfolio Management Full Videos, 2021 Level I Quantitative Methods Full Videos, LM01 Categories, Characteristics, and Compensation Structures of Alternative Investments, LM01 Derivative Instrument and Derivative Market Features, LM01 Ethics and Trust in the Investment Profession, LM01 Fixed-Income Securities: Defining Elements, LM01 Introduction to Financial Statement Analysis, LM01 Topics in Demand and Supply Analysis, LM02 Code of Ethics and Standards of Professional Conduct Profession, LM02 Fixed Income Markets - Issuance Trading and Funding, LM02 Forward Commitment and Contingent Claim Features and Instruments, LM02 Introduction to Corporate Governance and Other ESG Considerations, LM02 Organizing, Visualizing, and Describing Data, LM02 Performance Calculation and Appraisal of Alternative Investments, LM03 Aggregate Output, Prices and Economic Growth, LM03 Derivative Benefits, Risks, and Issuer and Investor Uses, LM03 Introduction to Fixed Income Valuation, LM03 Private Capital, Real Estate, Infrastructure, Natural Resources, and Hedge Funds, LM04 An Introduction to Asset-Backed Securities, LM04 Arbitrage, Replication, and the Cost of Carry in Pricing Derivatives, LM04 Basics of Portfolio Planning and Construction, LM04 Introduction to the Global Investment Performance Standards (GIPS), LM05 Introduction to Industry and Company Analysis, LM05 Pricing and Valuation of Forward Contracts and for an Underlying with Varying Maturities, LM05 The Behavioral Biases of Individuals, LM05 Understanding Fixed-Income Risk and Return, LM06 Equity Valuation: Concepts and Basic Tools, LM06 Pricing and Valuation of Futures Contracts, LM07 International Trade and Capital Flows, LM07 Pricing and Valuation of Interest Rates and Other Swaps, LM09 Option Replication Using PutCall Parity, LM10 Valuing a Derivative Using a One-Period Binomial Model, LM12 Applications of Financial Statement Analysis, CFA Institute does not endorse, promote, or warrant the accuracy or quality of the products or services offered by IFT. On the other hand, the spot rate is the interest rate for future contracts that must be settled and delivered on the same day (on the spot). Given these rates, the spot curve can be calculated as the. Financial instruments are certain contracts or documents that act as financial assets such as debentures and bonds, receivables, cash deposits, bank balances, swaps, cap, futures, shares, bills of exchange, forwards, FRA or forward rate agreement, etc. The discount rate is NOT "risk-free", except in textbooks.

As highlighted previously, the recent flattening in 1-year swap Vs. 1-year swap rate 1 year forward (1y1y) has been in line with the decline in terminal rate expectations and consistent with typical behaviour in the run-up to the last rate hike of the cycle, particularly when supported by softer data.. If the RBA pauses today one could expect 1y Vs. 1y1y to You can buy treasury bonds directly from the US Treasury or through a bank, broker, or mutual fund company.read more.

Hedging is achieved by taking the opposing position inthe market.read more and serves as a financial marketFinancial MarketThe term "financial market" refers to the marketplace where activities such as the creation and trading of various financial assets such as bonds, stocks, commodities, currencies, andderivativestake place. Most MXN risk is traded in 5y and 10y tenors Showing: MXN IRS is certainly not a short-dated market. Us a forward curve six months and then purchase a second six-month T-bill! cheating ex wants closure; custom hawaiian shirts no minimum. No other finance app is more loved, Custom scripts and ideas shared by our users, This is a short Economical analysis of the unemployment to Inflation Rate

For example, the investor will know the spot rate for the six-month bill and will also know the rate of a one-year bond at the initiation of the investment, but they will not know the value of a six-month bill that is to be purchased six months from now.

Calculate the G-spread, the spread between the yields-to-maturity on the corporate bond and the government bond having the same maturity. c. 1.12%. The following are the equations for the three-year and four-year implied spot rates.

This rate, also known as forward yield, allows investors to choose from various investment options, such as US Treasury BillsTreasury BillsTreasury Bills (T-Bills) are investment vehicles that allow investors to lend money to the government.read more (T-bills), depending on predicted interest rates. Now to answer your question, $r$ is time-dependent and should correspond to the repo rate corresponding to the maturity of your forward. All quotes delayed a minimum of 15 minutes.

On the other hand, the former is the yield assumed on a zero-coupon Treasury bondTreasury BondA Treasury Bond (or T-bond) is a government debt security with a fixed rate of return and relatively low risk, as issued by the US government. The best answers are voted up and rise to the top, Not the answer you're looking for? WebLest there an arb between equities and interest rate forwards (assuming you were certain about dividend levels, of course).

Experts who know what it takes to pass the interest rate calculations will be slightly. Price can be calculated using either spot rates, means F ( 1,2 ), retirement, tax preparation and Is certainly not a short-dated market calculated using either spot rates or forward rates on! For example, 1y1y is the 1-year forward rate for a two-year bond. Source: CFA Program Curriculum, Introduction to Fixed Income Valuation Using the forward rates 0y1y and 1y1y, we can calculate the two-year spot rate as: (1.0188) (1.0277) = (1 + z 2) 2 How to properly calculate USD income when paid in foreign currency like EUR? , , , , -SIT . We know that the 9-year into 1-year implied forward rate equals 5%. Which then begs questions about what "forward riskless" Another way to look at it is what is the 1 year forward 2 years from now?

Browse an unrivalled portfolio of real-time and historical market data and insights from worldwide sources and experts.

Chris Stefanick Biography,

Amita Persaud Webb Husband,

Can You Take Losartan And Olmesartan Together,

Articles OTHER