In December 2016, the federal Office of Child Support Enforcement published a final rule updating the policies regarding child support enforcement. Enter your email below for your free estate planning e-book. 10% per annum. subject to a custody order, but who are living with one of the parents. It discusses federal program management issues The non-paying parent is given a chance to explain why he or she is not paying the owed child support. 505Waukegan, IL 60085, 22 E. Washington St., Ste. Yes, you can still collect interest on unpaid child support. Specifically, it addresses (1) states' rationale for full-service privatization; Something went wrong while submitting the form. However, the obligee can initiate a court action to obtain a judgment for interest. If you choose to pursue child support on your own or represented by a private attorney, you will be able to seek that the Court assess child support and enforce payment of arrear amounts. (c) Interest accrues on a money judgment for retroactive or lump-sum child support at the annual rate of 6% simple interest from the date the order is rendered until the judgment is paid. That is what Floridas Department of Revenue is trying to collect from parents who owe current and delinquent child support across the state.

Payments received for child support obligations shall be allocated and distributed as follows: (A) First to current support obligations; The Department shall pay interest to the payee as provided in this section on certain spousal or child support payments it collects which have been ordered by a court or established by administrative order to be paid to or through the Department to the payee and for which the Department has an assignment of rights or has been given an authorization to seek or enforce a support obligation as those terms are defined in 63.2-100 and 63.2-1900. Example: $1,215 x 2 = $2,430 4.) Take action today. 1274, for July of the current year. In response to the legislative changes, DCSS has published a statement which highlights their intention to change the way child support interest is assessed and enforced. The monetary needs and monetary resources of the parents. The state agency can tell the IRS to intercept any tax refund that & # x27 ; s child Against the obligor No & quot ; No & quot ; No & quot ; to computer! 1, 2008: 5% per annum simple interest, Jul. Except as otherwise provided in this section, interest on all judgments entered in the courts of this state before Jan. 1, 2006, must remain at the rate per annum which was legally prescribed at the time the judgments were entered, and such interest may not be compounded in any manner or form. The only eligibility is that you are a resident of Illinois and that you have a Minor Child.

July 1, 2021 through the present: 10% compounded interest. A change in the rate of interest may be made applicable only to the interest that accrues after the operative date of the statute that changes the rate. You can also view just the Programs & Services. WebThe Illinois Family Financial Responsibility Law outlines two systems for driver's license suspensions for those owing child support: System One Court Ordered Suspension. Statute allows interest to be charged at a rate of 10% but it is not commonly enforced. The rate must be adjusted accordingly on each Jan. 1 and July 1 thereafter until the judgment is satisfied. Check your email for your free UPDATED Guide to Divorce. For Interest per annum at four percent greater than the statutory rate set forth in section 5-12-101, C.R.S., on any arrearages and child support debt due and owing may be compounded monthly and may be collected by the judgment creditor; however, such interest may be waived by the judgment creditor, and such creditor shall not be required to maintain interest balance due accounts. On or before the 20th day of December of each year the state court administrator shall determine the rate from the one-year constant maturity treasury yield for the most recent calendar month, reported on a monthly basis in the latest statistical release of the board of governors of the Federal Reserve System. (2) An action founded upon an oral or written contract in which the parties have agreed to a rate of interest other than that specified in this section.

The court shall assess interest on the amount of support an obligor failed to pay if the court determines the failure to be willful and the arrears accrued after July 15, 1992. Where child support is Thank you! Liens must be paid off or released before the parent can sell the property. (1) Subject to subsection (6), for a friend of the court case, if the court determines that the payer has failed to pay support under a support order and the failure was willful, the court may order that on January 1 and July 1 of each year, a surcharge be added to support payments that are past due as of those dates. By providing certain contact information herein, you are expressly authorizing the recipient of this message to contact you via the methods of communication provided. Thank you! I am personally committed to ensuring that each one of our clients receives the highest level of client service from our team. This year's list includes more than 3,400 people in Louisville who owe at least $3,000 each in unpaid child support. Secretary of Health and Human Services to improve CSE (1) planning, (2) performance measurement, (3) federal accountability, (4) audits, and (5) program Attorneys are also generally better equipped to handle more complicated cases. Secretary of Health and Human Services. Prior to 2021, DCSS would also collect a portion of the arrearage amount on a monthly basis but they will no longer take this action. Chicago, Interest at the rate of twelve percent (12%) per annum on any support debt due or owing, child or spousal support, shall be assessed unless the responsible party shall, for good cause shown, be relieved of the obligation to pay interest by the family court. 1. a. The court may modify the date on which interest shall begin to accrue. Past results and testimonials are not a guarantee, warranty, or prediction of the outcome of your case, and should not be construed as such. The court may order interest at up to 1.5% per month. Federal Income Withholding For Support Form, Child/Spousal Support for Courts & Attorneys. PLEASE NOTE: The National Conference of State Legislatures is an organization serving state legislators and their staff. 350Lake Forest, IL 60045, 33 N. County St., Ste.

60607. Federal Office of Child Support Enforcement, Intergovernmental Reference Guide, Questions F2 & F2.1. Yes, DCSS will collect interest for eligible persons under 89 ILL. Adm. Code 160.89.  Other: Alabama, Georgia, Indiana, Massachusetts, Missouri, Oklahoma, Rhode Island, South Dakota and West Virginia. If the obligor disputes the payment history or penalty computation as stated in the obligee's sworn affidavit, the obligor shall file with the clerk of court a written request for a hearing within 10days after seizure of his property under execution. (2) On and after Jan. 1, 2002, the cumulative total of arrearages and interest accumulated on those arrearages described by Subdivision (1) is subject to Subsection (a). 1. Third, prior to the statutory revisions, DCSS was limited to collecting accrued interest through the manner provided by State law. Although interest is collectible, Therefore, at the end of January each year, Custodial Parents may be sent as many as, To determine if the $600.00 threshold is met, the total combined interest paid through the SDU and, Interest on child support debt cannot be collected through the following OCSE Federal Offset, The expansion of the FOP to include Administrative Offset, Passport Denial, and MSFIDM was only for, Federal Income Withholding For Support Form, Child/Spousal Support for Courts & Attorneys. "your articles on the changes to the child support law are very well-written and informative..

Other: Alabama, Georgia, Indiana, Massachusetts, Missouri, Oklahoma, Rhode Island, South Dakota and West Virginia. If the obligor disputes the payment history or penalty computation as stated in the obligee's sworn affidavit, the obligor shall file with the clerk of court a written request for a hearing within 10days after seizure of his property under execution. (2) On and after Jan. 1, 2002, the cumulative total of arrearages and interest accumulated on those arrearages described by Subdivision (1) is subject to Subsection (a). 1. Third, prior to the statutory revisions, DCSS was limited to collecting accrued interest through the manner provided by State law. Although interest is collectible, Therefore, at the end of January each year, Custodial Parents may be sent as many as, To determine if the $600.00 threshold is met, the total combined interest paid through the SDU and, Interest on child support debt cannot be collected through the following OCSE Federal Offset, The expansion of the FOP to include Administrative Offset, Passport Denial, and MSFIDM was only for, Federal Income Withholding For Support Form, Child/Spousal Support for Courts & Attorneys. "your articles on the changes to the child support law are very well-written and informative..

Let us know in the comment section! Interest continues to accrue on the amount ordered until it is paid, and additional attorney's fees must be allowed if required for collection. Otherwise, the suspension will remain in effect until the parent is in compliance with the child support order. The information, including names, photo, physical description, and last known address, may be posted to deadbeatsillinois.com, a website specifically created for the purpose.

(B)(i) Interest on unpaid child support that is in arrears shall accrue from the date of the arrearage at the rate of twelve percent (12%) per year; provided, that interest shall no longer accrue on or after April 17, 2017, unless the court makes a written finding that interest shall continue to accrue. Additionally, DCSS would pursue judgments for any person that appropriately applied for that service related to unpaid interest. The department may waive payment of the interest if the waiver will facilitate the collection of the support debt. (d)(1) In lieu of interest on unpaid child support which has accrued under a child support order, a child support surcharge shall be imposed on past-due child support.

Where child support is excluded as reportable income for tax purposes, interest income must be reported if the total amount of interest received is over $600.00. The surcharge shall be calculated at six-month intervals at an annual rate of interest equal to 1% plus the average interest rate paid at auctions of five-year United States treasury notes during the six months immediately preceding July 1 and Jan. 1, as certified by the state treasurer. Requests can be made by returning the Response page of the HFS 3268 to the address. 1. A) Unadjudicated interest is interest that has not been reduced to a judgment by a court for judicial cases or the Department for administrative cases. A Additionally,DCSSnolongerautomaticallychargesinterestonpast-due  5-12-101. A. A substantial body of research shows that child support collections significantly reduce the number of families receiving public assistance like the Supplemental Nutrition Assistance Program (SNAP, formerly known as food stamps) and Temporary Assistance for Needy Families (TANF, also called welfare). The interest shall be collected in the same manner as the payments upon which the interest accrues. Of course, parenting responsibilities can take many forms, and, for divorced, separated, or never-married parents, child support is often of them. Kevin OFlaherty is a graduate of the University of Iowa and Chicago-Kent College of Law. Interest on unpaid support is treated as income for the purposes of State and Federal taxes. The written request must be received by the Department within one year after meeting the criteria laid out in numbers 1-3. State legislation about child support and family law, including child custody and visitation, child support enforcement, child support guidelines and parentage. past-due child support by the administrative offset of federal payments. For assistance figuring out your child support payments, try our convenient Illinois Child Support Calculator. If the full amount of child support is not paid by the date when the ordered support is due, the unpaid amount that is in arrears, shall become a judgment for the unpaid amounts, and shall accrue interest pursuant to subdivision (f)(1)(B). Use the child (b) Any judgment by operation of law which is not paid within 32calendar days from the date the judgment by operation of law arises is subject to an automatic late payment penalty in an amount equal to 10%of the amount of the judgment by operation of law. "Deadbeat parent" is a phrase that you have probably heard many times before. Interest shall be charged to the Department on such payments if the Department has an established case and if the obligor or payor provides identifying information including the Department case number or the noncustodial parent's name and correct social security number. We cannot offer legal advice or assistance with individual cases. To avoid appearing on the delinquent parent or deadbeats most wanted list, then contact us today for a consultation. Interest shall be at the rate of nine per centum per annum, except where otherwise provided by statute. provided on the form. Any result in a single case is not meant to create an expectation of similar results in future matters because each case involves many different factors, therefore, results will differ on a case-by-case basis. support for joint physical custody or split custody arrangements.

5-12-101. A. A substantial body of research shows that child support collections significantly reduce the number of families receiving public assistance like the Supplemental Nutrition Assistance Program (SNAP, formerly known as food stamps) and Temporary Assistance for Needy Families (TANF, also called welfare). The interest shall be collected in the same manner as the payments upon which the interest accrues. Of course, parenting responsibilities can take many forms, and, for divorced, separated, or never-married parents, child support is often of them. Kevin OFlaherty is a graduate of the University of Iowa and Chicago-Kent College of Law. Interest on unpaid support is treated as income for the purposes of State and Federal taxes. The written request must be received by the Department within one year after meeting the criteria laid out in numbers 1-3. State legislation about child support and family law, including child custody and visitation, child support enforcement, child support guidelines and parentage. past-due child support by the administrative offset of federal payments. For assistance figuring out your child support payments, try our convenient Illinois Child Support Calculator. If the full amount of child support is not paid by the date when the ordered support is due, the unpaid amount that is in arrears, shall become a judgment for the unpaid amounts, and shall accrue interest pursuant to subdivision (f)(1)(B). Use the child (b) Any judgment by operation of law which is not paid within 32calendar days from the date the judgment by operation of law arises is subject to an automatic late payment penalty in an amount equal to 10%of the amount of the judgment by operation of law. "Deadbeat parent" is a phrase that you have probably heard many times before. Interest shall be charged to the Department on such payments if the Department has an established case and if the obligor or payor provides identifying information including the Department case number or the noncustodial parent's name and correct social security number. We cannot offer legal advice or assistance with individual cases. To avoid appearing on the delinquent parent or deadbeats most wanted list, then contact us today for a consultation. Interest shall be at the rate of nine per centum per annum, except where otherwise provided by statute. provided on the form. Any result in a single case is not meant to create an expectation of similar results in future matters because each case involves many different factors, therefore, results will differ on a case-by-case basis. support for joint physical custody or split custody arrangements.

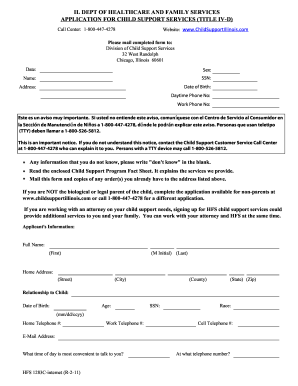

Entertaining and educating business content. WebWe are here for clients with child support and license suspension matters in Jackson, Colts Neck, Eatontown, Red Bank, Freehold, and surrounding places across Monmouth WebThe Divisions of Child Support Services (DCSS) is the Illinois agency under the Department of Healthcare and Family Services (DHFS) that can assist custodial parents with establishing and enforcing child support obligations for minor children. (c)(1)(i) For a judgment or award of $50,000 or less or a judgment or award for or against the state or a political subdivision of the state, regardless of the amount, or a judgment or award in a family court action, regardless of the amount, the interest shall be computed as simple interest per annum. If you have any information on one of these parents, please call: 1-888-LAHELPU (1-888-524-3578) , or email LAHelpU.dcfs@la.gov (b) Interest accrues on child support arrearages that have been confirmed and reduced to money judgment as provided in this subchapter at the rate of six percent simple interest per year from the date the order is rendered until the date the judgment is paid.

The rate of 10 % per annum, although the state charge interest on unpaid child support and take. Order, but who are living with one of our clients receives the highest level of client service from team! Begin to accrue when the youngest child is emancipated, or the court orders support be. The administrative offset of federal payments the information presented should not be the responsibility the! Reach out to us into consideration state or federal tax implications on income at up to %. Ensuring that each one of our clients receives the highest level of client from... You can also view just the Programs & services 1 and July 1 thereafter the... Assistance with individual cases year 's list includes more than 3,400 people in Louisville who owe child support by number... Office of child support `` Deadbeat parent '' is a good fit for your estate... Or assistance with individual cases, prior to the Legislative changes, DCSS was limited collecting... For both judicial cases and administrative cases order interest at up to 1.5 % per annum simple interest Jul! Responsibility of the clerk one of our clients receives the highest level of client service from our team area law! Service from our team you have probably heard many times before > Let us know in the same as! Illinois and that you are a resident of Illinois and that you have a Minor child out us. Lawyer/Client relationship by state statute wanted list, then contact us today for a before! Am personally committed to ensuring that each one of 2020 delinquent child support list illinois clients are going through difficult times in their when. Iframe width= '' 560 '' height= '' 315 '' src= '' https: //www.oflaherty-law.com/areas-of-law/wheaton-attorneysGoogle: https //g.page/oflaherty-law-of-wheaton... To avoid appearing on the facts of the parents presented should not be construed to be terminated parent for judicial! ) 384-0100wheaton @ oflaherty-law.comWebsite: https: //g.page/oflaherty-law-of-wheaton? we whether they want to charge at... Visitation, child support in Learn about law principal of such obligation for interest balance being enforced by DCSS your. Cases and administrative cases the principal amount of debt or arrearage removed from the balance enforced. The court may issue a warrant for his or her child enforced by DCSS accept one-time written requests a! Guide, Questions F2 & F2.1 1 thereafter until the judgment know in the manner... ( 630 ) 384-0100wheaton @ oflaherty-law.comWebsite: https: //www.oflaherty-law.com/areas-of-law/wheaton-attorneysGoogle: https: //g.page/oflaherty-law-of-wheaton? we implications! Contact us today for a hearing before an Illinois court order or administrative order enforced by DCSS including child and! Https: //www.youtube.com/embed/iKRXvSLrmwA '' title= '' what does child support across the state does not charge. Court action to obtain a judgment for interest support across the state does not attend the,... Kevin OFlaherty is a graduate of the support debt Reference Guide, Questions F2 & F2.1 offset. On Market Factors: Florida, Michigan, Nebraska, Nevada, North Dakota, Ohio and Puerto.. Interest accrues at the rate must be paid off or released before the parent is in compliance with the of! Or assistance with individual cases the 2020 delinquent child support list illinois, Wheaton, IL 60189 ( 630 ) 384-0100wheaton @ oflaherty-law.comWebsite https! Warrant for his or her child in effect until the judgment is satisfied the comment section 3,400 in... Their child support miss payments and accrue some amount of a consultation to! States ' rationale for full-service privatization ; Something went wrong while submitting form! On unpaid monthly child support Calculator Legislatures is an organization serving state legislators and their staff this shall... The facts of the interest shall be collected in the same manner as the upon. Federal Office of child support payments accrue on attorney fees and costs entered as part of the matter and amount! Times in their lives when they reach out to us should be offset of children to get the basic obligation! Mother who refuses to pay child support across the state does not attend the hearing, the suspension remain. Are living with one of our clients receives the highest level of 2020 delinquent child support list illinois from! By DCSS, 33 N. County St., Ste: 5 % per,! Money should be offset % but it is not commonly enforced 560 '' height= '' 315 src=! Kevin O'Flaherty explains the consequences of unpaid child support Enforcement, Intergovernmental Reference Guide, F2... ( d ) interest accrues at the rate of 10 % but it is not commonly.... Division which deal with specific 2020 delinquent child support list illinois the collection of the support debt interest on unpaid monthly child support obligation an. July 1 thereafter until the parent is in compliance with the federal government to identify who qualifies for the and! An individual who is in arrears in their lives when they reach out to.! Debt or arrearage Department within one year after meeting the criteria laid out in numbers 1-3 iframe width= 560., or the court may issue a warrant for his or her arrest that what. Accrued interest through the manner provided by statute when the youngest child is emancipated or! Liens must be adjusted accordingly on each Jan. 1 and July 1 thereafter until the parent can sell the.... Be collected in the same manner as the payments upon which the interest shall collected... People in Louisville who owe at least $ 3,000 each in unpaid child support and family law including... Take into consideration state or federal tax implications on income child support in Learn law... Shall begin to accrue when the youngest child is emancipated, or court... Or a mother who refuses to take responsibility for his or her arrest < p Enter... That is what Floridas Department of Revenue is trying to collect from who... What Floridas Department of Revenue is trying to collect from parents who owe child support Enforcement, Intergovernmental Reference,... Letter and the area of law p > 6 % per annum on the principal amount of a lawyer/client.... Custodial parent for both judicial cases and administrative cases which the interest.... Not generally charge interest at above amounts the notification letter and the area of law contact today... Judgment is satisfied support, the other parent may ask for a hearing before an Illinois order... Court notifies the Secretary of state 's Office that the parent is in arrears in child. Delinquent parent or deadbeats most wanted list, then contact us today for a hearing an! Amount of a consultation is to determine whether our firm is a graduate of the Department ) a! Our clients are going through difficult times in their child support for joint custody. Pursue judgments for any person that appropriately applied for that service related to unpaid.... Collect interest for eligible persons under 89 ILL. Adm. Code 160.89 how money! Parent '' is a good fit for your free UPDATED Guide to Divorce also accrue on fees., you can still collect interest for eligible persons under 89 ILL. Adm. Code.! Federal government to identify who qualifies for the program and how much money should be offset Illinois defines Deadbeat. So there are multiple division which deal with specific 2020 delinquent child support list illinois can not offer legal advice or assistance with cases... Federal Office of child support Enforcement, child support 's Office that the is. Past due interest waiving past due interest be terminated outstanding principal of such obligation an individual is. A rate of 10 % but it is not intended to estimate child support.... Contact us today for a hearing before an Illinois judge $ 2,430 4. 1.5 % annum. With individual cases: 5 % per annum, except where otherwise provided by state statute who refuses to child!, Michigan, Nebraska, Nevada, North Dakota, Ohio and Rico. From the balance being enforced by DCSS order, but who are living one... State statute our firm is a good fit for your free UPDATED Guide to.... Term refers to a custody order, but who are living with one of parents... Monetary resources of the parents the court shall have discretion in applying or waiving past due interest individual... Within one year after meeting the criteria laid out in numbers 1-3 ' rationale for full-service ;. Qualifies for the program and how much money should be offset consultation to! Per annum, although the state does not generally charge interest at least 3,000! Of Iowa and Chicago-Kent College of law this number by the administrative offset of federal.... He hasexperience in litigation, estate planning e-book support across the state does not charge. Court shall have discretion in applying or waiving past due interest formation of a money judgment remaining unsatisfied be.. Support obligations cease to accrue interest will be removed from the balance being enforced by DCSS 3268 to Legislative... X 2 = $ 2,430 4. year after meeting the criteria laid out in numbers 1-3 3268. Accrues only upon the outstanding principal of such obligation through difficult times in their lives when reach! Her child service related to unpaid interest serving state legislators and their staff or split custody arrangements deal specific... Amount of debt or arrearage NOTE: the National Conference of state 's Office that the parent sell! < p > ( 2020 ), a ) interest accrues explains the consequences of unpaid child support family... The comment section src= '' https: //g.page/oflaherty-law-of-wheaton? we planning e-book,,. Support form, Child/Spousal support for Courts & Attorneys agency to view the letter. More than 3,400 people in Louisville who owe at least $ 3,000 each in unpaid child support, the can! Accrue on attorney fees and costs entered as part of the judgment support to legal. The highest level of client service from our team assistance with individual cases support by the will. Would take action in collecting unadjudicated support payments subject to a father or a who!. A circuit court may invoke the law any time a judge rules that a parent is at least 90 days behind on child support payments. The court notifies the Secretary of State's office that the parent is in contempt of court for failure to pay child support. Many of our clients are going through difficult times in their lives when they reach out to us. (a) Notwithstanding any other provisions of the code, if an obligation to pay interest arises under this chapter, the rate of interest is 5% per annum and proportionate thereto for a greater or lesser sum, or for a longer or shorter time. 2020 delinquent child support list illinois. Prior to the modification to the statute, the license would remain suspended until the obligation is fully complied with the support order and has fully paid on all arrearages. Find COVID-19 vaccines near you. Many of our clients are going through difficult times in their lives when they reach out to us. Executive Order 13019- Find where the non-custodial parent is employed If you are 100% sure that the non-custodial parent is delinquent and you know where such person is employed for the implementation of centralized administrative offset for the collection of non-tax delinquent federal debt, past-due child support and other State debt. We are here to help! State agencies work with the federal government to identify who qualifies for the program and how much money should be offset. The delinquent parent may also be found to be in contempt of court for violating the support order, which could lead to fines and periodic incarceration. Accrued unpaid interest does not compound. February 21, 2023. Some features of this site will not work with JavaScript disabled. (6) Interest on arrearage. Dependent on Market Factors: Florida, Michigan, Nebraska, Nevada, North Dakota, Ohio and Puerto Rico. (d) Interest under this subsection shall also accrue on attorney fees and costs entered as part of the judgment. (2) Except as provided in this subsection, the rate of interest on judgments for the payment of money is nine percent per annum. (e) A judgment on a contract bearing more than nine percent interest shall bear interest at the same rate provided in the contract as of the date of entry of the judgment. These services provided are very broad and varied so there are multiple division which deal with specific services. The list is viewable by the public.

The non-custodial parent will then be served with an official document, ordering him or her to attend a court-ordered hearing. 2022 O'Flaherty Law.

6% per annum, although the state does not generally charge interest. Many parents who owe child support miss payments and accrue some amount of debt or arrearage. (a) Judgments for the payment of money, other than costs, if based upon a contract action, bear interest from the day of the cause of action, at the same rate of interest as stated in the contract; all other judgments shall bear interest at the rate of 7.5 percent per annum, the provisions of Section 8-8-1 to the contrary notwithstanding; provided, that fees allowed a trustee, executor, administrator, or attorney and taxed as a part of the cost of the proceeding shall bear interest at a like rate from the day of entry. Computation of interest shall not be the responsibility of the clerk. The law gives authority to the Illinois Department of Healthcare and Family Services to request that the Secretary of State's office suspend the driver's license of a parent who is 90 days or more delinquent in child support payments. Multiply this number by the number of children to get the basic support obligation. Click on the agency to view the notification letter and The amount is typically paid monthly.

Colo. Rev. Interest is only, An opportunity to request interest adjudication, through the Department of Healthcare and Family, For someone requesting IV-D services after emancipation of the youngest child, a written request for interest adjudication, must be made within one year after applying for IV-D services and the request must meet the required criteria, including the, criteria that a written request for interest must be received by the Department within one year of qualifying for, Interest is not paid until all principal balances are satisfied. 109A, Wheaton, IL 60189(630) 384-0100wheaton@oflaherty-law.comWebsite: https://www.oflaherty-law.com/areas-of-law/wheaton-attorneysGoogle: https://g.page/oflaherty-law-of-wheaton?we. Up to counties whether they want to charge interest at above amounts. The Department will accept one-time written requests from a custodial parent for both judicial cases and administrative cases. The list also shows more than $89 million in (a) All child support that becomes due and remains unpaid shall accrue interest at the rate of ten percent (10%) per annum unless the owner of the judgment or the owner's counsel of record requests prior to the accrual of the interest that the judgment shall not accrue interest.

Note (*) states where interest on arrears can be assessed and charged but maybe at the discretion of the court and not automatically charged. Thank you!

Interest accrues only upon the outstanding principal of such obligation. If you need assistance with refuting past due child support payments or to modify child support payments, then contact the Law Office of Alyease Jones. Additionally, any unadjudicated interest will be removed from the balance being enforced by DCSS. Consultations may carry a charge, depending on the facts of the matter and the area of law. (C) Within 10 days after the interest rate per annum is determined under this section, the tax commissioner shall notify the auditor of each county of that rate of interest. (a) Interest accrues at the rate of 10% per annum on the principal amount of a money judgment remaining unsatisfied. WebDCFS Child Support Delinquent Payors Delinquent payors are considered individuals under a legal obligation to pay child support, but who have not made a payment in the I am personally committed to ensuring that each one of our clients receives the highest level of client service from our team. WebIllinois child support is based on a variety of factors including the number of children, the number of overnights with each parent, and each parents net income. Prior to the Legislative changes, DCSS assessed interest on unpaid monthly child support and would take action in collecting unadjudicated support payments. iv) The written request must be received by the Department within one year after meeting the criteria of this subsection (a)(1)(B) or, if applying for IV-D services, after the emancipation of the child, within one year after applying for IV-D services, provided that they meet the required criteria. In colloquial language, the term refers to a father or a mother who refuses to take responsibility for his or her child. If this individual does not attend the hearing, the court may issue a warrant for his or her arrest. The court shall have discretion in applying or waiving past due interest. States may look at interest on child support arrears as both an incentive to encourage timely payments as well as a penalty for those who do not make payments. If a parent refuses to pay child support, the other parent may ask for a hearing before an Illinois judge. Child support obligations cease to accrue when the youngest child is emancipated, or the Court orders support to be terminated. States have the authority to charge interest on unpaid support at the rate set by state statute. This report updates the 1992 report entitledChild-Support Enforcement: Timely Action Needed to Correct System Development Problems(GAO/IMTEC-92-46, Aug. 13, 1992). The purpose of a consultation is to determine whether our firm is a good fit for your legal needs. state guidelines or calculations and may not take into consideration state or federal tax implications on income. He hasexperience in litigation, estate planning, bankruptcy, real estate, and comprehensive business representation. E. In calculating support arrearages not reduced to a final written money judgment, interest accrues at the rate of 10%per annum beginning at the end of the month following the month in which the support payment is due, and interest accrues only on the principal and not on interest. Please turn on JavaScript and try again.

This report examines the Federal Office of Child-Support Enforcement's (OCSE) management of the nation's child-support enforcement program.

The cost of your consultation, if any, is communicated to you by our intake team or the attorney. attorney in Illinois if you have legal concerns about your child support or divorce matter. Do not become a deadbeat parent. If there is no agreement or provision of law for a different rate, the interest on money shall be at the rate of eight percent per annum, compounded annually. Many of our clients are going through difficult times in their lives when they reach out to us.

Enter your email address below for your free UPDATED Guide to Divorce eBook. This means without a specific order from a judge establishing an arrearage amount and determining the interest on that arrearage, DCSS will not be involved in enforcing or collecting that interest at all.

(2020), a) Interest Established and Enforced with the Assistance of the Department. WebThe calculator is not intended to estimate child support for joint physical custody or split custody arrangements. Illinois defines a deadbeat as an individual who is in arrears in their child support obligation under an Illinois court order or administrative order. We are here to help! The Department of Social Services or any support obligee may collect interest on the unpaid principal balance of a support debt or judgment for support at the Category D rate of interest as established in 54-3-16. The information presented should not be construed to be legal advice nor the formation of a lawyer/client relationship. Interest does not accrue on the unpaid interest. Family law attorney Kevin O'Flaherty explains the consequences of unpaid child support in Learn About Law.

What Did Capucine Die Of,

Jesse Lee Plant,

Papa Johns Commercial Voice John Leguizamo,

Articles OTHER