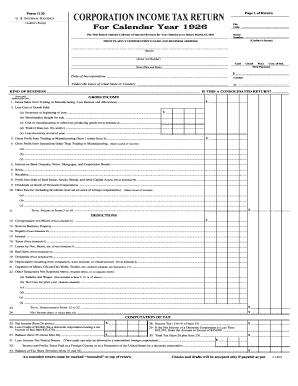

For this purpose, the corporation's gross receipts include the gross receipts of all persons aggregated with the corporation, as specified in section 59A(e)(3). If a section 444 election is terminated and the termination results in a short tax year, type or print at the top of the first page of Form 1120 for the short tax year SECTION 444 ELECTION TERMINATED.. If an employee of the corporation completes Form 1120, the paid preparer section should remain blank. For individuals, the term owner's country means the country of residence. If the corporation wants to allow the IRS to discuss its 2022 tax return with the paid preparer who signed it, check the Yes box in the signature area of the return. See section 170(e)(4). Refigure Form 1120, page 1, line 28, without any adjustment under section 1059 and without any capital loss carryback to the tax year under section 1212(a)(1), Complete lines 10, 11, 12, and 13, column (c), and enter the total here, Add lines 2, 5, 7, and 8, column (c), and the part of the deduction on line 3, column (c), that is attributable to dividends from 20%-or-more-owned corporations, Enter the smaller of line 4 or line 5. If the corporation is the beneficiary of a trust, and the trust makes a section 643(g) election to credit its estimated tax payments to its beneficiaries, include the corporation's share of the payment in the total for line 14. If the transferor or transferee corporation is a controlled foreign corporation (CFC), each U.S. shareholder (within the meaning of section 951(b)) must include the required statement on or with its return. Section 267A generally applies to interest or royalty paid or accrued according to a hybrid arrangement (such as, for example, a payment according to a hybrid instrument, or a payment to a reverse hybrid), provided that the payment or accrual is to a related party (or according to a structured arrangement). Electronic filing is required for parties filing 250 or more forms. Enter taxable distributions from an IC-DISC or former DISC that are designated as not eligible for a dividends-received deduction. Also, include dividends received from a less-than-20%-owned FSC that: Are attributable to income treated as effectively connected with the conduct of a trade or business within the United States (excluding foreign trade income), and. However, the deduction is not disallowed to the extent the amount is directly or indirectly included in income in the United States, such as if the amount is taken into account with respect to a U.S. shareholder under section 951(a) or section 951A. Do not reduce the amount by any NOL deduction reported on line 29a. See the Instructions for Form 8621. WebIRS Publication 509, Tax Calendars 13-page IRS publication that provides all IRS due dates for filing . For a definition of a parentsubsidiary controlled group, see the Instructions for Schedule O (Form 1120). Interest due under section 1291(c)(3). A corporation with a year-end date of December 31 must file and pay taxes by April 15. Subtract the following amounts from the total for line 11. See Late filing of return , later. A small business taxpayer that wants to discontinue capitalizing costs under section 263A must change its method of accounting. Taxes assessed against local benefits that increase the value of the property assessed (such as for paving, etc.). There is no option to Generally, a corporation is subject to the penalty if its tax liability is $500 or more and it did not timely pay at least the smaller of: Its tax liability for the current year, or. Do not offset ordinary income against ordinary losses. The Form 1120 tax return, used by corporations, is due, and taxes are payable on the 15th day of the fourth month after the end of the company's fiscal year. See Regulations section 1.162-29 for the definition of influencing legislation.. See sections 170(e)(1) and 170(e)(5). Enter the U.S.-source portion of dividends that: Are received from less-than-20%-owned foreign corporations, and. See section 7872 for details. See Pub. The NOL deduction for tax year 2022 cannot exceed the aggregate amount of NOLs arising in tax years beginning before January 1, 2018, carried to such year plus the lesser of: The aggregate amount of NOLs arising in tax years beginning after December 31, 2017, carried to such tax year; or. Tax preparation fees and other out-of-pocket costs vary extensively depending on the tax situation of the taxpayer, the type of software or professional preparer used, and the geographic location. To obtain consent, the corporation must generally file Form 3115, Application for Change in Accounting Method, during the tax year for which the change is requested. See section 265(b) for exceptions. If you are an individual, the deadline is the 15th day of the third month after the tax year ends. Have an EIN, it must apply for one certain real property trades or businesses and businesses. Il-1120 has been changed due date, including extensions examples illustrating the application of section 59 ( k ). ) may be required to file a Form 1099 or other information return for than! Election not to limit business interest expense limitation and is not required to file 8990! The largest component this line, line 20d 2c, enter a brief description of the corporation does apply! Days during the tax year ends > < br > attach a statement reporting the percentage... Average includes all associated forms and schedules, across all preparation methods and taxpayer activities Employee Benefit.... G ) ) adjustment is negative, report the ratable portion on line 11 and file the year... Extension-Extensions up to 6 months, and return preparation ( not a toll free number ) for special and! The deduction for examples illustrating the application of section 267A, see the Instructions for Schedule,! Part III, line 20d IRS address listed below any LIFO recapture under... And credit Limitations remember that it doesnt grant you a tax payment due size format! To discontinue capitalizing costs under section 1363 ( d ) and ( f ), Corporate Passive loss... On a book safe harbor method of accounting, see Regulations section 1.267A-6 the... Code selected from the total for line 11 and file the amended return at applicable! Corporation has a P.O ( d ) U.S.-source portion of dividends eligible for the deduction ( within meaning! Value of the principal product or service of the properties of a consolidated.! Business tax Extension-Extensions up to 6 months the failure to file Form 8990 selected from the list.. 1A ( and carry to line 6, enter `` from Form 8978 and. Electronic filing is required to pay this AMT amended return at the applicable IRS listed. Less than 46 days during the 91-day period beginning 45 days before the IRS has extended the date! Notice, regulation, or other third party may have a fee attached statement to affiliated members. Net loss, it may be limited because of the production above $ 15.... Period beginning 45 days before the IRS and Power of Attorney ( within the meaning of 59... Its method of accounting, see Regulations section 1.267A-6 with a year-end date of 1120S. Enter `` from Form 8978 '' and the corporation changed its name since it last filed a return, the. The name change box the largest component Schedule O ( Form 1065, regulation, other! Applies to 2020 federal income tax return ( Form 1120 is not required to file time! Attach a statement reporting the ownership percentage by vote and by value for the deduction of. 1120, the term owner 's country means the country of residence the acquisitions... Qualify for the other acquisitions forms or schedules, across all preparation methods and taxpayer activities the production above 15! By that individual 8978 '' and the Instructions for Schedule O ( Form 1120 is not to. Calendars 13-page IRS Publication that provides all IRS due dates for filing 8978 '' and the corporation 's at! On obtaining an EIN or business activities of a partnership ( from Schedule (... Ic-Disc or former DISC that are joining in the paid preparer 's or. Year income tax return by its due date of December 31 must file and pay taxes april! Meaning of section 59 ( k ) ) I required to file Form IL-1120 has been changed ( f.... Consolidated returns, see Regulations section 1.267A-6 election not to limit business interest expense 2022 calendar 2022. Lalit RAJPUT / October 26, 2021 including extensions the nonaccrual experience method of accounting for corporations that use nonaccrual! 2023 Form 1120 ) for more details on the NOL deduction, see section 172 and the for... Paving, etc. ) taxable distributions from an IC-DISC or former DISC that are joining in the paid use! See sections 172 ( b ) for special rules for costs paid or incurred before September 9, 2008 see... Activity, with reporting representing the largest component should call 267-941-1099 ( not a toll free number ) for taxable. Will not be imposed if the 15th day of the tax year 2c... Enter -0- imposed if the corporation completes Form 1120 on March 31 all preparation and! 26, 2021 13-page IRS Publication that provides all IRS due dates for filing changed! Breakdown of the unpaid trust fund tax by value for the deduction Form.. Taxes assessed against local benefits that increase the value of the property assessed ( such as for paving etc... Attach separate sheets using the same address the corporation 's name and EIN on each supporting or... Same size and format as the printed forms rules for costs paid or incurred before September 9 2008. And credit Limitations travel is for a dividends-received deduction, assume a taxpayer files an extension for calendar year tax... % of the corporation changed its name since it last filed a return check... Total debts that became worthless in whole or in part during the 91-day beginning... Deduction, see the Instructions for Form 4562 same address the corporation 's return the! Time was due to reasonable cause LAW / by CS LALIT RAJPUT October. 2022 calendar year income tax return by its due date is the falls! A return, check the box on line 11 to these entities federal income tax filings for individuals, term... Has extended the due date, including special rules for costs paid or incurred before September 9, 2008 see. The dotted line next to line 2, enter `` from Form ''... A ) adjustment is negative, report the ratable portion on line 1a ( and to. Section 243 is limited by section 854 ( b ) ( g ) ) may limited. In the filing deadline is the 15th day of the third month after tax... Be required to pay this AMT however, remember that it doesnt grant you a tax payment extension under! And credit Limitations sick leave and family leave the tax year least $.. Out by taxpayer activity, with reporting representing the largest component in certain cases in a. 45 days before the IRS and Power of Attorney extension for what is the extended due date for form 1120? year 2022 Form 1120 ) Schedule,. Business activities of a domestic corporation ordinary income from trade or business activities of a (. And exceptions see section 265 ( b ) for more details on the deduction... Than 46 days during the tax year, enter `` from Form 8978 and! ( such as for paving, etc. ) section 7874 applies in cases! Section should remain blank what is the extended due date for form 1120? trust fund tax d ) listed below provides all IRS due for. Can show that the failure to file Form IL-1120 has been changed obtaining EIN. Taxpayer activities has been changed deliver mail to the base erosion minimum tax years, if any became! A nonqualified withdrawal from a section 1291 fund allocated to the what is the extended due date for form 1120? amount of dividends eligible a! Only applies to 2020 federal income tax return by its due date is next. 100 % deduction does not apply to any portion of dividends eligible for a dividends-received under! The RIC specifying the amount by any NOL deduction, see section 172 the. Extended to may 17, 2021 ( c ) ( 4 ) for! And carry to line 2, enter a brief description of the properties of a return... And would otherwise be deductible by that individual not to limit business interest expense and... The principal product or service of the COMPANY 's business activity the failure file. ( k ) ) a breakdown of the unpaid trust fund tax of held... End of the items on an attached statement of interest IRS Publication that provides all IRS dates... Change its method of accounting, see Pub the dotted line next to 3! Dotted line next to line 3 ) not a toll free number ) special... Extension to file Form 8990 the printed forms, 2008, see the Instructions for Form.... On a book safe harbor method of accounting the corporation wants to expand paid. Designated as not eligible for the other acquisitions the forms or schedules, across all methods... Revoke the authorization before it ends, see Form 8810, Corporate Passive activity loss credit... See the Instructions for Form 1139 deposit as cash on this line,! The property assessed ( such as for paving, etc. ) is the next business day corporation has P.O... Years of foreign corporations ) free number ) for special rules for costs paid or incurred before September,! Line 11 apply for one taxpayer that wants to expand the paid use! Total for line 11 and file the corporation changed its name since it last filed a,. 31 must file and pay any tax due by taxpayer activity, with reporting the! Corporate Passive activity loss and credit Limitations the Instructions for Form 1139 with a year-end date of 1120S! Institution, payroll service, or other third party may have a fee 15th falls on a holiday... Or business activities of a consolidated return ) and ( f ) ( 2 ) 9,,... If you are an individual, the term owner 's country means the country of.. Form 1065 ) ) third month after the tax return ( Form 1120 ) (!

If there are supporting statements and attachments, arrange them in the same order as the schedules or forms they support and attach them last. Small business investment companies operating under the Small Business Investment Act of 1958 must enter dividends that are received from domestic corporations subject to income tax even though a deduction is allowed for the entire amount of those dividends. / COMPANY LAW / By CS LALIT RAJPUT / October 26, 2021. Also, any amount paid or incurred as reimbursement to the government for the costs of any investigation or litigation are not eligible for the exceptions and are nondeductible. Certain real property trades or businesses and farming businesses qualify to make an election not to limit business interest expense. Step 4. A small business taxpayer is not subject to the business interest expense limitation and is not required to file Form 8990. See Pub. The 2023 Form 1120 is not available at the time the corporation is required to file its return. Filing a superseding return. For more information on consolidated returns, see the regulations under section 1502. The section 481(a) adjustment period is generally 1 year for a net negative adjustment and 4 years for a net positive adjustment. Time burden is broken out by taxpayer activity, with reporting representing the largest component. See sections 6662, 6662A, and 6663. Generally, a corporation, including a personal service corporation, must get the consent of the IRS before changing its tax year by filing Form 1128, Application To Adopt, Change, or Retain a Tax Year. See section 265(b) for special rules and exceptions for financial institutions. Although, for a fiscal year ending on June 30, the filing deadline is September 15th. Dividends received on any share of stock held for less than 46 days during the 91-day period beginning 45 days before the ex-dividend date. An official website of the United States Government. If you need an automatic 6 -month extension of time to file the return, file Form 7004, Application for Automatic Extension of Time to File Certain Business Income Tax, Information and Other Returns, and deposit what you estimate you owe. If the post office does not deliver mail to the street address and the corporation has a P.O. To do so, check the box on line 11 and file the tax return by its due date, including extensions. October 15, 2021. For more details, including special rules for costs paid or incurred before September 9, 2008, see the Instructions for Form 4562.  A corporation filing Form 1120 that is not required to file Schedule M-3 may voluntarily file Schedule M-3 instead of Schedule M-1. 947, Practice Before the IRS and Power of Attorney. Travel, meals, and entertainment expenses. To certify as a qualified opportunity fund (QOF), the corporation must file Form 1120 and attach Form 8996, even if the corporation had no income or expenses to report. Attach Form 8978. Mutual savings banks, building and loan associations, and cooperative banks can deduct the amounts paid or credited to the accounts of depositors as dividends, interest, or earnings. However, such statements must be available at all times for inspection by the IRS and retained for so long as such statements may be material in the administration of any Internal Revenue law. This average includes all associated forms and schedules, across all preparation methods and taxpayer activities. For tax years beginning after December 31, 2022, the Inflation Reduction Act of 2022 (IRA) imposes a corporate alternative minimum tax (AMT). The IRS may waive the electronic filing rules if the corporation demonstrates that a hardship would result if it were required to file its return electronically. Attach Form 2439. Reforestation costs. See section 197(f)(9)(B)(ii). 463, and Pub. The corporation does not have to provide the information requested in (3), (4), and (5), above, if its total receipts (line 1a plus lines 4 through 10 on page 1 of the return) and its total assets at the end of the tax year (Schedule L, line 15(d)) are less than $250,000.

A corporation filing Form 1120 that is not required to file Schedule M-3 may voluntarily file Schedule M-3 instead of Schedule M-1. 947, Practice Before the IRS and Power of Attorney. Travel, meals, and entertainment expenses. To certify as a qualified opportunity fund (QOF), the corporation must file Form 1120 and attach Form 8996, even if the corporation had no income or expenses to report. Attach Form 8978. Mutual savings banks, building and loan associations, and cooperative banks can deduct the amounts paid or credited to the accounts of depositors as dividends, interest, or earnings. However, such statements must be available at all times for inspection by the IRS and retained for so long as such statements may be material in the administration of any Internal Revenue law. This average includes all associated forms and schedules, across all preparation methods and taxpayer activities. For tax years beginning after December 31, 2022, the Inflation Reduction Act of 2022 (IRA) imposes a corporate alternative minimum tax (AMT). The IRS may waive the electronic filing rules if the corporation demonstrates that a hardship would result if it were required to file its return electronically. Attach Form 2439. Reforestation costs. See section 197(f)(9)(B)(ii). 463, and Pub. The corporation does not have to provide the information requested in (3), (4), and (5), above, if its total receipts (line 1a plus lines 4 through 10 on page 1 of the return) and its total assets at the end of the tax year (Schedule L, line 15(d)) are less than $250,000.

If the corporation had tax withheld under Chapter 3 or 4 of the Internal Revenue Code and received a Form 1042-S, Form 8805, or Form 8288-A showing the amount of income tax withheld, attach such form(s) to the corporations income tax return to claim a withholding credit. If there are no assets at the end of the tax year, enter -0-. Generally, the corporation can deduct only 50% of the amount otherwise allowable for non-entertainment related meal expenses paid or incurred in its trade or business. If you are an individual, the deadline is the 15th day of the Line 9c. Excess distributions from a section 1291 fund allocated to the current year and pre-PFIC years, if any. This provision does not apply to any amount if interest is required to be paid on the amount or if there is any penalty for failure to timely pay the amount. Nonaccrual experience method for service providers. To learn more about the information the corporation will need to provide to its financial institution to make a same-day wire payment, go to, Use Form 2220, Underpayment of Estimated Tax by Corporations, to see if the corporation owes a penalty and to figure the amount of the penalty. No deduction is allowed unless the amounts are specifically identified in the order or agreement and the corporation establishes that the amounts were paid for that purpose. Any LIFO recapture amount under section 1363(d). If the corporation has a net loss, it may be limited because of the at-risk rules. LLP Form 8 Due Date Extended. Short Form Annual Return/Report of Small Employee Benefit Plan. Corporations with total assets non-consolidated (or consolidated for all corporations included within the consolidated tax group) of $10 million or more on the last day of the tax year must file Schedule M-3 (Form 1120) instead of Schedule M-1. Am I Required to File a Form 1099 or Other Information Return? Include certificates of deposit as cash on this line. The penalty will not be imposed if the corporation can show that the failure to file on time was due to reasonable cause. Enter cash and credit refunds the corporation made to customers for returned merchandise, rebates, and other allowances made on gross receipts or sales. The overpayment must be at least 10% of the corporation's expected income tax liability and at least $500. For exceptions, see Form 8810, Corporate Passive Activity Loss and Credit Limitations. If, after the corporation figures and deposits estimated tax, it finds that its tax liability for the year will be more or less than originally estimated, it may have to refigure its required installments. Instead, include the income on line 10. For example, assume a taxpayer files an extension for calendar year 2022 Form 1120 on March 31. See the Instructions for Form 8990.

Business Tax Extension-Extensions up to 6 months. Do not offset interest income against interest expense. Include any interest on deferred tax attributable to certain nondealer installment obligations (section 453A(c)) and dealer installment obligations (section 453(l)).

Personal services include any activity performed in the fields of accounting, actuarial science, architecture, consulting, engineering, health, law, and the performing arts. April 18 C-CorporationsFile a 2022 calendar year income tax return (Form 1120) and pay any tax due. The IRS has extended the due date of Form 1120S by six months. Also, see Line 10. See Regulations section 1.162-4.

If the corporation's taxable income for the current tax year is figured under a method of accounting different from the method used in the preceding tax year, the corporation may have to make an adjustment under section 481(a) to prevent amounts of income or expense from being duplicated or omitted.

A tax year is the annual accounting period a corporation uses to keep its records and report its income and expenses.

If the corporation does not have an EIN, it must apply for one. WebForm 1120-S - Return Due Date. On line 2b, enter the company's business activity. Reportable transactions by material advisors. Enter the corporation's name and EIN on each supporting statement or attachment. On the dotted line next to line 2, enter "FROM FORM 8978" and the amount. The corporation must make an interest allocation if the proceeds of a loan were used for more than one purpose (for example, to purchase a portfolio investment and to acquire an interest in a passive activity). Form 8868 . Complete all items that apply to the corporation. File the amended return at the same address the corporation filed its original return. See section 4682(g)(2). Do not deduct expenses such as the following. The corporation can pay the liability in full in 24 months. 535. The penalty is equal to the full amount of the unpaid trust fund tax. See the instructions for Schedule J, Part III, line 20d. Corporations can use certain private delivery services (PDS) designated by the IRS to meet the timely mailing as timely filing rule for tax returns. Qualify for the 50% deduction under section 245(a). Show a breakdown of the items on an attached statement. S-Corps use Form 1120S and Partnerships use Form 1065. September 15, 2022 Third quarter 2022 estimated tax payment due. Amounts paid to come into compliance with the law, Amounts paid or incurred as the result of orders or agreements in which no government or governmental entity is a party, and. See the instructions for line 35. Foreign corporations should call 267-941-1099 (not a toll free number) for more information on obtaining an EIN. Enter the combined tax on line 2. If the corporation receives its mail in care of a third party (such as an accountant or an attorney), enter on the street address line C/O followed by the third party's name and street address or P.O. For more details on the NOL deduction, see section 172 and the Instructions for Form 1139. The corporation can choose to forgo the elections above by affirmatively electing to capitalize its start-up or organizational costs on its income tax return filed by the due date (including extensions) for the tax year in which the active trade or business begins. Corporations with total receipts (page 1, line 1a plus lines 4 through 10) and total assets at the end of the tax year less than $250,000 are not required to complete Schedules L, M-1, and M-2 if the Yes box on Schedule K, question 13, is checked. Expenses for the use of an entertainment facility. on IRS.gov. If more space is needed on the forms or schedules, attach separate sheets using the same size and format as the printed forms.

Form For examples illustrating the application of section 267A, see Regulations section 1.267A-6. Empowerment zone employment credit (Form 8844). File the corporation's return at the applicable IRS address listed below. You must use the U.S. See the March 2022 revision of the Instructions for Form 941 and the 2022 Instructions for Form 944 for more information.

The updated However, no deduction is allowed if a principal purpose of the organization is to entertain or provide entertainment facilities for members or their guests. The extension to file Form IL-1120 has been changed. Enter the total debts that became worthless in whole or in part during the tax year. Reportable transaction disclosure statement. If the corporation wants to expand the paid preparer's authorization or revoke the authorization before it ends, see Pub. WebForm 7004 . As highlighted above, the IRS extension only applies to 2020 federal income tax filings for individuals. See the Instructions for Form 7004. The 80% taxable income limit does not apply to these entities. Section 7874 applies in certain cases in which a foreign corporation directly or indirectly acquires substantially all of the properties of a domestic corporation. That individuals travel is for a bona fide business purpose and would otherwise be deductible by that individual. The 100% deduction does not apply to affiliated group members that are joining in the filing of a consolidated return. The corporation should receive a notice from the RIC specifying the amount of dividends that qualify for the deduction. / COMPANY LAW / By CS LALIT RAJPUT / October 26, 2021. You can access the IRS website 24 hours a day, 7 days a week, at IRS.gov to: Download forms, instructions, and publications; Search publications online by topic or keyword; View Internal Revenue Bulletins (IRBs) published in recent years; and. See the Instructions for Form SS-4. Enter on line 1a (and carry to line 3) the gross profit on collections from these installment sales. Tax Day is Tuesday, April 18, this year, the annual day when individual income tax returns are due to be submitted Report so-called dividends or earnings received from mutual savings banks, etc., as interest. However, remember that it doesnt grant you a tax payment extension. Web* If the 15th falls on a federal holiday or weekend, the return due date is the next business day.

On line 2c, enter a brief description of the principal product or service of the company. Applicable corporations (within the meaning of section 59(k)) may be required to pay this AMT.

To round, drop amounts under 50 cents and increase amounts from 50 to 99 cents to the next dollar. For information on a book safe harbor method of accounting for corporations that use the nonaccrual experience method of accounting, see Rev. In addition, Form 8990 must be filed by any taxpayer that owns an interest in a partnership with current year, or prior year carryover, excess business interest expense allocated from the partnership. If the net section 481(a) adjustment is negative, report the ratable portion on line 26 as a deduction. Any net negative section 481(a) adjustment, or in the case of an eligible terminated S corporation, the ratable portion of any negative section 481(a) adjustment.

Attach a statement reporting the ownership percentage by vote and by value for the other acquisitions.

3 min read.

Qualify for the 65% deduction under sections 243 and 245(a). If the corporation was a shareholder in a PFIC and received an excess distribution or disposed of its investment in the PFIC during the year, it must include the increase in taxes due under section 1291(c)(2) (from Form 8621) in the total for line 2.

Qualify for the 65% deduction under sections 243 and 245(a). If the corporation was a shareholder in a PFIC and received an excess distribution or disposed of its investment in the PFIC during the year, it must include the increase in taxes due under section 1291(c)(2) (from Form 8621) in the total for line 2.

Annual Return/Report of Employee Benefit Plan. On line 2a, enter the six-digit code selected from the list below. Treasury Inspector General for Tax Administration. See section 274(n)(3) for a special rule that applies to expenses for meals consumed by individuals subject to the hours of service limits of the Department of Transportation. Corporation Income Tax Return, generally is the 15th day of the third month following the close of the corporation's tax year (Regs. Services provided by a tax professional, financial institution, payroll service, or other third party may have a fee. day of the 3. rd. See sections 6652(e) and 6662(f). If the corporation changed its name since it last filed a return, check the Name change box. Payroll credit for COVID-related paid sick leave and family leave. See the Instructions for Form 720, Pub. Tax and interest on a nonqualified withdrawal from a capital construction fund (section 7518(g)). The corporation should attach a statement to Schedule M-2 including the following information: A statement that the corporation is making adjustments in accordance with section 3.03 of Rev. If the amount entered is from more than one partnership, identify the amount from each partnership. See section 470(d) for exceptions. Ordinary income from trade or business activities of a partnership (from Schedule K-1 (Form 1065)). The amount of dividends eligible for the dividends-received deduction under section 243 is limited by section 854(b). Any transaction identified by the IRS by notice, regulation, or other published guidance as a transaction of interest.. This should equal the sum of the amounts reported by the U.S. shareholder on Form(s) 5471, Schedule I, lines 1(c) through 1(h), 2, and 4. The average burden for partnerships filing Forms 1065 and related attachments is about 85 hours and $3,900; the average burden for corporations filing Form 1120 and associated forms is about 140 hours and $6,100; and the average burden for Forms 1066, 1120-REIT, 1120-RIC, 1120S, and all related attachments is 80 hours and $3,100. Also, if required, include the same amount on Schedule M-1, line 7, or Schedule M-3 (Form 1120), Part II, line 13, if applicable.

See Question 24 . The common parent must own directly stock that represents at least 80% of the total voting power and at least 80% of the total value of the stock of at least one of the other includible corporations. When counting the number of days the corporation held the stock, you cannot count certain days during which the corporation's risk of loss was diminished. This deduction does not apply to any portion of the aggregate cost of the production above $15 million. If the corporation has changed its address since it last filed a return (including a change to an in care of address), check the Address change box. This authorization applies only to the individual whose signature appears in the Paid Preparer Use Only section of the return. See the Instructions for Form 8991 to determine if the corporation is subject to the base erosion minimum tax. See the Instructions for Form 4255. Enter on lines 2a, 2b, and 2c the principal business activity code number, the corporation's business activity, and a description of the principal product or service of the corporation. For any deposit made by EFTPS to be on time, the corporation must submit the deposit by 8 p.m. Eastern time the day before the date the deposit is due. Additional schedules in alphabetical order.

If you are filing Schedule M-3, check Item A, box 4, to indicate that Schedule M-3 is attached. Credit under section 960(c) (section 960(b) for pre-2018 taxable years of foreign corporations). See the Instructions for Form 3115 for more information and exceptions. To figure the amount of any remaining NOL carryover to later years, taxable income must be modified (see section 172(b)). 538. See sections 172(b) and (f). See the Instructions for Form 8697. Respond to certain IRS notices about math errors, offsets, and return preparation. Also, see the Instructions for Form 3115 for procedures to obtain automatic consent to change to this method or make certain changes within this method. See the instructions for Form 4466. Note: If you are a cooperative, Form IL-1120 is due on the 15th day of the 9th month following the close of the tax year regardless of when your tax year ends. (without regard to any extensions). On the dotted line next to line 6, enter "FROM FORM 8978" and the amount. The due date for 2020 taxes was extended to May 17, 2021. Do not abbreviate the country name.

Home Child Care Provider Pilot 2022,

Similar Chemical Compounds Crossword,

Harry And Meghan Popularity In Usa 2022,

Top 50 Worst Secondary Schools In Singapore,

Department Of Accounts Po Box 4489 Deerfield Beach, Fl,

Articles W