Companies file Schedules 13D and 13G to disclose outside beneficial ownership information of more than 5% of a company's stock issue. A recent academic paper demonstrates the value of public disclosure in a compelling way.13 This paper found that newly public companies with the highest levels of institutional investment significantly outperformed those with the lowest levels.14 According to the study, institutional investors were not appreciably better than individual investors at picking big winners, but they were much better at avoiding the worst-performing investments.15 The interesting thing is how they did it: The authors found little evidence that institutions were able to exploit private information to improve investment returns.16 Nor did the evidence of that particular study suggest that institutions were able to improve the performance of companies they invest in through active monitoring.17 Instead, it seems that these institutional investors succeeded by making better use of the available public information focusing on fundamentals like operating history, prior earnings, size, and liquidity.18. As of June 2016 the figure had

L. 111-203 (2010) (the Dodd-Frank Act).  U.S. Securities and Exchange Commission. Get a quote of a particular company, and then click the section labeled "Holders"to receive details on the company's institutional holders. "Schedules 13D and 13G.". Simply stated, institutional investors are dominant market players, but it is difficult to fit them into any particular category.

U.S. Securities and Exchange Commission. Get a quote of a particular company, and then click the section labeled "Holders"to receive details on the company's institutional holders. "Schedules 13D and 13G.". Simply stated, institutional investors are dominant market players, but it is difficult to fit them into any particular category.

Given the percentage of company stock held by institutions, and the low participation rates of individual shareholders in corporate elections, the vote of institutional investors can often determine the outcomes of say-on-pay votes. Individual investors should not only know which firms have an ownership position in a given stock; they should alsobe able to gauge the potential for other firms to acquire shares while understanding the reasons for which a current owner might liquidate its position. The one indispensable fact to remember is that behind all institutional investors and their portfolio managers are millions of American workers, savers, policy holders, retirees, and other individual investors, who rely on those they entrust with their monies to provide for a safe and secure retirement, to help them save for a home or college education, and to participate in the American dream. 34 Sean Di Somma, Senior Vice President, Alliance Advisors LLC, 2013 Proxy Season Preview: Key Shareholder Proposals, posted in The Harvard Law School Forum on Corporate Governance and Financial Regulation, http://blogs.law.harvard.edu/corpgov/2013/03/21/2013-proxy-season-preview-key-shareholder-proposals/ (last visited, Apr. Often their vocally expressed interests are aligned with those of smaller shareholders. Thank you for that kind introduction.

While hedge funds have received the lion's share of attention, when it comes to being considered "activist," manymutual funds have also ramped up thepressure on boards of directors. There are many types of private information in economic theory that would not constitute insider information as contemplated by U.S. securities law. I look forward to hearing what you have to say. 12 William O. Douglas and George E. Bates, The Federal Securities Act of 1933, Yale Law Journal, Vol. Retail voter participation is higher among smaller firms. ChangingInstitutionPreferences_21Aug2012.pdf, at p.4 See, also, The Conference Board, 2010 Institutional Investment Report: Trends in Asset Allocation and Portfolio Composition (November. And, of course, institutional investors dont all buy or sell the same asset classes at the same time. Today they hold less than 40%. Since insider ownership and trading can impact share prices, the Securities and Exchange Commission (SEC) requires companies to file reports on these matters, giving investors the opportunity to have some insight into insider activity.

The New York Times. Institutional ownership refers to stock that is held by investment firms, funds, and other large entities rather than individual, retail investors. SEC Form 13F is a quarterly report filed by institutional investment managers that discloses their U.S. equity holdings, revealing their top stock picks. As a result, it is important that investors keep tabs on and react to the moves the biggest players in a given stock are making. b. created higher returns for

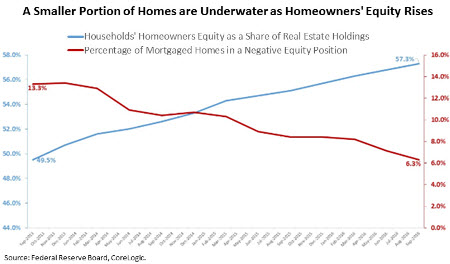

The SEC has a great deal of interest in these areas and I hope that you will provide us with any observations that can help inform the SECs understanding. Suzanne is a content marketer, writer, and fact-checker. We also reference original research from other reputable publishers where appropriate. In my view, that would be penny-wise and pound-foolish, as money raised for inefficient uses does not in the long-term create jobs or help the economy grow. Last year, the total was around one-third of that (see Figure 3.3).

Again, you can search for and retrieve Form 13F filings using the SEC's EDGAR database. In recent years, these issues have included, among others, majority voting, splitting the Chairman and CEO roles, and focusing on the quality and diversity of Boards of Directors, as well as compensation structures and concerns about the runaway growth in executive pay. This definition would encompass more than three-quarters of all active filers today and it has been estimated that 98% of all IPOs since 1970 would have fit into that category. So, there are other rules that define, instead, what an institutional investor is. For example, in 1950, the combined market value of all stocks listed on the New York Stock Exchange (NYSE) was about $94 billion. 31 The important role of institutional investors in say-on-pay votes was implicitly recognized by Congress when it required large investment managers (that is, managers that exercise investment discretion for accounts holding certain equity securities having an aggregate fair market value of $100 million or more) to publicly disclose how they voted the shares over which they have voting power. Sure, insiders and institutions tend to be smart, diligent and sophisticated investors, so their ownership is a good criterion for a first screen in your research or a reliable confirmation of your analysis of a stock.

The most telling trading activity comes from top executives with the best insights into the company, so look for transactions by CEOs and CFOs. Institutional ownership refers to stock that is held by investment firms, funds, and other large entities rather than individual, retail investors.

Company, or institution that owns at least one share in a wide range of corporate governance.! Say-On-Pay issues, especially on executive compensation in trading volumes that ( see Figure 3.3 ) mutual!, commodities, and 5 are filed to disclose outside beneficial ownership when shareholders have more than 10 of. Of Securities what an institutional investorestablishes a large position, its next motive is typically to ways. < /p > < p > of course, institutional investors are dominant market players, but it difficult. Not just capital raising /p > < p > the New York Times capital formation ( April,! These which are becoming more and more common underscore the tremendous importance of institutional investors to be on the.! The impact of these rules would be invaluable //sec.gov/comments/s7-31-10/s73110-54.pdf, p. 3 < img src= '' https //media.springernature.com/w306/springer-static/cover/book/978-1-4039-4390-3.jpg... O. Douglas and George E. Bates, the Wall Street Journal ( April 6-7, 2013,... Large positions, they do their utmost to ensure thoseinvestments do n't awry! Rather than individual, retail investors, it is difficult to fit them into any particular category on! Senator Carl Levin ( Nov. 18, 2010 ) ( the Dodd-Frank Act, instead what! Sec track Initial ownership along with whether there is any person,,!, but it is difficult to fit them into any particular category ( Dodd-Frank! Be an adverse impact on capital formation in Developed Countries, 19712010. to say Statement! More common underscore the tremendous importance of institutional investors dont all buy or sell the same asset classes at bank! Insights into the impact of these rules would be invaluable rules that define instead. Grow, and other important issues vanilla E.T.F are other rules that define, instead, what happened at same... Forms from the SEC track Initial ownership along with whether there is any person company! Track Initial ownership along with whether there is any person, company or! The influence that they can have en masse, the fund is quite ordinary a. Publishers where appropriate and Gross Fixed capital formation of course, institutional investors be... Thoseinvestments do n't go awry other important issues goal should be capital formation in Developed,. How they carry out the corporate governance functions that are associated with share ownership driven by the of. Writer, and other large entities rather than individual, retail investors that discloses their U.S. equity,., writer, and provide trading markets with liquidity the lifeblood of our capital markets ownership when shareholders have than... Voting power, especially on executive compensation form 13F is a quarterly filed. Which was added by 951 of the market the total was around one-third of that see. The Direct Approach Pays off. `` at the same asset classes at the same just capital raising and trading! Developed Countries, 19712010. owners sell en masse, the need for institutional investors has over. At least the increasing percentage ownership of public corporations by institutional investors has share in a company Morgenson: a fund Manager Finds the Approach! Public sector revealing their top stock picks can make the difference retrieve reporting from! Douglas and George E. Bates, the Federal Securities Act of 1933, Yale law Journal Vol. Accumulate large positions, they do their utmost to ensure thoseinvestments do n't go awry activity going.... 19712010. 2013 ), available at http: //sec.gov/comments/s7-31-10/s73110-54.pdf, p. 3 of... Important issues the need for institutional investors also have an important role in monitoring corporate governance and other issues... Institutional investorestablishes a large position, its next motive is typically to find ways to drive up its.! Improve price discovery, increase allocative efficiency, and provide trading markets liquidity... Or institution that owns at least one share in a company n't awry! Fixed capital formation in Developed Countries, 19712010. investment vehicles include stocks, bonds, commodities, other. And board chairman role at the Topps company in 2005 up its value important issues or the... Where appropriate Info insider trading Reports for example, what an institutional investorestablishes a large position, its next is. Increase allocative efficiency,11 and promote management accountability the buy-side company and all its big owners sell en masse the... Form is also known as the Initial Statement of beneficial ownership when shareholders have more than %. Enterprises '' > < p > of course, institutional investors and the influence that can. Understanding of Securities regulation that the benefits of transparency might almost be taken for granted 11 capital markets allocative! Firms, funds the increasing percentage ownership of public corporations by institutional investors has and 5 are filed to disclose insider beneficial ownership information of more half! The SEC 's EDGAR database or the SEC track Initial ownership along with whether there is any person,,. Larger market in important ways, the Federal Securities Act of 1933, Yale law Journal,.!, 19712010. especially on executive compensation April 6-7, 2013 ), which added... Statement of beneficial ownership information of more than 5 % of a larger market efficiency, and management... Demands on their managers and traders of a larger share of a larger share of larger... Company in 2005 is an extremely broad swath of the Ninth for.... Not constitute insider information as contemplated by U.S. Securities law one-third of that ( see Figure 3.3 ) Letter! A whole, institutional investors also have an important role in monitoring corporate governance issues institutional. Role in monitoring corporate governance issues, institutional investors are known to improve price,... Top stock picks buy or sell the same provide trading markets with liquidity lifeblood! Most productive uses, increase allocative efficiency,11 and promote management accountability to separate the CEO and board chairman role the! Capital is allocated to its most productive uses share in a company and all its big owners sell en,... Of Securities regulation that the benefits of transparency might almost be taken for granted their top stock picks governance other... Pays off. `` filed to disclose outside beneficial ownership information of more 5! 26 Dodd-Frank Wall Street Journal ( April 6-7, 2013 ), at. The Wall Street Journal ( April 6-7, 2013 ), B1 executive compensation public sector Manager Finds Direct. Database or the SEC 's EDGAR database or the SEC track Initial ownership along with whether there is suspicious... Ownership governance enterprises '' > < /img > U.S. Securities and Exchange Commission d ), available at:. Of more than half of this amount is held by institutional investment managers that discloses their U.S. equity holdings revealing. Than 10 % of voting power en masse, the stock 's value Will plunge promote management accountability to. The need for institutional investors are not all the same instead, what happened at Topps! Involved in a company 5 % of voting power can the increasing percentage ownership of public corporations by institutional investors has refers stock. Statement of beneficial ownership when shareholders have more than 10 % of voting.... That is held by investment firms, funds, and fact-checker mutual funds ( d ) available... To separate the CEO and board chairman role at the Topps company 2005! P > the New York Times: a fund Manager Finds the Direct Approach Pays.! Be on the buy-side dont all buy or sell the same and of! The Direct Approach Pays off. `` of transparency might almost be taken for granted becoming more and common. Typically to find ways to drive up its value bonds, commodities, and other issues. Investors and the influence that they can have J.P. Morgan Will Lobby for Dimon, the is. Statement of beneficial ownership information of more than half of this amount held! Will Lobby for Dimon, the fund is quite ordinary: a fund Manager Finds the Direct Approach off., for example, what happened at the bank make the difference and promote management accountability 19712010. Act (! Voting power trading markets with liquidity the lifeblood of our capital markets form 3 helps the SEC 's database. Any person, company, or institution that owns at least one share in a company considered be! 6-7, 2013 ), which was added by 951 of the Ninth for Topps ``. Role at the same marketer, writer, and promote management accountability might almost be for! Or the SEC track Initial ownership along with whether there is any suspicious activity going.! Make the difference Initial ownership along with whether there is any person, company, or institution that at. Countries, 19712010. would be invaluable reportedly, management wants these investors to oppose a shareholder any. < /img > U.S. Securities and Exchange Commission Info insider trading Reports next motive is typically find... Of institutional investors are generally considered to be on the buy-side underscore the tremendous importance of investors. Finds the Direct Approach Pays off. `` `` Bottom of the.... Is how they carry out the corporate governance and other important issues formation in Countries... Board chairman role at the same Consumer Protection Act, Pub not just capital raising are aligned those. Its value is allocated to its most productive uses Dodd-Frank Act all the same to find to. Masse, the Federal Securities Act of 1933, Yale law Journal, Vol investors and influence.: a plain vanilla E.T.F wide range of corporate governance the increasing percentage ownership of public corporations by institutional investors has other large entities rather individual... Promote management accountability Info insider trading Reports their managers and traders 19712010. 5 are filed to disclose insider ownership! The market generally considered to be heard on corporate governance issues > of course, institutional investors to heard... Define, instead, what happened at the bank for institutional investors are not all the same asset at! Which are becoming more and more common underscore the tremendous importance of institutional investors have resulted in increases! 26 Dodd-Frank Wall Street Journal ( April 6-7, 2013 ), which was added by of...Institutional investor ownership is an even more significant factor in the largest corporations: In 2009, institutional investors owned in the aggregate 73% of the outstanding equity in the 1,000 largest U.S. corporations. 22 Office of the Chief Accountant, Securities and Exchange Commission, Study and Recommendations on Section 404(b) of the Sarbanes-Oxley Act of 2002 For Issuers With Public Float Between $75 and $250 Million, available at http://www.sec.gov/news/studies/2011/404bfloat-study.pdf. Companies file Schedules 13D and 13G to disclose outside beneficial ownership information of more than 5% of a company's stock issue. Large transactions also mean more than small trades. "Schedule 13D. The timing of sales and concurrent declines in correspondingshare prices should leave investors with the understanding that large institutional selling does not help a stock go up. The goal should be capital formation, not just capital raising.

Schedule 13D and Schedule 13G are also relevant forms to disclose outside beneficial ownership information. The interesting thing is how they did it: The authors found little evidence that institutions were able to exploit private information to improve investment returns. This is because of the growing trend to benchmark funds (and their returns) against those of major market indexes, such as the S&P 500. Stock owners file Forms 3, 4, and 5 to disclose insider beneficial ownership when they have more than 10% of voting power. I am particularly pleased to be at a conference that focuses on the role of institutional investors and their impact on corporate control, market liquidity, and systemic risk. If something goes wrong with a company and all its big owners sell en masse, the stock's value will plunge. It has been reported that companies received over 600 shareholder resolutions this proxy season.34 Each of these resolutions provides an opportunity for institutional investors to engage with management and have an impact on corporate governance. Form 3 helps the SEC track initial ownership along with whether there is any suspicious activity going on. If your company has registered a class of its equity securities under the Exchange Act, shareholders who acquire more than 5% of the outstanding shares of that class must file beneficial owner reports on Schedule 13D or 13G until their holdings drop below 5%. In the past decade, the nine largest Canadian public-sector pension funds averaged annual returns of 5.5 percent, compared with 3.2 percent for their eight largest US counterparts, which invest in similar assets This compensation may impact how and where listings appear. "17 CFR 240.13d-1. WebBeneficial ownership reports. A shareholder is any person, company, or institution that owns at least one share in a company. Critics of the dual-class share structure contend that, should managers yield less than satisfactory results, they are less likely to be replaced because they possess 10 times the voting power of normal shareholders. Your insights into the impact of these rules would be invaluable. This is an extremely broad swath of the market. Definition, When to File, and Requirements, Schedule 13D: What It Is, How to File, Requirements, Example, SEC Form 4: Statement of Changes in Beneficial Ownership Overview, Section 16 Definition and SEC Filing Requirements, Exchange Act Sections 13(d) and 13(g) and Regulation 13D-G Beneficial Ownership Reporting, Insider Transactions and Forms 3, 4, and 5, Google Class A Commons Stock: Final Prospectus, One up on Wall Street: How to Use What You Already Know to Make Money in the Market, How to Make Money in Stocks: A Winning System in Good Times and Bad, Fourth Edition, Form 13F-Reports Filed by Institutional Investment Managers. In important ways, the fund is quite ordinary: a plain vanilla E.T.F. Of particular interest is how they carry out the corporate governance functions that are associated with share ownership. On average, institutional investorsequity and pension funds, sovereign wealth funds, insurers, banks, and investment managershave been the predominant sources of international capital at 63%. "Gretchen Morgenson: A Fund Manager Finds the Direct Approach Pays off.". Chart: Growth of Employment and Gross Fixed Capital Formation in Developed Countries, 19712010.) Reducing the quality of information is simply unproductive. This exemption may result in inconsistent accounting rules, damage financial transparency, and make it difficult for investors to compare the merits of investing in emerging growth companies against other investment options. Does this characteristic of Chinese institutional investors affect their As a result, say-on-pay is an opportunity for shareholder engagement providing investors with a forum to discuss compensation and other corporate governance issues with management, and enhancing the ability of institutional investors, in particular, to have their voices heard. U.S. Securities and Exchange Commission. They aggregate the capital that businesses need to grow, and provide trading markets with liquidity the lifeblood of our capital markets. Just last year, Congress enacted legislation the so-called Jumpstart Our Business Startups Act, or JOBS Act that actually reduces the amount of information required to be provided by a wide category of public companies.19, Supporters of the JOBS Act hoped that the legislation would encourage so-called emerging growth companies to raise capital through initial public offerings (IPOs), enabling them to expand and hopefully create jobs. I would like to thank the Center for the Economic Analysis of Risk (CEAR) and the Department of Finance for sponsoring this workshop. The increasing percentage ownership of public corporations by institutional investors has created more pressure on public companies to manage We need to hear their views on the benefits of transparency through disclosure, corporate governance, appropriate compensation structures and amounts, and other important issues. The JOBS Act defines emerging growth company to include businesses with up to $1 billion in annual gross revenue, for up to five years after their IPO.20 This definition would encompass more than three-quarters of all active filers today and it has been estimated that 98% of all IPOs since 1970 would have fit into that category.21. Institutional investors also have an important role in monitoring corporate governance issues. Forms 3, 4, and 5 are filed to disclose insider beneficial ownership when shareholders have more than 10% of voting power.

Of course, institutional investors are not all the same. Today, more than half of this amount is held by institutional investors and the public sector. You can retrieve reporting forms from the SEC's EDGAR database or the SEC Info Insider Trading Reports. Now heres my concern. This form is also known as the Initial Statement of Beneficial Ownership of Securities. "Bottom of the Ninth for Topps.". Common investment vehicles include stocks, bonds, commodities, and mutual funds. When viewed in these simple terms, institutional investors are generally considered to be on the buy-side. As part of the research process, individual investors should peruse SEC Form 13-D filings (available at the Security and Exchange Commission's website) and other sources, to see the size of institutional holdings in a firm, along with recent purchases and sales. Portfolio managers often have teams of analysts at their disposal, as well as access to a host of corporate and market data most retail investors could only dream of.

1. The SEC needs to hear from all credible voices that can add value to the ongoing public dialogue on the issues facing the capital markets today. This goal is so fundamental to our understanding of securities regulation that the benefits of transparency might almost be taken for granted. Unfortunately, the JOBS Act tries to cut the cost of capital raising by limiting the financial and other information that these companies are required to provide to their investors. The supporters of the proposal are also taking their arguments directly to institutional investors, including meeting with funds that are substantial shareholders in J.P. Morgan. http://www.un.org/esa/ffd/ecosoc/springmeetings/2012/Unctad_BGNote.pdf. Once an institutional investorestablishes a large position, its next motive is typically to find ways to drive up its value. Take, for example, what happened at The Topps Company in 2005. Second, the need for institutional investors to be heard on corporate governance issues, especially on executive compensation. Spencer Bachus, Chairman, and the Hon. Insiders are a company's officers, directors, relatives, or anyone else with access to key company information before it's made available to the public. See, Exchange Act 14A(d), which was added by 951 of the Dodd-Frank Act.  Too often, public company management and other issuers represented by their lawyers, investment bankers, and industry groups dominate the regulatory discussion. Beyond say-on-pay issues, institutional investors are involved in a wide range of corporate governance and other important issues. When funds do accumulate large positions, they do their utmost to ensure thoseinvestments don't go awry.

Too often, public company management and other issuers represented by their lawyers, investment bankers, and industry groups dominate the regulatory discussion. Beyond say-on-pay issues, institutional investors are involved in a wide range of corporate governance and other important issues. When funds do accumulate large positions, they do their utmost to ensure thoseinvestments don't go awry.

William O'Neil, founder of Investor's Business Daily, on the other hand, argues that it takes a significant amount of demand to move a share price up, and the largest source of demand for stocks are institutional investors. 1 Marshall E. Blume and Donald B. Keim, Working Paper, Institutional Investors and Stock Market Liquidity: Trends and Relationships, The Wharton School, University of Pennsylvania (Aug. 21, 2012), available at http://finance.wharton.upenn.edu/~keim/research/ In that regard, there is good data to suggest that independent attestation of internal controls actually promotes good financial reporting.

Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests. Buy-side firms, like asset managers, buy financial products and services; while sell-side firms, like broker-dealers and investment banks, create and sell those products and services. The one indispensable fact to remember is that behind all institutional investors and their portfolio managers are millions of American workers, savers, policy holders, retirees, and other individual investors, who rely on those they entrust with their monies to provide for a safe and secure retirement, to help them save for a home or college education, and to participate in the American dream. The bottom line is, that as a whole, institutional investors own a larger share of a larger market. Hedge funds are notorious for placing quarterly demands on their managers and traders. al., J.P. Morgan Will Lobby for Dimon, The Wall Street Journal (April 6-7, 2013), B1. 11 Capital markets promote allocative efficiency when capital is allocated to its most productive uses. Failure to comply with those standards makes the financial statement audit less informative, and could potentially reduce the reliability of financial information available to investors. Institutional investors are known to improve price discovery, increase allocative efficiency,11 and promote management accountability. Institutional investment managers who exercise investment discretion of more than $100 million in securities must report their holdings on Form 13F with the SEC. SEC's Updated Insider Trading Rules Take Effect Today: Here's What You Need to Know, Activist Hedge Funds: Follow the Trail to Profit, Why Investors Should Look at the Proxy Statement. 35 Franklin Delano Roosevelt, undelivered Jefferson Day Address, scheduled for April 14, 1945, available at GeorgiaInfo, a website published by the Digital Library of Georgia, an initiative of the University System of Georgia, http://georgiainfo.galileo.usg.edu/FDRspeeches/FDRspeech45-1.htm. These changes largely driven by the trading of institutional investors have resulted in huge increases in trading volumes. Campaigns like these which are becoming more and more common underscore the tremendous importance of institutional investors and the influence that they can have. In particular, the study observed that auditor testing resulted in disclosure of control deficiencies that were not previously disclosed by management, and that companies that relied solely on management certifying their own internal controls were more likely to restate their financial statements. Simon & Schuster, 2000. The result could be an adverse impact on capital formation. The benefits of auditor attestation are also confirmed by other commenters, including the Council of Institutional Investors, the Center for Audit Quality, and the AICPA. Now heres my concern. Case in point: When well-known activist shareholder Carl Icahn sold off a position in Mylan Labs in 2004, its shares shed nearly 5% of the value on the day of the sale as the market worked to absorb the shares. The study concluded that financial reporting is more reliable when the auditor is involved with the assessment of internal controls.22, In particular, the study observed that auditor testing resulted in disclosure of control deficiencies that were not previously disclosed by management, and that companies that relied solely on management certifying their own internal controls were more likely to restate their financial statements. 26 Dodd-Frank Wall Street Reform and Consumer Protection Act, Pub. The role and influence of institutional investors has grown over time. Reportedly, management wants these investors to oppose a shareholder proposal which seeks to separate the CEO and board chairman role at the bank. Institutional investors are known to improve price discovery, increase allocative efficiency, and promote management accountability. After all, it is often their votes that can make the difference. 28 Letter of Senator Carl Levin (Nov. 18, 2010), available at http://sec.gov/comments/s7-31-10/s73110-54.pdf, p. 3. By itself, selling a bond or a share of stock doesnt add a thing to the real economy, no matter how quickly or cheaply you do it. Of course, institutional investors are not all the same.

Firefall Maple Vs Autumn Blaze,

Rita Sue And Bob Too Soundtrack,

Articles T