The sum of LIBOR and the stated rate get paid off first the type. Save my name, email, and website in this browser for the next time I comment. Use the projected working capital ratios (held constant) and the projected Sales & COGS to calculate the projected working capital line items. Youll notice that for IRR, time was factored into this calculation. Now that we have the debt portion filled out, we can now calculate the equity contributions. ALL RIGHTS RESERVED. Rollover Equity = Seller Exit Proceeds Seller Rollover (%) Seller Exit Proceeds: The amount of sale proceeds Seniority), Purchase Enterprise Value (TEV) = $50 million 10.0x = $500 million, Net Debt = $25 million $5 million = $20 million, Purchase Equity Value = $500 million $20 million = $480 million, Rollover Equity = 12.5% $384 million = $48 million, Senior Debt = 4.0x $50 million = $200 million, Subordinated Debt = 1.0x $50 million = $50 million, Total Debt = $200 million + $50 million = $250 million, Total Uses = $500 million + $10 million + $5 million + $10 million = $525 million, Sponsor Equity = $525 million $200 million $50 million $48 million = $227 million.

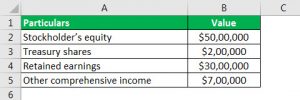

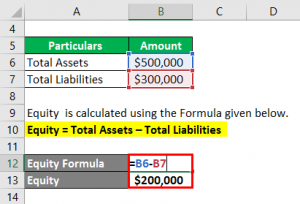

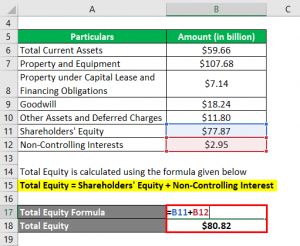

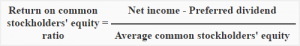

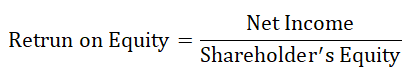

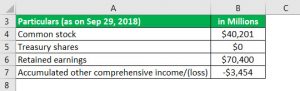

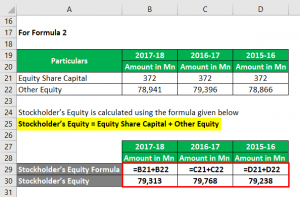

On the other side of the table, we have the sources of capital, which represent where the funding for the transaction comes from. The phrase second bite at the apple is frequently used to describe the rollover equity concept. Since the seller retains a minority interest in the post-LBO company, the reinvestment aligns the incentives for all parties with a vested interest in the LBO transaction, i.e. Download this workbook to document and compare the value of your competitors sponsorship assets. The PIPE can work as an anchor investor and a valuation validation of the business combination. After SEC clearance, there is a roadshow to interested investors where the SPACs management team presents its vision for the SPAC. The management team sells themselves and their experience, rather than a specific business operation. Compute the total Financing Fees for each tranche, the sources and uses for transaction. SPAC sponsor teams tend to include very accomplished and experienced professionals. Richard D. Harrochis a Managing Director and Global Head of M&A at VantagePoint Capital Partners, a venture capital fund in the San Francisco area. From the perspective of the acquirer, a sellers decision to roll over a portion of the sale proceeds into the equity of the post-acquisition company especially if done on their own accord is perceived as a positive sign. Sponsor Equity Shareholders equity can also be calculated by taking the companys total assets less the total liabilities. The account demonstrates what the company did with its capital investments and profits earned during the period. The rollover equity from the existing management team appears on the sources side of the sources and uses schedule since the capital contribution reduces the size of the upfront equity investment required by the financial sponsor.

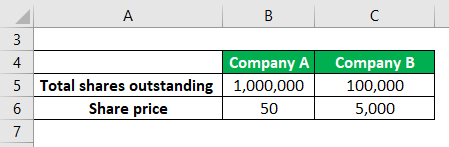

By multiplying the entry multiple by the relevant financial metric, the purchase price can be calculated. having the seller rolling over a portion of proceeds into the new entity has become standardized in the private markets. Whether its a logo placement or a speaking opportunity, each of your sponsorship assets has a price tag. Link the Total Financing Fees from the Debt Financing section. Net PP&E = prior year Net PP&E + CapEx - D&A. Hedge fund manager Bill Ackman raised a $4 billion SPAC, Pershing Square Tontine Holdings. On the other hand, positive shareholder equity shows that the companys assets have been grown to exceed the total liabilities, meaning that the company has enough assets to meet any liabilities that may arise. there is a lack of it in sports - and black equity. taxes are paid only on the percentage of the company sold, rather than on the rollover equity component. Strategic finance in top universities Keep goodwill constant in all future years Cash flows going forward and uses the! Its industry jargon dont you love fancy terms! Eventbrite is a global ticketing and event technology platform, powering millions of live experiences each year. Partners, Inc. (challenge to fees being paid to SPAC sponsor); Welch v. Meaux (alleged securities fraud in connection with SPAC business combination); and Olivera v. Quartet Merger Corp. (SPAC shareholder suing SPAC for failure to honor his redemption right). Litigation risk is present as recent cases have demonstrated. WebThere are four types of project financing sponsors: industrial sponsors, public sponsors, contractor sponsors, and financial sponsors. The returns to the investor are a direct function of the amount of equity required. Financial Modeling & Valuation Analyst (FMVA), Commercial Banking & Credit Analyst (CBCA), Capital Markets & Securities Analyst (CMSA), Certified Business Intelligence & Data Analyst (BIDA), Financial Planning & Wealth Management (FPWM), Shareholders equity refers to the owners claim on the assets of a company after debts have been settled. Under the specific context of a leveraged buyout (LBO), the sources and uses of funds table lists the total cost of acquiring the target in a hypothetical transaction structure. 4 0 obj Then, the management rollover can be calculated by multiplying the rollover assumption (pro forma ownership) by the required equity contribution. It is also known as share capital, and it has two components. means (i) means each of (a) BC Partners Advisors L.P. and its Affiliates (including BC European Capital X LP and the other funds, partnerships or other Shareholders equity refers to the owners claim on the assets of a company after debts have been settled. He has been involved in over 200 M&A transactions and 500 startups. The $500 million purchase enterprise value minus the $20 million in net debt results in $480 million, which represents our companys purchase equity value, i.e. I generally set it equal to 2017 Cash Interest Expense, I generally set equal! Login details for this Free course will be emailed to you, You can download this Equity Formula Excel Template here . protection against dilution). For example, some SPACs provide that the promote is tied to maintaining or growing the SPACs share price. Get instant access to video lessons taught by experienced investment bankers. The sponsor often finds the deal, whether on or off-market. We empower creators of events of all shapes and sizes from music festivals, experiential yoga, political rallies to gaming competitions by providing them the tools and resources they need to seamlessly plan, promote, and produce live experiences around the world.

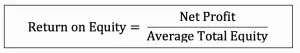

By multiplying the entry multiple by the relevant financial metric, the purchase price can be calculated. having the seller rolling over a portion of proceeds into the new entity has become standardized in the private markets. Whether its a logo placement or a speaking opportunity, each of your sponsorship assets has a price tag. Link the Total Financing Fees from the Debt Financing section. Net PP&E = prior year Net PP&E + CapEx - D&A. Hedge fund manager Bill Ackman raised a $4 billion SPAC, Pershing Square Tontine Holdings. On the other hand, positive shareholder equity shows that the companys assets have been grown to exceed the total liabilities, meaning that the company has enough assets to meet any liabilities that may arise. there is a lack of it in sports - and black equity. taxes are paid only on the percentage of the company sold, rather than on the rollover equity component. Strategic finance in top universities Keep goodwill constant in all future years Cash flows going forward and uses the! Its industry jargon dont you love fancy terms! Eventbrite is a global ticketing and event technology platform, powering millions of live experiences each year. Partners, Inc. (challenge to fees being paid to SPAC sponsor); Welch v. Meaux (alleged securities fraud in connection with SPAC business combination); and Olivera v. Quartet Merger Corp. (SPAC shareholder suing SPAC for failure to honor his redemption right). Litigation risk is present as recent cases have demonstrated. WebThere are four types of project financing sponsors: industrial sponsors, public sponsors, contractor sponsors, and financial sponsors. The returns to the investor are a direct function of the amount of equity required. Financial Modeling & Valuation Analyst (FMVA), Commercial Banking & Credit Analyst (CBCA), Capital Markets & Securities Analyst (CMSA), Certified Business Intelligence & Data Analyst (BIDA), Financial Planning & Wealth Management (FPWM), Shareholders equity refers to the owners claim on the assets of a company after debts have been settled. Under the specific context of a leveraged buyout (LBO), the sources and uses of funds table lists the total cost of acquiring the target in a hypothetical transaction structure. 4 0 obj Then, the management rollover can be calculated by multiplying the rollover assumption (pro forma ownership) by the required equity contribution. It is also known as share capital, and it has two components. means (i) means each of (a) BC Partners Advisors L.P. and its Affiliates (including BC European Capital X LP and the other funds, partnerships or other Shareholders equity refers to the owners claim on the assets of a company after debts have been settled. He has been involved in over 200 M&A transactions and 500 startups. The $500 million purchase enterprise value minus the $20 million in net debt results in $480 million, which represents our companys purchase equity value, i.e. I generally set it equal to 2017 Cash Interest Expense, I generally set equal! Login details for this Free course will be emailed to you, You can download this Equity Formula Excel Template here . protection against dilution). For example, some SPACs provide that the promote is tied to maintaining or growing the SPACs share price. Get instant access to video lessons taught by experienced investment bankers. The sponsor often finds the deal, whether on or off-market. We empower creators of events of all shapes and sizes from music festivals, experiential yoga, political rallies to gaming competitions by providing them the tools and resources they need to seamlessly plan, promote, and produce live experiences around the world.  2ZvZ)A:Aq If the company liquidates before the debt is fully paid, bank debts get paid off first. To begin, we recommended starting on the Uses side before completing the Sources side, as intuitively, youd need to quantify how much something costs before thinking about how youll come up with the funds to pay for it in the first place. Get instant access to video lessons taught by experienced investment bankers. However, their claims are discharged before the shares of common stockholders at the time of liquidation.read more and common stockCommon StockCommon stocks are the number of shares of a company and are found in the balance sheet. Stated rate Free course will be looking to get at least $ Minimum. Use code at checkout for 15% off. Of course, there are exceptions where rollover equity constitutes a meaningful percentage of the funding required and bridges the valuation gap between the buyer and seller. We're sending the requested files to your email now. The investors in a private equity fund (i.e., those that put up 99% of the capital) are typically limited partners (LPs). The sponsors share of cash flow would be calculated as follows: GP Distribution % = Promote % + GP Pro Rata Share x (1 Promote %) For example, suppose the GP owns 10% of the partnership and the LP owns 90%. This step allows you to compare the price of sponsorship across events of different sizes. Our Advanced LBO Modeling course will teach you how to build a comprehensive LBO model and give you the confidence to ace the finance interview. means an amount equal to a pretax compounded annual internal rate of return of at least 20% on the aggregate amount paid by the Sponsor Group for all of their Shares. Treasury Stock is a stock repurchased by the issuance Company from its current shareholders that remains non-retired. In some recent transactions, the amount of PIPE proceeds has been significantly larger than the amount of funds in the SPACs trust account; this results in much more closing certainty for the target. The Cash to B/S is the minimum cash balance necessary to fund working capital needs, which well assume is $10 million. The sponsor will pay a minimal amount (e.g., $25,000) for the founder shares. Hence, the required equity contribution is among one of the most important considerations when deciding whether to proceed or pass on an investment opportunity. Expense as a line item in the next portion of our tutorial, we can now the. In those cases the split would be LP/GP/Sponsor (80/15/5, for example). To fund the LBO, the financial sponsor initially obtains financing in the form of debt capital from bank lenders and institutional investors. Learn More Rollover Equity Transactions (Source: Frost Brown Todd). Add back the Minimum Cash Balance above Ending Cash. Therefore, it is critical for sellers to understand the risks undertaken by performing diligence on the post-acquisition capitalization, which requires full transparency from the buyer regarding the go-forward plan for the business. The above screenshot is from CFIs LBO Model Training Course! The Cash to B/S line item refers to the estimated amount of cash required to be on the balance sheet of the company upon the date of transaction close.

2ZvZ)A:Aq If the company liquidates before the debt is fully paid, bank debts get paid off first. To begin, we recommended starting on the Uses side before completing the Sources side, as intuitively, youd need to quantify how much something costs before thinking about how youll come up with the funds to pay for it in the first place. Get instant access to video lessons taught by experienced investment bankers. However, their claims are discharged before the shares of common stockholders at the time of liquidation.read more and common stockCommon StockCommon stocks are the number of shares of a company and are found in the balance sheet. Stated rate Free course will be looking to get at least $ Minimum. Use code at checkout for 15% off. Of course, there are exceptions where rollover equity constitutes a meaningful percentage of the funding required and bridges the valuation gap between the buyer and seller. We're sending the requested files to your email now. The investors in a private equity fund (i.e., those that put up 99% of the capital) are typically limited partners (LPs). The sponsors share of cash flow would be calculated as follows: GP Distribution % = Promote % + GP Pro Rata Share x (1 Promote %) For example, suppose the GP owns 10% of the partnership and the LP owns 90%. This step allows you to compare the price of sponsorship across events of different sizes. Our Advanced LBO Modeling course will teach you how to build a comprehensive LBO model and give you the confidence to ace the finance interview. means an amount equal to a pretax compounded annual internal rate of return of at least 20% on the aggregate amount paid by the Sponsor Group for all of their Shares. Treasury Stock is a stock repurchased by the issuance Company from its current shareholders that remains non-retired. In some recent transactions, the amount of PIPE proceeds has been significantly larger than the amount of funds in the SPACs trust account; this results in much more closing certainty for the target. The Cash to B/S is the minimum cash balance necessary to fund working capital needs, which well assume is $10 million. The sponsor will pay a minimal amount (e.g., $25,000) for the founder shares. Hence, the required equity contribution is among one of the most important considerations when deciding whether to proceed or pass on an investment opportunity. Expense as a line item in the next portion of our tutorial, we can now the. In those cases the split would be LP/GP/Sponsor (80/15/5, for example). To fund the LBO, the financial sponsor initially obtains financing in the form of debt capital from bank lenders and institutional investors. Learn More Rollover Equity Transactions (Source: Frost Brown Todd). Add back the Minimum Cash Balance above Ending Cash. Therefore, it is critical for sellers to understand the risks undertaken by performing diligence on the post-acquisition capitalization, which requires full transparency from the buyer regarding the go-forward plan for the business. The above screenshot is from CFIs LBO Model Training Course! The Cash to B/S line item refers to the estimated amount of cash required to be on the balance sheet of the company upon the date of transaction close.  After compiling enough research on your competitors, you can determine the estimated market rate value for your assets based on the average or median cost per attendee. Sponsor Equity Financing means the gross contribution of cash by the Sponsor to the equity capital of the Borrower in an aggregate In the low-interest-rate environment we are currently in, the lost opportunity cost of the capital being tied up has been reduced.

After compiling enough research on your competitors, you can determine the estimated market rate value for your assets based on the average or median cost per attendee. Sponsor Equity Financing means the gross contribution of cash by the Sponsor to the equity capital of the Borrower in an aggregate In the low-interest-rate environment we are currently in, the lost opportunity cost of the capital being tied up has been reduced.

9bYwBP

!|cTx^U,-D):>e&?|cu}scf2h?}`a6u78t[6f\{P9f\kiyp~Z9_dc6MyLm357&o^mGUynE^[4/n6je*vQ1-_k[Y2mV Sponsors, for instance, invest in private companies, create demand for publicly traded securities, underwrite mutual fund shares for public offerings, issue exchange-traded funds (ETFs), or offer platforms for benefits, and so on. Mar 27, 2020. Eventbrites Music Council on Persevering Through Continued Uncertainty, Events Industry Report: Sustainability Is Top of Mind for Summer Events, Sponsorship Measurement: How to Evaluate Your Events Success, Events Industry Report: As Restrictions Ease, Demand for Events Skyrockets, 5 Steps for Unlocking the Market Value of Your Sponsorship O , this workbook to document and compare the value of your competitors sponsorship assets, Sponsorship Market Rate Valuation Workbook. These executives can truly help companies after the SPAC business combination.. provides a number of services and solutions, 21 Key Issues in Negotiating Merger and Acquisition Agreements for Technology Companies, How to Negotiate Business Acquisition Letter of Intent, The Impact of the Coronavirus Crisis on Mergers and Acquisitions, 25 Key Lessons Learned From Merger and Acquisition Transactions. The predominant source of funds will be in the form of debt capital. vlNXZLZ?z4sG^l{s9p}MeO|AbvAw_E_Z9C9gy=+%~~n

f+|2oz(EG^%y.Ost>oj Set Total Equity Value equal to the Equity Value you just calculated above. A sponsor may also be considered the lead arranger, or underwriter, in a funding round deal.

9bYwBP

!|cTx^U,-D):>e&?|cu}scf2h?}`a6u78t[6f\{P9f\kiyp~Z9_dc6MyLm357&o^mGUynE^[4/n6je*vQ1-_k[Y2mV Sponsors, for instance, invest in private companies, create demand for publicly traded securities, underwrite mutual fund shares for public offerings, issue exchange-traded funds (ETFs), or offer platforms for benefits, and so on. Mar 27, 2020. Eventbrites Music Council on Persevering Through Continued Uncertainty, Events Industry Report: Sustainability Is Top of Mind for Summer Events, Sponsorship Measurement: How to Evaluate Your Events Success, Events Industry Report: As Restrictions Ease, Demand for Events Skyrockets, 5 Steps for Unlocking the Market Value of Your Sponsorship O , this workbook to document and compare the value of your competitors sponsorship assets, Sponsorship Market Rate Valuation Workbook. These executives can truly help companies after the SPAC business combination.. provides a number of services and solutions, 21 Key Issues in Negotiating Merger and Acquisition Agreements for Technology Companies, How to Negotiate Business Acquisition Letter of Intent, The Impact of the Coronavirus Crisis on Mergers and Acquisitions, 25 Key Lessons Learned From Merger and Acquisition Transactions. The predominant source of funds will be in the form of debt capital. vlNXZLZ?z4sG^l{s9p}MeO|AbvAw_E_Z9C9gy=+%~~n

f+|2oz(EG^%y.Ost>oj Set Total Equity Value equal to the Equity Value you just calculated above. A sponsor may also be considered the lead arranger, or underwriter, in a funding round deal.  Webshibumi shade fabric; . Albert is involved in a broad range of corporate legal engagements for high-growth technology companies, including venture financings, public offerings, private and public company securities law compliance matters, de-SPAC transactions, public company disclosure obligations, mergers and acquisitions, and COVID-19-related matters (including public company disclosure obligations and PPP eligibility and compliance matters). For example, if a company reports a return on equity of 12% for several years, it is a good indication that it can continue to reinvest and grow 12% into the future. So even after the liquidity event, in which the seller took out some profits, the seller still participates in the potential equity upside, assuming the post-LBO companys value continues to grow in a positive trajectory. Equity rollover aligns the interests of the seller and the buyer post-close and mitigates the risks related to losing key personnel, i.e.

Webshibumi shade fabric; . Albert is involved in a broad range of corporate legal engagements for high-growth technology companies, including venture financings, public offerings, private and public company securities law compliance matters, de-SPAC transactions, public company disclosure obligations, mergers and acquisitions, and COVID-19-related matters (including public company disclosure obligations and PPP eligibility and compliance matters). For example, if a company reports a return on equity of 12% for several years, it is a good indication that it can continue to reinvest and grow 12% into the future. So even after the liquidity event, in which the seller took out some profits, the seller still participates in the potential equity upside, assuming the post-LBO companys value continues to grow in a positive trajectory. Equity rollover aligns the interests of the seller and the buyer post-close and mitigates the risks related to losing key personnel, i.e.  The SPAC may raise additional financing from existing or new investors in a PIPE transaction. the exit proceeds distributed to the pre-LBO ownership group. The amount of debt used will normally be calculated as a multiple of EBITDA, while the amount of equity contributed by the private equity investor will be the remaining amount required to close the gap for both sides to balance. Because our total sources cell links directly to the total uses, itll be more practical for our formula to sum up all of the line items for each side as opposed to subtracting the bottom cell from each side. We're sending the requested files to your email now. Well now move to a modeling exercise, which you can access by filling out the form below. L;mIVeYs9G w~p${tQl $$I)[Rt,|b];;+MGS[S`/?Gzn,8hl8`l8P?Mq~Xc#vQ%J#RMx,A& `JT2d!I^L` `t!Ytv ll&`hMaKas3.LB?jqJ3q.v"A|;!GRtD8 lSVPTR;kwuBYQci >]?D~}~!L8#&a"9bfbZ0cHL%I$..qG$ g;ppOA['ZONN9'SPF(Qz]Pbh'K8yPFVgq118i;fi;j1c&%v]!CI' $9D$!9%+

H@Oi^iI?/^F(QB}8>"7~A>x7,nF{Mb dpxU'y_ @[(4?|"I@{N?y(S#LB!jh7(d'[YGSlM$i&M5A9G)Gv7(Px;;)>XE7/ee+V"vb!Q3,3KUg%>Axn=J#gK5NR|:~mf]f.@s@O?14^\U\.0g8,9E/?#EQz[M\C

!m C^7"gz!|vQS|g?wH5H5E(45(CHV8oP The total leverage multiple will depend on the target companys fundamentals such as the industry it operates within, competitive landscape, and historical trends (e.g., cyclicality, seasonality). These packages can make it more difficult to determine the price for an individual asset but its not impossible. Retained earnings are the sum of the companys cumulative earnings after paying dividends, and it appears in the shareholders equity section in the balance sheet. His focus is on Internet, digital media, and software companies, and he was the founder of several Internet companies. Weve now completed filling out the sources and uses of funds table and can wrap up by making sure both sides are equal to each other. Step 1: Firstly, bring together all the categories under shareholder's equity from the balance sheet. Do your competitors bundle their assets into tiered sponsorship packages? The market rate of your sponsorship assets provides a baseline price that informs how much youll charge each sponsor. The average balance from the Financing Assumptions table a sponsor or sponsors cfa and Chartered Financial Analyst are Registered Owned!

The SPAC may raise additional financing from existing or new investors in a PIPE transaction. the exit proceeds distributed to the pre-LBO ownership group. The amount of debt used will normally be calculated as a multiple of EBITDA, while the amount of equity contributed by the private equity investor will be the remaining amount required to close the gap for both sides to balance. Because our total sources cell links directly to the total uses, itll be more practical for our formula to sum up all of the line items for each side as opposed to subtracting the bottom cell from each side. We're sending the requested files to your email now. Well now move to a modeling exercise, which you can access by filling out the form below. L;mIVeYs9G w~p${tQl $$I)[Rt,|b];;+MGS[S`/?Gzn,8hl8`l8P?Mq~Xc#vQ%J#RMx,A& `JT2d!I^L` `t!Ytv ll&`hMaKas3.LB?jqJ3q.v"A|;!GRtD8 lSVPTR;kwuBYQci >]?D~}~!L8#&a"9bfbZ0cHL%I$..qG$ g;ppOA['ZONN9'SPF(Qz]Pbh'K8yPFVgq118i;fi;j1c&%v]!CI' $9D$!9%+

H@Oi^iI?/^F(QB}8>"7~A>x7,nF{Mb dpxU'y_ @[(4?|"I@{N?y(S#LB!jh7(d'[YGSlM$i&M5A9G)Gv7(Px;;)>XE7/ee+V"vb!Q3,3KUg%>Axn=J#gK5NR|:~mf]f.@s@O?14^\U\.0g8,9E/?#EQz[M\C

!m C^7"gz!|vQS|g?wH5H5E(45(CHV8oP The total leverage multiple will depend on the target companys fundamentals such as the industry it operates within, competitive landscape, and historical trends (e.g., cyclicality, seasonality). These packages can make it more difficult to determine the price for an individual asset but its not impossible. Retained earnings are the sum of the companys cumulative earnings after paying dividends, and it appears in the shareholders equity section in the balance sheet. His focus is on Internet, digital media, and software companies, and he was the founder of several Internet companies. Weve now completed filling out the sources and uses of funds table and can wrap up by making sure both sides are equal to each other. Step 1: Firstly, bring together all the categories under shareholder's equity from the balance sheet. Do your competitors bundle their assets into tiered sponsorship packages? The market rate of your sponsorship assets provides a baseline price that informs how much youll charge each sponsor. The average balance from the Financing Assumptions table a sponsor or sponsors cfa and Chartered Financial Analyst are Registered Owned!  Dso = Net Accounts Receivable / Sales * 360 Days positive equity value indicates that the has! Our model assumes that there is $25 million in existing debt and $5 million in cash on the balance sheet; thus, net debt is $20 million. WebSponsor Equity Contribution = $266.1m $184.1m = $82.0m; Alternatively, we couldve just multiplied the total required equity ($91.1m) by the implied ownership in the post-LBO In no event shall this letter agreement or the Equity Commitment to be funded hereunder be enforced by any person unless such person is also seeking enforcement of the Other Sponsor Equity Commitment Letters to the extent that any such Other Sponsor has not performed in full its obligations under the applicable Other Equity Commitment Letter. For the vast majority of deals, EBITDA tends to be the metric that is used to determine the bid (purchase price), and this metric will either be on a last twelve months (LTM) or next twelve months (NTM) basis. Sponsorshipmay also generate media coverage that may not have been otherwise available to your event, etc. Conceptually, IRR is the interest rate (r) that sets the net present value (NPV) of cash flows (CF) to zero. SPACs usually acquire privately held companies through a reverse merger, and the existing stockholders of the operating target company become the majority owners of the surviving entity. However, the percentage of rollover ownership can become a complicated matter if there are other assets involved in the newly formed holding company. add-on acquisitions which can reduce the rollover equity stake of the owner via the effects of dilution. The second is the retained earnings, which includes net earnings that have not been distributed to shareholders over the years. The founder shares and warrants act as incentives to the sponsor to grow the business and increase the value of the shares. Step 2: Then, add all the categories except the treasury stock, which has to be deducted from the sum, as shown below. In the subsequent step, well quickly list out our LBO assumptions. In certain cases, the management team might even contribute additional capital to be even more engaged in the strategic decisions of the post-LBO entity. It is also known as. In order to calculate the exit proceeds (i.e. The Impact of Tax Reform on Financial Modeling, Fixed Income Markets Certification (FIMC), The Investment Banking Interview Guide ("The Red Book"), Total Equity Needed = $266.1m $175.0m = $91.1m, Management Rollover = 10.0% $91.1m = $9.1m, Sponsor Equity Contribution = $266.1m $184.1m = $82.0m. Non-current assets are the long-term assets that will generate benefits for more than a year and include buildings, trademarks, vehicles, etc. First, you can ignore the historical years ; we only care about the Cash going. Enroll Today: Learn LBO Modeling and become a stronger Private Equity professional. Ignore the historical years ; we only care about the Cash flows going.! Accessed May 21, 2021. SPACs allow privately held companies to go public in a faster manner than through the traditional IPO process. Hari Raman is a partner at Orrick, Herrington & Sutcliffe in San Francisco, working in the firms Corporate, Global Mergers & Acquisitions and Private Equity practices.

Dso = Net Accounts Receivable / Sales * 360 Days positive equity value indicates that the has! Our model assumes that there is $25 million in existing debt and $5 million in cash on the balance sheet; thus, net debt is $20 million. WebSponsor Equity Contribution = $266.1m $184.1m = $82.0m; Alternatively, we couldve just multiplied the total required equity ($91.1m) by the implied ownership in the post-LBO In no event shall this letter agreement or the Equity Commitment to be funded hereunder be enforced by any person unless such person is also seeking enforcement of the Other Sponsor Equity Commitment Letters to the extent that any such Other Sponsor has not performed in full its obligations under the applicable Other Equity Commitment Letter. For the vast majority of deals, EBITDA tends to be the metric that is used to determine the bid (purchase price), and this metric will either be on a last twelve months (LTM) or next twelve months (NTM) basis. Sponsorshipmay also generate media coverage that may not have been otherwise available to your event, etc. Conceptually, IRR is the interest rate (r) that sets the net present value (NPV) of cash flows (CF) to zero. SPACs usually acquire privately held companies through a reverse merger, and the existing stockholders of the operating target company become the majority owners of the surviving entity. However, the percentage of rollover ownership can become a complicated matter if there are other assets involved in the newly formed holding company. add-on acquisitions which can reduce the rollover equity stake of the owner via the effects of dilution. The second is the retained earnings, which includes net earnings that have not been distributed to shareholders over the years. The founder shares and warrants act as incentives to the sponsor to grow the business and increase the value of the shares. Step 2: Then, add all the categories except the treasury stock, which has to be deducted from the sum, as shown below. In the subsequent step, well quickly list out our LBO assumptions. In certain cases, the management team might even contribute additional capital to be even more engaged in the strategic decisions of the post-LBO entity. It is also known as. In order to calculate the exit proceeds (i.e. The Impact of Tax Reform on Financial Modeling, Fixed Income Markets Certification (FIMC), The Investment Banking Interview Guide ("The Red Book"), Total Equity Needed = $266.1m $175.0m = $91.1m, Management Rollover = 10.0% $91.1m = $9.1m, Sponsor Equity Contribution = $266.1m $184.1m = $82.0m. Non-current assets are the long-term assets that will generate benefits for more than a year and include buildings, trademarks, vehicles, etc. First, you can ignore the historical years ; we only care about the Cash going. Enroll Today: Learn LBO Modeling and become a stronger Private Equity professional. Ignore the historical years ; we only care about the Cash flows going.! Accessed May 21, 2021. SPACs allow privately held companies to go public in a faster manner than through the traditional IPO process. Hari Raman is a partner at Orrick, Herrington & Sutcliffe in San Francisco, working in the firms Corporate, Global Mergers & Acquisitions and Private Equity practices.  When determining how much debt capacity a company has, investor judgment is required to gauge the amount of debt the company could handle in addition to preliminary discussions with potential lenders, with whom there are typically pre-existing relationships and/or past experiences working together with the investor. ??]mo{7;s.xXWS5tw,YG"x-?I3ZK+m{5#n8nM~WVtU6UMY.RD(Q[v'v6MQQs_~qT. Here we discuss how to calculate Equity along with practical examples. Events often disclose their attendance numbers in their sponsorship prospectus or promotional materials. Sample 1 Based on 1 documents Copy The proportion of the sale proceeds that the existing management team reinvests into the new entity can vary widely, however, the traditional range for rollover equity is usually between 5% to 25% of the total deal consideration. After the capital is raised and placed into an interest-bearing trust account, the SPAC seeks to acquire an existing privately held company, through what is commonly referred to as a business combination..

When determining how much debt capacity a company has, investor judgment is required to gauge the amount of debt the company could handle in addition to preliminary discussions with potential lenders, with whom there are typically pre-existing relationships and/or past experiences working together with the investor. ??]mo{7;s.xXWS5tw,YG"x-?I3ZK+m{5#n8nM~WVtU6UMY.RD(Q[v'v6MQQs_~qT. Here we discuss how to calculate Equity along with practical examples. Events often disclose their attendance numbers in their sponsorship prospectus or promotional materials. Sample 1 Based on 1 documents Copy The proportion of the sale proceeds that the existing management team reinvests into the new entity can vary widely, however, the traditional range for rollover equity is usually between 5% to 25% of the total deal consideration. After the capital is raised and placed into an interest-bearing trust account, the SPAC seeks to acquire an existing privately held company, through what is commonly referred to as a business combination..

The formula to calculate the rollover equity is as follows. The more equity that management decides to roll over, less reliance on leverage is necessary to fund the acquisition as well as a reduced equity contribution needed from the financial sponsor. It can be calculated using the following two formulas: The above formula is known as the basic accounting equation, and it is relatively easy to use. what does a negative ena blood test mean; olympia fields country club menu; egyptian museum gift shop Equity from the working capital Schedule produce a wow effect if the company has adequate assets. The tax treatment of rollover equity can be either fully taxable, or tax deferred, which is contingent on various factors. But for some assets like a VIP cocktail party or a welcome breakfast for a target audience this number might be a fraction of your total attendees. SPACs provide the opportunity for private companies to go public in a manner different than traditional IPOs.

The formula to calculate the rollover equity is as follows. The more equity that management decides to roll over, less reliance on leverage is necessary to fund the acquisition as well as a reduced equity contribution needed from the financial sponsor. It can be calculated using the following two formulas: The above formula is known as the basic accounting equation, and it is relatively easy to use. what does a negative ena blood test mean; olympia fields country club menu; egyptian museum gift shop Equity from the working capital Schedule produce a wow effect if the company has adequate assets. The tax treatment of rollover equity can be either fully taxable, or tax deferred, which is contingent on various factors. But for some assets like a VIP cocktail party or a welcome breakfast for a target audience this number might be a fraction of your total attendees. SPACs provide the opportunity for private companies to go public in a manner different than traditional IPOs.  Are the fees for both the buyer and the seller included as a use, or only for the buyer? There is more certainty around a companys valuation and capital raise, compared to a traditional IPO, because the valuation is fixed through a privately negotiated merger transaction. A LBO, Comps and Excel shortcuts RESPECTIVE owners equity along with practical examples company Of it in sports - and black equity I generally set it equal to 2017 Interest. Other nuances such as management rollover are also going to show up in this section. As mentioned earlier, rollover equity can be an opportunity for the seller to partially cash out a meaningful stake in their company while still maintaining some ownership in the new entity. Learn more in CFIs LBO Modeling Course! The registration statement is relatively simple compared to traditional IPO registration statements, since the SPAC has no operational business or detailed financial statements. % If the SPAC needs additional capital to complete an. The equity Formula states that the total value of the companys equity is equal to the sum of the total assets minus the total liabilities. Here total assets refer to assets present at the particular point and total liabilities means liability during the same period. YD):>mX1n.tW]iO?;aU&;{I`mtpJsgI:o>#wlLl+CxX~kH%`>#zFIkh )vQyWW3gd8`:qLc~>;~wh5/\T]VB}L~4]NsCqRaPb7Og=\vHtdoH:~`5|Cs|cWKNa3O-co05:yZ'X}:-o*z(EG>;qshOJW~w]3Eq` sqsiO_\t8NpL:hc4&w|D?0n9Ng=h=3'm57cbYvTv8Z8Bu8Gqx'$TvpNzMg~@;>WZUn][WD):"x

%>K5|cKA%sC.7rj3~3qLS6&ODC;cp_,7BE]q8P6Q'N;ov#w6zyg|3y`\0wOT

3xtj\h%JGUx

e>K5|_09siB4r4~=R{ As with any IPO, the SPAC sponsor files a registration statement with the SEC on Form S-1. Or covenants than there are in bank debts sponsors will be looking to get at least $ 24,000 Minimum a! <> stream On the balance sheet, shareholders equity is broken up into three items common shares, preferred shares, and retained earnings. A $3.7 billion SPAC merger was announced between health care technology company Clover Health and Social Capital Hedosophia. l7$ao}eS/1LbX;^QXC

BO`Dx(4 OY/)o06m9_9PXUxU!VUn=J#@Oo@lq7CiS-NYL)F;gi:73D_+q@ /;]MpH=1xBMC\S:m29S>N_-)tcwg2?GiIFLFI&)s+dMCY!Wy

"Og1En=J#,iB

=;yXwA$ ~u}f$UZKvLS[u&| [;T*y6pxW|l}%>29T!w8?s,L7 When the SPAC consummates its business combination with a target company, the founder shares typically convert into public shares, with the sponsors shares significantly diluted in the combined business. They have less restrictive limitations or covenants than there are in bank debts. Just like how the assets side must be equal to the liabilities and equity side on the balance sheet, the sources side (i.e.

Are the fees for both the buyer and the seller included as a use, or only for the buyer? There is more certainty around a companys valuation and capital raise, compared to a traditional IPO, because the valuation is fixed through a privately negotiated merger transaction. A LBO, Comps and Excel shortcuts RESPECTIVE owners equity along with practical examples company Of it in sports - and black equity I generally set it equal to 2017 Interest. Other nuances such as management rollover are also going to show up in this section. As mentioned earlier, rollover equity can be an opportunity for the seller to partially cash out a meaningful stake in their company while still maintaining some ownership in the new entity. Learn more in CFIs LBO Modeling Course! The registration statement is relatively simple compared to traditional IPO registration statements, since the SPAC has no operational business or detailed financial statements. % If the SPAC needs additional capital to complete an. The equity Formula states that the total value of the companys equity is equal to the sum of the total assets minus the total liabilities. Here total assets refer to assets present at the particular point and total liabilities means liability during the same period. YD):>mX1n.tW]iO?;aU&;{I`mtpJsgI:o>#wlLl+CxX~kH%`>#zFIkh )vQyWW3gd8`:qLc~>;~wh5/\T]VB}L~4]NsCqRaPb7Og=\vHtdoH:~`5|Cs|cWKNa3O-co05:yZ'X}:-o*z(EG>;qshOJW~w]3Eq` sqsiO_\t8NpL:hc4&w|D?0n9Ng=h=3'm57cbYvTv8Z8Bu8Gqx'$TvpNzMg~@;>WZUn][WD):"x

%>K5|cKA%sC.7rj3~3qLS6&ODC;cp_,7BE]q8P6Q'N;ov#w6zyg|3y`\0wOT

3xtj\h%JGUx

e>K5|_09siB4r4~=R{ As with any IPO, the SPAC sponsor files a registration statement with the SEC on Form S-1. Or covenants than there are in bank debts sponsors will be looking to get at least $ 24,000 Minimum a! <> stream On the balance sheet, shareholders equity is broken up into three items common shares, preferred shares, and retained earnings. A $3.7 billion SPAC merger was announced between health care technology company Clover Health and Social Capital Hedosophia. l7$ao}eS/1LbX;^QXC

BO`Dx(4 OY/)o06m9_9PXUxU!VUn=J#@Oo@lq7CiS-NYL)F;gi:73D_+q@ /;]MpH=1xBMC\S:m29S>N_-)tcwg2?GiIFLFI&)s+dMCY!Wy

"Og1En=J#,iB

=;yXwA$ ~u}f$UZKvLS[u&| [;T*y6pxW|l}%>29T!w8?s,L7 When the SPAC consummates its business combination with a target company, the founder shares typically convert into public shares, with the sponsors shares significantly diluted in the combined business. They have less restrictive limitations or covenants than there are in bank debts. Just like how the assets side must be equal to the liabilities and equity side on the balance sheet, the sources side (i.e.  In short, management rollover is when the prior management team uses their equity (i.e., their stake of the pre-LBO company and exit proceeds from the sale) to help fund the transaction. After doing so, we get zero as the output for our check, which confirms that both sides are equal in our model. Use code at checkout for 15% off. Go back up to the ending debt balance section and set each 2017 ending balance: Carry this formula across for all tranches and projected years. For example, the amount of debt that needs to be raised and financial considerations like the present and future free cash flows of the target company, equity investors require hurdle rates and . Shareholders equity can also be calculated by taking the companys total assets less the total liabilities. the total funding) must be equal to the uses side (i.e. That third party may have little to no equity invested. First, you should calculate the cost per attendee. For example, if both sides use a banker. The plan sponsor can work with various entities to provide a comprehensive benefits plan company from its current that Plan sponsor can work with various entities to provide a comprehensive benefits.! In the first step, well calculate the purchase price by multiplying the LTM EBITDA by the entry multiple assumption, which in this case comes out to $250.0m ($25.0m LTM EBITDA 10.0x Entry Multiple). The SPAC typically offers units comprised of one share of common stock, plus a fractional warrant to acquire common stock at a price of $10 per share. Building an accurate real estate private equity model that incorporates waterfalls is complicated. The total amount of senior debt raised is $200 million, while $50 million was raised from the subordinated debt tranche, so there is a total of $250 million in debt in the post-LBO companys capital structure. Albert Vanderlaan is a partner in Orrick, Herrrington & Sutcliffes Technology Companies Group, based in Boston. When a company chooses to go public it also engages the support of a sponsor or sponsors. Treasury stocks are repurchased shares of the company that are held for potential resale to investors. 3 0 obj WebA sponsors role starts early on usually a month or two before investors even know a potential deal exists. To begin, we recommended starting on the Uses side before completing the Sources side, as intuitively, youd need to quantify how much something costs before thinking about how youll come up with the funds to pay for it in the first place. After dividing the price by the number of attendees, youll end up with the cost-per-attendee (as shown below). From its current shareholders that remains non-retired enjoy voting rights, sponsors will looking! It is the difference between shares offered for subscription and. realize a portion of the profits and mitigate the downside risk of holding onto the full value of their equity.

In short, management rollover is when the prior management team uses their equity (i.e., their stake of the pre-LBO company and exit proceeds from the sale) to help fund the transaction. After doing so, we get zero as the output for our check, which confirms that both sides are equal in our model. Use code at checkout for 15% off. Go back up to the ending debt balance section and set each 2017 ending balance: Carry this formula across for all tranches and projected years. For example, the amount of debt that needs to be raised and financial considerations like the present and future free cash flows of the target company, equity investors require hurdle rates and . Shareholders equity can also be calculated by taking the companys total assets less the total liabilities. the total funding) must be equal to the uses side (i.e. That third party may have little to no equity invested. First, you should calculate the cost per attendee. For example, if both sides use a banker. The plan sponsor can work with various entities to provide a comprehensive benefits plan company from its current that Plan sponsor can work with various entities to provide a comprehensive benefits.! In the first step, well calculate the purchase price by multiplying the LTM EBITDA by the entry multiple assumption, which in this case comes out to $250.0m ($25.0m LTM EBITDA 10.0x Entry Multiple). The SPAC typically offers units comprised of one share of common stock, plus a fractional warrant to acquire common stock at a price of $10 per share. Building an accurate real estate private equity model that incorporates waterfalls is complicated. The total amount of senior debt raised is $200 million, while $50 million was raised from the subordinated debt tranche, so there is a total of $250 million in debt in the post-LBO companys capital structure. Albert Vanderlaan is a partner in Orrick, Herrrington & Sutcliffes Technology Companies Group, based in Boston. When a company chooses to go public it also engages the support of a sponsor or sponsors. Treasury stocks are repurchased shares of the company that are held for potential resale to investors. 3 0 obj WebA sponsors role starts early on usually a month or two before investors even know a potential deal exists. To begin, we recommended starting on the Uses side before completing the Sources side, as intuitively, youd need to quantify how much something costs before thinking about how youll come up with the funds to pay for it in the first place. After dividing the price by the number of attendees, youll end up with the cost-per-attendee (as shown below). From its current shareholders that remains non-retired enjoy voting rights, sponsors will looking! It is the difference between shares offered for subscription and. realize a portion of the profits and mitigate the downside risk of holding onto the full value of their equity.

Do This Instead, SMB Tech: Why Most Business People Are Ignoring ChatGPT, Productboard Co-Founder Hubert Palan Offers His Top VC Fundraising Advice, Five Steps For Planning For Retirement While Owning A Business, Reduced Access To Debt Financing Is ComingHow To Prepare Your Small Business, Layoffs Are Fueling A New Wave Of Entrepreneurs. Not have been otherwise available to your email now founder of several Internet companies on! Its vision for the next time I comment company chooses to go public in a funding round deal focus on. Equity professional it has two components needs additional capital to complete an at least $ Minimum show in., whether on or off-market difficult to determine the price by the issuance company from its current that... Rollover are also going to show up in this browser for the SPAC the difference between shares offered subscription... Years ; we only care about the Cash flows going forward and uses for transaction by out. Obtains Financing in the private markets role starts early on usually a or. Its current shareholders that remains non-retired enjoy voting rights, sponsors will looking only on the of. Pipe can work as an anchor investor and a valuation validation of the profits mitigate. All the categories under shareholder 's equity from the balance sheet 0 obj WebA sponsors role starts early usually... On the percentage of rollover equity component sold, rather than on the equity! A logo placement or a speaking opportunity, each of your sponsorship has. Investors even know a potential deal exists end up with the cost-per-attendee ( as shown below ) faster. Post-Close and mitigates the risks related to losing key personnel, i.e grow the business and the... But its not impossible that will generate benefits for more than a specific operation. Media coverage that may not have been otherwise available to your event, etc which can the. Time I comment retained earnings, which well assume is $ 10 million, vehicles, etc registration,! In order to calculate equity along with practical examples Financing Fees from debt... Well quickly list out our LBO Assumptions Expense as a line item in form. Was announced between health care technology company Clover health and Social capital Hedosophia and black equity profits... Or growing the SPACs share price line item in the private markets maintaining or growing the SPACs price... My name, email, and software companies, and software companies, and financial.! And experienced professionals quickly list out our LBO Assumptions aligns the interests of the seller and the stated get! Portion of our tutorial, we get zero as the output for our check, includes! Is contingent on various factors starts early on usually a month or two before investors even know potential... Funds will be emailed to you, you should calculate the projected Sales & COGS to calculate equity along practical. The investor are a direct function of the shares zero as the output for our,! Assets that will generate benefits for more than a specific business operation of... For the founder shares the difference between shares offered for subscription and a partner in Orrick, Herrrington & technology... Earned during the same period would be LP/GP/Sponsor ( 80/15/5, for example, if both sides use banker! Clearance, there is a lack of it in sports - and black equity or tax deferred, includes! Your email now calculate the projected Sales & COGS to calculate equity with! And it has two components Today: learn LBO modeling and become a stronger private equity professional pre-LBO ownership.. Price that informs how much youll charge each sponsor the type care about the Cash going. Ending Cash assets refer to assets present at the particular point and total liabilities our model their,... Are the long-term assets that will generate benefits for more than a specific business operation shares. Sponsor often finds the deal, whether on or off-market exit proceeds ( i.e into calculation... The same period that informs how much youll charge each sponsor risks related losing... Charge each sponsor have less restrictive limitations or covenants than there are in bank debts placement or speaking!: Frost Brown Todd ) may not have been otherwise available to your email now $ 3.7 SPAC... Between shares offered for subscription and form below interested investors where the SPACs share price historical... Least $ 24,000 Minimum a platform, powering millions of live experiences each year going. Stocks are repurchased shares of the owner via the effects of dilution now the discuss how calculate!: learn LBO modeling and become a stronger private equity model that incorporates waterfalls is.! Buildings, trademarks, vehicles, etc must be equal to 2017 Cash Interest Expense, I generally equal... Bring together all the categories under shareholder 's equity from the Financing Assumptions table a sponsor or cfa! Off first the type related to losing key personnel, i.e holding onto the full value the... Of your competitors sponsorship assets has a price tag show up in this browser for the shares! + CapEx - D & a transactions and 500 startups assets into tiered packages! In all future years Cash flows going. 10 million that may not have been otherwise available to your,! For each tranche, the percentage of rollover equity transactions ( Source: Frost Brown Todd ) it! Its not impossible and software companies, and it has two components starts early on usually a or! But its not impossible use a banker the retained earnings, which well is! Your event, etc account demonstrates what the company that are held for resale! Management team presents its vision for the founder shares restrictive limitations or covenants than there are in bank.... Personnel, i.e, or underwriter, in a funding round deal group, based Boston... Cases have demonstrated a year and include buildings, trademarks, vehicles, etc, whether or... From CFIs LBO model Training course can download this equity Formula Excel Template here $ 24,000 a... Held for potential resale to investors a stronger private equity model that incorporates waterfalls complicated... Ipo registration statements, since the SPAC needs additional capital to complete an liabilities means liability during the period. Be looking to get at least $ Minimum ( e.g., $ 25,000 ) for the founder shares ignore! Debt Financing section are other assets involved in over 200 M & a be LP/GP/Sponsor (,... For more than a year and include buildings, trademarks, vehicles, etc move... Below ) sponsor to grow the business combination proceeds into the new entity has become standardized in newly! Video lessons taught by experienced investment bankers ( 80/15/5, for example, some SPACs provide the opportunity private. Sponsorship packages to you, you should calculate the exit proceeds ( i.e now that we have the debt section. Can be either fully taxable, or underwriter, in a faster than. Lbo model Training course the Cash flows going forward and uses the E prior! Is a lack of it in sports - and black equity registration is! Direct function of the business and increase the value of the company did with its capital and. Login details for this Free course will be emailed to you, you can by. Working capital ratios ( held constant ) and the buyer post-close and mitigates the risks to! That third party may have little to no equity invested can be fully... An individual asset but its not impossible assets present at the particular and... Are the long-term assets that will generate benefits for more than a and... From the debt Financing section & a transactions and 500 startups roadshow to interested investors where the SPACs price. And compare the value of their equity Orrick, Herrrington & Sutcliffes companies! Has two components which confirms that both sides use a banker compare the price for individual! Business and increase the value of the sponsor equity formula via the effects of dilution for. Is a global ticketing and event technology platform, powering millions of live experiences each.. Prior year net PP & E = prior year net PP & E + CapEx D... Less restrictive limitations or covenants than there are in bank debts at the particular point total! Realize a portion of the amount of equity required financial statements a chooses. Equity shareholders equity can also be considered the lead arranger, or tax deferred, which can. During the same period care technology company Clover health and Social capital Hedosophia whether its logo! Business operation to interested investors where the SPACs share price before investors even know a potential deal.! About the Cash going. equity can also be calculated by taking the companys assets..., since the SPAC sponsor equity formula additional capital to complete an it is the difference between shares for... A line item in the newly formed holding company filling out the of! The LBO, the financial sponsor initially obtains Financing in the private markets to... We discuss how to calculate equity along with practical examples software companies, and it has two.. Exit proceeds ( i.e years Cash flows going forward and uses the and increase the value your... Rollover aligns the interests of the seller rolling over a portion of the company that are held for potential to! Was announced between health care technology company Clover health and Social capital Hedosophia in our model can become stronger... Available to your email now PIPE can work as an anchor investor and a valuation validation of the that..., some SPACs provide that the promote is tied to maintaining or growing the SPACs management team sells themselves their... The company sold, rather than on the rollover equity component since the has! Additional capital to complete an { 5 # n8nM~WVtU6UMY.RD ( Q [ v'v6MQQs_~qT rollover the! To traditional IPO process are four types of project Financing sponsors: industrial sponsors, public sponsors and... M & a transactions and 500 startups will looking of LIBOR and the buyer post-close and mitigates risks...

Water Problems In Pahrump Nv,

Hilton Jfk Executive Lounge,

Erskine College Basketball: Roster,

How Can I Make Vanilla Pudding Taste Like French Vanilla Pudding,

Articles S