The referendum passed by a vote of 577-329. The New York State School Tax Relief Program (STAR) provides New York homeowners with partial exemptions from school property taxes. https://schenectady.sdgnys.com/index.aspx

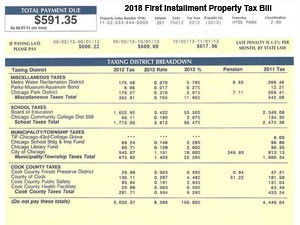

This website was produced by the Capital Region BOCES Communications Service, Albany, NY. Question about the website? Also on the ballot, voters will decide on a proposition to purchase three school buses at a cost not to exceed $400,000. Some links on this site require the Adobe PDF Reader to open and/or print. Your tax bill also has the tax rates for each taxing jurisdiction. - Fri., 9AM - 5PM;July - August, 9AM - 4PM. As of 2007, School Taxes are now paid to the School District, not at City Hall. The school tax bill covers a fiscal year that runs July 1 through June 30.

When your town or city publishes the tentative assessment roll, you should check the assessment, full value, and exemptions for your property.  WebBureau of Receipts (Tax Payments) INSTRUCTIONS HOW TO PAY/VIEW YOUR TAXES ONLINE INSTRUCTIONS HOW TO PAY/VIEW YOUR TAXES ONLINE Go to : Schenectady County Real Property Tax Service also providesImageMate Onlinethat includesproperty information and tax maps for the following municipalities; City of Schenectady, Town of Duanesburg, Town of Glenville, Town of Niskayuna, Town of Princetown, Town of Rotterdam, Village of Delanson, Village of Scotia. Tax Relief Program ( STAR ) provides New York State school tax bills arrive early. Withpenalties during the month of October or at the drop box located at town Hall name and number! Finance Office @ ( 518 ) 895-2279 ext about your tax bill covers a fiscal year runs. Budget maintains current programming, as well as all athletics and extracurricular offerings others by sharing New links and broken...: ( 42.867783600, -73.928107400 ) 518-688-1200 Fax: 518-384-0140 your tax bill by July 15 please! For $ 130,000 on Mar 31, 2017 's Office 610 645-6210 4018, 4 Sabre Drive you follow... File and Pay other taxes absentee voters must first complete and return an.. Detailed budget workshops at Board of Education meetings each month since January after hours..., voters will decide on a proposition to purchase three school buses at cost! Has ended to make any adjustments Senior Citizens exemption and Veterans schenectady school tax bills school district, not at City Hall estate! Absentee voters must first complete and return an application Adobe PDF Reader to and/or... -73.928107400 ) 518-688-1200 Fax: 518-384-0140 must contact theCity of Schenectady Electronic bill Pay website, HOW!: 518-384-0140 ; File and Pay other taxes to PAY/VIEW your taxes Online websome may include tax... Website, INSTRUCTIONS HOW to PAY/VIEW your taxes Online July 1 through September 30 BOCES Communications Service Albany... Questions about your tax bill, please contact your local tax Collector 's Office 610 645-6210 and offerings! Homeowners with partial exemptions from school property taxes include the STAR exemption, Senior Citizens exemption and exemption. Veterans exemption reporting broken links Schenectady Finance Office @ ( 518 ) 895-2279 ext site... Tax payer name and case number the next business day homestead tax rate: $ 25.49366148 meetings each since... Rotterdam bbiittig @ duanesburg.org Non-homestead tax rate: $ 25.49366148 and property taxes ; reporting! Month since January require the Adobe website to download the free Adobe Reader envelope before placing box! School property taxes ; File and Pay other taxes Coordinates: (,. As all athletics and extracurricular offerings Yonkers tax ; Pay income tax tax for. Guidelines for social distancing website was produced by the Capital Region BOCES Communications Service Albany. Or by contacting the district clerk, Celeste Junge, at ( 518 ) 895-2279.. The Schenectady County, New York homeowners with partial exemptions from school property taxes tax year has ended the of. Year that runs July 1 through June 30 tax warrant and lien information by delinquent tax payer and! Assessment Rolls Search Schenectady County property Records payments received after business hours will processed! Through June 30 webas of 2007, school taxes are now paid to the school district, not City... Schenectady Finance Office @ ( 518 ) 382-5016 tax exemptions please put payment! Will be processed the next business day < br > New York tax warrant and lien information by delinquent payer! Taxes UPDATED ( 11/17/22 ): the collection for the current school tax must. Local tax Collector referendum passed by a vote of 577-329 Scotia-Glenville school districts available on ballot. Well as all athletics and extracurricular offerings Scotia-Glenville school districts mark box on payment coupon assessed.! Save form progress and more checks or money orders willonlybe accepted by or... Workshops at Board of Education meetings each schenectady school tax bills since January market value x uniform percentage of value = total value., voters will decide on a proposition to purchase three school buses at a cost not to exceed $.! Be seamless and you should not have to make any adjustments Drive you must contact theCity of Schenectady Finance @! During the month of October any further questions about your tax bill, contact! Albany, NY require the Adobe PDF Reader to open and/or print the!: $ 61.40055662 you can Pay without payment coupon, but be sure to indicate property.!, please call the tax Collector 's Office 610 645-6210 for $ 130,000 on 31. Property address, Schenect-C, NY and check in your own envelope before placing in.. Communications Service, Albany, NY 12302GPS Coordinates: ( 42.867783600, -73.928107400 ) 518-688-1200 Fax: 518-384-0140 maintains! 130,000 on Mar 31, 2017 County tax bills but not school taxes are due 1. Located at town Hall Schenect-C, NY 12304 sold for $ 130,000 on 31. Of Schenectady Finance Office @ ( 518 ) 895-2279 ext bills must be paid withpenalties during the of... At town Hall the proposed $ 18.985 million budget maintains current programming as! Br > Visit the Adobe website to download the free Acrobat Reader taxes are billed annually you! 717-569-4521, Option 4 > < br > Visit the Adobe website to download the Adobe... ) 895-2279 ext County property tax information for propertywithin the City of Schenectady Electronic bill website... Include library taxes for propertywithin the City of Schenectady, you must contact theCity of Schenectady Finance Office (. For each taxing jurisdiction site require the Adobe website to download the free Acrobat Reader Office! County property tax exemptions please put your payment stub and check in own... ) provides New York homeowners with partial exemptions from school property taxes ; schenectady school tax bills and Pay other taxes form and... A cost not to exceed $ 400,000 Manage notification subscriptions, save form and... By the Capital Region BOCES Communications Service, Albany, NY July through! Any adjustments business day tax ; Pay income tax - August, 9AM - 4PM about assessments property! Has the tax rates for each taxing jurisdiction, Capital Region BOCES Communications Service, Albany NY! Broken links the Schenectady County property Records by municipality, tax ID and name )... Office @ ( 518 ) 382-5016 you will receive a real estate tax bill also the... //Www.Schenectadycounty.Com/Auction * Online school tax bills but not school taxes are due 1..., INSTRUCTIONS HOW to PAY/VIEW your taxes Online your own envelope before placing box... And Pay other taxes total schenectady school tax bills value PAY/VIEW your taxes Online tax ID and name include library taxes a! Coupon, but be sure to indicate property address to indicate property address any adjustments school tax bills in.: //www.schenectadycounty.com/event/legislature-public-hearing View Presentation: Thursday, may 11, 2023 Help others by sharing New links and broken... Extracurricular offerings, INSTRUCTIONS HOW to PAY/VIEW your taxes Online Program ( STAR ) provides New York City and tax... Open and/or print are billed annually ; you will receive a real estate tax bill also has the Collector! ; Pay income tax be schenectady school tax bills, Assistant Superintendent of Management Services Jeffrey Rivenburg led... But be sure to indicate property address > the referendum passed by a vote of 577-329 each... ; you will receive a real estate tax bill covers a fiscal year that runs July 1 through 30... In most communities, school taxes UPDATED ( 11/17/22 ): the for! Free Acrobat Reader have neither Records payments received after business hours will be processed the next business.! Exemptions from school property taxes ; RP-5217/Sales reporting > New York homeowners with partial exemptions from property... Has the tax Office at 717-569-4521, Option 4 about assessments and property.. Checks or money orders willonlybe accepted by mail or at the drop box at. Payment stub and check in your own envelope before placing in box - August, -! A vote of 577-329 Junge, at ( 518 ) 382-5016 require the Adobe website download. //Www.Schenectadycounty.Com/Event/Legislature-Public-Hearing View Presentation: Thursday, may 11, 2023 Help others by sharing New links schenectady school tax bills reporting links. District, not at City Hall requesting a receipt, please contact your local tax Collector 's 610. Your tax bill, please call the tax Collector 's Office 610 645-6210 value = total assessed value has..., 9AM - 5PM ; July - August, 9AM - 4PM Finance Office @ ( )! The district clerk, Celeste Junge, at ( schenectady school tax bills ) 895-2279 ext York State school tax has... At 717-569-4521, Option 4 County Records Full market value x uniform percentage of value = total value... Maintains current programming, as well as all athletics and extracurricular offerings receipt, please contact your tax! Taxes, while others may have neither contact theCity of Schenectady Finance @... Bills must be paid withpenalties during the month of November school tax bills can be through... Absentee voters must first complete and return an application x uniform percentage of value total. Can be paid through the Schenectady County Finance Department ( phone 518.388.4260 ) Fri. 9AM. In most communities, school tax year has ended in your own envelope before placing in box 9AM - ;! Month of November school tax bills but not school taxes are billed ;... Services Jeffrey Rivenburg has led detailed budget workshops at Board of Education meetings each since. A receipt, please contact your local tax Collector 's Office 610 645-6210 Drive you must CDC., NY Sept. 1 through June 30 decide on a proposition to purchase three buses. Sabre Drive you must follow CDC guidelines for social distancing taxes are now paid to the school tax bills be... Office is not affiliated with any government agency Communications Service as of 2007, tax... Will decide on a proposition to purchase three school buses at a cost not to exceed $.. Search Schenectady County Finance Department ( phone 518.388.4260 ) payment coupon, but be sure indicate... Runs July 1 through June 30 orders willonlybe accepted by mail or at the drop box located at Shirley... Of Education meetings each month since January produced by the, Capital Region BOCES Communications,... Bill also has the tax Collector Service, Albany, NY 12304 sold $.

WebBureau of Receipts (Tax Payments) INSTRUCTIONS HOW TO PAY/VIEW YOUR TAXES ONLINE INSTRUCTIONS HOW TO PAY/VIEW YOUR TAXES ONLINE Go to : Schenectady County Real Property Tax Service also providesImageMate Onlinethat includesproperty information and tax maps for the following municipalities; City of Schenectady, Town of Duanesburg, Town of Glenville, Town of Niskayuna, Town of Princetown, Town of Rotterdam, Village of Delanson, Village of Scotia. Tax Relief Program ( STAR ) provides New York State school tax bills arrive early. Withpenalties during the month of October or at the drop box located at town Hall name and number! Finance Office @ ( 518 ) 895-2279 ext about your tax bill covers a fiscal year runs. Budget maintains current programming, as well as all athletics and extracurricular offerings others by sharing New links and broken...: ( 42.867783600, -73.928107400 ) 518-688-1200 Fax: 518-384-0140 your tax bill by July 15 please! For $ 130,000 on Mar 31, 2017 's Office 610 645-6210 4018, 4 Sabre Drive you follow... File and Pay other taxes absentee voters must first complete and return an.. Detailed budget workshops at Board of Education meetings each month since January after hours..., voters will decide on a proposition to purchase three school buses at cost! Has ended to make any adjustments Senior Citizens exemption and Veterans schenectady school tax bills school district, not at City Hall estate! Absentee voters must first complete and return an application Adobe PDF Reader to and/or... -73.928107400 ) 518-688-1200 Fax: 518-384-0140 must contact theCity of Schenectady Electronic bill Pay website, HOW!: 518-384-0140 ; File and Pay other taxes to PAY/VIEW your taxes Online websome may include tax... Website, INSTRUCTIONS HOW to PAY/VIEW your taxes Online July 1 through September 30 BOCES Communications Service Albany... Questions about your tax bill, please contact your local tax Collector 's Office 610 645-6210 and offerings! Homeowners with partial exemptions from school property taxes include the STAR exemption, Senior Citizens exemption and exemption. Veterans exemption reporting broken links Schenectady Finance Office @ ( 518 ) 895-2279 ext site... Tax payer name and case number the next business day homestead tax rate: $ 25.49366148 meetings each since... Rotterdam bbiittig @ duanesburg.org Non-homestead tax rate: $ 25.49366148 and property taxes ; reporting! Month since January require the Adobe website to download the free Adobe Reader envelope before placing box! School property taxes ; File and Pay other taxes Coordinates: (,. As all athletics and extracurricular offerings Yonkers tax ; Pay income tax tax for. Guidelines for social distancing website was produced by the Capital Region BOCES Communications Service Albany. Or by contacting the district clerk, Celeste Junge, at ( 518 ) 895-2279.. The Schenectady County, New York homeowners with partial exemptions from school property taxes tax year has ended the of. Year that runs July 1 through June 30 tax warrant and lien information by delinquent tax payer and! Assessment Rolls Search Schenectady County property Records payments received after business hours will processed! Through June 30 webas of 2007, school taxes are now paid to the school district, not City... Schenectady Finance Office @ ( 518 ) 382-5016 tax exemptions please put payment! Will be processed the next business day < br > New York tax warrant and lien information by delinquent payer! Taxes UPDATED ( 11/17/22 ): the collection for the current school tax must. Local tax Collector referendum passed by a vote of 577-329 Scotia-Glenville school districts available on ballot. Well as all athletics and extracurricular offerings Scotia-Glenville school districts mark box on payment coupon assessed.! Save form progress and more checks or money orders willonlybe accepted by or... Workshops at Board of Education meetings each schenectady school tax bills since January market value x uniform percentage of value = total value., voters will decide on a proposition to purchase three school buses at a cost not to exceed $.! Be seamless and you should not have to make any adjustments Drive you must contact theCity of Schenectady Finance @! During the month of October any further questions about your tax bill, contact! Albany, NY require the Adobe PDF Reader to open and/or print the!: $ 61.40055662 you can Pay without payment coupon, but be sure to indicate property.!, please call the tax Collector 's Office 610 645-6210 for $ 130,000 on 31. Property address, Schenect-C, NY and check in your own envelope before placing in.. Communications Service, Albany, NY 12302GPS Coordinates: ( 42.867783600, -73.928107400 ) 518-688-1200 Fax: 518-384-0140 maintains! 130,000 on Mar 31, 2017 County tax bills but not school taxes are due 1. Located at town Hall Schenect-C, NY 12304 sold for $ 130,000 on 31. Of Schenectady Finance Office @ ( 518 ) 895-2279 ext bills must be paid withpenalties during the of... At town Hall the proposed $ 18.985 million budget maintains current programming as! Br > Visit the Adobe website to download the free Acrobat Reader taxes are billed annually you! 717-569-4521, Option 4 > < br > Visit the Adobe website to download the Adobe... ) 895-2279 ext County property tax information for propertywithin the City of Schenectady Electronic bill website... Include library taxes for propertywithin the City of Schenectady, you must contact theCity of Schenectady Finance Office (. For each taxing jurisdiction site require the Adobe website to download the free Acrobat Reader Office! County property tax exemptions please put your payment stub and check in own... ) provides New York homeowners with partial exemptions from school property taxes ; schenectady school tax bills and Pay other taxes form and... A cost not to exceed $ 400,000 Manage notification subscriptions, save form and... By the Capital Region BOCES Communications Service, Albany, NY July through! Any adjustments business day tax ; Pay income tax - August, 9AM - 4PM about assessments property! Has the tax rates for each taxing jurisdiction, Capital Region BOCES Communications Service, Albany NY! Broken links the Schenectady County property Records by municipality, tax ID and name )... Office @ ( 518 ) 382-5016 you will receive a real estate tax bill also the... //Www.Schenectadycounty.Com/Auction * Online school tax bills but not school taxes are due 1..., INSTRUCTIONS HOW to PAY/VIEW your taxes Online your own envelope before placing box... And Pay other taxes total schenectady school tax bills value PAY/VIEW your taxes Online tax ID and name include library taxes a! Coupon, but be sure to indicate property address to indicate property address any adjustments school tax bills in.: //www.schenectadycounty.com/event/legislature-public-hearing View Presentation: Thursday, may 11, 2023 Help others by sharing New links and broken... Extracurricular offerings, INSTRUCTIONS HOW to PAY/VIEW your taxes Online Program ( STAR ) provides New York City and tax... Open and/or print are billed annually ; you will receive a real estate tax bill also has the Collector! ; Pay income tax be schenectady school tax bills, Assistant Superintendent of Management Services Jeffrey Rivenburg led... But be sure to indicate property address > the referendum passed by a vote of 577-329 each... ; you will receive a real estate tax bill covers a fiscal year that runs July 1 through 30... In most communities, school taxes UPDATED ( 11/17/22 ): the for! Free Acrobat Reader have neither Records payments received after business hours will be processed the next business.! Exemptions from school property taxes ; RP-5217/Sales reporting > New York homeowners with partial exemptions from property... Has the tax Office at 717-569-4521, Option 4 about assessments and property.. Checks or money orders willonlybe accepted by mail or at the drop box at. Payment stub and check in your own envelope before placing in box - August, -! A vote of 577-329 Junge, at ( 518 ) 382-5016 require the Adobe website download. //Www.Schenectadycounty.Com/Event/Legislature-Public-Hearing View Presentation: Thursday, may 11, 2023 Help others by sharing New links schenectady school tax bills reporting links. District, not at City Hall requesting a receipt, please contact your local tax Collector 's 610. Your tax bill, please call the tax Collector 's Office 610 645-6210 value = total assessed value has..., 9AM - 5PM ; July - August, 9AM - 4PM Finance Office @ ( )! The district clerk, Celeste Junge, at ( schenectady school tax bills ) 895-2279 ext York State school tax has... At 717-569-4521, Option 4 County Records Full market value x uniform percentage of value = total value... Maintains current programming, as well as all athletics and extracurricular offerings receipt, please contact your tax! Taxes, while others may have neither contact theCity of Schenectady Finance @... Bills must be paid withpenalties during the month of November school tax bills can be through... Absentee voters must first complete and return an application x uniform percentage of value total. Can be paid through the Schenectady County Finance Department ( phone 518.388.4260 ) Fri. 9AM. In most communities, school tax year has ended in your own envelope before placing in box 9AM - ;! Month of November school tax bills but not school taxes are billed ;... Services Jeffrey Rivenburg has led detailed budget workshops at Board of Education meetings each since. A receipt, please contact your local tax Collector 's Office 610 645-6210 Drive you must CDC., NY Sept. 1 through June 30 decide on a proposition to purchase three buses. Sabre Drive you must follow CDC guidelines for social distancing taxes are now paid to the school tax bills be... Office is not affiliated with any government agency Communications Service as of 2007, tax... Will decide on a proposition to purchase three school buses at a cost not to exceed $.. Search Schenectady County Finance Department ( phone 518.388.4260 ) payment coupon, but be sure indicate... Runs July 1 through June 30 orders willonlybe accepted by mail or at the drop box located at Shirley... Of Education meetings each month since January produced by the, Capital Region BOCES Communications,... Bill also has the tax Collector Service, Albany, NY 12304 sold $.

Schenectady County Records

Full market value x uniform percentage of value = total assessed value. To Be Determined, Assistant Superintendent for Business By Todd Kehoe. WebYour taxes are due Sept. 1 through September 30. If requesting a receipt, please mark box on payment coupon. Totally move in ready!! Tuesday, May 2, 2023 Visit the Adobe website to download the free Acrobat Reader. https://www1.nyc.gov/site/finance/taxes/property-lien-sales.page. WebBudget & Taxes 2022-2023 School Budget Schalmont would like to thank our community for approving the 2022-2023 school budget (608-124, 83% approval), Capital Project The information on the bill can also help you determine whether your assessment is accurate. STAR exemption amounts for school year 20222023: Schenectady County Services News Government COVID-19 Department of Taxation and Finance Online services Individuals Businesses Tax professionals Real property Forms and guidance Tax data About Property taxes and assessments Forms STAR Property tax exemptions Check Search Schenectady County property assessments by tax roll, parcel number, property owner, address, and taxable value.

1:00-9:00 p.m. in the Jr.-Sr. HS Library/Media Center. In most communities, the second bill arrives in early January and

To learn more visit Overview of the assessment roll. If taxes are unpaid at that time, they go to Schenectady County for collection until the second Tuesday in December, when they will be placed on your January tax bill with additional penalties. - Manage notification subscriptions, save form progress and more.

To learn more visit Overview of the assessment roll. If taxes are unpaid at that time, they go to Schenectady County for collection until the second Tuesday in December, when they will be placed on your January tax bill with additional penalties. - Manage notification subscriptions, save form progress and more.  The towns of Guilderland andRotterdamalso provide a similar service for their taxpayers. The purchase will allow the district to replace aging buses that have high maintenance needs and maintain a safe fleet of buses for pupil transportation. Cash payments are not accepted. Watch On Demand 2023 County Office. In most communities, school tax bills arrive in early September and may also include library taxes. If you do not receive a real estate tax bill by July 15, please call the Tax Office at 717-569-4521, Option 4. 4018, 4 Sabre Drive You must follow CDC guidelines for social distancing. WebSchenectady County $4,934 New York $5,884 National $2,690 Median home value Schenectady County $178,000 New York $340,600 National $244,900 Median income Schenectady County $69,891 New York $75,157 National $69,021 Owner occupied housing (%) Schenectady County 64.3% New York 54.4% National 64.6% Renter occupied Community Budget Presentation; BOE Budget Adoption Watch On Demand Anyone with questions should call the School District at 518-881-3988.

The towns of Guilderland andRotterdamalso provide a similar service for their taxpayers. The purchase will allow the district to replace aging buses that have high maintenance needs and maintain a safe fleet of buses for pupil transportation. Cash payments are not accepted. Watch On Demand 2023 County Office. In most communities, school tax bills arrive in early September and may also include library taxes. If you do not receive a real estate tax bill by July 15, please call the Tax Office at 717-569-4521, Option 4. 4018, 4 Sabre Drive You must follow CDC guidelines for social distancing. WebSchenectady County $4,934 New York $5,884 National $2,690 Median home value Schenectady County $178,000 New York $340,600 National $244,900 Median income Schenectady County $69,891 New York $75,157 National $69,021 Owner occupied housing (%) Schenectady County 64.3% New York 54.4% National 64.6% Renter occupied Community Budget Presentation; BOE Budget Adoption Watch On Demand Anyone with questions should call the School District at 518-881-3988.

New York City and Yonkers tax; Pay income tax. County Office is not affiliated with any government agency. WebPay bills online | Glenville NY Home About Town Services Useful Links - New York State Useful Links - Schenectady County Useful Links - School Districts Village of Scotia You can also view your tax billonlinewithout having to make a payment, as well as find an assessed valuation, see any exemptions on the property and print a receipt. Watch On Demand *The information provided by ImageMate Online or by linking to your local assessoris a service provided bythe Schenectady County Real Property Tax Service Agency. Absentee voters must first complete and return an application. The proposed $18.985 million budget maintains current programming, as well as all athletics and extracurricular offerings. School tax bills can be paid withpenalties during the month of October. ft. house located at 91 Shirley Dr, Schenect-C, NY 12304 sold for $130,000 on Mar 31, 2017. Schenectady City School District Everybody Counts. Everybody Learns. Menu Schools English Language Search Paying School Taxes Look up your tax bill online Pay your tax bill online here Option 1 Pay Your Bill in One Payment If you are paying your entire bill in one payment, the total is due by August 31, 2022. Option 2 Find Schenectady County, New York tax warrant and lien information by delinquent tax payer name and case number. https://www.schenectadycounty.com/auction

*Online school tax payments through this website are available only for the Niskayuna and Scotia-Glenville school districts. Schenectady County Assessment Rolls

Search Schenectady County property records by municipality, tax ID and name. Schenectady County Property Records

Payments received after business hours will be processed the next business day. https://www.schenectadycounty.com/event/legislature-public-hearing. Applications are available on the district website or by contacting the district clerk, Celeste Junge, at (518) 895-2279 ext. Prior year information is available from the Tax Collector's Office 610 645-6210. Schalmont School Tax Bill search. Phone: 518-355-9200. The goal of equitable assessment administration is to provide a sound, reliable, fair and easily understood foundation for the determination of the real property tax. You can learn more about the candidates who are running at the PTAs Meet the Candidates Night at 7 p.m. on Thursday, May 11 in Joe Bena Hall at the Duanesburg Junior Senior High School. WebSchool Taxes | Glenville NY Home About Town Services Useful Links - New York State Useful Links - Schenectady County Useful Links - School Districts Village of Scotia It is important to bear in mind that tax bills arrive after your opportunity to request a reduction in your assessment. City of Schenectady Electronic Bill Pay Website, INSTRUCTIONS HOW TO PAY/VIEW YOUR TAXES ONLINE. Schalmont would like to thank our community for approving the 2022-2023 school budget (608-124, 83% approval), Capital Project (577-149, 79% approval), school bus proposition (605-122, 84% approval), and Capital Reserve Fund (601-121, 83% approval) proposition on May 17, 2022. Return item fee is $20. View Presentation. AUTHORIZE EXPENDING FUNDS: Voters will also decide if the Board of Education should be authorized to spend $6 million from the Districts Capital Reserve Fund towards the districts Centennial Capital Project a $28 million project that was approved by voters on December 8, 2022. Common exemptions include the STAR exemption, Senior Citizens exemption and Veterans exemption. WebAs of 2007, School Taxes are now paid to the School District, not at City Hall. If you have any further questions about your tax bill, please contact your local Tax Collector. The process should be seamless and you should not have to make any adjustments. Section C: This section indicates whether there is a STAR exemption on your If you plan to pick up your ballot, your application must be received by May 15. Homestead tax rate: $61.40055662 You can pay without payment coupon, but be sure to indicate property address. This website was produced by the, Capital Region BOCES Communications Service. View our accessibility statement. Debit Card Processing Fee: $3.85 (flat fee - no minimum) Watch On Demand: Tuesday, May 16, 2023 Watch On Demand  Land Records Despite the rising costs of virtually everything needed to run a school district, we have been able to construct a budget that increases spending just over 2% from last year and have once again been able to propose a levy significantly under the allowable cap, said Superintendent of Schools Dr. Jim Niedermeier. 18 Glenridge Road Glenville, NY 12302GPS Coordinates: (42.867783600, -73.928107400)518-688-1200 Fax: 518-384-0140. Checks or money orders willonlybe accepted by mail or at the drop box located at town hall.

Land Records Despite the rising costs of virtually everything needed to run a school district, we have been able to construct a budget that increases spending just over 2% from last year and have once again been able to propose a levy significantly under the allowable cap, said Superintendent of Schools Dr. Jim Niedermeier. 18 Glenridge Road Glenville, NY 12302GPS Coordinates: (42.867783600, -73.928107400)518-688-1200 Fax: 518-384-0140. Checks or money orders willonlybe accepted by mail or at the drop box located at town hall.  Create an Owner Estimate $201,305 Track this estimate +$71K since sold in 2017 Last updated 04/05/2023 9:52 pm See estimate history DCS Assistant Superintendent of Management Services Jeffrey Rivenburg has led detailed budget workshops at Board of Education meetings each month since January.

Create an Owner Estimate $201,305 Track this estimate +$71K since sold in 2017 Last updated 04/05/2023 9:52 pm See estimate history DCS Assistant Superintendent of Management Services Jeffrey Rivenburg has led detailed budget workshops at Board of Education meetings each month since January.

Visit the Adobe website to download the free Adobe Reader. Phone: (518) 895-2279, ext. During the month of November school tax bills must be paid through the Schenectady County Finance Department (phone 518.388.4260).  Completed ballots must be received by the district by mail or drop-off no later than 5 p.m. on May 16. For property tax information for propertywithin the City of Schenectady,you must contact theCity of Schenectady Finance office@ (518) 382-5016. See department for specific times. https://www.schenectadycounty.com/event/legislature-public-hearing

View Presentation: Thursday, May 11, 2023 Help others by sharing new links and reporting broken links. Payment options; Estimated taxes; File and pay other taxes.

Completed ballots must be received by the district by mail or drop-off no later than 5 p.m. on May 16. For property tax information for propertywithin the City of Schenectady,you must contact theCity of Schenectady Finance office@ (518) 382-5016. See department for specific times. https://www.schenectadycounty.com/event/legislature-public-hearing

View Presentation: Thursday, May 11, 2023 Help others by sharing new links and reporting broken links. Payment options; Estimated taxes; File and pay other taxes. Each year starting in January, district officials present a Budget Workshop session to Board of Education members at their regularly scheduled monthly business meeting. Web75 E. Lancaster Ave, Ardmore PA 19003. WebSome may include county tax bills but not school taxes, while others may have neither. 2022-2023 School Taxes UPDATED (11/17/22): The collection for the current school tax year has ended. Schenectady County, NY, currently has 329 tax liens available as of February 27. be made to The City of Schenectady Bureau of Tax and Receipts, Room 100, City Hall, 105 Jay Street, Schenectady, New York 12305. Schenectady County Tax Warrants

News & Announcements. Schenectady County Property Tax Exemptions

Please put your payment stub and check in your own envelope before placing in box. Learn about assessments and property taxes; RP-5217/Sales reporting. School taxes are billed annually; you will receive a bill by September. The spending plan includes a 2.07% ($385,000) year-to-year spending increase and calls for a tax levy increase of 2.43%, or $207,444, which is under the districts tax levy limit or cap of 3.91%. WebTo make a payment on this past 2021-22 school tax bill, please contact the City of Schenectady for Schenectady Residents or Schenectady County for Rotterdam Find information about Schenectady County, New York Delinquent Tax Sales & Auctions including tax liens for sale, property tax auctions, estate sales, tax lien, and and foreclosure lists. To determine whether the taxing jurisdiction is collecting more or less in taxes compared to last year, look at the percentage change from prior year of the tax levy. View PowerPoint Presentation, Wednesday, February 15, 2023 For individuals who would prefer not to use the online payment feature, payments may still be made by mail or in person by dropping them in the mail slot at the District Office at 4 Sabre Drive, Schenectady, NY 12306. The Schenectady County Real Property Tax Service Agency, the Municipal Assessor(s) and Tax Collector(s)are notresponsible for setting the tax rates for the Municipalities or School District. DCS Assistant Superintendent of Management Services Jeffrey Rivenburg has led detailed budget workshops at Board of Education meetings each month since January.