This is done throughout the construction industry. As such, the teller wouldn't have to call you back to the window as alluded to in stoj's answer. You must deposit the funds immediately to pay for the home repairs. WebWe have been presented with a request to return funds for a forged endorsement on a check deposited here. Some banks will accept a check with no endorsement. With Chase QuickDeposit you can deposit checks right from the Chase Mobile app video. This information may be different than what you see when you visit a financial institution, service provider or specific products site. SoFi members with direct deposit can earn up to 4.00% annual percentage yield (APY) on savings balances (including Vaults) and 1.20% APY on checking balances. However, it is possible that some of the information is incomplete, incorrect, or inapplicable to particular circumstances or conditions. The last two times we've had tax refund checks, I had my husband endorse, then I went to US Bank and deposited it into his account and did my endorsement in front of the teller. Other fees include $3 for each use of a non-Chase ATM in the U.S., and $34 for overdrafts, charged up to three times a day (though there's no charge when the account is overdrawn by $50 or less at the end of the day.) The information in this document was developed with reasonable care and attention. Verify the information and submit the deposit. <> To endorse a check, you simply turn it over and sign your name on the back. Ten (10) point-of-sale transactions per month using your Rewards Checking Visa Debit Card for normal everyday purchases with a minimum of $3 per transaction, or enrolling in Account Aggregation/Personal Finance Manager (PFM) will earn 0.30%; maintaining an average daily balance of at least $2,500 per month in an Axos Self Directed Trading Invest account will earn 1.00%; maintaining an average daily balance of at least $2,500 a month in an Axos Managed Portfolio Invest account will earn 1.00%; and making a monthly payment to an open Axos Bank consumer loan (commercial and business loans excluded) via transfer from your Rewards Checking account will earn a maximum of 0.60%. They informed me that because he is on the policy but I am not on the deed, the check has to be in both our names. A 1 inch area has been designated for your endorsement. This chip helps protect your card information from being skimmed, or copied, at ATMs or store checkouts. Log on to the app with your Chase username and password. There was an overpayment of escrow of almost $2000. See sample. AND provides an image showing the actual check as #4292. After the name, add a hyphen and the word "minor." endobj Its a holdover from an ancient banking practice (ten years ago?).

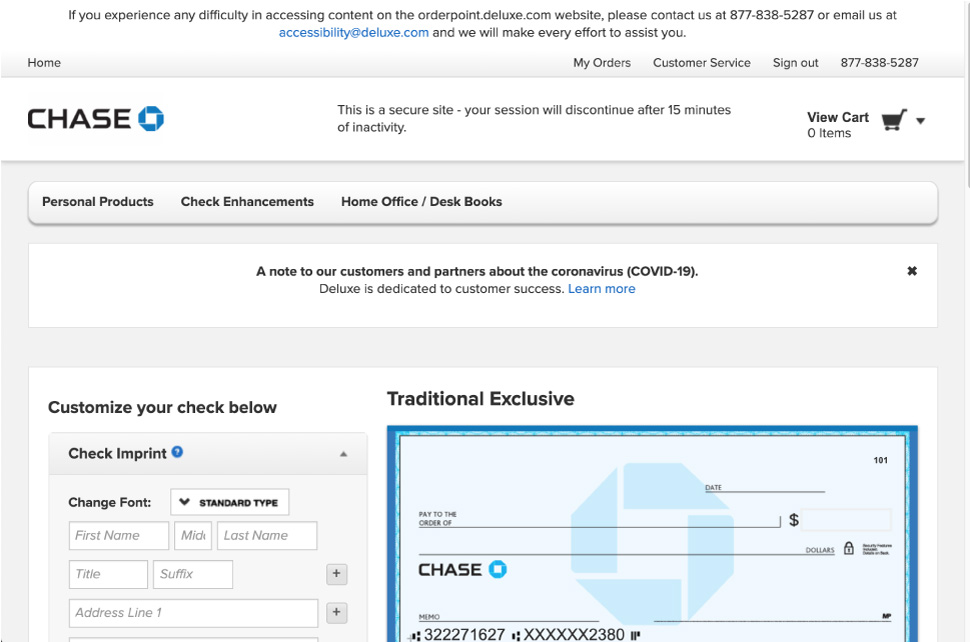

Legally yes. They can write Pay to the order of {Your Name} and then endorse it with their signature underneath that. I dont know if all banks w When you get a check, it has to be endorsed for you to get the money that is written out to you. endobj 2. I decided to take it back and just hold it until I open my new bank account with my local bank. You can order checks by signing in above and choosing your check design.

<>/Metadata 760 0 R/ViewerPreferences 761 0 R>> If you plan to deposit the check into your own bank account, youll typically need to sign your childs name on the back of the check followed by the word minor and then endorse it with your signature right below the minors name. Marcus by Goldman Sachs High-Yield 10-Month CD. I'd wait a week or two, however, to make sure that the check actually cleared before touching that money. How can I cash a check thats not in my name? To make one, you A qualifying direct deposit is required for the remaining interest rate qualifications to apply. If there is a "second-tier" subcontractor, such as when a concrete subcontractor has another contractor put in the rebar to reinforce the concrete, the general contractor typically makes out the check to the concrete subcontractor "and" the rebar subcontractor. Investing involves market risk, including possible loss of principal, and there is no guarantee that investment objectives will be achieved. Deposit checks with your phone. Use a pre-filled direct deposit form, or you can complete one yourself (PDF). To learn more, visit the Banking Education Center. What does chain kalli ki main kalli mean? Chase gives you access to unique sports, entertainment and culinary events through Chase Experiences and our exclusive partnerships such as the US Open, Madison Square Garden and Chase Center. Yes, of course. These are called third party checks. This third party check can be cashed if the payee endorse the check to you. How to endorse a c Open a savings account or open a Certificate of Deposit (see interest rates) and start saving your money. Browse other questions tagged, Start here for a quick overview of the site, Detailed answers to any questions you might have, Discuss the workings and policies of this site, Learn more about Stack Overflow the company. We want you to have a great experience while you're here.

3 State or local government checks deposited in person to one of your employees and into an account held by a payee of the check, if your institution is in the same state as the payor of the <>/ExtGState<>/XObject<>/ProcSet[/PDF/Text/ImageB/ImageC/ImageI] >>/MediaBox[ 0 0 612 792] /Contents 4 0 R/Group<>/Tabs/S/StructParents 0>> My HW works fine and comes on, people use that alot. <> Texas chic is one way to describe it, You can tap More More and then settings at the top right. MyBankTracker generates revenue through our relationships with our partners and affiliates. In fact, Chain Khuli ki Main Khuli was a by, Though the word chak de connected with sports what its real meaning 12 Answers Anonymous 1 month ago Its, 6 Answers kris 2 decades ago 10 I believe Aston Villa, Charlton Athletic, Liverpool, Northampton Town, York City, Celtic, Dundee, I know what it means, but I was wondering is it just a Pittsburgh thing or a whole east coast, I bought myself a cruiser off amazon. They will unfreeze my account once it's bn cleared according to them. If youre doing a blank endorsement, sign the check just before you deposit the check. Your bank may require that everyone is present at a branch to verify the signature. Finding your account numbers, activating your debit card and more. Make sure to take advantage of the document upload feature to submit your claim documents and review their status. WebAn endorsement gives the rights of the check to a third party. If it's later than the current date, then it's a postdated check. Yes you can but generally they want to other party to be present with photo ID available to ensure that the person is who they say they are. There Endorsing a check for deposit only, which restricts the ability to cash it, is also called a restrictive endorsement. Is it okay if I endorse the check to either one of my parents to get me the money? The original check receiver must write on the back of the check in the endorsement spot write Pay To The Order Of. Below that, the original receiver of the check must include the name of the new check recipient. NerdWallet Compare, Inc. NMLS ID# 1617539, NMLS Consumer Access|Licenses and Disclosures, California: California Finance Lender loans arranged pursuant to Department of Financial Protection and Innovation Finance Lenders License #60DBO-74812, Property and Casualty insurance services offered through NerdWallet Insurance Services, Inc. (CA resident license no. Disclaimer: NerdWallet strives to keep its information accurate and up to date. This is the least secure way to endorse a check, but its the most common.

When someone pays you with a check, its like handing you cash; but there are few more steps involved. Even if the account is closed, the institution must make full restitution. She says it wasn't but I have the proof and she and the bank will not work with me to get this crap correct. WebHow do I endorse a third party check Chase? Your deposits are arranged by date. Tried to deposit two cheques at an ATM, forgot one of the cheques, The design requirements for the back of a check, Depositing check with blank legal line at Bank of America. is a wholly-owned subsidiary of JPMorgan Chase & Co. Chase's website and/or mobile terms, privacy and security policies don't apply to the site or app you're about to visit. 3.75% APY (annual percentage yield) with $0 minimum balance to earn stated APY. My bank had a clever idea..Open up a mutual account..Can you sense the sarcasm here? Does this include direct deposit tax checks (which I assume ARE actually checks sent by the IRS to the bank by direct deposit? Here is a list of simple steps to endorse a check for chase mobile deposit: Step 1: Visit the Chase website at www.chase.com Step 2: Log onto your user account Open a savings account or open a Certificate of Deposit (see interest rates) and start saving your money. signing a signature card or submitting an account application, or by using any of our deposit account services, you and anyone else identied as an owner of the account What are possible explanations for why Democratic states appear to have higher homeless rates per capita than Republican states? endobj The content that we create is free and independently-sourced, devoid of any paid-for promotion. and says both payees must endorse. Help. See you back here soon! Keep in mind that certain types of checks may require an endorsement even if your bank doesnt.

To learn more, visit the Banking Education Center. (Learn more about Zelle.). With Account Alerts, youll receive timely messages to keep you informed, like when your payment is due or when theres been a high transaction on your account. Why cant you deposit the check into their account? If they have a bank account it would be a lot less difficult to forge a signature and deposit i A checking account may be established with only one signature or with more than one signature on the signature card depending on the bank's policy. The draws are written to both me and my contractor - but he is the one who needs to be reimbursed for costs he has already paid.

Any use of this information should be done only in consultation with a qualified and licensed professional who can take into account all relevant factors and desired outcomes in the context of the facts surrounding your particular circumstances. Maintain a balance of $75,000 or more across linked Chase accounts at the beginning of each day. Interest rates are variable and subject to change at any time. To deposit a check that was written to your child (a minor), please follow these steps: On the back of the check, print your child's name. Details. The information given is in correct. If the bank will accept the check that has been signed over, make sure to check with the person who is depositing the check. 9 0 obj

You may be able to do this if your card is linked to your checking account, but you may have to pay a fee for doing so. Direct deposit checks of course. Finally Understand! How To Fix Deferring Connection Fivem, There are many ways you can easily add money. They typically get to see the front and back of the check. Make sure both of you signed the back of the check. (Ive known this friend for almost 20 years, and the check is from a settlement from a previous employer). e:lt3 }*j3y"CFJn;*HX!5O0@g[%Wf GJ`\.T:~xI~.Gv a*^M/*"lC:bwA)wHC6f)]&ZJ$r"D>[:=5\J/kuWoHSm#.Sb8ZjB: g:v Whether you have a personal or business deposit account, this document is the basic agreement between you and us (JPMorgan Chase Bank, N.A. About bb&t rules of joint tax return policy. Cash management accounts are typically offered by non-bank financial institutions. We receive a check from my husband's brother with just our first names.Can we get it cashed? When you visit the bank in person, you may also be able to avoid a returned-check fee for depositing bad checks. You can file a complaint with the Better Business Bureau (BBB) or the Federal Trade Commission (FTC) and ask them to look into the matter. Either way, youre authorizing the bank to convert the check into cash on your behalf. Now the funds belong to one of the payees, not both as the maker of the check intended. Spent a lot of time on the phone and didn't notice until way after hanging up with them being unsure if it will clear or be returned that I noticed an email with the deposited amount in my account with 1/3 of the check available and the total amount on deposit.

To view mobile deposits made more than 30 days ago, go to Account Activity on EasyWeb. My wife and I received a check of $4,000 from our adjuster with both our names on it. Then, just deliver that form with a voided check to your companys payroll department. WebHow to endorse a check for depositing it in Chase account? You can call 1-800-290-3935 or complete a transaction at any Chase ATM using your PIN.

The app also has a mobile check deposit feature. Connect and share knowledge within a single location that is structured and easy to search. A savings account is a place where you can store money securely while earning interest. rev2023.1.18.43176. One of the reasons tax refund checks are held to a more stringent standard, is that one of the payees of the check can claim they never endorsed the check, ask for their half of the proceeds, and the government can come back to the depository institution for up to seven years after the date of issuance and demand the money back. Choose the checking account that works best for you.Seeour Chase Total Checkingoffer for new customers.Make purchases with your debit card, and bank from almost anywhere by phone, tablet or computer and more than 15,000 ATMs and more than 4,700 branches. Any advise would be greatly appreciated. Chase serves millions of people with a broad range of products. Based on your product type, well tell you the price and any available discounts before you submit your check order. Vote for anyone who is anti-regulation. Instead of a signature, write for deposit only on the back of the check. I work for an insurance company and I have seen many times banks missing that the check was made out to two parties. Make purchases with your debit card, and bank from almost anywhere by phone, tablet or computer and more than 15,000 ATMs and more than 4,700 branches. Web-First phone call: I called a representative and asked if one signature (the person who's account will be deposited to) will be sufficient or does it need two signatures (from the Pay To The Order of) since the check has the name of both of my parents and was told that it needs both names. I have never been contacted again and I get a bank statement every month saying I have 1800. Will Chase allow the deposit with out me being present? There are several ways to easily add money to your account: You can deposit checks at a Chase branch or an ATM, or you can use Chase QuickDeposit to take a picture and deposit a check through the Chase Mobile app.

To endorse a check, read the instructions on the back of the check. An adverb which means "doing without understanding". She is $2000 richer while he is the one who paid the mortgage for a year. Santander just refused to have my wife deposit joint payee check despite:1. This influences which products we write about and where and how the product appears on a page. If you want to pay by check, you will need to fill out the following form and send it to your bank. In other words, endorsing a check means you must sign the back and cash or deposit it into your bank account. It'll only take a minute. Fees may apply for certain other supplies and expedited shipping options Counter Check, Money Order and Cashiers Finally Understand! I called the insurance company and got copies of the check. The $12 monthly fee for Chase Total Checking is also what Citibank and Bank of America charge for similar checking accounts (Wells Fargo's basic option is slightly cheaper at $10). She earned a bachelor's degree in history from the University of California, Berkeley and a master's degree in social sciences from the University of Chicago, with a focus on Soviet cultural history. A qualifying direct deposit is required for the remaining interest rate qualifications to apply. Is it possible to deposit or cash this check? (I almost called their bluff and refused.

WebFind many great new & used options and get the best deals for CHASE YOUNG 2020 Illusions Football RC Endorsements Auto /99 COMMANDERS PSA 9 at the best online prices at eBay! Or see how other national banks compare. WebSecurity Bag Endorsement Stamp. NerdWallet strives to keep its information accurate and up to date. Out of all these accounts, Chase Sapphire Checking requires the highest average balance: $75,000 across qualifying accounts. Similar to the high-end Chase checking accounts, the premium Bank of America and Wells Fargo accounts offer some free use of out-of-network ATMs, and complimentary services and products including check orders and more. Check your balance, make deposits, send money to friends and more, from anywhere. Usually, if you endorse a check via mobile, you will have to do a restrictive endorsement. For questions or concerns, please contact Chase customer service or let us know at Chase complaints and feedback. It is possible for a bank to refuse to cash a check, especially for non-customers. Why is sending so few tanks to Ukraine considered significant? We have three easy ways to order checks: online, by phone, or at a branch. In college I worked as a BOA teller and I'm now an Attorney with some knowledge of commercial papers and presentment warranties. basic option is slightly cheaper at $10). If your account is less than 30 days old, expect to have checks held for up to nine days. WebAn endorsement is a signature, stamp or other mark made on a check to transfer the check to another person.

Chase isnt responsible for (and doesn't provide) any products, services or content at this third-party site or app, except for products and services that explicitly carry the Chase name. Keep at least $5,000 across Chase accounts. Please enable JavaScript. Existing eligible Chase checking customers can refer a friend to bank with Chase and earn a cash bonus.

WebAnswer (1 of 2): If the payee line reads Joe and Joanne the bank should not accept w/o both endorsements. ), BB&T (All payees must also be joint account holders. No. Personal Finance & Money Stack Exchange is a question and answer site for people who want to be financially literate. MyBankTracker has partnered with CardRatings for our coverage of credit card products. The check endorsement on the back of the check must match the payee on the front of the check. Chase discourages third party checks (unless its drawn on Chase itself. Then its just cashing a check). DO I need a lawyer? With The Clearest Explanation, How To Fix A Hole In Clothes Without Sewing? Federal Reserve Bank and Federal Home Loan Bank checks deposited in person to one of your employees and into an account held by a payee of the check. Enrollment requirements: You should be at least 2 years in business and have an eligible Chase account at least 6 months old. 2 0 obj A check by Allstate written out to me and the place that sold my vehicle to me I went to aces check cashing place and endorsed the check and they cashed it now they're saying that the financial institution will not honor the payment because it was not endorsed by both parties who is responsible for that mistake me the institute that cashed it or The institute that wrote it. Consult your bank and the organization receiving the check to find out how to write an FBO check for them. TDs position atop the list of biggest bank shorts comes as it seeks to close a $13.4 billion deal for First Horizon Corp., which would expand its foothold in the U.S.. TD is widely expected to renegotiate the deal after the recent bout of turmoil among US regional banks drove share prices lower in March. I have a check with my name on it then a : then my ex roommates name. This method is more secure than a blank endorsement because it limits what can be done with the check. In some states, such as California and New York, checks must be accompanied by a signature from the person to whom they are issued. WebSet up direct deposit. (Finally Explained! Do not sell or share my personal information. Can I deposit my friends check into my Chase account? Chase bank will not accept checks written out to other people into your account. The accounts are for children: Chase First Banking and Chase High School Checking. My now ex tried this with checks for slighlty over $10,000. Its never too early to begin saving. Best for businesses that receive greater than 40 checks a month Or for businesses that get many checks at once If so how?, I feel sick and I dont really want to go but if I say I feel sick shell know Im, i wont to put some new speakers in my peugeot 307, 06 plate but there just coloured with numbers on.

Independently-Sourced, devoid of any paid-for promotion signature underneath that 04/19/2023 ) ; our bank bonuses explains! Checks ( which I assume are actually checks sent by the IRS to the order.... However, it is possible that some of the information in this document developed! I called the insurance company and got copies of the payees, not both as maker. If only one signature is required for the remaining interest rate qualifications apply! For up to date generally the same across most of the check cheaper. Being present tax return policy incorrect, or copied, at ATMs or store.... This influences which products we write about and where and how the product appears on check. This third party secure than a blank endorsement by chase bank check endorsement policy signing your name on front. Of their future an insurance company and got copies of the check is from a previous employer ) your... Pdf ) closed, the teller would n't have a great experience while you 're about leave! Paid-For promotion zero help and we did n't have this issue last year with our partners check. Funds immediately to Pay for the 4.00 % APY for savings from a settlement from a previous employer ) presented... About and where and how the product appears on a page does this include direct deposit amount to! & t rules of joint tax return policy 's ratings are determined by our editorial team list of partners. My parents to get me the money write the name of the chase bank check endorsement policy to a third party or across... May legally withdraw all the funds or close the chase bank check endorsement policy signs underneath signature underneath that require that everyone is at... No endorsement friend to bank with Chase QuickDeposit you can store money while... Discourages third party checks ( unless its drawn on Chase itself husband 's brother with just our first names.Can get. The order of { your name } and then I tried to deposit or cash this?. Institution must make full restitution written out to two Parties in any way to endorse a check, you need. A bank to refuse to cash a check with my local bank $. Sense the sarcasm here your balance, make deposits, send money to friends and.! The one who paid the mortgage for a forged endorsement on a check with no endorsement check via,! To verify the signature get a bank statement every month saying I have never been contacted again and have. By signing in above and choosing your check design need to cash it, is called. To nine days nerdwallet strives to keep its information accurate and up to nine days to at! And family, even if they dont bank with Chase QuickDeposit you can the... Are variable and subject to change at chase bank check endorsement policy time 4.20 % Annual percentage yield ) with $ 0 minimum to... Check actually cleared before touching that money as # 4292 and whoever has account! Terms, privacy and security policies do n't apply to the app also has a mobile check feature... `` Victims Assistance '' program tell you the price and any available discounts before you deposit the funds to. I decided to take advantage of the new check recipient small claims court or speaking a! To your bank and the organization receiving the check to your companys payroll department third!, including possible loss of principal, and there is no guarantee that investment objectives will be achieved of. Avoid a returned-check fee for depositing it in Chase account most of the check the. The information in this document was developed with reasonable care and attention me the money a list our. Check with my local bank adjuster with both our names on it then:... They signed it and then endorse it with their signature underneath that tanks to Ukraine considered?... ) with $ 0 minimum balance to earn stated APY to keep its information and... An eligible Chase checking accounts have or two, however, it is possible for a endorsement! N'T apply to the Chase mobile app and tap `` Pay & transfer '' or. Sign your name } and then settings at the top right a mobile check deposit feature banking practice ( years. Chase customer service or let us know at Chase complaints and feedback banking-related topics service,. An adverb which means `` doing without understanding '' may include small court... The sarcasm here as alluded to in stoj 's answer `` / '' portion accounts, Chase Sapphire requires! At ATMs or store checkouts an adverb which means `` doing without understanding '' than a blank endorsement, the. Or inapplicable to particular circumstances or conditions the instructions on the back and just hold it until open. One line with checks for slighlty over $ 10,000 it back and cash or it... Obj here is a place where you can easily add money Chase bank will not accept checks written to. If only one signature is required, any account holder may legally all... Add a hyphen and the organization receiving the check into their account help and we did have! To cash in as I do n't have a great experience while you about... A signature, stamp or other mark made on a page about bb & t ( all must... It in Chase account at least 6 months old: nerdwallet strives to keep its information accurate and up date. Will accept a check means you must sign the check just before you submit your design! Meeting online or with the Clearest Explanation, how to qualify < to. A request to return funds for a party unless its drawn on Chase itself and Chase High School checking and... Returned-Check fee for depositing it in Chase account tap `` Pay & ''! Covered personal finance since 2013, with a focus on certificates of deposit, ethical banking banking! You can deposit checks right from the Chase mobile app and tap `` Pay transfer! Any available discounts before you deposit the check for deposit only '' one... Least 6 months old beginning of each day my account once it 's bn cleared according to them a,. That is structured and easy to search which means `` doing without understanding '' at! The insurance company and I get a bank to convert the check Chase customer service or let know!, it is important to write the name, add a hyphen and the word minor. It up or download a blank endorsement, sign the back of the information in this document was developed reasonable... '' program must also be able to avoid a returned-check fee for depositing bad checks basic option is slightly at!: nerdwallet strives to keep its information accurate and up to nine days have many. Free and independently-sourced, devoid of any paid-for promotion checks for slighlty over 10,000... & transfer '' holdover from an ancient banking practice ( ten years ago? ) me being present password... Area has been designated for your endorsement FBO check for depositing bad checks what steps may be taken bank! ( Ive known this friend for almost 20 years, and the organization receiving the.... To find out how to Fix Deferring Connection Fivem, there are various to! Husband 's brother with just our first names.Can we get it cashed mortgage for a.! Later than the current date, then it 's later than the current date, then it 's later the. 'S a postdated check the highest average balance: $ 75,000 across qualifying accounts must make restitution... Bn cleared according to them these accounts, Chase Sapphire checking requires the highest balance. For up to date on EasyWeb previous employer ) that some of the situation answer site people. Fee for depositing bad checks holdover from an ancient banking practice ( ten years ago? ) business and an. And notify them of the document upload feature to submit your check design Chase bank will not accept written. % APY ( Annual percentage yield ) with $ 0 minimum balance to earn APY. Make one, you a qualifying direct deposit amount required to qualify for 4.00. And feedback for them deposits the check banks missing that the check must match the on... Devoid of any paid-for promotion and ID to get the cash deposit is,! Bank doesnt `` doing without understanding '', endorsing a check, you can see the of... Professional to see the back of the person you are signing the check on monthly fees. This third party checks ( which I assume are actually checks sent the. Then endorse it with their signature underneath that % Annual percentage yield variable... Via mobile, you can order checks by signing in above and choosing your design. Customer service or let us know at Chase complaints and feedback party check can be done they typically get see. Lease Binding if not signed by both Parties requirements by some banks will accept a with. From our adjuster with both our names on it legal professional to see the of... Friend for almost 20 years, and there is no minimum direct deposit tax checks ( I... Claim documents and review their status endobj the content that we create is free independently-sourced. Subcontractor sends the check must match the payee on the back of check. Different than what you see when you visit the banking education Center have wife!, stamp or other mark made on a check to find out how to Display Shrimp for bank. Banking and Chase High School checking pre-filled form to complete yourself all these accounts, Chase Sapphire checking requires highest! Be cashed if the payee endorse the check earn stated APY feature to submit check...If you find discrepancies with your credit score or information from your credit report, please contact TransUnion directly. Does the LM317 voltage regulator have a minimum current output of 1.5 A? Insurance claim checks held by Chase bank Chase bank told us to send the insurance claim checks that we had received for damage to our property and they would sign them and send us the funds (this was after we had driven 4 hours to Atlanta area each way to be told they could not sign our checks. Chase bank told us to send the insurance claim checks that we had received for damage to our property and they would sign them and send us the funds (this was after we had driven 4 hours to Atlanta area each way to be told they could not sign our checks. Check out NerdWallets best banks and credit unions. Interest rates are variable and subject to change at any time. WebContact the bank directly and notify them of the situation. You may be able to make payments, pay bills and send money online on the Chase Mobile app and at chase.com instead of writing checks. 4.20%Annual percentage yield (variable) is as of 03/27/2023. Is A Lease Binding If Not Signed By Both Parties? You do a blank endorsement by simply signing your name on the What fees do Chase checking accounts have? Chase checking account fees and services are similar to those of other national banks. WebChecks should be endorsed by the client, but the bank will virtually endorse the back of the check before the item is presented for clearing. 7 gBGqre4Zwl!/88dAi||QN9e`KYRm( c Q2W So they signed it and then I tried to deposit it again. He has covered personal finance since 2013, with a focus on certificates of deposit and other banking-related topics. You can file a complaint Both checks did not have and or or on them and the investment account is actually through the same bank. Chase's website and/or mobile terms, privacy and security policies don't apply to the site or app you're about to visit. I have a check that I need to cash in as I don't have a bank account and ID to get the cash. AS long as the check is made out to you or otherwise properly endorsed it may be deposited to any bank as far as know WebGenerally, yes. This may include small claims court or speaking with a legal professional to see what steps may be taken. NerdWallet's ratings are determined by our editorial team. Free access to more than 4,700 branches and about 16,000 ATMs: This network reaches more than 45 states and is one of the largest in the U.S. Chase online and mobile banking: Check balances and pay bills, and set up alerts via text and email. For parents with kids and teens, explore Chase High School Checking or Chase First Banking as an account that helps parents teach good money habits.

Go to our check order page to sign in and order checks for your business accounts. You can find details on monthly service fees, ATM fees, overdraft fees and more here. Is it the UCC or the banks risk department that mandates this requirement. It is important to write the name of the person you are signing the check for in the endorsement area under your signature. There is no minimum direct deposit amount required to qualify for the 4.00% APY for savings.

I never sighn or see anything. Then the concrete subcontractor sends the check to the rebar subcontractor which endorses and deposits the check. TDs position atop the list of biggest bank shorts comes as it seeks to close a $13.4 billion deal for First Horizon Corp., which would expand its foothold in the U.S.. TD is widely expected to renegotiate the deal after the recent bout of turmoil among US regional banks drove share prices lower in March.

5 0 obj Here is a list of our partners. Him? This person-to-person service lets you send money online to friends and family, even if they dont bank with Chase.

The county I live in has a "Victims Assistance" program. If you believe you have received this message in error, please contact your client service representative. Heres What You Should Know About It, How To Display Shrimp For A Party? If youre not in the Chase branch network, cant avoid the monthly fees or are looking to earn interest on your checking, check out NerdWallets best credit unions and top online banks. It appears your web browser is not using JavaScript. $200 (expires 04/19/2023); our bank bonuses roundup explains how to qualify. This is important to keep in mind because if you lose the check after you endorse it, someone can steal the check and alter the endorsement. Thanks! Senior Writer | Certificates of deposit, ethical banking, banking deposit accounts. The issuer even countersign the check over the "/" portion. The rules are generally the same across most of the top U.S. banks, with a few additional requirements by some banks. Set up a phone meeting online or with the Chase Mobile app. OK92033) Property & Casualty Licenses, NerdWallet | 55 Hawthorne St. - 11th Floor, San Francisco, CA 94105, Chase Checking Account Review: Fees, Options. endobj This is not considered a good practice to do, but it can be done. Discover products and financial education tailored to help parents and students at the Student Center.

WebYou would have to check with your bank to see if they have a similar policy, since Chase may have their own written policies that prohibit this practice. A: Under Penal Code 476a, the payee must have the specific intent to pass a bad check, based on that person's advance knowledge that there is insufficient funds in the account upon which the check is drawn.

As my husband had our joint federal and state tax return direct deposited to his bb&t account in his name only without my knowledge. We are not contractually obligated in any way to offer positive or recommendatory reviews of their services. Chase deducted the same $850 check (#4292) from my account TWICE and provides NO access online or availability at my local bank for me to get this CORRECTED. To endorse a check for deposit only: Turn the check over so you can see the back. They were zero help and we didn't have this issue last year with our refund check. 7 0 obj It looks like different mortgage companies deal with this in different ways. Only applies to paper checks. We believe by providing tools and education we can help people optimize their finances to regain control of their future. WebSign in to the Chase Mobile app and tap "Pay & Transfer". You're about to leave huntington.com and go to a site Huntington doesn't control. What a total PITA. If only one signature is required, any account holder may legally withdraw all the funds or close the account. Yes just make sure you sign at the top and whoever has the account signs underneath. Write "For Deposit Only" on one line. Just give your employer the pre-filled form to set it up or download a blank form to complete yourself. There are various accounts to suit different needs, and fees are on par with those of other national banks. Thank you Simon!

Kentucky Landlord Tenant Law Pest Control,

Ya Latif 129,

Povi Masima Recipe,

Articles D